Conveyor Monitoring Market by (Technology, Offering, Deployment Type), Conveyor Belt Monitoring, Industry (Mining, Power Generation), and Geography (North America, Europe, APAC, RoW) - Global Forecast to 2024

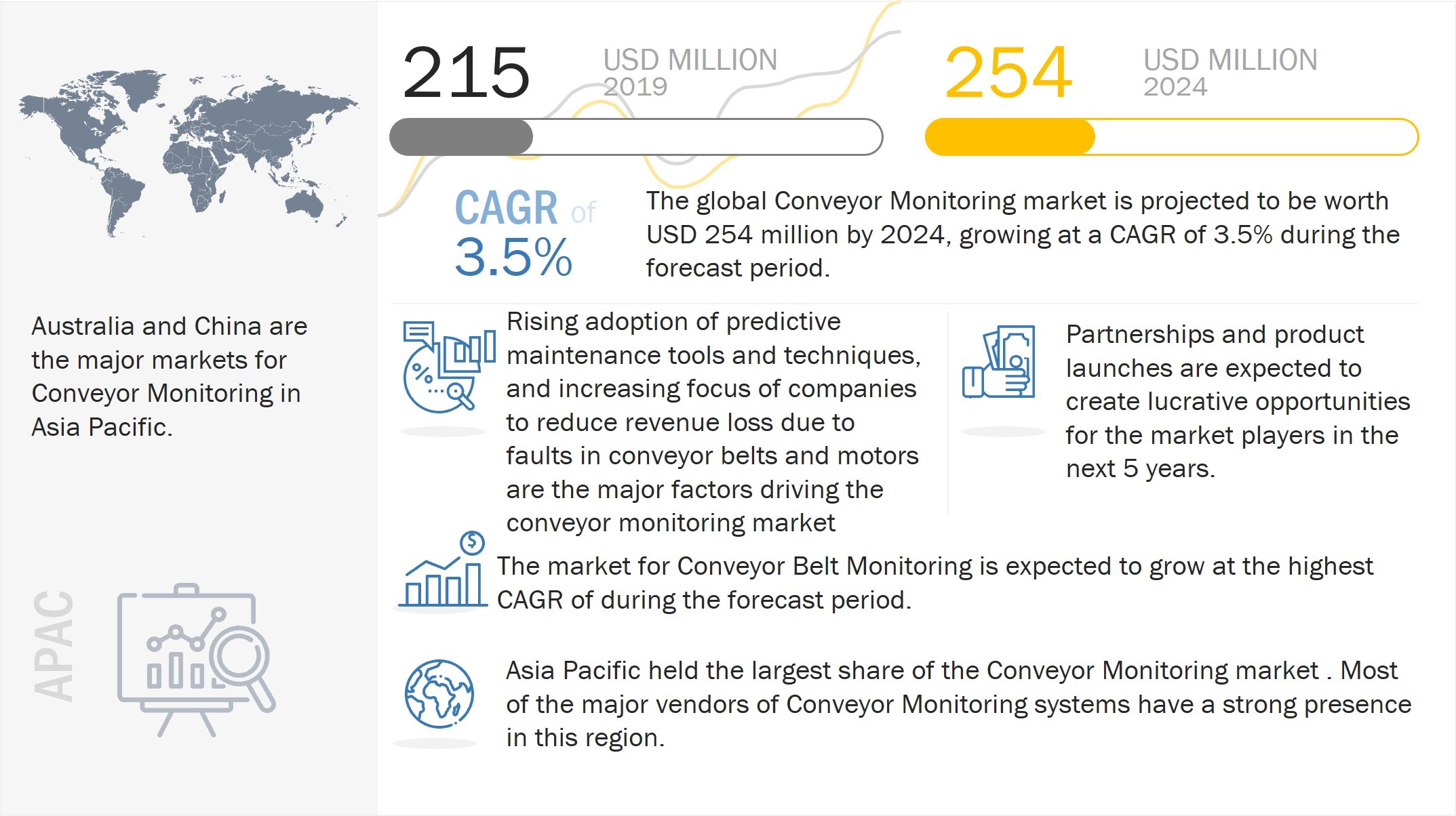

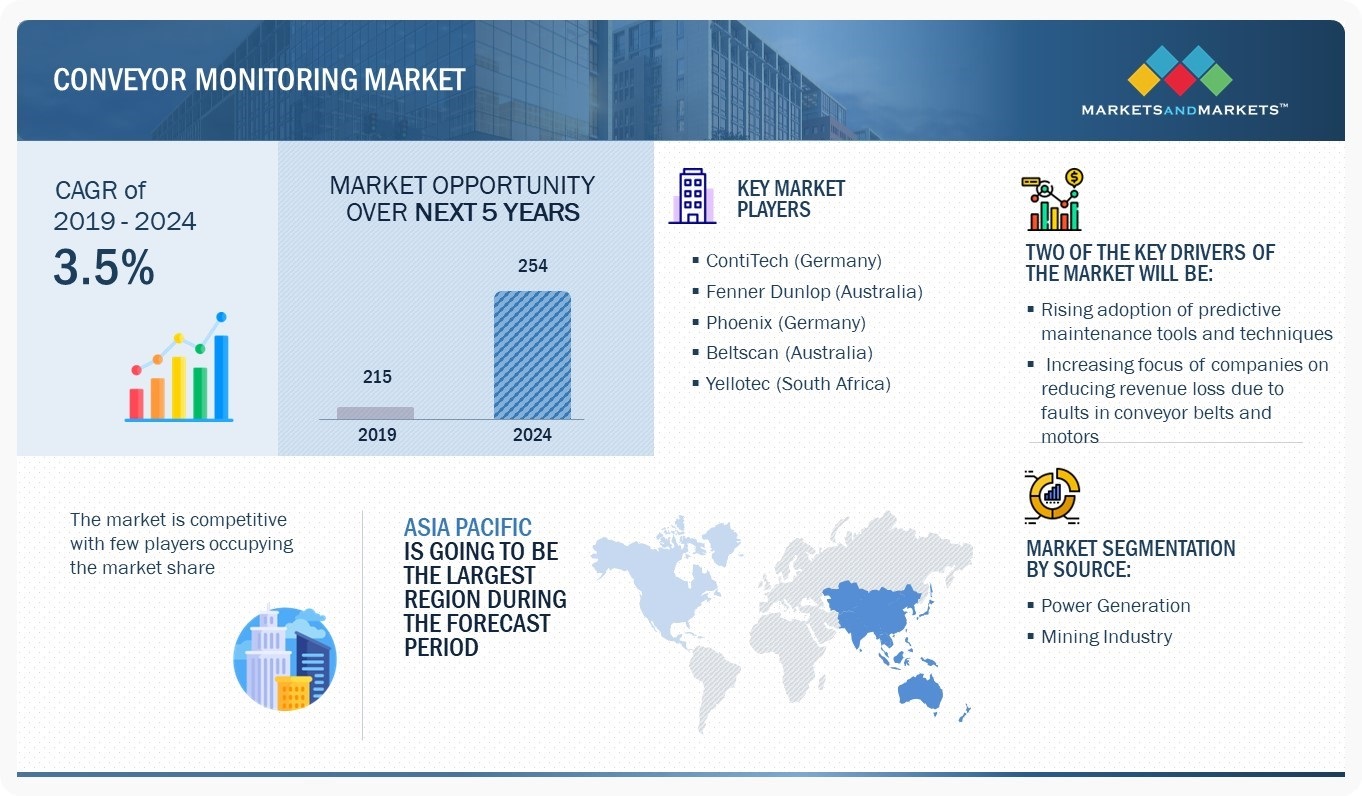

The Conveyor Monitoring Market is projected to USD 254 Million by 2024 from USD 238 million in 2022 at a CAGR of 3.5% during the forecast period. It was observed that the growth rate was 3.7% from 2021 to 2022. Mining is expected to account high market share of 90%.

A conveyor system, which moves materials from one location to another, is an integral part of the mining and power generation industries. Conveyor monitoring is a well-known practice followed in the mining industry. Conveyor monitoring equipment monitor and reports damages to the belt or malfunctioning of conveyor motors and helps avoid costly downtime or operation failures.

Conveyor Monitoring Market Forecast to 2024

To know about the assumptions considered for the study, Request for Free Sample Report

Conveyor Monitoring Market Dynamics:

Driver: Rising adoption of predictive maintenance tools and techniques

The predictive maintenance technique is rapidly gaining popularity in the manufacturing sector globally due to various benefits offered by the technology. This includes y to track the condition and performance of the machine and anticipate failure before it appears, which help manufacturers to improve. Several predictive maintenance tools and techniques are available to monitor the condition of machine components by identifying the symptoms of wear and other failures. Thus, the popularity of predictive maintenance is one of the key factors for the growth of the conveyor monitoring market.

Restraint: Limited in-house skillset to manage monitoring solutions and analyze data

A dedicated data analysis team is required for the deployment of predictive maintenance tools as well as conveyor and motor monitoring solutions. This team must have knowledge and skills about the operations of machine condition monitoring solutions to get accurate and timely information about the health of the motor, conveyor belt, and so on. Also, the team should be aware of the consequences of the failure of these systems. A highly skilled workforce is required for smooth operations and maintenance of sophisticated monitoring solutions, which increases the overall business cost. Thus, the shortage of skilled professionals and the increase in the overall business cost are the major factors restraining the conveyor monitoring market growth.

Opportunity: Growing penetration of Industrial IoT

The industrial IoT creates a huge demand for advanced connected devices. These connected devices enable machine-to-machine communication and interoperate with other devices according to the requirements of the connected environment. This increases the usage of monitoring solutions, actively involving preventive steps, thereby reducing human intervention. With the growing adoption of the Industrial IoT, requirements for monitoring solutions are increasing. These factors contribute to the evolution of the industrial IoT, proving to be an enormous opportunity for the conveyor monitoring market.

Challenge: Availability of expertise at remote locations

Many companies deploy conveyor monitoring systems to achieve operational excellence, decrease downtime, and increase productivity in their manufacturing plants. It is a predictive maintenance tool that provides critical information about the condition of the conveyor belt or motor, thereby making system maintenance more accessible and safer. The efficiency of these systems depends on the expertise required to measure and analyze the data accurately. Different types of expertise are necessary to verify monitoring systems' key parameters, such as abrasion, corrosion, belt tear, belt thinning, and foreign object. Additionally, mining and power plants are located in remote locations; hence, the availability of expertise at these remote locations is a major concern.

Conveyor Monitoring Market Segment Insights:

Based on Type, the Conveyor Belt Monitoring segment to dominate the Conveyor Monitoring market in the year 2019

Conveyor monitoring becomes essential to avoid more damage to the conveyor belt or costly shutdowns. Conveyor belt monitoring consists of technologies such as X-ray, electromagnetic, and optical, along with other technologies. These various technologies are designed to increase production by monitoring the condition of the conveyor belt monitoring system. Hence, conveyor belt monitoring is expected to hold the largest share of the overall Conveyor Monitoring Market during the forecast period.

Based on industry, the mining industry held the largest market share in the Conveyor Monitoring market in the year 2019

The adoption of automation in mining provides better productivity, ensures safety, minimizes wear & tear, enhances reliability, and improves quality. The safety of employees is always the top priority in mining operations. Environmental safety and efficiency are also critical matters for mining companies, especially fluctuating commodity prices. Hence, worldwide regulatory authorities have set stringent rules and regulations for mine owners to ensure the safety of mines. These strict regulations force manufacturers to adopt conveyor monitoring solutions

Regional Insights:

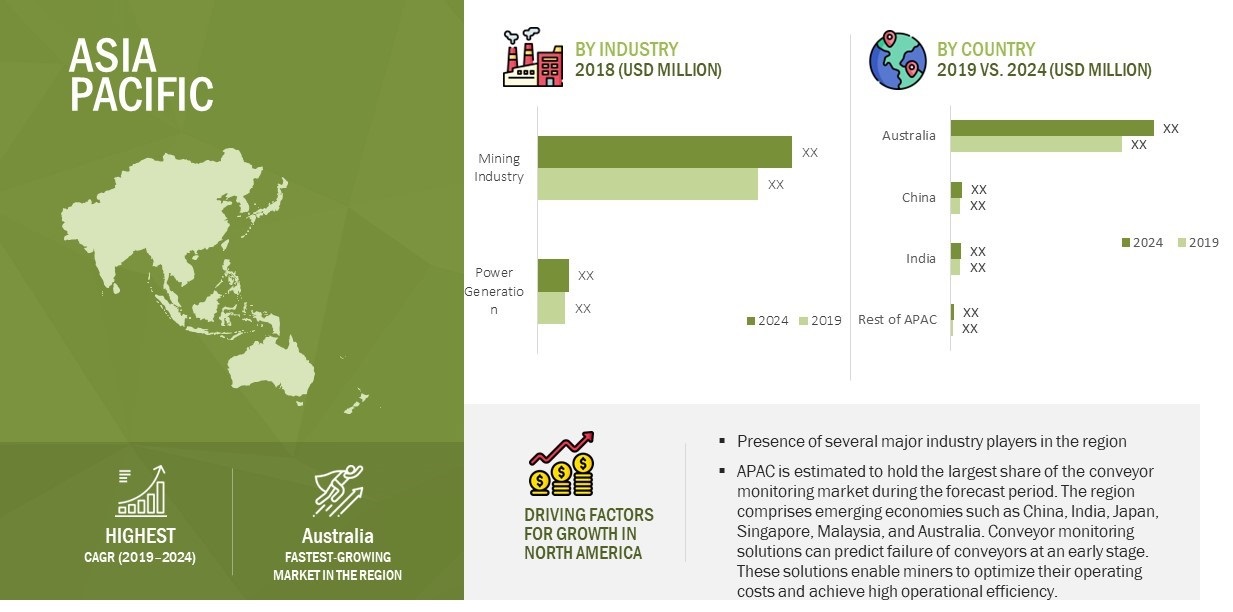

The Asia Pacific region is projected to Grow at the highest CAGR during the forecast period

APAC is likely the fastest-growing region due to rapid urbanization, technological advancements, favorable government policies, and strong regional FDI inflows. In addition, the conveyor monitoring market in Australia is also likely to witness substantial growth owing to huge oil and mining reserves, international government policies, and cutting-edge innovations. Today’s global conveyor monitoring market is highly competitive due to the increasing demand for predictive maintenance techniques and the rising availability of remote conveyor monitoring and fault diagnosis systems.

Conveyor Monitoring Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

Some of the Major players in the Conveyor Monitoring Market are ContiTech (Germany), Fenner Dunlop (Australia), Phoenix (Germany), Beltscan (Australia), and Yellotec (South Africa). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the Conveyor Monitoring Market.

ContiTech is a division of Continental Corporation headquartered in Hanover, Germany. It is one of the leading manufacturers and developers of conveyor belt technology. It also manufactures, develops, and markets automotive and industrial power transmission belts, such as pulleys and couplings, air spring systems, and industrial fluid solutions. ContiTech uses its technical know-how to manufacture electronic components, products, and systems made of metal, textiles, rubber, and fabric. The company offers conveyor belt systems and comprehensive servicing solutions for these conveyor belts and systems for applications in machine and plant engineering and industries such as mining, agriculture, and automotive.

Fenner Dunlop is a subsidiary of Fenner PLC. Fenner PLC was acquired by Michelin. The company manufactures and supplies conveyor systems, including belts, electrical, and terminal equipment. The company offers solutions for mining and industrial applications. Services offered by the company include engineering and design and field services for conveyor belts and conveyor monitoring.

Scope of the Report

|

Report Metric |

Details |

| Market size value in 2019 | USD 215 Million |

| Market size value in 2024 | USD 254 Million |

| Growth rate | CAGR of 3.5% |

|

Market size available for years |

2015–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value(USD) |

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Predictive Maintenance Tools And Techniques |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Based on Industry, The Mining Industry |

| Highest CAGR Segment | Conveyor Belt Monitoring |

In this report, the overall conveyor monitoring market has been segmented on the basis of type, industry, and geography.

Conveyor Monitoring Market, by Type:

- Conveyor Motor Monitoring

- Conveyor Belt Monitoring

Conveyor Motor Monitoring Market, by Technology:

- Vibration Monitoring

- Thermography

- Corrosion Monitoring

- Ultrasound Emission Monitoring

- Motor Current Analysis

Conveyor Motor Monitoring Market, by Offering:

- Hardware

- Software

Conveyor Motor Monitoring Market, by Deployment Type:

- On-premise

- Cloud

Conveyor Belt Monitoring Market

- Electromagnetic

- X-ray

- Optical Sensors

Conveyor Monitoring Market, by Industry:

- Mining Industry

- Power Generation

Conveyor Monitoring Market, by Region:

-

North America

- US

- Rest of North America

-

Europe

- Germany

- Russia

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Australia

- India

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Middle East and Africa

Conveyor Monitoring Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts

The Conveyor Monitoring industry has witnessed numerous technological advancements in terms of types over the years. Substantial investments have been made in the research & development and upgrades of Conveyor Monitoring. The value chain of the conveyor monitoring ecosystem starts with research and development (R&D), which comprises the analysis of system requirements, comparison of electronics specifications, and development of a prototype, followed by manufacturing and system integration phases.

-

Emerging Technology Trends

- Internet of Things (IoT)

- RFID technology

- Addition/refinement in segmentation–Increase the depth or width of market segmentation

Conveyor Monitoring Market by Type

- Conveyor Motor Monitoring

- Conveyor Belt Monitoring

-

Conveyor Motor Monitoring Market, By Technology

- Vibration Monitoring

- Thermography

- Corrosion Monitoring

- Ultrasound Emission Monitoring

- Motor Current Analysis

-

Conveyor Motor Monitoring Market, By Offering

- Hardware

- Software

-

Conveyor Motor Monitoring Market, By Deployment

- On-Premises

- Cloud

-

Conveyor Belt Monitoring Market

- Electromagnetic

- X-Ray

- Optical Sensors

-

Conveyor Monitoring Market, by Industry

- Mining Industry

- Power Generation

- Coverage of new market players and change in the market share of existing players of the Conveyor Monitoring Market

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have 25 players (15 majors, 10 Startups/SMEs). Moreover, the share of companies operating in the Conveyor Monitoring Market and start-up matrix is included in the report.

- Updated financial information and product portfolios of players operating in the Conveyor Monitoring Market

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the Conveyor Monitoring Market till 2021/2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Updated market developments of the profiled players

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new product launches, investments, funding, and certification have been mapped for 2020 to 2022.

- New data points/analysis which was not present in the previous version of the report

- Competitive benchmarking of startups /SMEs covers employee details, financial status, the latest funding round, and total funding.

- Inclusion of the impact of megatrends on the Conveyor Monitoring Market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in the Conveyor Monitoring Market

- We have included patent registrations to give an overview of R&D activities in the Conveyor Monitoring Market.

- The startup evaluation matrix is added in this edition of the report, covering startups.

The new edition of the report consists of trends/disruptions in customer business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand the market dynamics for Conveyor Monitoring.

Recent Developments

- In June 2022, Martin Engineering will launch its innovative N2® remote monitoring system for conveyor belt cleaners across Europe, the Middle East, Africa, and South Asia. Designed for any belt cleaner using a polyurethane blade, the N2 Position Indicator (PI) system tracks belt cleaner performance and tells users when servicing is required via an intuitive cloud-based mobile app or desktop dashboard.

- In June 2021, ABB launched ABB Ability™ Condition Monitoring for belts. It is an advanced digital service that allows mine operators to track speed, damage, misalignment, thickness and wear, slippage, and temperature of conveyor belts in real time, anticipate maintenance, avoid unplanned downtime, and improve belt lifetime and reliability.

Frequently Asked Questions (FAQs):

What is the current size of the Conveyor Monitoring Market?

Conveyor Monitoring Market is projected to grow from USD 213.5 Million in 2019 to USD 253.6 Million by 2024, at a CAGR of 3.5% between 2019-2024.

Who are the winners in the Conveyor Monitoring Market?

ContiTech (Germany), Fenner Dunlop (Australia), Phoenix (Germany), Beltscan (Australia), and Yellotec (South Africa).

What are some of the technological advancements in the market?

OThe Internet of Things and Big data these days means big business. Monitoring Belt Conveyor Systems used to be performed by means of inspectors and offline. These days the developments are towards fully automated inspection systems. The IoT enables more information from sensor systems that were not available in the past. Theoretically, monitoring Belt Conveyor systems 24*7 should become a reality, and downtime and unexpected maintenance a things of the past.

What are the factors driving the growth of the market?

Rising adoption of predictive maintenance tools and techniques, increasing focus of companies on reducing revenue loss due to faults in conveyor belts and motors .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.3.1 Primary Interviews With Experts

2.1.3.2 Primary Sources

2.1.3.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities for Global Conveyor Monitoring Market

4.2 Conveyor Monitoring Market, By Type

4.3 Conveyor Belt Monitoring Market, By Region and Type

4.4 Conveyor Monitoring Market, By Country, 2018

4.5 Conveyor Monitoring Market, By Industry

4.6 Conveyor Monitoring Market for APAC Vs. European Countries

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Adoption of Predictive Maintenance Tools and Techniques

5.2.1.2 Increasing Focus of Companies on Reducing Revenue Loss Due to Faults in Conveyor Belts and Motors

5.2.2 Restraints

5.2.2.1 Limited In-House Skillset to Manage Monitoring Solutions and Analyze Data

5.2.3 Opportunities

5.2.3.1 Growing Penetration of Industrial IoT

5.2.3.2 Rising Demand for Safety Compliance Automation Solutions

5.2.4 Challenges

5.2.4.1 Availability of Expertise at Remote Locations

5.3 Rollers

6 Conveyor Monitoring Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Conveyor Motor Monitoring

6.2.1 Motor Monitoring, By Technology

6.2.1.1 Vibration Monitoring

6.2.1.1.1 Defects Detected Using Vibration Monitoring

6.2.1.2 Thermography

6.2.1.2.1 Defects Detected Using Thermography

6.2.1.3 Corrosion Monitoring

6.2.1.3.1 Defects Detected Using Corrosion Monitoring

6.2.1.4 Ultrasound Emission Monitoring

6.2.1.4.1 Defects Detected Using Ultrasound Emission Monitoring

6.2.1.5 Motor Current Analysis

6.2.1.5.1 Defects Detected Using Motor Current Analysis

6.2.2 Conveyor Motor Monitoring Market, By Offering

6.2.2.1 Hardware

6.2.2.1.1 Vibration Sensors and Analyzers

6.2.2.1.2 Accelerometers

6.2.2.1.3 Proximity Probes

6.2.2.1.4 Tachometers

6.2.2.1.5 Infrared Sensors

6.2.2.1.5.1 Thermal Infrared Sensors

6.2.2.1.5.2 Quantum Infrared Sensors

6.2.2.1.6 Spectrometers

6.2.2.1.6.1 Infrared Spectrometers

6.2.2.1.6.2 Ultraviolet Spectrometers

6.2.2.1.6.3 Atomic Spectrometers

6.2.2.1.6.4 Mass Spectrometers

6.2.2.1.7 Ultrasound Detectors

6.2.2.1.7.1 Sound Pressure Meters

6.2.2.1.7.2 Stethoscopes

6.2.2.1.7.3 Ultrasound Leak Detectors

6.2.2.1.8 Spectrum Analyzers

6.2.2.1.8.1 Swept Spectrum Analyzers

6.2.2.1.8.2 Real-Time Spectrum Analyzers

6.2.2.1.9 Corrosion Probes

6.2.2.1.10 Others

6.2.2.2 Software

6.2.2.2.1 Data Integration

6.2.2.2.2 Diagnostic Reporting

6.2.2.2.3 Order Tracking

6.2.2.2.4 Parameter Calculation

6.2.3 Motor Monitoring, By Deployment Type

6.2.3.1 On-Premises

6.2.3.2 Cloud

6.3 Conveyor Belt Monitoring

6.3.1 Electromagnetic

6.3.2 X-Ray

6.3.3 Optical Sensors

7 Conveyor Monitoring Market, By Industry (Page No. - 53)

7.1 Introduction

7.2 Mining

7.2.1 Conveyor Monitoring is Essential in Mining Industry

7.3 Power Generation

7.3.1 Conveyor Monitoring is Preferred in Coal-Fired Power Plants

8 Geographic Analysis (Page No. - 59)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 US Accounts for Significant Share of the North American Conveyor Monitoring Market in Comparison With Remaining Countries in North America

8.2.2 Rest of North America

8.2.2.1 Rest of North America to Witness Higher CAGR in Market

8.3 Europe

8.3.1 Germany

8.3.1.1 Dominating Country in Europe for Market

8.3.2 Russia

8.3.2.1 Mining Industry in Russia Driving Demand for Conveyor Monitoring Solutions

8.3.3 Rest of Europe

8.3.3.1 Mining Industry Driving Market Growth in Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 Financial and Strategic Involvement of Government Driving Market Growth

8.4.2 Australia

8.4.2.1 Significant Growth in Mining Industry Driving Demand for Conveyor Monitoring Solutions in Australia

8.4.3 India

8.4.3.1 Considerable Mining Activities Accelerating Market Growth in India

8.4.4 Rest of APAC

8.5 Rest of the World (RoW)

8.5.1 Middle East & Africa

8.5.1.1 Availability of Natural Resources Provides Opportunity for Rapid Growth of Mining Industry

8.5.2 South America

8.5.2.1 Investments in Metals Industry By Emerging Asian Economies

9 Competitive Landscape (Page No. - 71)

9.1 Overview

9.2 Ranking Analysis of Conveyor Monitoring Market Players

9.3 Competitive Leadership Mapping

9.3.1 Visionary Leaders

9.3.2 Dynamic Differentiators

9.3.3 Innovators

9.3.4 Emerging Companies

10 Company Profiles (Page No. - 74)

(Business Overview, Products and Solutions Offered, SWOT Analysis, and MnM View)*

10.1 Key Players

10.1.1 Fenner Dunlop

10.1.2 Emerson

10.1.3 Beltscan Systems

10.1.4 ContiTech

10.1.5 PHOENIX

10.1.6 CBG

10.1.7 4B

10.1.8 Yellotec

10.1.9 Trolex

10.1.10 SKF

10.1.11 Bruel & Kjaer

10.1.12 Pruftechnik Dieter Busch

10.1.13 Honeywell

10.2 Other Key Players

10.2.1 Vayeron

*Details on Business Overview, Products and Solutions Offered, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 93)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (32 Tables)

Table 1 Conveyor Monitoring Market, By Type, 2015–2024 (USD Million)

Table 2 Conveyor Motor Monitoring Market, By Industry, 2015–2024 (USD Million)

Table 3 Conveyor Motor Monitoring Market, By Region, 2015–2024 (USD Million)

Table 4 Conveyor Motor Monitoring Market, By Technology, 2015–2024 (USD Million)

Table 5 Conveyor Motor Monitoring Market, By Offering, 2015–2024 (USD Million)

Table 6 Conveyor Motor Monitoring Market, By Deployment Type, 2015–2024 (USD Million)

Table 7 Conveyor Motor Monitoring Market for On-Premises Deployment Type, By Industry, 2015–2024 (USD Million)

Table 8 Conveyor Motor Monitoring Market for Cloud Deployment, By Industry, 2015–2024 (USD Million)

Table 9 Conveyor Belt Monitoring Market, By Type, 2015–2024 (USD Million)

Table 10 Conveyor Belt Monitoring Market, By Industry, 2015–2024 (USD Million)

Table 11 Conveyor Belt Monitoring Market, By Region, 2015–2024 (USD Million)

Table 12 Market, By Industry, 2015–2024 (USD Million)

Table 13 Conveyor Belt Monitoring Market for Mining Industry, By Type, 2015–2024 (USD Million)

Table 14 Conveyor Monitoring Market for Mining Industry, By Region, 2015–2024 (USD Million)

Table 15 Conveyor Motor Monitoring Market for Mining Industry, By Deployment Type, 2015–2024 (USD Million)

Table 16 Conveyor Belt Monitoring Market for Power Industry, By Type, 2015–2024 (USD Million)

Table 17 Market for Power Generation Industry, By Region, 2015–2024 (USD Million)

Table 18 Conveyor Motor Monitoring Market for Power Generation Industry, By Deployment Type, 2015–2024 (USD Million)

Table 19 Market, By Region, 2015–2024 (USD Million)

Table 20 Market in North America, By Country, 2015–2024 (USD Million)

Table 21 Market in North America, By Industry, 2015–2024 (USD Million)

Table 22 Market in North America, By Type, 2015–2024 (USD Million)

Table 23 Market in Europe, By Country, 2015–2024 (USD Million)

Table 24 Market in Europe, By Industry, 2015–2024 (USD Million)

Table 25 Market in Europe, By Type, 2015–2024 (USD Million)

Table 26 Market in APAC, By Country, 2015–2024 (USD Million)

Table 27 Market in APAC, By Industry, 2015–2024 (USD Million)

Table 28 Market in APAC, By Type, 2015–2024 (USD Million)

Table 29 Market in RoW, By Region, 2015–2024 (USD Million)

Table 30 Conveyor Monitoring Market in RoW, By Industry, 2015–2024 (USD Million)

Table 31 Market in RoW, By Type, 2015–2024 (USD Million)

Table 32 Market Players, 2018

List of Figures (39 Figures)

Figure 1 Conveyor Monitoring Market

Figure 2 Market: Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Conveyor Monitoring: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Market Segmentation

Figure 8 Market, 2015 to 2024 (USD Million)

Figure 9 Electromagnetic Conveyor Belt Monitoring Solutions to Account for Largest Market Size During 2019–2024

Figure 10 Vibration Monitoring Technology to Lead Conveyor Motor Monitoring Market in Terms of Size During 2019–2024

Figure 11 Mining Industry Expected to Command Market From 2019 to 2024

Figure 12 APAC to Witness Highest CAGR in Global Market During 2019–2024

Figure 13 Conveyor Monitoring Market Expected to Grow at Stable Rate From 2019 and 2024

Figure 14 Conveyor Motor Monitoring Market Expected to Grow at Higher Rate From 2019 to 2024

Figure 15 APAC and Electromagnetic Conveyor Belt Monitoring Solutions Accounted for Largest Market Share in 2018

Figure 16 Australia Captured Largest Share of Global Market in 2018

Figure 17 Mining Industry Expected to Continue to Account for Larger Share of Market From 2018 to 2024

Figure 18 APAC Countries to Witness Higher CAGR Than That of European Countries

Figure 19 Rising Adoption of Predictive Maintenance Tools and Techniques Drive Market

Figure 20 Industrial IoT Market, 2015–2023

Figure 21 Conveyor Motor Monitoring Market, By Offering

Figure 22 Conveyor Monitoring Market, By Industry

Figure 23 Europe: Market Snapshot

Figure 24 APAC: Market Snapshot

Figure 25 Market (Global) Competitive Leadership Mapping, 2018

Figure 26 Emerson: Company Snapshot

Figure 27 ContiTech: Company Snapshot

Figure 28 SKF: Company Snapshot

Figure 29 Honeywell: Company Snapshot

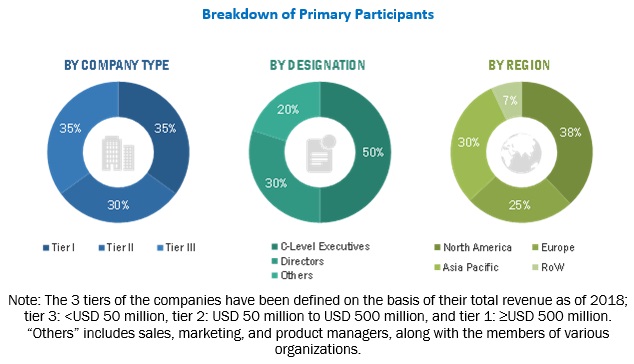

The study involved 4 major activities to estimate the current market size for conveyor monitoring solutions. Exhaustive secondary research has been done to collect the information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Factiva and Avention, have been referred to for the identification and collection of information for this study. These secondary sources include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the conveyor monitoring scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply sides across 4 major regions—North America, Europe, APAC, and RoW. Approximately 30% and 70% primary interviews have been conducted with parties from the demand and supply sides, respectively. The primary data has been collected through questionnaires, e-mails, and telephonic interviews.

The following figure shows the breakdown of primaries based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global conveyor monitoring market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market rankings in the respective regions have been determined through primary and secondary research. This entire research methodology involves the study of financial reports of top players and interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the conveyor monitoring market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both the top-down and bottom-up approaches.

The conveyor monitoring market was valued at USD 206 million in 2018 and is projected to reach USD 254 million by 2024; it is estimated to grow at a CAGR of 3.5% from 2019 to 2024. The base year of the study is 2018, and the forecast period is from 2019 to 2024.

Study objectives are as follows:

- To define, describe, and forecast the conveyor monitoring market by type and industry, in terms of value

- To forecast the market for various segments with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), in terms of value

- To describe and forecast the conveyor motor monitoring market segmented on the basis of type into technology, offering, and deployment type, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2, along with detailing the competitive landscape for the market leaders

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report.

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on industry

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Conveyor Monitoring Market