Computer-Aided Facilities Management Market - Global Forecast to 2029

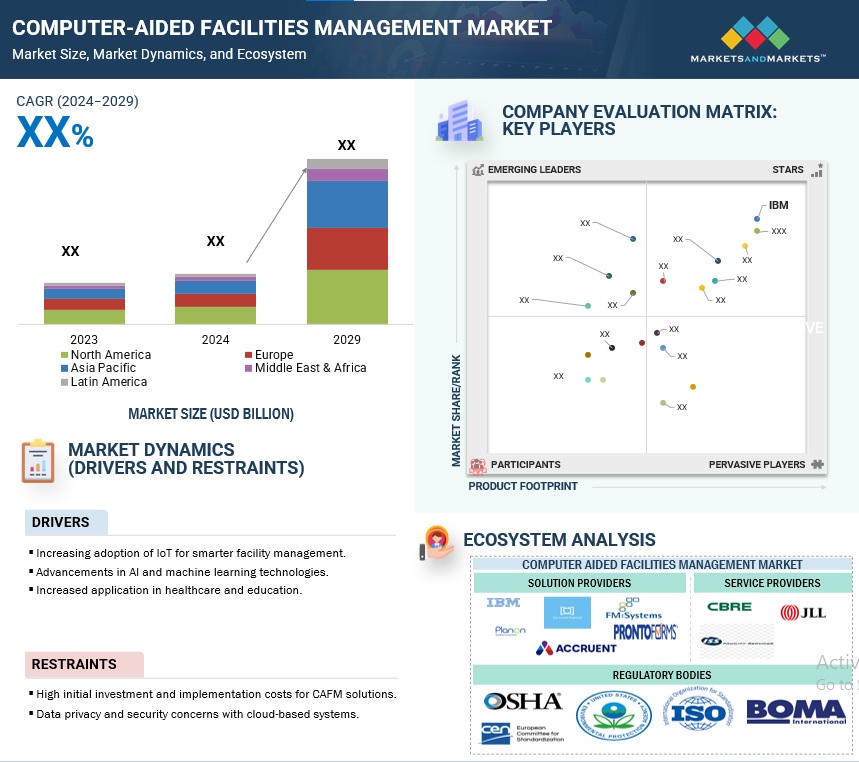

The computer-aided facilities management (CAFM) market is projected to grow from USD XXX billion in 2024 to USD XXX billion by 2029, at a CAGR of XX% during the forecast period.

Growing complexity in facility management, rising requirements for operational efficiency, and the pressure to reduce costs are creating the demand for CAFM solutions. Cloud-based CAFM systems are becoming popular since they are more suitable for further development and can be easily extended and accessed through the Internet. Furthermore, Internet of Things (IoT) devices and sensors are used for real-time monitoring, thus aiding with predictive maintenance, energy consumption, and space usage. Integration of AI and ML is standard in CAFM systems today to perform tasks automatically and offer insights that can be useful in decision-making processes. Thus, with the growing need for sustainable and smart buildings, CAFM solutions are turning into vital tools for facility managers to enhance business performance and advance the goal of environmental sustainability.

ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN COMPUTER-AIDED FACILITIES MANAGEMENT MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

USE CASES OF AI/GENERATIVE AI IN COMPUTER-AIDED FACILITIES MANAGEMENT MARKET

Generative AI significantly improves computer-aided facilities management applications with a series of novel use cases. The concept of generative AI is slowly changing the CAFM market as organizations learn how to employ it to make better facility management decisions. From identifying equipment that is due for repair to determining the best layout of equipment, location of energy sources, and even formulating an effective evacuation plan, AI provides solutions, drives efficiency, and makes decision-making easier. Through generative AI, organizations can cut costs, enhance tenant satisfaction, and attain sustainability goals, making facility management more dynamic and future oriented.

COMPUTER-AIDED FACILITIES MANAGEMENT MARKET DYNAMICS

Driver: Rising Demand for Smart Building Solutions

The growing use of smart building technologies is a significant factor that has boosted the computer-aided facilities management (CAFM) market. CAFM solutions are being used by organizations to enhance usage of available resource utilization, minimize energy consumption, and enhance organizational effectiveness. With the rise of IoT, CAFM systems act as core components of smart buildings by providing information about real-time energy consumption, occupancy patterns, and asset performance. For instance, with facilities that have predictive maintenance, problems can be identified before they occur, preventing loss of time and money. As sustainability becomes the new norm, mainly due to global regulation directing companies to achieve carbon neutrality, CAFM solutions are being employed to monitor and minimize greenhouse gas emissions. These tools are being implemented by organizations for ESG (Environmental, Social, and Governance) compliance, making the CAFM a necessity for progressive organizations.

Restraint: High implementation costs

The CAFM market has numerous constraints. However, the most critical is the high cost of deployment. The application of CAFM systems involves software hardware and training facilities, which may be expensive for SMEs. Additionally, the integration of CAFM with other existing IT infrastructure and legacy systems can be a challenging and costly affair, particularly for organizations operating across multiple locations. Additional costs are also incurred concerning customization since most businesses have unique needs that can only be met through a specialized solution to a particular issue. This financial challenge is more apparent in developing nations; in such places, the budgets are often tight, and there is low technological preparedness. The global market for cloud-based CAFM solutions is slowly emerging due to the relatively low initial investments. However, the constant costs related to the subscription and possible expansion hinder the market development.

Opportunity: Integration with Artificial Intelligence and IoT

Integrating artificial intelligence (AI) and the Internet of Things (IoT) is a value-additive prospect for the CAFM market. Analytics generated by artificial intelligence helps facilities managers develop predictive models to predict maintenance, energy usage, and occupancy patterns, thereby helping in the decision-making process. IoT devices, such as smart sensors and connected HVAC systems, improve CAFM platforms by providing real-time data to address the facility requirements. For example, IoT-integrated CAFM systems can control lighting or temperature based on occupancy and save much energy. This integration also enables the evolution of ‘digital twins,’ where virtual models of the facilities can be used to test and plan layout and operation without interfering with the physical space. Any firm that adopts AI and IoT in CAFM solutions will be able to reap big on cost control and increase operational efficiency, consequently giving it a competitive edge in the market.

Challenge: Data Privacy and Security Concerns

With a growing trend towards using connected devices and cloud-based solutions, data privacy and cyber security have become a key concern for CAFM systems. Some information processed and managed in facilities include layouts of buildings, security measures, and employee data, making these systems vulnerable to cyber criminals. This risk is further increased by the rising adoption of IoT devices in CAFM solutions since they pose security risks due to their inherent vulnerabilities. A single breach could result in substantial financial losses, brand reputational damage, and compliance issues, especially under strict regulatory environments such as GDPR and CCPA. Solving these issues is impossible without investing in cybersecurity, which becomes a problem for small organizations with limited budgets. Security is a critical aspect when it comes to CAFM systems; making sure that the systems are end-to-end encrypted and have strong access controls, as well as undergoing system audits periodically, is mandatory but, at the same time, increases the level of difficulty when deploying the systems. To mitigate these challenges, there must be cooperation at the industry level and enhancing innovations in the secure system design.

COMPUTER-AIDED FACILITIES MANAGEMENT MARKET ECOSYSTEM

The computer-aided facilities management market is somewhat fragmented, with many specialized providers offering different solutions and services tailored to various industries. While some larger companies like IBM and Honeywell have a strong presence, many smaller and niche players also contribute to the market, offering unique features and targeting specific verticals. Several changes in the computer-aided facilities management market have occurred in recent years. The Computer-Aided Facilities Management (CAFM) ecosystem comprises solution providers, service providers, and regulatory bodies. These players work together to offer integrated platforms for efficient facility management, covering areas such as asset tracking, maintenance, space management, and energy optimization.

To know about the assumptions considered for the study, download the pdf brochure

Solution segment to account for the largest market share during the forecast period

CAFM solutions are software applications that manage facility management services, including asset management, maintenance scheduling, space planning, and real-time data processing. These solutions can be used as a unified solution for resource and infrastructure management, and their integration with IoT devices allows for real-time data on facility conditions. Using advanced analytics, CAFM systems assist management in decision-making, thus enhancing organizational effectiveness. Modern CAFM solutions include AI/Machine learning to forecast equipment breakdowns, perform tasks, and control energy consumption. There are also centralized CAFM software solutions that are hosted in the cloud, and these solutions are scalable and accessible remotely. These systems integrate with enterprise resource planning (ERP) tools, providing a comprehensive approach to facilities management.

Healthcare vertical to register higher CAGR during the forecast period

CAFM solutions are critical in ensuring operational efficiency, patient safety, and regulatory compliance in the healthcare industry. Healthcare facilities face unique challenges, such as managing high-value medical equipment, maintaining stringent hygiene standards, and ensuring optimal use of limited space. CAFM systems help healthcare administrators schedule preventive maintenance, energy consumption monitoring, and space management for patient care and medical services. For instance, through CAFM software based predictive maintenance, hospitals avoid long downtimes of vital equipment such as MRI scanners while caring for the patients. Furthermore, CAFM tools ensure that healthcare providers align to standards such as the Joint Commission’s accreditation standards to enhance the quality of the services and performance. The need for CAFM in healthcare is further driven by smart hospitals, where IoT-enabled systems and automated workflows are becoming integral to facility management.

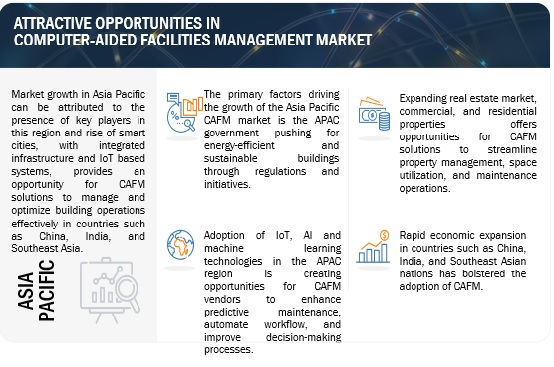

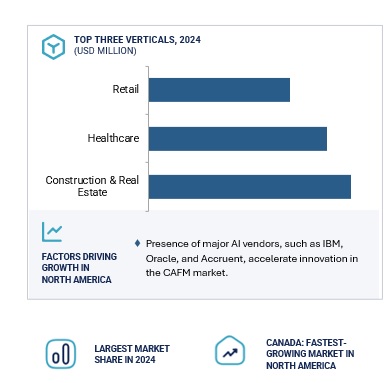

By region, North America accounted for the largest market share during the forecast period.

North America holds the largest revenue share in the computer-aided facilities management market. North America is a key market for CAFM solutions due to its highly developed technological network, high utilization of IoT, and sustainability concerns. The largest markets are the USA and Canada, where large enterprises and government organizations are driving the adoption of CAFM systems. The construction and real estate industries in the region also play a role in market expansion as more buildings incorporate CAFM solutions for better management and energy conservation. Another factor pushing the use of CAFM tools is the regulatory pressures of state energy efficiency standards and LEED certifications. Healthcare, retail, and commercial real estate sectors are the most significant adopters across North America, where CAFM systems help to tackle intricate facilities. Emerging technologies like AI and IoT analytics are already quickly influencing FM practices in the region and are among the most forward-thinking in the global markets.

Key Market Players

The major players in the computer-aided facilities management market include IBM(US), Jones Lang LaSalle Incorporated (JLL) (US), Oracle (US), MRI Software LLC (US), AssetWorks (US), Zoho Corporation (India), CBRE Group (US), Idox (UK), Elecosoft (UK), and ScienceSoft (US). These players have adopted various growth strategies, such as partnerships, agreements, and product launches & enhancements, to expand their footprint in the computer-aided facilities management market.

Recent Developments:

- In March 2024, Auberon Technologies launched Optima, its third-generation CAFM system, which utilizes advanced artificial intelligence (AI) technology to enhance productivity and insights.

- In March 2024, MDS Critical Facilities Services partnered with property operations software firm Facilio to implement their cloud-based Connected CaFM solution to optimize and streamline its data center operations.

- In October 2023, TMA Systems announced the upgrade of its Eagle CMMS, designed for businesses of all sizes requiring robust asset maintenance solutions. The upgraded platform focuses on usability and ease of adoption, aiming to accelerate time to value for users.

- In April 2021, VertiGIS acquired KMS Computer GmbH, a CAFM software specialist, to enhance its facility management solutions and expand its technological capabilities. The integration strengthens the development of ProOffice and GEBman, benefiting customers globally.

Frequently Asked Questions (FAQ):

What is the definition of the computer-aided facilities management market?

Computer-aided facility management (CAFM) software helps businesses manage and monitor the various aspects of a facility. It provides a holistic overview of a facility’s operations, from coordinating maintenance activities to working space and tracking assets. The confluence of technology and facility management enables managers to carry out their tasks more efficiently and effectively.

What is the size of the computer-aided facilities management market?

The computer-aided facilities management market is projected to grow from USD XXX billion in 2024 to USD XXX billion by 2029, at a CAGR of XX% during the forecast period.

What are the major drivers in the computer-aided facilities management market?

Major drivers in the computer-aided facilities management market are the rising demand for efficient facility management, the shift to cloud-based CAFM solutions, and the need for real-time data and analysis. Furthermore, the integration of IoT and AI analytics in the market is also increasing at a high pace, increasing the demand for the market.

Who are the key players operating in the computer-aided facilities management market?

The major players in the computer-aided facilities management market are IBM(US), Jones Lang LaSalle Incorporated (JLL) (US), Oracle (US), MRI Software, LLC (US), AssetWorks (US), Zoho Corporation (India), CBRE Group (US), Idox (UK), Elecosoft (UK), and ScienceSoft (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches/enhancements, and acquisitions to expand their footprint in the computer-aided facilities management market.

What are the opportunities for new entrants in the computer-aided facilities management market?

The computer aided facilities management market has immense future growth potential. New entrants into the CAFM market have opportunities in niche markets, merge the technology into other sectors/industries, and offer highly targeted services. They can devote themselves to particular sectors, present cloud services, combine IoT and AI, or specialize in specific services such as energy management or sustainability services.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Computer-Aided Facilities Management Market