CT/NG Testing Market by Product (Assays, Kits & Analyzers), Test Type (Laboratory, Point-of-care Testing), Technology (INAAT, PCR, Immunodiagnostics), End User (Diagnostic Labs, Hospitals & Clinics) & Region - Global Forecast to 2028

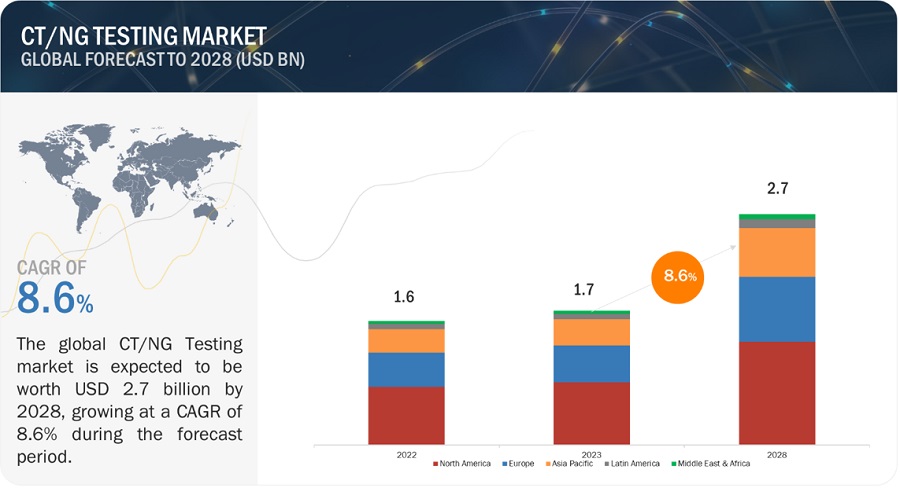

The global CT/NG testing market, valued at US$1.6 billion in 2022, stood at US$1.7 billion in 2023 and is projected to advance at a resilient CAGR of 8.6% from 2023 to 2028, culminating in a forecasted valuation of US$2.7 billion by the end of the period. Market growth is largely driven by the increasing prevalence of CT/NG infections and the growing investments and funding for R&D in CT/NG diagnosis.

On the other hand, the unfavorable reimbursement scenario and the high cost of instruments and kits may restrain the growth of this market to a certain extent.

Attractive Opportunities in the CT/NG testing Market

To know about the assumptions considered for the study, Request for Free Sample Report

CT/NG testing Market Dynamics

DRIVER: Increasing investments and funding to drive market growth

Government initiatives, schemes, or funding activities that support and promote innovation and development provide growth opportunities in the CT/NG testing market. These financial incentives and support systems enable companies to invest in research and development, infrastructure, and the production of advanced diagnostic technologies. By facilitating access to funds, the manufacturers are encouraged to push the boundaries of CT/NG testing, leading to breakthrough innovations in disease detection, monitoring, and personalized medicine. For instance, in April 2022, the Chiricahua Community Health Centers, Inc. (CCHCI) stated that it was collaborating with The Body Agency Collective (TBAC) and Visby Medical, Inc., to improve sexually transmitted infection (STI) diagnosis and treatment in observance of National STD Awareness Week. This project will utilize a new PCR diagnostic device which is the Sexual Health Click Test, and it detects three of the most common and curable STIs in women – gonorrhea, chlamydia, and trichomoniasis.

RESTRAINT: High cost of instruments

The entire cost is increased by the variable costs of the required reagents, instruments and those set up by the suppliers. Maintenance and insurance, laboratory supervision, and administrative costs (including rent, office space and administration) are extra costs as well. Only major hospitals and reference laboratories with healthy capital budgets may be able to afford the huge amount of diagnostic equipment. On the other hand, small laboratories, physicians’ offices, and private or individual practitioners encounter capital constraints and therefore, can find it difficult to afford a big or huge instruments and analyzer. Generally, a CT/NG testing kits and instruments can cost between USD 2,000 and USD 80,000. These, costly requirements might hinder the growth of the CT/NG (STI) testing market.

OPPORTUNITY: Growing opportunities in emerging countries

Emerging economies such as India, South Korea, Brazil, and Mexico offer significant growth opportunities to players operating in the CT/NG testing market. This can be attributed to the low regulatory barriers, improvements in healthcare infrastructure, growing patient population, rising prevalence of infections, and rising healthcare expenditure. Moreover, the regulatory policies in some of these countries are more adaptive and business-friendly than those in developed countries. For example, according to the OECD, the purchasing power of the growing middle-class population is expected to increase to 65% by 2022 from 23% in 2009. This is expected to result in the increasing medical needs of the middle-class population, which will favor market growth. Moreover, as markets in the US and Europe mature, most players will shift their focus to emerging markets. The high investments in healthcare and life science research in emerging markets play an essential role in upgrading laboratory infrastructure in these countries. This, in turn, supports the installation of diagnostic systems in laboratories and leads to the growing adoption of CT/NG testing (CT/NG testing).

CHALLENGE: Operational barriers and shortage of skills across major markets

Clinical laboratories are still developing in all; technicians must overcome practical obstacles to ensure efficient sample collection, storage, and transportation. To prevent cross-contamination and maintain efficient time management, laboratory areas must also be redesigned to conduct particular diagnostic procedures used for pathogen detection. This causes maintenance and operation of modern CT/NG devices, particularly those equipped to handle a single sample type, to significantly increase in cost.

Furthermore, clinical laboratories need to embrace cutting-edge technologies capable of quick sample diagnosis due to due to rapid mutation of micro-organisms and the rise in epidemic outbreak. However, the overall adoption of modern molecular diagnostics technologies has hampered, particularly in emerging economies, by the lack of experienced and technically educated laboratory staff.

CT/NG Testing Ecosystem/Market Map

Assays & kits segment accounted for the largest share of the CT/NG Testing Industry in 2022, by product

Based on product, the global CT/NG testing market is segmented into two segments namely, assays & kits and instruments/analyzers. In 2022, the assays & kits segment accounted for the largest share of the CT/NG testing market. The high share of this segment is attributed to its in-demand and continuous need for diagnosis and treatment. Due to recurrent purchasing it is a high cost product and thereby adds to the segment growth.

Lab tests segment accounted for the largest share in the CT/NG testing industry in 2022, by testing type

The global CT/NG testing market is categorized into lab tests and PoC tests based on test type. In 2022, the lab tests segment held the largest share in the CT/NG testing market, categorized by test type. The growth of this segment can be attributed to factors such as the growing demand for automation in laboratory settings and the increasing incidence of various infectious diseases.

Lab tests are equipped with higher sensitivity and specificity compared to PoC tests. Having a controlled laboratory environment ensures more accurate and sensitive measurements, thereby reducing the chances of false-negative or false-positive results. Another advantage of lab tests is the ability to process a more number of samples simultaneously. Such factors are expected to fuel the growth of this segment.

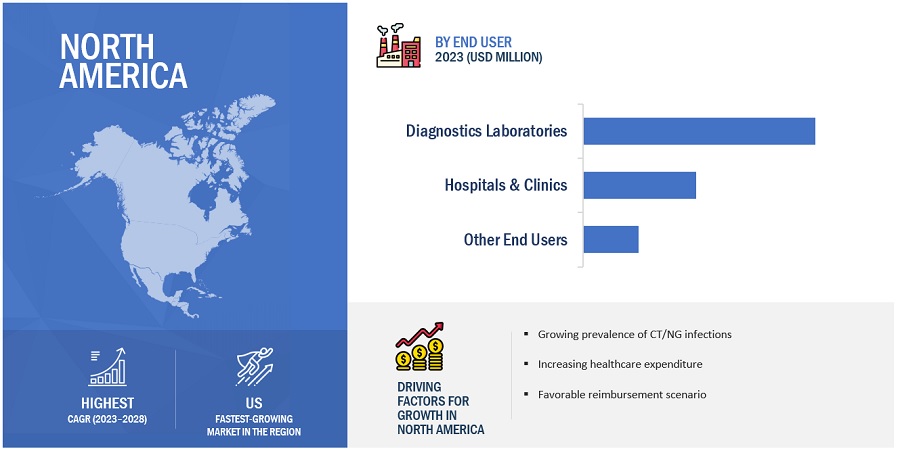

North America accounted for the largest share of the CT/NG testing industry in 2022

The CT/NG testing market is segmented into five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America emerged as the leading contributor, claiming the largest portion of the market share in the CT/NG testing industry. North America has been at the forefront of technological advancements in the field of diagnostics. The region has a robust infrastructure for R&D, which has led to the rapid adoption of innovative diagnostic techniques and platforms. Also, North America houses several major companies operating in the CT/NG testing sector. These companies have significant expertise, resources, and established distribution networks, which contribute to the region's market dominance. Examples of prominent CT/NG testing companies in North America include Hologic, Inc. (US), PerkinElmer, Inc. (US), Abbott Laboratories (US), and Thermo Fisher Scientific Inc. (US).

To know about the assumptions considered for the study, download the pdf brochure

The major players in CT/NG Testing Market are F. Hoffmann-La Roche Ltd. (Switzerland), Hologic, Inc. (US), Thermo Fisher Scientific Inc. (US), Abbott Laboratories (US), Bio-Rad Laboratories, Inc. (US), Siemens Healthineers AG (Germany), Danaher (US), Becton, Dickinson and Company (US). The market leadership of these players stems from their comprehensive product portfolios and expanding global footprint. These dominant market players possess several advantages, including strong marketing and distribution networks, substantial research and development budgets, and well-established brand recognition.

Scope of the CT/NG Testing Industry

|

Report Metric |

Details |

|

Market Revenue by 2023 |

$1.7 billion |

|

Projected Revenue by 2028 |

$2.7 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 8.6% |

|

Market Driver |

Increasing investments and funding to drive market growth |

|

Market Opportunity |

Growing opportunities in emerging countries |

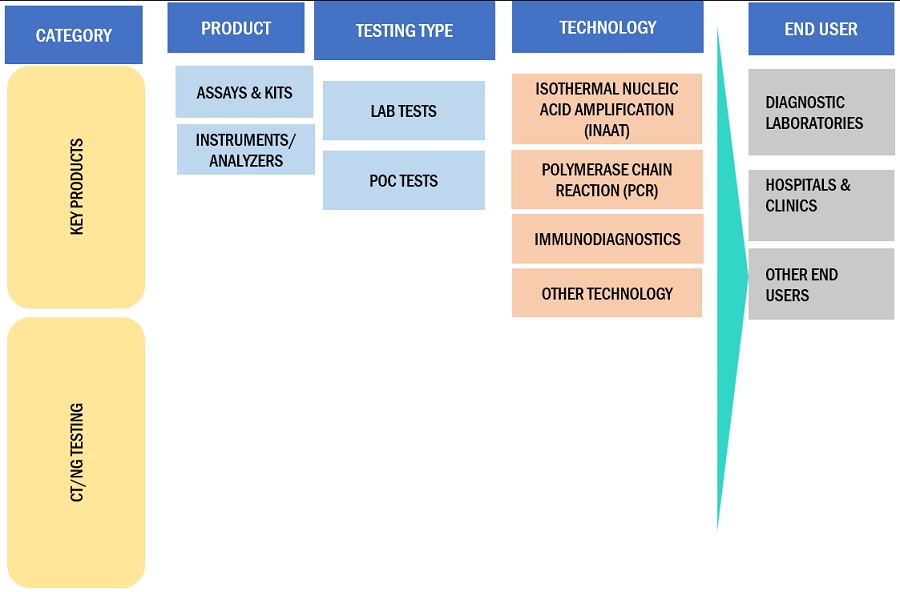

This report categorizes the CT/NG testing market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Assays & Kits

- Instruments/Analyzers

By Testing Type

- Lab Tests

- PoC Tests

By Technology

- Isothermal Nucleic Acid Amplification Technology

- Polymerase Chain Reaction

- Immunodiagnostics

- Other Technologies

By End User

- Diagnostic Laboratories

- Hospitals & Clinics

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments in CT/NG Testing Industry

- In February 2023, Thermo Fisher Scientific Inc. (US) acquired TIB Molbiol (Germany), to expand its PCR test portfolio with a wide range of assays for infectious diseases.

- In May 2022, Hologic, Inc. (US) acquired Diagenode (US), a developer and manufacturer of molecular diagnostic assays and epigenetics products. This acquisition will further strengthen the company’s molecular diagnostics business by expanding its international capabilities and improving its regional time-to-market.

- In December 2021, Hologic, Inc. (US) launched Panther Trax for high-volume molecular testing.

- In September 2020, QIAGEN (Netherlands) Acquired NeuMoDx Molecular (US) to expand QIAGEN’s portfolio of automated molecular testing solutions based on the proven PCR technology

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global CT/NG testing market?

The global CT/NG testing market boasts a total revenue value of $2.7 billion by 2028.

What is the estimated growth rate (CAGR) of the global CT/NG testing market?

The global CT/NG testing market has an estimated compound annual growth rate (CAGR) of 8.6% and a revenue size in the region of $1.7 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing prevalence of CT/NG infections- Increasing investments and initiatives in CT/NG- Growing awareness of early disease diagnosis in emerging economiesRESTRAINTS- Unfavorable reimbursement scenario for diagnostic companies- High cost of instruments and lack of budget for small laboratories and physicians’ officesOPPORTUNITIES- Growth opportunities in emerging economiesCHALLENGES- Changing regulatory landscape in European Union and US- Operational barriers and shortage of skilled laboratory technicians

- 5.3 PRICING ANALYSIS

-

5.4 PATENT ANALYSISLIST OF KEY PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM MARKET MAPCT/NG TESTING MARKET: ROLE IN ECOSYSTEM

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- IndiaLATIN AMERICA- Brazil- MexicoMIDDLE EASTAFRICA

-

5.10 TRADE ANALYSISTRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS

- 5.11 PESTLE ANALYSIS

- 5.12 TECHNOLOGY ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND REVENUE POCKETS FOR CT/NG TESTING PRODUCT MANUFACTURERSREVENUE SHIFT IN CT/NG TESTING MARKET

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ASSAYS AND KITSRECURRENT REQUIREMENT AND PURCHASE OF ASSAYS AND KITS TO DRIVE GROWTH

-

6.3 INSTRUMENTS/ANALYZERSINCREASING NEED FOR FASTER AND MORE ACCURATE TEST RESULTS TO BOOST GROWTH

- 7.1 INTRODUCTION

-

7.2 LABORATORY TESTINGADVANCEMENTS IN DIAGNOSTIC TECHNOLOGIES AND INCREASING FOCUS ON EARLY DISEASE DETECTION TO DRIVE GROWTH

-

7.3 POINT-OF-CARE TESTINGFASTER TURNAROUND TIME TO DRIVE GROWTH

- 8.1 INTRODUCTION

-

8.2 PCRGROWING USE OF PCR IN PROTEOMICS AND GENOMICS TO DRIVE GROWTH

-

8.3 INAATCOST-BENEFITS OF INAAT TO DRIVE GROWTH

-

8.4 IMMUNODIAGNOSTICSRISING PREVALENCE OF CT/NG AND DEMAND FOR RAPID DIAGNOSTIC KITS TO DRIVE GROWTH

- 8.5 OTHER TECHNOLOGIES

- 9.1 INTRODUCTION

-

9.2 DIAGNOSTIC LABORATORIESAVAILABILITY OF WIDE RANGE OF TEST PANELS FOR DISEASE TESTING TO SUPPORT GROWTH

-

9.3 HOSPITALS AND CLINICSINCREASING NUMBER OF HOSPITALS TO DRIVE GROWTH

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT: NORTH AMERICAUS- Growing prevalence of infectious diseases to drive marketCANADA- Rising government initiatives to propel market growth in coming years

-

10.3 EUROPERECESSION IMPACT: EUROPEGERMANY- Increasing healthcare expenditure to drive market growthUK- Growing number of accredited diagnostic laboratories to propel market growthFRANCE- Rising R&D expenditure in France to drive market growthITALY- Adoption of advanced diagnostic technologies to favor growthSPAIN- Growing demand for diagnostic testing in Spain to favor market growthREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT: ASIA PACIFICCHINA- Growing public access to modern healthcare to drive market growthJAPAN- Universal healthcare reimbursement policy to drive market growth in JapanINDIA- Increasing private and public investments in country’s healthcare system to drive market growthREST OF ASIA PACIFIC

-

10.5 LATIN AMERICAIMPROVING HEALTHCARE INFRASTRUCTURE TO DRIVE GROWTH OF CT/NG TESTING MARKET IN LATIN AMERICARECESSION IMPACT: LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICALACK OF SKILLED RESOURCES TO RESTRICT MARKET GROWTHRECESSION IMPACT: MIDDLE EAST & AFRICA

- 11.1 OVERVIEW

-

11.2 STRATEGIES OF KEY PLAYERSOVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN CT/NG TESTING MARKET

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

-

11.4 MARKET SHARE ANALYSISCT/NG TESTING MARKET

-

11.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

11.7 COMPETITIVE BENCHMARKINGPRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSF. HOFFMANN-LA ROCHE LTD- Business overview- Products offered- Recent developments- MnM viewHOLOGIC, INC.- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products offered- Recent developments- MnM viewABBOTT LABORATORIES- Business overview- Products offered- Recent developments- MnM viewPERKINELMER, INC.- Business overview- Products offered- Recent developments- MnM viewQIAGEN- Business overview- Products offered- Recent developmentsSIEMENS HEALTHINEERS AG- Business overview- Products offeredDANAHER- Business overview- Products offered- Recent developmentsBECTON, DICKINSON AND COMPANY- Business overview- Products offeredBIO-RAD LABORATORIES, INC.- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSSEEGENE, INC.MERIDIAN BIOSCIENCEGENETIC SIGNATURESELITECHGROUPMOLBIO DIAGNOSTICS PVT. LTD.BINX HEALTH, INC.VISBY MEDICAL, INC.GENEPROOF A.S.BIONEER CORPORATIONMICROBIOLOGICSSANSURE BIOTECH, INC.VIRCELLOPERONTIANLONGGOFFIN MOLECULAR TECHNOLOGIES

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE OF CT/NG TESTING PRODUCTS (2023)

- TABLE 2 CT/NG TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: CLASSIFICATION OF DEVICES

- TABLE 8 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 9 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 CT/NG TESTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2023–2024

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CT/NG TESTING PRODUCTS

- TABLE 13 KEY BUYING CRITERIA FOR CT/NG TESTING PRODUCTS

- TABLE 14 CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 15 KEY ASSAYS AND KITS OFFERED BY MARKET PLAYERS

- TABLE 16 CT/NG TESTING MARKET FOR ASSAYS AND KITS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 KEY INSTRUMENTS/ANALYZERS OFFERED BY MARKET PLAYERS

- TABLE 18 CT/NG TESTING MARKET FOR INSTRUMENTS/ANALYZERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 20 CT/NG TESTING MARKET FOR LABORATORY TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 CT/NG TESTING MARKET FOR POINT-OF-CARE TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 23 CT/NG TESTING MARKET FOR PCR, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 CT/NG TESTING MARKET FOR INAAT, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 CT/NG TESTING MARKET FOR IMMUNODIAGNOSTICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 CT/NG TESTING MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 28 CT/NG TESTING MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 CT/NG TESTING MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 CT/NG TESTING MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 CT/NG TESTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: CT/NG TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 37 US: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 38 US: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 39 US: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 40 US: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 41 CANADA: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 42 CANADA: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 43 CANADA: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 44 CANADA: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: CT/NG TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 48 EUROPE: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 49 EUROPE: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 50 GERMANY: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 51 GERMANY: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 52 GERMANY: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 53 GERMANY: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 54 UK: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 55 UK: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 56 UK: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 57 UK: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 58 FRANCE: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 59 FRANCE: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 60 FRANCE: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 61 FRANCE: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 ITALY: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 63 ITALY: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 64 ITALY: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 65 ITALY: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 66 SPAIN: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 67 SPAIN: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 68 SPAIN: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 69 SPAIN: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 70 REST OF EUROPE: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 71 REST OF EUROPE: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 72 REST OF EUROPE: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 73 REST OF EUROPE: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: CT/NG TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 CHINA: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 80 CHINA: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 81 CHINA: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 82 CHINA: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 JAPAN: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 84 JAPAN: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 85 JAPAN: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 86 JAPAN: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 INDIA: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 88 INDIA: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 89 INDIA: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 90 INDIA: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 LATIN AMERICA: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 96 LATIN AMERICA: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 97 LATIN AMERICA: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 98 LATIN AMERICA: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: CT/NG TESTING MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: CT/NG TESTING MARKET, BY TESTING TYPE, 2021–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: CT/NG TESTING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: CT/NG TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 103 OVERVIEW OF STRATEGIES DEPLOYED BY KEY CT/NG TESTING PRODUCTS MANUFACTURING COMPANIES

- TABLE 104 CT/NG TESTING MARKET: DEGREE OF COMPETITION

- TABLE 105 CT/NG TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 106 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 107 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 108 CT/NG TESTING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 109 KEY PRODUCT LAUNCHES AND REGULATORY APPROVALS

- TABLE 110 KEY DEALS

- TABLE 111 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 112 HOLOGIC, INC.: BUSINESS OVERVIEW

- TABLE 113 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- TABLE 114 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 115 PERKINELMER, INC.: BUSINESS OVERVIEW

- TABLE 116 QIAGEN: BUSINESS OVERVIEW

- TABLE 117 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

- TABLE 118 DANAHER: BUSINESS OVERVIEW

- TABLE 119 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 120 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- FIGURE 1 CT/NG TESTING MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

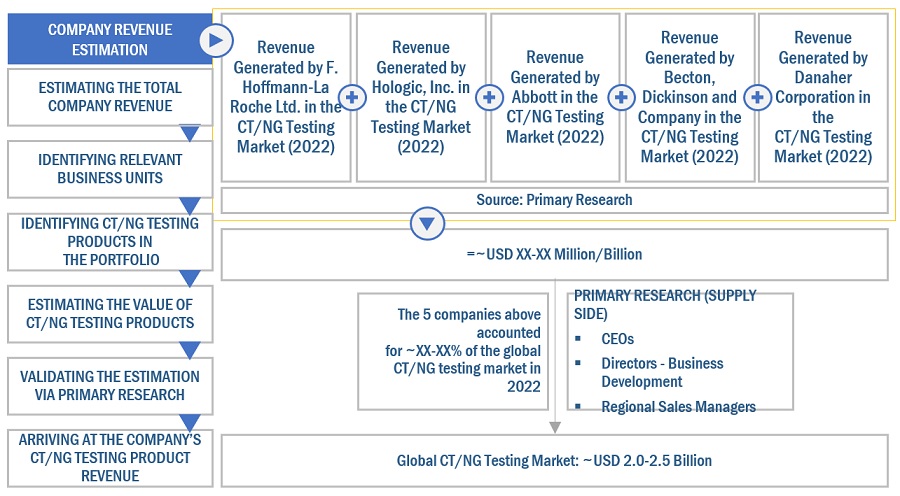

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

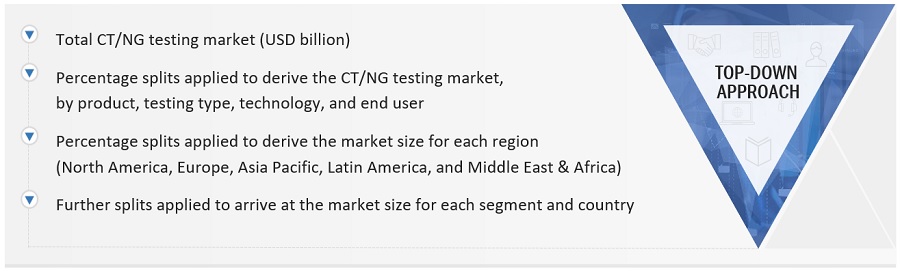

- FIGURE 6 CT/NG TESTING MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 CT/NG TESTING MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 CT/NG TESTING MARKET, BY TESTING TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 CT/NG TESTING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 CT/NG TESTING MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 CT/NG TESTING MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 INCREASING PREVALENCE OF CT/NG INFECTIONS TO DRIVE MARKET

- FIGURE 14 ASSAYS AND KITS SEGMENT TO DOMINATE CT/NG TESTING MARKET IN 2028

- FIGURE 15 LABORATORY TESTING SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 16 PCR SEGMENT TO DOMINATE CT/NG TESTING MARKET DURING STUDY PERIOD

- FIGURE 17 DIAGNOSTIC LABORATORIES SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 18 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE IN CT/NG TESTING MARKET DURING FORECAST PERIOD

- FIGURE 19 CT/NG TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 PATENT ANALYSIS FOR ISOTHERMAL NUCLEIC ACID AMPLIFICATION TECHNOLOGIES (JANUARY 2013–DECEMBER 2022)

- FIGURE 21 VALUE CHAIN ANALYSIS OF CT/NG TESTING MARKET: MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASES

- FIGURE 22 CT/NG TESTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 CT/NG TESTING MARKET: ECOSYSTEM MARKET MAP

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CT/NG TESTING PRODUCTS

- FIGURE 25 KEY BUYING CRITERIA FOR CT/NG TESTING PRODUCTS

- FIGURE 26 NORTH AMERICA: CT/NG TESTING MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: CT/NG TESTING MARKET SNAPSHOT

- FIGURE 28 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN CT/NG TESTING MARKET

- FIGURE 29 CT/NG TESTING MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 30 CT/NG TESTING MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 31 CT/NG TESTING MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 32 PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS OF TOP PLAYERS

- FIGURE 33 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 34 HOLOGIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 35 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 36 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 37 PERKINELMER, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 QIAGEN: COMPANY SNAPSHOT (2022)

- FIGURE 39 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2022)

- FIGURE 40 DANAHER: COMPANY SNAPSHOT (2022)

- FIGURE 41 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 42 BIO-RAD LABORATORIES: COMPANY SNAPSHOT (2022)

The objective of the study is analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies developments such as acquisitions, product launches, expansions, agreements and partnerships of the leading players, the competitive landscape of the CT/NG testing market to analyzes market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were use to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

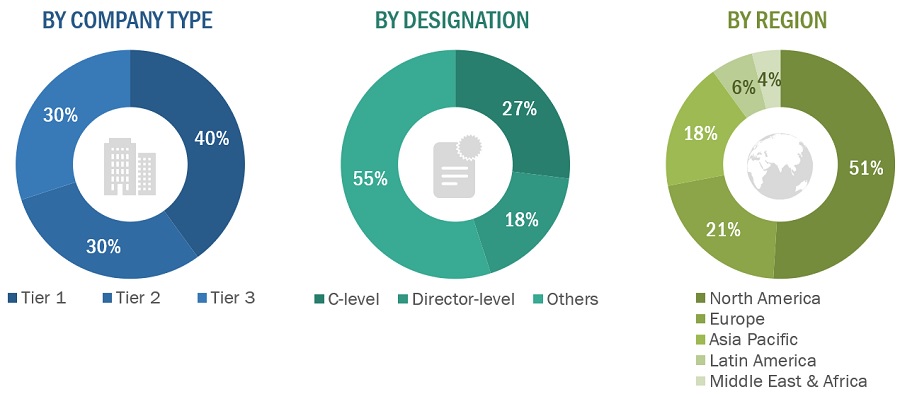

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Abbott |

Marketing Manager |

|

F. Hoffmann-La Roche Ltd |

Senior Product Manager |

|

Danaher |

Marketing Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the CT/NG testing market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the CT/NG testing market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global CT/NG testing Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global CT/NG testing market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Chlamydia trachomatis/Neisseria gonorrhoeae (CT/NG) infections are the most common sexually transmitted diseases (STDs) worldwide. CT/NG testing is a technique used to identify and analyze nucleic acids at a molecular level using molecular diagnostics and immunodiagnostics methods. This technique assesses an individual’s genetic makeup to identify a predisposition to the disease or condition and diagnose it.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global CT/NG testing market, by product, testing type, technology, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall CT/NG testing market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

MarketsandMarkets offers the following customizations for this market report

Country Information

- Additional country-level analysis of the CT/NG testing market

Company profiles

- Additional five company profiles of players operating in the CT/NG testing market.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the CT/NG testing market

Growth opportunities and latent adjacency in CT/NG Testing Market