Content Security Market by Component (Solutions, Services), by Solutions (E-Mail Content Security, Web Content Security, Others), by Organization Size, by Vertical (BFSI, IT and ITeS, Retail and eCommerce, Media and Entertainment) and by Region - Global Forecast to 2027

The Content Security Policy improve the document’s security. It can limit how resources like JavaScript, CSS, HTML frames, and web workers are used that loads the browser. It is mostly used as a header for a HTTP response. CSP gives website owners a standard way to declare content origins that have been approved and should be allowed to be loaded by browsers on that website.

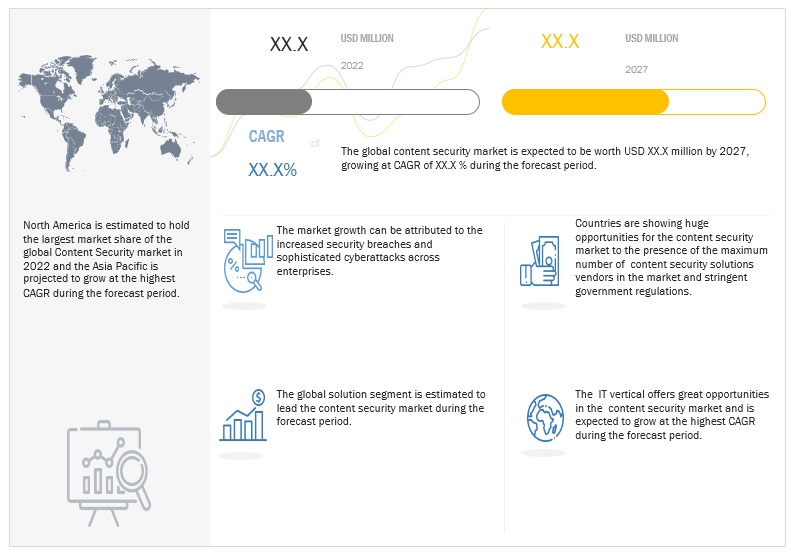

The global content security market size is estimated to grow from USD XX million in 2022 to USD XX million by 2027, at a CAGR of XX%. The purpose of the security standard widely adopted practice was to stop code injection attacks like clickjacking, cross-site scripting (XSS), and others that occur when malicious content is run in the trusted web page context.

To know about the assumptions considered for the study, Request for Free Sample Report

Driver: Web Security.

In the era of startups and subsequent website launches for the general public, the potential security risks that could affect the nature of the business or the privacy of end users were brought to light and emphasized. For instance, according to Siteefy, there are approximately 175 brand-new websites built each minute. Thus, approximately 252,000 brand-new websites are created each day worldwide.

Increased digitalization and adoption of IoT.

Due to the need for real-time threat protection, increased IT spending and investments, and rising demand for cloud-based applications, the global content security market is anticipated to expand at an exponential rate.

Challenge: Lack of supervising laws and regulations

The adoption of content security solutions is hampered by the integration of content security tools for various industry sectors and clients, posing a challenge to the market's expansion. For instance, there are loose security policies in place, lack of watermarking, minimal permissions/ open access, lack of encryption, work home routers, no network control, and third-party vendors outside the system. All these factors are acting as a barrier to content security’s global expansion.

Key Market Players

Cartesian Inc. (US), Microsoft Corporation (US), Trend Micro Inc. (Japan), Check point Software Technologies (Israel), Barracuda Networks (US), Sophos Technologies Pvt. Ltd (UK)., Proofpoint (US), Forcepoint (US), Verimetrix (France), Lookout (US), CommScope (US) and Infosec Information Technologies (Istanbul) are few key players in the content security market.

Recent developments:

- In 2022, the world's leading initiative for film and television content security, The Trusted Partner Network (TPN), is expanding its program to better serve the media and entertainment industry as it continues to grow globally and in complexity and now conducts much of its business in the cloud.

- In China 2021, research had been done on the growth of artificial intelligence and how it affected content security. (Content security based on AI)

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.4 MARKET FORECAST

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 USE CASES

5.4 VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM

5.6 PORTER’S FIVE FORCES MODEL ANALYSIS

5.7 AVERAGE SELLING PRICE ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.9 PATENT ANALYSIS

5.10 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

5.13 KEY CONFERENCES AND EVENTS IN 2022-23

6 CONTENT SECURITY MARKET, BY OFFERING

6.1 INTRODUCTION

6.2 SOLUTION

6.2.1 E-MAIL CONTENT SECURITY

6.2.2 WEB CONTENT SECURITY

6.2.2 OTHERS

6.3 SERVICES

7 CONTENT SECURITY MARKET, BY ORGANIZATION SIZE

7.1 INTRODUCTION

7.2 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

7.3 LARGE ENTERPRISES

8 CONTENT SECURITY MARKET, BY VERTICAL

8.1 INTRODUCTION

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

8.3 IT AND ITES

8.4 MEDIA AND ENTERTAINMENT

8.5 MANUFACTURING

8.6 HEALTHCARE

8.7 RETAIL AND ECOMMERCE

8.8 OTHER VERTICALS

9 CONTENT SECURITY MARKET, BY REGION

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.3 EUROPE

9.4 ASIA PACIFIC (APAC)

9.5 MIDDLE EAST AND AFRICA (MEA)

9.6 LATIN AMERICA

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

10.3 REVENUE ANALYSIS OF LEADING PLAYERS

10.4 MARKET SHARE ANALYSIS OF THE TOP MARKET PLAYERS

10.5 HISTORICAL REVENUE ANALYSIS

10.6 RANKING OF KEY PLAYERS IN THE CONTENT SECURITY MARKET

10.7 KEY COMPANY EVALUATION QUADRANT

10.7.1 STARS

10.7.2 EMERGING LEADERS

10.7.3 PERVASIVE PLAYERS

10.7.4 PARTICIPANTS

10.8 COMPETITIVE BENCHMARKING

10.8.1 KEY COMPANY EVALUATION CRITERIA

10.8.2 SME/STARTUP COMPANY EVALUATION CRITERIA

10.9 SME/STARTUP EVALUATION QUADRANT

10.9.1 PROGRESSIVE COMPANIES

10.9.2 RESPONSIVE COMPANIES

10.9.3 DYNAMIC COMPANIES

10.9.4 STARTING BLOCKS

10.10 COMPETITIVE SCENARIO AND TRENDS

10.10.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

10.10.2 DEALS

11 COMPANY PROFILES

*Note – details on business overview, company financial snapshot (public listed companies only), solutions and services offered, recent developments, and other key insights will be covered.

Also, based on the market segmentations a list of vendors will be shortlisted tentatively for the profiling section and finalized based on further assessment.

11.1 KEY PLAYERS*

11.1.1 CARTESIAN INC

11.1.2 MICROSOFT

11.1.3 VERIMETRIX

11.1.4 LOOKOUT

11.1.5 TREND MICRO INC

11.1.6 FORCEPOINT

11.1.7 CHECK POINT SOFTWARE TECHNOLOGIES

11.1.8 BARRACUDA NETWORKS

11.1.9 SYNOPSYS

11.1.10 PROOFPOINT

11.1.11 COMMSCOPE

11.1.12 INFOSEC INFORMATION TECHNOLOGIES

11.1.13 OTHERS

11.2 OTHER PLAYERS

12 ADJACENT MARKETS

12.1 INTRODUCTION TO ADJACENT MARKETS

12.2 LIMITATIONS

12.3 CONTENT SECURITY : ADJACENT MARKETS

12.4 ADJACENT MARKET 1

12.5 ADJACENT MARKET 2

13 APPENDIX

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

[Note -This is a tentative table of content. The scope of the study is subject to be modified/changed during the course of the study]

Growth opportunities and latent adjacency in Content Security Market