Conductive Inks Market by Type ( Silver, Copper, Carbon/Graphene, Carbon Nanotube, Conductive Polymer), Application (Photovoltaics, RFID, PCB, Membrane Switches, Displays, Thermal Heating), Region - Global Forecast to 2025

Updated on : March 21, 2024

Conductive Inks Market

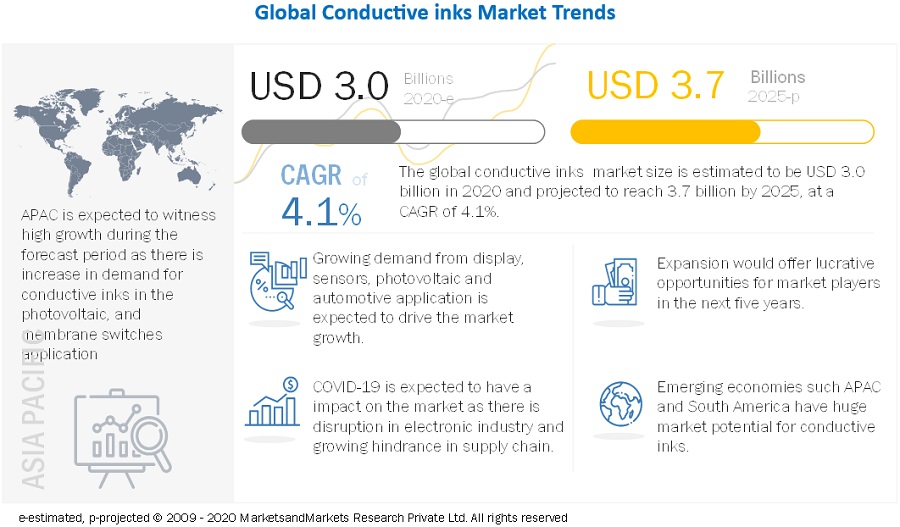

The global conductive inks market was valued at USD 3.0 billion in 2020 and is projected to reach USD 3.7 billion by 2025, growing at 4.1% cagr from 2020 to 2025. The growth of the conductive inks market can be attributed to the increasing usage of conductive inks in the electronic industry lication.

COVID-19 Impact on the Conductive inks Market

The global Conductive inks market includes major Tier I and II suppliers like DowDuPont , Henkel AG & Co. KGaA , Heraeus Holding GmbH, Johnson Matthey, Poly-Ink, Sun Chemical Corporation, NovaCentrix . These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and Middle East & Africa. COVID-19 has impacted their businesses as well.

These players have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in the US, France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for Conductive inks is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from tier 1 manufacturers.

Conductive inks: Market Dynamics:

Driver: Increasing demand for efficiency and miniaturization of devices

Governments worldwide have imposed environmental regulations to encourage industries for reducing the amount of heavy materials used in any device by replacing them with lightweight advanced materials. Along with this factor, the consumer preference for small and lightweight electronics has increased the demand for miniaturization of products in the consumer electronics industry. Lightweight construction is used to improve functional characteristics, reduce material input, and save energy. Conductive inks are efficient, effective, and reliable and are widely used as a replacement for conventional wire and circuit arrangement to enhance efficiency and reduce the weight of electronic components.

The use of conductive inks offers the following properties:

- Reduced material density

- Lower component weight

- Easy handling

Hence, the above-mentioned advantages of using conductive inks to cater to the growing demand for miniaturized and more efficient devices is a major driver for the market.

Restraint: Requirment of high-end technologies

Conductive inks are produced either by incorporating different types of metals such as silver and copper or by using carbon particles. Carbon particles are preferred in many applications as they offer adequate technical properties at a low cost. In comparison to other metals, carbon inks have relatively less and unreliable conductivity. While using carbon particles, direct conductivity can only be achieved through curing, but this is a complicated and expensive process.

The major factor acting as a restraint for the conductive inks market growth is the lack of chemical compatibility with most of the polymers, which is necessary to provide mechanical endurance. In addition, there is a need to develop technologies that can impart long-term stability of conductive inks for commercial purposes. This issue is mainly faced with nanoparticle inks, as the technologies required for its use are expensive. Emerging applications have increased the need for optimizing the use of conductive inks in specialized printing processes.

Despite these shortcomings, the increased focus on innovation and R&D activities is expected to provide cost-efficient and reliable technologies for conductive inks in the future.

Opportunity: Development of cheaper alternatives to silver-based conductive inks

There is a need for more economical alternatives to silver-based conductive inks owing to the rising prices of silver. Graphene-based conductive inks have come up as an alternative. Graphene is a single layer of carbon atoms and is the most conductive form of carbon. It can provide mechanical flexibility and high performance at a low cost and can help in protecting metals from corrosion. Graphene-based conductive inks can be used in complex devices to achieve high conductivity even at intricate levels.

Conductive inks are mainly made by using materials such as silver, copper, and carbon. Silver is highly conductive, but expensive, whereas copper is cheaper, but is more prone to oxidation. On the other hand, graphene is a beneficial alternative for these materials and can deliver the same properties at much cheaper rates. Graphene-based conductive inks can readily compete with silver-based and carbon-based conductive inks in applications such as displays and RFID antennae.

The use of graphene-based conductive inks is still in the development stage and is likely to be commercialized in the future. Various companies are resorting to this alternative to offer effective solutions for both price and performance, thereby, creating an opportunity for conductive inks manufacturers.

Challenges: High cost of silver-based conductive inks

Silver is one of the most widely used metals in the electronics industry because of its high conductivity, oxidation stability, and other unique properties. However, the fluctuations in silver prices have created a shift toward low-cost conductive metals such as copper, carbon, graphene, and aluminum. The increased cost of silver has generated a need to either reduce the use of expensive materials or replace them. However, the properties of the alternatives that are being offered are marginally at par with silver. A complete replacement of silver with alternative materials is impossible.

In order to reduce the effect of rising silver prices, conventional silver conductive inks are being replaced with other inks such as silver flakes and nanosilver-based inks. These inks provide equivalent conductivity; however, the quantity of silver used is relatively lesser than conventional conductive inks. In spite of these advantages, the use of nanosilver inks has not yet gained an impetus. The technology and tools required for their use add to the cost of the inks, which is much higher than that of the traditional silver inks and pastes.

The manufacturers are developing substitutes for silver-based conductive inks as the prices of silver are expected to increase in the future. Although these substitutes have less growth opportunities owing to their inferior properties, they can be improved to meet the requirements in the long run.

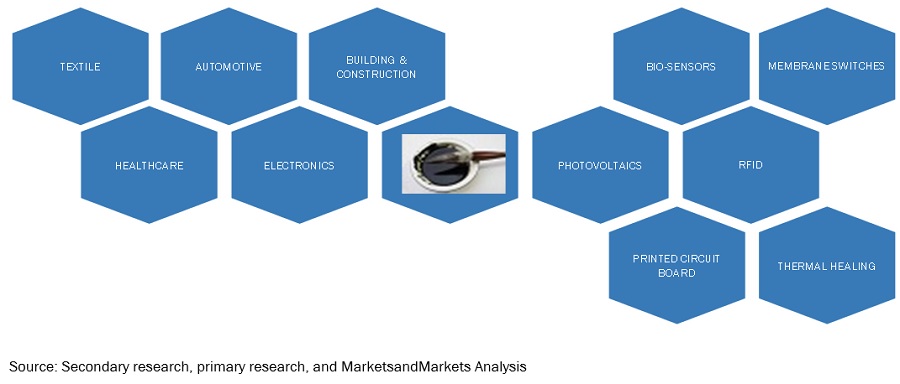

Ecosystem ANALYSIS: Conductive inks Market

Source: Secondary research, primary research, and MarketsandMarkets Analysis

By type silver conductive inks segment is projected to account for the largest share during the forecast period.

The conductive inks market has been classified based on type into silver inks, copper inks, carbon nanotubes inks, carbon/graphene inks, conductive polymer and others. Silver inks are widely used in the photovoltaic application and are hence, the most preferred type. The upcoming trend of integration of different technologies is being driven by the use of silver inks.

By application RFID segment is expected to witness the highest CAGR during the forecast period.

Based on end-use industry, the conductive inks market has been segmented into photovoltaics, membrane switches, displays, automotive, bio-sensors, RFID, PCB, thermal heating and others. RFID application is projected to register the highest CAGR during the forecast period. The use of conductive inks in the printing of RFID chips have several benefits, such as reduction in size and faster and more efficient production, which results in cheaper cost of production. Rising demand for RFID tags is expected to drive the growth of the market.

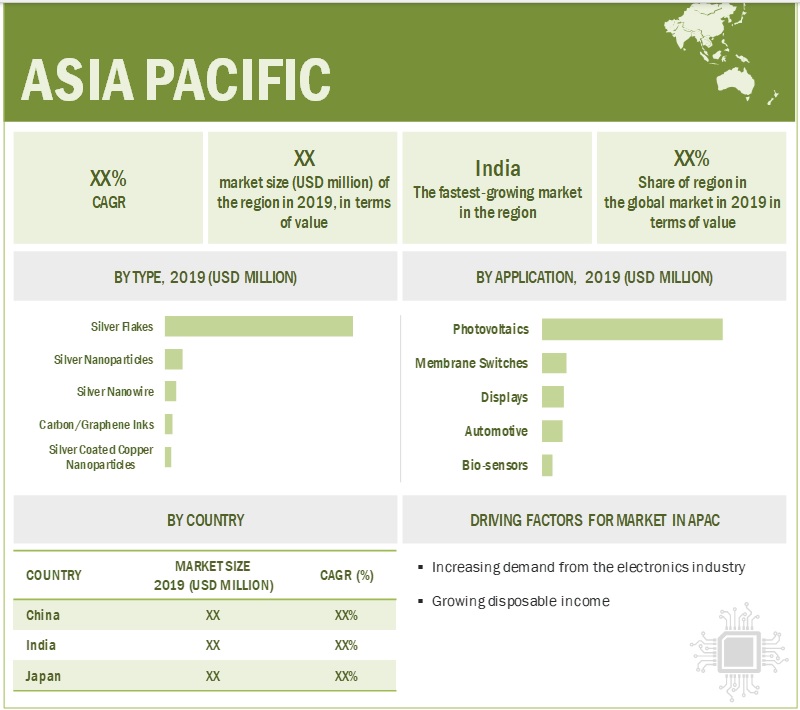

APAC is estimated to account for the largest market share in the Conductive inks market.

APAC is estimated to be the leading conductive inks market. The growth in the APAC region can be attributed to the growing demand for conductive inks due to high economic growth of the emerging economies and the increasing disposable income in the region contribute to APAC being an attractive market for conductive inks manufacturers. Moreover, the tremendous growth of the photovoltaics, PCBs, touchscreen segments and the increasing use of windshield sensors in vehicles are primarily responsible for the high demand for conductive inks in the region.

Key Market Players

Some of the key players operating in the conductive inks market are DowDuPont (US), Henkel AG & Co. KGaA (Germany), Heraeus Holding GmbH (Germany), Johnson Matthey (UK), Poly-Ink (France), Sun Chemical Corporation (US), NovaCentrix (US), Creative Materials Inc. (US), Applied Ink Solutions (US), and Vorbeck Materials (US). Competition among these players is high, and they mostly compete with each other on prices and quality of their products and product customization. The growth of the end-use segments of the conductive inks market is likely to encourage the manufactures to provide better products and technologies to their customers and explore the untapped markets.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) and Volume (ton) |

|

Segments covered |

By Application, By Type, & By Region |

By type

-

- Silver Flakes

- Carbon / Graphene

- Silver Nanoparticles

- Silver Nanowire

- Silver Coated Copper Nanoparticles

- Carbon Nanotube Inks

- Copper Flakes

- Copper Nanoparticles

- Copper Oxide Nanoparticle Inks

- Conductive Polymer

- Others

By Application

-

- Photovoltaics

- Membrane Switches

- Displays

- Automotive

- Bio-sensors

- RFID

- Printed Circuit Boards

- Thermal Heating

- Others

- Pharmaceutical Formulation

- Food & Nutrition

- Others

By Region

-

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Recent Developments

- In November 2018, Omya AG (Switzerland) opened a research center for crop cultivation at Oftringen. The company carries out studies of “systematic analyses of natural conductive inks in agriculture.” Insights gained at the center proved valuable for the development of new products and innovative technologies for agriculture.

- In February 2018, Imerys (Spain) acquired the carbonate business of Vimal Microns (India), a major producer of ground conductive inks for polymer and coatings applications. This acquisition helped the company strengthen its presence in India.

- In July 2018, Minerals Technologies Inc. (US) entered into an agreement with Shouguang Meilun Paper Co., Ltd., a wholly owned subsidiary of Shandong Chenming Paper Holdings Ltd. (China) to build a satellite precipitated conductive inks plant at its paper mill in Shouguang, Shandong Province, China. This new plant has a capacity of 150,000 metric ton per year. This agreement helped the company improve its presence in the Chinese paper market.

Frequently Asked Questions (FAQs):

- Does this report cover volume tables in addition to the value tables?

- Yes, volume tables are provided for each segment except offering.

- Which countries are considered in the European region?

-

The report includes the following Western European countries

- Germany

- France

- Spain

- UK

- Italy

- Netherlands

- Rest of Europe

- Who are the winners in the global Conductive inks market?

- Companies such as Henkel AG & Co. KGaA Heraeus Holding GmbH ,Johnson Matthey, and Poly-Ink,fall under the winners category. These companies cater to the requirements of their customers by providing customized products. Moreover, these companies have multiple supply contracts with global OEMs and have effective supply chain strategies. Such advantages give these companies an edge over other companies that are Conductive inks, product suppliers.

- What is the COVID-19 impact on the Conductive inks market?

- Industry experts believe that COVID-19 will have impact on Conductive inks market as there is dispruption in supply chain and there is decreased in demand for electronic products and automobile in which conductive inks are majorly used.

- What are some of the benefits of Conductive inks?

- Conductive inks can be easily used for 3D printing because of their flexibility. They are also adaptable to inkjet printing or aerosol jet printing

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 CONDUCTIVE INKS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNITS CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 CONDUCTIVE INKS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH

2.3 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4 DATA TRIANGULATION

FIGURE 4 CONDUCTIVE INKS MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 5 SILVER FLAKES SEGMENT TO DOMINATE THE CONDUCTIVE INKS MARKET DURING THE FORECAST PERIOD

FIGURE 6 PHOTOVOLTAICS TO BE THE LARGEST APPLICATION SEGMENT IN THE CONDUCTIVE INKS MARKET DURING THE FORECAST PERIOD

FIGURE 7 APAC WAS THE LARGEST REGIONAL SEGMENT IN THE CONDUCTIVE INKS MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CONDUCTIVE INKS MARKET

FIGURE 8 GROWING RFID APPLICATIONS TO DRIVE THE CONDUCTIVE INKS MARKET BETWEEN 2020 AND 2025

4.2 APAC: CONDUCTIVE INKS MARKET, BY APPLICATION AND COUNTRY IN 2019

FIGURE 9 PHOTOVOLTAIC APPLICATIONS AND CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE CONDUCTIVE INKS MARKET

4.3 CONDUCTIVE INKS MARKET, BY COUNTRY

FIGURE 10 CONDUCTIVE INKS MARKET IN INDIA AND CHINA TO WITNESS HIGH GROWTH

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONDUCTIVE INKS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for efficiency and miniaturization of devices

5.2.1.2 New applications in the electronics industry

5.2.1.2.1 Batteries

5.2.1.2.2 Fuel Cells

5.2.2 RESTRAINTS

5.2.2.1 Requirement of high-end technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Development of cheaper alternatives to silver-based conductive inks

5.2.3.2 Increased investment for R&D in nanomaterials

5.2.4 CHALLENGES

5.2.4.1 High cost of silver-based conductive inks

5.3 INDUSTRY TRENDS

5.3.1 PORTER'S FIVE FORCES ANALYSIS

FIGURE 12 PORTER'S FIVE FORCES ANALYSIS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 BARGAINING POWER OF BUYERS

5.3.6 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 TRENDS AND FORECAST OF GDP BEFORE COVID-19 OUTBREAK

TABLE 1 TRENDS AND FORECAST OF GDP, 2016-2019(USD MILLION)

5.4.2 PHOTOVOLTAICS INDUSTRY

TABLE 2 PHOTOVOLTAICS CUMULATIVE INSTALLED CAPACITY 2019 (MW)

5.4.3 PRODUCTION STATISTICS OF AUTOMOTIVE INDUSTRY 2019

TABLE 3 PRODUCTION STATISTICS OF AUTOMOBILES 2019 (UNITS)

5.4.4 EXPORT STATISTICS OF ELECTRONICS INDUSTRY 2019

TABLE 4 EXPORT STATISTICS OF ELECTRONIC CIRCUIT 2019 (USD BILLION)

5.5 IMPACT OF COVID-19 ON CONDUCTIVE INKS MARKET

5.5.1 DISRUPTION IN APPLICATIONS OF CONDUCTIVE INKS

5.5.2 COVID-19 IMPACT ON CHEMICAL INDUSTRY

6 CONDUCTIVE INKS MARKET, BY TYPE (Page No. - 67)

6.1 INTRODUCTION

FIGURE 13 SILVER FLAKES SEGMENT TO DOMINATE THE CONDUCTIVE INKS MARKET

TABLE 5 CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 6 CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 7 CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 8 CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

6.2 SILVER-BASED CONDUCTIVE INKS

6.2.1 SILVER FLAKES

6.2.1.1 Rising use of silver flakes in photovoltaics application to drive their demand

TABLE 9 SILVER FLAKE: CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 10 SILVER FLAKE: CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 11 SILVER FLAKE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 12 SILVER FLAKE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.2.2 SILVER NANOWIRE

6.2.2.1 Rising use of silver nanowire in touchscreens, photovoltaics, bio-sensors and PCB to drive their demand

TABLE 13 SILVER NANOWIRE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 14 SILVER NANOWIRE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 15 SILVER NANOWIRE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 16 SILVER NANOWIRE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TON)

6.2.3 SILVER NANOPARTICLES

6.2.3.1 Increasing use of flexible electronics to drive the demand for silver nanoparticles

TABLE 17 SILVER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 18 SILVER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 19 SILVER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 20 SILVER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.3 COPPER-BASED CONDUCTIVE INKS

6.3.1 COPPER FLAKES

6.3.1.1 Increasing demand for copper flakes in screen printing applications to drive the demand in APAC

TABLE 21 COPPER FLAKE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 22 COPPER FLAKE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 23 COPPER FLAKE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 24 COPPER FLAKE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.3.2 COPPER NANOPARTICLES

6.3.2.1 Rising demand for RFID application in APAC to drive the demand for copper nanoparticles

TABLE 25 COPPER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 26 COPPER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 27 COPPER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 28 COPPER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.3.3 COPPER OXIDE NANOPARTICLES

6.3.3.1 Increasing use of RFID in smart packaging to drive demand for copper oxide nanoparticles in APAC

TABLE 29 COPPER OXIDE NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 30 COPPER OXIDE NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 31 COPPER OXIDE NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 32 COPPER OXIDE NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.3.4 SILVER-COATED COPPER NANOPARTICLES

6.3.4.1 Reduced oxidation of copper nanoparticles due to silver coating is driving the use of silver-coated copper nanoparticles in various applications in APAC

TABLE 33 SILVER-COATED COPPER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 34 SILVER-COATED COPPER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 35 SILVER-COATED COPPER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 36 SILVER-COATED COPPER NANOPARTICLE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.4 CONDUCTIVE POLYMER INKS

6.4.1 WIDE SCALE USE IN FLEXIBLE DISPLAYS, TOUCHSCREENS, AND LCDS IS BOOSTING THE MARKET

TABLE 37 CONDUCTIVE POLYMER INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 38 CONDUCTIVE POLYMER INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 39 CONDUCTIVE POLYMER INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 40 CONDUCTIVE POLYMER INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.5 CARBON NANOTUBE (CNT) INKS

6.5.1 LOW POWER CONSUMPTION MAKES CARBON NANOTUBE INKS SUITABLE FOR USE IN SENSORS

TABLE 41 CARBON NANOTUBE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION

TABLE 42 CARBON NANOTUBE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 43 CARBON NANOTUBE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 44 CARBON NANOTUBE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.6 CARBON/GRAPHENE INKS

6.6.1 PRINTED ELECTRONICS INDUSTRY IS LIKELY TO DRIVE THIS SEGMENT OF THE CONDUCTIVE INKS MARKET

TABLE 45 CARBON/GRAPHENE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 46 CARBON/GRAPHENE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 47 CARBON/GRAPHENE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 48 CARBON/GRAPHENE CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

6.7 OTHERS

6.7.1 GOLD-BASED INKS

6.7.2 ALUMINUM-BASED INKS

6.7.3 NICKEL-BASED INKS

TABLE 49 OTHER CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 50 OTHER CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 51 OTHER CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 52 OTHER CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

7 CONDUCTIVE INKS MARKET, BY APPLICATION (Page No. - 90)

7.1 INTRODUCTION

FIGURE 14 PHOTOVOLTAICS TO BE THE LARGEST APPLICATION OF CONDUCTIVE INKS DURING THE FORECAST PERIOD

TABLE 53 CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 54 CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 55 CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 56 CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

7.2 PHOTOVOLTAICS (PV)

7.2.1 PHOTOVOLTAICS APPLICATIONS TO DRIVE THE SILVER CONDUCTIVE INKS MARKET

TABLE 57 CONDUCTIVE INKS MARKET SIZE IN PHOTOVOLTAIC APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 58 CONDUCTIVE INKS MARKET SIZE IN PHOTOVOLTAIC APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 59 CONDUCTIVE INKS MARKET SIZE IN PHOTOVOLTAIC APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 60 CONDUCTIVE INKS MARKET SIZE IN PHOTOVOLTAIC APPLICATIONS, BY REGION, 2020-2025 (TONS)

7.3 MEMBRANE SWITCHES

7.3.1 SILVER, COPPER, AND DIELECTRIC CONDUCTIVE INKS ARE WIDELY USED IN MEMBRANE SWITCHES

TABLE 61 CONDUCTIVE INKS MARKET SIZE IN MEMBRANE SWITCH APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 62 CONDUCTIVE INKS MARKET SIZE IN MEMBRANE SWITCH APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 63 CONDUCTIVE INKS MARKET SIZE IN MEMBRANE SWITCH APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 64 CONDUCTIVE INKS MARKET SIZE IN MEMBRANE SWITCH APPLICATIONS, BY REGION, 2020-2025 (TONS)

7.4 DISPLAYS

7.4.1 SILVER NANOWIRE CONDUCTIVE INKS ARE REPLACING INDIUM TIN OXIDE IN FLEXIBLE DISPLAYS

TABLE 65 CONDUCTIVE INKS MARKET SIZE IN DISPLAY APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 66 CONDUCTIVE INKS MARKET SIZE IN DISPLAY APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 67 CONDUCTIVE INKS MARKET SIZE IN DISPLAY APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 68 CONDUCTIVE INKS MARKET SIZE IN DISPLAY APPLICATIONS, BY REGION, 2020-2025 (TONS)

7.5 AUTOMOTIVES

7.5.1 GROWING FOCUS ON LIGHTWEIGHT AUTOMOBILES IS CONTRIBUTING TO

THE CONDUCTIVE INKS MARKET GROWTH IN THE AUTOMOTIVES SEGMENT 99

TABLE 69 CONDUCTIVE INKS MARKET SIZE IN AUTOMOTIVE APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 70 CONDUCTIVE INKS MARKET SIZE IN AUTOMOTIVE APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 71 CONDUCTIVE INKS MARKET SIZE IN AUTOMOTIVE APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 72 CONDUCTIVE INKS MARKET SIZE IN AUTOMOTIVE APPLICATIONS, BY REGION, 2020-2025 (TONS)

7.6 BIO-SENSORS

7.6.1 GROWING USE OF SENSORS IN HEALTHCARE AND CONSUMER ELECTRONICS INDUSTRIES IN MAJOR REGIONS IS DRIVING GROWTH

TABLE 73 CONDUCTIVE INKS MARKET SIZE IN BIO-SENSOR APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 74 CONDUCTIVE INKS MARKET SIZE IN BIO-SENSOR APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 75 CONDUCTIVE INKS MARKET SIZE IN BIO-SENSOR APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 76 CONDUCTIVE INKS MARKET SIZE IN BIO-SENSOR APPLICATIONS, BY REGION, 2020-2025 (TONS)

7.7 RADIO-FREQUENCY IDENTIFICATION (RFID)

7.7.1 SMART PACKAGING FOR CONSUMER GOODS IS DRIVING THE CONDUCTIVE INKS MARKET IN THE RFID APPLICATION SEGMENT

TABLE 77 CONDUCTIVE INKS MARKET SIZE IN RFID APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 78 CONDUCTIVE INKS MARKET SIZE IN RFID APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 79 CONDUCTIVE INKS MARKET SIZE IN RFID APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 80 CONDUCTIVE INKS MARKET SIZE IN RFID APPLICATIONS, BY REGION, 2020-2025 (TONS)

7.8 PRINTED CIRCUIT BOARDS (PCB)

7.8.1 APAC IS ESTIMATED TO DRIVE THE MARKET IN THE PCB APPLICATION SEGMENT

TABLE 81 CONDUCTIVE INKS MARKET SIZE IN PRINTED CIRCUIT BOARD APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 82 CONDUCTIVE INKS MARKET SIZE IN PRINTED CIRCUIT BOARD APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 83 CONDUCTIVE INKS MARKET SIZE IN PRINTED CIRCUIT BOARD APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 84 CONDUCTIVE INKS MARKET SIZE IN PRINTED CIRCUIT BOARD APPLICATIONS, BY REGION, 2020-2025 (TONS)

7.9 THERMAL HEATING

7.9.1 THE USE OF CONDUCTIVE INKS IS INCREASING IN DIFFERENT THERMAL HEATING APPLICATIONS

TABLE 85 CONDUCTIVE INKS MARKET SIZE IN THERMAL HEATING APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 86 CONDUCTIVE INKS MARKET SIZE IN THERMAL HEATING APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 87 CONDUCTIVE INKS MARKET SIZE IN THERMAL HEATING APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 88 CONDUCTIVE INKS MARKET SIZE IN THERMAL HEATING APPLICATIONS, BY REGION, 2020-2025 (TONS)

7.1 OTHERS

TABLE 89 CONDUCTIVE INKS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016-2019 (USD MILLION)

TABLE 90 CONDUCTIVE INKS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2025 (USD MILLION)

TABLE 91 CONDUCTIVE INKS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016-2019 (TONS)

TABLE 92 CONDUCTIVE INKS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020-2025 (TONS)

8 CONDUCTIVE INKS MARKET, BY REGION (Page No. - 109)

8.1 INTRODUCTION

FIGURE 15 REGIONAL SNAPSHOT OF CONDUCTIVE INKS MARKET

TABLE 93 CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 94 CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 95 CONDUCTIVE INKS MARKET SIZE, BY REGION, 2016-2019 (TONS)

TABLE 96 CONDUCTIVE INKS MARKET SIZE, BY REGION, 2020-2025 (TONS)

8.2 ASIA PACIFIC

8.2.1 IMPACT OF COVID-19 ON CONDUCTIVE INKS MARKET IN APAC

FIGURE 16 ASIA PACIFIC: CONDUCTIVE INKS MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 98 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 99 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (TONS)

TABLE 100 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (TONS)

TABLE 101 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 102 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 103 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 104 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 105 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 106 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 107 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 108 ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.2.2 CHINA

8.2.2.1 Governmental policies supporting the use of conductive inks in applications such as RFID, wearable electronics, 3D printing, and photovoltaics are supporting the market growth

TABLE 109 CHINA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 110 CHINA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 111 CHINA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 112 CHINA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 113 CHINA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 114 CHINA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 115 CHINA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 116 CHINA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.2.3 JAPAN

8.2.3.1 Demand for conductive inks in Japan is primarily driven by electronics applications such as displays, photovoltaics, and antennae

TABLE 117 JAPAN: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 118 JAPAN: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 119 JAPAN: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 120 JAPAN: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 121 JAPAN: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 122 JAPAN: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025(USD MILLION)

TABLE 123 JAPAN: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 124 JAPAN: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.2.4 SOUTH KOREA

8.2.4.1 Increasing use of conductive inks in the printed electronics industry is likely to boost the use of conductive inks

TABLE 125 SOUTH KOREA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 126 SOUTH KOREA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 127 SOUTH KOREA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 128 SOUTH KOREA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 129 SOUTH KOREA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 130 SOUTH KOREA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 131 SOUTH KOREA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 132 SOUTH KOREA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.2.5 INDIA

8.2.5.1 Growth of various industries such as electronics, automotive, and consumer goods are likely to drive the demand for conductive inks in the country

TABLE 133 INDIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 134 INDIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 135 INDIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 136 INDIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 137 INDIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 138 INDIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 139 INDIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 140 INDIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.2.6 AUSTRALIA

8.2.6.1 Large number of PV installations is enabling the growth of the conductive inks market in Australia

TABLE 141 AUSTRALIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 142 AUSTRALIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 143 AUSTRALIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 144 AUSTRALIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 145 AUSTRALIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 146 AUSTRALIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 147 AUSTRALIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 148 AUSTRALIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.2.7 THAILAND

8.2.7.1 Significant economic development of Thailand is the main driving factor for the market in the country

TABLE 149 THAILAND: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 150 THAILAND: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 151 THAILAND: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 152 THAILAND: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 153 THAILAND: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 154 THAILAND: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, \2020-2025 (USD MILLION)

TABLE 155 THAILAND: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 156 THAILAND: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.2.8 REST OF ASIA PACIFIC

TABLE 157 REST OF ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 158 REST OF ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 160 REST OF ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 161 REST OF ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 164 REST OF ASIA PACIFIC: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3 EUROPE

8.3.1 IMPACT OF COVID-19 ON CONDUCTIVE INKS MARKET IN EUROPE

FIGURE 17 EUROPE: CONDUCTIVE INKS MARKET SNAPSHOT

TABLE 165 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 166 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 167 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (TONS)

TABLE 168 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (TONS)

TABLE 169 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 170 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 171 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 172 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 173 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 174 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 175 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 176 EUROPE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3.2 GERMANY

8.3.2.1 Rising awareness among consumers about renewable and clean energy sources is driving the demand for conductive inks in the photovoltaics application

TABLE 177 GERMANY: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 178 GERMANY: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 179 GERMANY: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 180 GERMANY: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 181 GERMANY: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 182 GERMANY: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 183 GERMANY: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 184 GERMANY: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3.3 UK

8.3.3.1 The conductive inks market in the UK is expected to grow owing to high demand from the RFID and photovoltaics segments

TABLE 185 UK: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 186 UK: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 187 UK: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 188 UK: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 189 UK: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 190 UK: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 191 UK: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 192 UK: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3.4 FRANCE

8.3.4.1 Diversified economy and improving regulations regarding the solar sector are contributing to the conductive inks market growth

TABLE 193 FRANCE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 194 FRANCE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 195 FRANCE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 196 FRANCE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 197 FRANCE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 198 FRANCE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 199 FRANCE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 200 FRANCE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3.5 SPAIN

8.3.5.1 Government initiatives to promote the use of renewable energy are driving the market

TABLE 201 SPAIN: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 202 SPAIN: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 203 SPAIN: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 204 SPAIN: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 205 SPAIN: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 206 SPAIN: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 207 SPAIN: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 208 SPAIN: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3.6 ITALY

8.3.6.1 A considerable demand for conductive inks is generated from the automotive sector in Italy

TABLE 209 ITALY: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 210 ITALY: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 211 ITALY: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 212 ITALY: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 213 ITALY: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 214 ITALY: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 215 ITALY: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 216 ITALY: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3.7 NETHERLANDS

8.3.7.1 Growing solar energy industry and increasing use of metal nanoparticles are boosting the market

TABLE 217 NETHERLANDS: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 218 NETHERLANDS: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 219 NETHERLANDS: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 220 NETHERLANDS: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 221 NETHERLANDS: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 222 NETHERLANDS: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 223 NETHERLANDS: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 224 NETHERLANDS: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3.8 DENMARK

8.3.8.1 Increasing demand for renewable energy is driving the use of conductive inks in photovoltaics application

TABLE 225 DENMARK: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 226 DENMARK: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 227 DENMARK: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 228 DENMARK: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 229 DENMARK: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 230 DENMARK: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 231 DENMARK: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 232 DENMARK: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.3.9 REST OF EUROPE

TABLE 233 REST OF EUROPE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 234 REST OF EUROPE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 235 REST OF EUROPE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 236 REST OF EUROPE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 237 REST OF EUROPE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 238 REST OF EUROPE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 239 REST OF EUROPE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 240 REST OF EUROPE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.4 NORTH AMERICA

8.4.1 IMPACT OF COVID-19 ON CONDUCTIVE INKS MARKET IN NORTH AMERICA

FIGURE 18 NORTH AMERICA: CONDUCTIVE INKS MARKET SNAPSHOT

TABLE 241 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 242 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 243 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (TONS)

TABLE 244 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (TONS)

TABLE 245 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 246 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 247 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 248 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 249 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 250 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 251 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 252 NORTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.4.2 US

8.4.2.1 Presence of major players is one of the driving factors for the conductive inks market in the country

TABLE 253 US: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 254 US: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 255 US: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 256 US: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 257 US: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 258 US: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 259 US: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 260 US: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.4.3 CANADA

8.4.3.1 Use of conductive inks in the photovoltaics application is expected to drive the market in Canada

TABLE 261 CANADA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 262 CANADA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 263 CANADA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 264 CANADA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 265 CANADA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 266 CANADA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 267 CANADA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 268 CANADA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.4.4 MEXICO

8.4.4.1 Use of new technologies and significant foreign investments are the market drivers in Mexico

TABLE 269 MEXICO: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 270 MEXICO: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 271 MEXICO: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 272 MEXICO: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 273 MEXICO: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 274 MEXICO: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 275 MEXICO: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019(TONS)

TABLE 276 MEXICO: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.5 MIDDLE EAST & AFRICA

8.5.1 IMPACT OF COVID-19 ON CONDUCTIVE INKS MARKET IN MIDDLE EAST & AFRICA

FIGURE 19 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SNAPSHOT

TABLE 277 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 278 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 279 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (TONS)

TABLE 280 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (TONS)

TABLE 281 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 282 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 283 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 284 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 285 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 286 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 287 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 288 MIDDLE EAST & AFRICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.5.2 EGYPT

8.5.2.1 Growth of various applications are likely to boost the market in Egypt

TABLE 289 EGYPT: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 290 EGYPT: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 291 EGYPT: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 292 EGYPT: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 293 EGYPT: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 294 EGYPT: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 295 EGYPT: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 296 EGYPT: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.5.3 ISRAEL

8.5.3.1 With abundant hydrocarbon reserves, Israel is a key conductive inks market

TABLE 297 ISRAEL: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 298 ISRAEL: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 299 ISRAEL: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 300 ISRAEL: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 301 ISRAEL: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 302 ISRAEL: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 303 ISRAEL: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 304 ISRAEL: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.5.4 SAUDI ARABIA

8.5.4.1 The demand for conductive inks in Saudi Arabia is driven by its use in the photovoltaics and RFID applications

TABLE 305 SAUDI ARABIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 306 SAUDI ARABIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 307 SAUDI ARABIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 308 SAUDI ARABIA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 309 SAUDI ARABIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 310 SAUDI ARABIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 311 SAUDI ARABIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION,2016-2019 (TONS)

TABLE 312 SAUDI ARABIA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.5.5 UAE

8.5.5.1 The RFID segment is expected to witness the fastest growth in the UAE conductive inks market

TABLE 313 UAE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 314 UAE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 315 UAE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 316 UAE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 317 UAE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 318 UAE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 319 UAE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 320 UAE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 321 REST OF MEA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 322 REST OF MEA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 323 REST OF MEA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 324 REST MEA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 325 REST OF MEA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 326 REST OF MEA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 327 REST OF MEA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 328 REST OF MEA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.6 SOUTH AMERICA

8.6.1 IMPACT OF COVID-19 ON CONDUCTIVE INK MARKET IN SOUTH AMERICA

FIGURE 20 SOUTH AMERICA: CONDUCTIVE INKS MARKET SNAPSHOT

TABLE 329 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 330 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 331 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2016-2019 (TONS)

TABLE 332 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY COUNTRY, 2020-2025 (TONS)

TABLE 333 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 334 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 335 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 336 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 337 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 338 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 339 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 340 SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.6.2 BRAZIL

8.6.2.1 Economic recovery and demand for low-cost conductive fillers are expected to drive the market

TABLE 341 BRAZIL: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 342 BRAZIL: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 343 BRAZIL: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 344 BRAZIL: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 345 BRAZIL: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 346 BRAZIL: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 347 BRAZIL: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 348 BRAZIL: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.6.3 CHILE

8.6.3.1 The abundance of copper in the country is helping the conductive inks market

TABLE 349 CHILE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 350 CHILE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 351 CHILE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 352 CHILE: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 353 CHILE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 354 CHILE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 355 CHILE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 356 CHILE: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

8.6.4 REST OF SOUTH AMERICA

TABLE 357 REST OF SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 358 REST OF SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 359 REST OF SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2016-2019 (TONS)

TABLE 360 REST OF SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY TYPE, 2020-2025 (TONS)

TABLE 361 REST OF SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 362 REST OF SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 363 REST OF SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2016-2019 (TONS)

TABLE 364 REST OF SOUTH AMERICA: CONDUCTIVE INKS MARKET SIZE, BY APPLICATION, 2020-2025 (TONS)

9 COMPETITIVE LANDSCAPE (Page No. - 253)

9.1 OVERVIEW

FIGURE 21 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS THE KEY GROWTH STRATEGY BETWEEN 2016 AND 2020

9.2 MARKET SHARE ANALYSIS

FIGURE 22 MARKET SHARE OF KEY PLAYERS IN CONDUCTIVE INKS MARKET, 2019

9.3 COMPETITIVE SCENARIO

9.3.1 NEW PRODUCT LAUNCH

TABLE 365 NEW PRODUCT LAUNCH, 2016-2020

9.3.2 PARTNERSHIP & AGREEMENT

TABLE 366 PARTNERSHIP & AGREEMENT, 2016-2019

9.3.3 MERGER & ACQUISITION

TABLE 367 MERGER & ACQUISITION, 2016-2020

9.3.4 EXPANSION

TABLE 368 EXPANSION, 2019-2020

9.4 COMPETITIVE BENCHMARKING

TABLE 369 REGIONAL PRESENCE AND BRANDS OF KEY PLAYERS IN THE CONDUCTIVE INKS MARKET

10 COMPANY PROFILES (Page No. - 261)

(Overview, Products Offered, Recent Developments, SWOT Analysis, Winning imperatives, Current Focus and Strategies, Threat from Competition, Right to Win)*

10.1 DUPONT

FIGURE 23 DUPONT: COMPANY SNAPSHOT

FIGURE 24 DUPONT: SWOT ANALYSIS

10.2 HENKEL AG & CO. KGAA

FIGURE 25 HENKEL AG & CO KGAA: COMPANY SNAPSHOT

FIGURE 26 HENKEL: SWOT ANALYSIS

10.3 HERAEUS HOLDING GMBH

FIGURE 27 HERAEUS HOLDING GMBH: COMPANY SNAPSHOT

FIGURE 28 HERAEUS HOLDING GMBH: SWOT ANALYSIS

10.4 JOHNSON MATTHEY

FIGURE 29 JOHNSON MATTHEY: COMPANY SNAPSHOT

FIGURE 30 JOHNSON MATTHEY: SWOT ANALYSIS

10.5 SUN CHEMICAL CORPORATION

FIGURE 31 SUN CHEMICAL CORPORATION: SWOT ANALYSIS

10.6 POLY-INK

10.7 NOVACENTRIX

10.8 CREATIVE MATERIALS INC.

10.9 KAYAKU ADVANCED MATERIALS, INC.

10.1 VORBECK MATERIALS

10.11 ADDITIONAL COMPANY PROFILES

10.11.1 ADVANCED NANO PRODUCTS CO. LTD.

10.11.2 AGFA-GEVAERT N.V.

10.11.3 ELEPHANTECH INC.

10.11.4 APPLIED NANOTECH

10.11.5 BANDO CHEMICAL INDUSTRIES, LTD.

10.11.6 CARTESIAN CO.

10.11.7 CIMA NANOTECH INC.

10.11.8 COLLOIDAL INK CO., LTD.

10.11.9 DAICEL CORPORATION (TOKYO, JAPAN)

10.11.10 INKTEC CORPORATION

10.11.11 METHODE ELECTRONICS, INC.

10.11.12 PARKER CHOMERICS

*Details on Overview, Products Offered, Recent Developments, SWOT Analysis, Winning imperatives, Current Focus and Strategies, Threat from Competition, might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 293)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities to estimate the current market size for conductive inks. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and the sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These

secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; food safety organizations; regulatory bodies; trade directories; and databases.

Primary Research

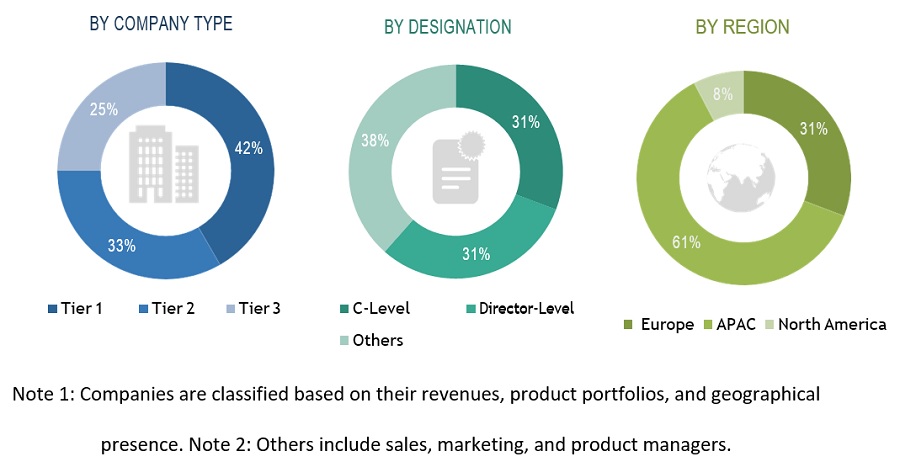

The primary sources considered in the study mainly included several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the conductive inks industry’s supply chain. After arriving at the overall market size, the total market was split into several segments and sub-segments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during this research study on the conductive inks market:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the conductive inks market. These methods were also used extensively to estimate the size of various sub- segments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Conductive Inks: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above, the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the conductive inks market.

Research Objectives

- To define, describe, and forecast the conductive inks market size, in terms of value and volume

- To identify and analyze the key drivers, restraints, challenges, and opportunities influencing the market

- To define and segment the conductive inks market by type and application

- To forecast the size of the conductive inks market, on the basis of region, into North America, Europe, Asia Pacific (APAC), South America, and Middle East & Africa

- To estimate and forecast the market at the country-level in each of the regions

- To analyze the market opportunities and competitive landscape of the stakeholders and market leaders

- To analyze the recent market developments and competitive strategies such as new product development, merger & acquisitions, expansion, agreement, and partnership to draw the competitive landscape in the market

- To strategically identify and profile the key market players and analyze their core competencies of the conductive inks market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional conductive inks market to the country level with additional applications and/or types

Country Information

- Additional country information (up to three)

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Conductive Inks Market

Inquiry on conductive ink, market size, and market trends

Application or enduse industries showing strong growth in conductive inks

carbon-based conductive inks market with import export data