Corn Gluten Meal Market by Process (Wet-milling, Dry-milling), Form (Unprocessed, Granulated, and Pelletized), Livestock (Poultry, Ruminants, Swine, Aquaculture, Others), and Key Region - Forecasted to 2027

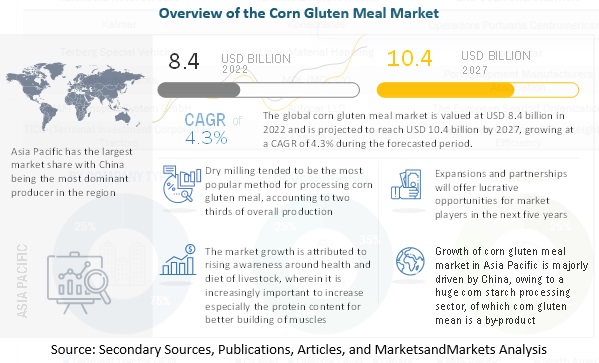

According to MarketsandMarkets, the global Corn gluten meal market is estimated to be valued at USD 8.4 billion in 2022. It is projected to reach USD 10.4 billion by 2027, with a CAGR of 4.3%, in terms of value between 2022 and 2027. Corn gluten meal is increasingly used as animal feed to improve their nutrition, especially focusing on proteins.

Corn Gluten Meal Market Dynamics

Drivers: Rising concern for health and muscle content of livestock pushing for demand of corn gluten meal

Since corn gluten meal is a naturally occurring product with a high protein content, it is being used as a healthy feed additive for animals. Further, corn gluten meal also provides animal feed with required dietary fiber, thereby further increasing its demand in the animal feed market.

Restraints: Soy used in animal feed turns out to be a major restraint for growth of corn gluten market

Soy is the mass manufactured crop to feed animals for higher protein availability and hence better muscular build. However, this presents a hurdle in the uptick of demand for corn gluten meal, which is also used as a source of protein in animal feed. The dominance of soy in market therefore raises restraints for corn gluten meal market.

Opportunities: Rising demand to replace chemically processed and pricier regular feeds

Corn gluten meal is being increasingly preferred over regular bovine and aquaculture feed. This is since the meal offers as a superior non-toxic feed product, when compared to other chemically processed feeds. It is gaining the fastest traction as a replacement for aquaculture meal owing to it being cheaper than the latter.

Challenges: Greatest challenge in the market revolves around testing of corn-gluten quality

Corn gluten meal market in general does not yet have provisions to check the quality of corn gluten used in it. The only characteristics tested are protein content and feed-safety evaluation, and therefore corn gluten meal market faces hurdles in adoption as animal feed as quality of its ingredient, which is corn gluten, is not determined in the product.

Corn gluten meal is being increasingly recognized as a natural herbicide.

The market for corn gluten meal is supported by its rising image as a naturally occurring herbicide, which prevents grass and weed seeds from sprouting while causing no harm to existing plants. Therefore, it has witnessed a rise in usage in organic weed control products as well.

By livestock, use of corn gluten meal is expected to showcase the fastest growth in aquaculture.

Aquaculture industry is expected to propel the demand for corn gluten meal over the forecasted period. This is since corn gluten meal is being increasingly considered as a fish meal as against the regular feed available in market, which tends to be pricier than corn gluten meal.

Asia Pacific has the largest market share in 2022 with China being the most dominant producer of corn gluten meal in the region. Both, higher yields and consumption of China are driven by the fact that the country also manages a large corn starch processing sector, of which corn gluten meal is a by-product.

Key Market Players:

Key players in this market include Ingredion Incorporated (US), Grain Processing Corporation (US), Cargill Incorporated (US), Tate & Lyle Plc. (England), Archer Daniels Midland Company (US), among others.

FAQs:

- Which are the major Corn gluten meal segments considered in this study and which of them are projected to have promising growth rates in the future?

- I am interested in the Asia Pacific market for unprocessed and granulated corn gluten meal segment. Is the customization available for the same? What all information would be included in the same?

- What are some of the drivers fuelling the growth of the Corn gluten meal market?

- I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

- What kind of information is provided in the competitive landscape section?

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMERíS BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 2022-2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTERíS FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 CORN GLUTEN MEAL MARKET, BY PROCESS

7.1 INTRODUCTION

7.2 WET-MILLING

7.3 DRY-MILLING

8 CORN GLUTEN MEAL MARKET, BY FORM

8.1 INTRODUCTION

8.2 UNPROCESSED

8.3 GRANULATED

8.4 PELLETIZED

9 CORN GLUTEN MEAL MARKET, BY LIVESTOCK

9.1 INTRODUCTION

9.2 POULTRY

9.3 RUMINANTS

9.4 SWINE

9.5 AQUACULTURE

9.6 OTHERS

10 CORN GLUTEN MEAL MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 UK

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 INDIA

10.4.3 JAPAN

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.5 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 REST OF THE WORLD

10.6.1 AFRICA

10.6.2 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS*

11.3 KEY PLAYERS STRATEGIES

11.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

11.5.5 COMPETITIVE BENCHMARKING

11.6 PRODUCT FOOTPRINTS

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

11.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.8.1 NEW PRODUCT LAUNCHES

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

11.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

12 COMPANY PROFILES

12.1 INGREDION INCORPORATED

12.2 GRAIN PROCESSING CORPORATION

12.3 TATE & LYLE PLC.

12.4 CARGILL INCORPORATED

12.5 ARCHER DANIELS MIDLAND COMPANY

12.6 BUNGE LTD.

12.7 THE ROQUETTE GROUP

12.8 AGRANA GROUP

12.9 TEREOS SYRAL

Note: Currently, list of only 9 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon clientís interest

13 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Corn Gluten Meal Market