Cryotherapy Market by Product (Cryosurgery Devices, Localized Cryotherapy Devices, Cryosaunas), Application (Surgical Application, Pain Management, Health & Beauty), End User (Hospitals & Specialty Clinics, Spas) - Global Forecast to 2024

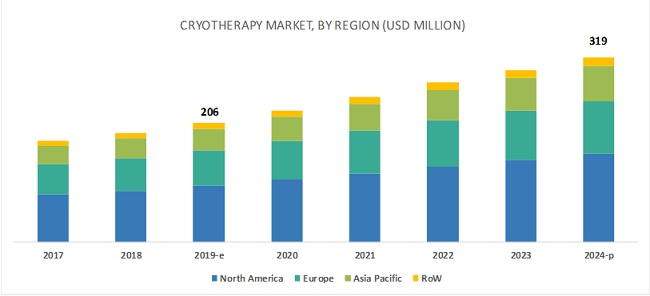

The Cryotherapy Market is projected to reach USD 319 million by 2024, at a CAGR of 9.1%. Growth in the cryotherapy market is primarily driven by factors such as the growing incidences of sports injuries, cardiac diseases, & cancers, and technological advancements in cryotherapy technology.

Cryotherapy Market Dynamics

Driver: Technological Advancements in cryotherapy equipment

Cryotherapy has become an important treatment option, mainly due to the various technological innovations and advancements in cryotherapy equipment over the years. Developments have been observed in various equipment, including cryosurgery units and accessories. Cryochambers and cryosaunas, which are widely used in the treatment of inflammation, rheumatoid arthritis, and pain management, along with general beauty and wellness therapies, have also undergone developmental enhancements. Moreover, cryosurgical equipment has also witnessed significant developments such as the use of supercooled liquid nitrogen or other cryogens for cooling, the introduction of thin and efficient probes which are available in several sizes, and the use of narrow and improved cryoablation needles. For instance, in September 2018, Galil Medical launched the ICEfx cryoablation system, an upgradation to the firms existing Visual ICE system. The new system features an advanced needle platform with helium-free thaw capability, to accelerate thaw-time while eliminating the cost of helium. It is also compact, easily mobilized and simplifies the procedure through a set of user-friendly on-screen prompts.

Restraint: Limited access to cryotherapy and lack of awareness

Cryotherapy remains limited to very few geographic regions. The extent of cryotherapy practices is majorly limited to North America and Europe, with few other countries like Japan, China, and Australia witnessing any developments in this field, mainly due to lack of awareness. Even though it is found to be safer and less-painful than highly invasive surgical procedures, it is generally utilized only for surgical treatments on a large scale. According to the “International Patient Survey: Ledderhose disease,” patients found cryotherapy to be a more effective treatment option but less available than conventional methods. The US NIH National Cancer Institute asserts that although cryosurgery may widely be available for the treatment of cervical neoplasias, a very limited number of hospitals and cancer centers throughout the US house the necessary technology to perform cryosurgery for other noncancerous, precancerous, and cancerous conditions. Limited access to cryotherapy and a lack of awareness regarding its benefits and advantages may restrict market growth to a certain extent during the forecast period.

Opportunity: Growing focus on expanding cryotherapy applications

Cryotherapy is currently used as a treatment option for several medical conditions, including cancer, cardiac conditions, and dermatological conditions. Partial and whole-body cryotherapy is used as a therapy for inflammation, pain management, and soreness. Being minimally invasive and drug-free, cryotherapy is further being explored for applications in the treatment of various other medical conditions and diseases.

A study published in the US NIH National Library of Medicine (NIH/NLM) in July 2017, on the “Clinical Practice Guidelines for Cryosurgery of Pancreatic Cancer,” states that cryosurgery is less invasive, safer, and improves targeting of cancer with fewer complications. Although it is an advantageous adjuvant therapy, more research is required for its detailed analysis. Many research departments in various branches of the Florida Hospital (US) are conducting clinical trials to develop new techniques for colon and urethral cancer. Similarly, a study published in the journal Frontiers in Physiology, in May 2017, concluded that whole-body cryotherapy (WBC) is sufficiently effective in alleviating a whole set of inflammatory conditions that could affect an athlete, along with the improvement of post-exercise recovery. Thus, WBC is being perceived as a stimulating treatment with the ability to enhance the anti-inflammatory and anti-oxidant barriers and counteract harmful stimuli.

Challenge: Lack of evidence for the efficacy of whole-body cryotherapy

While whole-body cryotherapy (WBC) is widely used as a treatment option in spas, health & wellness centers, and fitness centers, the US FDA released a report in 2016 warning the public against the claims made by spas and wellness centers regarding the efficacy of WBC. While it may help in alleviating pain and speeding up recovery, the FDA is yet to ascertain whether the therapy is able to treat diseases or conditions like Alzheimer’s, fibromyalgia, migraines, rheumatoid arthritis, multiple sclerosis, and stress. On the other hand, the FDA warns, cryotherapy involving liquid nitrogen lowers the oxygen in the air, which could leave people feeling light-headed or cause a loss of consciousness. To date, the US FDA has not approved a single WBC device as a medical device.

Cryosurgery equipment, on the other hand, is used with the clearance and approval of the US FDA and other regulatory bodies. Even though most WBC devices have received European Medical Device Approval and UL (Underwriters Laboratories) listing, the chances of FDA approval for devices like cryochambers and cryosaunas seem remote, especially after the death of a 24-year-old spa worker in 2015. Such stern warnings, issued by authoritative bodies discouraging the use of whole-body cryotherapy, may challenge market growth in the coming years.

The cryosurgery devices segment is projected to grow at the highest rate during the forecast period

By product, the cryotherapy market is segmented into cryosurgery devices (tissue contact probes, tissue spray probes, and epidermal & subcutaneous cryoablation devices), localized cryotherapy devices, and cryochambers & cryosaunas. The cryosurgery devices segment is expected to witness the fastest growth during the forecast period. Advantages offered by cryosurgery, such as fewer side effects and greater affordability, are increasing its adoption. Consequently, the demand for cryotherapy devices is also growing.

Surgical applications held the largest share of the cryotherapy market

Cryotherapy is widely used for the treatment of health conditions like pain, malignant & benign tumors, tissue damages or lesions, and sports injuries. The cryotherapy applications market is segmented into surgical applications (oncology, dermatology, cardiology, and other surgical applications); pain management; and recovery, health, & beauty applications. The surgical applications segment held the largest share of the market in 2018, a trend that is expected to continue during the forecast period. The large share of this segment can be attributed to higher adoption of cryoablation for cancer treatment as well as the advantages offered by this technique over traditional surgery.

North America is expected to hold a dominant share in the cryotherapy market during the forecast period

North America held the largest share of the market in 2018 and is projected to continue to do so during the forecast period. Factors such as the growing popularity of cryotherapy, rising prevalence of cancer, increase in sports and physical activity-related injuries, and rising prevalence of CVDs are driving the North American cryotherapy market. Lately, the US has seen a growing popularity of cryotherapy among athletes and fitness & beauty enthusiasts, leading to many professional and collegiate training departments installing cryosauna machines at their facilities. Moreover, the Canadian Cancer Society encourages the adoption of cryosurgery/cryoablation for the treatment of various cancer conditions.

Cryotherapy Market Key Players

The major vendors in the cryotherapy market include Medtronic (Ireland), Galil Medical (US), and CooperSurgical (US). These leading players offer an expansive product portfolio for cryoablation and have a wide geographic presence. The other players in this market include Impact Cryotherapy (US), Zimmer MedizinSysteme (Germany), Metrum Cryoflex (Poland), Brymill Cryogenic Systems (UK), Erbe Elektromedizin (Germany), CryoConcepts (US), US Cryotherapy (US), Professional Products (US), and Kriosystem Life (Poland).

Cryotherapy Market Scope

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Application, End User, and Region |

|

Geographies covered |

North America (US & Canada), Europe (UK, Germany, Poland, RoE), APAC, RoW |

|

Companies covered |

Medtronic (Ireland), Galil Medical (US), and CooperSurgical (US). Major 12 players covered. |

This research report categorizes the cryotherapy market based on product, application, end user, and region.

By Product

-

Cryosurgery Devices

- Tissue Contact Probes

- Tissue Spray Probes

- Epidermal and Subcutaneous Cryoablation Devices

- Localized Cryotherapy Devices

- Cryochambers & Cryosaunas

By Application

-

Surgical Applications

- Oncology

- Cardiology

- Dermatology

- Other Surgical Applications

- Pain Management

- Recovery, Health, and Beauty

By End User

- Hospitals & Specialty Clinics

- Cryotherapy Centers

- Spas & Fitness Centers

By Region

- North America

- US

- Canada

- Europe

- Germany

- Poland

- UK

- RoE

- Asia Pacific

- Rest of the World

Recent Developments

- In 2019, Medtronic collaborated with Phillips (Netherlands) to facilitate the sale of products on behalf of Philips to provide an innovative, integrated image guidance solution for cryoablation procedures, for the advance treatment of paroxysmal atrial fibrillation (PAF), a common heart rhythm disorder.

- Kriosystem Life was the official supplier of cryotherapy devices for The World Games 2017, held in Wroclaw, Poland.

Frequently Asked Questions (FAQs):

What is the size of Cryotherapy Market?

The Cryotherapy Market is projected to reach USD 319 million by 2024, at a CAGR of 9.1%.

What are the major growth factors of Cryotherapy Market?

Growth in the cryotherapy market is primarily driven by factors such as the growing incidences of sports injuries, cardiac diseases, & cancers, and technological advancements in cryotherapy technology.

Who all are the prominent players of Cryotherapy Market?

The major vendors in the cryotherapy market include Medtronic (Ireland), Galil Medical (US), and CooperSurgical (US). These leading players offer an expansive product portfolio for cryoablation and have a wide geographic presence. The other players in this market include Impact Cryotherapy (US), Zimmer MedizinSysteme (Germany), Metrum Cryoflex (Poland), Brymill Cryogenic Systems (UK), Erbe Elektromedizin (Germany), CryoConcepts (US), US Cryotherapy (US), Professional Products (US), and Kriosystem Life (Poland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Market Scope

1.2.2 Markets Covered

1.2.3 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Research Methodology Steps

2.2.1 Secondary Data

2.2.1.1 Secondary Sources

2.2.2 Primary Data

2.2.2.1 Primary Sources

2.2.2.2 Key Insights From Primary Sources

2.3 Market Size Estimation Methodology

2.4 Market Data Estimation and Triangulation

2.5 Assumptions of the Study

3 Executive Summary

4 Premium Insights

4.1 Cryotherapy: Market Overview

4.2 Europe: Cryotherapy Market, By Product (2018)

4.3 Cryotherapy Market Share, By Application, 2019 vs 2024

4.4 Cryotherapy Market Share, By Product, 2019 vs 2024

4.5 Cryotherapy Market Share, By End User, 2019 vs 2024

4.6 Geographical Snapshot of the Cryotherapy Market

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Minimally Invasive/Non-Invasive Procedures

5.2.1.2 Growing Incidence of Sports Injuries, Cancer, and Cardiac Conditions

5.2.1.3 Technological Advancements in Cryotherapy Equipment

5.2.1.4 Growing Popularity in the Beauty, Wellness, and Fitness Industries

5.2.2 Restraints

5.2.2.1 Limited Access to Cryotherapy and Lack of Awareness

5.2.3 Opportunities

5.2.3.1 Growing Focus on Expanding Cryotherapy Applications

5.2.4 Challenges

5.2.4.1 Hazardous Effects of Cryogenic Gases

5.2.4.2 Lack of Evidence for the Efficacy of Whole-Body Cryotherapy

6 Cryotherapy Market, By Product

6.1 Introduction

6.2 Cryosurgery Devices

6.2.1 Tissue Contact Probes

6.2.2 Tissue Spray Probes

6.2.3 Epidermal & Subcutaneous Cryoablation Devices

6.3 Localized Cryotherapy Devices

6.4 Cryochambers & Cryosaunas

7 Cryotherapy Market, By Application

7.1 Introduction

7.2 Surgical Applications

7.2.1 Oncology

7.2.2 Dermatology

7.2.3 Cardiology

7.2.4 Other Surgical Applications

7.3 Pain Management

7.4 Recovery, Health, and Beauty Applications

8 Cryotherapy Market, By End User

8.1 Introduction

8.2 Hospitals & Specialty Clinics

8.3 Cryotherapy Centers

8.4 Spas & Fitness Centers

9 Cryotherapy Market, By Region

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.2.1.2 US: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.2.1.3 US: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.2.1.4 US: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.2.1.5 US: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.2.2 Canada

9.2.2.1 Canada: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.2.2.2 Canada: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.2.2.3 Canada: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.2.2.4 Canada: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.2.2.5 Canada: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.3.1.2 Germany: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.3.1.3 Germany: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.3.1.4 Germany: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.3.1.5 Germany: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.3.2 Poland

9.3.2.1 Poland: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.3.2.2 Poland: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.3.2.3 Poland: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.3.2.4 Poland: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.3.2.5 Poland: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.3.3 UK

9.3.3.1 UK: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.3.3.2 UK: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.3.3.3 UK: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.3.3.4 UK: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.3.3.5 UK: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.3.4 France

9.3.4.1 France: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.3.4.2 France: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.3.4.3 France: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.3.4.4 France: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.3.4.5 France: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.3.5 Spain

9.3.5.1 Spain: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.3.5.2 Spain: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.3.5.3 Spain: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.3.5.4 Spain: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.3.5.5 Spain: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.3.6 Italy

9.3.6.1 Italy: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.3.6.2 Italy: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.3.6.3 Italy: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.3.6.4 Italy: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.3.6.5 Italy: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.3.7 Rest of Europe (RoE)

9.3.7.1 RoE: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.3.7.2 RoE: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.3.7.3 RoE: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.3.7.4 RoE: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.3.7.5 RoE: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Japan: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.4.1.2 Japan: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.4.1.3 Japan: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.4.1.4 Japan: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.4.1.5 Japan: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.4.2 Rest of Asia Pacific

9.4.2.1 Rest of Asia Pacific: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.4.2.2 Rest of Asia Pacific: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.4.2.3 Rest of Asia Pacific: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.4.2.4 Rest of Asia Pacific: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.4.2.5 Rest of Asia Pacific: Cryotherapy Market, By End User, 2017–2024 (USD Million)

9.5 Rest of the World (RoW)

9.5.1 Rest of the World: Cryotherapy Market, By Product, 2017–2024 (USD Million)

9.5.2 Rest of the World: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

9.5.3 Rest of the World: Cryotherapy Market, By Application, 2017–2024 (USD Million)

9.5.4 Rest of the World: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

9.5.5 Rest of the World: Cryotherapy Market, By End User, 2017–2024 (USD Million)

10 Competitive Landscape

10.1 Introduction

10.2 Market Ranking Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Competitive Scenario

10.4.1 Product Launches

10.4.2 Product Launches & Deployments

10.4.3 Partnerships and Collaborations

11 Company Profiles

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Medtronic

11.1.1 Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Impact Cryotherapy

11.2.1 Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Zimmer Medizinsysteme

11.3.1 Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Metrum Cryoflex

11.4.1 Overview

11.4.2 Products Offered

11.4.3 SWOT Analysis

11.4.4 MnM View

11.5 Brymill Cryogenic Systems

11.5.1 Overview

11.5.2 Products Offered

11.5.3 SWOT Analysis

11.5.4 MnM View

11.6 Galil Medical (A Subsidiary of BTG PLC)

11.6.1 Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 MnM View

11.7 Coopersurgical (A Subsidiary of the Cooper Companies)

11.7.1 Overview

11.7.2 Products Offered

11.7.3 MnM View

11.8 ryoconcepts LP

11.8.1 Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 MnM View

11.9 Kriosystem Life

11.9.1 Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.9.4 MnM View

11.10 US Cryotherapy

11.10.1 Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.10.4 MnM View

11.11 Professional Products

11.11.1 Overview

11.11.2 Products Offered

11.11.3 MnM View

11.12 Erbe Elektromedizin

11.12.1 Overview

11.12.2 Products Offered

11.12.3 MnM View

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (112 Tables)

Table 1 Technologically Advanced Product Launches in Cryotherapy Equipment

Table 2 Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 3 Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 4 Cryosurgery Devices Market, By Region, 2017–2024 (USD Million)

Table 5 Tissue Contact Probes Market, By Region, 2017–2024 (USD Million)

Table 5 Tissue Contact Probes Market, By Application, 2017–2024 (USD Million)

Table 5 Tissue Contact Probes Market, By End User, 2017–2024 (USD Million)

Table 6 Tissue Spray Probes Market, By Region, 2017–2024 (USD Million)

Table 7 Tissue Spray Probes Market, By Application, 2017–2024 (USD Million)

Table 8 Tissue Spray Probes Market, By End User, 2017–2024 (USD Million)

Table 9 Epidermal and Subcutaneous Cryoablation Devices Market, By Region, 2017–2024 (USD Million)

Table 10 Epidermal and Subcutaneous Cryoablation Devices Market, By Application, 2017–2024 (USD Million)

Table 11 Epidermal and Subcutaneous Cryoablation Devices Market, By End User, 2017–2024 (USD Million)

Table 12 Localized Cryotherapy Devices Market, By Region, 2017–2024 (USD Million)

Table 13 Localized Cryotherapy Devices Market, By Application, 2017–2024 (USD Million)

Table 14 Localized Cryotherapy Devices Market, By End User, 2017–2024 (USD Million)

Table 15 Cryochambers & Cryosaunas Market, By Region, 2017–2024 (USD Million)

Table 16 Cryochambers & Cryosaunas Market, By Application, 2017–2024 (USD Million)

Table 17 Cryochambers & Cryosaunas Market, By End User, 2017–2024 (USD Million)

Table 18 Cryotherapy Market, By Application, 2017–2024 (USD Million

Table 19 Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 20 Cryotherapy Market for Surgical Applications, By Region, 2017–2024 (USD Million)

Table 21 Cryotherapy Market for Oncology, By Region, 2017–2024 (USD Million)

Table 22 Cryotherapy Market for Dermatology, By Region, 2017–2024 (USD Million)

Table 23 Cryotherapy Market for Cardiology, By Region, 2017–2024 (USD Million)

Table 24 Cryotherapy Market for Other Surgical Applications, By Region, 2017–2024 (USD Million)

Table 25 Cryotherapy Market for Pain Management, By Region, 2017–2024 (USD Million)

Table 26 Cryotherapy Market for Recovery, Health, & Beauty Applications, By Region, 2017–2024 (USD Million)

Table 27 Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 28 Cryotherapy Market for Hospitals & Specialty Clinics, By Region, 2017–2024 (USD Million)

Table 29 Cryotherapy Centers Market, By Region, 2017–2024 (USD Million)

Table 30 Cryotherapy Market for Spas & Fitness Centers, By Region, 2017–2024 (USD Million)

Table 31 Cryotherapy Market, By Region, 2017–2024 (USD Million)

Table 32 North America: Cryotherapy Market, By Country, 2017–2024 (USD Million)

Table 33 North America: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 34 North America: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 35 North America: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 36 North America: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 37 North America: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 38 US: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 39 US: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 40 US: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 41 US: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 42 US: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 43 Canada: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 44 Canada: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 45 Canada: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 46 Canada: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 47 Canada: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 48 Europe: Cryotherapy Market, By Country, 2017–2024 (USD Million)

Table 49 Europe: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 50 Europe: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 51 Europe: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 52 Europe: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 53 Europe: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 54 Germany: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 55 Germany: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 56 Germany: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 57 Germany: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 58 Germany: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 59 Poland: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 60 Poland: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 61 Poland: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 62 Poland: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 63 Poland: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 64 UK: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 65 UK: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 66 UK: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 67 UK: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 69 UK: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 70 France: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 71 France: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 72 France: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 73 France: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 74 UK: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 75 Spain: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 76 Spain: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 77 Spain: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 78 Spain: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 79 Spain: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 80 Italy: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 81 Italy: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 82 Italy: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 83 Italy: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 84 Italy: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 85 RoE: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 86 RoE: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 87 RoE: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 88 RoE: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 89 RoE: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 90 Asia Pacific: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 91 APAC: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 92 APAC: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 93 APAC: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 94 APAC: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 95 Japan: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 96 Japan: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 97 Japan: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 98 Japan: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 99 Japan: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 100 RoAPAC: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 101 RoAPAC: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 102 RoAPAC: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 103 RoAPAC: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 104 RoAPAC: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 105 RoW: Cryotherapy Market, By Product, 2017–2024 (USD Million)

Table 106 RoW: Cryosurgery Devices Market, By Type, 2017–2024 (USD Million)

Table 107 RoW: Cryotherapy Market, By Application, 2017–2024 (USD Million)

Table 108 RoW: Cryotherapy Market for Surgical Applications, By Type, 2017–2024 (USD Million)

Table 109 RoW: Cryotherapy Market, By End User, 2017–2024 (USD Million)

Table 110 Product Approvals (2016–2019)

Table 111 Product Launches & Deployments (2016–2019)

Table 112 Partnerships and Collaborations (2016–2019)

List of Figures (31 Figures)

Figure 1 Research Methodology: Cryotherapy Market

Figure 2 Research Design

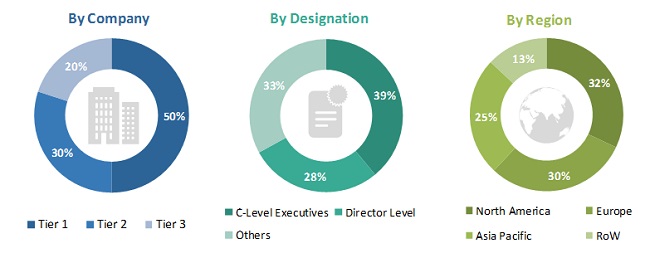

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Cryotherapy Market Share, By Product, 2018

Figure 8 Cryotherapy Market, By Application, 2019 vs 2024 (USD Million)

Figure 9 Cryotherapy Market, By End User, 2019 vs 2024 (USD Million)

Figure 10 Geographical Snapshot of the Cryotherapy Market

Figure 11 Increasing Prevalence of Cancer & Cardiac Conditions to Drive Market Growth

Figure 12 Cryosurgery Devices Accounted for the Largest Share of the European Cryotherapy Market in 2018

Figure 13 Surgical Applications Will Continue to Dominate the Cryotherapy Market in 2024

Figure 14 Cryosurgery Devices Segment to Account for the Largest Market Share in 2019

Figure 15 Hospitals & Specialty Clinics are the Largest End User of the Cryotherapy Market

Figure 16 APAC to Register the Highest Growth in the Forecast Period (2019–2024)

Figure 17 Cryotherapy Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Cryosurgery Devices to Command the Largest Share of the Global Cryotherapy Market in 2018

Figure 19 Epidermal & Subcutaneous Cryoablation Devices to Register the Highest Growth Rate in the Forecast Period

Figure 20 Surgical Applications Segment to Register the Highest Growth in the Forecast Period

Figure 21 Oncology Will Command the Largest Share of the Global Cryotherapy Market for Surgical Applications in 2018

Figure 22 Hospitals & Specialty Clinics Segment Will Continue to Dominate the Cryotherapy Market in 2024

Figure 23 North America Dominates the Cryotherapy Market During the Study Period

Figure 24 North America: Cryotherapy Market Snapshot

Figure 25 Europe: Cryotherapy Market Snapshot

Figure 26 Asia Pacific: Cryotherapy Market Snapshot

Figure 27 RoW: Cryotherapy Market Snapshot

Figure 28 Key Developments in the Cryotherapy Market, 2016-2019

Figure 29 Cryotherapy Market Ranking, 2018

Figure 30 Cryotherapy Market (Global) Competitive Leadership Mapping, 2018

Figure 31 Medtronic: Company Snapshot (2018)

The study involved four major activities to estimate the current size of the cryotherapy market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation was used to estimate the market size of segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, D&B, Bloomberg Business, and Factiva have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The cryotherapy market has several stakeholders such as ablation device manufacturing companies, portable/localized cryotherapy device manufacturing companies, cryosauna & cryochamber manufacturing companies, cryotherapy centers, spas, wellness, and health centers, healthcare institutions (hospitals, medical schools, group practices, individual surgeons, and governing bodies), medical device vendors/service providers, research institutes, market research companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following the breakdown of primary respondents –

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cryotherapy market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the cryotherapy industry.

Report Objectives

- To define, describe, and forecast the cryotherapy market on the basis of product, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches & approvals; partnerships & collaborations; and acquisitions in the cryotherapy market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global cryotherapy market report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cryotherapy Market