Composable Infrastructure Market by Type (Software and Hardware), Vertical (BFSI, Healthcare, IT and Telecom, Government, Manufacturing), and Region (North America, Europe, Asia Pacific, and RoW) - Global Forecast to 2023

The study involved 4 major steps in the process of estimation of the current market size for composable infrastructure. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the composable infrastructure market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, databases and industry associations, such as Data Centre Alliance (DCA) Global, and Open Data Centre Alliance (ODCA).

Primary Research

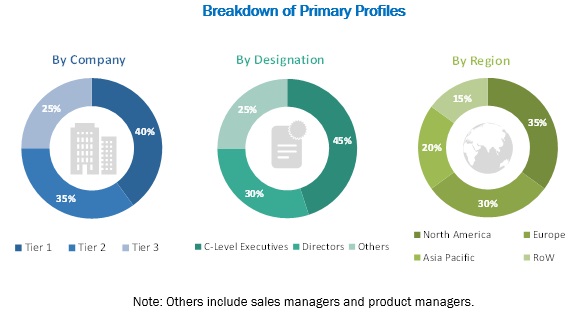

The composable infrastructure market comprises several stakeholders, such as composable infrastructure platform providers, IT service providers, and hardware providers. In-depth interviews were conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of leading market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess the market prospects. Following is the breakdown of interviews with primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the composable infrastructure market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market sizes included the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall composable infrastructure market size using the market size estimation processes explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the supply sides in the data storage and data center industries.

Report Objectives

- To define, segment, and project the global market size for composable infrastructure

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 4 regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze competitive developments, such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements in the market

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

HGST (US), HPE (US), Dell EMC (US), Lenovo (China), DriveScale (US), TidalScale (US), Liqid (US), OSS (US), Cloudistics (US), and QCT (Taiwan) |

This research report categorizes the composable infrastructure market based on type, vertical, and region.

On the basis of Type:

- Software

- Hardware

On the basis of Vertical:

- BFSI

- IT and Telecom

- Government

- Healthcare

- Manufacturing

- Others*

- *Others include Retail, Energy and Utility, and Media and Entertainment

On the basis of Region:

- North America

- Europe

- Asia Pacific

- RoW (Latin America, Middle East & Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC market into countries contributing 75% to the regional market size

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the European market into countries contributing 75% to the regional market size

Product Analysis

Product matrix, which gives a detailed comparison of the product portfolio of each company

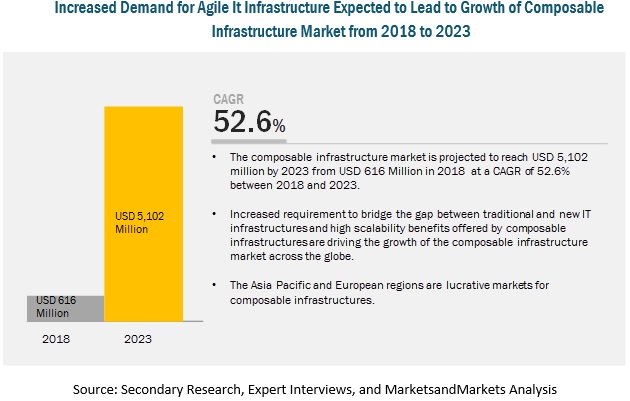

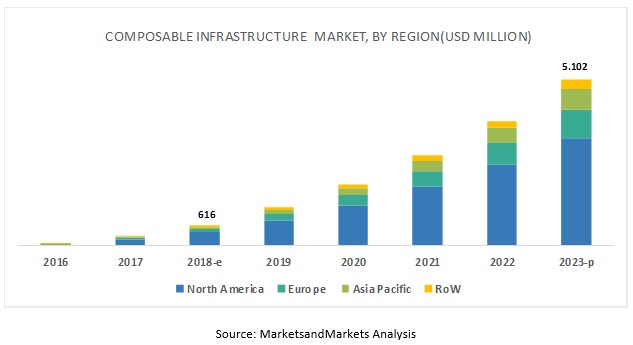

The composable infrastructure market size is estimated to be USD 616 million in 2018 and expected to reach USD 5,102 million by 2023, at a Compound Annual Growth Rate (CAGR) of 52.6% during the forecast period. The major factors driving the growth of the market include the growing need to bridge the gap between traditional and new infrastructure and high scalability and agility of composable infrastructure.

Composable infrastructure hardware segment is expected to grow at a higher rate during the forecast period

The scope of this report covers the analysis of the composable infrastructure market by type, by vertical, and by region. The composable infrastructure market by type includes software and hardware. Composable infrastructure software can be referred to as infrastructure as code, which allows the creation of the infrastructure a user wants with the use of software commands (either Graphic User Interface (GUI) or API). Whereas, composable hardware includes appliances and platforms powered by composable software. The composable infrastructure hardware segment is expected to grow at the highest CAGR in the global market by type during the forecast period. The growing demand for composable infrastructure hardware is mainly due to the increasing number of enterprise applications and demand for dynamic hardware requirements to make IT infrastructure more agile and scalable.

Growing influx of the new technologies in BFSI vertical resulting in the rapid adoption of composable infrastructure

The BFSI segment is expected to implement composable infrastructure solutions at the highest CAGR during the forecast period. This infrastructure is expected to help financial institutions and financial service providers improve their operational efficiency and productivity. Some of the key advantages of deploying composable infrastructure solutions include seamless scalability, low operational expenditure, and reduced management overheads. However, the BFSI sector is more likely to deploy composable infrastructure, as these solutions help increase the speed of data processing and alleviate business risks by unifying the control of all operations from a single point.

North America is expected to account for the largest market size during the forecast period

As per the geographic analysis, North America is expected to account for the largest market share during the forecast period. Factors, including the presence of well-established players, such as HPE, Dell, DriveScale, and Liqid; growing demand for enterprise applications; simplification of existing IT with the advent of new technologies; surging demand for scalability in solutions, reduction in operational expenditure, and low total ownership cost on IT infrastructure are the prime factors driving the growth of the composable infrastructure market in this region.

The major factors that are expected to hinder market growth are vendor lock-in and single point of failure. The key composable infrastructure market players profiled in this report include HGST (US), HPE (US), Dell EMC (US), Lenovo (China), DriveScale (US), TidalScale (US), Liqid (US), One Stop Systems (US), Cloudistics (US), and QCT (Taiwan). These players offer various composable infrastructure software and hardware to cater to the demands and needs of the market space. The major growth strategies adopted by these players are partnerships, collaborations and agreements, and new product launches/product enhancements.

Recent Developments

- In July 2018, Lenovo expanded its ThinkAgile portfolio with the ThinkAgile CP Series composable cloud platform that offers all the ease-of-use of a public cloud environment secured behind the customer’s own data center firewall. Think Agile CP Series is a fully-integrated infrastructure with application marketplace and end-to-end automation of software-defined network, compute, and storage.

- In June 2018, One Stop Systems enhanced its composable infrastructure portfolio with the release of the newest version of GPUltima-CI, a rack-scale composable infrastructure solution with the latest NVIDIA V100 Tensor Core GPU accelerators, at the ISC High Performance 2018 annual conference. The newest version of the GPUltima-CI features hardware and software from the OSS partner, Dolphin Interconnect Solutions.

- In March 2018, Liqid, along with Inspur Systems, a leading data center and cloud computing total solutions provider, is expected to offer a joint solution designed specifically for advanced, Graphic Processing Unit (GPU) intensive applications and workflows. This collaboration is aimed at delivering the most advanced composable GPU platform on the market along with Liqid’s fabric technology.

Key questions addressed by the report

- What are the opportunities in the composable infrastructure market?

- What is the competitive landscape in the market?

- What are the use cases of the market?

- How has composable infrastructure evolved from traditional infrastructure?

- What are the dynamics of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Breakdown of Primaries

2.1.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 25)

4.1 Attractive Opportunities in the Composable Infrastructure Market

4.2 Market By Type, 2018 & 2023

4.3 Market By Vertical, 2016–2023

4.4 Market Investment Scenario

5 Market Overview (Page No. - 28)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Growing Need to Bridge the Gap Between Traditional and New IT Infrastructure

5.1.1.2 High Scalability of Composable Infrastructure

5.1.1.3 Reduced Capex and Opex Due to Adoption of Composable Infrastructure

5.1.1.4 High Adoption of Virtualization

5.1.2 Restraints

5.1.2.1 Choice of Hypervisor Being Vendor-Dependent

5.1.2.2 Single Point of Failure

5.1.3 Opportunities

5.1.3.1 Anticipated Increase in Adoption of Composable Infrastructure Solutions

5.1.3.2 Emergence of Hybrid Cloud

5.1.3.3 Increasing Investments in Data Center Technologies

5.1.4 Challenges

5.1.4.1 Single Vendor Lock-Ins

5.1.4.2 Lack of Awareness About the Benefits of Composable Infrastructure

5.2 Industry Trends

5.2.1 Introduction

5.2.2 Evolution

5.2.3 Case Studies

5.2.3.1 Case Study 1: Hudsonalpha Institute for Biotechnology Uses HPE Composable Infrastructure Solution to Balance Cost and Performance Requirements

5.2.3.2 Case Study 2: Travel Industry Technology Provider Uses HPE Composable Infrastructure Solution

5.2.3.3 Case Study 3: Layerx Group Uses HPE Composable Infrastructure Solution to Simplify IT Infrastructure Management

5.2.3.4 Case Study 4: Franciscan Missionaries of Our Lady Health System Deployed HPE Composable Infrastructure

6 Composable Infrastructure Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Software

6.2.1 Software is Required to Manage All the Discrete Assets and to Compose the Optimum Configuration for A Specific Application

6.3 Hardware

6.3.1 Hardware Platform Along With the Management Software Allows Rapid and Seamless Management of Resources

7 Composable Infrastructure Market, By Vertical (Page No. - 43)

7.1 Introduction

7.2 BFSI

7.2.1 The BFSI Sector is Deploying Composable Infrastructure Solutions to Avoid Billion-Dollar Losses Due to Distruption While Processing Huge Data

7.3 IT and Telecom

7.3.1 Composable Infrastructure Solutions Provide Centralized Control and Management of Data Center Resources, Including Power and Cooling Facilities

7.4 Government

7.4.1 Composable Infrastructure Solutions Assist Government Agencies to Improve the Operational Efficiency of Data Centers By Simplifying Complex Storage Networks

7.5 Healthcare

7.5.1 Composable Infrastructure Solutions Help Organizations in the Healthcare Sector Overcome Challenges Such as Network Bottlenecks, Data Security, and Data Access

7.6 Manufacturing

7.6.1 Composable Infrastructure has Revolutionized the Process of Accessing Data Center Resources, as They Eliminate the Hardware Cost and Reduce Operational Expenditure

7.7 Others

7.7.1 Composable Infrastructure Helps Enhance the Operational Efficiency of Companies Operating in Energy and Utility, Media and Entertainment and Retail Verticals

8 Regional Analysis (Page No. - 50)

8.1 Introduction

8.2 North America

8.2.1 Presence of Established Players in the Region is Likely to Drive the Market for Composable Infrastructure in North America

8.3 Europe

8.3.1 Rapid Adoption of New Technologies and High Concentration of Start-Ups are Expected to Increase the Demand for Composable Infrastructure in Europe

8.4 Asia Pacific

8.4.1 Increased Spending on Improving Infrastructures and Smart Cities Initiatives are Some of the Factors Driving the Market in APAC

8.5 Rest of the World

8.5.1 Increased Spending on IT Infrastructure and Growing Number of Data Centers are Expected to Fuel the Market in RoW

9 Competitive Landscape (Page No. - 59)

9.1 Overview

9.2 Market Ranking Analysis for the Composable Infrastructure Market

9.3 Competitive Scenario

9.3.1 New Product Launches

9.3.2 Agreements and Partnerships

9.3.3 Business Expansions

10 Company Profiles (Page No. - 63)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.1 HGST

10.2 HPE

10.3 Dell EMC

10.4 Lenovo

10.5 Drivescale

10.6 Tidalscale

10.7 One Stop Systems

10.8 Liqid

10.9 Cloudistics

10.10 QCT

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 80)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (22 Tables)

Table 1 Composable Infrastructure Market Size, By Type, 2016–2023 (USD Million)

Table 2 Software: Market Size By Region, 2016–2023 (USD Million)

Table 3 Hardware: Market Size By Region, 2016–2023 (USD Million)

Table 4 Composable Infrastructure Market Size, By Vertical, 2016–2023 (USD Million)

Table 5 BFSI: Market Size By Region, 2016–2023 (USD Million)

Table 6 IT and Telecom: Market Size By Region, 2016–2023 (USD Million)

Table 7 Government: Market Size By Region, 2016–2023 (USD Million)

Table 8 Healthcare: Composable Infrastructure Market Size, By Region, 2016–2023 (USD Million)

Table 9 Manufacturing: Market Size By Region, 2016–2023 (USD Million)

Table 10 Others: Market Size By Region, 2016–2023 (USD Million)

Table 11 North America: Market Size By Type, 2016–2023 (USD Million)

Table 12 North America: Market Size By Vertical, 2016–2023 (USD Million)

Table 13 Europe: Composable Infrastructure Market Size, By Type, 2016–2023 (USD Million)

Table 14 Europe: Market Size By Vertical, 2016–2023 (USD Million)

Table 15 Asia Pacific: Market Size By Type, 2016–2023 (USD Million)

Table 16 Asia Pacific: Market Size By Vertical, 2016–2023 (USD Million)

Table 17 Rest of the World: Market Size By Type, 2016–2023 (USD Million)

Table 18 Rest of the World: Composable Infrastructure Market Size, By Vertical, 2016-2023 (USD Million)

Table 19 Market Ranking, 2018

Table 20 New Product Launches/Product Enhancements, 2017–2018

Table 21 Agreements and Partnerships, 2017–2018

Table 22 Business Expansions, 2017–2018

List of Figures (33 Figures)

Figure 1 Composable Infrastructure Market Segmentation

Figure 2 Composable Infrastructure Market: Research Design

Figure 3 Research Methodology

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Composable Infrastructure Market Expected to Witness Robust Growth From 2018 to 2023

Figure 9 Largest Share Segments of Market in 2018

Figure 10 Composable Infrastructure Market, By Region

Figure 11 Increased Demand for Agile IT Infrastructures Expected to Lead to Growth of Composable Infrastructure Market From 2018 to 2023

Figure 12 Hardware Segment Projected to Lead Market From 2018 to 2023

Figure 13 IT and Telecom Segment Projected to Lead Market From 2016 to 2023

Figure 14 Market Investment Scenario

Figure 15 Composable Infrastructure Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Composable Infrastructure: Speed of Deployment of IT Resources

Figure 17 Major Business Outcomes Achieved By Deploying Composable Infrastructure

Figure 18 Multi-Hypervisor Environments Adopted By End Users

Figure 19 Evolution of IT Infrastructures

Figure 20 Hardware Segment Expected to Account for Larger Market Share During Forecast Period

Figure 21 Telecom and IT Segment Projected to Lead the Composable Infrastructure Market During the Forecast Period

Figure 22 Asia Pacific Expected Grow at the Highest CAGR During Forecast Period

Figure 23 North America Market Snapshot

Figure 24 Asia Pacific Market Snapshot

Figure 25 Key Developments By Leading Players in the Composable Infrastructure Market During 2016–2018

Figure 26 HGST: Company Snapshot

Figure 27 HGST: SWOT Analysis

Figure 28 HPE: Company Snapshot

Figure 29 HPE: SWOT Analysis

Figure 30 Dell EMC: Company Snapshot

Figure 31 Dell EMC: SWOT Analysis

Figure 32 Lenovo: Company Snapshot

Figure 33 One Stop System: Company Snapshot

Growth opportunities and latent adjacency in Composable Infrastructure Market

Interested in the composable infrastructure market