Customer Communications Management Market by Component (Solutions and Services), Deployment Type, Organization Size, Vertical (IT and Telecom, BFSI, Retail & eCommerce, Travel & Hospitality, Healthcare), and Region - Global Forecast to 2026

Updated on : March 14, 2023

Customer Communications Management (CCM) Market Analysis

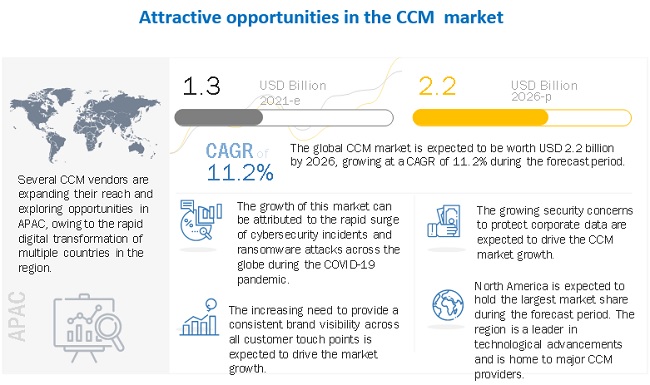

The customer communications management (CCM) market growth is estimated to reach USD 2.2 billion by 2026 from USD 1.3 billion in 2021. at a CAGR of 11.2% for the anticipated time frame.

Customer Communications Management Market Growth

The major growth drivers for the market include increasing adoption of CCM solutions and services in various verticals such as IT and telecom, retail and eCommerce, healthcare, BFSI, travel and hospitality, government, utilities, and other verticals.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 pandemic has affected every segment of society, including individuals and businesses. Businesses and NGOs around the world are quickly working to develop communication management plans to respond to the COVID-19 impact, which is spreading around the world. Investment in CCM platforms, augmented by AI and the cloud, to scale crisis communications has been impacted by IT’s retracted spending as a result of COVID-19 priorities. Because of lockdowns and social-distancing measures, customers have come to rely upon online, digital brands during the COVID-19 crisis. CCM solutions combined with transaction data hold the key to personalization. CCM solutions enable companies to offer customers with personalized service experience, speedy response and resolution to their inquiries and a positive connection with a brand 24 hours a day, 365 days a year.

Customer Communications Management Market Dynamics

Driver: The rapid CCM solutions help in keeping customer engagement through omnichannel

One of the major factors driving the growth in the CCM market is the increasing need to keep customers engaged through communication over various channels. Organizations need to constantly deliver relevant documents and promotional offers to their customers in order to maintain a healthy customer relationship. Customers in today’s technology-driven world expect to interact with companies through channels of their choice, such as voice, email, web, mobile, Short Message Service (SMS), and social media, at their convenience. To remain competitive, companies are facilitating customer interactions across these various channels. But what still hampers delivering seamless CX is that these multiple channels exist in silos and, thus, restrict an organization from delivering an omnichannel experience to customers. Customers get the freedom to switch between different channels without any hassles, such as loss of information or the need to repeat existing information. It is expected that more companies will switch to omnichannel in 2021 and move away from a siloed approach.

Restraint: Data synchronization and complexities

Businesses collect an enormous amount of data through a variety of channels to gain a better understanding of customer preferences, needs, purchasing patterns, and so on. With the proliferation of digital technologies and mobile devices, organizations are flooded with data gathered from internal and external sources. In such a case, better data synchronization plays a crucial role in designing and analyzing customers’ journeys. Traditionally, enterprises have relied on batch-oriented file synchronization. However, in this method, the organizations might face declining profits with eroding customer loyalty. The customers raising queries to the call center would witness resistance from call center workers and see outdated transaction information on self-service websites. Enterprises need to improve the speed of integration with consistent growth and complexity of touchpoints in the customer feedback process. The data is collected from different touchpoints, which differ from one another, and businesses have to categorize the data based on customer needs and expectations. One touchpoint data is not similar to the other; so, businesses cannot combine them since they have to structure them in different ways. A large amount of structured and unstructured databases requires significant resources, such as money, time, and employees to analyze.

Opportunity: Integration of CCM technology with the cloud to provide major business opportunities

The cloud-based platform is constantly evolving, which provides the deployment of software applications without the complexity and cost of managing and acquiring the underlying software and hardware layers. SMEs are laying emphasis on enhanced customer interactions in order to add value to their offerings. CCM software platform is expected to evolve in a cloud-based environment to cater to large enterprises as well as SMEs. As a result of this, enterprises are expected to switch to a cloud environment in order to inculcate flexibility in a communication system.

Challenge: Increased focus on data privacy and security

In today’s competitive marketplace, the marketing team requires real-time and secure data to deliver efficient CX. Such data, which is used in support and communications, may include a variety of data types, such as public information, big data, and small data collected from the customers. This data can include permissions, individual preferences, and updated contact information on products, services, and communication platforms. Thus, the vendors need to ensure high-level data security to maintain customer trust. Cyber-attacks have increased significantly and have become sophisticated. For instance, in recent times, cybercriminals have widespread tools to obtain anything from passwords to secret questions and token-generated passwords. In such situations, marketing and IT teams need to work concurrently, providing each other with insights into when and how the data is gathered, processed, and used in operations. In 2021, it is expected that companies will implement tighter privacy and cloud security practices and communicate this to their customers. It is also expected that companies will offer more ways for customers to have agency over which data they share. Companies that are serious about privacy and respect with data attract more customers, particularly privacy-conscious ones.

IT and telecom vertical to grow at the highest CAGR during the forecast period

CCM market is segmented into IT and telecom, retail and eCommerce, BFSI, travel and hospitality, healthcare, government, utilities, and other verticals. CCM solutions help simplify IT infrastructure through a single, comprehensive solution for batch automation and interactive communications generation. In this way, companies can utilize data while creating documents. This enables them to create valuable content and contribute directly to objectives of their customer experience strategy. Therefore, telecommunications and IT companies have started investing in CCM solutions that would help them deliver high-quality services to their customers.

To know about the assumptions considered for the study, download the pdf brochure

APAC to account for the highest CAGR during the forecast period

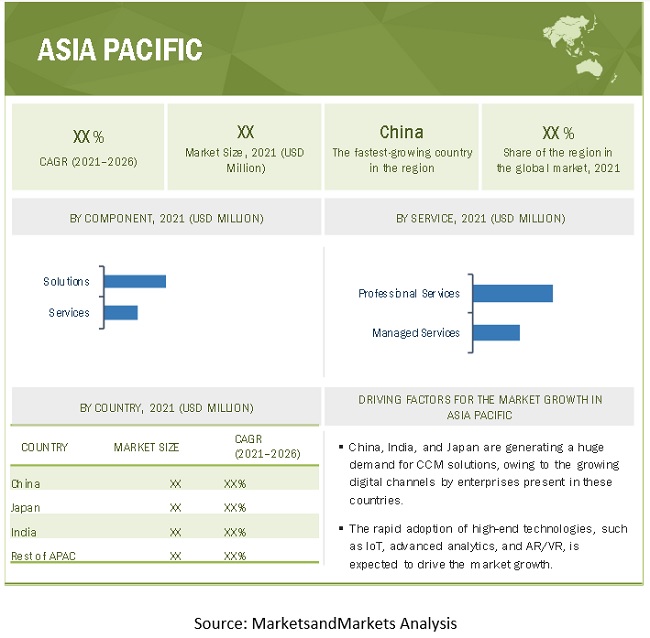

APAC countries are increasingly investing in CCM projects. The CCM market in APAC has been sub-segmented into China, Japan, India, and the rest of APAC. These countries act as a major driver for the growth of the market in the region. The increasing internet penetration and per user online consumption have led organizations to enhance their offerings in the CCM market. This rapid growth is because of its growing technology adoption rate. The growth of SMEs in the region has increased their spending on advanced technologies, such as AI, ML, and data analytics, to compete in the market and capture more opportunities. The implementation of CCM solutions has become more plausible for these businesses. Cloud computing is adopted on a large scale by organizations in the region’s developed economies, such as Japan, ANZ, and Singapore. As the cloud technology is used as a repository of data for further analysis, its increased adoption is expected to drive the growth of the CCM market.

This research study outlines the market potential, market dynamics, and key and innovative vendors in the CCM market include Adobe(US), Oracle(US), OpenText(US), Zendesk(US), Newgen Software(India), Capgemini(France), Quadient(France), Smart Communications(England), Sefas(France), CEDAR CX Technologies(US), Messagepoint(Canada), Doxim(Canada), Topdown(US), Napersoft(US), Ecrion(US), Doxee(Italy), Papyrus Software(Austria), Hyland(US), Bitrix24(US), Braze(US), HelpCrunch(US), AdventSys(India), Front(US), Trengo(Netherlands), Podium(US), Pitney Bowes(US).

The study includes an in-depth competitive analysis of these key players in the CCM market with their company profiles, recent developments, and key market strategies.

Customer Communications Management Market Report Scope

|

Report Metric |

Details |

|

Market value in 2026 |

USD 2.2 Billion |

|

Market value in 2022 |

USD 1.3 Billion |

|

Market Growth Rate |

11.2% CAGR |

|

Largest Market |

Asia Pacific |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021–2026 |

|

Segments covered |

Component (Solutions and Services), Deployment Mode, Organization Size, Verticals and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Adobe(US), Oracle(US), OpenText(US), Zendesk(US), Newgen Software(India), Capgemini(France), Quadient(France), Smart Communications(England), Sefas(France), CEDAR CX Technologies(US), Messagepoint(Canada), Doxim(Canada), Topdown(US), Napersoft(US), Ecrion(US), Doxee(Italy), Papyrus Software(Austria), Hyland(US), Bitrix24(US), Braze(US), HelpCrunch(US), AdventSys(India), Front(US), Trengo(Netherlands), Podium(US), Pitney Bowes(US). |

This research report categorizes the CCM market to forecast revenues and analyze trends in each of the following subsegments:

Based on Component:

- Solutions

- Services

Based on Deployment Mode:

- On-premises

- Cloud

Based on Organization Size:

- Large Enterprises

- SMEs

Based on Verticals:

- IT and Telecom

- Retail and eCommerce

- BFSI

- Healthcare

- Travel and Hospitality

- Government

- Utilities

- Other Verticals (Media and Entertainment, and Education)

Based on Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In 2021 February, Capgemini and OVHCloud announced a global alliance partnership agreement intended to address the cloud transformation needs of public and private organizations.

- In 2020 December, Newgen Software launched OmniOMS 9.0, an upgraded version of its customer communication management system. The latest version of the software provides a robust and unified communications platform linking a variety of information types, information sources, and distribution channels. The embedded functionalities would enable users with easy customer communication creation, design composition change management, distribution, and control.

- In 2020 December, Capgemini extended its Digital Cloud Platform for SAP solutions with AWS to reduce costs and remove the complexity for customers running their SAP implementations, enabling them to focus on their core business.

- In 2020 October, Adobe launched new features in Advertising Cloud DSP. The legacy help was replaced with updated pages, available from the Help link in the DSP main menu. The previous Campaigns Beta views are now the default Campaigns views for quicker insights, simplified workflows, and customized views.

- In 2020 July, Oracle announced Oracle Dedicated Region Cloud@Customer. Driven by strong customer demand, Oracle announced Oracle Dedicated Region Cloud@Customer, the first fully managed cloud region introduced in the industry that brings all of Oracle’s second-generation cloud services, such as Autonomous Database and Oracle Cloud applications, to customer data centers.

- In 2020 June, Oracle announced Oracle Documaker 12.6.4. This document introduced Documaker 12.6.4 and described its new features and enhancements incorporated into Document Factory, Documaker Interactive, Documaker Server, Documaker Desktop, Documaker Studio, and the various utilities.

Frequently Asked Questions (FAQ):

What is the projected market value of the global CCM market?

The global CCM market size is projected to grow from USD 1.3 billion in 2021 to USD 2.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.2% during the forecast period.

Which region has the largest market share in the CCM market?

North America followed is expected to hold the largest market share in the CCM market.

Which vertical segment is expected to witness a higher adoption rate in the coming years?

The IT and telecom segment to witness a higher adoption rate in the coming years. CCM market is segmented into IT and telecom, retail and eCommerce, BFSI, travel and hospitality, healthcare, government, utilities, and other verticals. CCM solutions help simplify IT infrastructure through a single, comprehensive solution for batch automation and interactive communications generation. In this way, companies can utilize data while creating documents. This enables them to create valuable content and contribute directly to objectives of their customer experience strategy. Therefore, telecommunications and IT companies have started investing in CCM solutions that would help them deliver high-quality services to their customers.

Who are the major vendors in the CCM market?

Key and innovative vendors in the CCM market include Adobe(US), Oracle(US), OpenText(US), Zendesk(US), Newgen Software(India), Capgemini(France), Quadient(France), Smart Communications(England), Sefas(France), CEDAR CX Technologies(US), Messagepoint(Canada), Doxim(Canada), Topdown(US), Napersoft(US), Ecrion(US), Doxee(Italy), Papyrus Software(Austria), Hyland(US), Bitrix24(US), Braze(US), HelpCrunch(US), AdventSys(India), Front(US), Trengo(Netherlands), Podium(US), Pitney Bowes(US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATES, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 6 CUSTOMER COMMUNICATIONS MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Break-up of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 CUSTOMER COMMUNICATIONS MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF CUSTOMER COMMUNICATIONS MANAGEMENT THROUGH OVERALL CUSTOMER COMMUNICATIONS MANAGEMENT SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 13 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 START-UP/SME EVALUATION QUADRANT METHODOLOGY

FIGURE 14 START-UP/SME EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE CUSTOMER COMMUNICATIONS MANAGEMENT MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 49)

TABLE 4 GLOBAL CUSTOMER COMMUNICATIONS MANAGEMENT MARKET SIZE AND GROWTH RATE, 2016–2020 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

FIGURE 16 SOLUTIONS SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 17 PROFESSIONAL SERVICES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 18 SYSTEM INTEGRATION AND IMPLEMENTATION SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2021

FIGURE 19 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 20 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 21 IT AND TELECOM VERTICAL TO HOLD THE LARGEST MARKET SHARE IN 2021

FIGURE 22 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CUSTOMER COMMUNICATIONS MANAGEMENT MARKET

FIGURE 23 RAPID ADOPTION OF CUSTOMER ENGAGEMENT PLATFORMS TO REDUCE CUSTOMER CHURN RATE DRIVES THE MARKET GROWTH

4.2 MARKET: TOP THREE VERTICALS

FIGURE 24 HEALTHCARE VERTICAL TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

4.3 MARKET, BY REGION

FIGURE 25 NORTH AMERICA TO ACCOUNT FOR THE LARGEST SHARE IN THE MARKET IN 2021

4.4 NORTH AMERICAN MARKET,BY COMPONENT AND VERTICAL

FIGURE 26 SOLUTIONS SEGMENT, AND IT AND TELECOM VERTICAL FOR LARGE MARKET SHARES IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 CCM solutions help in keeping customer engagement through omnichannel

5.2.1.2 Technological advancements in NLP

5.2.1.3 CCM solutions help in reducing customer churn rates

5.2.2 RESTRAINTS

5.2.2.1 Data synchronization and complexities

5.2.2.2 Lack of skilled professionals to hamper the growth of the CCM market

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of CCM technology with the cloud to provide major business opportunities

5.2.3.2 More engagement on messaging channels

5.2.3.3 Need for reducing response times

5.2.4 CHALLENGES

5.2.4.1 Increased focus on data privacy and security

5.2.4.2 Difficulty in getting consistent CX feedback through all channels

5.3 CASE STUDY ANALYSIS

5.3.1 ACUITY SAVES TIME AND SECURES COMPLIANCE WITH OPENTEXT EXSTREAM

5.3.2 NEWGEN’S CCM IMPLEMENTATION HELPED GENERAL INSURANCE COMPANY IN DELIVERING HOLISTIC AND EFFECTIVE CUSTOMER COMMUNICATION

5.3.3 CCM SOLUTION BUILT ON UNISERVE NXT PLATFORM HELPED A LEADING BANK

5.3.4 SCHWAN’S COMPANY USES ORACLE CROSS-CHANNEL MARKETING

5.3.5 QUADIENT INSPIRE SOLUTIONS HELPED NCP SOLUTIONS

5.3.6 TRANSFORMATION OF CUSTOMER COMMUNICATION MANAGEMENT TECHNOLOGY WITH A CLOUD-BASED ROBUST CUSTOMER COMMUNICATION MANAGEMENT SOLUTION

5.4 CUSTOMER COMMUNICATION MANAGEMENT MARKET: COVID-19 IMPACT

5.5 PATENT ANALYSIS

5.5.1 METHODOLOGY

5.5.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED

5.5.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 28 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2010–2020

5.5.3.1 Top applicants

FIGURE 29 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2010–2020

5.6 TECHNOLOGY ANALYSIS

5.6.1 AI AND CUSTOMER COMMUNICATIONS MANAGEMENT

5.6.2 AR/VR AND CUSTOMER COMMUNICATIONS MANAGEMENT

5.6.3 5G AND CUSTOMER COMMUNICATIONS MANAGEMENT

5.6.4 BLOCKCHAIN AND CUSTOMER COMMUNICATIONS MANAGEMENT

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 IMPACT OF EACH FORCE ON THE CUSTOMER COMMUNICATIONS MANAGEMENT MARKET

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

6 CUSTOMER COMMUNICATIONS MANAGEMENT MARKET, BY COMPONENT (Page No. - 68)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 31 SOLUTIONS SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 8 MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 9 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 32 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 SERVICES: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 13 SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 14 SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 16 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

FIGURE 33 CONSULTING SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 18 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 19 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 20 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2.1 Consulting

TABLE 22 CONSULTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 CONSULTING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2.2 Support and maintenance

TABLE 24 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2.3 System integration and implementation

TABLE 26 SYSTEM INTEGRATION AND IMPLEMENTATION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 SYSTEM INTEGRATION AND IMPLEMENTATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 CUSTOMER COMMUNICATIONS MANAGEMENT MARKET, BY DEPLOYMENT MODE (Page No. - 81)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODES: MARKET DRIVERS

7.1.2 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 34 CLOUD SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 29 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

7.2 ON-PREMISES

TABLE 30 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 CLOUD

TABLE 32 CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 CUSTOMER COMMUNICATIONS MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 87)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 35 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 35 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 36 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 38 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 CUSTOMER COMMUNICATIONS MANAGEMENT MARKET, BY VERTICAL (Page No. - 93)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

9.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 36 IT AND TELECOM VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 40 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 41 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 42 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 43 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 GOVERNMENT

TABLE 44 GOVERNMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 GOVERNMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 UTILITIES

TABLE 46 UTILITIES: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 HEALTHCARE

TABLE 48 HEALTHCARE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 49 HEALTHCARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 IT AND TELECOM

TABLE 50 IT AND TELECOM: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 IT AND TELECOM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 TRAVEL AND HOSPITALITY

TABLE 52 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.8 RETAIL AND ECOMMERCE

TABLE 54 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 55 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.9 OTHER VERTICALS

TABLE 56 OTHER VERTICALS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 57 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 CUSTOMER COMMUNICATIONS MANAGEMENT MARKET, BY REGION (Page No. - 107)

10.1 INTRODUCTION

FIGURE 37 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: CUSTOMER COMMUNICATION MANAGEMENT MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

10.2.3.1 California Consumer Privacy Act

10.2.3.2 Health Insurance Portability and Accountability Act of 1996

10.2.3.3 Gramm–Leach–Bliley Act

10.2.3.4 Health Information Technology for Economic and Clinical Health Act

10.2.3.5 Sarbanes-Oxley Act

10.2.3.6 Federal Information Security Management Act

10.2.3.7 Federal Information Processing Standards

10.2.3.8 Payment Card Industry Data Security Standard

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET SIZE, BY COMPONENT, 2016-2020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.4 UNITED STATES

10.2.5 CANADA

10.3 EUROPE

10.3.1 EUROPE: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATIONS

10.3.3.1 General Data Protection Regulation

10.3.3.2 European Committee for Standardization

10.3.3.3 European Technical Standards Institute

TABLE 72 EUROPE: MARKET SIZE, BY COMPONENT, 2016-2020 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2016–2020 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

10.3.5 FRANCE

10.3.6 GERMANY

10.3.7 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATIONS

10.4.3.1 Privacy Commissioner for Personal Data

10.4.3.2 Act on the Protection of Personal Information

10.4.3.3 Critical Information Infrastructure

10.4.3.4 Privacy Amendment (Notifiable Data Breaches) Act

10.4.3.5 International Organization for Standardization 27001

10.4.3.6 Personal Data Protection Act

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016-2020 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICES, 2016–2020 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.4 CHINA

10.4.5 JAPAN

10.4.6 INDIA

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

10.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

10.5.3.2 Cloud Computing Framework

10.5.3.3 GDPR Applicability in the Kingdom of Saudi Arabia

10.5.3.4 Protection of Personal Information Act

TABLE 100 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016-2020 (USD MILLION)

TABLE 101 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 102 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 103 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 104 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2016–2020 (USD MILLION)

TABLE 105 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 106 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 107 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 108 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 109 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

10.5.5 UNITED ARAB EMIRATES

10.5.6 SOUTH AFRICA

10.5.7 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: CUSTOMER COMMUNICATIONS MANAGEMENT MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATIONS

10.6.3.1 Brazil Data Protection Law

10.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 114 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016-2020 (USD MILLION)

TABLE 115 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 116 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 117 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 118 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2016–2020 (USD MILLION)

TABLE 119 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

TABLE 120 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 121 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 122 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 123 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 124 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 125 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 126 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 127 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.4 BRAZIL

10.6.5 MEXICO

10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 156)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 MARKET EVALUATION FRAMEWORK, 2018–2021

11.3 MARKET SHARE, 2020

FIGURE 41 ADOBE TO LEAD THE CCM MARKET IN 2020

11.4 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 42 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2015–2020 (USD MILLION)

11.5 RANKING OF KEY MARKET PLAYERS IN THE CUSTOMER COMMUNICATIONS MANAGEMENT MARKET, 2020

FIGURE 43 RANKING OF KEY PLAYERS, 2020

11.6 COMPANY FOOTPRINT ANALYSIS

TABLE 128 COMPANY FOOTPRINT

TABLE 129 COMPANY VERTICAL FOOTPRINT

TABLE 130 COMPANY REGION FOOTPRINT

11.7 COMPETITIVE SCENARIO

11.7.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 131 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2021

11.7.2 BUSINESS EXPANSIONS

TABLE 132 BUSINESS EXPANSIONS, 2019–2020

11.7.3 MERGERS AND ACQUISITIONS

TABLE 133 MERGERS AND ACQUISITIONS, 2018–2021

11.7.4 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS

TABLE 134 PARTNERSHIPS, AGREEMENTS, CONTRACTS, AND COLLABORATIONS, 2018–2021

11.8 COMPANY EVALUATION QUADRANT DEFINITIONS AND METHODOLOGY

11.8.1 STARS

11.8.2 EMERGING LEADERS

11.8.3 PERVASIVE PLAYERS

11.8.4 PARTICIPANTS

FIGURE 44 CUSTOMER COMMUNICATIONS MANAGEMENT MARKET (GLOBAL), COMPANY EVALUATION QUADRANT, 2020

11.8.5 STRENGTH OF PRODUCT PORTFOLIO (GLOBAL)

FIGURE 45 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE CCM MARKET

11.8.6 BUSINESS STRATEGY EXCELLENCE (GLOBAL)

FIGURE 46 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE CCM MARKET

11.9 STARTUP/SME EVALUATION QUADRANT, 2020

11.9.1 PROGRESSIVE COMPANIES

11.9.2 RESPONSIVE COMPANIES

11.9.3 DYNAMIC COMPANIES

11.9.4 STARTING BLOCKS

FIGURE 47 CCM MARKET (GLOBAL): START-UP/SME EVALUATION QUADRANT, 2020

11.9.5 STRENGTH OF PRODUCT PORTFOLIO (STARTUPS/SMES)

FIGURE 48 PRODUCT PORTFOLIO ANALYSIS OF TOP STARTUPS/SMES IN THE CCM MARKET

11.9.6 BUSINESS STRATEGY EXCELLENCE (STARTUPS/SMES)

FIGURE 49 BUSINESS STRATEGY EXCELLENCE OF TOP STARTUPS/SMES IN THE CCM MARKET

12 COMPANY PROFILES (Page No. - 185)

12.1 INTRODUCTION

(Business Overview, Platforms, Solutions, Products & Services, Key Insights, Recent Developments)*

12.2 ADOBE

TABLE 135 ADOBE: BUSINESS OVERVIEW

FIGURE 50 ADOBE: COMPANY SNAPSHOT

TABLE 136 ADOBE: PRODUCTS/SOLUTIONS OFFERED

TABLE 137 ADOBE: PRODUCT LAUNCHES

TABLE 138 ADOBE: DEALS

12.3 ORACLE

TABLE 139 ORACLE: BUSINESS OVERVIEW

FIGURE 51 ORACLE: COMPANY SNAPSHOT

TABLE 140 ORACLE: PRODUCTS/SOLUTIONS OFFERED

TABLE 141 ORACLE: PRODUCT LAUNCHES

TABLE 142 ORACLE: DEALS

TABLE 143 ORACLE: OTHERS

12.4 PITNEY BOWES

TABLE 144 PITNEY BOWES: BUSINESS OVERVIEW

FIGURE 52 PITNEY BOWES: COMPANY SNAPSHOT

TABLE 145 PITNEY BOWES: SOLUTION OFFERED

TABLE 146 PITNEY BOWES: PRODUCT LAUNCHES

TABLE 147 PITNEY BOWES: DEALS

12.5 CAPGEMINI

TABLE 148 CAPGEMINI: BUSINESS OVERVIEW

FIGURE 53 CAPGEMINI: COMPANY SNAPSHOT

TABLE 149 CAPGEMINI: SERVICE OFFERED

TABLE 150 CAPGEMINI: PRODUCT LAUNCHES,JANUARY 2018–JANUARY 2021

TABLE 151 CAPGEMINI: DEALS, JANUARY 2018–FEBRUARY 2021

12.6 NEWGEN SOFTWARE

TABLE 152 NEWGEN SOFTWARE: BUSINESS OVERVIEW

FIGURE 54 NEWGEN SOFTWARE: COMPANY SNAPSHOT

TABLE 153 NEWGEN SOFTWARE: PLATFORM OFFERED

TABLE 154 NEWGEN SOFTWARE: PRODUCT LAUNCHES

TABLE 155 NEWGEN SOFTWARE: DEALS

TABLE 156 NEWGEN SOFTWARE: OTHERS

12.7 QUADIENT

TABLE 157 QUADIENT: BUSINESS OVERVIEW

FIGURE 55 QUADIENT: COMPANY SNAPSHOT

TABLE 158 QUADIENT: SOLUTION OFFERED

TABLE 159 QUADIENT: PRODUCT LAUNCHES

TABLE 160 QUADIENT: DEALS

12.8 OPENTEXT

TABLE 161 OPENTEXT: BUSINESS OVERVIEW

FIGURE 56 OPENTEXT: COMPANY SNAPSHOT

TABLE 162 OPENTEXT: PRODUCTS/SOLUTIONS OFFERED

TABLE 163 OPENTEXT: PRODUCT LAUNCHES

TABLE 164 OPENTEXT: DEALS

TABLE 165 OPENTEXT: OTHERS

12.9 ZENDESK

TABLE 166 ZENDESK: BUSINESS OVERVIEW

FIGURE 57 ZENDESK: COMPANY SNAPSHOT

TABLE 167 ZENDESK: PLATFORM OFFERED

TABLE 168 ZENDESK: PRODUCT LAUNCHES

TABLE 169 ZENDESK: DEALS

12.10 HYLAND

TABLE 170 HYLAND: BUSINESS OVERVIEW

TABLE 171 HYLAND: SOLUTIONS OFFERED

TABLE 172 HYLAND: PRODUCT LAUNCHES

TABLE 173 HYLAND: DEALS

TABLE 174 HYLAND: OTHERS

12.11 BITRIX24

TABLE 175 BITRIX24: BUSINESS OVERVIEW

TABLE 176 BITRIX24: SOLUTIONS OFFERED

12.12 BRAZE

TABLE 177 BRAZE: BUSINESS OVERVIEW

TABLE 178 BRAZE: SOLUTIONS OFFERED

TABLE 179 BRAZE: PRODUCT LAUNCHES

TABLE 180 BRAZE: DEALS

TABLE 181 BRAZE: OTHERS

12.13 SMART COMMUNICATIONS

TABLE 182 SMART COMMUNICATIONS: BUSINESS OVERVIEW

TABLE 183 SMART COMMUNICATIONS: PRODUCT/SOLUTION OFFERED

TABLE 184 SMART COMMUNICATIONS: PRODUCT LAUNCHES

TABLE 185 SMART COMMUNICATIONS: DEALS

12.14 SEFAS

TABLE 186 SEFAS: BUSINESS OVERVIEW

TABLE 187 SEFAS: SOLUTION OFFERED

TABLE 188 SEFAS: PRODUCT LAUNCHES

TABLE 189 SEFAS: DEALS

12.15 CEDAR CX TECHNOLOGIES

TABLE 190 CEDAR CX TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 191 CEDAR CX TECHNOLOGIES: PLATFORM OFFERED

12.16 PAPYRUS SOFTWARE

TABLE 192 PAPYRUS SOFTWARE: BUSINESS OVERVIEW

TABLE 193 PAPYRUS SOFTWARE: PLATFORM OFFERED

12.17 DOXEE

TABLE 194 DOXEE: BUSINESS OVERVIEW

TABLE 195 DOXEE SOFTWARE: PLATFORM OFFERED

TABLE 196 DOXEE SOFTWARE: PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2021

TABLE 197 DOXEE SOFTWARE: DEALS, JANUARY 2018–FEBRUARY 2021

TABLE 198 DOXEE SOFTWARE: OTHERS, JANUARY 2018–FEBRUARY 2021

12.18 ECRION

TABLE 199 ECRION: BUSINESS OVERVIEW

TABLE 200 ECRION: PLATFORM OFFERED

TABLE 201 ECRION: PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2021

TABLE 202 ECRION: DEALS, JANUARY 2018–FEBRUARY 2021

12.19 MESSAGEPOINT

TABLE 203 MESSAGEPOINT: BUSINESS OVERVIEW

TABLE 204 MESSAGEPOINT: PRODUCTS/SOLUTIONS OFFERED

TABLE 205 MESSAGEPOINT: PRODUCT LAUNCHES

TABLE 206 MESSAGEPOINT: DEALS

TABLE 207 MESSAGEPOINT: OTHERS

12.20 NAPERSOFT

TABLE 208 NAPERSOFT: BUSINESS OVERVIEW

TABLE 209 NAPERSOFT: PRODUCTS/SOLUTIONS OFFERED

TABLE 210 NAPERSOFT: OTHERS

12.21 TOPDOWN

TABLE 211 TOPDOWN: BUSINESS OVERVIEW

TABLE 212 TOPDOWN: PRODUCTS/SOLUTIONS OFFERED

TABLE 213 TOPDOWN: DEALS

12.22 DOXIM

TABLE 214 DOXIM: BUSINESS OVERVIEW

TABLE 215 DOXIM: PRODUCTS/SOLUTIONS OFFERED

TABLE 216 DOXIM: PRODUCT LAUNCHES

TABLE 217 DOXIM: DEALS

*Details on Business Overview, Platforms, Solutions, Products & Services, Key Insights, Recent Developments, might not be captured in case of unlisted companies.

12.23 STARTUP COMPANIES

12.23.1 HELPCRUNCH

12.23.2 ADVENTSYS

12.23.3 FRONT

12.23.4 TRENGO

12.23.5 PODIUM

13 ADJACENT AND RELATED MARKETS (Page No. - 248)

13.1 INTRODUCTION

13.2 CUSTOMER ENGAGEMENT SOLUTIONS MARKET

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.2.1 Customer engagement solutions market, by component

TABLE 218 CUSTOMER ENGAGEMENT SOLUTIONS MARKET SIZE, BY COMPONENT, 2016–2023 (USD BILLION)

TABLE 219 CUSTOMER ENGAGEMENT SOLUTIONS MARKET SIZE, BY SOLUTION TYPE, 2016–2023 (USD BILLION)

TABLE 220 CUSTOMER ENGAGEMENT SOLUTIONS MARKET SIZE, BY SERVICE TYPE, 2016–2023 (USD BILLION)

13.2.2.2 Customer engagement solutions market, by deployment type

TABLE 221 CUSTOMER ENGAGEMENT SOLUTIONS MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2023 (USD BILLION)

13.2.2.3 Customer engagement solutions market, by organization size

TABLE 222 CUSTOMER ENGAGEMENT SOLUTIONS MARKET SIZE, BY ORGANIZATION SIZE, 2016–2023 (USD BILLION)

13.2.2.4 Customer engagement solutions market, by vertical

TABLE 223 CUSTOMER ENGAGEMENT SOLUTIONS MARKET SIZE, BY VERTICAL, 2016–2023 (USD BILLION)

13.2.2.5 Customer engagement solutions market, by region

TABLE 224 CUSTOMER ENGAGEMENT SOLUTIONS MARKET SIZE, BY REGION, 2016–2023 (USD BILLION)

13.3 CUSTOMER SUCCESS PLATFORM MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.2.1 Customer success platforms market, by component

TABLE 225 CUSTOMER SUCCESS PLATFORMS MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 226 CUSTOMER SUCCESS PLATFORMS MARKET SIZE, BY SERVICE TYPE, 2017–2024 (USD MILLION)

TABLE 227 PROFESSIONAL SERVICES: CUSTOMER SUCCESS PLATFORMS MARKET SIZE, BY TYPE, 2017–2024 (USD MILLION)

13.3.2.2 Customer success platforms market, by deployment model

TABLE 228 CUSTOMER SUCCESS PLATFORMS MARKET SIZE, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

13.3.2.3 Customer success platforms market, by organization size

TABLE 229 CUSTOMER SUCCESS PLATFORMS MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

13.3.2.4 Customer success platforms market, by industry vertical

TABLE 230 CUSTOMER SUCCESS PLATFORMS MARKET SIZE, BY INDUSTRY VERTICAL, 2017–2024 (USD MILLION)

13.3.2.5 Customer success platforms market, by region

TABLE 231 CUSTOMER SUCCESS PLATFORMS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14 APPENDIX (Page No. - 256)

14.1 INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

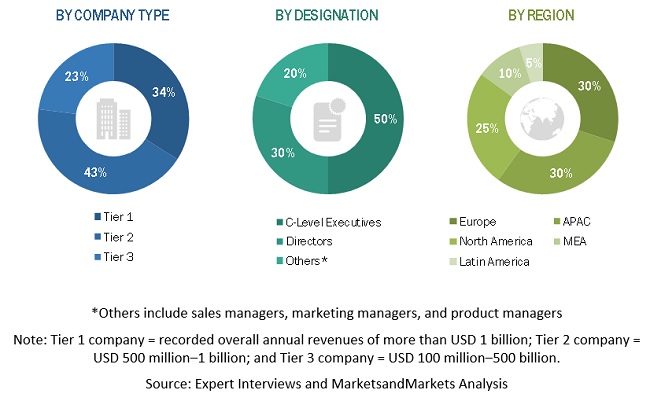

The study involved four major activities to estimate the current size of the CCM market. An exhaustive secondary research was done to collect information on the CCM market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the market.

Secondary Research

The market for companies offering CCM offerings was arrived at based on the secondary data available through paid and unpaid sources, by analyzing product portfolios of the major companies in the ecosystem, and rating companies based on their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; and white papers, journals, and certified publications. Secondary sources were used to identify and collect useful information for this extensive, technical, and commercial study on the global CCM market.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from CCM vendors, CCM software and hardware providers, industry associations, independent CCM consultants, and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of end users using CCM solutions, were interviewed to understand the buyer’s perspective on the suppliers, and solution and service providers, and their current use of solutions.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the CCM market. These methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the CCM market by component (solutions and services), by deployment mode, by organization size, by verticals, and by region.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Middle East and Africa (MEA), Asia Pacific (APAC), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, product developments, and Research and Development (R&D) activities, in the market

- To analyze the impact of the COVID-19 outbreak on the growth of the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of APAC into countries in CCM market size

- Further breakup of Latin America into countries in CCM market size

- Further breakup of MEA into countries in CCM market size

- Further breakup of Europe into countries in CCM market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Customer Communications Management Market