Cooler Box Market by Type (Disposable, Reusable), Raw Material (Polyurethane Foam, EPS, EPP, XPS, Others), End-Use Industry (Pharmaceuticals, Food & Beverages) and Region - Global Forecast to 2025

Updated on : August 25, 2025

Cooler Box Market

The cooler box market was valued at USD 4.6 billion in 2020 and is projected to reach USD 8.1 billion by 2025, growing at 12.1% cagr from 2020 to 2025. Growth in the pharmaceutical industry, ongoing COVID-19 vaccination drives, technological advancements in the cooler box industry for the transportation of processed and fresh fruits, vegetables, dairy products, and other perishable food products are contributing to the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Cooler Box Market

The cooler box market includes major Tier I and II companies like Sonoco ThermoSafe (US), B Medical Systems (Luxembourg), Blowkings (India), ISONOVA (Italy), Eurobox Logistics (Romania), Nilkamal Ltd. (India), AOV International LLP (India), Cool Ice Box Co Ltd (UK), Apex International (India), Softbox Systems Ltd. (UK), va-Q-tec AG (Germany), Coldchain Technologies, Inc. (US), Sofrigam Group (France), FEURER GmbH (Germany), ORCA Coolers (US), Cold Chain Controls (India), CIP Industries CC (South Africa), Igloo Coolers (US), Liderkit (Spain), YETI Coolers, LLC (US), Dhruvraj Syndicate (India), MB Plastic Industries (India), Rollawaycontainer (Italy), K2 coolers (US), Grizzly Coolers LLC (US), Koolatron (Canada), Coleman Company, Inc.(US),Cambro (US), Engel Coolers (US), Harwal Group of Companies (UAE), Polar Tech Industries Inc. (US), Embalex S.L.U., and AUCMA Company Limited (China). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and Middle East & Africa. COVID-19 has impacted their businesses as well.

- In December 2020, B Medical Systems announced the establishment of a new manufacturing factory in Gujarat, India. This facility is projected to cater the increasing demand for medically certified vaccine cold chain products in India. This is expected to help the country reinforce the critical cold chain required to deliver COVID-19 vaccines.

- In November 2020, Coldchain Technologies Inc. opened a new facility in Lebanon, Tennessee (US) to increase the production of reusable and single-use passive thermal boxes to meet the unprecedented demand for the delivery of the COVID-19 vaccine to the public.

- In October 2020, Va-Q-Tec AG expanded its TempChain service network in Scotland and the US. The expansion of the network is expected to further optimize the global availability of va-Q-tec’s container and box rental fleet.

Cooler Box Market Dynamics

Increasing need for temperature control to prevent food loss and potential health hazards

Food security, food safety, economic & environmental sustainability, and minimal food waste are major focus areas in the food industry. Food loss and waste are caused due to various reasons. For instance, perishable products are often exposed to fluctuating temperatures during transit and handling, which results in their spoilage and wastage. To overcome this, the demand for thermal controlled packaging solutions such as cooler boxes has increased across the globe.

Restraints: Stringent environmental rules & regulations

Growing concerns related to the environmental impact of packaging waste have caused governments worldwide to adopt firm policies. For instance, the Indian government updated its Plastic Waste Management Norms on June 26, 2020. Standard tests are also conducted to validate the ability of packaging systems to maintain the temperature range mandated by the International Safe Transit Association (ISTA) standards, which is focused on the packaging, storage, and transportation of goods. Packaging directives from the European Commission have also led to the imposition of challenging targets for recycling since governments are exploring new ways to discourage packaging waste. Thus, increasing awareness of environmental issues and proper disposal of waste act as restraints for the growth of this market.

Opportunities: High growth potential markets for insulated packaging

Emerging economies such as Brazil, India, and China provide significant growth opportunities in the insulated packaging industry. Strong economic development in China and India has provided a stimulus for the growth of the food & beverages, healthcare, and chemicals industries. Growth in these sectors has contributed to increasing demand for packaging of a wide range of products such as meat, fish, and poultry, among other perishable items. This has resulted in manufacturers of cooler boxes exploring the untapped potential of emerging countries to optimize their market share.

Challenges: Significant fluctuations in crude oil prices

The raw materials used to manufacture cooler boxes include plastic, glass, paper, and metal. Most of these raw materials are crude oil-based derivatives that are vulnerable to fluctuations in commodity prices. The increased price of crude oil is a major obstacle to developing polymers such as polyurethane, polyethylene, and polystyrene. A majority of cooler boxes are made of polymer foams, which are derived from petrochemical feedstock. Thus, volatile crude oil prices are expected to affect the prices of polymer foams in the near future.

Based on type, reusable cooler box segment is expected to grow at the highest CAGR during the forecast period.

The reusable cooler box segment accounted for the larger share of the cooler box market in 2019. Reusable cooler boxes available in the consumer market are becoming more robust in terms of their exterior, with hard shells being deployed in comparison to the cardboard and foam of disposable cooler boxes. These cooler boxes are primarily used in the pharmaceutical industry, wherein maintaining the temperature of products for a longer time is a critical factor.

PU Foam is expected to be the fastest-growing raw material segment of the cooler box market.

PU foam segment accounted for the larger share of the cooler box market in 2019. This raw material segment is expected to witness the fastest growth during the forecast period. PU foam has the lowest thermal conductivity among insulation materials, which enables space saving by using lower insulation thickness while achieving the same insulation efficiency as with other materials. This is especially important in space-limited cold chain logistics.

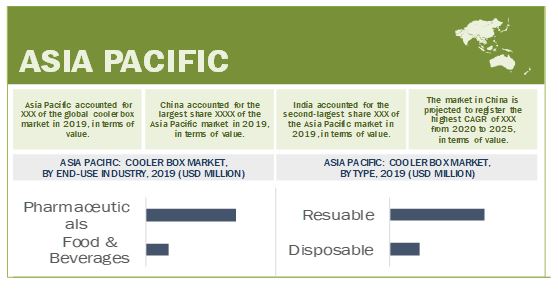

Asia Pacific is expected to be the fastest-growing regional segment in the cooler box market.

The cooler box market in the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. China, Japan, South Korea, and India are the key countries contributing to the high demand for cooler boxes in the Asia Pacific region. Availability of cheap labor and raw materials has resulted in making Asia Pacific a preferred region for manufacturing facilities of cooler boxes. This makes Asia Pacific the fastest-growing region of the cooler box market.

Cooler Box Market Players

Some of the leading players operating in the cooler box market include Sonoco ThermoSafe (US), B Medical Systems (Luxembourg), Blowkings (India), ISONOVA (Italy), Eurobox Logistics (Romania), Softbox Systems Ltd. (UK), va-Q-tec AG (Germany), Coldchain Technologies, Inc. (US), Sofrigam Group (France) and FEURER GmbH (Germany). These players have expansions, acquisitions, agreements, product launches and investment as the major strategies to consolidate their position in the market.

Cooler Box Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018-2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020-2025 |

|

Forecast Units |

Value (USD million) and Volume (thousand/ million units) |

|

Segments Covered |

Type, Raw Material, End Use and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Some of the leading players operating in the cooler box market include Sonoco ThermoSafe (US), B Medical Systems (Luxembourg), Blowkings (India), ISONOVA (Italy), Eurobox Logistics (Romania), Softbox Systems Ltd. (UK), va-Q-tec AG (Germany), Coldchain Technologies, Inc. (US), Sofrigam Group (France) and FEURER GmbH (Germany) |

This research report categorizes the cooler box market based on type, raw material, end use and region.

Cooler Box Market, By Type

- Reusable

- Disposable

Cooler Box Market, By End Use

- Pharmaceuticals

- Food & Beverages

Cooler Box Market, By Raw Material

- PU Foam

- Expanded Polystyrene

- Extruded Polystyrene

- Expanded Polypropylene

- Others

Cooler Box Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In December 2020, B Medical Systems announced the establishment of a new manufacturing factory in Gujarat, India. This facility is projected to cater the increasing demand for medically certified vaccine cold chain products in India. This is expected to help the country reinforce the critical cold chain required to deliver COVID-19 vaccines.

- In August 2019, Sonoco ThermoSafe announced the manufacture of new passive temperature-controlled unit load devices under the brand name, Pegasus ULD. Pegasus ULD is the first passive bulk temperature-controlled container for pharmaceutical use which is an approved unit load device, at the lowest cost.

- In November 2020, Cold Chain Technologies Inc. opened a new facility in Lebanon, Tennessee to increase the production of reusable and single-use passive thermal boxes to meet the unprecedented demand for the delivery of the COVID-19 vaccine to the public.

Frequently Asked Questions (FAQ):

What is a cooler box?

A cooler box is a temperature-controlled packaging solution that is used to maintain a product within a specified low-temperature range from harvest/production until the point of consumption.

What are the different end uses of cooler boxes?

Cooler boxes are used in different end use industries such as pharmaceuticals and food & beverages industries.

What are the key driving factors for the growth of the global cooler box market?

Growth in the pharmaceutical industry, ongoing COVID-19 vaccination drives, technological advancements in the cooler box industry for the transportation of processed and fresh fruits, vegetables, dairy products, and other perishable food products are contributing to the growth of the cooler box market.

What is the biggest challenge for the growth of the global cooler box market?

Fluctuations in crude oil prices, rising fuel costs and high initial investment for technology pose as entry barriers for new market players and hence pose as biggest challenges for growth of this market.

What are the key regions in the global cooler box market?

In terms of region, the highest consumption was observed to be in North America. This is primarily due to a robust pharmaceutical and food & beverages industry. Adults in North America prefer to eat frozen or processed foods which directly use cooler boxes during storage and transportation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 COOLER BOX MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 COOLER BOX MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 COOLER BOX MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

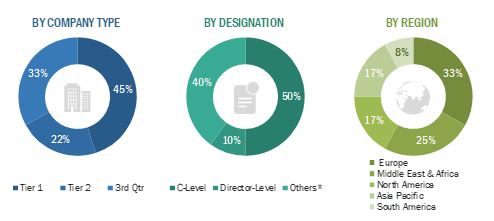

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

2.2 MARKET ENGINEERING PROCESS

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 BASE NUMBER CALCULATION

2.3.1 DEMAND SIDE APPROACH

2.3.2 SUPPLY SIDE APPROACH

2.4 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 2 COOLER BOX MARKET SNAPSHOT, 2020 & 2025

FIGURE 7 PHARMACEUTICALS ACCOUNTED FOR LARGEST SHARE OF COOLER BOX MARKET IN 2019 (THOUSAND UNITS)

FIGURE 8 REUSABLE COOLER BOXES DOMINATED MARKET IN 2019 (THOUSAND UNITS)

FIGURE 9 NORTH AMERICA TO LEAD COOLER BOX MARKET FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN COOLER BOX MARKET

FIGURE 10 NEED FOR PASSIVE COLD STORAGE FOR COVID-19 VACCINE DELIVERY BOOSTS MARKET GROWTH

4.2 COOLER BOX MARKET, BY REGION

FIGURE 11 ASIA PACIFIC MARKET PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.3 NORTH AMERICA COOLER BOX MARKET, BY END-USE INDUSTRY & COUNTRY

FIGURE 12 PHARMACEUTICALS AND US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN COOLER BOX MARKET IN 2020

4.4 COOLER BOX MARKET, MAJOR COUNTRIES

FIGURE 13 COOLER BOX MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 COOLER BOX MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing need for temperature control to prevent food loss and potential health hazards

FIGURE 15 INDIA: ANNUAL WASTAGE AS PERCENTAGE OF PRODUCTION

5.2.1.2 Ongoing COVID-19 vaccination drives across the globe

TABLE 3 LIST OF COVID-19 VACCINES

5.2.1.3 Stringent temperature control requirements in pharmaceutical industry

5.2.1.4 Growth in international food trade due to trade liberalization

5.2.2 RESTRAINTS

5.2.2.1 Stringent environmental rules & regulations

5.2.3 OPPORTUNITIES

5.2.3.1 High growth potential markets for insulated packaging

5.2.3.2 Growth in organized retail sector

FIGURE 16 US: RETAIL SALES, 2010-2019 (USD TRILLION)

FIGURE 17 GCC: RETAIL FOOD SALES PENETRATION, BY COUNTRY (%)

5.2.4 CHALLENGES

5.2.4.1 Significant fluctuations in crude oil prices

FIGURE 18 FLUCTUATION IN PRICES OF CRUDE OIL, 2000—2020

5.2.4.2 Rising fuel cost and high capital investment requirements

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF RIVALRY

6 INDUSTRY TRENDS (Page No. - 58)

6.1 COVID-19 IMPACT ANALYSIS

6.1.1 INTRODUCTION

6.1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COUNTRY-WISE SPREAD OF COVID-19

6.1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

6.1.3.1 COVID-19 Impact on the Economy—Scenario Assessment

FIGURE 22 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 23 SCENARIOS OF COVID-19 IMPACT

6.1.4 IMPACT OF COVID-19 ON COOLER BOX MARKET

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 24 SUPPLY CHAIN ANALYSIS OF COOLER BOX MARKET

6.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING MANUFACTURING PROCESS

6.3.1 PROMINENT COMPANIES

6.3.2 SMALL & MEDIUM ENTERPRISES

6.4 YC-YCC SHIFT

FIGURE 26 YC-YCC SHIFT FOR COOLER BOX MARKET

6.5 PRODUCTION TECHNOLOGY

6.5.1 PRODUCTION TECHNOLOGY FOR REUSABLE & DISPOSABLE COOLER BOXES

6.6 PRICE ANALYSIS

TABLE 4 AVERAGE PRICES OF COOLER BOX, BY REGION (USD)

6.7 PATENT ANALYSIS

TABLE 5 IMPORTANT PATENTS RELATED TO COOLER BOXES

6.8 COOLER BOX MARKET ECOSYSTEM

6.8.1 ORIGINAL EQUIPMENT MANUFACTURERS

TABLE 6 COMPANIES MANUFACTURING COOLER BOXES

6.8.2 DISTRIBUTORS OF COOLER BOXES

TABLE 7 COMPANIES DISTRIBUTING COOLER BOXES

6.8.3 END USERS OF COOLER BOXES

TABLE 8 COMPANIES IN COLD STORAGE & COLD CHAIN LOGISTICS

6.9 IMPORT & EXPORT TRADE ANALYSIS

FIGURE 27 GLOBAL TRADE ROUTES FOR COOLER BOXES

6.10 REGULATORY LANDSCAPE

TABLE 9 WORLD HEALTH ORGANIZATION: VACCINE COOLER BOX RECOMMENDATIONS

6.11 MACROECONOMIC INDICATORS

6.11.1 HEALTHCARE

FIGURE 28 HEALTHCARE SPENDING, 2019

6.11.2 TRENDS OF OIL & NATURAL GAS PRICES

TABLE 10 GLOBAL OIL & GAS PRICES, USD/BBL (2013–2019)

FIGURE 29 CRUDE OIL BRENT WITNESSED SHARPEST DIP IN PRICES (2015–2019)

6.11.3 TRENDS AND FORECAST OF GDP

TABLE 11 GLOBAL GDP PER CAPITA, USD BILLION (2013–2019)

FIGURE 30 GDP TRENDS AND FORECAST OF 25 COUNTRIES, USD BILLION (2019)

6.11.4 URBANIZATION

TABLE 12 URBAN POPULATION, SELECT COUNTRIES, 2019

6.11.5 PER CAPITA INCOME

TABLE 13 PER CAPITA INCOME, SELECT COUNTRIES, 2019

6.12 CASE STUDY ANALYSIS

6.12.1 COVID-19 VACCINE

6.12.1.1 Cold Chain Technologies, Inc. set up a new facility to manufacture special cooler boxes for COVID-19 vaccine delivery

6.12.2 PHARMACEUTICALS

6.12.2.1 B Medical Systems partnered with SEEDR to develop advanced passive cold storage equipment for vaccine and pharmaceutical delivery

6.12.2.2 Sonoco ThermoSafe developed advanced and durable cooler box for pharmaceutical cold chain

6.12.2.3 Softbox Systems Ltd. developed eco-friendly recyclable cooler box for pharmaceutical cold chain

6.12.3 FOOD & BEVERAGES

6.12.3.1 FEURER GmbH developed special packaging solutions for food & beverages industry

7 COOLER BOX MARKET, BY COOLING MATERIAL (Page No. - 91)

7.1 INTRODUCTION

7.2 DRY ICE

TABLE 14 DRY ICE REQUIREMENT DURING TRANSIT

7.3 WET ICE

7.4 GEL PACKS

TABLE 15 TYPES OF CONTAINERS USED FOR GEL PACKS

7.5 EUTECTIC PLATES

7.6 LIQUID NITROGEN

7.7 INSULATED BLANKETS

8 COOLER BOX MARKET, BY RAW MATERIAL (Page No. - 93)

8.1 INTRODUCTION

TABLE 16 THERMAL CONDUCTIVITY OF MATERIALS USED TO MANUFACTURE COOLER BOXES

8.1.1 COVID-19 IMPACT ON RAW MATERIAL SEGMENT

8.2 EXPANDED POLYSTYRENE

8.2.1 DEMAND FOR EXPANDED POLYSTYRENE TO INCREASE FOR VACCINE TRANSPORTATION

8.3 EXTRUDED POLYSTYRENE

8.3.1 EXTRUDED POLYSTYRENE ACCOUNTS FOR THIRD-LARGEST SHARE

8.4 EXPANDED POLYPROPYLENE

8.4.1 EXPANDED POLYPROPYLENE WIDELY USED IN FOOD & BEVERAGE SEGMENT

8.5 POLYURETHANE FOAM

8.5.1 POLYURETHANE FOAM ACCOUNTS FOR LARGEST MARKET SHARE

8.5.2 OTHERS

9 COOLER BOX MARKET, BY TYPE (Page No. - 97)

9.1 INTRODUCTION

FIGURE 31 COOLER BOX MARKET, BY TYPE, 2020 & 2025

TABLE 17 COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 18 COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

9.1.1 COVID-19 IMPACT ON TYPE SEGMENT

9.2 REUSABLE COOLER BOXES

9.2.1 REUSABLE COOLER BOXES ACCOUNT FOR LARGEST SHARE IN MARKET

TABLE 19 REUSABLE COOLER BOX MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 REUSABLE COOLER BOX MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

9.3 DISPOSABLE COOLER BOXES

9.3.1 DEMAND FOR DISPOSABLE COOLER BOXES DRIVEN BY AFFORDABILITY

TABLE 21 DISPOSABLE COOLER BOX MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 DISPOSABLE COOLER BOX MARKET, BY REGION, 2018–2025 (THOUSAND UNITS)

10 COOLER BOX MARKET, BY END-USE INDUSTRY (Page No. - 102)

10.1 INTRODUCTION

FIGURE 32 COOLER BOX MARKET, BY END-USE INDUSTRY, 2020 & 2025

TABLE 23 COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 24 COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

10.2 PHARMACEUTICALS

10.2.1 COVID-19 VACCINATION CAMPAIGNS TO BOOST MARKET FOR COOLER BOXES

10.2.1.1 COVID-19 impact on Pharmaceutical Industry

TABLE 25 COOLER BOX MARKET IN PHARMACEUTICALS, BY REGION, 2018–2025 (THOUSAND UNITS)

10.3 FOOD & BEVERAGES

10.3.1 FOOD & BEVERAGE HOLDS SECOND-LARGEST SHARE IN GLOBAL COOLER BOX MARKET

10.3.1.1 COVID-19 impact on food & beverage industry

TABLE 26 COOLER BOX MARKET IN FOOD & BEVERAGES, BY REGION, 2018–2025 (THOUSAND UNITS)

11 COOLER BOX MARKET, BY REGION (Page No. - 108)

11.1 INTRODUCTION

FIGURE 33 MARKET IN INDIA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 27 COOLER BOX MARKET SIZE, BY REGION, 2018-2025 (MILLION UNITS)

TABLE 28 COOLER BOX MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: COOLER BOX MARKET SNAPSHOT

TABLE 29 ASIA PACIFIC: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 ASIA PACIFIC: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 31 ASIA PACIFIC: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 32 ASIA PACIFIC: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 33 ASIA PACIFIC: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 34 ASIA PACIFIC: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.2.1 CHINA

11.2.1.1 China is largest Asia Pacific market for cooler boxes

11.2.1.2 COVID-19 impact on China

TABLE 35 CHINA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 36 CHINA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 37 CHINA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 38 CHINA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.2.2 JAPAN

11.2.2.1 Increase in need for temperature-controlled packaging solutions spurs demand for cooler boxes in Japan

11.2.2.2 COVID-19 impact on Japan

TABLE 39 JAPAN: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 40 JAPAN: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 41 JAPAN: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 42 JAPAN: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.2.3 INDIA

11.2.3.1 Frozen food market in India contributes to growth of cooler box market

11.2.3.2 COVID-19 impact on India

TABLE 43 INDIA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 INDIA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 45 INDIA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 46 INDIA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.2.4 SOUTH KOREA

11.2.4.1 COVID-19 vaccination drives boost demand for cooler boxes in South Korea

11.2.4.2 COVID-19 impact on South Korea

TABLE 47 SOUTH KOREA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 48 SOUTH KOREA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 49 SOUTH KOREA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 50 SOUTH KOREA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.2.5 INDONESIA

TABLE 51 INDONESIA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 52 INDONESIA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 53 INDONESIA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 54 INDONESIA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.2.6 REST OF ASIA PACIFIC

TABLE 55 REST OF ASIA PACIFIC: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 REST OF ASIA PACIFIC: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 57 REST OF ASIA PACIFIC: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 58 REST OF ASIA PACIFIC: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: COOLER BOX MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 61 NORTH AMERICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 63 NORTH AMERICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.3.1 US

11.3.1.1 US is largest market for cooler boxes in North America

11.3.1.2 COVID-19 impact on the US

TABLE 65 US: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 US: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 67 US: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 68 US: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.3.2 CANADA

11.3.2.1 Ongoing COVID-19 vaccination drive to spur demand for cooler boxes in Canada

TABLE 69 CANADA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 CANADA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 71 CANADA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 72 CANADA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.3.3 MEXICO

11.3.3.1 Trade liberalization to boost demand for cooler boxes in Mexico

TABLE 73 MEXICO: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 MEXICO: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 75 MEXICO: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 76 MEXICO: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.4 EUROPE

FIGURE 36 EUROPE: COOLER BOX MARKET SNAPSHOT

TABLE 77 EUROPE: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 78 EUROPE: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 79 EUROPE: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 EUROPE: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 81 EUROPE: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 82 EUROPE: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.4.1 GERMANY

11.4.1.1 Germany is largest European market for cooler boxes

11.4.1.2 COVID-19 impact on Germany

TABLE 83 GERMANY: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 GERMANY: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 85 GERMANY: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 86 GERMANY: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.4.2 UK

11.4.2.1 Ongoing COVID-19 vaccination drive boosts demand for cooler boxes in UK

11.4.2.2 COVID-19 impact on the UK

TABLE 87 UK: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 UK: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 89 UK: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 90 UK: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.4.3 FRANCE

11.4.3.1 Frozen food market in France contributes to growth of cooler box market

11.4.3.2 COVID-19 impact on France

TABLE 91 FRANCE: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 FRANCE: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 93 FRANCE: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 94 FRANCE: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.4.4 ITALY

11.4.4.1 Increasing prevalence of infectious diseases in Italy drives use of cooler boxes in pharmaceuticals

TABLE 95 ITALY: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 ITALY: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 97 ITALY: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 98 ITALY: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.4.5 SPAIN

11.4.5.1 Growth in vaccine market to boost demand for cooler boxes in Spain

TABLE 99 SPAIN: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 SPAIN: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 101 SPAIN: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 102 SPAIN: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.4.6 REST OF EUROPE

TABLE 103 REST OF EUROPE: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 REST OF EUROPE: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 105 REST OF EUROPE: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 106 REST OF EUROPE: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.5 MIDDLE EAST & AFRICA

TABLE 107 MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 109 MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 111 MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.5.1 SAUDI ARABIA

11.5.1.1 Saudi Arabia market to recover with increasing oil prices

TABLE 113 SAUDI ARABIA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 SAUDI ARABIA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 115 SAUDI ARABIA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 116 SAUDI ARABIA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.5.2 UAE

11.5.2.1 High demand for cooler boxes in UAE for COVID-19 vaccination

TABLE 117 UAE: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 UAE: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 119 UAE: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 120 UAE: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.5.3 REST OF MIDDLE EAST & AFRICA

11.5.3.1 Demand from healthcare and pharmaceutical industry to fuel growth in Rest of Middle East & Africa

TABLE 121 REST OF MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 122 REST OF MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 123 REST OF MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 124 REST OF MIDDLE EAST & AFRICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.6 SOUTH AMERICA

TABLE 125 SOUTH AMERICA: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 126 SOUTH AMERICA: COOLER BOX MARKET, BY COUNTRY, 2018–2025 (THOUSAND UNITS)

TABLE 127 SOUTH AMERICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 SOUTH AMERICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 129 SOUTH AMERICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 130 SOUTH AMERICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.6.1 BRAZIL

11.6.1.1 Brazil accounts for largest share in South American cooler box market

TABLE 131 BRAZIL: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 132 BRAZIL: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 133 BRAZIL: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 134 BRAZIL: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.6.2 ARGENTINA

11.6.2.1 Food & beverage industry in Argentina drives demand for cooler boxes

TABLE 135 ARGENTINA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 136 ARGENTINA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 137 ARGENTINA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 138 ARGENTINA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

11.6.3 REST OF SOUTH AMERICA

11.6.3.1 Trade agreements aid growth of market in Rest of South America

TABLE 139 REST OF SOUTH AMERICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 140 REST OF SOUTH AMERICA: COOLER BOX MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 141 REST OF SOUTH AMERICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 142 REST OF SOUTH AMERICA: COOLER BOX MARKET, BY END-USE INDUSTRY, 2018–2025 (THOUSAND UNITS)

12 COMPETITIVE LANDSCAPE (Page No. - 154)

12.1 OVERVIEW

FIGURE 37 COMPANIES ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2018 AND DECEMBER 2020

12.2 MARKET SHARE ANALYSIS

FIGURE 38 GLOBAL COOLER BOX MARKET: KEY PLAYER RANKING, 2019

12.3 KEY MARKET DEVELOPMENTS

TABLE 143 EXPANSIONS, 2017–2020

TABLE 144 PRODUCT LAUNCHES, 2017–2020

TABLE 145 PARTNERSHIPS, 2017–2020

TABLE 146 ACQUISITIONS, 2017–2020

TABLE 147 INVESTMENTS, 2017–2020

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 161)

13.1 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2019

13.1.1 STAR

13.1.2 EMERGING LEADER

13.1.3 PERVASIVE

13.1.4 PARTICIPANT

FIGURE 39 COOLER BOX MARKET: COMPETITIVE LANDSCAPE MAPPING, 2019

13.2 COMPETITIVE BENCHMARKING

13.2.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN COOLER BOX MARKET

13.2.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN COOLER BOX MARKET

13.3 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, COVID-19 Related Developments, and MnM View)*

13.3.1 BLOWKINGS

13.3.2 B MEDICAL SYSTEMS

13.3.3 NILKAMAL LTD.

FIGURE 42 NILKAMAL LIMITED: COMPANY SNAPSHOT

13.3.4 ISONOVA

13.3.5 SONOCO THERMOSAFE

13.3.6 EUROBOX LOGISTICS

13.3.7 SOFTBOX SYSTEMS LTD.

13.3.8 VA-Q-TEC AG

FIGURE 43 VA-Q-TEC AG: COMPANY SNAPSHOT

13.3.9 AOV INTERNATIONAL LLP

13.3.10 COLD CHAIN TECHNOLOGIES, INC.

13.3.11 SOFRIGAM GROUP

13.3.12 FEURER

13.3.13 COLDCHAIN CONTROLS

13.3.14 APEX INTERNATIONAL

13.3.15 COOL ICE BOX COMPANY LTD.

13.3.16 ORCA COOLERS

* Business Overview, Products Offered, Recent Developments, COVID-19 Related Developments, and MnM View might not be captured in case of unlisted companies.

13.4 SME MATRIX, 2019

13.4.1 PROGRESSIVE COMPANIES

13.4.2 EMERGING COMPANY

13.4.3 STARTING BLOCKS

13.4.4 DYNAMIC COMPANIES

FIGURE 44 COOLER BOX MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2019

13.5 OTHER PLAYERS

13.5.1 IGLOO COOLERS

13.5.2 CIP INDUSTRIES CC

13.5.3 LIDERKIT

13.5.4 YETI COOLERS, LLC

13.5.5 DHRUVRAJ SYNDICATE

13.5.6 MB PLASTIC INDUSTRIES

13.5.7 ROLLAWAYCONTAINER

13.5.8 K2 COOLERS

13.5.9 GRIZZLY COOLERS LLC

13.5.10 KOOLATRON

13.5.11 COLEMAN COMPANY, INC.,

13.5.12 CAMBRO

13.5.13 ENGEL COOLERS

13.5.14 HARWAL GROUP OF COMPANIES

13.5.15 POLAR TECH INDUSTRIES INC

13.5.16 EMBALEX S.L.U

13.5.17 AUCMA

14 APPENDIX (Page No. - 201)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved four major activities in estimating the current market size for cooler boxes. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to for identifying and collecting information for this study. These secondary sources included association journals, annual reports of key players, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The cooler box market comprises several stakeholders, such as raw material suppliers, technology providers and end-users in the supply chain. The demand side of this market is characterized by the growth of the pharmaceutical and food & beverages industries. Currently, the demand for special cooler boxes is also stimulated by the COVID-19 vaccine campaigns undergoing across various countries. The supply side is characterized by advancements in technology. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents interviewed:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the cooler box market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into three segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To estimate and forecast the cooler box market, in terms of value (USD million) and volume (thousand units) at the global and country level

- To define and segment the cooler box market based on type, end-use industry, material, and region

- To estimate and forecast the market on the basis of end-use industry, type, and material at the country-level across North America, Asia Pacific, Europe, South America, and the Middle East & Africa

- To identify and analyze the key growth drivers, restraints, opportunities, and challenges influencing the overall market

- To analyze recent developments and strategies such as acquistions, partnerships, product launches and expansions to draw a competitive landscape of the market

- To strategically identify and profile the key market players and analyze their core competencies*

The following customization options are available for the report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

- Further breakdown of the Rest of Asia Pacific, the Rest of Europe, and the Rest of Middle East & Africa in terms of Value

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cooler Box Market