Craniomaxillofacial Implants Market by Type (Mid Face, Plates, Screws, Mandibular Orthognathic Implants, Neuro, Mesh, Bone Graft, Dural Repair), by Material of Construction (Titanium, Polymer), by Application Site & Property - Global Forecast to 2021

The global Craniomaxillofacial implants market size is projected to grow at a CAGR of 6.9%. The global market is broadly classified into type, application site, material of construction, property and regions.

Based on type, the craniomaxillofacial implants market is segmented into mid face implants, mandibular orthognathic implants, cranial/neuro implants, bone graft substitutes, distraction systems, total TMJ replacement systems, cranial flap fixation systems, thoracic fixation systems, and dural repair products. Mid-face implants segment is poised to witness the highest growth rate in the market. The growth of this market segment is attributed to the increasing number of road accident and trauma cases worldwide.

Based on material of construction, the craniomaxillofacial implants market is segmented into titanium, other metals, and alloys; polymers/biomaterials; and calcium phosphate ceramics. Polymers/biomaterials segment is expected to witness highest growth rate in the market. This growth is attributed due to the growing preference for polymers/biomaterials as a result of their resorbable properties among the clinicians across the globe.

The craniomaxillofacial implants market, by application site, is segmented into external fixators and internal fixators The external fixators segment is expected witness the highest growth rate in the market. The growth of this segment is attributed to extensive usage of external fixators in the neurosurgery.

The craniomaxillofacial implants market, by property, is segmented into non-resorbable fixators and resorbabale fixators. Resorbable fixators segment is expected to witness the highest growth rate in the craniomaxillofacial implants. This growth is mainly driven by advantages of resorbable fixators such as Shorter healing time and no need for the follow up surgery to remove the fixator.

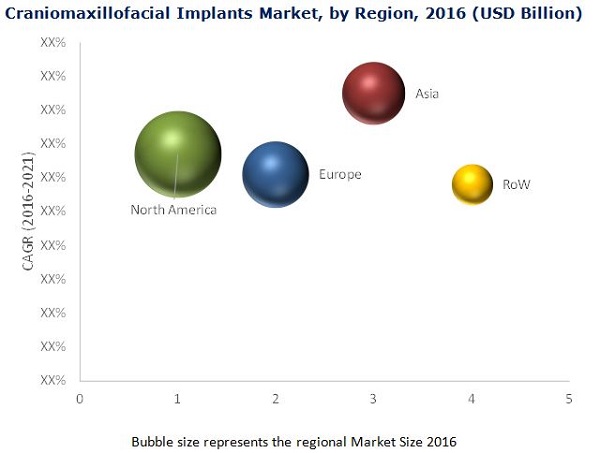

In the coming five years, growth in the Craniomaxillofacial implants market is likely to be centered in Asia. Growth in this region can be attributed to the increasing number of road accident cases and resultant injuries, trauma cases, growing number of hospitals, and rising number of newborns with facial deformities in the Asian region is further driving the growth of this market.

The key players in the craniomaxillofacial implants market are Stryker (U.S.), KLS Martin (U.S.), Depuy Synthes (U.S.)., Zimmer Biomet (U.S.), Medtronic (Ireland), Integra Lifesciences (U.S.), OsteoMed (U.S.), Medartis AG (Switzerland), Matrix Surgical USA (U.S.), and Calavera (U.S.)

Target Audience for this Report

- Craniomaxillofacial Implants Manufacturers

- Craniomaxillofacial Implants Distributors

- Hospitals

- Research and Consulting Firms

- Venture Capitalists

- Regulatory Bodies

Value Addition for the Buyer

This report aims to provide insights into the craniomaxillofacial implants market. It provides valuable information on the type, application site, material of construction, and property, in the market. Furthermore, the information for these segments, by region, is also presented in this report. Leading players in the market are profiled to study their product offerings and understand the strategies undertaken by them to be competitive in this market.

The above-mentioned information would benefit the buyer by helping them understand the market dynamics. In addition, the forecasts provided in the report will enable firms to understand the trends in this market and better position themselves to capitalize the growth opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Craniomaxillofacial Implants Market Report Scope

This report categorizes the craniomaxillofacial implants market into the following segments:

By Type

-

Mid Face Implants

- Screws

- Plates

-

Mandibular Orthognathic Implants

- Screws

- Plates

-

Cranial or Neuro Implants

- Screws

- Plates

- Contourable Mesh

- Bone Graft Substitutes

- Distraction Systems

- Total TMJ Replacement Systems

- Cranial Flap Fixation Systems

- Thoracic Fixation Systems

-

Dural Repair Products

- Dural Substitutes

- Dural Sealants

By Application Site

- Internal Fixators

- External Fixators

By Material of Construction

- Titanium, other metals and alloys

- Calcium Phosphate Ceramics

- Polymers/Biomaterials

By Property

- Resorbable Fixators

- Non-resorbable Fixators

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- France

- RoE

-

Asia

- China

- Japan

- India

- RoA

- Rest of the World (RoW)

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

Craniomaxillofacial implants refers to implants used in the Craniomaxillofacial surgeries. Craniomaxillofacial surgery is performed to treat injuries, defects, and diseases in the head, neck, face, jaws, hard and soft tissues of the oral and maxillofacial region. It is internationally recognized surgical speciality. The major factors driving the growth of this market are increasing number of road accidents, trauma cases, rising demand for minimally invasive reconstruction surgeries, rising prevalence of congenital facial deformities, and technological advancements. High growth potential in emerging markets have opened an array of opportunities for the market. On the other hand, high cost of craniomaxillofacial surgeries is a major factor expected to restrain the growth of this market during the forecast period.

Based on type, the craniomaxillofacial implants market is segmented into mid face implants, mandibular orthognathic implants, cranial/neuro implants, bone graft substitutes, distraction systems, total TMJ replacement systems, cranial flap fixation systems, thoracic fixation systems, and dural repair products. Mid-face implants segment is poised to witness the highest growth rate in the market in 2016. The growth of this market segment is attributed to the increasing number of road accident and trauma cases worldwide.

Based on material of construction, the craniomaxillofacial implants market is segmented into titanium, other metals, and alloys; polymers/biomaterials; and calcium phosphate ceramics. Polymers/biomaterials segment is expected to witness highest growth rate in the market in 2016. This growth is attributed due to the growing preference for polymers/biomaterials as a result of their resorbable properties among the clinicians across the globe.

The craniomaxillofacial implants market, by application site, is segmented into external fixators and internal fixators. The external fixators segment is expected witness the highest growth rate in the market in 2016. The growth of this segment is attributed to extensive usage of external fixators in the neurosurgery.

The craniomaxillofacial implants market, by property, is segmented into non-resorbable fixators and resorbabale fixators. Resorbable fixators segment is expected to witness the highest growth rate in the market in 2016. This growth is mainly driven by advantages of resorbable fixators such as Shorter healing time and no need for the follow up surgery to remove the fixator.

Source: Annual Reports, SEC Filings, Press Releases, Investor Presentations, WHO, USFDA, Insurance Institute for Highway Safety Highway Loss Data Institute, National Trauma Data Bank, National Trauma Registry (Canada), National Audit Office (U.K.), Global Registry and Database on Craniofacial Anomalies, International Society for Craniofacial Surgery, International Association of Oral and Maxillofacial Surgeons, American Academy of Craniomaxillofacial Surgeons, American Society of Craniofacial Surgery, European Society of Craniofacial Surgery, Association of Oral and Maxillofacial Surgeons of India, Organisation for Economic Co-operation and Development (OECD), Expert Interviews, and MarketsandMarkets Analysis

The global craniomaxillofacial implants market is dominated by North America, followed by Europe, Asia, and the Rest of the World (RoW). North America will continue to dominate the global craniomaxillofacial market in the forecast period. Growth in this regional segment is driven by factors such as the increasing number of road accident injuries, rising prevalence of congenital facial deformities are driving the growth in North America. However, Asia is expected to witness the highest CAGR, with the growth in this market centered at China and India. Growth in these regions can be attributed to the increasing number of road accident cases and resultant injuries, trauma cases, growing number of hospitals, and rising number of newborns with facial deformities.

The key players in the craniomaxillofacial implants market are Stryker (U.S.), KLS Martin (U.S.), Depuy Synthes (U.S.)., Zimmer Biomet (U.S.), Medtronic (Ireland), Integra Lifesciences (U.S.), OsteoMed (U.S.), Medartis AG (Switzerland), Matrix Surgical USA (U.S.), and Calavera (U.S.)

Frequently Asked Questions (FAQ):

What is the size of Craniomaxillofacial Implants Market ?

The global Craniomaxillofacial Implants Market size is growing at a CAGR of 6.9%

What are the major growth factors of Craniomaxillofacial Implants Market ?

In the coming five years, growth in the Craniomaxillofacial implants market is likely to be centered in Asia. Growth in this region can be attributed to the increasing number of road accident cases and resultant injuries, trauma cases, growing number of hospitals, and rising number of newborns with facial deformities in the Asian region is further driving the growth of this market.

Who all are the prominent players of Craniomaxillofacial Implants Market ?

The key players in the craniomaxillofacial implants market are Stryker (U.S.), KLS Martin (U.S.), Depuy Synthes (U.S.)., Zimmer Biomet (U.S.), Medtronic (Ireland), Integra Lifesciences (U.S.), OsteoMed (U.S.), Medartis AG (Switzerland), Matrix Surgical USA (U.S.), and Calavera (U.S.) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.3 Market Share Estimation

2.3.1 Key Data From Secondary Sources

2.3.2 Key Data From Primary Sources

2.4 Key Industry Insights

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Market Overview

4.2 Market, By Type

4.3 Market, By Material of Construction

4.4 Geographical Snapshot of the Market

4.5 Life Cycle Analysis

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Number of Road Accidents & Trauma Cases Globally

5.3.1.2 Rising Demand for Minimally Invasive Reconstruction Surgeries

5.3.1.3 Growing Number of Congenital Facial Deformities

5.3.1.4 New and Improved Procedural Techniques and Technologically Advanced Products

5.3.2 Restraint

5.3.2.1 High Cost of Craniomaxillofacial Surgeries

5.3.3 Opportunity

5.3.3.1 Emerging Markets to Offer Significant Opportunities for Expansion

5.4 Regulations & Safety Issues

6 Craniomaxillofacial Implants Market, By Type (Page No. - 49)

6.1 Introduction

6.1.1 Mid-Face Implants

6.1.1.1 Plates

6.1.1.2 Screws

6.1.2 Mandibular Orthognathic Implants

6.1.2.1 Plates

6.1.2.2 Screws

6.1.3 Cranial/Neuro Implants

6.1.3.1 Contourable Meshes

6.1.3.2 Plates

6.1.3.3 Screws

6.1.4 Bone Graft Substitutes

6.1.5 Distraction Systems

6.1.6 Total Tmj Replacement Systems

6.1.7 Cranial Flap Fixation Systems

6.1.8 Thoracic Fixation Systems

6.1.9 Dural Repair Products

6.1.9.1 Dural Substitutes

6.1.9.2 Dural Sealants

7 Craniomaxillofacial Implants Market, By Application Site (Page No. - 68)

7.1 Introduction

7.2 External Fixators

7.3 Internal Fixators

8 Craniomaxillofacial Implants Market, By Material of Construction (Page No. - 72)

8.1 Introduction

8.1.1 Titanium, Other Metals, and Alloys

8.1.2 Polymers/Biomaterials

8.1.3 Calcium Phosphate Ceramics

9 Craniomaxillofacial Implants Market, By Property (Page No. - 82)

9.1 Introduction

9.2 Non-Resorbable Fixators

9.3 Resorbable Fixators

10 Craniomaxillofacial Implants Market, By Region (Page No. - 86)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Rest of Europe (RoE)

10.4 Asia

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia (RoA)

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 115)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situations and Trends

11.3.1 Mergers and Acquisitions

11.3.2 New Product Launches

11.3.3 Partnerships and Agreements

11.3.4 Expansions

12 Company Profiles (Page No. - 121)

(Business Overview, Products & Services, Developments, MnM View)*

12.1 Introduction

12.2 Stryker Corporation

12.3 KLS Martin

12.4 Depuy Synthes

12.5 Medtronic PLC

12.6 Zimmer Biomet Holdings, Inc.

12.7 Osteomed L.P.

12.8 Integra Life Sciences

12.9 Medartis Ag

12.10 Matrix Surgical USA

12.11 Calavera Surgical Design

*Details on Marketsandmarkets View, Introduction, Product & Services, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 140)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (95 Tables)

Table 1 Increasing Number of Road Accidents & Trauma Cases Globally to Trigger Market Growth

Table 2 High Cost of Craniomaxillofacial Surgeries to Restrain Market Growth

Table 3 Emerging Markets Offer Significant Opportunities for Market Players

Table 4 Craniomaxillofacial Implants Market Size, By Type,2014–2021 (USD Million)

Table 5 Mid-Face Implants Market Size, By Region, 2014–2021 (USD Million)

Table 6 Mid-Face Implants Market Size, By Type, 2014-2021 (USD Million)

Table 7 Mid-Face Plates Market Size, By Region, 2014–2021 (USD Million)

Table 8 Mid-Face Screws Market Size, By Region, 2014–2021 (USD Million)

Table 9 Mandibular Orthognathic Implants Market Size, By Region,2014–2021 (USD Million)

Table 10 Mandibular Orthognathic Implants Market Size, By Type,2014-2021 (USD Million)

Table 11 Mandibular Orthognathic Plates Market Size, By Region,2014–2021 (USD Million)

Table 12 Mandibular Orthognathic Screws Market Size, By Region,2014–2021 (USD Million)

Table 13 Cranial/Neuro Implants Market Size, By Region,2014–2021 (USD Million)

Table 14 Cranial/Neuro Implants Market Size, By Type, 2014-2021 (USD Million)

Table 15 Cranial/Neuro Contourable Meshes Market Size, By Region,2014–2021 (USD Million)

Table 16 Cranial/Neuro Plates Market Size, By Region, 2014–2021 (USD Million)

Table 17 Cranial/Neuro Screws Market Size, By Region, 2014–2021 (USD Million)

Table 18 Bone Graft Substitutes Market Size, By Region, 2014–2021 (USD Million)

Table 19 Distraction Systems Market Size, By Region, 2014–2021 (USD Million)

Table 20 Total Tmj Replacement Systems Market Size, By Region,2014–2021 (USD Million)

Table 21 Cranial Flap Fixation Implants Market Size, By Region,2014–2021 (USD Million)

Table 22 Thoracic Fixation Systems Market Size, By Region,2014–2021 (USD Million)

Table 23 Dural Repair Products Market Size, By Region, 2014–2021 (USD Million)

Table 24 Dural Substitutes Market Size, By Region, 2014–2021 (USD Million)

Table 25 Dural Sealants Market Size, By Region, 2014–2021 (USD Million)

Table 26 Market Size, By Application Site,2014–2021 (USD Million)

Table 27 External Craniomaxillofacial Fixators Market Size, By Region,2014–2021 (USD Million)

Table 28 Internal Craniomaxillofacial Fixators Market Size, By Region,2014–2021 (USD Million)

Table 29 Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 30 Market Size for Titanium, Other Metals, and Alloys, By Region, 2014–2021 (USD Million)

Table 31 North America: Market Size for Titanium, Other Metals, and Alloys, By Country, 2014–2021 (USD Million)

Table 32 Europe: Market Size for Titanium, Other Metals, and Alloys, By Country, 2014–2021 (USD Million)

Table 33 Asia: Market Size for Titanium, Other Metals, and Alloys, By Country, 2014–2021 (USD Million)

Table 34 Market Size for Polymers/Biomaterials, By Region, 2014–2021 (USD Million)

Table 35 North America: Market Size for Polymers/Biomaterials, By Country, 2014–2021 (USD Million)

Table 36 Europe: Market Size for Polymers/Biomaterials, By Country, 2014–2021 (USD Million)

Table 37 Asia: Market Size for Polymers/Biomaterials, By Country, 2014–2021 (USD Million)

Table 38 Market Size for Calcium Phosphate Ceramics, By Region, 2014–2021 (USD Million)

Table 39 North America: Market Size for Calcium Phosphate Ceramics, By Country, 2014–2021 (USD Million)

Table 40 Europe: Market Size for Calcium Phosphate Ceramics, By Country, 2014–2021 (USD Million)

Table 41 Asia: Market Size for Calcium Phosphate Ceramics, By Country, 2014–2021 (USD Million)

Table 42 Market Size, By Property,2013–2021 (USD Million)

Table 43 Non-Resorbable Craniomaxillofacial Fixators Market Size, By Region, 2014–2021 (USD Million)

Table 44 Resorbable Craniomaxillofacial Fixators Market Size, By Region,2014–2021 (USD Million)

Table 45 Market Size, By Region,2014–2021 (USD Million)

Table 46 North America: Market Size,By Country, 2014–2021 (USD Million)

Table 47 Europe: Market Size, By Country,2014–2021 (USD Million)

Table 48 Asia: Market Size, By Country,2014–2021 (USD Million)

Table 49 North America: Market Size,By Type, 2014–2021 (USD Million)

Table 50 North America: Mid-Face Implants Market Size, By Type,2014-2021 (USD Million)

Table 51 North America: Mandibular Orthognathic Implants Market Size,By Type, 2014-2021 (USD Million)

Table 52 North America: Cranial/Neuro Implants Market Size, By Type,2014-2021 (USD Million)

Table 53 North America: Dural Repair Implants Market Size, By Type,2014-2021 (USD Million)

Table 54 North America: Market Size,By Application Site, 2014–2021 (USD Million)

Table 55 North America: Market Size,By Material of Construction, 2014–2021 (USD Million)

Table 56 North America: Market Size,By Property, 2014–2021 (USD Million)

Table 57 U.S.: Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 58 Canada: Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 59 Europe: Craniomaxillofacial Implants Market Size, By Type,2014–2021 (USD Million)

Table 60 Europe: Mid-Face Implants Market Size, By Type, 2014-2021 (USD Million)

Table 61 Europe: Mandibular Orthognathic Implants Market Size, By Type,2014-2021 (USD Million)

Table 62 Europe: Cranial/Neuro Implants Market Size, By Type,2014-2021 (USD Million)

Table 63 Europe: Dural Repair Implants Market Size, By Type,2014-2021 (USD Million)

Table 64 Europe: Craniomaxillofacial Implants Market Size, By Application Site, 2014–2021 (USD Million)

Table 65 Europe: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 66 Europe: Craniomaxillofacial Implants Market Size, By Property,2014–2021 (USD Million)

Table 67 Germany: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 68 France: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 69 U.K.: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 70 Number of People Injured in Road Accidents, 2015

Table 71 RoE: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 72 Asia: Craniomaxillofacial Implants Market Size, By Type,2014–2021 (USD Million)

Table 73 Asia: Mid-Face Implants Market Size, By Type, 2014-2021 (USD Million)

Table 74 Asia: Mandibular Orthognathic Implants Market Size, By Type,2014-2021 (USD Million)

Table 75 Asia: Cranial/Neuro Implants Market Size, By Type,2014-2021 (USD Million)

Table 76 Asia: Dural Repair Implants Market Size, By Type,2014-2021 (USD Million)

Table 77 Asia: Craniomaxillofacial Implants Market Size, By Application Site, 2014–2021 (USD Million)

Table 78 Asia: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 79 Asia: Craniomaxillofacial Implants Market Size, By Property,2014–2021 (USD Million)

Table 80 China: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 81 India: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 82 Japan: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 83 RoA: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 84 RoW: Craniomaxillofacial Implants Market Size, By Type,2014–2021 (USD Million)

Table 85 RoW: Mid-Face Implants Market Size, By Type, 2014-2021 (USD Million)

Table 86 RoW: Mandibular Orthognathic Implants Market Size, By Type,2014-2021 (USD Million)

Table 87 RoW: Cranial/Neuro Implants Market Size, By Type,2014-2021 (USD Million)

Table 88 RoW: Dural Repair Implants Market Size, By Type,2014-2021 (USD Million)

Table 89 RoW: Craniomaxillofacial Implants Market Size, By Application Site, 2014–2021 (USD Million)

Table 90 RoW: Craniomaxillofacial Implants Market Size, By Material of Construction, 2014–2021 (USD Million)

Table 91 RoW: Craniomaxillofacial Implants Market Size, By Property, 2014–2021 (USD Million)

Table 92 Mergers and Acquisitions, 2013–2016

Table 93 New Product Launches, 2013–2016

Table 94 Partnerships and Agreements, 2013–2016

Table 95 Expansions, 2013–2016

List of Figures (41 Figures)

Figure 1 Research Design

Figure 2 Top-Down Approach

Figure 3 Bottom-Up Approach

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Data Triangulation Methodology

Figure 6 Mid-Face Implants to Dominate in the Craniomaxillofacial Implants Market

Figure 7 Polymers/Biomaterials to Register Highest Growth in the Craniomaxillofacial Implants Market

Figure 8 External Fixators is the Largest Segment in the Global Craniomaxillofacial Implants Market

Figure 9 Non-Resorbable Fixators to Dominate the Craniomaxillofacial Implants Market in the Forecast Period

Figure 10 Geographic Analysis: Craniomaxillofacial Implants Market

Figure 11 Emerging Economies Offer Significant Growth Opportunities for Players in the Craniomaxillofacial Implants Market During the Forecast Period

Figure 12 Mid-Face Implants to Witness the Highest Growth Rate During the Forecast Period

Figure 13 Titanium, Other Metals, and Alloys Segment in North America to Account for the Largest Share in 2015

Figure 14 Asian Market to Grow at the Highest CAGR During the Forecast Period

Figure 15 Asia Holds Lucrative Growth Potential During the Forecast Period

Figure 16 Craniomaxillofacial Implants Market, By Type

Figure 17 Craniomaxillofacial Implants Market, By Application Site

Figure 18 Craniomaxillofacial Implants Market, By Material of Construction

Figure 19 Craniomaxillofacial Implants Market, By Property

Figure 20 Craniomaxillofacial Implants Market, By Region

Figure 21 Craniomaxillofacial Implants Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 Mid-Face Implants Segment Dominates the Craniomaxillofacial Implants Market in 2016

Figure 23 North America is the Largest Market for Mid-Face Implants

Figure 24 Contourable Meshes is the Largest Segment in the Cranial/Neuro Implants Market

Figure 25 North America Holds the Largest Share of the Global Dural Repair Products Market

Figure 26 External Fixators Commands the Largest Share in the Craniomaxillofacial Implants Market During the Forecast Period

Figure 27 Craniomaxillofacial Implants Market Size, By Material of Construction, 2016 vs. 2021

Figure 28 North America to Account for the Largest Share of the Craniomaxillofacial Implants Market for Titanium, Other Metals, and Alloys in 2016

Figure 29 Non-Resorbable Fixators is the Largest Segment in the Craniomaxillofacial Implants Market

Figure 30 Asia to Witness Highest Growth in the Craniomaxillofacial Implants Market

Figure 31 North American Craniomaxillofacial Implants Market Snapshot

Figure 32 European Craniomaxillofacial Implants Market Snapshot

Figure 33 Asian Craniomaxillofacial Implants Market Snapshot

Figure 34 Mergers and Acquisitions—Key Growth Strategy Adopted By Market Players Between 2013 and 2016

Figure 35 Market Share Analysis: Craniomaxillofacial Implants Market

Figure 36 Battle for Market Share: Mergers and Acquisitions Was the Most-Widely Adopted Growth Strategy Between 2013 & 2016

Figure 37 Product Benchmarking of the Top 5 Players in the Craniomaxillofacial Implants Market

Figure 38 Company Snapshot: Stryker Corporation

Figure 39 Company Snapshot: Medtronic PLC

Figure 40 Company Snapshot: Zimmer Biomet Holdings, Inc.

Figure 41 Company Snapshot: Integra Lifesciences

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Craniomaxillofacial Implants Market