Cross-Border E-Commerce Logistics Software Market - Global Forecast to 2029

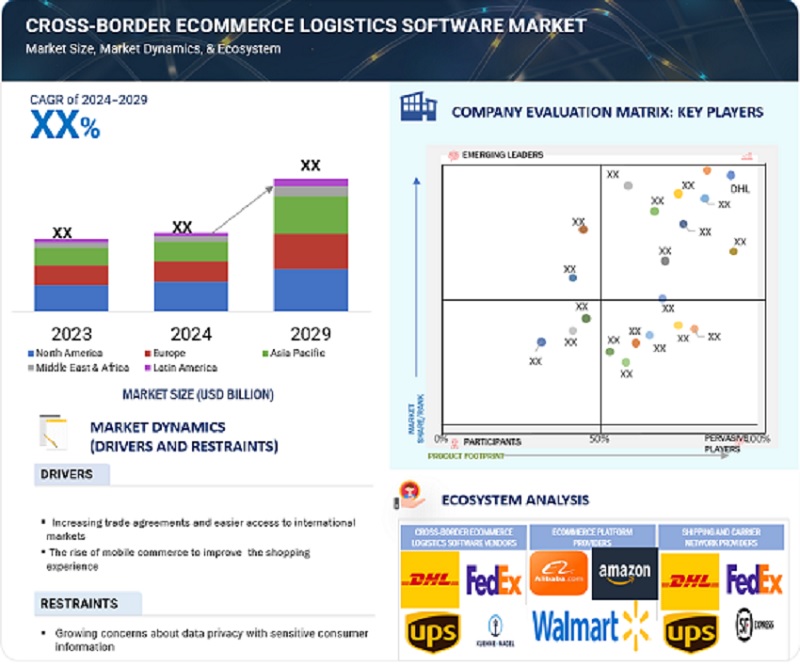

The cross-border e-commerce logistics software market will grow from USD xx billion in 2024 to USD xx billion by 2029 at a compounded annual growth rate (CAGR) of xx% during the forecast period. The increasing globalization and adoption of online retail, driven by consumer demand for foreign goods and more seamless shopping experiences, is driving the adoption of cross-border e-commerce logistics software. The growing adoption of AI, machine learning, and predictive analytics applications helps provide more accurate demand forecasts and delivery time estimates. In addition, businesses are also searching for eco-friendly solutions, such as carbon-neutral shipping and improved route planning, to meet regulatory requirements and achieve sustainability.

The advancements in software capabilities to meet omnichannel logistics demand include unified inventory management across physical stores and online platforms. The cross-border e-commerce logistics software transforms the logistics industry by offering real-time visibility, optimized inventory management, route planning, and delivery schedules across supply chains. These trends reflect the growing adoption of the cross-border e-commerce logistics software market during the forecast period.

Global Cross-Border E-commerce Logistics Software Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

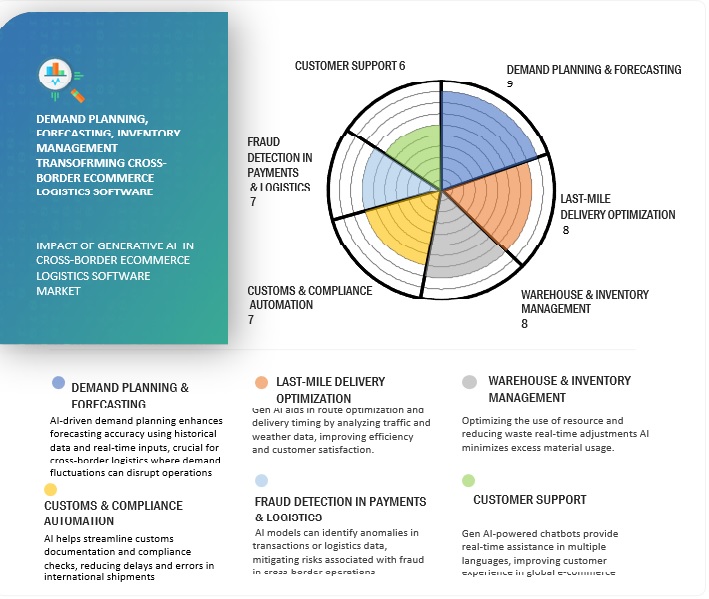

Impact of Gen AI on the Cross-Border E-commerce Logistics Software Market

Cross-Border E-commerce Logistics Software Market Dynamics

Driver: The rise of mobile commerce to improve the shopping experience

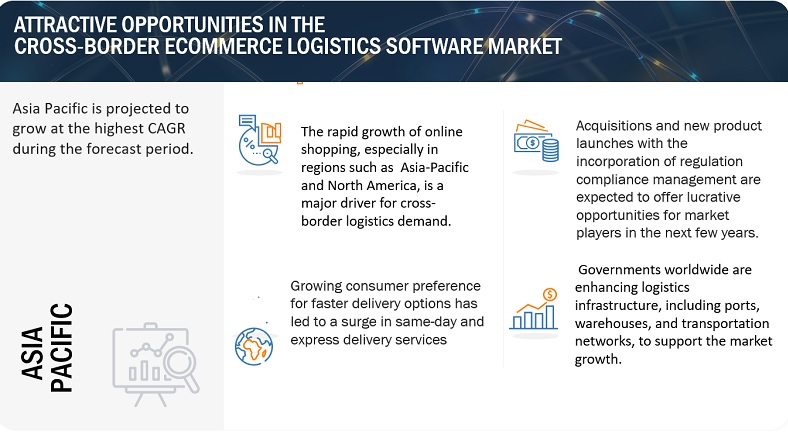

The expansion of the cross-border e-commerce software market is driven by mobile commerce, which changes how consumers and businesses conduct international trade. With better penetration of smartphones and improved access to mobile internet worldwide, mobile commerce has become a leading online shopper within no time. Cross-border e-commerce is growing as mobile devices allow users to shop anywhere and access international markets more easily. This trend has necessitated specialized logistics software for managing specific demands that m-commerce-driven global transactions pose.

M-commerce provides easy access to international e-commerce sites, thus enhancing cross-border sales. The potential for cross-border sales is very high in emerging markets like Southeast Asia, Africa, and Latin America, where mobile-first internet users dominate. Cross-border e-commerce logistics software has a crucial role in managing international shipping, including the complexities of handling diverse shipping methods, optimizing delivery timelines, and customs compliance. For mobile-first shopping, real-time shipment tracking and mobile-friendly interfaces enhance the user experience, ensuring higher customer satisfaction and repeat business.

Restraint: Growing concerns about data privacy of sensitive consumer information

Growing concerns over data privacy and the usage of private consumer information substantially limit cross-border e-commerce logistics software market growth. This is mainly because, during cross-border transactions, the level of personal and transactional data gathered has significantly grown, including addresses, payment information, and purchase histories. Data privacy regulations, such as the General Data Protection Regulation of the EU and the California Consumer Privacy Act of the US, demand that companies be extremely cautious in their dealings with consumers' data. This often leads to increased costs in measures that guarantee data security. Advanced logistics software may be too expensive for small companies.

Opportunity: Integration with E-commerce platforms

Integrating cross-border e-commerce logistics software with popular e-commerce platforms would hold a tremendous opportunity for growth. Amazon, Shopify, eBay, and Alibaba are essential to businesses that want to reach international customers. Logistics software that can be integrated with these platforms makes cross-border operations easier. Introducing logistics software into an e-commerce platform allows for automated order fulfillment and inventory control with real-time shipment tracking. This integration knocks out manual workflows, gives fewer errors, and increases efficiencies, making it easier to scale business globally.

Moreover, The integration of the e-commerce platform enhances customer experience in business. It offers consumers several features, such as localized shipping options, dynamic tax calculations, and transparent delivery timelines, to give them trust and satisfaction. Also supported by integration are advanced analytics to help businesses learn more about international buying trends, optimize regional inventory, and refine delivery strategies.

Challenge: Integration with the legacy systems

Integration with legacy systems is one of the biggest challenges in implementing cross-border e-commerce logistics software. Most companies, especially established ones, rely on legacy infrastructure that may not be compatible with digital solutions. These older systems generally have outdated protocols, flexibility is limited, and their data architectures are fractured; hence, it becomes challenging to make them integrate seamlessly with sophisticated logistics platforms. It gets even more complicated when businesses depend on a combination of in-house and third-party systems because discrepancies in data formats and operational workflows can be significant obstacles.

Cross-border E-commerce Logistics Software Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The B2C segment will hold the most significant market share in 2024 based on the E-commerce type.

The expansion of worldwide online shopping and the need for seamless consumer experiences have encouraged the B2C market's adoption of cross-border e-commerce logistics software. By integrating features like real-time shipment tracking, support for multi-currency payments, customs compliance, and appropriate transportation networks, these solutions help organizations manage intricate global supply chains. Additionally, innovative capabilities such as AI-driven route optimization and automated documentation increase operational performance, making it an essential part of any organization looking to grow worldwide. Further, growth in digital marketplaces and direct-to-consumer business models. Businesses use these technologies to expedite last-mile delivery, address regional preferences, and reverse logistics for return. As the world becomes more global, demand for such software will increase in the B2C segment to remain ahead of the competition and build customer loyalty.

Based on verticals, the retail & consumer goods vertical will hold the largest market share in 2024.

The retail and consumer goods sector has witnessed increasing use of cross-border e-commerce logistics software driven by the ongoing growth of overseas retail business and consumer behavior changes. The markets across borders are increasingly being targeted with intensity to tap fast-rising demand for products such as fashion, electronics, and home goods. Logistics software optimizes international supply chains, allowing real-time tracking, simplifying customs procedures, and ensuring cost-effective last-mile delivery solutions. Retailers use these platforms to manage the complexity of operations, including multiple currencies, taxes, and international returns—crucial factors in offering a seamless customer experience. Logistics software will help these companies overcome challenges related to product packaging and regulatory standards across different geographies.

Based on the region, North America holds the largest market share during the forecast period.

The adoption of cross-border e-commerce logistics software continues to grow in North America due to the region's increasing emphasis on customer-centric delivery solutions and the rise of omnichannel retail tactics. These software programs are being used by businesses to expedite their cross-border shipping procedures, such as managing customs paperwork, calculating taxes and tariffs, and adhering to international trade regulations. Growing environmental concerns are pressuring North American businesses to implement sustainable business practices, such as managing their carbon footprint and using eco-friendly packaging. Additionally, companies are integrating analytics capabilities to forecast demand and optimize inventory allocations. These developments reflect the region's cross-border e-commerce logistics software growth during the forecast period.

Key Market Players

The cross-border e-commerce logistics software market is dominated by a few globally established players such as DHL (Germany), FedEx (US), UPS (US), Alibaba Group (China), Maersk (Germany), DB Schenker (Germany), SF Express (China), Kuehne + Nagel Management AG (Switzerland), Yamato Transport (Japan), ShipBob (US), Onfleet (US), CEVA Logistics (France), C.H. Robinson (US), XPO Logistics (US), among others, are the key vendors that secured cross-border e-commerce logistics software market in last few years.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2019-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Service Type, Delivery Type, Delivery Mode, E-commerce Type, organization size, and vertical |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

FedEx (US), DHL (Germany), UPS (US), Alibaba Group (China), Maersk (Germany), DB Schenker (Germany), SF Express (China), Kuehne + Nagel Management AG (Switzerland), Yamato Transport (Japan), ShipBob (US), Onfleet (US), CEVA Logistics (France) C.H. Robinson (US), XPO Logistics (US), among others. |

Recent Developments:

- In September 2024, DHL Global Forwarding, a freight company of DHL Group, introduced cross-border e-commerce solutions to offer cross-border shipping from China to different parts of the globe with varying levels of service and features such as integrated tracking system and visibility to meet the peak demand ahead of the holiday season.

- In June 2024, FedEx launched two new cross-border e-commerce handbooks to help SMEs understand the digital landscape and customer expectations to expand their business in China and Japan.

- In November 2024, Alibaba Group announced the formation of the new Alibaba E-Commerce Business Group, integrating several e-commerce businesses under one umbrella. The latest business group will drive significant synergies across global supply chains and support merchant growth opportunities with expanded market access and success in China and beyond.

- In March 2024, Kuehne+Nagel announced the acquisition of City Zone Express, a subsidiary of the listed company Chasen Holdings Ltd, from Singapore Exchange to provide significant growth momentum for cross-border road logistics services. This has enhanced the presence of Kuehne+Nagel in Asia's logistics market and enabled it to build multiple country road transportation networks.

Frequently Asked Questions (FAQ):

What is cross-border e-commerce logistics software?

It refers to software for e-commerce logistics that specializes in offering dedicated digital tools and platforms to handle the complexities of global supply chains for e-commerce. It has simplified many international shipping procedures, including warehouse management, last-mile delivery coordination, real-time cargo tracking, duty and tax computations, and customs clearance.

What initiatives have tech giants implemented to enhance the development of cross-border e-commerce logistic software?

Tech giants are advancing cross-border e-commerce logistics software through AI-driven predictive analytics, blockchain for secure tracking, and automated customs management. They also focus on global fulfillment networks and API integrations to streamline international trade operations.

Which are the key vendors exploring cross-border e-commerce logistics software?

Some of the significant vendors offering cross-border e-commerce logistics software worldwide include FedEx (US), DHL (Germany), UPS (US), Alibaba Group (China), and Maersk (Germany).

What is the total CAGR recorded for the cross-border e-commerce logistics software market from 2024 to 2029?

The cross-border e-commerce logistics software market is expected to achieve a CAGR of xx% from 2024 to 2029.

Who are vital clients adopting cross-border e-commerce logistics software?

Key clients adopting the cross-border e-commerce logistics software include: -

- Retail and Consumer Goods Companies

- Third-party Logistics Providers

- E-commerce Platform Providers

- Electronics Manufacturers

- Automotive Companies

- Healthcare and Pharmaceutical Firms

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Cross-Border E-Commerce Logistics Software Market