Conversational Systems Market by Component (Compute Platforms, Solutions, Services), Type (Voice and Text), Application (Customer Support and Personal Assistant, Branding and Advertisement, and Compliance), Vertical, and Region - Global Forecast to 2024

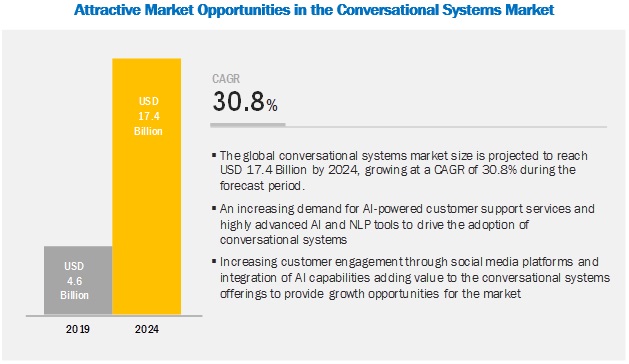

[130 Pages Report] The Conversational Systems Market size is projected to reach USD 17.4 billion by 2024, at a CAGR of 30.8%. Major growth drivers for the market include highly advanced AI and NLP tools and an increasing demand for AI-powered customer support services.

Services to grow at the highest CAGR during the forecast period

Most of the conversational solutions providers offer technical support services and consulting services to manage the deployment of AI-based solutions in the market. The services ensure faster and smoother implementation that maximizes the value of enterprise investments. They ensure the end-to-end deployment of the conversational systems platform and address pre and post-deployment queries that are required.

Branding and advertisement application to grow at the highest CAGR in conversational systems market during the forecast period

Enterprises are leveraging the computational platform to create awareness and post ads about the latest and upcoming products through this digital channel. The conversational systems can also be used by enterprises for cross-selling and up-selling purposes leading to the reduction in the operational cost. With the implementation of AI-based computational platform, enterprises can provide an initial set of information to the potential customers and recognize their interest level. Enterprises can determine customer behavior and purchasing trends so that they can reach to the appropriate target audience for branding and advertisement of their new product.

Text assistant segment to hold a larger market size during the forecast period

In the text assisted conversational system, text messages, Graphics Interchange Format (GIF) files, and graphs are used to communicate with customers. Most of the websites, live streaming solutions, and personal assistant or chatbots use text as one of the most important mediums to interact with their clients. The text assistant chatbots can integrate various accessible tools, which enable operators to optimize and prototype text output applications by effortlessly forming optimization data, such as user dictionaries, user text instructions, and prompts.

North America to hold the largest market size during the forecast period

North America is contributing significantly to the conversational systems market and is expected to grow further. The US is the largest adopter of conversational systems in the region. Furthermore, the presence of global vendors such as IBM, Google, Microsoft, and AWS plays a vital role in the implementation of conversational systems solutions in the market.

Key Players

Major vendors in the global market include Google (US), Microsoft (US), IBM (US), AWS (US), Baidu (China), Oracle (US), SAP (Germany), Nuance (US), Artificial Solutions (Spain), Conversica (US), Haptik (India), Rasa (Germany), Rulai (US), Avaamo (US), Kore.ai (US), Solvvy (US), Pypestream (US), Inbenta (US), and Saarthi.ai (India).

Google is one of the key technology players in the conversational systems market. It significantly invests in R&D activities to innovate its advertising, cloud, ML, search, and new products and services. It has made significant investments and advancements in AI. In April 2018, Google launched Dialogflow in 2 versions: standard and enterprise editions. Organizations can leverage the benefits of the Dialogflow platform to build AI-powered engaging voices and text-based conversational interfaces on various platforms, including Facebook Messenger, Google Assistant, Amazon Alexa, Cortana, Slack, and Twilio, for interacting with their customers.

Scope of the report

|

Report Metrics |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Components, Type, Applications, Verticals, and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

IBM (US), Google (US), Microsoft (US), AWS (US), SAP (US), Oracle (US), Baidu (China), Nuance (US), Artificial Solutions (Spain), Conversica (US), Haptik (India), Rasa (Germany), Avaamo (US), Kore.ai (India), Inbenta (US), Rulai (US), Solvvy (US), Pypestream (US), and Saarthi.ai (India) |

The research report categorizes the conversational systems market based on components, type, applications, verticals, and regions.

Based on Components, market has the following segments:

- Compute Platforms

- Solutions

- Services

Based on Type, market has the following segments:

- Voice Assisted

- Text Assistant

- Others (Gesture Recognition, Object Recognition and Expression Recognition)

Based on Applications, conversational systems market has the following segments:

- Customer Support and Personal Assistant

- Branding and Advertisement

- Data Privacy and Compliance

- Others (Campaign Analysis and Data Aggregation)

Based on Verticals, market has the following segments:

- BFSI

- Media and Entertainment

- Retail and eCommerce

- Travel and Hospitality

- Telecom

- Healthcare and Life Sciences

- Others (Government, Manufacturing, Education, and Energy and Utilities)

Based on Regions, the Conversational systems market has the following segments:

- North America

- Europe

- APAC

- Latin America

- MEA

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Conversational systems market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Recent Developments

- In January 2019, Oracle collaborated with Chatbox, an integrated messaging platform provider, to provide a rich and more-contextual user experience. The collaboration would provide customers with chatbots capable of delivering rich and more-contextual user experiences.

Critical questions the report answers

- What are the current trends that are driving the market?

- In which applications areas are most of the verticals are deploying conversational AI?

- Where will all these developments take the industry in the mid to long-term?

- Which companies are the top vendors in the market and what is their competitive analysis?

- What are the drivers and challenges of the conversational systems market?

Frequently Asked Questions (FAQ):

What does Conversational Systems mean?

Intelligent machine systems that understand language and can conduct a written or verbal conversation with their users are known as conversational systems. They utilize speech-based assistants and facilitate stronger interactions and greater engagement across users and platforms. Conversational systems combine speech-based technology, Natural Language Processing (NLP) and Machine Learning (ML) into a single platform to develop and build applications for a specific, as well as for multiple use cases across verticals.

What are the top trends in Conversational systems market?

Following are the key trends in Conversational systems market.

- Evolution of Chatbots to Conversational AI bots

- High adoption of Low code/No-code Platforms

- Digital Assistants for Enterprises

- Augmented Reality in Conversational AI

- Solution Bots

Who are the major vendors in the Conversational Systems Market?

Major vendors in the Conversational Systems Market are Google, Microsoft, IBM, AWS, Baidu, Oracle, SAP, Nuance, Artificial Solutions, Conversica, Haptik, Rasa, Rulai, Avaamo, Kore.ai, Solvvy, Pypestream, Inbenta, and Saarthi.ai.

What are the major Conversational systems application areas?

Following are the key application area for Conversational systems market.

- Customer support and personal assistance

- Branding and advertisement

- Data privacy and compliance

How big is the Conversational Systems Market?

Conversational Systems Market expected to grow from $4.6 billion in 2019 to USD 17.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 30.8%.

What are the major Conversational systems verticals?

Banking, Financial Services, and Insurance, Media and Entertainment, Retail and Ecommerce, Travel and Hospitality, Telecom and Healthcare and Life Sciences .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Conversational Systems Market

4.2 Market By Application

4.3 Market By Region

4.4 Market in North America, By Component, Type, and Application

5 Market Overview and Industry Trends (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Highly Advanced AI and NLP Tools Bolstering the Market Growth

5.2.1.2 Increasing Demand for AI-Powered Customer Support Services

5.2.2 Restraints

5.2.2.1 Dependency on Deployment Platforms

5.2.2.2 Lack of Awareness of Emerging Technologies

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Smartphones

5.2.3.2 Integration of Advanced AI Capabilities Adding Value to the Conversational Systems Offerings

5.2.3.3 Rise in Customer Engagement Through Social Media Platforms

5.2.4 Challenges

5.2.4.1 Lack of Awareness and Reluctance to Use Chatbots

5.2.4.2 Lack of Accuracy in Chatbots and Virtual Assistants

5.3 Use Cases

5.3.1 Use Case: Scenario 1

5.3.2 Use Case: Scenario 2

5.3.3 Use Case: Scenario 3

5.3.4 Use Case: Scenario 4

5.3.5 Use Case: Scenario 5

5.4 Regulatory Implications

5.4.1 GDPR

5.4.2 HIPAA

5.4.3 FTC

5.4.4 ISO/IEC JTC 1/SC 42

6 Conversational Systems Market, By Component (Page No. - 39)

6.1 Introduction

6.2 Compute Platforms

6.2.1 Increasing Demand to Develop Nlp and Ml Enabled Conversational Solutions to Drive the Growth of Market

6.3 Solutions

6.3.1 AI-Enabled Solutions to Automate Conversation Across Channels to Grow at A Rapid Pace in the Coming Years

6.4 Services

6.4.1 Increasing Need to Provide Post Purchase Engagement With Clients to Drive the Growth of Services in Market

7 Market, By Type (Page No. - 44)

7.1 Introduction

7.2 Voice Assisted

7.2.1 Increasing Demand for Voice Assisted Solutions to Pave the Way for Market in Different Verticals

7.3 Text Assistant

7.3.1 AI-Enabled Text Assistant Solutions to Automate Conversation Across Channels to Grow at A Rapid Pace in the Coming Years

7.4 Others

8 Market, By Application (Page No. - 47)

8.1 Introduction

8.2 Customer Support and Personal Assistance

8.2.1 Growing Demand for Handling Customer Queries to Increase the Demand for Market in Various Verticals

8.3 Branding and Advertisement

8.3.1 Growing Need to Create Awareness and Perform Effective Branding Activities to Increase the Demand for Market

8.4 Data Privacy and Compliance

8.4.1 Increasing Need to Secure Customers Data and Comply With Stringent Regulations to Fuel the Adoption of Conversational Systems Among Enterprises

8.5 Others

9 Conversational Systems Market, By Vertical (Page No. - 51)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.2.1 Presence of A Large Number of Data Across BFSI Vertical to Help Financial Institutions Provide Enhanced Customer Experience

9.3 Media and Entertainment

9.3.1 Personalized and Enhanced Customer Experience Using Conversational Systems Solutions

9.4 Retail and Ecommerce

9.4.1 Increasing Deployment of Conversational Systems Solutions By Retail and Ecommerce Vertical on Various Channels for Greater Customer Engagement

9.5 Travel and Hospitality

9.5.1 Automation of Booking Process Through Various Platforms to Increase the Adoption of Chatbots and Personal Assistants

9.6 Telecom

9.6.1 Increasing Use of Chatbots to Provide Customized Services to Customers Will Lead Market

9.7 Healthcare and Life Sciences

9.7.1 Conversational Systems Solutions to Improve Patient Management, Monitoring, and Experience and Engagement

9.8 Others

10 Conversational Systems Market, By Region (Page No. - 60)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.1.1 Growing Implementation of AI- and Ml-Based Solutions to Fuel the Demand for Conversational Systems in the US

10.2.2 Canada

10.2.2.1 Increase in AI-Based Investments and Research Activities to Drive the Growth of Market in Canada

10.3 Europe

10.3.1 United Kingdom

10.3.1.1 Growing Investments to Fuel the Adoption of Conversational Systems Solutions in the UK

10.3.2 Germany

10.3.2.1 Increasing Adoption of Conversational Systems Solutions Across Major Verticals to Drive the Market in Germany

10.3.3 France

10.3.3.1 Heavy Inflow of Capital From Various Investors to Drive the Market in France

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 Increasing Investments in AI Landscape to Drive the Adoption of Conversational Systems Solutions in China

10.4.2 Japan

10.4.2.1 Rising Use of Chatbots and Intelligent Virtual Agents in the Telecom Vertical to Fuel the Adoption of Conversational Systems Solutions in Japan

10.4.3 India

10.4.3.1 Increase in Investments Among Startups and Growth of AI Technology Among Verticals to Trigger Conversational Systems Adoption in India

10.4.4 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Israel

10.5.1.1 Upcoming AI Startups in the Country to Drive the Growth of Market in Israel

10.5.2 United Arab Emirates

10.5.2.1 Government Initiatives to Drive the Adoption of AI-Based Solutions in the UAE

10.5.3 Rest of Middle East and Africa

10.6 Latin America

10.6.1 Brazil

10.6.1.1 Emerging Startups in Brazil to Drive the Growth of Conversational Systems Market in the Coming Years

10.6.2 Mexico

10.6.2.1 Growing Demand for AI-Based Technologies to Fuel the Adoption of Conversational Systems Solutions in Mexico

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 84)

11.1 Competitive Leadership Mapping

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic

11.1.4 Emerging

11.2 Competitive Landscape Overview

11.3 Competitive Scenario

11.3.1 New Product Launches/Product Enhancements

11.3.2 Partnerships, Agreements, and Collaborations

11.3.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 92)

12.1 Introduction

(Business Overview, Platforms Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 Google

12.3 Microsoft

12.4 AWS

12.5 IBM

12.6 Oracle

12.7 Nuance

12.8 Baidu

12.9 SAP

12.1 Artificial Solutions

12.11 Kore.Ai

12.12 Avaamo

12.13 Conversica

12.14 Haptik

12.15 Rasa

12.16 Solvvy

12.17 Pypestream

12.18 Inbenta

12.19 Rulai

12.2 Saarthi.Ai

*Details on Business Overview, Platforms Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 123)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (46 Tables)

Table 1 Currency Exchange Table

Table 2 Factor Analysis

Table 3 Global Market Size and Growth Rate, 20172024 (USD Million, Y-O-Y %)

Table 4 Conversational Systems Market Size, By Component, 20172024 (USD Million)

Table 5 Compute Platforms: Market Size By Region, 20172024 (USD Million)

Table 6 Solutions: Market Size By Region, 20172024 (USD Million)

Table 7 Services: Market Size By Region, 20172024 (USD Million)

Table 8 Market Size By Type, 20172024 (USD Million)

Table 9 Market Size By Application, 20172024 (USD Million)

Table 10 Conversational Systems Market Size, By Vertical, 20172024 (USD Million)

Table 11 Banking, Financial Services, and Insurance: Market Size By Region, 20172024 (USD Million)

Table 12 Media and Entertainment: Market Size By Region, 20172024 (USD Million)

Table 13 Retail and Ecommerce: Market Size By Region, 20172024 (USD Million)

Table 14 Travel and Hospitality: Market Size By Region, 20172024 (USD Million)

Table 15 Telecom: Market Size By Region, 20172024 (USD Million)

Table 16 Healthcare and Life Sciences: Market Size By Region, 20172024 (USD Million)

Table 17 Others: Market Size By Region, 20172024 (USD Million)

Table 18 Conversational Systems Market Size, By Region, 20172024 (USD Million)

Table 19 North America: Market Size By Component, 20172024 (USD Million)

Table 20 North America: Market Size By Type, 20172024 (USD Million)

Table 21 North America: Market Size By Application, 20172024 (USD Million)

Table 22 North America: Market Size By Vertical, 20172024 (USD Million)

Table 23 North America: Market Size By Country, 20172024 (USD Million)

Table 24 Europe: Market Size, By Component, 20172024 (USD Million)

Table 25 Europe: Market Size By Type, 20172024 (USD Million)

Table 26 Europe: Market Size By Application, 20172024 (USD Million)

Table 27 Europe: Market Size By Vertical, 20172024 (USD Million)

Table 28 Europe: Market Size By Country, 20172024 (USD Million)

Table 29 Asia Pacific: Conversational Systems Market Size, By Component, 20172024 (USD Million)

Table 30 Asia Pacific: Market Size By Type, 20172024 (USD Million)

Table 31 Asia Pacific: Market Size By Application, 20172024 (USD Million)

Table 32 Asia Pacific: Market Size By Vertical, 20172024 (USD Million)

Table 33 Asia Pacific: Market Size By Country, 20172024 (USD Million)

Table 34 Middle East and Africa: Market Size, By Component, 20172024 (USD Million)

Table 35 Middle East and Africa: Market Size By Type, 20172024 (USD Million)

Table 36 Middle East and Africa: Market Size By Application, 20172024 (USD Million)

Table 37 Middle East and Africa: Market Size By Vertical, 20172024 (USD Million)

Table 38 Middle East and Africa: Market Size By Country, 20172024 (USD Million)

Table 39 Latin America: Conversational Systems Market Size, By Component, 20172024 (USD Million)

Table 40 Latin America: Market Size By Type, 20172024 (USD Million)

Table 41 Latin America: Market Size By Application, 20172024 (USD Million)

Table 42 Latin America: Market Size By Vertical, 20172024 (USD Million)

Table 43 Latin America: Market Size By Country, 20172024 (USD Million)

Table 44 New Product Launches/Product Enhancements

Table 45 Partnerships, Agreements, and Collaborations

Table 46 Mergers and Acquisitions

List of Figures (37 Figures)

Figure 1 Global Conversational Systems Market: Research Design

Figure 2 Market: Top-Down and Bottom-Up Approaches

Figure 3 Market Snapshot By Component

Figure 4 Market Snapshot By Type

Figure 5 Market Snapshot By Application

Figure 6 Market Snapshot By Vertical

Figure 7 Market Snapshot By Region

Figure 8 Increasing Demand for AI-Powered Customer Support Services to Drive the Overall Growth of the Conversational Systems Market During the Forecast Period

Figure 9 Branding and Advertisement Segment to Grow at A Significant Pace During the Forecast Period

Figure 10 North America to Hold the Highest Market Share in 2019

Figure 11 Compute Platforms, Text Assistant, and Customer Support and Personal Assistant Segments in North America Accounted for the Highest Market Shares in 2019

Figure 12 Drivers, Restraints, Opportunities, and Challenges: Conversational Systems Market

Figure 13 Services Segment to Grow at the Highest CAGR During the Forecast Period

Figure 14 Voice Assisted Segment to Grow at the Highest CAGR During the Forecast Period

Figure 15 Customer Support and Personal Assistant Segment to Hold the Highest Market Size During the Forecast Period

Figure 16 Retail and Ecommerce Segment to Register the Highest CAGR During the Forecast Period

Figure 17 North America to Hold the Largest Market Size During the Forecast Period

Figure 18 India to Register the Highest CAGR During the Forecast Period

Figure 19 Asia Pacific to Account for the Highest CAGR During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Conversational Systems Market (Global) Competitive Leadership Mapping, 2019

Figure 23 Key Developments in the Market During 20172019

Figure 24 Geographical Segmentation of the Top Players in the Market

Figure 25 Google: Company Snapshot

Figure 26 Google: SWOT Analysis

Figure 27 Microsoft: Company Snapshot

Figure 28 Microsoft: SWOT Analysis

Figure 29 AWS: Company Snapshot

Figure 30 AWS: SWOT Analysis

Figure 31 IBM: Company Snapshot

Figure 32 IBM: SWOT Analysis

Figure 33 Oracle: Company Snapshot

Figure 34 Oracle: SWOT Analysis

Figure 35 Nuance: Company Snapshot

Figure 36 Baidu: Company Snapshot

Figure 37 SAP: Company Snapshot

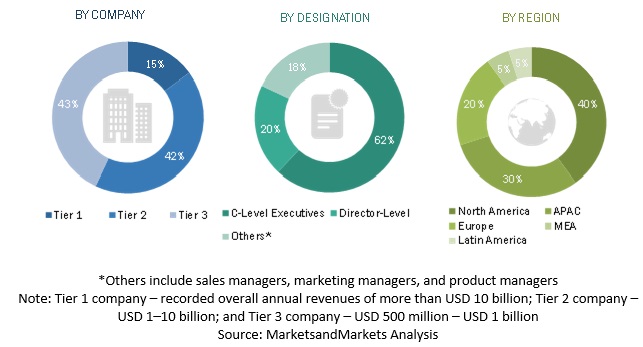

The study consists of 4 major activities to estimate the current market size of the conversational systems market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the conversational systems.

Secondary research

In the secondary research process, various secondary sources such as D&B Hoovers and Bloomberg BusinessWeek have been referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors, gold standard and silver standard websites, Research and Development (R&D) organizations, regulatory bodies, and databases.

Primary research

various primary sources from both supply and demand sides of the conversational systems market were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors of conversational systems solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the profile breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the conversational systems market. The methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using the study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the size of the conversational systems market by component, type, services, application, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market

- To analyze opportunities in the market for stakeholders by identifying the high growth segments of the conversational systems ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches, such as product launches, acquisitions, contracts, agreements, and partnerships, in the market

Growth opportunities and latent adjacency in Conversational Systems Market