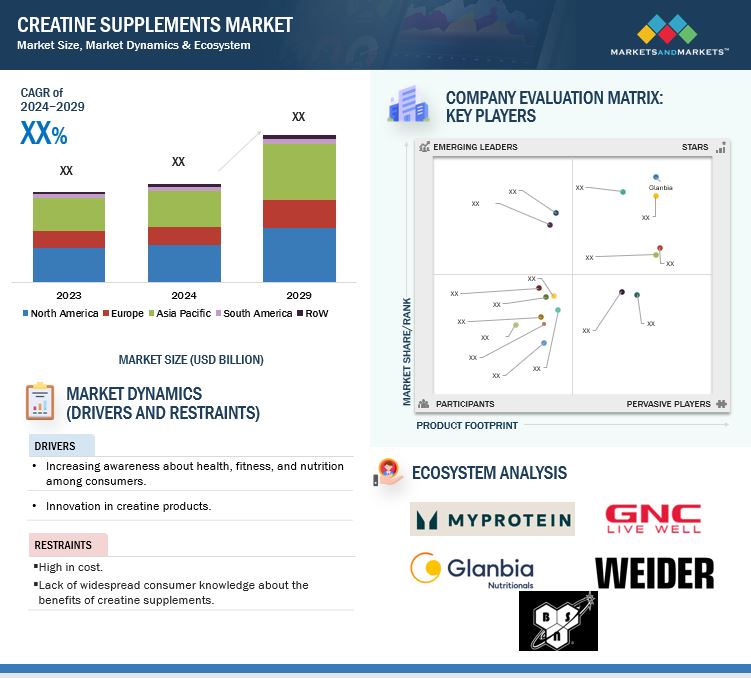

Creatine Supplement Market

The global creatine supplement market is projected to expand from USD xx million in 2024 to USD xx million by 2029, at a CAGR of xx% during the forecast period. The global creatine supplement market is growing fast due to increasing health consciousness, demand for convenient and functional beverages, and innovation in creatine formulations. As there are several factors favoring the supplement, an important factor driving the growing creatine supplement market is based upon the combination of requirements among changing consumers. Continuous increases in research and developments that prove creatine has become a vital booster of public confidence and demand for consumption. As there has been wide acceptance from professional athletes and trainers who use such supplements creatine's credibility will gradually increase within the body-fit community. Also, the trend toward personalization in nutrition has created an environment that has prompted consumers to look for tailor-made supplement solutions, where products are developed according to various needs such as endurance, strength, or recovery post-workout.

Global Creatine Supplement Market Trends

Attractive Opportunities For Players In The Creatine Supplement Market

Drivers:

The increasing awareness about health, fitness, and nutrition among consumers is driving the creatine supplement market growth.

Increased consumer awareness about fitness and health is another factor driving the creatine supplements market, especially awareness among people to attain better health and performance from their physical activities. Therefore, health-conscious consumers are also becoming interested in supplements capable of aiding muscle growth and recovery while improving athletic performances. Creatine is well known to help individuals in increasing their strength, endurance, and even muscle mass. As time passes, more people now see its value as part of any fitness regimen, be it an athlete, fitness enthusiast, or an aging individual trying to hold onto as much muscle mass as possible or just simply trying to live healthier with greater functionality in their body. Therefore, the increasing number of consumers adding creatine to their fitness programs is driving up demand for these supplements in different regions. The improved understanding of fitness and health also increases the demand for scientifically backed products, hence boosting the credibility and uptake of creatine supplements in the market. Thus, the increasing awareness about health, fitness, and nutrition among consumers is driving creatine supplements market growth.

Restraints:

Lack of Awareness about the benefits of creatine

A major inhibition of the growth of the market for creatine supplements emanates from the unawareness of the benefits and the right usage of creatine. Although creatine is amongst the most researched and successful sports supplements available, this supplement remains unknown to most probable consumers, especially outside the professional athletic domains, about its beneficial aspects towards muscle growth, strength, and overall physical activity. Many people, mainly those who are new to sports or do not train intensively, are not enough aware about creatine. This means consumers may miss out on creatine as a supplement and would rather use something else-a protein powder or vitamins, which is more popular.

The unawareness does not only exist among general consumers but also among certain parameters, such as older adults or those who follow vegetarian or vegan diets, who might need creatine but are not aware of plant-based alternatives or the role that creatine might play in maintaining muscle mass and even cognitive function. This ignorance, along with minimal marketing efforts toward those groups, denies the market access to an expanded crowd. Without a successful awareness campaign and clear communication regarding the benefits and safety of creatine, the market will continue to be constrained in growth and adoption.

Opportunities:

Innovation in product formats.

Innovation in product formats offers a major opportunity for the creatine supplement market to cater to evolving consumer preferences and make the supplementation process more convenient, enjoyable, and accessible. Traditional creatine supplements are usually available in powder or capsule form, but most consumers are looking for something that better suits their lifestyle and consumption habits. Introducing new formats, such as creatine gummies, chews, or ready-to-drink (RTD) beverages, can appeal to a wider audience, including those who may find powders difficult to mix or capsules inconvenient to swallow.

For example, flavored creatine powders and gummies may help to overcome the aversion to taste that many users experience with traditional creatine supplements. This is a product that is much more appealing to consumers who would otherwise avoid creatine due to its often-unpleasant flavor. Ready-to-drink creatine beverages can also offer on-the-go convenience for busy consumers who don't have the time or inclination to mix powders before a workout. In addition, innovations in the creativity and delivery of creatine supplements, such as vegan and allergy-free variants, have brought in a larger consumer base as well. With all these factors, coupled with increasing disposable incomes in key regions such as Asia-Pacific and Latin America, the market for creatine supplements is on the rise.

Challenges:

High cost of creatine supplements.

The most important challenge for the creatine supplement market, in particular in the price-sensitive segments and emerging markets, is due to the high cost of high-quality creatine products like micronized creatine or creatine HCl. Such advanced formulations incur higher production costs due to sophisticated processing and added ingredients needed to enhance the absorption solubility and even efficacy. While the above premium products offer improved performance advantages, the increased cost would therefore be costly to many of the target audience in the target regions due to consumers' low disposable incomes.

In developing markets where there is an increased interest in health and fitness supplements, but consumers' income is relatively lower, many will not consider or purchase the more expensive creatine-based supplement brands. Therefore, highly price-sensitive consumers will prefer low-priced products such as standard creatine monohydrate. Consequently, it will restrain the market share of premium creatine products. The perception that creatine is not a necessary supplement for some customers increases price sensitivity even further because many consumers treat it as an optional supplement and not something necessary in their exercise routine.

Creatine Supplements Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of creatine supplements market. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Glanbia plc (US), GNC Holdings Inc. (US), The Hut.com Ltd (India), WEIDER (Poland), BSN (US), MuscleTech (Canada), Nutrex Research (US), ALLMAX Nutrition (Canada), GAT WHP (US), Alzchem Group AG (Germany), Muscle Feast (US), BioTRUST Nutrition (Canada), N&R Industries (China), Merck KGaA (Germany), TRADICHEM (Spain).

Based on product type, the creatine monohydrate segment is estimated to grow at the highest CAGR during the studied period.

Based on product type, the creatine monohydrate segment is estimated to grow at the highest CAGR during the studied period. Creatine monohydrate continues to be the leading segment in the product type in the creatine supplement market as it is one of the most researched and proven types of creatine, which has been shown to increase strength, power, and muscle mass, thereby making it a mostly consumed in the fitness industry.

The relatively lower cost of production of monohydrate allows for easier sales at a more accessible level, thus reaching more clients, especially in the less price-sensitive markets and countries. For most people, most especially beginners or noncompetitive athletes, creatine monohydrate becomes a simple and effective answer, without the premium price that any other formulation would attract to it.

Additionally, creatine monohydrate comes in a variety of forms: powders, capsules, and tablets, to name a few. Because of this, it has become highly versatile and may be added to many types of exercise regimens. Being on the market for so long has given creatine monohydrate high consumer recognition, which adds to its demand.

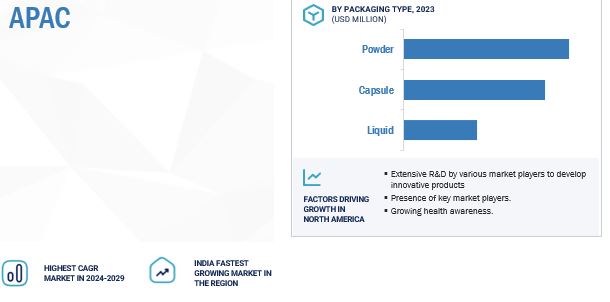

Based on form, the powder segment is estimated to grow at the highest CAGR during the studied period.

The powder form is the most dominant segment because it is practical, affordable, and easy to use. An important reason for its wide usage is the flexibility one gets in terms of dose. Consumers can easily bring down or increase their requirement of creatine powder to make up for their specific objectives such as muscle growth or performance or faster recovery. Unlike all the pre-measured capsules or tablets, creatine powder will let the person have the freedom to decide on the appropriate serving size based on the specific goal set for use in the fitness activity.

In addition, creatine powder often proves to be more inexpensive than other forms of creatine, such as capsules that usually carry with them additional costs in the production and packaging. It makes more sense for manufacturers to distribute larger quantities at more favorable prices, which creates more appeal to a bigger audience of consumers. With its cheaper price, it also easily becomes the top choice of athletes, bodybuilders, or fitness enthusiasts whose workouts become more intense and may require supplementing regularly. Another reason behind the dominance of creatine powder is that it pairs well with other supplements.

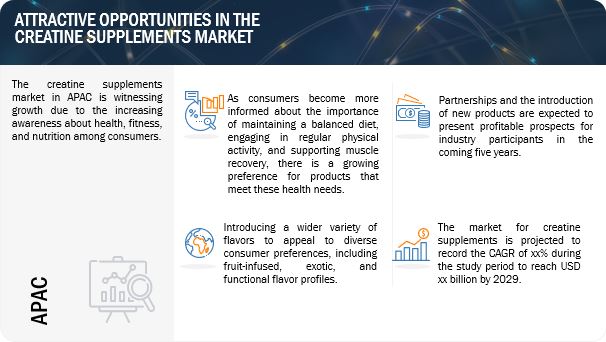

The APAC region is anticipated to experience rapid growth between 2024 and 2029.

The APAC region is anticipated to experience rapid growth between 2024 and 2029. As consumers in the U.S. and Canada increasingly prioritize their diets, the demand for functional beverages that offer hydration and nutrients in one convenient package is growing. Health-conscious behavior is another trend that, driven by such trends as fitness, weight management, and clean eating, propels demand for creatine supplements. The availability of the product has also improved with an increase in gyms, fitness centers, and health clubs along with better retail access and the Internet. This is particularly true in urban environments where busy, active lifestyles characterize the population, creating the demand for convenient, quick creatine sources. APAC consumers are also very responsive to new and innovative products, which motivates brands to innovate unique flavors and formulations suitable for regional tastes. The strong culture of innovation in the food and beverage industry combined with increasing demand for creatine makes APAC well-positioned to continue to be at the forefront of the growth trajectory for the creatine supplements market.

Key Market Players

- Glanbia plc (US)

- GNC Holdings Inc. (US)

- The Hut.com Ltd(India)

- WEIDER (Poland)

- BSN (US)

- MuscleTech (Canada)

- Nutrex Research (US)

- ALLMAX Nutrition (Canada)

- GAT WHP (US)

- Alzchem Group AG (Germany)

- Muscle Feast (US)

- BioTRUST Nutrition (Canada)

- N&R Industries (China)

- Merck KGaA (Germany)

- TRADICHEM (Spain)

These market players are focusing on increasing their presence through agreements and partnerships. These companies have a strong presence in North America, Europe, Asia Pacific, South America, and RoW. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In September 2024, Create Wellness, Inc., one of the leading innovators in creatine-based products, announced it has raised USD 5 million in a Series A funding round led by Unilever Ventures. This latest round brings the company's total funding to USD 7.3 million. The investment will accelerate Create's mission to bring the benefits of proper creatine supplementation to a wider audience.

- In July 2024, BrainMD launched Smart Creatine+, a creatine monohydrate powder supplement developed by neuroscientists. The new product is designed to help support body and muscle health as well as cognitive function. The naturally quick formula is fully soluble and is designed for improved absorption, drinkability, and bloat-free digestion. It is formulated with the branded ingredient iCreatine, which is standardized for purity.

- In Jan 2024, Ascent Protein, one of the leaders in the sports nutrition category, announced the debut of Ascent Clean Creatine, a brand-new product poised to elevate athletic performance to new levels. Ascent Clean Creatine joined a lineup of sports nutrition essentials including whey protein, plant protein, pre-workout, and micellar casein, showcasing Ascent's commitment to providing athletes with a comprehensive range of top-tier nutrition products.

- In December 2022, Prorganiq launched a new range of Creatine Monohydrate Supplement. Creatine Monohydrate is a high-energy source that gives muscles the strength and power they require to work out to their full potential.

Frequently Asked Questions (FAQ):

What is the current size of the creatine supplements market?

The creatine supplements market is estimated at USD xx million in 2024 and is projected to reach USD xx million by 2029, at a CAGR of xx%.

What are the key market players, and how intense is the competition?

The key market players include Glanbia plc (US), GNC Holdings Inc. (US), The Hut.com Ltd (India), WEIDER (Poland), BSN (US), MuscleTech (Canada), Nutrex Research (US), ALLMAX Nutrition (Canada), GAT WHP (US), Alzchem Group AG (Germany), Muscle Feast (US), BioTRUST Nutrition (Canada), N&R Industries (China), Merck KGaA (Germany), TRADICHEM (Spain). The creatine supplements market is expanding rapidly, with increasing mergers, acquisitions, partnerships, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is estimated to account for the largest share of creatine supplements in 2024?

The APAC market is estimated to dominate the creatine supplements market in 2024. The increasing awareness about health, fitness, and nutrition among consumers is driving creatine supplements market growth.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to illustrate the company's potential better.

What are the factors driving the creatine supplements market?

The introduction of a wider variety of flavors will help the creatine supplements market to grow significantly, tapping into the diverse preferences of a growing and increasingly health-conscious consumer base.

Growth opportunities and latent adjacency in Creatine Supplement Market