Crash Barrier Systems Market by Type (Portable & Fixed), Technology (Rigid, Semi-Rigid & Flexible), Device (Crash Cushions, End Treatments, and GEAT), Application (Roadside, Median, Work-zone, and Bridge) & Region - Global Forecast to 2028

Get the updated report with forecasts to 2028 : Inquire Now

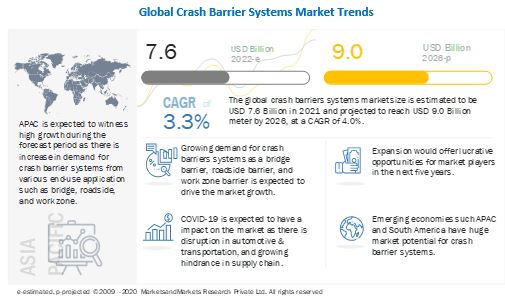

The crash barrier systems market is projected to reach USD 9.0 billion by 2026, at a CAGR of 3.1%. The driving factors for crash barrier systems market is its growing construction & automotive industries across the world.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Crash barrier systems market

The global Crash barrier systems market includes major Tier I and II suppliers like as Tata steel Europe (UK), NV Bekaert S.A. (Belgium), Valmont Industries, Inc. (UK), Trinity Industries Inc (US), and Nucor Corporation (US). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and Rest of the World. COVID-19 has impacted their businesses as well.

These players have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in the US, France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for crash barrier systems is expected to decline in 2021. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from tier 1 manufacturers.

Crash Barrier Systems Market Dynamics:

Driver: Growiing construction and automotive industries

The crash barrier systems market is projected to be driven by the performance of the construction and automotive industries. The rising per capita income of the middle-class population has increased their purchasing power, which has resulted in an increase in the number of vehicles and hence, new roads. The movement of rural populations to urban areas in developing countries has also increased, due to which, the demand in the construction sector is rising. APAC is projected to witness the highest demand for new constructions with China being the leader among all APAC countries. According to Organisation Internationale des Constructeurs dAutomobiles (OICA), the automotive industry in India, Brazil, and South Africa, along with the US, Canada, Germany, Italy, and Australia, is projected to grow at more than 10% in the next five years, which will result in high demand for crash barrier products. The development of the commercial real estate, coupled with modification of transport infrastructure across the globe, is expected to propel market growth over the forecast period.

Restraint: High crash severity due to barrier collision

Rigid barriers are used along roads to minimize the severity of accidents after impact. In the US, motorcycles comprise only 3% of the vehicle fleet but account for nearly half of all fatalities resulting from guardrail collisions and 22% of the fatalities from concrete barrier collisions. Hence, the severity of the crash increases post-impact when rigid and semi-rigid barriers are used. Rigid barriers are less effective as more of the energy of the impact is transmitted to the vehicle occupants resulting in greater injuries. This effect is known as ride-down in barrier crash testing. The high reparation cost of barrier systems acts as a restraint in the global crash barrier systems market growth. With the crash impact, barrier systems such as concrete blocks, wooden fences, and end treatments necessitate high costs for their reconstruction. Because of this, most highway authorities, such as ERF and NCHRP, have started installing flexible crash barriers with ropes and wires, which absorb the most energy during impact with vehicles, thus reducing the severity of crashes.

Opportunity: growing opportunities in emerging region

APAC is projected to see the highest number of new constructions and infrastructural activities in the near future. According to WHO, the increase in spending on construction from 2014 to 2019 in China was estimated at 7.3%, while for India and Vietnam, it was estimated at 7% and 6.8%, respectively. This provides an opportunity to the crash barrier systems market to grow in these countries. Latin American countries such as Brazil, Argentina, and Colombia, as well as African countries such as South Africa, have shown signs of development in recent years. Due to the increase in the GDP of these countries, urbanization has shot up. Thus, these countries present a huge opportunity for the crash barrier systems market to grow.

Challenges: Volatility in raw material prices

The crash barriers systems market relies heavily on raw materials for production. As long as these raw materials are available at a reasonable price, production becomes easy. However, the prices of raw materials are highly volatile; if these prices go up, the production prices also go up, which results in inflated prices of the finished products for end users. Raw materials used for crash barriers include steel and concrete. Due to the outbreak of COVID-19 around the world, steel prices were put in pressure. Chinese hot-rolled coil (HRC) price was USD 465 per metric ton in the fourth quarter of 2019 (pre-COVID-19). It dropped to USD 440 in the second quarter and briefly approached USD 420. By late December 2020, Chinese HRC price reached USD 775 (an 85% increase). This increase in steel prices eventually resulted in an increase in prices of crash barriers. Zinc is used for galvanizing crash barriers. The zinc price has been fluctuating high because of the pandemic situation. In 2020, the average London Metal Exchange price for zinc fell by 11% to USD 2,267/ton compared to 2019. Thus, volatile raw material prices act as a challenge in the global crash barrier systems market.

Ecosystem Analysis: Crash Barrier Systems Market

The Crash barrier systems market is projected to register a CAGR of 3.3% during the forecast period, in terms of value.

The global Crash barrier systems market is estimated to be USD 7,625.1 million in 2021 and is projected to reach USD 8,960.3 million by 2026, at a CAGR of 3.3% from 2021 to 2026. The growth is due to the growing construction and automotive industries throughout the world. Crash barriers are intended to resist the impact of vehicles of certain weights at a concerned angle while traveling at the specified speed. They are anticipated to guide the vehicle back on the road while keeping the level of damage to vehicles as well as to the barriers within tolerable limits. The increasing use of roadside barriers is driving the crash barrier systems market. High crash severity due to barrier collision for the Crash barrier systems market.

By Region

Europe is the largest market for Crash barrier systems.

Europe accounted for the largest share of the Crash barrier systems market in 2020. The market in the region is growing because of the willingness of companies in the region to take up capital-intensive projects, along with the availability of technical expertise.

Key Players in Crash Barrier Systems Market

Crash barrier systems is a diversified and competitive market with a large number of global players and few regional and local players. Tata steel Europe (UK), NV Bekaert S.A. (Belgium), Valmont Industries, Inc. (UK), Trinity Industries Inc (US), and Nucor Corporation (US). are some of the key players in the market.

Recent Developments

- In December 2019, Valmont Industries, Inc. introduced HighwayGuard LDS, which is a MASH 16 TL-3 compliant steel safety barrier. It has a T-connector, which provides quicker installation, removal, and separation of barrier sections. It also offers the ability to remove sections within a run to create access gaps, replace damaged sections or alter barrier runs.

- In March 2019, Nucor Corporation announced that it would build its new state-of-the-art steel plate mill in Brandenburg, Kentucky, located along the Ohio River, southwest of Louisville. The company will invest approximately USD 1.35 billion to build the mill, which will be capable of producing 1.2 million tons per year of steel plate products. The new plate mill will significantly strengthen Nucors plate product portfolio.

- In August 2019, Lindsay Corporation launched ABSORB-M, a new, non-redirective, water-filled crash cushion system. Tested to the American Association of State Highway and Transportation Officials (AASHTO) Manual for Assessing Safety Hardware (MASH) Test Level TL-2 and TL-3 standards, the ABSORB-M is suited for narrow areas where road and workspace are limited.

Frequently Asked Questions (FAQ):

Which Market hold maximum market share of the Crash Barrier Systems Market?

Europe hold the maximum market share of the Crash Barrier Systems Market

What is the Leading Applications of Crash Barrier Systems Market?

The leading Applications of Crash Barrier Systems Market are Roadside, Median, Work-zone, Bridge

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except offering.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- U.K.

- Italy

- Russia

- France

- Rest of Europe

What is the COVID-19 impact on the crash barrier systems market?

Industry experts believe that COVID-19 would have a impact on crash barrier systems market. Major countires across the world have imposed lockdown and social distancing measures to prevent the Covid-19 spread. Due to unavailability of labor force, many infrastructure and construction projects have been put on hold .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 CRASH BARRIER SYSTEMS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION APPROACH

2.2.1 ESTIMATION OF CRASH BARRIER SYSTEMS MARKET SIZE BASED ON MARKET SHARE ANALYSIS

FIGURE 1 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 2 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 3 CRASH BARRIER SYSTEMS MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 4 FIXED BARRIER TO DOMINATE THE CRASH BARRIER SYSTEMS MARKET

FIGURE 5 SEMI-RIGID BARRIER TO DOMINATE THE CRASH BARRIER SYSTEMS MARKET

FIGURE 6 CRASH CUSHIONS SEGMENT TO LEAD THE CRASH BARRIER SYSTEMS MARKET

FIGURE 7 ROADSIDE BARRIERS APPLICATION TO LEAD THE MARKET

FIGURE 8 EUROPE LED THE CRASH BARRIER SYSTEMS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN CRASH BARRIER SYSTEMS MARKET

FIGURE 9 INCREASING USAGE OF CRASH BARRIER SYSTEMS TO DRIVE THE MARKET

4.2 CRASH BARRIER SYSTEM MARKET, BY REGION

FIGURE 10 EUROPE TO BE THE LARGEST MARKET BETWEEN 2021 AND 2026

4.3 EUROPE: CRASH BARRIER SYSTEM MARKET, BY COUNTRY AND APPLICATION

FIGURE 11 RUSSIA AND ROADSIDE BARRIERS SEGMENT ACCOUNTED FOR LARGEST SHARES

4.4 CRASH BARRIER SYSTEM MARKET: BY MAJOR COUNTRIES

FIGURE 12 INDIA TO BE THE FASTEST-GROWING MARKET BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CRASH BARRIER SYSTEMS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing infrastructural spending

5.2.1.2 Increasing incidences of road crash

5.2.1.3 Government regulations and obligations

5.2.2 RESTRAINTS

5.2.2.1 High crash severity due to barrier collision

5.2.3 OPPORTUNITIES

5.2.3.1 Growing opportunities in emerging regions

5.2.3.2 Growing construction and automotive industries

5.2.3.3 Growth of the flexible crash barriers segment

5.2.4 CHALLENGES

5.2.4.1 Interference of the highway agencies

5.2.4.2 Volatility in raw material prices

6 INDUSTRY TRENDS (Page No. - 55)

6.1 PORTER’S FIVE FORCES ANALYSIS

FIGURE 14 PORTER’S FIVE FORCES ANALYSIS

TABLE 1 CRASH BARRIER SYSTEMS MARKET: PORTER’S FIVE FORCE ANALYSIS

6.1.1 BARGAINING POWER OF SUPPLIERS

6.1.2 THREAT OF NEW ENTRANTS

6.1.3 THREAT OF SUBSTITUTES

6.1.4 BARGAINING POWER OF BUYERS

6.1.5 RIVALRY AMONG EXISTING COMPETITORS

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 15 RAW MATERIAL SUPPLIERS AND MANUFACTURERS ADD MAJOR VALUE TO CRASH BARRIER SYSTEMS

TABLE 2 CRASH BARRIER SYSTEMS MARKET: VALUE CHAIN

6.2.1 PROMINENT COMPANIES

6.2.2 SMALL & MEDIUM ENTERPRISES

6.2.3 IMPACT OF COVID-19 ON SUPPLY CHAIN

6.3 TRADE ANALYSIS

TABLE 3 STEEL EXPORT DATA 2019 (MILLION TONS)

TABLE 4 STEEL IMPORT DATA 2019 (MILLION TONS)

6.4 MARKET MAP

6.5 PRICING ANALYSIS

FIGURE 16 AVERAGE SELLING PRICE (2018-2025)

6.6 TECHNOLOGY ANALYSIS

6.7 CASE STUDY ANALYSIS

6.7.1 SAFETY BARRIER SYSTEM ROLLOUT FOR M74 BRIDGE IN SCOTLAND

6.7.1.1 Hardstaff Barriers supplies safety barrier system to Transport Scotland

6.7.1.1.1 Objective

6.7.1.1.2 Solution statement

6.7.1.1.3 Benefits

6.8 PATENT ANALYSIS

6.9 POLICY & REGULATIONS

6.9.1 EUROPEAN ROAD FEDERATION (ERF)

6.9.2 NATIONAL COOPERATIVE HIGHWAY RESEARCH PROGRAM

TABLE 5 SIGNIFICANT CHANGES BETWEEN NCHRP 350 AND MASH

TABLE 6 AASHTO M-180 STANDARD FOR GUARDRAIL BARRIER

TABLE 7 MECHANICAL PROPERTIES OF THE BASE METAL FOR GUARDRAIL BARRIER

6.10 MACROECONOMIC INDICATORS

6.10.1 TRENDS AND FORECAST OF GDP

TABLE 8 TRENDS AND FORECAST OF GDP, BY KEY COUNTRIES, 2016-2023 (USD MILLION)

6.10.2 PRODUCTION STATISTICS OF STEEL, 2019

TABLE 9 WORLD CRUDE STEEL PRODUCTION, BY MAJOR COUNTRIES, 2018–2019 (MILLION TON)

7 CRASH BARRIER SYSTEMS MARKET, BY TYPE (Page No. - 73)

7.1 INTRODUCTION

FIGURE 17 FIXED BARRIER SYSTEMS DOMINATED OVERALL MARKET IN 2020

TABLE 10 CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019-2026 (USD MILLION)

TABLE 11 CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019-2026 (MILLION METER)

7.2 PORTABLE BARRIER SYSTEMS

7.2.1 INCREASING DEMAND FOR MOVABLE BARRIERS IN TRAFFIC CONTROL ON HIGHWAYS TO DRIVE THE MARKET

TABLE 12 PORTABLE BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 13 PORTABLE BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

7.3 FIXED BARRIER SYSTEMS

7.3.1 LOW LIFE CYCLE COST OF FIXED BARRIER SYSTEMS TO BOOST THE MARKET

TABLE 14 FIXED BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 15 FIXED BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

8 CRASH BARRIER SYSTEMS MARKET, BY TECHNOLOGY (Page No. - 78)

8.1 INTRODUCTION

TABLE 16 SELECTION CRITERIA FOR ROADSIDE BARRIERS

FIGURE 18 SEMI-RIGID BARRIER SYSTEMS DOMINATED CRASH BARRIER SYSTEMS MARKET IN 2020

TABLE 17 CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019-2026 (USD MILLION)

TABLE 18 CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY 2019-2026 (MILLION METER)

8.2 RIGID BARRIER SYSTEMS

8.2.1 LOW MAINTENANCE REQUIREMENT OF RIGID BARRIERS TO DRIVE THE MARKET

8.2.2 CONCRETE BARRIERS

8.2.3 PRE-CAST CONCRETE BARRIERS

TABLE 19 COMPLIANCES OF TEST LEVELS FOR RIGID BARRIERS

TABLE 20 RIGID BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 21 RIGID BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

8.3 SEMI-RIGID BARRIER SYSTEMS

8.3.1 INCREASING DEMAND FOR SEMI-RIGID BARRIERS ON HIGHWAYS AND MEDIAN TO DRIVE THE MARKET

8.3.2 W-BEAM BARRIERS

8.3.3 THRIE-BEAM BARRIERS

8.3.4 BOX BEAM BARRIERS

TABLE 22 COMPLIANCES OF TEST LEVELS FOR SEMI-RIGID BARRIERS

TABLE 23 SEMI-RIGID BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 24 SEMI-RIGID BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

8.4 FLEXIBLE BARRIER SYSTEMS

8.4.1 LOWEST INSTALLATION AND MAINTENANCE COST OF FLEXIBLE BARRIER SYSTEMS TO BOOST THE MARKET

8.4.2 CABLE AND CHAIN BEAM BARRIERS

TABLE 25 FLEXIBLE BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 26 FLEXIBLE BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

9 CRASH BARRIER SYSTEMS MARKET, BY DEVICE (Page No. - 88)

9.1 INTRODUCTION

FIGURE 19 CRASH CUSHIONS SEGMENT DOMINATES OVERALL CRASH BARRIER SYSTEMS MARKET

TABLE 27 CRASH BARRIER SYSTEM MARKET SIZE, BY DEVICE, 2019-2026 (USD MILLION)

TABLE 28 CRASH BARRIER SYSTEM MARKET SIZE, BY DEVICE, 2019-2026 (MILLION METER)

9.2 CRASH CUSHIONS

9.2.1 EXCELLENT IMPACT ABSORPTION CAPACITY OF CRASH CUSHIONS TO DRIVE THE DEMAND

TABLE 29 CRASH CUSHION MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 30 CRASH CUSHION MARKET SIZE, BY REGION, 2019-2026(MILLION METER)

9.3 END TREATMENT

9.3.1 END TREATMENT TO WITNESS MODERATE GROWTH DURING THE FORECAST PERIOD

TABLE 31 END TREATMENT MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 32 END TREATMENT MARKET SIZE, BY REGION, 2019-2026(MILLION METER)

9.4 WATER AND SAND FILLED BARRELS

9.4.1 GROWING DEMAND FROM WORK ZONE & BRIDGE DECKS TO SUPPORT THE MARKET

TABLE 33 WATER- AND SAND-FILLED BARREL MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 34 WATER- AND SAND-FILLED BARREL MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

9.5 GUARDRAIL ENERGY ABSORBENT TERMINALS (GEAT)

9.5.1 EASY ASSEMBLY AND INSTALLATION OF GEAT TO DRIVE THE MARKET

TABLE 35 GEAT MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 36 GEAT MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

9.6 OTHERS

TABLE 37 OTHERS CRASH BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 38 OTHERS CRASH BARRIER SYSTEM MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

10 CRASH BARRIER SYSTEMS MARKET, BY APPLICATION (Page No. - 95)

10.1 INTRODUCTION

FIGURE 20 ROADSIDE BARRIERS TO LEAD OVERALL CRASH BARRIER SYSTEMS MARKET DURING THE FORECAST PERIOD

TABLE 39 CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 40 CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

10.2 ROADSIDE BARRIER

10.2.1 RISING DEMAND FOR GUARDRAIL AND WIRE ROPES TO BOOST THE MARKET

TABLE 41 ROADSIDE BARRIER MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 42 ROADSIDE BARRIER MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

10.3 MEDIAN BARRIER

10.3.1 INCREASED DEMAND FROM HEAVY TRAFFIC ZONES EXPECTED TO BOOST THE MARKET

TABLE 43 MEDIAN BARRIER MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 44 MEDIAN BARRIER MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

10.4 WORK ZONE BARRIER

10.4.1 INCREASING DEMAND FOR SAFETY OF PERSONNEL ON HIGHWAYS AND ROADWAYS TO DRIVE THE DEMAND

TABLE 45 WORK ZONE BARRIER MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 46 WORK ZONE BARRIER MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

10.5 BRIDGE BARRIER

10.5.1 NEW CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT PROJECTS IN EMERGING ECONOMIES TO BOOST THE MARKET

TABLE 47 BRIDGE BARRIER MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 48 BRIDGE BARRIER MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

10.6 OTHERS

TABLE 49 OTHERS CRASH BARRIER SYSTEMS MARKET SIZE BY REGION, 2019-2026 (USD MILLION)

TABLE 50 OTHERS CRASH BARRIER SYSTEM MARKET SIZE BY REGION, 2019-2026 (MILLION METER)

11 CRASH BARRIER SYSTEMS MARKET, BY REGION (Page No. - 102)

11.1 INTRODUCTION

FIGURE 21 APAC TO RECORD FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 51 CRASH BARRIER SYSTEMS MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 52 CRASH BARRIER SYSTEM MARKET SIZE, BY REGION, 2019-2026 (MILLION METER)

11.2 NORTH AMERICA

11.2.1 IMPACT OF COVID-19 IN NORTH AMERICA

FIGURE 22 NORTH AMERICA: CRASH BARRIER SYSTEM MARKET SNAPSHOT

TABLE 53 NORTH AMERICA: CRASH BARRIER SYSTEMS MARKET SIZE, BY COUNTRY, 2019-2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019-2026 (MILLION METER)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY DEVICE, 2019-2026 (USD MILLION)

TABLE 60 NORTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY DEVICE, 2019-2026 (MILLION METER)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 62 NORTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.2.2 US

11.2.2.1 Presence of established crash barrier systems manufacturers to drive the market

TABLE 63 US: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 US: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 65 US: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 66 US: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 67 US: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 68 US: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.2.3 CANADA

11.2.3.1 Large road network to drive the market in the country

TABLE 69 CANADA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 CANADA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 71 CANADA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 72 CANADA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 73 CANADA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 74 CANADA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.2.4 MEXICO

11.2.4.1 Road safety initiatives to propel market growth

TABLE 75 MEXICO: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 MEXICO: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 77 MEXICO: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 78 MEXICO: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 79 MEXICO: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 80 MEXICO: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.3 EUROPE

11.3.1 IMPACT OF COVID-19 IN EUROPE

FIGURE 23 EUROPE: CRASH BARRIER SYSTEMS MARKET SNAPSHOT

TABLE 81 EUROPE: CRASH BARRIER SYSTEM MARKET SIZE, BY COUNTRY, 2019-2026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY COUNTRY, 2019-2026 (MILLION METER)

TABLE 83 EUROPE: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 85 EUROPE: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 87 EUROPE: CRASH BARRIER SYSTEM MARKET SIZE, BY DEVICE, 2019-2026 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY DEVICE, 2019-2026 (MILLION METER)

TABLE 89 EUROPE: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.3.2 RUSSIA

11.3.2.1 Continuous improvement in road safety measures

TABLE 91 RUSSIA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 RUSSIA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 93 RUSSIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 94 RUSSIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 95 RUSSIA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 96 RUSSIA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.3.3 GERMANY

11.3.3.1 Slow growth during the forecast period due mature market

TABLE 97 GERMANY: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 GERMANY: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 99 GERMANY: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 100 GERMANY: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 101 GERMANY: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 102 GERMANY: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.3.4 FRANCE

11.3.4.1 Strict regulation of road safety driving the demand

TABLE 103 FRANCE: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE,2019–2026 (USD MILLION)

TABLE 104 FRANCE: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 105 FRANCE: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 106 FRANCE: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 107 FRANCE: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 108 FRANCE: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.3.5 ITALY

11.3.5.1 Growing number of highway projects to drive the demand

TABLE 109 ITALY: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 ITALY: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 111 ITALY: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 112 ITALY: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 113 ITALY: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 114 ITALY: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION,2019-2026 (MILLION METER)

11.3.6 SPAIN

11.3.6.1 Increasing government initiatives supporting market growth

TABLE 115 SPAIN: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 SPAIN: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 117 SPAIN: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 118 SPAIN: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 119 SPAIN: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 120 SPAIN: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.3.7 UK

11.3.7.1 Strict government regulations for road safety to boost the market

TABLE 121 UK: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 UK: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 123 UK MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 124 UK: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 125 UK: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 126 UK: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.3.8 REST OF EUROPE

TABLE 127 REST OF EUROPE: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 REST OF EUROPE: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 129 REST OF EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 130 REST OF EUROPE: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 131 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 132 REST OF EUROPE: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.4 APAC

11.4.1 IMPACT OF COVID-19 IN APAC

FIGURE 24 APAC: CRASH BARRIER SYSTEMS MARKET SNAPSHOT

TABLE 133 APAC: CRASH BARRIER SYSTEM MARKET SIZE, BY COUNTRY, 2019-2026 (USD MILLION)

TABLE 134 APAC: MARKET SIZE, BY COUNTRY, 2019-2026 (MILLION METER)

TABLE 135 APAC: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 APAC: MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 137 APAC: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 138 APAC: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 139 APAC: CRASH BARRIER SYSTEM MARKET SIZE, BY DEVICE, 2019-2026 (USD MILLION)

TABLE 140 APAC: MARKET SIZE, BY DEVICE, 2019-2026 (MILLION METER)

TABLE 141 APAC: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 142 APAC: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.4.2 CHINA

11.4.2.1 Booming investment in infrastructure sector to drive the market

TABLE 143 CHINA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE,2019–2026 (USD MILLION)

TABLE 144 CHINA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 145 CHINA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 146 CHINA: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 147 CHINA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 148 CHINA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.4.3 JAPAN

11.4.3.1 Established steel manufacturing to drive the market

TABLE 149 JAPAN: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 JAPAN: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 151 JAPAN: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 152 JAPAN: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 153 JAPAN: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 154 JAPAN: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.4.4 INDIA

11.4.4.1 Upcoming highway projects in the country to increase demand for crash barrier systems

TABLE 155 INDIA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE,2019–2026 (USD MILLION)

TABLE 156 INDIA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 157 INDIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 158 INDIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 159 INDIA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 160 INDIA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.4.5 INDONESIA

11.4.5.1 Increasing roadways network to fuel the market

TABLE 161 INDONESIA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 162 INDONESIA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 163 INDONESIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 164 INDONESIA: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 165 INDONESIA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 166 INDONESIA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.4.6 AUSTRALIA

11.4.6.1 Increasing government initiatives to drive market

TABLE 167 AUSTRALIA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 168 AUSTRALIA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 169 AUSTRALIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 170 AUSTRALIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 171 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 172 AUSTRALIA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.4.7 REST OF APAC

TABLE 173 REST OF APAC: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 REST OF APAC: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 175 REST OF APAC: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 176 REST OF APAC: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 177 REST OF APAC: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 178 REST OF APAC: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.5 MIDDLE EAST & AFRICA

11.5.1 IMPACT OF COVID-19 IN MIDDLE EAST & AFRICA

TABLE 179 MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEMS MARKET SIZE, BY COUNTRY, 2019-2026 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY COUNTRY, 2019-2026 (MILLION METER)

TABLE 181 MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 183 MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 185 MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY DEVICE, 2019-2026 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEVICE, 2019-2026 (MILLION METER)

TABLE 187 MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.5.2 SAUDI ARABIA

11.5.2.1 Improving road safety projects to drive the market

TABLE 189 SAUDI ARABIA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 190 SAUDI ARABIA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 191 SAUDI ARABIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 192 SAUDI ARABIA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 193 SAUDI ARABIA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 194 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.5.3 UAE

11.5.3.1 Large infrastructure projects in the country to drive the market

TABLE 195 UAE: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 196 UAE: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 197 UAE: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 198 UAE: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 199 UAE: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 200 UAE: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.5.4 SOUTH AFRICA

11.5.4.1 Increasing investment by SANRAL in road safety projects

TABLE 201 SOUTH AFRICA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 202 SOUTH AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 203 SOUTH AFRICA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 204 SOUTH AFRICA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 205 SOUTH AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 206 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 207 REST OF MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 208 REST OF MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 209 REST OF MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 210 REST OF MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 211 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 212 REST OF MIDDLE EAST & AFRICA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.6 SOUTH AMERICA

11.6.1 IMPACT OF COVID-19 IN SOUTH AMERICA

TABLE 213 SOUTH AMERICA: CRASH BARRIER SYSTEMS MARKET SIZE, BY COUNTRY, 2019-2026 (USD MILLION)

TABLE 214 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019-2026 (MILLION METER)

TABLE 215 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 216 SOUTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 217 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 218 SOUTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 219 SOUTH AMERICA: CRASH BARRIER SYSTEMS MARKET SIZE, BY DEVICE, 2019-2026 (USD MILLION)

TABLE 220 SOUTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY DEVICE, 2019-2026 (MILLION METER)

TABLE 221 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 222 SOUTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.6.2 BRAZIL

11.6.2.1 Booming investment in infrastructure sector

TABLE 223 BRAZIL: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 224 BRAZIL: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 225 BRAZIL: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 226 BRAZIL: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 227 BRAZIL: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 228 BRAZIL: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.6.3 ARGENTINA

11.6.3.1 New highway projects to increase demand

TABLE 229 ARGENTINA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 230 ARGENTINA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 231 ARGENTINA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 232 ARGENTINA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 233 ARGENTINA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 234 ARGENTINA: CRASH BARRIER SYSTEM MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

11.6.4 REST OF SOUTH AMERICA

TABLE 235 REST OF SOUTH AMERICA: CRASH BARRIER SYSTEMS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 236 REST OF SOUTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TYPE, 2019–2026 (MILLION METER)

TABLE 237 REST OF SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 238 REST OF SOUTH AMERICA: CRASH BARRIER SYSTEM MARKET SIZE, BY TECHNOLOGY, 2019–2026 (MILLION METERS)

TABLE 239 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019-2026 (USD MILLION)

TABLE 240 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2019-2026 (MILLION METER)

12 COMPETITIVE LANDSCAPE (Page No. - 166)

12.1 OVERVIEW

FIGURE 25 COMPANIES ADOPTED NEW PRODUCT LAUNCHES AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

12.2 MARKET SHARE ANALYSIS

FIGURE 26 MARKET SHARE OF KEY PLAYERS IN CRASH BARRIER SYSTEMS MARKET, 2020

12.3 MARKET EVALUATION FRAMEWORK

TABLE 241 MARKET EVALUATION FRAMEWORK

12.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 27 TOP 5 PLAYERS DOMINATED THE MARKET IN LAST 5 YEARS

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STAR

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE

12.5.4 EMERGING COMPANIES

FIGURE 28 COMPETITIVE LEADERSHIP MAPPING: CRASH BARRIER SYSTEM MARKET, 2020

TABLE 242 COMPANY PRODUCT FOOTPRINT

TABLE 243 COMPANY REGION FOOTPRINT

12.6 SME MATRIX, 2020

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 29 SME MATRIX: CRASH BARRIER SYSTEMS MARKET, 2020

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCH

TABLE 244 CRASH BARRIER SYSTEM MARKET: PRODUCT LAUNCHES, 2019

12.7.2 MERGER & ACQUISITION

TABLE 245 MERGER & ACQUISITION, 2017-2019

12.7.3 AGREEMENTS & CONTRACTS

TABLE 246 AGREEMENTS & CONTRACTS, 2020

12.7.4 EXPANSION

TABLE 247 EXPANSION, 2019

12.7.5 PARTNERSHIP & COLLABORATION

TABLE 248 PARTNERSHIP & COLLABORATION, 2019

13 COMPANY PROFILES (Page No. - 177)

13.1 MAJOR PLAYERS

(Business Overview, Products Offered, MnM view, Key strengths/Right to win, Strategic choices made, Weakness and competitive threats)*

13.1.1 TATA STEEL EUROPE

TABLE 249 TATA STEEL EUROPE: BUSINESS OVERVIEW

FIGURE 30 TATA STEEL EUROPE: COMPANY SNAPSHOT

13.1.2 NV BEKAERT S.A.

TABLE 250 NV BEKAERT S.A.: BUSINESS OVERVIEW

FIGURE 31 NV BEKAERT S.A.: COMPANY SNAPSHOT

13.1.3 VALMONT INDUSTRIES, INC.

TABLE 251 VALMONT INDUSTRIES, INC.: BUSINESS OVERVIEW

FIGURE 32 VALMONT INDUSTRIES, INC.: COMPANY SNAPSHOT

13.1.4 TRINITY INDUSTRIES INC.

TABLE 252 TRINITY INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 33 TRINITY INDUSTRIES INC.: COMPANY SNAPSHOT

13.1.5 NUCOR CORPORATION

TABLE 253 NUCOR CORPORATION: BUSINESS OVERVIEW

FIGURE 34 NUCOR CORPORATION: COMPANY SNAPSHOT

13.1.6 LINDSAY CORPORATION

TABLE 254 LINDSAY CORPORATION: BUSINESS OVERVIEW

FIGURE 35 LINDSAY CORPORATION: COMPANY SNAPSHOT

13.1.7 HILL & SMITH HOLDING PLC

TABLE 255 HILL & SMITH HOLDINGS PLC: BUSINESS OVERVIEW

FIGURE 36 HILL & SMITH HOLDINGS PLC: COMPANY SNAPSHOT

13.1.8 TRANSPO INDUSTRIES, INC.

TABLE 256 TRANSPO INDUSTRIES, INC.: BUSINESS OVERVIEW

13.1.9 ARBUS LIMITED

TABLE 257 ARBUS LIMITED: BUSINESS OVERVIEW

13.1.10 AVON BARRIER CORPORATION LTD.

TABLE 258 AVON BARRIER CORPORATION LTD.: BUSINESS OVERVIEW

13.2 OTHER PLAYERS

13.2.1 PENNAR INDUSTRIES LTD.

13.2.2 JINDAL INDIA LIMITED

13.2.3 OTW SAFETY

13.2.4 DELTABLOC INTERNATIONAL GMBH

13.2.5 SHEETAL GROUP

13.2.6 FRONTIER POLYMERS LTD.

13.2.7 HOUSTAN SYSTEMS PRIVATE LIMITED.

13.2.8 BARRIER1 SYSTEMS, LLC

13.2.9 KARTIKEYA INDUSTRIES PRIVATE LTD.

13.2.10 ROWA CIL INFRASTRUCTURES

13.2.11 SUMMIT PRECAST CONCRETE

13.2.12 GUANGXI SHITENG TRAFFIC FACILITIES CO. LTD.

13.2.13 MEDITERRANEAN BUILDING MATERIALS

13.2.14 DANA STEEL PROCESSING INDUSTRY LLC

13.2.15 GALVACOAT

*Details on Business Overview, Products Offered, MnM view, Key strengths/Right to win, Strategic choices made, Weakness and competitive threats, might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 213)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

Overview of Barrier Systems Market

Barrier systems refer to physical structures or devices that are designed to restrict access, prevent or limit movement, and provide protection against potential hazards. Barrier systems are used in various applications, including road safety, industrial safety, public safety, and others. The global barrier systems market is expected to witness significant growth in the coming years, primarily driven by the increasing demand for safety and security solutions across various end-use industries.

Crash barriers are a type of barrier system designed to prevent vehicles from colliding with hazardous obstacles, such as buildings, walls, or other vehicles. Crash barriers are an essential component of road safety systems and are widely used in highways, bridges, tunnels, and other public areas. The crash barrier market is a significant segment of the barrier systems market, and the demand for crash barriers is expected to continue to grow due to the increasing focus on road safety worldwide.

The growth of the barrier systems market is expected to have a significant impact on the crash barrier market, as the demand for crash barriers is closely linked to the growth of the road safety market. The increasing focus on road safety and the rising number of accidents and fatalities on roads worldwide are driving the demand for crash barriers. Additionally, the increasing adoption of advanced barrier systems, such as automatic crash barriers, is expected to create new growth opportunities for the crash barrier market in the future.

Futuristic Growth Use-Cases of Barrier Systems Market

The barrier systems market is expected to witness significant growth in the future, driven by the increasing demand for safety and security solutions in various end-use industries. Some of the potential growth use-cases of the barrier systems market include: Increasing adoption of smart barrier systems that incorporate advanced technologies such as sensors, cameras, and IoT devices to provide real-time monitoring and control. Growing demand for automated barrier systems that can be operated remotely or automatically using software and control systems. Increasing focus on environmental safety and the use of barrier systems to prevent pollution and contain hazardous materials.

Top Players in Barrier Systems Market

Some of the top players operating in the barrier systems market include Tata Steel Europe Ltd., Hill & Smith Holdings PLC, Bekaert SA, Trinity Industries Inc., Lindsay Corporation, Avon Barrier Corporation Ltd., Tata Steel Ltd., Valmont Industries Inc.

Other Industries Impacted by Barrier Systems Market

The barrier systems market is expected to impact various other industries in the future, such as:

1. Construction Industry: Barrier systems are widely used in the construction industry for safety and security purposes, such as securing construction sites, restricting access to hazardous areas, and preventing falls from heights.

2. Industrial Safety: Barrier systems are an essential component of industrial safety systems, and their demand is expected to grow as companies focus on improving workplace safety and reducing the risk of accidents and injuries.

3. Public Safety: Barrier systems are also used for public safety purposes, such as crowd control, perimeter security, and protection against terrorism and other threats. The demand for barrier systems in public safety applications is expected to grow due to increasing security concerns

Speak to our Analyst today to know more about Barrier Systems Market!

The study involved four major activities in estimating the size of the Crash Barrier Systems Market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

The crash barrier systems market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the crash barrier systems market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the crash barrier systems market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets were identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Crash barrier systems: Bottom-Up Approach

Crash barrier systems: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the crash barrier systems market.

Report Objectives

-

To define, describe, and forecast the crash barrier systems market in terms of value and volume

To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

To analyze and forecast the market size based on type, technology, device and applications.

To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), South America and Middle East and Africa (MEA) (along with the key countries in each region)

To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

To analyze the competitive developments, such as new product launch, expansion, mergers & acquisitions, joint venture, and agreement & contracts in the crash barrier systems market

To strategically profile the key players and comprehensively analyze their core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Crash Barrier Systems Market

What is the Crash Barrier Systems Market Size, Share Analysis with Industry Forecasts in 2022 - 2027?