Compute Express Link (CXL) Market - Global Market

Compute Express Link (CXL) is a type of an open standard interface that is used for the high-speed communication applications in processors, accelerators, and memory expansion devices. This interconnect technology offers faster connectivity between many forms of memory devices and supports the memory coherency between the central processing unit (CPU) memory space and memory on the attached devices. The adoption of CXL technology helps to reduce the software stack complexity, provides higher performance, and lowers overall system costs.

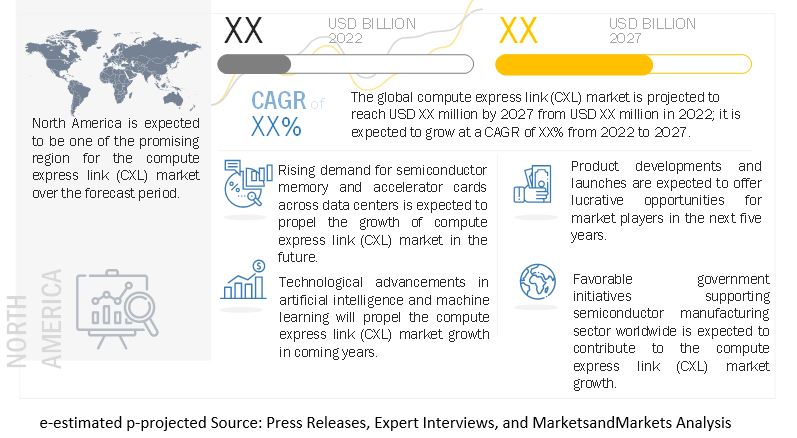

The global compute express link (CXL) market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The proliferation of data center facilities worldwide, and increasing uptake of CXL technology by semiconductor giants are the major factors fueling the growth of compute express link (CXL) market.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Proliferation of data center facilities worldwide

The compute express link (CXL) offers high-end connectivity in between many forms of memory-attached devices including graphics processing unit (GPU), tensor processing unit (TPU), central processing unit (CPU), and other processors types, utilized in the modern data centers. This technology helps data center operators to efficiently handle the yottabytes (YB) of data which is primarily generated by machine learning (ML) and artificial intelligence (AI) applications. Surging digitalization across various industry verticals is expected to increase the deployment of newer data center facilities world wide. This will further increase the uptake of CXL technology-based high-end memory-attached devices across these new data center facilities in coming years, supporting the market growth.

Increasing uptake of CXL technology by semiconductor giants

Exponential data growth is encouraging the semiconductor industry to embrace distuptive technologies across storage and memory devices, interconnect components, and processors. Several tech giants such as Intel Corporation (US), Synopsys, Inc. (US), Dell Technologes Inc. (US), Samsung (South Korea), Advanced Micro Devices, Inc. (US), Rambus Inc. (US), are extensively focusing on incorporating compute express link (CXL) technology in their upcoming product offerings to gain competitive edge in the market. For instance, in March 2022, Intel Corporation (US) launched Agilex M-Series FPGAs which are integrated with compute express link (CXL) and Peripheral Component Interconnect Express (PCIe) Gen5 interconnect technology. The incorporation of this technology will help the company to cater to growing demand for semiconductor memory, including capacity, bandwidth, latency and power efficiency across storage and networking applications. Such development initiatives will fuel the compute express link (CXL) market growth over the forecast period.

Challenges: Clallenges associated with latency optimizations of CXL-based memory solutions

Concerns with latency optimizations of CXL-based memory solutions pose a major challenge to the compute express link (CXL) market growth over the forecast period. The CXL-based memory solution provides high flexibility and can be used with the existing PCIe-based infrastructure. However, on the downside, a fluctuation in the latency optimizations can be observed across a persistent memory devices integrated with CXL-technology, which is expected to impact the market growth to some extent.

Key players in the market

Intel Corporation (US), Rambus Inc. (US), Montage Technology (China), Samsung (South Korea), SK Hynix (South Korea), Tanzanite Silicon Solutions, Inc. (Marvell) (US), Advanced Micro Devices, Inc. (US), Astera Labs, Inc. (US), and Mobiveil, Inc. (US) are few key players in the compute express link (CXL) market globally.

Recent Developments

- In August 2022, SK Hynix (South Korea) launched new memory expansion module which is incorporated with the CXL 2.0 specification. The company’s CXL 2.0 memory expansion modules bring RAM (Random-access Memory) to EDSFF (Enterprise and Data Center SSD Form Factor) for next-generation server applications.

- In August 2022, SMART Modular Technologies, Inc. (US) launched ‘DDR5 XMM CXL’, which is its new compute express link (CXL) memory module. The new memory module is designed to meet the bandwidth and capacity needs for data centers and server applications and workloads in the market.

- In October 2021, Rambus Inc. (US) launched new CXL 2.0 controller with industry-leading zero-latency Integrity and Data Encryption (IDE) modules. The new controller offers high security at speed in CXL specification which helps to solve the bandwidth bottleneck in data center infrastructure.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1 Study Objective

1.2 Definition

1.3 Study Scope

1.4 Stakeholder

1.5 Summary of changes

2 Research Methodology

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Driver

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Technology Analysis

5.4 Value Chain Analysis

5.5 Ecosystem

5.6 Trends/Disruptions Impacting Customer’s Business

5.7 Porter’s Five Forces Analysis

5.8 Case Study Analysis

5.9 Patent Analysis

5.10 Key Conferences & Events In 2022-23

5.11 Standards & Regulatory Landscape

5.11.1 Regulatory Bodies, Government Agencies, and Other Organizations

5.11.2 Regulatory Standards

5.11.3 Government Regulations

5.12 Key Stakeholders & Buying Criteria

6 Compute Express Link (CXL) Market, by Specification

6.1 Introduction

6.2 CXL 1.x

6.2.1 CXL 1.0

6.2.2 CXL 1.1

6.3 CXL 2.0

7 Compute Express Link (CXL) Market, by Protocol

7.1 Introduction

7.2 CXL.io

7.3 CXL.cache

7.4 CXL.mem

8 Compute Express Link (CXL) Market, by Device Type

8.1 Introduction

8.2 Type 1 devices (Type 1 devices are devices which use CXL.io and CXL.cache protocols; They are caching devices such as Accelerators and SmartNICs)

8.3 Type 2 devices (Type 2 devices are devices which use CXL.io, CXL.cache and CXL.mem protocols; They are GPUs and FPGAs that have memories like DDR and HBM attached to the device)

8.4 Type 3 devices (Type 3 devices are devices which use CXL.io, and CXL.mem protocols; They are memory expansion devices that allows host processors to access CXL device memory cache coherently through CXL.mem transactions)

9 Compute Express Link (CXL) Market, by Application

9.1 Introduction

9.2 Processors (Processors such as CPUs and GPUs)

9.3 Memory expansion (DDR4, DDR5, DDR6, etc.)

9.4 Accelerators (Smart NIC, FPGA Accelerator, etc.)

10 Compute Express Link (CXL) Market, By Region

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3. Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Rest of Europe

10.4. APAC

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 Rest of the APAC

10.5. RoW

10.5.1 South America

10.5.2 Middle East & Africa

11 Competitive Landscape

11.1 Key Player Strategies/Right to Win

11.2 Overview

11.3 Top 5 Company Revenue Analysis

11.4 Market Share Analysis (2021)

11.5 Company Evaluation Quadrant (2021)

11.5.1 Star

11.5.2 Pervasive

11.5.3 Emerging Leader

11.5.4 Participant

11.5.5 Competitive Benchmarking

11.6. Small and Medium Enterprises (SME) Evaluation Quadrant (2021)

11.6.1 Progressive Company

11.6.2 Responsive Company

11.6.3 Dynamic Company

11.6.4 Starting Block

11.7 CXL Market- Company Footprint

11.8 CXL Market- Company Region Footprint

11.9 Competitive Scenario

11.9.1 CXL Market- Product Launches

11.9.2 CXL Market- Deals

12 Company Profiles

13.1. Key Players

12.1.1 Montage Technology, Inc.

12.1.2 Astera Labs, Inc.

12.1.3 SK Hynix

12.1.4 Rambus.com

12.1.5 SAMSUNG

12.1.6 Intel Corporation

12.1.7 Tanzanite Silicon Solutions, Inc. (Marvell)

12.1.8 Advanced Micro Devices, Inc.

12.1.9 Mobiveil, Inc.

12.2. Other Players

12.2.1 SmartDV Technologies India Private Limited

12.2.2 Teledyne Lecroy

12.2.3 Avery Design Systems

12.2.4 GigaIO

12.2.5 Synopsys, Inc.

12.2.6 Cadence Design Systems, Inc.

12.2.7 Advantest Corporation

12.2.8 Truechip

12.2.9 Primesoc Technologies

12.2.10 SMART Modular Technologies, a SGH company

12.2.11 VIAVI Solutions Inc.

13 Appendix (Page No. - )

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: MarketsandMarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

Growth opportunities and latent adjacency in Compute Express Link (CXL) Market