Crop Insurance Market by Coverage (Multi peril crop insurance, Crop hail insurance), Type (Crop yield insurance, Crop revenue insurance), Distribution Channel (Bank, Insurance companies, Broker/agent) & Region - Global Forecast to 2029

The crop insurance market is estimated at USD XX billion in 2024; it is projected to grow at a CAGR of 6.1% to reach USD XX billion by 2029. The demand for crop insurance has surged primarily due to several interconnected factors in the agricultural landscape. Climate change has intensified weather variability, leading to more frequent and severe droughts, floods, storms, and other extreme events. These unpredictable conditions pose significant risks to crop yields, threatening farmers' incomes and livelihoods. In response, farmers increasingly recognize the need for financial protection to safeguard their investments against these risks.

Moreover, the globalization of agricultural markets has introduced new complexities. Fluctuations in global commodity prices and market demands can profoundly impact farmers' profitability. Crop insurance offers a buffer against such market risks, providing farmers with a predictable income stream even when prices plummet or market conditions deteriorate. Government policies and subsidies also play a crucial role in driving the demand for crop insurance. Many governments worldwide incentivize or mandate crop insurance programs to ensure the stability of the agricultural sector. These programs often include subsidies that reduce the cost of insurance premiums for farmers, making it more affordable and attractive.

Technological advancements have further enhanced the appeal and effectiveness of crop insurance. Remote sensing technologies, satellite imagery, and data analytics enable insurers to assess risks more accurately and efficiently. This data-driven approach not only improves the underwriting process but also enhances the responsiveness of insurance payouts, ensuring farmers receive timely compensation for their losses.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Crop Insurance Market Dynamics

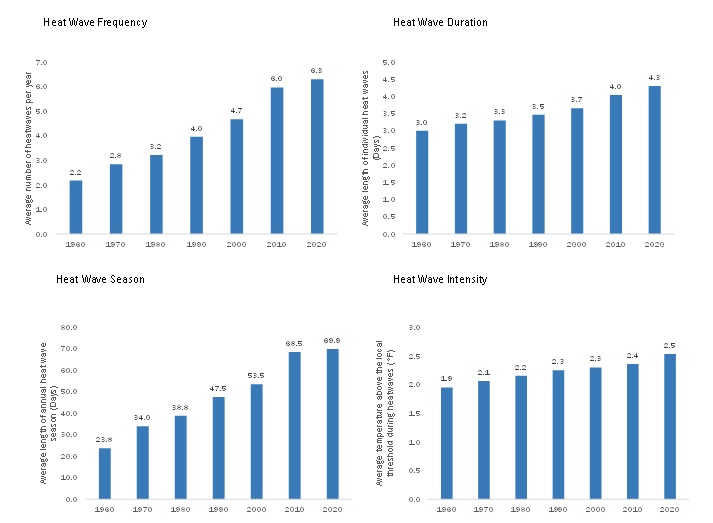

Driver: Increasing frequency of extreme weather events

The escalating frequency and severity of extreme weather events are exerting profound effects on the crop insurance market globally. As climate change continues to disrupt traditional weather patterns, farmers are increasingly vulnerable to unpredictable conditions such as prolonged droughts, intense storms, heatwaves, and unexpected frosts. These events can devastate crops, leading to significant financial losses for farmers who rely on stable weather conditions for their livelihoods. the demand for crop insurance has grown substantially. Farmers are turning to insurance policies to mitigate the financial risks associated with weather-related crop failures. Insurance providers are adapting by developing more sophisticated products that cater to diverse agricultural needs and risks. These products cover a wide range of scenarios, including crop damage from excessive rainfall, yield reductions due to extreme heat, and losses from pests and diseases exacerbated by changing climate conditions.

The evolution of the crop insurance market is crucial for fostering resilience in agricultural communities. By providing a safety net against weather-related losses, insurance enables farmers to recover more quickly and continue their operations. Moreover, it encourages investment in technologies and practices that enhance agricultural resilience to climate change. This shift towards more comprehensive and responsive insurance solutions not only supports individual farmers but also contributes to the overall stability and sustainability of food production in a changing climate landscape.

Environmental Fluctuations in US, (1960-2020)

Restraint:Complexity in policy terms

Complexity in policy terms poses a significant restraint for the crop insurance market on multiple fronts. Farmers often face challenges in comprehending intricate coverage details, eligibility criteria, and claims procedures, which can discourage them from investing in insurance plans. This lack of understanding may lead to hesitancy in adopting insurance, particularly among small-scale farmers who may find the process overwhelming or burdensome. Moreover, complex policies can drive up administrative costs for insurers, potentially resulting in higher premiums that are unaffordable for many farmers. The intricacies involved in risk assessment and claims processing further complicate matters, potentially delaying settlements and undermining trust in the insurance system. Additionally, overly complex regulatory requirements may discourage new entrants into the market, limiting competition and innovation in insurance products tailored to agricultural risks. Simplifying policy terms and procedures could mitigate these barriers, promoting greater transparency, affordability, and accessibility in crop insurance and ultimately improving risk management outcomes for farmers.

Opportunity:Growing awareness and government support

Government support can significantly benefit the crop insurance market in several ways, as exemplified by recent initiatives such as India's Pradhan Mantri Fasal Bima Yojana (PMFBY). Launched to provide comprehensive risk coverage and financial support to farmers, PMFBY illustrates the impact of increased subsidies. Farmers pay a nominal premium, with the remainder subsidized equally by central and state governments. This approach has expanded coverage to include more farmers, particularly in high-risk areas, making insurance more affordable and attractive. Moreover, PMFBY integrates advanced technology like satellite imagery for better risk assessment, fostering innovation in insurance products tailored to regional agricultural needs. Such government-backed programs not only enhance risk management capabilities but also stimulate market growth by attracting private insurers, thereby improving service quality and overall sector resilience against natural disasters and economic uncertainties.

Challenge: Assessing and pricing risks in the crop insurance market

Assessing and pricing risks in the crop insurance market poses significant challenges due to the intricate interactions of factors affecting crop health and yield. These complexities stem from a multitude of variables including weather patterns, soil conditions, pest infestations, and diseases, each of which can vary widely across regions and seasons. The availability and quality of data on these factors also vary, complicating efforts to build reliable risk assessment models. Moreover, the interconnected nature of these risks means that their combined impact may not be straightforward to predict or mitigate. Traditional actuarial models often struggle to capture such complexities comprehensively, necessitating the integration of advanced statistical techniques and data analytics. By leveraging improved data collection methods, satellite imagery, and interdisciplinary collaboration among actuaries, agronomists, and scientists, the crop insurance industry can enhance its ability to accurately assess and price risks, thereby better supporting farmers and insurers alike in managing agricultural uncertainties.

CROP INSURANCE MARKET ECOSYSTEM

The ecosystem of the crop insurance market is a complex network involving various stakeholders crucial to its functioning. At its core are the insurance companies that underwrite policies, assessing risks based on factors like historical data, weather patterns, and crop yield projections. Farmers, the primary beneficiaries, purchase these policies to safeguard against losses due to adverse weather conditions, pests, or market fluctuations. Government bodies play a pivotal role by often subsidizing premiums to make insurance more affordable and promoting broader adoption among farmers. Additionally, agricultural experts, actuaries, and data analysts contribute by assessing risks, designing policies, and improving the accuracy of payout mechanisms. Reinsurers provide financial stability by assuming portions of the risk from primary insurers, ensuring that the market remains robust and capable of handling large-scale losses. Together, these entities form an interconnected ecosystem that balances risk mitigation for farmers with sustainability and profitability for insurers, underpinning the resilience of agricultural economies worldwide.

Based on coverage, the hail crop insurance is having a significant market share.

The demand for hail crop insurance is rising primarily due to the increasing unpredictability and severity of weather patterns attributed to climate change. Farmers face heightened risks of hailstorms, which can devastate crops in a matter of minutes, leading to significant financial losses. Insurance provides a crucial safety net, helping farmers mitigate the financial impact of crop damage caused by hail. As extreme weather events become more frequent and intense, the need for reliable insurance coverage grows, ensuring farmers can recover and sustain their livelihoods amidst these uncertainties. Additionally, government policies and incentives often encourage or require farmers to insure their crops against such risks, further driving up the demand for hail crop insurance.

In April 2024, In Kashmir, recent hail storms and heavy rainfall have dealt a devastating blow to fruit growers, leading to widespread losses across orchards. The Kashmir Valley Fruit Growers cum Dealers Union has responded by intensifying their longstanding advocacy for a robust crop insurance scheme. They are urging the administration to swiftly assess the extensive damages inflicted by these natural calamities and provide immediate financial aid to affected farmers. This renewed emphasis on crop insurance highlights its critical role in safeguarding agricultural livelihoods against unpredictable weather events in Kashmir's vital horticultural sector.

The demand for crop insurance reflects a growing recognition of its importance in mitigating risks for farmers who face increasing climate uncertainties. By advocating for comprehensive coverage, the Union aims to protect not only current losses but also to bolster resilience against future environmental challenges. This initiative underscores the urgent need for proactive measures to support agricultural sustainability and economic stability in the region.

The insurance companies dominates the market during studied period.

Insurance companies hold a dominant position in the Crop Insurance Market, surpassing both banks and brokers/agents in influence and operational scale. This trend is poised to continue into the foreseeable future. For instance, in India, since the inception of the PMFBY scheme five years ago, these insurers have successfully amassed a substantial USD XX billion through premium payments. In parallel, they have disbursed a commendable USD 8.73 billion in loss claims to support farmers, ultimately yielding impressive savings of nearly 31%. This scheme has proven highly beneficial, impacting the lives of XX million farmers from April 2016 to December 14, 2023. The scale of participation is immense, with farmers submitting a staggering 269.9 million crop insurance applications, covering an expansive XX million hectares of cultivated land. These statistics underscore the pivotal role played by insurance companies in safeguarding agricultural interests and promoting resilience within the sector.

The Asia Pacific region is anticipated to experience the most rapid growth between 2024 and 2029.

The demand for crop insurance in the APAC region is witnessing significant growth due to increasing agricultural risks posed by climate change, natural disasters, and evolving farming practices. Countries like India, China, and Indonesia are leading this demand, driven by government initiatives to mitigate farmer vulnerabilities and ensure food security. The expansion of schemes like India's Pradhan Mantri Fasal Bima Yojana (PMFBY), which now includes coverage for assets beyond crops, exemplifies this trend. By integrating insurance for assets like ponds, tractors, and livestock under PMFBY, the Indian government aims to enhance resilience among farmers and stimulate broader adoption of agricultural insurance in the APAC market. This proactive approach not only supports agricultural sustainability but also boosts the insurance sector's role in economic stability and rural development.

In relation to the above article, in October 2023, the Indian government's decision to allocate Rs 30,000 crore for expanding PMFBY aligns with the broader APAC trend of enhancing agricultural insurance coverage. By transitioning PMFBY into a comprehensive platform covering various agricultural assets, India is addressing critical gaps in insurance protection for farmers. This initiative is expected to increase the insured area and participation of insurance companies, thereby bolstering the crop insurance market in India and potentially influencing similar developments across the APAC region. As APAC countries face similar agricultural challenges, the success and expansion of PMFBY could serve as a model for enhancing agricultural risk management strategies regionally.

Key Market Players

Key Market Players in this include Great American Insurance Company (US), ICICI Lombard General Insurance Company Limited (India), QBE Holdings, Inc. (Switzerland), Allianz Ghana (Germany), Sompo International Holdings Ltd. (Bermuda).

Other players include HDFC-ERGO General Insurance Company Ltd. (India), IFFCO-Tokio General Insurance Company Ltd. (India), Cholamandalam MS General Insurance Company Ltd. (India), Bajaj Allianz General Insurance Company Ltd. (India), Reliance General Insurance Company Ltd. (India), Future Generali India Insurance Company Ltd. (India), Tata-AIG General Insurance Company Ltd. (India), SBI General Insurance Company Ltd. (India), Universal Sompo General Insurance Company Ltd. (India).

These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In October 2022, nurture.farm, an AgTech startup in India, has partnered with HDFC ERGO General Insurance to enhance insurance solutions for farmers. The partnership aims to provide financial security against risks like weather anomalies, health issues, and market fluctuations. nurture.farm plans to expand its insurance coverage to 2 million farmers by 2022-23, offering innovative, cost-effective solutions including remote sensing-based farm-level insurance. This initiative supports their goal of improving agricultural resilience and sustainability across India.

- In June 2022, Cloud to Street (C2S)'s partnership with Munich Re and Raincoat to implement a parametric flood insurance program in Colombia. This initiative aims to address the global coverage gap by providing immediate financial relief to smallholder farmers affected by floods. C2S utilizes advanced flood intelligence technology, including satellite data and machine learning, to enable rapid and accurate payouts without the need for physical damage inspections. The program represents a significant step in climate adaptation and financial protection for vulnerable populations.

- In June 2024, Kshema General Insurance has launched a national marketing campaign focusing on crop insurance to coincide with the Kharif season. The campaign includes a TV commercial highlighting their Sukriti and Prakriti crop insurance plans, emphasizing financial security for farmers amidst increasing climate risks. Supported by Mudramax, the campaign integrates TV, print, digital, and outdoor media to reach farmers comprehensively. It aims to educate about the benefits of crop insurance in mitigating financial losses due to natural perils, targeting India's agricultural sector significantly impacted by climate change.

Frequently Asked Questions (FAQ):

What is the current size of the crop insurance market?

The crop insurance market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of 6.1% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

The key players in this market include Great American Insurance Company (US), ICICI Lombard General Insurance Company Limited (India), QBE Holdings, Inc. (Switzerland), Allianz Ghana (Germany), Sompo International Holdings Ltd. (Bermuda).

The market for crop insurance is expanding rapidly, with more mergers, acquisitions, and partnerships. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the crop insurance market?

The North American market is expected to dominate during the forecast period. The demand for crop insurance in North America is steadily rising due to several factors. Climate change has introduced greater unpredictability in weather patterns, leading to increased risks of crop damage from extreme events like droughts, floods, and storms. Farmers face heightened financial vulnerability as a result, prompting a greater uptake of insurance to mitigate losses and stabilize income.

What kind of information is provided in the company profile section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the crop insurance market?

Advancements in technology and data analytics have improved risk assessment accuracy, making insurance products more attractive and accessible. Government support through subsidies and incentives also plays a pivotal role in expanding the market, encouraging farmers to invest in insurance as a strategic risk management tool against the uncertainties posed by a changing climate and volatile agricultural markets. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Crop Insurance Market