Cover Crops Market by Type (Legumes, Grasses, & Broadleaf Non-Legumes), Application (Soil Fertility Management, Soil Erosion Prevention, Weed Management, & Pest Management), Seed (Certified Seed & Farmed Saved Seed) and Region - Global Forecast to 2029

According to MarketsandMarkets, the cover crops market is projected to reach USD XX billion by 2029 from USD XX billion by 2024, at a CAGR of 6.2% during the forecast period in terms of value. The market for cover crops is expanding globally as more people become aware of their many advantages in sustainable agriculture. Legumes and grasses are examples of cover crops that are essential for promoting soil health because they decrease erosion, improve soil structure, and increase the amount of organic matter in the soil. They are essential to the cycling of nutrients, especially nitrogen, which lessens reliance on synthetic fertilizers and reduces environmental effect. Additionally, cover crops maintain biodiversity in agricultural landscapes by providing habitat for beneficial insects and helping to suppress weeds, which decreases the demand for pesticides. Global usage of cover crops is increasing as concerns over food security, resilience to climate change, and sustainable agricultural practices grow. Through incentives and instructional initiatives, governments and agricultural organizations are progressively endorsing these methods, further driving market growth and adoption worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Controlling weeds

Weed suppression is a key benefit driving the use of covering crops among farmers. Crops such as cereal rye and annual ryegrass effectively reduce weed growth by competing with them during their growth phase and creating a natural mulch that suppresses weeds after they are terminated. These cover crops establish quickly and produce a lot of biomasses, which can significantly reduce winter weeds by up to 50 to 100% before farmers plant their main crops in spring. This reduces the need for herbicides both before planting and after crops begin to grow. For example, studies in Kentucky have shown that covered crops with high biomass can sometimes completely replace the need for herbicides, saving money and lowering the risk of weeds becoming resistant to herbicides like glyphosate. However, it's important for farmers to choose cover crops carefully based on their crop rotation plans. Annual ryegrass, for instance, can be too aggressive if wheat is part of the crop rotation and should be avoided in those cases.

While legume cover crops such as crimson clover may not suppress weeds as effectively due to slower growth and less biomass, mixtures of grasses and legumes can offer both weed control and enrich the soil with nutrients for future cash crops. This dual benefit improves soil health and reduces the need for artificial fertilizers, promoting sustainable farming practices. As more farmers adopt integrated strategies to manage weeds and enhance soil fertility, the demand for diverse cover crop options is expected to grow, driving the cover crops market forward.

Restraint : Delayed or reduced crop emergence due to soil moisture

Delayed or reduced crop emergence due to soil moisture challenges from cover crop residue is a significant issue for the cover crops market. Cover crop leftovers can prevent the soil from warming up quickly, especially in cooler climates or wet springs. This delay can force farmers to wait longer for ideal planting conditions, pushing planting beyond the best window for crop growth. As a result, crops may grow late, facing more competition from weeds that require extra herbicides or manual weeding, increasing costs. Late-emerging crops also have less time to grow and mature, potentially lowering yields. This delay can disrupt crop rotation plans and affect market timing and profits, especially in regions with short growing seasons or unpredictable weather. To manage this, farmers need to time the termination of cover crops well, choose types that break down faster, and use strategies to control soil moisture and temperature. Education is also very important to help farmers understand and manage these risks, promoting sustainable farming practices.

Opportunity : Increase in organic agricultural practices

The market for cover crops has a lot of potential due to the growth of organic farming. Cover crops are an essential part of organic systems because they use natural ways instead of synthetic ones to control pests and soil fertility. According to the FiBL & IFOAM - Organics International (2024) report, considering lands under conversion, approximately XX million hectares of agricultural land were committed to organic farming methods globally in 2022. At XX million hectares (55%), Oceania is in first place, followed by Europe at XX million hectares (19%). Africa, Asia, North America, and Latin America all provide substantial contributions. A lot of organic agricultural land is found in nations like Argentina (XX million hectares), India (XX million hectares), and Australia (XX million hectares). As they improve soil, cover crops meet the specifications of organic farming, which in turn provides a solid market for them.

Challenge: Complexity in managing nitrogen levels.

One challenge for the cover crops market is managing nitrogen dynamics. Fall-grown cover crops capture leftover fertilizer nitrogen and nitrogen from soil organic matter. When these cover crops decompose, some nitrogen is released for the next cash crop, but some is absorbed by soil microbes. If the cover crop has a high carbon-to-nitrogen (C/N) ratio, like cereal rye, more nitrogen goes to the microbes, leaving less for the cash crop. This means farmers often need to add extra nitrogen, about 25 to 50 pounds per acre, for crops like corn after using cereal rye. Legume cover crops capture more nitrogen because they fix it biologically and take it from the soil. They can contribute 45 to 100 pounds of nitrogen per acre to the next crop, but the exact amount varies based on factors like biomass, C/N ratio, and when the cover crop is terminated. Predicting nitrogen contribution from legumes is difficult, and ongoing research is needed to better understand this. This complexity in managing nitrogen levels is a challenge for the cover crops market.

COVER CROPS MARKET ECOSYSTEM

Key players within this market consist of reputable and financially robust cover crops seeds products manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, cutting-edge technologies, and robust global sales and marketing networks. Prominent companies in this market are YIELD10 BIOSCIENCE, INC (US), Advance Cover Crops (US), Johnston Seed Company (US), Cope Seeds & Grain (UK), AGF Seeds Pty. Ltd (Australia), Lidea Seeds (France), Hudson Valley Seed Company (US), Capstone Seeds (South Africa), ProHarvest Seeds (US), Hancock Farm & Seed Co (US), Renovo Seed (US), Swell Seed Company (US), Roundstone (US), Nuseed (Australia), and Victory Seed Company (US).

By application, the soil fertility management segment is expected to dominate the cover crops market during the forecast period.

The soil fertility management segment is set to lead the cover crops market because cover crops like legumes and grasses are crucial for improving soil health and fertility. They help soil by making it more structured, improving water flow, and increasing organic matter through plant growth and decay. Cover crops also reduce the need for artificial fertilizers by capturing nitrogen from the air, cutting costs and lowering environmental impact. They also prevent weeds and soil erosion, making the soil more productive and resilient. As agriculture focuses more on sustainable practices for long-term productivity and to combat climate change, the use of cover crops to manage soil fertility is expected to grow, making it a dominant force in the market.

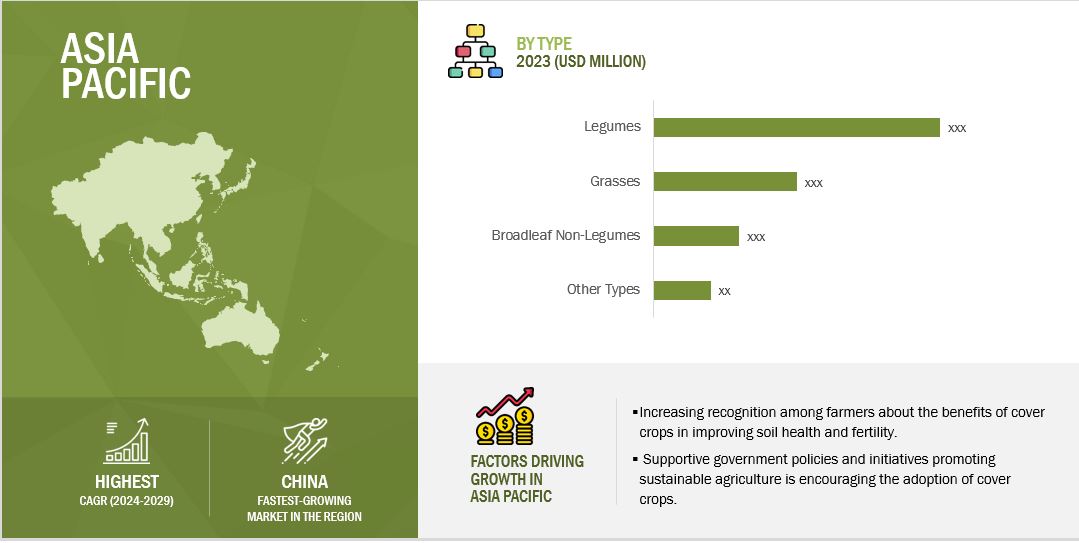

The Asia Pacific region is expected to grow at the highest CAGR during the forecast period in the cover crops market.

Farmers are becoming more conscious of the advantages of cover crops in improving soil sustainability and health, which is fueling this rise. Reducing environmental impact and enhancing agricultural resilience are becoming increasingly important as agriculture grows and intensifies throughout the region, especially in Southeast Asian, China, and India. Legume and grass-based cover crops, for example, assist in maintaining soil moisture, inhibit weed growth, and increase nutrient levels—all of which are critical in the varied farming systems found throughout Asia-Pacific. Adoption is helped by government policies that support sustainable agriculture methods. When all these factors come together, the usage of cover crops is expected to increase significantly in the Asia-Pacific region, which will propel market expansion in the next years.

Key Market Players

The key players in the market include YIELD10 BIOSCIENCE, INC (US), Advance Cover Crops (US), Johnston Seed Company (US), Cope Seeds & Grain (UK), AGF Seeds Pty. Ltd (Australia), Lidea Seeds (France), Hudson Valley Seed Company (US), Capstone Seeds (South Africa), ProHarvest Seeds (US), Hancock Farm & Seed Co (US), Renovo Seed (US), Swell Seed Company (US), Roundstone (US), Nuseed (Australia), and Victory Seed Company (US). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, Europe, and Middle East & Africa and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Recent Developments

- In May 2024, the extension of Nuseed Carinata and Omega-3 Canola Production System contract programs for 2024 was recently announced by Nuseed. Now available throughout the Southern United States, the Nuseed Carinata program assists farmers in improving agronomic conditions and soil health, supporting sustainable farming practices and raising productivity. This, in turn, has a beneficial effect on the market for cover crops by promoting a wider adoption of the product.

- In August 2020, A three-year non-exclusive research agreement has been established between Yield10 Bioscience, Inc., an agricultural bioscience firm, and GDM, a plant genetics specialist company, to assess innovative yield features in soybeans.

Frequently Asked Questions (FAQ):

Which are the major companies in the cover crops market? What are their major strategies to strengthen their market presence?

The key players in the market include YIELD10 BIOSCIENCE, INC (US), Advance Cover Crops (US), Johnston Seed Company (US), Cope Seeds & Grain (UK), AGF Seeds Pty. Ltd (Australia), Lidea Seeds (France), Hudson Valley Seed Company (US), Capstone Seeds (South Africa), ProHarvest Seeds (US), Hancock Farm & Seed Co (US), Renovo Seed (US), Swell Seed Company (US), Roundstone (US), Nuseed (Australia), and Victory Seed Company (US). These players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, South America, and Europe. They also have strong distribution networks across these regions.

What are the drivers and opportunities for the cover crops market?

The market for cover crops offers many prospects for expansion and is influenced by several factors. A growing number of individuals are becoming aware of and implementing sustainable agriculture methods, which include enhancing soil health, reducing erosion, and improving water quality. Farmers are given incentives to use cover crops in their crop rotations through government support and incentive initiatives, which in turn stimulate market expansion. The need to cover crops is increased by the global trend towards organic farming practices since these crops are essential to organic systems because they naturally control soil fertility and pests without the need for synthetic inputs. With the help of continuing agricultural research, advances in cover crop varieties and management strategies present chances to improve their efficacy and applicability in a range of climates and cropping systems. Furthermore, the potential for cover crops to provide.

Which region is expected to hold the highest market share?

North America is the market leader for covering crops market, mostly because of the broad adoption of these methods fostered by government incentives that support the enhancement of soil health and sustainable farming practices. The utilization of cover crops to improve soil fertility, limit erosion, and control weeds is encouraged by the region's varied agricultural environment, which ranges from large-scale commodity crops to smaller specialty crops. Furthermore, efficient cultivation of cover crops and their incorporation into crop rotations are supported by advanced agricultural infrastructure and favorable weather conditions. These elements support North America's leadership in the global cover crops market, together with a strong network of extension and research centers that highlight the advantages of cover crops.

What are the key technology trends prevailing in the cover crops market?

The development of precision agriculture methods specifically for the management of cover crops, such as remote sensing and GIS mapping for accurate planting and monitoring, is one of the major technological advancements in the cover crops sector. Technological developments in seed coatings increase the efficiency of nutrient absorption and increase germination rates in a variety of soil types. In addition, a rising number of cover crop species and mixes customized for farming objectives are being used, utilizing genetic innovations and biotechnology to maximize biomass output and insect resistance. These technical advancements are essential for tackling issues like soil health and climate variability, as well as for boosting productivity and sustainability in contemporary farming methods.

What total CAGR is expected to be recorded for the cover crops market from 2024 to 2029?

The CAGR is expected to be 6.2% from 2024-2029 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Cover Crops Market