Composite Doors & Windows Market by Resin Type (Polyester, Polyvinylchloride (PVC)), Type (Fiber Reinforced Plastics (FRP), Wood Plastic Composites (WPC)), Application (Industrial, Commercial, and Residential), and Region - Global Forecast to 2021

[134 Pages Report] The composite doors & windows market was valued at USD 812.0 million in 2015 and is projected to reach USD 1,171.4 million by 2021, at a CAGR of 6.3% during the forecast period. In this study, 2015 has been considered as the base year, while the forecast period is from 2016 to 2021.

Market Dynamics

Drivers

- Durability and low maintenance of FRP doors and windows

- Exceptional properties of WPC and FRP doors & windows

- Increasing use of composites in construction applications

- Economic growth and upcoming renovations of building and infrastructure in emerging economies

Opportunities

- Increase in the use of composite doors & windows in various end-use industries

- Increasing use of WPC in green buildings

Challenges

- To produce low-cost composite doors & windows

Durability and low maintenance of FRP doors and windows

Composite doors & windows have good resistance to acids, salts, or any alkali substances. They are even resistant to heat and cold. In short, they can withstand any harsh environmental condition. Their other strong properties like stiffness, sealing, electrical insulation, energy efficiency, and low weight make them preferable options than any other door and window. FRP doors and windows do not degrade easily unlike wood or plastic doors. Their quality, color, and property remain the same for an average of 60 years. Their average life span is more due to the influence of all the properties which the FRP composite has. Due to these properties, they have low running cost. Their requirement for maintenance is very low which saves the cost and makes them more preferred in hospitals, food industry, pharmaceuticals, and so on. For instance, Dortek (Ireland) has developed and installed FRP hygienic doors at two art Spire hospitals. Such developments are encouraging the use of composite doors & windows in various applications, thus driving the market growth.

Objectives of the Study:

- To define, describe, and forecast the composite doors & windows market on the basis of type, resin type, application, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the composite doors & windows market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

In this report, the research methodology used to estimate and forecast the composite doors and composite windows market began with gathering data on key company revenues and raw material costs through secondary sources such as Factiva, Hoovers, Manta, and others. Product offerings of different companies were taken into consideration to determine market segmentation. The bottom-up approach was used to arrive at the overall market size of composite doors from the revenues of key players. After arriving at the total market size, the overall market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were used to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments

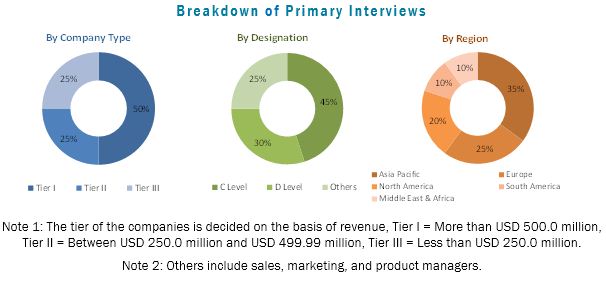

The figure below illustrates the breakdown of profiles of primary interview participants.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the composite doors industry includes manufacturers of resins, fibers, and adhesives. Key players in the composite doors market are Dortek (Ireland), Special-lite INC (U.S.), Curries ASSA ABLOY Group (U.S.), Vello Nordic AS (Norway), Andersen Corporation (U.S.), and Pella Corporation (U.S.). Composite doors and composite windows are used in industrial, commercial, and residential applications.

Major Market Developments

- In September 2016, Dortek launched a new hospital door in the range of healthcare doors. The company produces a range of seamless GRP doors that are designed specifically to meet the stringent needs of high hygiene areas within a hospital. As they do not contain timber or organic materials, these doors prevent bacterial growth and maximize hygiene and cleanability.

- In August 2016, Special-Lite Inc. The company launched BasiX door that includes many of the features of a Special- Lite SL-20 sandstone-textured FRP flush door, with no lead-time, and has a competitive price point. BasiX doors are lightweight and resistant to chemicals and corrosion. This product door can fit into any existing frame, which helps the company replace the product with existing doors in an easier way.

- In August 2016, Curries, Assa Abloy Group added borrowed lights, aluminum sidelights, and frames to their FRP doors. The new sidelights, borrowed lights, and frames are made from tubular 6063-T6 aluminum. This new product adds advantages such as having lights and side lights to their existing FRP doors.

Key Target Audience:

- Composite Doors & Windows Manufacturers

- Raw Material Suppliers

- Distributors & Suppliers

- Industry Associations

Scope Of The Report

The research report segments the composite doors and composite windows market into the following:

By Type:

- Fiber Reinforced Plastics (FRP)

- Wood Plastic Composites (WPC)

By Resin Type:

- Polyester

- PVC

- Others

By Application:

- Industrial

- Commercial

- Residential

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Each region has been further segmented into key countries in that region.

Critical questions which the report answers

- What are the upcoming trends for composite doors & windows market in developing nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the North America composite doors & windows market

- Further breakdown of the Europe market

- Further breakdown of the Asia-Pacific market

- Further breakdown of the Middle East & Africa market

- Further breakdown of the Latin American market

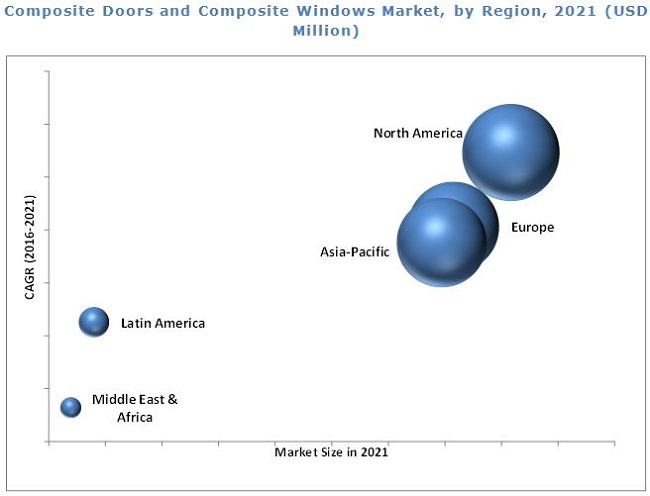

The composite doors and composite windows market is projected to reach USD 1,171.4 million by 2021, at a CAGR of 6.3% during the forecast period. The report covers the market for both composite doors & windows. The growth of this market is expected to be driven by the increase in demand for composite doors and composite windows from industrial and commercial applications. Composite materials are used in the manufacturing of lightweight doors to reduce the overall weight and provide exceptional properties such as resistance to high temperature, corrosion, and extreme weather conditions.

Composite doors & windows are widely used in a variety of construction applications due to their superior property of energy efficiency. Composite doors & windows are excellent insulators, which help in saving the energy where they are installed. Composite doors & windows include FRP- and WPC-based doors & windows. Glass fiber is the most preferred reinforcement used for composite doors & windows. FRP composite doors & windows are manufactured through continuous filaments of fiber, which are melt-impregnated with plastic polymer by the pultrusion process to create a high-performance bond.

Composite doors & windows are moderately capital-intensive, especially the FRP doors & windows. High investment equipment is required for its manufacturing. New technologies need to be developed to produce low-cost glass fibers and composite doors & windows to commercialize the end products. The development of low-cost composite doors & windows would enable its use in a wide range of applications, where cost intensity is an important issue. In the developing countries such as India and China, the applications that require these composite doors & windows are cost-intensive industries. Hence, the identification and development of low-cost technologies for manufacturing doors & windows are a major concern, globally.

North America is estimated to be the largest market for composite doors and composite windows. Presence of some of the major manufactures such as Special-lite INC (U.S.), Curries Assa Abloy Group (U.S.), Andersen Corporation (U.S.), and Pella Corporation (U.S.) is expected to aid the growth of the composite doors market in North America. The U.S. is a key market for composite doors and composite windows in North America.

Composite doors & windows market by type is segmented into fiber reinforced plastics (FRP) and wood plastic composites (WPC)

Fiberglass Reinforced Plastics (FRP)

Glass fiber is the most preferred reinforcement used for composite doors & windows. FRP composite doors & windows are manufactured through continuous filaments of fiber, which are melt-impregnated with plastic polymer by the pultrusion process to create a high-performance bond. These are then cut into composite pellets for convenient processing into net shapes via injection molding or extrusion processes. Glass fiber is commonly used as a reinforcing element in commercial and industrially used doors & windows.

Wood Plastic Composites (WPC)

WPC are the upcoming composite materials that are developing more in the areas of building, furniture, and infrastructure applications. Wood can be in the form of sawdust or wood fibers. The commonly used synthetic resins in WPC doors & windows are polyethylene, polypropylene, or polyvinyl chloride (PVC). Mixing wood flours increases the mechanical and thermal property of the composites. Mixing process is followed by extrusion, where the mixture is converted into the desired product.

Critical questions the report answers:

- What are the upcoming hot bets for composite doors & windows market?

- How market dynamics is changing for different forms in different applications?

Dortek (Ireland), Special-lite INC (U.S.), Curries Assa Abloy Group (U.S.), Vello Nordic AS (Norway), Fiber Tech Pvt. Ltd. (India), Andersen Corporation (U.S.), Pella Corporation (U.S.), and Wood Plastic Composites (India), among others, are some of the leading players in the composite doors and composite windows market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.3.1 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Significant Growth Opportunities in the Composite Doors Market & Composite Windows Market

4.2 Composite Doors & Windows Market, By Application

4.3 Market Share, By Region and Application, 2015

4.4 Market, By Country

4.5 Market, By Resin Type

4.6 Market, By Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Composite Doors Market & Composite Windows Market, By Type

5.2.2 Composite Doors & Windows Market, By Resin Type

5.2.3 Market, By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Durability and Low Maintenance of FRP Doors and Windows

5.3.1.2 Exceptional Properties of WPC and FRP Doors & Windows

5.3.1.3 Increasing Use of Composites in Construction Applications

5.3.1.4 Economic Growth and Upcoming Renovations of Buildings and Infrastructure in Emerging Economies

5.3.2 Restraints

5.3.2.1 High Production Cost and Availability of Low-Grade and Cheaper Products

5.3.3 Opportunities

5.3.3.1 Increase in the Use of Composite Doors & Windows in Various End-Use Industries

5.3.3.2 Increasing Use of WPC in “Green Buildings”

5.3.4 Challenges

5.3.4.1 to Produce Low-Cost Composite Doors & Windows

5.3.5 Impact Analysis of Drivers

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview (Page No. - 47)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Per Capita GDP vs Per Capita Construction Composite Demand

6.4 Trends and Forecast of the Construction Industry and Its Impact on the Construction Composites Market

6.4.1 Trends and Forecast of the Construction Industry in North America

6.4.1.1 Trends in Residential and Non-Residential Construction Industries in North America

6.4.2 Trends and Forecast of the Construction Industry in Europe

6.4.2.1 Construction Industry Trends in Europe

6.4.2.2 Trends in the Residential and Non-Residential Construction Industry in Europe

6.4.3 Trends and Forecast of the Construction Industry in Asia-Pacific

6.4.3.1 Construction Industry Trends in Asia-Pacific

6.4.4 Trends and Forecast of the Construction Industry in ME&A

6.4.5 Trends and Forecast of the Construction Industry in Latin America

7 Composite Doors & Windows Market, By Type (Page No. - 57)

7.1 Introduction

7.2 Fiberglass Reinforced Plastics (FRP)

7.3 Wood Plastic Composites (WPC)

8 Composite Doors & Windows Market, By Resin Type (Page No. - 63)

8.1 Introduction

8.2 Polyester

8.3 Polyvinyl Chloride (PVC)

8.4 Other Resins

9 Composite Doors & Windows Market, By Application (Page No. - 70)

9.1 Introduction

9.2 Industrial

9.2.1 Pharmaceutical Industries

9.2.2 Military Installations

9.2.3 Wastewater Management

9.3 Commercial

9.3.1 Malls, Resorts, and Hotels

9.3.2 Corporate Offices

9.4 Residential

10 Composite Doors & Windows Market, By Region (Page No. - 78)

10.1 Introduction

10.2 North America

10.2.1 Composite Doors & Windows Market, By Application

10.2.2 Composite Doors & Windows, By Country

10.2.2.1 U.S.

10.2.2.1.1 Market, By Application

10.2.2.2 Canada

10.2.2.2.1 Market, By Application

10.3 Europe

10.3.1 Composite Doors & Windows Market, By Application

10.3.2 Market, By Country

10.3.2.1 Germany

10.3.2.1.1 Market, By Application

10.3.2.2 France

10.3.2.3 Italy

10.3.2.3.1 Market, By Application

10.3.2.4 U.K.

10.3.2.4.1 Market, By Application

10.3.2.5 Spain

10.3.2.5.1 Market, By Application

10.3.2.5.2 Market, By Application

10.4 Asia-Pacific

10.4.1 Composite Doors & Windows Market, By Application

10.4.2 Market, By Country

10.4.2.1 China

10.4.2.1.1 Market, By Application

10.4.2.2 India

10.4.2.2.1 Market, By Application

10.4.2.3 Japan

10.4.2.3.1 Market, By Application

10.4.2.3.2 Market, By Application

10.5 Latin America

10.5.1 Composite Doors & Windows Market, By Application

10.5.2 Market, By Country

10.5.2.1 Brazil

10.5.2.1.1 Market, By Application

10.5.2.2 Mexico

10.5.2.2.1 Market, By Application

10.6 Middle East & Africa

10.6.1 Composite Doors & Windows Market, By Application

10.6.2 Composite Doors & Winodws Market, By Country

10.6.2.1 UAE

10.6.2.1.1 Market, By Application

11 Competitive Landscape (Page No. - 107)

11.1 Overview

11.2 New Product Launches/Developments: the Most Popular Growth Strategy

11.3 Maximum Developments in 2016

11.4 Market Ranking of Key Players

11.5 Recent Developments

11.5.1 New Product Developments

11.5.2 Expansions

11.5.3 Agreements & Partnerships

11.5.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 113)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Dortek

12.2 Special-Lite, Inc.

12.3 Curries, Assa Abloy Group

12.4 Pella Corporation

12.5 Vello Nordic as

12.6 Andersen Corporation

12.7 Wood Plastic Composite Technologies, Hardy Smith Group

12.8 Ecoste

12.9 Nationwide Windows Ltd.

12.10 Fiber Tech Composite Pvt.Ltd.

12.11 Other Companies

12.11.1 Fiberline Composites

12.11.2 Ravalsons

12.11.3 Fiberrxel

12.11.4 Bellagreen Pvt. Ltd.

12.11.5 Worthing Windows

12.11.6 Chem-Pruf

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 127)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (86 Tables)

Table 1 Composite Doors Market & Composite Windows Market Size, By Value and Volume, 2014–2021

Table 2 Trends and Forecast of GDP, 2015–2021 (USD Billion)

Table 3 Per Capita GDP vs Per Capita Construction Composite Demand, 2015

Table 4 Contribution of the Construction Industry to the GDP of North America, 2014–2021 (USD Billion)

Table 5 Contribution of the Construction Industry to the GDP of Europe, 2014–2021 (USD Billion)

Table 6 Contribution of the Construction Industry to the GDP of Asia-Pacific, 2014–2021 (USD Billion)

Table 7 Contribution of the Construction Industry to the GDP in the Middle East & Africa, 2014–2021 (USD Billion)

Table 8 Contribution of the Construction Industry to the GDP in Latin America, 2014–2021 (USD Billion)

Table 9 Composite Doors & Windows Market Size, By Type, 2014–2021 (USD Million)

Table 10 Market By Size, By Type, 2014–2021 (Million Square Foot)

Table 11 FRP Doors & Windows Market Size, By Region, 2014–2021 (USD Million)

Table 12 FRP Doors & Windows Market Size, By Region, 2014–2021 (Million Square Foot)

Table 13 WPC Doors & Windows Market Size, By Region, 2014–2021 (USD Million)

Table 14 WPC Doors & Windows Market Size, By Region, 2014–2021 (Million Square Foot)

Table 15 Composite Doors & Windows Market Size, By Resin Type, 2014–2021 (USD Million)

Table 16 Market By Size, By Resin Type, 2014–2021 (Million Square Foot)

Table 17 Polyester Resin-Based Composite Doors & Winodws Market Size, By Region, 2014–2021 (USD Million)

Table 18 Polyester Resin-Based Composite Doors & Winodws Market Size, By Region, 2014–2021 (Million Square Foot)

Table 19 PVC Resin-Based Composite Doors & Winodws Market Size, By Region, 2014–2021 (USD Million)

Table 20 PVC Resin-Based Composite Doors & Winodws Market Size, By Region, 2014–2021 (Million Square Foot)

Table 21 Other Resins-Based Composite Doors & Winodws Market Size, By Region, 2014–2021 (USD Million)

Table 22 Other Resins-Based Composite Doors & Winodws Market Size, By Region, 2014–2021 (Million Square Foot)

Table 23 Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 24 Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 25 Market By Size in Industrial Application, By Region, 2014–2021 (USD Million)

Table 26 Market By Size in Industrial Application, By Region, 2014–2021 (Million Square Foot)

Table 27 Market By Size in Commercial Application, By Region, 2014–2021 (USD Million)

Table 28 Market By Size in Commercial Application, By Region, 2014–2021 (Million Square Foot )

Table 29 Market By Size in Residential Application, By Region, 2014–2021 (USD Million)

Table 30 Market By Size in Residential Application, By Region, 2014–2021 (Square Foot Million)

Table 31 Market By Size, By Region, 2014–2021 (USD Million)

Table 32Market By Size, By Region, 2014–2021 (Million Square Foot)

Table 33 North America: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 34 North America: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 35 North America: Market By Size, By Country, 2014–2021 (USD Million)

Table 36 North America: Market By Size, By Country, 2014–2021 (Million Square Foot)

Table 37 U.S.: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 38 U.S.: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 39 Canada: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 40 Canada: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 41 Europe: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 42 Europe: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 43 Europe: Market By Size, By Country, 2014–2021 (USD Million)

Table 44 Europe: Market By Size, By Country, 2014–2021 (Million Square Foot)

Table 45 Germany: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 46 Germany: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 47 France: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 48 France: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 49 Italy: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 50 Italy: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 51 U.K.: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 52 U.K.: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 53 Spain: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 54 Spain: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 55 Rest of Europe: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 56 Rest of Europe: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 57 Asia-Pacific: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 58 Asia-Pacific: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 59 Asia-Pacific: Market By Size, By Country, 2014–2021 (USD Million)

Table 60 Asia-Pacific: Market By Size, By Country, 2014–2021 (Million Square Foot)

Table 61 China: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 62 China: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 63 India: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 64 India: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 65 Japan: Market By Size, By Application, 2014–2021 (USD Million)

Table 66 Japan: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 67 Rest of Asia-Pacific: Market By Size, By Application, 2014–2021 (USD Million)

Table 68 Rest of Asia-Pacific: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 69 Latin America: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 70 Latin America: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 71 Latin America: Market By Size, By Country, 2014–2021 (USD Million)

Table 72 Latin America: Market By Size, By Country, 2014–2021 (Million Square Foot)

Table 73 Brazil: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 74 Brazil: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 75 Mexico: Market By Size, By Application, 2014–2021 (USD Million)

Table 76 Mexico: Market By Size, By Application, 2014–2021 (Million Square Foot)

Table 77 Middle East & Africa: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 78 Middle East & Africa: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 79 Middle East & Africa: Market By Size, By Country, 2014–2021 (USD Million)

Table 80 Middle East & Africa: Market By Size, By Country, 2014–2021 (Million Square Foot)

Table 81 UAE: Composite Doors Market & Composite Windows Market Size, By Application, 2014–2021 (USD Million)

Table 82 UAE: Composite Doors & Windows Market Size, By Application, 2014–2021 (Million Square Foot)

Table 83 New Product Developments, 2012–2016

Table 84 Expansions, 2012–2016

Table 85 Agreements & Partnerships, 2012–2016

Table 86 Mergers & Acquisitions, 2012–2016

List of Figures (43 Figures)

Figure 1 Composite Doors & Windows: Market Segmentation

Figure 2 Composite Doors Market & Composite Windows Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Composite Doors & Windows: Data Triangulation

Figure 6 Industrial Application to Drive the Global Market, 2016–2021

Figure 7 Germany to Be the Fastest-Growing Market, 2016–2021

Figure 8 FRP to Lead the Composite Doors & Windows Market, By Fiber Type, 2016–2021

Figure 9 Polyester Resin to Drive the Market, 2016–2021

Figure 10 North America to Be the Fastest-Growing Market, in Terms of Volume, 2016–2021

Figure 11 High Growth Opportunities in the Global Market Between 2016 and 2021

Figure 12 Industrial Applications to Be the Fastest-Growing Segment of the Composite Doors & Windows Market Between 2016 and 2021

Figure 13 North America is the Largest Market for Composite Doors & Windows, in Terms of Value

Figure 14 Germany to Be the Fastest-Growing Market, in Terms of Volume, 2016–2021

Figure 15 Polyester Resin to Dominate the Composite Doors & Windows Market, 2016–2021

Figure 16 FRP Doors & Windows to Be the Fastest-Growing Segment, 2016–2021

Figure 17 Drivers, Restraints, Opportunities, and Challenges in Composite Doors & Windows Market

Figure 18 Durability and Low Maintainenece of FRP to Drive the Market in the Long Term

Figure 19 Porter’s Five Forces Analysis

Figure 20 Trends and Forecast of GDP, 2016–2021 (2015–2021)

Figure 21 Per Capita GDP vs Per Capita Construction Composite Demand

Figure 22 Trends and Forecast of the Construction Industry in North America

Figure 23 Trends of Residential and Non-Residential Construction Industries in North America

Figure 24 Trends and Forecast of the Construction Industry in Europe

Figure 25 Trends of Residential and Non-Residential Construction Industries in Europe

Figure 26 Trends and Forecast of the Construction Industry in Asia-Pacific

Figure 27 Construction Industry in Saudi Arabia Contributes the Maximum to the GDP in the Middle East & Africa, USD Billion, 2016 vs 2021

Figure 28 Construction Industry in Brazil Contributes the Maximum to the GDP in Latin America, USD Billion, 2016 vs 2021.

Figure 29 FRP to Dominate the Composite Doors & Windows Market in the Next Five Years

Figure 30 North America to Drive FRP Doors & Windows Market, 2016–2021

Figure 31 Europe to Dominate the WPC Doors & Windows Market, 2016–2021

Figure 32 Polyester Resin-Based Composite Doors & Winodws to Register the Highest CAGR in Europe Between 2016 and 2021

Figure 33 North America to Drive the Other Resins-Based Composite Doors & Windows Market, 2016–2021

Figure 34 North America to Lead the Market in the Industrial Application

Figure 35 North America to Lead the Market in the Residential Application, 2016–2021

Figure 36 Germany to Register the Highest CAGR in the Composite Doors & Windows Market During the Forecast Period

Figure 37 U.S.: the Most Lucrative Market in North America

Figure 38 Germany to Be the Fastest-Growing Composite Doors & Windows Market in Europe During the Forecast Period

Figure 39 China: the Largest Market in Asia-Pacific

Figure 40 Companies Adopted New Product Launches/Developments as the Key Growth Strategy Between 2012 and 2016

Figure 41 Key Growth Strategies in Composite Doors & Windows Market, 2012–2016

Figure 42 Developments in Composite Doors & Windows Market, 2012–2016

Figure 43 Dortek: the Largest Company in the Composite Doors Market & Composite Windows Market

Growth opportunities and latent adjacency in Composite Doors & Windows Market