Companion Animal Health Market by Animal Type (Dogs, Cats), Product (Vaccines, Pharmaceuticals, Diagnostics), End User (Veterinary Hospitals & Clinics, Diagnostics Laboratories) - Global Forecast to 2027

The companion animal health market is projected to reach USD 26.9 billion by 2027 from USD 19.2 billion in 2022 at a CAGR of 6.9% during the forecast period. The growth in this market is mainly attributed to increasing companion animal population, rising demand for pet insurance, growing animal health expenditure, and the increasing number of veterinary practitioners & their rising income level in developed countries. However, increasing pet care costs are expected to hinder market growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

“Vaccine segment holds largest share in the companion animal health market in 2021”

The companion animal health market is segmented into vaccine, pharmaceuticals (OTC and Prescription), feed additives, diagnostics on the basis of products. The clinical biochemistry segment holds the largest share of the companion animal health market in 2021. Vaccine is an important product used for prevention of infectious and metabolic disorders in small animals.

“Dog segment holds the largest share of by animal type of companion animal health market”

The companion animal health market is segmented into dogs, cats, horses, and other companion animals based on the animal type. Companion animal health for dogs holds the largest share of of this market in 2021. The large share and high growth in this segment is attributed to factors such as the increasing dog population and ownership rate, an increasing prevalence of zoonotic diseases, and increase in adoption of canine pet insurnace in the US.

The veterinary hospitals and clinics holds the largest share of companion animal health market in 2021”

The companion animal health market is segmented into veterinary hospitals & clinics, diagnostic laboratories, research institutes & universities,and home care settings based on the end user type. The veterinary hospitals & clinics segment holds the largest share of of this market in 2021. The large share of this segment can be attributed to a large number of animal as a patient visit in these hospitals and clinics. Rising awareness among pet owners regarding routine and preventive care is further expected to propel market growth.

“North America accounted for the largest share of the companion animal health market in 2021”

The companion animal health market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa based on the region type. North America holds largest share of of the companion animal health market in 2021. The large share of this segment can be attributed to the increasing animal population, growing pet insurance, and rising animal health expenditure in North America. The Asia Pacific region is projected to grow at a CAGR of during the forecast period. Factors such as the rapidly increasing animal population, growing awareness about animal welfare, and the rising prevalence of zoonotic diseases are driving the growth of this regional market.

To know about the assumptions considered for the study, download the pdf brochure

Recent Developments:

- In September 2021, Heska Corporation acquired Biotech Laboratories. This acquisition strengthened the company’s portfolio of Rapid Assay Point of Care Diagnostics.

- In January 2021, this acquisition strengthened the company’s portfolio of point-of-care digital cytology technology and telemedicine services.

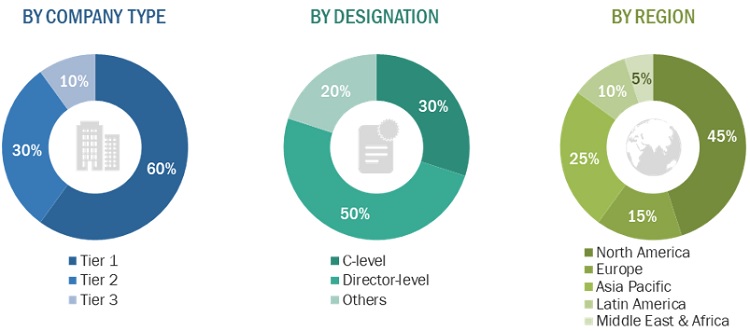

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1–60%, Tier 2–30%, and Tier 3–10%

- By Designation: C-level–30%, Director Level–50%, and Others–20%

- By Region: North America–45%, Europe–15%, Asia Pacific–23%, Latin America- 10%, and Middle East and Africa– 5%

Lits of Companies Profiled in the Report:

- Boehringer Ingelheim International Gmbh

- Zoetis Inc.

- Merck & Co., Inc.

- Elanco Animal Health Incorporated

- Dechra Pharmaceuticals

- Idexx Laboratories, Inc

- Heska Corporation

- Thermo Fisher Scientific Inc.

- Biomérieux SA

- Virbac

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2020–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Unit |

Value (USD Million) |

|

Segments Covered |

By product, animal type, end user, and region |

|

Countries Covered |

|

|

Companies Covered |

Boehringer Ingelheim International Gmbh (Germany), Zoetis, INC. (US), Merck & Co., Inc. (US), Elanco Animal Health Incorporated (US), Dechra Pharmaceuticals (UK), Idexx Laboratories, Inc (US), Heska Corporation (US), Thermo Fisher Scientific Inc. (US), Biomérieux Sa (France), Virbac (France), Vetiquinol (France), and Norbrook Laboratories Limited (Ireland) |

The research report companion animal health market into the following segments and sub-segments:

By Product

- Vaccines

- Pharmaceuticals

- OTC

- Prescription

- Feed Additives

- Diagnostics

- Others

By Animal

- Dog

- Cat

- Horse

- Other Companion Animals

By End User

- Veterinary Clinics and Hospitals

- Diagnostics Laboratories

- Research Institute and Universities

- Home-care Setting

By Country

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Rest of APAC

- Latin America

- Middle East & Africa

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CATEGORY-WISE INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

2.1.2.1 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 KEY INDUSTRY INSIGHTS

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing companion animal population

5.2.1.2 Rising demand for pet insurance and growing animal health expenditure

5.2.1.3 Growing number of veterinary practitioners and their rising income levels in developed countries

5.2.2 RESTRAINTS

5.2.2.1 Rising pet care costs

5.2.3 OPPORTUNITIES

5.2.3.1 Increased use of PCR testing panels to rule out COVID-19 virus in animals

5.2.3.2 Growing demand for rapid tests and portable instruments for point-of-care diagnostic services

5.2.3.3 Use of advanced technologies to improve disease diagnosis accuracy in companion animals

5.2.4 CHALLENGES

5.2.4.1 Shortage of veterinary practitioners in developing countries

5.3 INDUSTRY TRENDS

5.4 REGULATORY ANALYSIS

5.5 ECOSYSTEM ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 TRADE ANALYSIS

5.8 VALUE CHAIN ANALYSIS

5.9 PORTER’S FIVE FORCES ANALYSIS

5.10 PATENT ANALYSIS

5.11 SUPPLY CHAIN ANALYSIS

5.12 PRICING ANALYSIS

5.13 KEY CONFERENCES AND EVENTS (2022-2023)

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

6 COMPANION ANIMAL HEALTH MARKET, BY PRODUCT TYPE, 2020-2027 (USD MILLION)

6.1 INTRODUCTION

6.2 VACCINES

6.3 PHARMACEUTICALS

6.3.1 OTC

6.3.2 PRESCRIPTION

6.4 FEED ADDITIVES

6.5 DIAGNOSTICS

6.6 OTHERS

7 COMPANION ANIMAL HEALTH MARKET, BY ANIMAL TYPE, 2020-2027 (USD MILLION)

7.1 INTRODUCTION

7.2 DOG

7.3 CAT

7.4 HORSE

7.5 OTHER COMPANION ANIMALS

8 COMPANION ANIMAL HEALTH MARKET, BY END USER, 2020-2027 (USD MILLION)

8.1 INTRODUCTION

8.2 VETERINARY HOSPITALS & CLINICS

8.3 DIAGNOSTICS LABORATORIES

8.4 RESEARCH INSTITUTES & UNIVERSITIES

8.5 HOME-CARE SETTINGS

9 COMPANION ANIMAL HEALTH MARKET, BY REGION, 2020-2027 (USD MILLION)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.3 EUROPE

9.3.1 GERMANY

9.3.2 FRANCE

9.3.3 UK

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 REST OF EUROPE (ROE)

9.4 ASIA PACIFIC

9.4.1 JAPAN

9.4.2 CHINA

9.4.3 INDIA

9.4.4 REST OF APAC (ROAPAC)

9.5 LATIN AMERICA

9.6 MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

10.1 INTRODUCTION

10.2 REVENUE SHARE ANALYSIS

10.2.1 REVENUE ANALYSIS FOR KEY PLAYERS IN THE COMPANION ANIMAL HEALTH MARKET

10.3 MARKET SHARE ANALYSIS OF KEY PLAYERS IN COMPANION ANIMAL HEALTH MARKET

10.4 COMETITIVE BENCHMARKING

10.5 COMPANY GEOGRAPHIC FOOTPRINT

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STARS

10.6.2 PERVASIVE PLAYERS

10.6.3 EMERGING LEADERS

10.6.4 PARTICIPANTS

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

10.7.2 DEALS

11 COMPANY PROFILES

(Overview, Products, Financials, Strategy & Development)

11.1 KEY PLAYERS

11.1.1 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

11.1.2 ZOETIS INC.

11.1.3 MERCK & CO., INC.

11.1.4 ELANCO ANIMAL HEALTH INCORPORATED

11.1.5 DECHRA PHARMACEUTICALS

11.1.6 IDEXX LABORATORIES, INC

11.1.7 HESKA CORPORATION

11.1.8 THERMO FISHER SCIENTIFIC INC.

11.1.9 BIOMÉRIEUX SA

11.1.10 VIRBAC

11.2 OTHER PLAYERS

11.2.1 VETOQUINOL

11.2.2 NORBROOK LABORATORIES LIMITED

11.2.3 CEVA SANTE ANIMALE

11.2.4 NEOGEN CORPORATION

11.2.5 FUJIFILM HOLDINGS CORPORATION

11.2.6 INDICAL BIOSCIENCE GMBH

11.2.7 SHENZHEN MINDRAY ANIMAL MEDICAL TECHNOLOGY CO., LTD.

11.2.8 BIONOTE, INC.

11.2.9 SKYLA CORPORATION

11.2.10 EUROIMMUN MEDIZINISCHE LABORDIAGNOSTIKA AG

11.2.11 URIT MEDICAL ELECTRONIC CO., LTD

11.2.12 NOVA BIOMEDICAL

11.2.13 FASSISI GMBH

11.2.14 ALVEDIA

11.2.15 AGROLABO S.P.A

12 APPENDIX

Note:

This ToC is tentative, and the segmentation given may change slightly depending on research findings.

Under the company profiles section Key 15 – 25 companies in the overall global market will be profiled. Details on business overview, products and services, financials, strategy & development might not be captured in case of unlisted companies.

Years considered for the study would be Historical year – 2020, Base Year – 2021, Estimated Year – 2022, Forecast Period – 2022 to 2027

The market tables would include value data in USD for the years 2020, 2021 and forecasted value for 2027 along with CAGR for the period 2022-2027

The market information will be provided in terms of value (USD million) only.

The growth in this market is mainly attributed to the increasing companion animal population, rising demand for pet insurance, growing animal health expenditure, and the increasing number of veterinary practitioners & their rising income level in developed countries. However, increasing pet care costs are expected to hinder market growth to a certain extent.

Methodology

The report presents a detailed assessment of the companion animal health market, along with qualitative inputs and insights from MarketsandMarkets. This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics (such as drivers, restraints, opportunities, and challenges)

The following illustrative figure shows the market research methodology applied in making this report on the companion animal health market.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the companion animal health market. It was also used to obtain important information about the key players, market classification, and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the companion animal health market.

Market Size Estimation

The total size of the companion animal health market was arrived at after data triangulation from two different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the companion animal health businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the companion animal health market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of technologies in the companion animal health market was obtained from secondary data and validated by primary participants to arrive at the total companion animal health market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was conducted using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and the respective growth trends

Approach 2: Geographic adoption trends for individual product segments, by product, and growth prospects for each segment (assumptions and indicative estimates validated from primary interviews)

At each point, assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall companion animal health market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and shares of the leading players in a particular region or country.

Breakdown of Primary Interviews

A breakdown of the primary respondents for companion animal health market (supply side) market is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = To know about the assumptions considered for the study, download the pdf brochure After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process. The market rankings for leading players were ascertained after a detailed assessment of their revenues from the companion animal health business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts. With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:Data Triangulation

Approach to derive the market size and estimate market growth

Objectives of the Study

Available Customizations

Geographic Analysis

Competitive Landscape Assessment

Growth opportunities and latent adjacency in Companion Animal Health Market