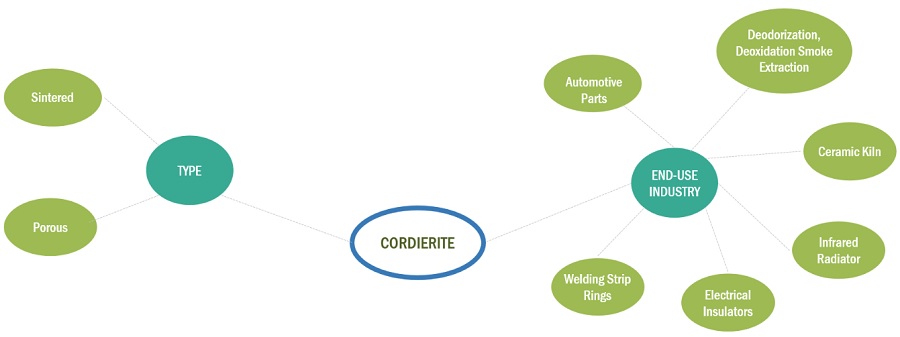

Cordierite Market by Type (Sintered, Porous), Application (Automotive Parts, Deodorization, Deoxidation Smoke Extraction, Ceramic Kiln, Infrared Radiator, Electrical Insulators, Welding Strip Rings), And Region - Global Forecast to 2028

Cordierite Market

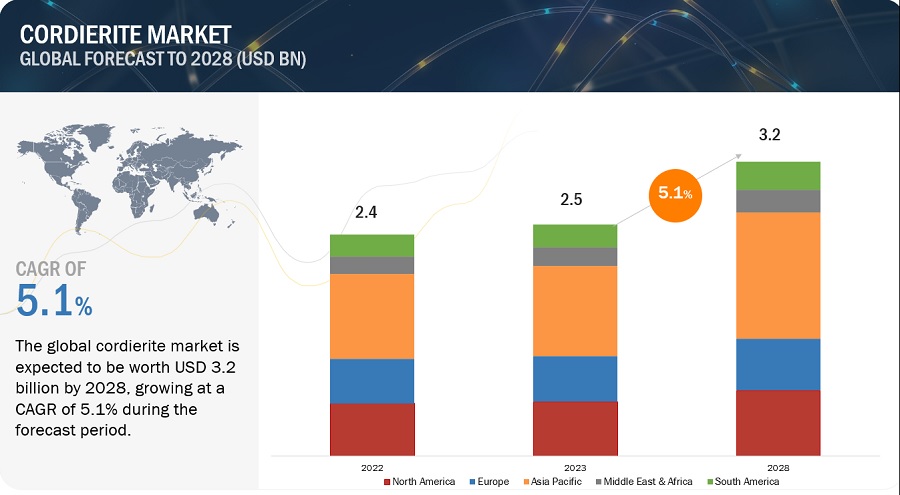

The global cordierite market is valued at USD 2.5 billion in 2023 and is projected to reach USD 3.2 billion by 2028, growing at 5.1% cagr during the forecast period. The demand for cordierite is being driven by the increasing demand for energy-efficient solutions and lightweight materials. Cordierite can be easily manufactured into various shapes and sizes using conventional ceramic processing techniques, including extrusion and injection molding. This flexibility in manufacturing allows for the production of complex and customized components. Cordierite exhibits high strength and rigidity, providing mechanical stability to components made from this material. It can withstand mechanical stresses and vibrations commonly experienced in automotive and industrial applications. This property is particularly crucial in environments where components need to maintain their structural integrity.

Global Cordierite Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Cordierite Market Dynamics

Driver: Growing demand from automotive and industrial sectors

The automotive industry is a major driver for the cordierite market. Cordierite-based products, such as catalytic converters and diesel particulate filters (DPFs), are extensively used in vehicles to reduce emissions and meet regulatory standards. As the global automotive industry continues to expand, particularly in emerging economies, the demand for cordierite-based components is expected to rise.

Cordierite's unique properties, including low thermal expansion, high thermal shock resistance, and good mechanical strength, make it suitable for various industrial applications. It is widely used in the manufactureing of kiln furniture, which is used to support and hold ceramic ware during firing processes. The expanding ceramics and glass industries, particularly in developing emerging regions, are driving the demand for cordierite-based kiln furniture.

Restraint: High manufacturing costs

Cordierite-based products require specialized manufacturing processes, including shaping, drying, and firing at high temperatures. These processes can be energy-intensive and require advanced equipment and expertise, resulting in relatively high manufacturing costs. The higher costs associated with cordierite production can act as a restraint, particularly in price-sensitive markets or during periods of economic downturn when cost-cutting measures become more prevalent.

Opportunity: Expansion of energy sector

The increasing focus on renewable energy sources, such as solar and wind power, presents opportunities for cordierite-based products in energy-related applications. Cordierite's thermal stability and insulation properties make it suitable for use in components like ceramic heat exchangers, combustion chambers, and thermal energy storage systems. As the renewable energy sector continues to grow, the demand for cordierite-based solutions in energy applications is expected to increase.

Challenges: Complex manufacturing processes and quality control

The production of cordierite-based products involves complex manufacturing processes, including mixing, shaping, drying, and firing. Maintaining consistent product quality throughout these processes can be challenging. Any variations in the manufacturing parameters or raw material quality can affect the final product's performance of the product. Implementing robust quality control measures and process optimization strategies is crucial to ensuring product consistency and meeting customer requirements.

Cordierite Market Ecosystem

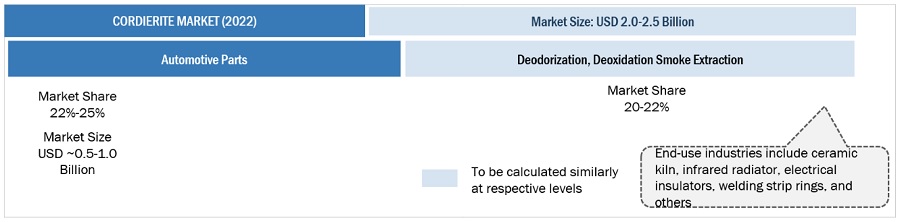

By application, automotive parts is estimated to be the third-fastest growing segment during the forecast period in the cordierite market.

Diesel Particulate Filters (DPF) are crucial components in diesel engines that capture and remove particulate matter (PM) or soot from the exhaust gases. Cordierite is widely used as the material for the DPF substrate due to its ability to withstand high temperatures and provide effective filtration. The cordierite substrate traps and stores the soot particles until they are burned off during the regeneration process, ensuring cleaner exhaust emissions. The consumption of cordierite in automotive parts, specifically catalytic converters and DPFs, depends on various factors, including the vehicle's type (gasoline or diesel), engine size, emission standards, and the specific design of the components. The size and shape of the cordierite substrate can vary depending on the application and the requirements of the vehicle manufacturer.

By type, sintered cordierite is estimated to be the fastest-growing segment during the forecast period in the cordierite

Sintered Cordierite is produced by compacting cordierite powder and firing it at high temperatures to achieve solid-state sintering. This process leads to a dense, non-porous ceramic structure. Sintered cordierite exhibits high mechanical strength, low thermal expansion, and excellent thermal shock resistance. It is known for its stability at high temperatures and good resistance to thermal cycling. This type of cordierite is commonly used in applications where high mechanical strength and thermal stability are required, such as automotive diesel particulate filters (DPFs), catalytic converters, and kiln furniture.

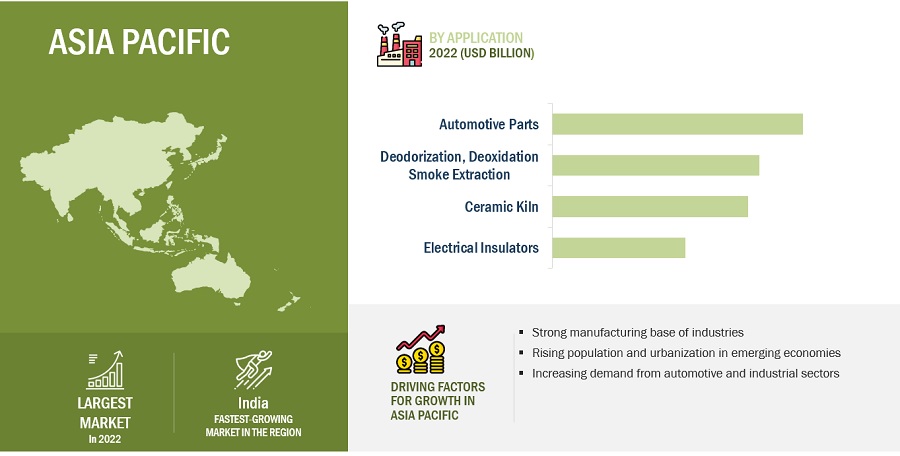

Asia Pacific is projected to be fastest growing amongst other regions in the cordierite market, in terms of value

Asia Pacific is projected to be the fastest-growing market for cordierite due to rapid industrialization in recent years, particularly in countries like China, India, and South Korea. This has led to an increase in demand for cordierite, which is used in various applications such as automotive parts, ceramic kiln, and electrical insulators among others. Industries are increasingly using cordierite for high-precision manufacturing processes, research & development, and quality control.

To know about the assumptions considered for the study, download the pdf brochure

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

Cordierite Market Players

The key players in the cordierite market include DENSO Corporation (Japan), Kyocera Corporation (Japan), Corning Inc. (US), TOTO Ltd. (Japan), NGK Insulators (Japan), Vesuvius Plc (UK), Elementis Plc (UK), CoorsTek (US), Unifrax (US), and CeramTec (Germany), among others. The cordierite market report analyzes the key growth strategies, such as partnerships, expansions, and acquisitions adopted by the leading market players between 2018 and 2023.

Cordierite Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 2.5 billion |

|

Revenue Forecast in 2028 |

USD 3.2 billion |

|

CAGR |

5.1% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion), Volume (Kiloton) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

DENSO Corporation (Japan), Kyocera Corporation (Japan), Corning Inc. (US), TOTO Ltd. (Japan), NGK Insulators (Japan), Vesuvius Plc (UK), Elementis Plc (UK), CoorsTek (US), Unifrax (US), and CeramTec (Germany) are the key players in the market. |

This report categorizes the global cordierite market based on type, application, and region.

On the basis of type, the cordierite market has been segmented as follows:

- Sintered

- Porous

On the basis of application, the cordierite market has been segmented as follows:

- Automotive Parts

- Deodorization, Deoxidation Smoke Extraction

- Ceramic Kilns

- Infrared Radiators

- Electrical Insulators

- Welding Strip Rings

- Others

On the basis of region, the cordierite market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2023, Denso Corporation, a prominent supplier in the mobility industry, and United Semiconductor Japan Co., Ltd., a subsidiary of global semiconductor foundry United Microelectronics Corporation, have recently entered a collaborative partnership. The objective of this collaboration is to manufacture insulated gate bipolar transistors (IGBT). These IGBTs have commenced mass production at the 300mm fabrication facility of United Semiconductor Japan Co., Ltd.

- In April 2023, Kyocera Corporation has recently announced its plans to acquire approximately 37 acres of land at the Minami Isahaya Industrial Park in Isahaya City, Nagasaki Prefecture, for the establishment of a new smart factory. This strategic move is in response to the increasing demand for components in the electronics industry. The new factory will be designed to manufacture fine ceramic components utilized in semiconductor-related applications, along with semiconductor packages. Kyocera aims to commence production at the facility in 2026, further strengthening its position in the semiconductor industry.

- In January 2022, Exeger, a Swedish industrial company, has entered a strategic partnership with NGK Insulators, Ltd. This collaboration aims to facilitate the expansion of both companies into new sectors and target additional markets. By combining their expertise, Exeger and NGK will offer manufacturers innovative low-power solutions and devices that boast extended or even infinite battery life. This partnership sets the stage for exciting advancements in the field of sustainable and long-lasting battery technologies.

Frequently Asked Questions (FAQ):

What is the current size of the global cordierite market?

The global cordierite market is projected to reach USD 3.2 billion by 2028, at a CAGR of 5.1% from USD 2.5 billion in 2023.

Who are the winners in the global cordierite market?

Companies such as DENSO Corporation (Japan), Kyocera Corporation (Japan), Corning Inc. (US), TOTO Ltd. (Japan), NGK Insulators (Japan), Vesuvius Plc (UK), Elementis Plc (UK), CoorsTek (US), Unifrax (US), and CeramTec (Germany). They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Growing demand in automotive and industrial sector drives the market.

Which segment on the basis of application is expected to garner the highest traction within the cordierite market?

Based on application, automotive parts segment held the largest share of the cordierite market in 2022.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships, expansions, and acquisitions as important growth tactics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 IMPACT OF RECESSION

-

5.3 MARKET DYNAMICSDRIVERS- Growing demand from automotive and industrial sectors- Stringent emission regulations- Increasing demand for energy-efficient solutions- Increasing demand for lightweight materialsRESTRAINTS- High manufacturing costs- Competition from substitute materials- Limited heat resistance- Limited availability of raw materialsOPPORTUNITIES- Advancements in ceramic manufacturing technologies- Expansion of energy sectorCHALLENGES- Complex manufacturing processes and quality control

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMATERIAL PROCESSING AND CORDIERITE MANUFACTURING COMPANIESMANUFACTURERSDISTRIBUTORSEND USERS

-

5.5 RAW MATERIAL PROCESSING ANALYSISRAW MATERIAL SOURCINGPRIMARY STAGE - PRE-PROCESSING AND SORTINGCHEMICAL TREATMENT AND REFININGPOLISHING STAGE - SIZE REDUCTION AND GRINDINGBLENDING AND MIXINGFORMINGDRYINGFIRINGFINISHING AND SURFACE TREATMENTQUALITY CONTROL AND TESTING

-

5.6 PORTER’S FIVE FORCE ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF RIVALRY

-

5.7 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

-

5.8 TARIFFS & REGULATIONSREGULATIONS- European Union- US- Global regulations

-

5.9 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS (2012–2022)INSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.10 TRADE ANALYSISIMPORT TRADE ANALYSISEXPORT TRADE ANALYSIS

-

5.11 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY COMPANY

-

5.12 ECOSYSTEM MAPPING

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

-

5.14 TECHNOLOGY TRENDSAUTOMOTIVE PARTSDEODORIZATIONCERAMIC KILNSINFRARED RADIATORSELECTRICAL INSULATORSWELDING STRIP RINGS

-

5.15 KEY FACTORS AFFECTING BUYING DECISIONQUALITY AND PERFORMANCEPRICE AND VALUE FOR MONEYTECHNICAL SUPPORT AND EXPERTISEREPUTATION AND TRUSTWORTHINESSCUSTOMIZATION AND FLEXIBILITYENVIRONMENTAL CONSIDERATIONSSUPPLY CHAIN AND LOGISTICSAFTER-SALES SUPPORT AND WARRANTY

-

5.16 CASE STUDYKYOCERA'S CUSTOMIZED CORDIERITE MATERIAL ENABLED ENHANCED PERFORMANCE OF SUBARU TELESCOPEREVOLUTIONIZING VEHICLE EMISSION CONTROL: CORNING'S INNOVATION IN CATALYTIC CONVERTER

- 6.1 INTRODUCTION

-

6.2 SINTERED CORDIERITETHERMAL STABILITY, HIGH STRENGTH, CHEMICAL RESISTANCE, AND ELECTRICAL INSULATION PROPERTIES TO DRIVE MARKET

-

6.3 POROUS CORDIERITEHIGH POROSITY, THERMAL INSULATION, CHEMICAL & CORROSION RESISTANCE, AND ACOUSTIC ABSORPTION PROPERTIES TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 AUTOMOTIVE PARTSEMISSION REDUCTION, ENHANCEMENT OF ENGINE PERFORMANCE, AND IMPROVEMENT IN FUEL EFFICIENCY TO DRIVE MARKETAUTOMOTIVE EXHAUST SYSTEMSCATALYTIC CONVERTERSHEAT INSULATION COMPONENTSOTHER AUTOMOTIVE APPLICATIONS

-

7.3 DEODORIZATION, DEOXIDATION SMOKE EXTRACTIONEXCELLENT THERMAL STABILITY, CHEMICAL RESISTANCE, AND HIGH POROSITY TO DRIVE MARKET

-

7.4 CERAMIC KILNSHIGH THERMAL STABILITY, LOW THERMAL EXPANSION, EXCELLENT RESISTANCE TO THERMAL SHOCK, AND GOOD CHEMICAL DURABILITY TO DRIVE MARKETKILN SHELVESPOSTS AND SUPPORTSSAGGERS AND SETTERSBURNER TUBES AND FLAME DIFFUSERS

-

7.5 INFRARED RADIATORSCONTROLLED EMISSION OF INFRARED RADIATION FACILITATING EFFECTIVE HEATING AND DRYING PROCESSES IN VARIOUS INDUSTRIAL APPLICATIONSRADIANT TUBESREFLECTORS AND DIFFUSERSELEMENT SUPPORTS

-

7.6 ELECTRICAL INSULATORSLOW ELECTRICAL CONDUCTIVITY, HIGH DIELECTRIC STRENGTH, AND THERMAL SHOCK RESISTANCE TO DRIVE MARKETSPARK PLUG INSULATORSHIGH VOLTAGE INSULATORSCERAMIC INSULATORS FOR HEATING ELEMENTSINSULATING BUSHINGS AND SLEEVES

-

7.7 WELDING STRIP RINGSHEAT RESISTANCE, THERMAL INSULATION, MECHANICAL STABILITY, CHEMICAL INERTNESS, AND WEAR RESISTANCE TO DRIVE MARKET

-

7.8 OTHERSCATALYST SUPPORTSGAS AND CHEMICAL FILTRATIONHEAT EXCHANGERSREFRACTORY MATERIALSFOUNDRY AND METAL CASTINGSEMICONDUCTOR MANUFACTURING

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- High growth of automotive sector to boost marketJAPAN- Automotive and industrial processing units to dominate marketINDIA- Low cost of production and raw materials, availability of skilled labor, and robust R&D centers to drive marketSOUTH KOREA- Significant automotive sector to boost marketINDONESIA- Automotive sector and exports to drive marketREST OF ASIA PACIFIC

-

8.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Increasing government support to lead to market growthCANADA- Emerging automotive technologies to drive marketMEXICO- Private investments in manufacturing and automotive sectors to enhance market growth

-

8.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Global pioneer in adopting renewable energy and environmental technologiesUK- Growing urbanization and innovations boosting market growthFRANCE- Rising industrial and automotive sectors to drive marketITALY- Investments in automotive sector for developing advanced production systems to drive marketSPAIN- Investments in eco and electric mobility infrastructure and R&D initiatives in automotive sector to drive marketREST OF EUROPE

-

8.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Aftermarket for off-road vehicles and sports utility vehicles (SUVs) to offer significant potentialSOUTH AFRICA- Expansion of automotive sector to drive marketUAE- Focus on energy efficiency and sustainability to drive marketREST OF MIDDLE EAST & AFRICA

-

8.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Growing industrialization to lead to market growthARGENTINA- Export market access, good economic environment, and skilled workforce to lead to growth of automotive industryREST OF SOUTH AMERICA

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 MARKET EVALUATION FRAMEWORK

- 9.4 REVENUE ANALYSIS

- 9.5 RANKING OF KEY PLAYERS

- 9.6 MARKET SHARE ANALYSIS

-

9.7 COMPANY EVALUATION MATRIX (TIER 1)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 9.8 STRENGTH OF PRODUCT PORTFOLIO

- 9.9 BUSINESS STRATEGY EXCELLENCE

-

9.10 COMPANY EVALUATION MATRIX (STARTUPS AND SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 9.11 STRENGTH OF PRODUCT PORTFOLIO (STARTUPS AND SMES)

- 9.12 BUSINESS STRATEGY EXCELLENCE (STARTUPS AND SMES)

-

9.13 COMPETITIVE BENCHMARKINGCOMPANY TYPE FOOTPRINTCOMPANY APPLICATION FOOTPRINTCOMPANY REGION FOOTPRINTCOMPANY FOOTPRINT

-

9.14 COMPETITIVE SCENARIOSPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHERS

-

10.1 KEY PLAYERSDENSO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- Other developments- Product launches- MnM viewKYOCERA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- Other developments- MnM viewCORNING INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOTO LTD.- Business overview- Products/Solutions/Services offered- MnM viewNGK INSULATORS, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVESUVIUS PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELEMENTIS PLC- Business overview- Products/Solutions/Services offered- Recent developments- Other developments- MnM viewCOORSTEK, INC.- Business overview- Products/Solutions/Services offered- Recent developments- Other developments- MnM viewUNIFRAX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCERAMTEC- Business overview- Products/Solutions/Services offered- Recent developments- Other developments- MnM view

-

10.2 OTHER PLAYERSNORITAKE CO., LIMITEDRESCO PRODUCTS, INC.GOODFELLOW CORPORATIONDU-CO CERAMICS COMPANYDINEX A/SELAN TECHNOLOGYBLASCH PRECISION CERAMICS, INC.STEATIT S.R.O.E.R. ADVANCED CERAMICS, INC.YUNNAN FILTER ENVIRONMENT PROTECTION S.&T. CO., LTD.ADVANCED CERAMIC MATERIALSSINOTRADE RESOURCES CO., LTD.TIANJIN CENTURY ELECTRONICS CO., LTD.TRANS-TECH, INC.YANSHI CITY GUANGMING HI-TECH REFRACTORIES PRODUCTS CO., LTD.GLOBAL CERAMIC INDUSTRY CO., LTD.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 CORDIERITE: VALUE CHAIN STAKEHOLDERS

- TABLE 3 CORDIERITE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 TRENDS OF PER CAPITA GDP, 2020–2022 (USD)

- TABLE 5 GDP GROWTH ESTIMATES AND PROJECTIONS FOR KEY COUNTRIES, 2023–2027 (USD MILLION)

- TABLE 6 LIST OF PATENTS BY NGK INSULATORS, LTD.

- TABLE 7 LIST OF PATENTS BY CORNING, INC.

- TABLE 8 TOP 10 PATENT OWNERS DURING LAST 10 YEARS

- TABLE 9 COUNTRY-WISE IMPORT TRADE (USD THOUSAND)

- TABLE 10 COUNTRY-WISE EXPORT TRADE (USD THOUSAND)

- TABLE 11 AVERAGE SELLING PRICE, BY TYPE (USD/KILOTON)

- TABLE 12 AVERAGE SELLING PRICE, BY COMPANY (USD/KILOTON)

- TABLE 13 CORDIERITE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 14 CORDIERITE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 15 CORDIERITE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 16 CORDIERITE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 17 CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 18 CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 19 CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 20 CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 21 CORDIERITE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 22 CORDIERITE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 CORDIERITE MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 24 CORDIERITE MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 25 ASIA PACIFIC: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 26 ASIA PACIFIC: CORDIERITE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 28 ASIA PACIFIC: CORDIERITE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 29 ASIA PACIFIC: CORDIERITE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 30 ASIA PACIFIC: CORDIERITE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: CORDIERITE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 32 ASIA PACIFIC: CORDIERITE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 33 ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 34 ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 36 ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 37 CHINA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 38 CHINA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 39 CHINA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 40 CHINA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 41 JAPAN: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 42 JAPAN: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 43 JAPAN: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 44 JAPAN: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 45 INDIA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 INDIA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 INDIA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 48 INDIA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 49 SOUTH KOREA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 SOUTH KOREA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 SOUTH KOREA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 52 SOUTH KOREA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 53 INDONESIA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 54 INDONESIA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 INDONESIA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 56 INDONESIA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 57 REST OF ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 60 REST OF ASIA PACIFIC: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 61 NORTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: CORDIERITE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 64 NORTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 65 NORTH AMERICA: CORDIERITE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: CORDIERITE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: CORDIERITE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 68 NORTH AMERICA: CORDIERITE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 69 NORTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 72 NORTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 73 US: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 US: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 US: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 76 US: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 77 CANADA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 78 CANADA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 CANADA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 80 CANADA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 81 MEXICO: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 MEXICO: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 MEXICO: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 84 MEXICO: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 85 EUROPE: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: CORDIERITE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 88 EUROPE: CORDIERITE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 89 EUROPE: CORDIERITE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 90 EUROPE: CORDIERITE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: CORDIERITE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 92 EUROPE: CORDIERITE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 93 EUROPE: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 96 EUROPE: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 97 GERMANY: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 GERMANY: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 GERMANY: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 100 GERMANY: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 101 UK: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 102 UK: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 UK: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 104 UK: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 105 FRANCE: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 FRANCE: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 FRANCE: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 108 FRANCE: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 109 ITALY: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 ITALY: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 ITALY: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 112 ITALY: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 113 SPAIN: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 SPAIN: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 SPAIN: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 116 SPAIN: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 117 REST OF EUROPE: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 REST OF EUROPE: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 120 REST OF EUROPE: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 121 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: CORDIERITE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 124 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 133 SAUDI ARABIA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 134 SAUDI ARABIA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 SAUDI ARABIA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 136 SAUDI ARABIA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 137 SOUTH AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 SOUTH AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 SOUTH AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 140 SOUTH AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 141 UAE: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 142 UAE: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 UAE: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 144 UAE: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 149 SOUTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 150 SOUTH AMERICA: CORDIERITE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 151 SOUTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 152 SOUTH AMERICA: CORDIERITE MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 153 SOUTH AMERICA: CORDIERITE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 154 SOUTH AMERICA: CORDIERITE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 SOUTH AMERICA: CORDIERITE MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 156 SOUTH AMERICA: CORDIERITE MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 157 SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 158 SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 160 SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 161 BRAZIL: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 BRAZIL: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 BRAZIL: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 164 BRAZIL: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 165 ARGENTINA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 166 ARGENTINA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 167 ARGENTINA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 168 ARGENTINA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 169 REST OF SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 172 REST OF SOUTH AMERICA: CORDIERITE MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 173 MARKET EVALUATION FRAMEWORK

- TABLE 174 REVENUE ANALYSIS OF KEY COMPANIES (2020–2022)

- TABLE 175 CORDIERITE MARKET: DEGREE OF COMPETITION

- TABLE 176 DETAILED LIST OF COMPANIES

- TABLE 177 OVERALL TYPE FOOTPRINT

- TABLE 178 OVERALL APPLICATION FOOTPRINT

- TABLE 179 OVERALL REGION FOOTPRINT

- TABLE 180 OVERALL COMPANY FOOTPRINT

- TABLE 181 PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2023

- TABLE 182 DEALS, 2018–2023

- TABLE 183 OTHERS, 2018–2023

- TABLE 184 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 185 PRODUCT OFFERINGS

- TABLE 186 DEALS

- TABLE 187 OTHER DEVELOPMENTS

- TABLE 188 PRODUCT LAUNCHES

- TABLE 189 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 190 PRODUCT OFFERINGS

- TABLE 191 DEALS

- TABLE 192 OTHER DEVELOPMENTS

- TABLE 193 CORNING INC.: COMPANY OVERVIEW

- TABLE 194 PRODUCT OFFERINGS

- TABLE 195 OTHER DEVELOPMENTS

- TABLE 196 TOTO LTD.: COMPANY OVERVIEW

- TABLE 197 PRODUCT OFFERINGS

- TABLE 198 NGK INSULATORS, LTD.: COMPANY OVERVIEW

- TABLE 199 PRODUCT OFFERINGS

- TABLE 200 RECENT DEVELOPMENTS

- TABLE 201 VESUVIUS PLC: COMPANY OVERVIEW

- TABLE 202 PRODUCT OFFERINGS

- TABLE 203 DEALS

- TABLE 204 ELEMENTIS PLC: COMPANY OVERVIEW

- TABLE 205 PRODUCT OFFERINGS

- TABLE 206 DEALS

- TABLE 207 OTHER DEVELOPMENTS

- TABLE 208 COORSTEK, INC: COMPANY OVERVIEW

- TABLE 209 PRODUCT OFFERINGS

- TABLE 210 DEALS

- TABLE 211 OTHER DEVELOPMENTS

- TABLE 212 UNIFRAX: COMPANY OVERVIEW

- TABLE 213 PRODUCT OFFERINGS

- TABLE 214 DEALS

- TABLE 215 CERAMTEC: COMPANY OVERVIEW

- TABLE 216 PRODUCT OFFERINGS

- TABLE 217 DEALS

- TABLE 218 OTHER DEVELOPMENTS

- TABLE 219 NORITAKE CO., LIMITED: COMPANY OVERVIEW

- TABLE 220 RESCO PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 221 GOODFELLOW CORPORATION: COMPANY OVERVIEW

- TABLE 222 DU-CO CERAMICS COMPANY: COMPANY OVERVIEW

- TABLE 223 DINEX A/S: COMPANY OVERVIEW

- TABLE 224 ELAN TECHNOLOGY: COMPANY OVERVIEW

- TABLE 225 BLASCH PRECISION CERAMICS, INC.: COMPANY OVERVIEW

- TABLE 226 STEATIT S.R.O.: COMPANY OVERVIEW

- TABLE 227 E.R. ADVANCED CERAMICS, INC.: COMPANY OVERVIEW

- TABLE 228 YUNNAN FILTER ENVIRONMENT PROTECTION S.&T. CO., LTD.: COMPANY OVERVIEW

- TABLE 229 ADVANCED CERAMIC MATERIALS: COMPANY OVERVIEW

- TABLE 230 SINOTRADE RESOURCES CO., LTD.: COMPANY OVERVIEW

- TABLE 231 TIANJIN CENTURY ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 232 TRANS-TECH, INC.: COMPANY OVERVIEW

- TABLE 233 YANSHI CITY GUANGMING HI-TECH REFRACTORIES PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 234 GLOBAL CERAMIC INDUSTRY CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 CORDIERITE MARKET SEGMENTATION

- FIGURE 2 CORDIERITE MARKET: RESEARCH DESIGN

- FIGURE 3 CORDIERITE MARKET SIZE ESTIMATION

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 CORDIERITE MARKET: DATA TRIANGULATION

- FIGURE 7 SINTERED SEGMENT TO ACCOUNT FOR LARGER SHARE OF OVERALL CORDIERITE MARKET

- FIGURE 8 DEODORIZATION, DEOXIDATION SMOKE EXTRACTION TO BE FASTEST-GROWING APPLICATION OF CORDIERITE DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 10 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN CORDIERITE MARKET DURING FORECAST PERIOD

- FIGURE 11 SINTERED SEGMENT TO LEAD CORDIERITE MARKET DURING FORECAST PERIOD

- FIGURE 12 AUTOMOTIVE PARTS SEGMENT TO WITNESS HIGHEST DEMAND IN CORDIERITE MARKET

- FIGURE 13 CORDIERITE MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CORDIERITE MARKET

- FIGURE 15 OVERVIEW OF VALUE CHAIN OF CORDIERITE MARKET

- FIGURE 16 CORDIERITE RAW MATERIAL PROCESSING ANALYSIS

- FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: CORDIERITE MARKET

- FIGURE 18 PATENTS REGISTERED (2012 TO 2022)

- FIGURE 19 NUMBER OF PATENTS REGISTERED DURING LAST 10 YEARS

- FIGURE 20 TOP JURISDICTIONS

- FIGURE 21 NGK INSULATORS, LTD. REGISTERED MAXIMUM NUMBER OF PATENTS

- FIGURE 22 AVERAGE SELLING PRICE, BY REGION (USD/KILOTON)

- FIGURE 23 CORDIERITE MARKET ECOSYSTEM

- FIGURE 24 AUTOMOTIVE INDUSTRY TO DRIVE GROWTH IN CORDIERITE MARKET

- FIGURE 25 SUPPLIER SELECTION CRITERIA

- FIGURE 26 SINTERED CORDIERITE SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 27 AUTOMOTIVE PARTS SEGMENT TO LEAD CORDIERITE MARKET TILL 2028

- FIGURE 28 CORDIERITE MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC: CORDIERITE MARKET SNAPSHOT

- FIGURE 30 NORTH AMERICA: CORDIERITE MARKET SNAPSHOT

- FIGURE 31 DEMAND FOR AUTOMOTIVE PARTS SEGMENT TO BE HIGHEST IN REGION

- FIGURE 32 COMPANIES ADOPTED ACQUISITIONS AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2023

- FIGURE 33 RANKING OF TOP FIVE PLAYERS IN CORDIERITE MARKET

- FIGURE 34 CORDIERITE MARKET SHARE, BY COMPANY (2022)

- FIGURE 35 CORDIERITE MARKET: COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2023

- FIGURE 36 CORDIERITE MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS AND SMES, 2023

- FIGURE 37 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 CORNING INC.: COMPANY SNAPSHOT

- FIGURE 40 TOTO LTD.: COMPANY SNAPSHOT

- FIGURE 41 NGK INSULATORS, LTD.: COMPANY SNAPSHOT

- FIGURE 42 VESUVIUS PLC: COMPANY SNAPSHOT

- FIGURE 43 ELEMENTIS PLC: COMPANY SNAPSHOT

- FIGURE 44 CERAMTEC: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the cordierite market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

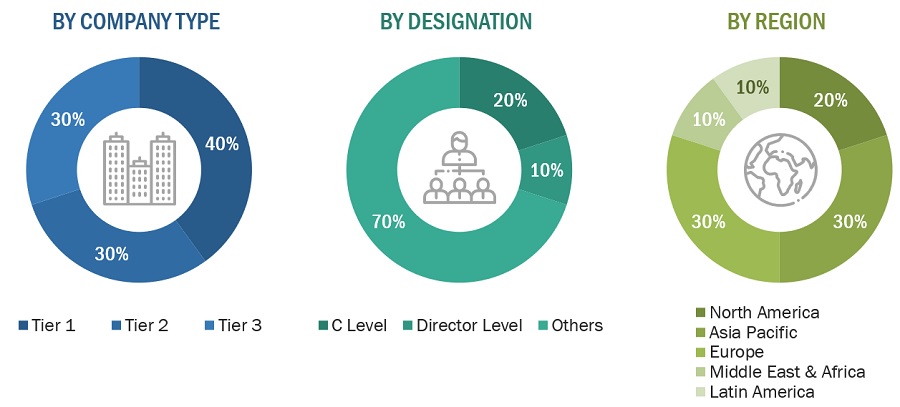

The cordierite market comprises several stakeholders in the value chain, which include raw material suppliers, material processing, cordierite manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the cordierite market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the cordierite industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of cordierite and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

DENSO Corporation |

Sales Director |

|

Kyocera Corporation |

Sales Manager |

|

CeramTec |

Director |

|

Elementis Plc |

Marketing Manager |

|

CoorsTek |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the cordierite market.

- The key players in the industry have been identified through extensive secondary research.

- The purification process of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Cordierite Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Cordierite Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Cordierite is a magnesium aluminum silicate material that has been widely used in applications where thermal shock resistance is important. Cordierite is also useful because it has a low thermal expansion and good electrical insulation compared to other ceramic materials. Cordierite combines great thermal shock properties, low thermal expansion rate, and good electrical insulation. It is an excellent fit for inexpensive insulators used in manufacturing and durable goods.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the cordierite market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as partnerships, expansions, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Cordierite Market