Consumer IoT Market by Offerings (Node Components, Network Infrastructure, Solutions, snd Services), End-Use Application (Wearable Devices, Consumer Electronics, Healthcare, Home Automation, Automotive), and Geography - Global Forecast to 2025-2035

Consumer IoT Market Forecast 2025 to 2035

The global consumer Internet of Things market is witnessing unprecedented growth as connected devices and smart technologies increasingly become integral parts of daily life. Consumer IoT refers to a network of interconnected devices designed for personal and household use that collect, share, and analyze data to enhance user convenience, efficiency, and comfort. These devices include wearable gadgets, smart home systems, connected appliances, and in-vehicle technologies that are revolutionizing the way consumers interact with their environment. The period between 2025 and 2035 is expected to mark a significant transformation in this market as rapid advancements in communication technologies, artificial intelligence, and data analytics drive the expansion of IoT ecosystems across the globe.

The consumer IoT market is being propelled by the growing adoption of smart home solutions, the rising popularity of wearable devices, and the increasing need for real time monitoring in healthcare and automotive applications. With the integration of sensors, wireless networks, and cloud platforms, consumers now have the ability to control and automate a wide range of activities, from adjusting home temperatures to tracking health metrics or remotely managing vehicles. The growing penetration of the internet, expanding smartphone usage, and declining costs of IoT components have collectively accelerated market growth. Furthermore, government initiatives promoting digitalization and smart living are supporting the large scale adoption of consumer IoT technologies across developed and emerging economies.

Market Overview and Key Growth Drivers

The rapid expansion of connected devices and the widespread availability of high speed networks such as 5G have become central to the evolution of the consumer IoT market. As connectivity improves, consumers are increasingly adopting smart devices that communicate seamlessly through wireless protocols including Wi Fi, Bluetooth, Zigbee, and cellular networks. The convergence of IoT with artificial intelligence and cloud computing is enabling devices to learn user preferences, make autonomous decisions, and deliver personalized experiences. This trend is redefining consumer lifestyles by providing convenience, efficiency, and enhanced control over personal environments.

One of the primary factors driving market growth is the increasing focus on smart homes. Consumers are adopting connected devices such as smart speakers, thermostats, lighting systems, and security cameras to create energy efficient and automated living spaces. Smart home ecosystems allow users to control appliances remotely through mobile applications or voice commands. The integration of IoT with digital assistants such as Amazon Alexa, Google Assistant, and Apple Siri has made connected home management more intuitive and accessible. Additionally, the growing emphasis on home security and energy efficiency is further boosting demand for IoT enabled devices.

The healthcare industry is also experiencing a significant transformation through the integration of consumer IoT solutions. Wearable devices such as fitness bands, smartwatches, and health monitors allow users to track vital parameters including heart rate, blood pressure, and sleep quality. These devices enable individuals to monitor their well being in real time and share data with healthcare providers for proactive medical interventions. The rise of telemedicine and remote patient monitoring has further fueled the adoption of IoT devices, especially among aging populations and individuals with chronic conditions. Continuous innovation in sensor technology and data analytics is enhancing the accuracy and reliability of health tracking systems, making them indispensable tools for preventive healthcare.

Another major growth factor is the increasing demand for connected vehicles and in-vehicle infotainment systems. Automotive manufacturers are integrating IoT technology to enhance vehicle safety, navigation, and performance monitoring. Connected cars equipped with IoT sensors can communicate with other vehicles and infrastructure to prevent collisions and optimize traffic flow. The integration of IoT also supports predictive maintenance by alerting drivers to potential mechanical issues before they become critical. As electric and autonomous vehicles become more prevalent, IoT will play a crucial role in enabling real time data exchange, improving efficiency, and enhancing the overall driving experience.

By Offerings

The consumer IoT market can be segmented by offerings into node components, network infrastructure, solutions, and services. Each segment plays a critical role in the development and functionality of the IoT ecosystem.

Node components form the foundation of IoT devices and include sensors, microcontrollers, connectivity chips, and actuators. These components collect and transmit data from physical environments, allowing devices to respond intelligently to various inputs. The demand for energy efficient and miniaturized sensors has grown significantly as manufacturers aim to improve device performance while reducing power consumption. Advancements in semiconductor technology are enabling the production of highly integrated chips that combine multiple functions, thus enhancing processing capabilities and connectivity. The ongoing innovation in sensor technologies such as accelerometers, gyroscopes, temperature sensors, and biometric sensors is expanding the scope of IoT applications across consumer electronics and wearable devices.

Network infrastructure represents the communication backbone that connects IoT devices to cloud platforms and other systems. This includes routers, gateways, cellular towers, and wireless communication modules that facilitate seamless data transmission. The proliferation of 5G networks is a major enabler of IoT expansion as it offers high speed, low latency, and reliable connectivity. Edge computing is also emerging as an important component of IoT infrastructure, allowing data to be processed closer to the source, thereby reducing latency and improving real time decision making. The increasing deployment of Wi Fi 6 and low power wide area networks such as LoRaWAN and NB IoT is further enhancing connectivity options for consumer IoT applications.

Solutions within the consumer IoT market encompass software platforms, analytics tools, and integrated systems that enable device management, data visualization, and predictive analysis. These solutions help consumers and service providers make sense of the vast amount of data generated by connected devices. The growing adoption of artificial intelligence and machine learning within IoT platforms allows for intelligent automation and personalized user experiences. For instance, smart home systems can learn occupant habits and automatically adjust lighting, temperature, and energy usage accordingly.

Services in the consumer IoT ecosystem include consulting, integration, maintenance, and managed services that support the deployment and operation of IoT networks. Service providers assist consumers and enterprises in designing customized IoT architectures, ensuring interoperability among devices, and maintaining system security. With the increasing complexity of connected ecosystems, demand for professional IoT services is rising, particularly in areas such as cybersecurity, cloud integration, and data management.

By End Use Application

The consumer IoT market can be categorized by end use application into wearable devices, consumer electronics, healthcare, home automation, and automotive.

Wearable devices are among the most dynamic and fast growing segments in the consumer IoT landscape. These include smartwatches, fitness trackers, smart glasses, and wearable medical sensors. Consumers use these devices to monitor physical activity, manage health conditions, and enhance productivity. The integration of IoT with biometric sensors enables accurate real time tracking of metrics such as steps taken, calories burned, heart rate, and oxygen levels. Wearables are also evolving beyond fitness applications to include functionalities such as mobile payments, notifications, and augmented reality experiences. The ongoing innovation in lightweight materials, flexible displays, and long lasting batteries is further expanding the market potential of wearable IoT devices.

Consumer electronics constitute another major segment, encompassing smart TVs, connected speakers, gaming consoles, and appliances. These devices leverage IoT technology to enhance entertainment experiences, optimize energy consumption, and provide remote access. Smart televisions equipped with voice assistants and streaming capabilities are now common in households worldwide. Similarly, connected kitchen appliances such as smart refrigerators and ovens allow users to monitor and control functions through mobile apps. The increasing integration of IoT into everyday appliances is transforming them into intelligent systems that adapt to user preferences and optimize performance automatically.

Healthcare applications of consumer IoT have gained significant momentum due to the global emphasis on preventive care and digital health monitoring. Smart medical devices, such as connected blood glucose monitors and portable ECG machines, allow patients to collect and share health data with doctors in real time. IoT based health platforms analyze this data to provide personalized insights and early warnings for potential health risks. The trend toward at home diagnostics and telehealth services is driving the proliferation of connected healthcare devices. The ability to remotely monitor patients not only improves healthcare outcomes but also reduces the burden on medical facilities.

Home automation is one of the largest and most established segments of the consumer IoT market. Smart homes are equipped with interconnected systems that manage lighting, climate, security, and entertainment. Consumers can control multiple devices using smartphones or voice commands, creating convenient and energy efficient living spaces. The integration of IoT with artificial intelligence allows these systems to learn user habits and adjust settings automatically. The global focus on sustainability and energy conservation is further promoting the adoption of smart thermostats, automated lighting systems, and energy management solutions. The growing interoperability between devices from different manufacturers is enhancing user experience and driving wider adoption.

The automotive segment is experiencing a rapid transformation as vehicles become increasingly connected and intelligent. Consumer IoT in the automotive industry includes applications such as in-vehicle infotainment, telematics, vehicle tracking, and driver assistance systems. Connected vehicles leverage IoT sensors to monitor engine performance, fuel efficiency, and driving behavior. The integration of IoT also supports over the air software updates, enabling manufacturers to enhance vehicle features without physical intervention. As autonomous driving technologies mature, IoT will play a pivotal role in enabling real time communication between vehicles and infrastructure, enhancing road safety and efficiency.

By Geography

The consumer IoT market is geographically segmented into North America, Europe, Asia Pacific, and the rest of the world. Each region exhibits distinct trends influenced by technological advancement, regulatory frameworks, and consumer preferences.

North America holds a dominant position in the global consumer IoT market due to its advanced digital infrastructure, high disposable income, and early adoption of smart technologies. The United States and Canada are at the forefront of implementing IoT solutions in smart homes, healthcare, and automotive sectors. The presence of leading technology companies, strong research and development activities, and widespread availability of high speed internet contribute to regional growth. The increasing popularity of connected home devices and wearable health monitors is expected to sustain market expansion across North America.

Europe is another significant market driven by growing investments in smart cities, renewable energy integration, and digital transformation initiatives. Countries such as Germany, France, and the United Kingdom are leading adopters of IoT enabled solutions for home automation and healthcare. European consumers are increasingly prioritizing sustainability and data privacy, prompting manufacturers to develop energy efficient and secure IoT devices. The European Union’s regulatory frameworks promoting interoperability and cybersecurity are supporting long term market stability.

The Asia Pacific region is projected to witness the fastest growth during the forecast period. Rapid urbanization, expanding internet connectivity, and a large tech savvy population are driving the adoption of IoT devices across the region. China, Japan, South Korea, and India are key contributors to market expansion. China’s strong manufacturing capabilities and government backed smart city programs are fostering widespread IoT deployment. Japan and South Korea are leaders in robotics and connected technology innovations, while India is emerging as a major consumer market for smart devices due to its expanding middle class and digitalization initiatives.

The rest of the world, including Latin America, the Middle East, and Africa, is gradually adopting consumer IoT technologies. Growing smartphone penetration, improving communication infrastructure, and government efforts to enhance digital inclusion are driving adoption. In particular, smart home solutions and wearable devices are gaining popularity as consumers seek convenience and connected lifestyles.

Future Outlook

The future of the consumer IoT market looks promising as advancements in technology continue to create new possibilities for connectivity and automation. The integration of artificial intelligence, edge computing, and blockchain will further enhance the functionality, security, and scalability of IoT ecosystems. AI powered devices will become more predictive and context aware, delivering highly personalized experiences. Edge computing will enable faster data processing by minimizing latency, making IoT applications more responsive and efficient. Blockchain technology will strengthen data security and transparency, addressing growing concerns about privacy and cyber threats.

The deployment of 5G networks will be a transformative factor for the consumer IoT market between 2025 and 2035. With its ability to handle massive device connectivity and real time communication, 5G will enable new applications in augmented reality, virtual reality, and autonomous systems. The combination of 5G and IoT will power smart cities, connected healthcare systems, and intelligent transportation networks, ultimately shaping a more connected and sustainable world.

Furthermore, as sustainability becomes a global priority, IoT will play a vital role in promoting energy efficiency and resource conservation. Smart grids, connected appliances, and intelligent energy management systems will help reduce carbon footprints and support environmental goals.

Between 2025 and 2035, the consumer IoT market is expected to experience exponential growth as technology becomes more affordable, accessible, and user centric. With continued innovation and collaboration among device manufacturers, network providers, and software developers, the consumer IoT ecosystem will evolve into a seamless, intelligent, and secure network of connected experiences, transforming how people live, work, and interact with technology on a global scale.

Key Market Players

The companies profiled in this report are Qualcomm Incorporated (US), Texas Instruments Incorporated (US), NXP Semiconductors N.V. (Netherlands), Intel Corporation (US), STMicroelectronics N.V. (Switzerland), International Business Machines Corporation (IBM) (US), General Electric (GE) (US), Symantec Corporation (US), TE Connectivity Ltd. (Switzerland), Schneider Electric SE (France), Cisco Systems, Inc. (US), Amazon.com, Inc. (US), Apple Inc. (US), Alphabet Inc. (US), LG Electronics Inc. (South Korea), Samsung Electronics Co., Ltd. (South Korea), Sony Corporation (Japan), Microsoft Corporation (US), AT&T Inc. (US), Honeywell International Inc. (US), and Hewlett Packard Enterprise Company (HPE) (US). Qualcomm is one of the leading players in the wireless connectivity segment.

The company designs, manufactures, and markets digital communication products and services based on code-division multiple access (CDMA), orthogonal frequency-division multiple access (OFDMA), and other technologies. The company has made high investments in R&D and is involved in continuous developments in wireless technologies. For the consumer IoT market, the company is developing new chipsets to meet the growing demand of consumers. Further, Texas Instruments is among the leading global semiconductor companies. The company has wide geographic presence and robust R&D capabilities. Its diversified market presence with global reach prevents its dependence on any particular market and customer. Broad product portfolio, and ability to form strategic collaborations and partnerships make the company one of the major players in the expected IoT boom.

Recent Developments

- In April 2018, TE Connectivity launched connectivity and sensor solutions for the global automobile industry. The sensor solutions enable autonomous driving and mobility.

- In February 2018, Qualcomm Technologies announced IoT development kits based on the QCA4020 and QCA4024 SoCs. The kits are designed for IoT applications such as smart cities, toys, home control and automation, appliances, networking, and home entertainment.

- In January 2018, IBM announced a strategic partnership with Salesforce (US), a global leader in customer relationship management (CRM). The partnership will bring together IBM Cloud and Watson services with Salesforce Quip and Salesforce Service Cloud Einstein to enable the companies to collaborate and connect with their customers more effectively.

Key questions addressed by the report

- How is the adoption of the IoT in consumer applications evolving?

- What are typical use cases and connected devices in the consumer IoT space?

- Which are the driving factors for the consumer IoT market growth?

- How does IoT impact various consumer end-use applications?

- What are the new application areas of IoT that are explored by the companies for consumers?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.4 Years Considered

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.1.1 Key Industry Insights

2.1.2 Secondary Data

2.1.2.1 List of Major Secondary Sources

2.1.2.2 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.3.1 Breakdown of Primaries

2.1.3.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 40)

4.1 Attractive Opportunities in Consumer IoT Market

4.2 Consumer IoT Market in North America, By Country and Offering

4.3 Consumer IoT Market, By Offering

4.4 Consumer IoT Market for Node Component, 2023

4.5 Consumer IoT Market for Network Infrastructure, 2018 vs 2023

4.6 Consumer IoT Market for Software, 2018 vs 2023

4.7 Consumer IoT Market for Platform, 2018

4.8 Consumer IoT Market for Service, By Type

4.9 Consumer IoT Market, By Geography

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Number of Internet Users and Adoption of Smart Devices

5.2.1.2 Increasing Awareness About Fitness and Rise in Disposable Incomes in Developing Economies

5.2.1.3 Consumer Preference for Increased Convenience and Better Lifestyle

5.2.1.4 Increasing Significance of Home Monitoring From Remote Locations

5.2.1.5 Government Regulations for Security of IoT Devices

5.2.2 Restraints

5.2.2.1 Breach in Data Security and Data Privacy

5.2.3 Opportunities

5.2.3.1 Government Funding in Research and Development Related to IoT

5.2.3.2 Favorable Government Regulations to Promote Green Buildings

5.2.4 Challenges

5.2.4.1 Lack of Common Protocols and Communication Standards

5.2.4.2 High Power Consumption By Connected Devices

5.2.4.3 Risks of Device Malfunctioning

5.3 Value Chain Analysis

5.3.1 Value Chain of Consumer IoT

6 Consumer IoT Node Component Market (Page No. - 56)

6.1 Introduction

6.2 Processor

6.2.1 Microcontroller (MUC)

6.2.2 Microprocessor (MPU)

6.2.2.1 Growing Demand for Smart Devices From Home Automation Industry Expected to Drive Market for Processors

6.2.3 Digital Signal Processor (DSP)

6.2.4 Application Processor (AP)

6.3 Sensor

6.3.1 Accelerometers

6.3.2 Inertial Measurement Units (IMUS)

6.3.3 Heart Rate Sensors

6.3.4 Pressure Sensors

6.3.5 Temperature Sensors

6.3.6 Blood Glucose Sensors

6.3.7 Blood Oxygen Sensors

6.3.8 Electrocardiogram (ECG) Sensors

6.3.9 Humidity Sensors

6.3.10 Image Sensors

6.3.11 Ambient Light Sensors

6.3.12 Carbon Monoxide Sensors

6.3.13 Motion and Position Sensors

6.3.13.1 Declining Price is the Key Driver for the Growth of Motion and Position Sensors

6.3.14 Camera Modules

6.4 Connectivity IC

6.4.1 Wired

6.4.1.1 Ethernet/IP

6.4.2 Wireless

6.4.2.1 ANT+

6.4.2.2 Bluetooth

6.4.2.3 Bluetooth Smart/Bluetooth Low Energy (BLE)

6.4.2.4 Zigbee

6.4.2.5 Wireless Fidelity (Wi-Fi)

6.4.2.5.1 Increased Demand for Wireless Sensor Networks for Creating Smart Infrastructure Driving Demand for Wireless Connectivity ICs

6.4.2.6 Near Field Communication (NFC)

6.4.2.7 Cellular Network

6.4.2.8 Global Positioning System (GPS)/Global Navigation Satellite System (GNSS) Module

6.4.2.9 Bluetooth/Wireless Local Area Network (WLAN)

6.5 Memory Device

6.5.1 Flash

6.5.1.1 Demand for Memory Devices to Increase With Growing Adoption of Smart Devices By Consumers

6.5.2 Dram

6.5.2.1 Demand for Dram is Majorly From Servers, Pcs, and Mobile Devices

6.6 Logic Device

6.6.1 Field-Programmable Gate Array (FPGA)

6.6.1.1 Smart Watches to Drive Consumer IoT Market for Logic Devices

7 Consumer IoT Network Infrastructure Market (Page No. - 76)

7.1 Introduction

7.2 Server

7.2.1 Tower Server

7.2.1.1 Demand for Efficient and Less Power-Consuming Servers is Increasing in Consumer IoT Market

7.2.2 Rack Server

7.2.2.1 Rack Server are Expandable and are Used for Small-Level Applications

7.2.3 Blade Server

7.2.3.1 Blade Servers Use Less Space and Energy Than Other Server Types

7.2.4 Density-Optimized Server

7.2.4.1 Density-Optimized Servers are Used for High-Performance Cloud Computing Applications

7.3 Storage

7.3.1 Need for High-Capacity and High-Speed Storage in Response to Increasing Data Generation By IoT-Enabled Devices

7.4 Ethernet Switch and Routing

7.4.1 Need for Secure Access Driving Demand for Ethernet Switches

7.5 Gateway

7.5.1 Intelligent Gateway Solutions Facilitating Creation and Deployment of New Applications and Services Expected to Witness High Growth

8 Consumer IoT Solution Market (Page No. - 81)

8.1 Introduction

8.2 Software

8.2.1 Real-Time Streaming Analytics

8.2.1.1 Real-Time Streaming Analytics Software Enable Organizations to Analyze the Data Generated in Different Formats in Real Time

8.2.2 Security Solution

8.2.2.1 Security Solution are Provided to Secure the Network of Connected Devices Such as Sensors, Computers, Cameras, and Alarming Devices

8.2.3 Data Management

8.2.3.1 Data Management Solutions Help to Manage Structured and Unstructured Data to Generate Insights From Huge Data Volumes

8.2.4 Remote Monitoring

8.2.4.1 Remote Monitoring Enables Users to Manage Operations of Devices From Remote Locations

8.2.5 Network Bandwidth Management

8.2.5.1 Network Bandwidth Management Controls and Monitors Bandwidth Utilization

8.3 Platform

8.3.1 Device Management

8.3.1.1 Device Management Assists in Device Content and Configuration Management as Well as in Policy and Compliance Management

8.3.2 Application Management

8.3.2.1 Application Management Platform Focuses on Managing Firmware and Software Updates in Devices and Applications

8.3.3 Network Management

8.3.3.1 Network Management Platform Helps in Analyzing the Data Transferred Over A Network and Automatically Routes It to Avoid Network Congestion

9 Consumer IoT Service Market (Page No. - 90)

9.1 Introduction

9.2 Professional Services

9.2.1 Deployment and Integration Service

9.2.1.1 Deployment and Integration Service Help Organizations Develop A Connected Environment By Integrating IoT Devices and Solutions With Their Existing It Infrastructure

9.2.2 Support and Maintenance

9.2.2.1 Complexity of Operations and Growing Deployment of IoT Solutions Expected to Drive Demand for Support and Maintenance Services

9.2.3 Consulting Services

9.2.3.1 Need of Assistance for Identifying Correct Solutions for Consumer IoT Market Expected to Drive Demand for Consulting Services

9.3 Managed Services

9.3.1 Companies Mainly Outsource Managed Services to Offer On-Time Delivery to Customers

10 Consumer IoT Market, By End-Use Application (Page No. - 95)

10.1 Introduction

10.2 Wearable Devices

10.2.1 Activity Monitors

10.2.2 Smart Watches

10.2.3 Smart Glasses

10.2.4 Body-Worn Cameras

10.3 Consumer Electronics

10.3.1 Smart Light

10.3.2 Smart TV

10.3.3 Smart Washing Machine

10.3.4 Smart Dryer

10.3.5 Smart Refrigerator

10.3.6 Smart Oven

10.3.7 Smart Cooktop

10.3.8 Smart Cooker

10.3.9 Smart Deep Freezer

10.3.10 Smart Dishwasher

10.3.11 Smart Coffee Maker

10.3.12 Smart Kettle

10.4 Healthcare

10.4.1 Fitness and Heart Rate Monitor

10.4.2 Blood Pressure Monitor

10.4.3 Blood Glucose Meter

10.4.4 Continuous Glucose Monitor

10.4.5 Pulse Oximeter

10.4.6 Automated External Defibrillator

10.4.7 Programmable Syringe Pump

10.4.8 Wearable Injector

10.4.9 Multi-Parameter Monitor

10.4.10 Fall Detector

10.4.11 Smart Pill Dispenser

10.5 Home Automation

10.5.1 Occupancy Sensors

10.5.2 Daylight Sensors

10.5.3 Smart Thermostats

10.5.4 IP Cameras

10.5.5 Smart Meters

10.5.6 Smart Locks

10.5.7 Smoke Detectors

10.6 Automotive

10.6.1 Connected Cars

10.6.1.1 Level-1 Automation – Driver Assistance

10.6.1.1.1 Adaptive Cruise Control (ACC)

10.6.1.1.2 Lane Departure Warning System (LDWS)

10.6.1.1.3 Parking Assist (Pa) System

10.6.1.2 Level-2 Automation – Partial Automation

10.6.1.2.1 Lane Keep Assist (LKA) and Improved ACC

10.6.1.2.2 Improved Pa Systems

10.6.1.3 Level-3 Automation – Conditional Automation

10.6.1.3.1 Traffic Jam Chauffeur

10.6.1.3.2 Highway Driving

10.6.1.4 Level-4 Automation – High Automation

10.6.1.4.1 Sensor Fusion

10.6.1.4.2 Automatic Pilot Highway

10.6.1.5 Ultrasonic Sensors

10.6.1.6 Cameras/Image Sensors

10.6.1.7 Radar

10.6.1.8 Lidar

10.6.1.9 Infrared (IR) Detector

10.6.2 In-Car Infotainment

10.6.3 Traffic Management

10.6.3.1 Vehicle Detection Sensor

10.6.3.2 Pedestrian Presence Sensor

10.6.3.3 Speed Sensor

10.6.3.4 Thermal Camera

10.6.3.5 Automated Incident Detection (AID)Camera

11 Geographic Analysis (Page No. - 123)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 US Accounted for the Largest Size of Consumer IoT Market in North America

11.2.2 Canada

11.2.2.1 Potential of IoT to Bring New Capabilities to Canadian Households Will Encourage Consumer Spending on Connected Devices

11.2.3 Mexico

11.2.3.1 Mexico Expected to Witness Highest Growth Rate in North American Consumer IoT Market During Forecast Period

11.3 Europe

11.3.1 UK

11.3.1.1 Significant Government Investments Toward Increasing Efficiency of Healthcare System Expected to Drive Growth of Market Growth in Uk

11.3.2 Germany

11.3.2.1 Network Infrastructure Expected to Hold Largest Size of Consumer IoT Market in Germany

11.3.3 France

11.3.3.1 France Holds Huge Potential for Growth of Home Automation Industry During Forecast Period

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 China Expected to Be Major Shareholder of Consumer IoT Market in APAC During Forecast Period

11.4.2 Japan

11.4.2.1 Huge Business Opportunities for IoT Vendors in Sectors Such as Telemetering, Transportation Management, Surveillance, and Data Backup That Create New Areas of Growth

11.4.3 South Korea

11.4.3.1 Huge Investments By Government in IoT Expected to Promote Adoption of Smart Devices in South Korea

11.4.4 India

11.4.4.1 Large-Scale Residential Development and Increasing Mobile and Internet Penetration Expected to Drive Growth of Indian Market

11.4.5 Rest of APAC

11.5 Rest of the World

11.5.1 Middle East and Africa

11.5.1.1 Automotive Industry to Witness Significant Adoption of IoT-Enabled Devices in Middle East and Africa

11.5.2 South America

11.5.2.1 Rising Penetration of Smartphones and Other Handheld Devices Expected to Drive Growth of Consumer IoT Market in South America

12 Competitive Landscape (Page No. - 146)

12.1 Overview

12.2 Market Ranking Analysis, 2017

12.3 Competitive Situations and Trends

12.3.1 Product Launches and Developments

12.3.2 Partnerships, Collaborations, Alliances, Strategic Agreements, and Joint Ventures

12.3.3 Acquisitions

12.3.4 Others

13 Company Profiles (Page No. - 154)

13.1 Key Players

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1.1 Qualcomm

13.1.2 Texas Instruments

13.1.3 NXP Semiconductors

13.1.4 Intel

13.1.5 Stmicroelectronics

13.1.6 International Business Machines (IBM)

13.1.7 General Electric

13.1.8 Symantec

13.1.9 TE Connectivity

13.1.10 Schneider Electric

13.1.11 Cisco Systems

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13.2 Other Key Players

13.2.1 Amazon

13.2.2 Apple

13.2.3 Alphabet

13.2.4 LG Electronics

13.2.5 Samsung Electronics

13.2.6 Sony

13.2.7 Microsoft

13.2.8 AT&T

13.2.9 Honeywell

13.2.10 Hewlett Packard Enterprise (HPE)

14 Appendix (Page No. - 202)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (66 Tables)

Table 1 Consumer IoT Market, By Offering, 2015–2023 (USD Billion)

Table 2 Consumer IoT Market for Node Component, By Component Type, 2015–2023 (Million Units)

Table 3 Consumer IoT Market for Node Component, By Component Type, 2015–2023 (USD Billion)

Table 4 Consumer IoT Node Component Market for Processor, By Type, 2015–2023 (Million Units)

Table 5 Consumer IoT Node Component Market for Processor, By End-Use Application, 2015–2023 (Million Units)

Table 6 Consumer IoT Node Component Market for Sensor, By Type, 2015–2023 (Million Units)

Table 7 Consumer IoT Node Component Market for Sensor, By End-Use Application, 2015–2023 (Million Units)

Table 8 Consumer IoT Node Component Market for Connectivity IC, By Technology, 2015–2023 (Million Units)

Table 9 Connectivity IC Market for Wired Technology, By Type, 2015–2023 (Million Units)

Table 10 Connectivity IC Market for Wireless Technology, By Type, 2015–2023 (Million Units)

Table 11 Consumer IoT Node Component Market for Connectivity IC, By End-Use Application, 2015–2023 (Million Units)

Table 12 Consumer IoT Node Component Market for Memory, By Type, 2015–2023 (Million Units)

Table 13 Consumer IoT Node Component Market for Memory, By End-Use Application, 2015–2023 (Million Units)

Table 14 Consumer IoT Node Component Market for Logic Device, By Type, 2015–2023 (Million Units)

Table 15 Consumer IoT Node Component Market for Logic Device, By End-Use Application, 2015–2023 (Million Units)

Table 16 Consumer IoT Market for Network Infrastructure, By Type, 2015–2023 (USD Billion)

Table 17 Consumer IoT Hardware Market, 2015–2023 (USD Billion)

Table 18 Consumer IoT Market for Network Infrastructure, By Region, 2015–2023 (USD Billion)

Table 19 Consumer IoT Solution Market, 2015–2023 (USD Billion)

Table 20 Consumer IoT Market for Software, By Type, 2015–2023 (USD Billion)

Table 21 Consumer IoT Market for Software, By Region, 2015–2023 (USD Billion)

Table 22 Consumer IoT Market for Platform, By Type, 2015–2023 (USD Billion)

Table 23 Consumer IoT Market for Platform, By Geography, 2015–2023 (USD Billion)

Table 24 Consumer IoT Service Market, By Type, 2015–2023 (USD Billion)

Table 25 Consumer IoT Service Market, By Region, 2015–2023 (USD Billion)

Table 26 Consumer IoT Market, By End-Use Application, 2015–2023 (USD Billion)

Table 27 Consumer IoT Node Component Market, By End-Use Application, 2015–2023 (Million Units)

Table 28 Consumer IoT Node Component Market, By End-Use Application, 2015–2023 (USD Billion)

Table 29 Consumer IoT Network Infrastructure Market, By End-Use Application, 2015–2023 (USD Billion)

Table 30 Consumer IoT Software Market, By End-Use Application, 2015–2023 (USD Billion)

Table 31 Consumer IoT Platform Market, By End-Use Application, 2015–2023 (USD Billion)

Table 32 Consumer IoT Service Market, By End-Use Application, 2015–2023 (USD Billion)

Table 33 Consumer IoT Node Component Market for Wearable Device, By Device Type, 2015–2023 (Million Units)

Table 34 Consumer IoT Node Component Market for Wearable Device, By Component Type, 2015–2023 (USD Million)

Table 35 Consumer IoT Node Component Market for Consumer Electronics, By Device Type, 2015–2023 (Million Units)

Table 36 Consumer IoT Node Component Market for Consumer Electronics, By Component Type, 2015–2023 (USD Million)

Table 37 Consumer IoT Node Component Market for Healthcare, By Device Type, 2015–2023 (Million Units)

Table 38 Consumer Node Component IoT for Healthcare, By Component Type, 2015–2023 (USD Million)

Table 39 Consumer IoT Node Component Market for Home Automation, By Device Type, 2015–2023 (Million Units)

Table 40 Consumer IoT Node Component Market for Home Automation, By Component Type, 2015–2023 (USD Million)

Table 41 Consumer IoT Node Component Market for Automotive, By Application Type, 2015–2023 (Million Units)

Table 42 Consumer IoT Node Component Market for Automotive, By Component Type, 2015–2023 (USD Million)

Table 43 Consumer IoT Market, By Region, 2015–2023 (USD Billion)

Table 44 Consumer IoT Market in North America, By Country, 2015–2023 (USD Billion)

Table 45 Consumer IoT Market in Us, By Offering, 2015–2023 (USD Billion)

Table 46 Consumer IoT Market in Canada, By Offering, 2015–2023 (USD Billion)

Table 47 Consumer IoT Market in Mexico, By Offering, 2015–2023 (USD Billion)

Table 48 Consumer IoT Market in Europe, By Country, 2015–2023 (USD Billion)

Table 49 Consumer IoT Market in Uk, By Offering, 2015–2023 (USD Billion)

Table 50 Consumer IoT Market in Germany, By Offering, 2015–2023 (USD Billion)

Table 51 Consumer IoT Market in France, By Offering, 2015–2023 (USD Billion)

Table 52 Consumer IoT Market in Rest of Europe, By Offering, 2015–2023 (USD Billion)

Table 53 Consumer IoT Market in APAC, By Country, 2015–2023 (USD Billion)

Table 54 Consumer IoT Market in China, By Offering, 2015–2023 (USD Billion)

Table 55 Consumer IoT Market in Japan, By Offering, 2015–2023 (USD Billion)

Table 56 Consumer IoT Market in South Korea, By Offering, 2015–2023 (USD Billion)

Table 57 Consumer IoT Market in India, By Offering, 2015–2023 (USD Billion)

Table 58 Consumer IoT Market in Rest of APAC, By Offering, 2015–2023 (USD Billion)

Table 59 Consumer IoT Market in RoW, By Region, 2015–2023 (USD Billion)

Table 60 Consumer IoT Market in Middle East and Africa, By Offering, 2015–2023 (USD Billion)

Table 61 Consumer IoT Market in South America, By Offering, 2015–2023 (USD Billion)

Table 62 Ranking of Key Players in Consumer IoT Market, 2017

Table 63 Product Launches and Developments (2017–2018)

Table 64 Partnerships, Collaborations, Alliances, Strategic Agreements, and Joint Ventures (2017–2018)

Table 65 Acquisitions (2017–2018)

Table 66 Others (2018)

List of Figures (63 Figures)

Figure 1 Consumer IoT Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown and Data Triangulation

Figure 5 Assumptions for Research Study

Figure 6 Service to Hold Major Share of Consumer IoT Market Based on Offering By 2023

Figure 7 Connectivity IC to Hold Largest Share of Consumer IoT Node Component Market, in Terms of Value, By 2018

Figure 8 Storage Expected to Hold Largest Share of Consumer IoT Network Infrastructure Market By 2023

Figure 9 Data Management to Dominate Consumer IoT Market for Software By 2018

Figure 10 Consumer IoT Platform Market for Device Management to Grow at Highest CAGR During Forecast Period

Figure 11 Professional Services to Hold Largest Share of Consumer IoT Service Market By 2018

Figure 12 Home Automation to Hold Largest Share of Consumer IoT Market By 2023

Figure 13 North America to Hold the Largest Share of Consumer IoT Market By 2018

Figure 14 Growing Preference Among Consumers for Increased Convenience and Better Lifestyle

Figure 15 Network Infrastructure to Hold Largest Share of Consumer IoT Market, in Terms of Value, By 2018

Figure 16 Service to Hold Largest Share of Consumer IoT Market By 2023

Figure 17 Memory to Hold Largest Share of Consumer IoT Market for Node Component, in Terms of Value, By 2023

Figure 18 Storage to Hold Largest Size of Consumer IoT Market for Network Infrastructure By 2023

Figure 19 Consumer IoT Software Market for Security Solution to Grow at Highest CAGR During Forecast Period

Figure 20 Device Management to Hold Largest Share of Consumer IoT Platform Market By 2018

Figure 21 Consumer IoT Market for Managed Services to Grow at Highest CAGR During Forecast Period

Figure 22 Consumer IoT Market in India to Grow at Highest CAGR During Forecast Period

Figure 23 Growing Adoption of Smart Devices and Consumer Preference for Increased Convenience and Better Lifestyle are Major Driving Factors for Consumer IoT Market

Figure 24 Internet Users Till December 31, 2017, By Region

Figure 25 GDP Per Capita in India and China

Figure 26 Value Chain: Consumer IoT

Figure 27 Logic Device to Exhibit Highest CAGR in Consumer IoT Market for Node Component, in Terms of Volume, During Forecast Period

Figure 28 Home Automation to Hold Largest Share of Consumer IoT Node Component Market for Processor, in Terms of Volume By 2023

Figure 29 Home Automation Held Largest Share of Consumer IoT Node Component Market for Sensor in 2017

Figure 30 Wireless Technology to Account for Larger Shipment in Consumer IoT Node Market for Connectivity ICs During Forecast Period

Figure 31 NFC to Exhibit Highest CAGR in Connectivity IC Market for Wireless Technology During Forecast Period

Figure 32 Wearable Devices to Exhibit Highest CAGR in Consumer IoT Node Component Market for Connectivity IC During Forecast Period

Figure 33 Storage to Hold Largest Share of Consumer IoT Market for Network Infrastructure By 2023

Figure 34 Network Infrastructure to Hold Larger Size of Consumer IoT Hardware Market During Forecast Period

Figure 35 Real-Time Streaming Analytics to Hold Largest Share of Consumer IoT Market for Software, in Terms of Value By 2023

Figure 36 Device Management to Hold Largest Size of Consumer IoT Market for Platform During Forecast Period

Figure 37 Professional Services to Hold Largest Share of Consumer IoT Service Market During Forecast Period

Figure 38 Consumer IoT Market, By End-Use Application

Figure 39 Consumer IoT Market for Home Automation to Grow at Highest CAGR During Forecast Period

Figure 40 Home Automation to Hold Largest Shipment Share of Consumer IoT Node Component Market By 2023

Figure 41 Wearable Devices – Key Applications

Figure 42 Smart Watch to Hold Largest Share of Consumer IoT Node Component Market for Wearable Device By 2023

Figure 43 Smart TV is to Hold Largest Share of Consumer IoT Node Component Market for Consumer Electronics, in Terms of Volume By 2023

Figure 44 Connectivity IC to Hold Largest Size of Consumer IoT Node Component Market for Healthcare By 2023

Figure 45 Smart Locks to Witness Highest CAGR in Consumer IoT Node Component Market for Home Automation, in Terms of Volume, During Forecast Period

Figure 46 In-Car Infotainment to Hold Largest Share of Consumer IoT Node Component Market for Automotive, in Terms of Volume, By 2023

Figure 47 Consumer IoT Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 48 North America: Consumer IoT Market Snapshot

Figure 49 Europe: Consumer IoT Market Snapshot

Figure 50 APAC: Consumer IoT Market Snapshot

Figure 51 Vendors in Consumer IoT Market Adopted Product Launches and Developments as Key Growth Strategies During 2016–2018

Figure 52 Product Launches and Developments as Key Strategies Adopted By Players From 2016 to 2018

Figure 53 Qualcomm: Company Snapshot

Figure 54 Texas Instruments: Company Snapshot

Figure 55 NXP Semiconductors: Company Snapshot

Figure 56 Intel: Company Snapshot

Figure 57 Stmicroelectronics: Company Snapshot

Figure 58 IBM: Company Snapshot

Figure 59 General Electric: Company Snapshot

Figure 60 Symantec: Company Snapshot

Figure 61 TE Connectivity: Company Snapshot

Figure 62 Schneider Electric: Company Snapshot

Figure 63 Cisco Systems: Company Snapshot

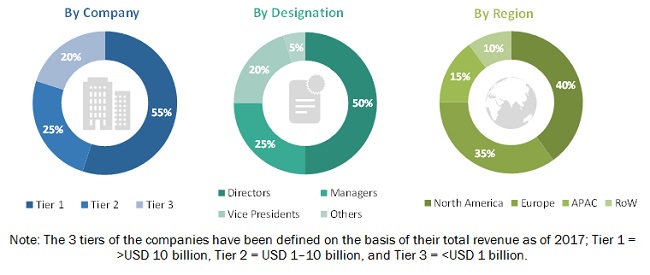

This research study involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical and commercial study of the consumer IoT market. In-depth interviews have been conducted with various primary respondents, which include experts from core and related industries along with the preferred suppliers, manufacturers, distributors, service providers, technology developers, key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify critical, qualitative, and quantitative information, as well as to assess prospects.

Secondary Research

Secondary sources referred for this research study includes corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT-related journals; certified publications; articles from recognized authors; directories; and databases. The secondary data have been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the consumer IoT market scenario through secondary research. Several primary interviews have been conducted with market experts from both demand and supply sides across 4 major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). These primary data have been collected through questionnaires, emails, and telephonic interviews.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the consumer IoT market and other dependent submarkets in the overall market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through the secondary research, and their market shares in respective regions have been determined through primary and secondary research.

- The entire research methodology includes the study of annual and financial reports of top players as well as interviews with industry experts (CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative).

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through the primary research, and analyzed to get the final quantitative and qualitative data. These data have been consolidated and added with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the market breakdown and data triangulation procedure have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the overall consumer Internet of Things (IoT) market on the basis of offering, end-use application, and geography

- To describe and forecast the consumer IoT market, in terms of value, segmented on the basis of offering into node component, network infrastructure, solution (software and platform), and service

- To forecast the market size, in terms of value, for various segments with respect to 4 main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To forecast the consumer IoT market for node component, in terms of volume

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze market rankings and core competencies

- To provide detailed information regarding market drivers, restraints, opportunities, and challenges, the major factors influencing the growth of the market

- To analyze the growth strategies, such as joint ventures, mergers and acquisitions, product launches and developments, and research and development, adopted by the major players in the consumer IoT market

- To map the competitive intelligence based on the company profiles, key player strategies, and game-changing developments, such as product developments, collaborations, and acquisitions

Scope of the Report

|

|

|

|

Years considered to provide market size |

2015–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value—USD and Volume—Units |

|

Segments covered |

Offering (node components, network infrastructure, solutions, and services), end-use application, and geography |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Qualcomm Incorporated (US), Texas Instruments Incorporated (US), NXP Semiconductors N.V. (Netherlands), Intel Corporation (US), STMicroelectronics N.V. (Switzerland), International Business Machines Corporation (IBM) (US), General Electric (GE) (US), Symantec Corporation (US), TE Connectivity Ltd. (Switzerland), Schneider Electric SE (France), Cisco Systems, Inc. (US), Amazon.com, Inc. (US), Apple Inc. (US), Alphabet Inc. (US), LG Electronics Inc. (South Korea), Samsung Electronics Co., Ltd. (South Korea), Sony Corporation (Japan), Microsoft Corporation (US), AT&T Inc. (US), Honeywell International Inc. (US), and Hewlett Packard Enterprise Company (HPE) (US). |

The consumer IoT market has been segmented on the basis of offering [node component, network infrastructure, solution (software and platform), and service], end-use application, and geography.

The consumer IoT market for node components has been further segmented as follows:

- Processor

- Microcontroller (MCU)

- Microprocessor (MPU)

- Digital Signal Processor (DSP)

- Application Processor (AP)

-

Sensor

- Accelerometers

- Inertial Measurement Units (IMUs)

- Heart Rate Sensors

- Pressure Sensors

- Temperature Sensors

- Blood Glucose Sensors

- Blood Oxygen Sensors

- Electrocardiogram (ECG) Sensors

- Humidity Sensors

- Image Sensors

- Ambient Light Sensors

- Carbon Monoxide Sensors

- Motion and Position Sensor

- Camera Modules

- Connectivity IC

-

Wired

- Ethernet/IP

-

Wireless

- ANT+

- Bluetooth

- Bluetooth Smart/Bluetooth Low Energy (BLE)

- ZigBee

- Wireless Fidelity (Wi-Fi)

- Near-Field Communication (NFC)

- Cellular Network

- Global Positioning System (GPS)/Global Navigation Satellite System (GNSS) Module

- Bluetooth/Wireless Local Area Network (WLAN)

- Memory Device

- Flash

- Dynamic Random Access Memory (DRAM)

- Logic Device

- Field-Programmable Gate Array (FPGA)

The consumer IoT market for network infrastructure has been further segmented as follows:

-

Server

- Tower Server

- Rack Server

- Blade Server

- Density-Optimized Server

- Storage

- Ethernet Switch and Routing

- Gateway

The consumer IoT market for solutions has been further segmented as follows:

-

Software

- Real-Time Streaming Analytics

- Security Solution

- Data Management

- Remote Monitoring

- Network Bandwidth Management

-

By Platform

- Device Management

- Application Management

- Network Management

The consumer IoT market for services has been further segmented as follows:

- Managed Services

- Professional Services

On the basis of end-use application, the consumer IoT market has been segmented as follows:

-

Wearable Devices

- Activity Monitors

- Smartwatches

- Smart Glasses

- Body-Worn Cameras

-

Consumer Electronics

- Smart Light

- Smart TV

- Smart Washing Machine

- Smart Dryer

- Smart Refrigerator

- Smart Oven

- Smart Cooktop

- Smart Cooker

- Smart Deep Freezer

- Smart Dishwasher

- Smart Coffee Maker

- Smart Kettle

-

Healthcare

- Fitness and Heart Rate Monitor

- Blood Pressure Monitor

- Blood Glucose Meter

- Continuous Glucose Monitor

- Pulse Oximeter

- Automated External Defibrillator

- Programmable Syringe Pump

- Wearable Injector

- Multi-parameter Monitor

- Fall Detector

- Smart Pill Dispenser

-

Home Automation

- Occupancy Sensors

- Daylight Sensors

- Smart Thermostats

- IP Cameras

- Smart Meters

- Smart Locks

- Smoke Detectors

-

Automotive

-

Connected Cars

-

Level 1 Automation – Driver Assistance

- Adaptive Cruise Control (ACC)

- Lane Departure Warning System (LDWS)

- Parking Assist (PA) System

-

Level 2 Automation – Partial Automation

- Lane Keep Assist (LKA) and ACC (Improved)

- Parking Assist (PA) (Improved)

-

Level 3 Automation – Conditional Automation

- Traffic Jam Chauffeur

- Highway Driving

-

Level 4 Automation – High Automation

- Sensor Fusion

- Automatic Pilot Highway

-

Level 1 Automation – Driver Assistance

-

Connected Cars

- Ultrasonic Sensors

- Cameras/Image Sensors

- Radar

- Lidar

- Infrared (IR) detector

- In-Car infotainment

-

Traffic Management

- Vehicle Detection Sensor

- Pedestrian Presence Sensor

- Speed Sensor

- Thermal Camera

- Automated Incident Detection (AID) Camera

On the basis of geography, the consumer IoT market has been segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Middle East and Africa (MEA)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Country-wise breakdown of the regions: North America, Europe, APAC, and RoW

- Subsegmentation of the market based on various end-use applications

- Comprehensive coverage of regulations followed in each region (North America, APAC, Europe, and RoW)

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Consumer IoT Market