Commercial Drone Market by Point Of Sale (OEM, Aftermarket), Systems (Platform, Payload, Datalink, Ground Control Station, Launch & Recovery Systems), Platform (Micro, Small, Medium, Large), Function (Passenger Drones, Inspection & Monitoring Drones, Surveying & Mapping Drones, Spraying & Seeding Drones, Cargo Air Vehicles, Others), End-Use (Agriculture, Insurance, Energy, Mining & Quarrying, Oil & Gas, Tranport, Logistics & Warehousing, Journalism & Media, Arts, Entertainment & Recreation, Healthcare & Social Assistance), MTOW (<25 Kg, 25-170 Kg, >170Kg), Range (Visual Line Of Sight, Extended Visual Line Of Sight, Beyond Visual Line Of Sight) & Region - Global Forecast to 2030

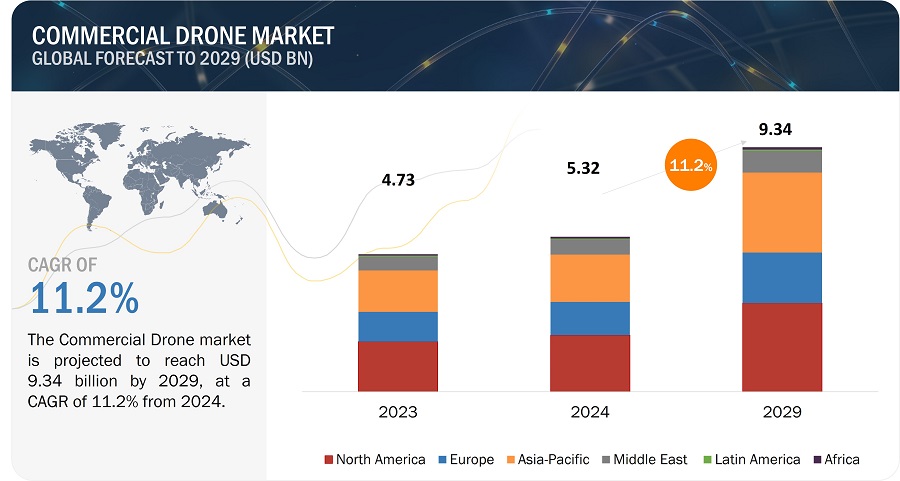

The Commercial Drone market is projected to grow from USD 5.32 billion in 2024 to USD 9.34 Billion by 2030, at a CAGR of 11.2% from 2024 to 2030. Commercial Drones are remotely piloted, optionally piloted, or fully autonomous aerial vehicles that play a significant role in the commercial sectors. They are commonly termed drones and are mostly known for their wide usage in various functions, such as Surveying & Mapping, Inspection & Monitoring among others. These vehicles are also used for mapping, surveying, and determining the weather conditions of a specific area.

Drones are being increasingly adopted in indudstries such as agriculture for crop monitoring, in construction for site inspection, in energy for inspecting power lines among others. The versatility of drones to perform various tasks efficiently is driving their adoption.

As drone technology advances, regulatory bodies globally are proactively shaping clearer and more supportive regulations to facilitate drone operations. This strategic initiative aims to lower operational barriers and enhance safety, thereby accelerating the adoption of drones across various sectors. Enhanced regulatory frameworks are anticipated to unlock significant business opportunities and drive innovation in drone applications.

Commercial Drone Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Commercial Drone Market Dynamics:

Driver: Increased use of drones in deliveries and inspection

Drones are particularly important for inspecting difficult-to-reach locations at certain altitudes or in contaminated surroundings. The use of drones has modernized the telecommunication tower scrutiny as they can be used to carry out supervision of these towers cost-effectively and in less time. Drones can also be employed for aerial evaluation of buildings and other infrastructures, such as pipelines, electric grids, offshore plants, and solar plates. They can use thermal imaging cameras to detect hotspots on solar plates; spots where energy is not spreading evenly. This can enhance the productivity of solar power plants by the instant identification of potentially problematic areas. For instance, the Lockheed Martin Procerus Technologies Indago quadrotor can be used for inspections near energy generation plants.

Drones can be used to deliver medical supplies in difficult terrains. Drones are considered the future of the last-mile delivery for consumer supplies since they will reduce cost per delivery, along with delivery time. As the wages of delivery persons persist to rise, autonomous delivery or human-less services will become gradually advantageous, especially in developed countries.

Restraint: High infrastructure costs and lack of skilled personnel for operating drones

Emerging economies lack access to roads, and this hampers speedy delivery of basic medical supplies such as blood, medicines, vaccines, drugs, etc. Air transportation of these supplies is costly. The success of drones in the fields of ecology and environment creates a trust factor that they can also be utilized in public health, especially to deliver medical couriers. The crucial aspect of using drones is that they reduce the travel time for diagnosis and treatment. Drones are a cost-effective replacement for road transportation in challenging terrains. Drones can be used in disaster relief processes for saving victims and delivering food, water, etc., to survivors and rescue teams. However, the lack of trained staff for operating drones and infrastructures such as runways is a prospective problem. For instance, the absence of regulations in Africa is compounded by the shortage of licensed drone pilot schools and licensing centers. The schools and the centers that are open in the continent presently and are approved by the concerned national civil aviation authority are restricted to South Africa. Therefore, the absence of accredited drone pilot training centers, the non-recognition of drone pilot licenses across borders of different countries, and the lack of coordination related to current regulations can pose key challenges to the growth of the drone-based service business across the world. The tolerance of drones to unfavorable environmental conditions such as wind and turbulence is yet to be evaluated completely. Electromagnetic interference can cause disturbances to signal receptions of drones from the ground.

Opportunity: Growing use in providing wireless coverage

Commercial drones can be provided wireless coverage during emergency cases where each drone serves as a aerial wireless base station when the cellular network goes down. They can also be used to supplement the ground base station to provide better coverage and higher data rates for users. Drones can also assit various terrestrial networks , such as device-to-device and vehicular networks. For instance, due to their mobility and LOS Communications, drones can facilitate rapid formation dissemination among ground device. Furthermore, drones can potentially improve the reliability of wireless links in D2D and vehicle-to-vehicle (V2V) communications while exploiting transmit diversity. Flying drones can help broadcast common information to ground devices, thereby reducing interferences in ground networks by decreasing the number of transmissions between devices.

Challenge: Consumer acceptance and health issues caused by noise from drone

Consumer acceptance plays an important role in the adoption of commercial drones. The use of drones for commercial applications by retailers globally is still in the nascent stage, while in some countries, such as Pakistan, they are still to witness acceptance. Moreover, concerns among consumers about the efficient delivery of parcels by drones, chances of their theft, and probability of damages to them due to weather conditions also act as challenges for the adoption of drones. Service providers and manufacturers of drones witness potential risks of losing parcels owing to the absence of insurance coverage for parcels. Commercial airline and general aviation accidents are hard to foresee even after using the most advanced modeling tools, though insurers at least come up with good premium calculations to cover up for losses each year. However, in case of commercial drone, there is little data for making similar predictions. Most models of drones are new, and thus, insurers have a limited understanding of the features that could impact the prospect of an accident or system failure. This makes it necessary for the service providers and manufacturers of drones to work closely with regulatory authorities to ensure that drones are used responsibly.

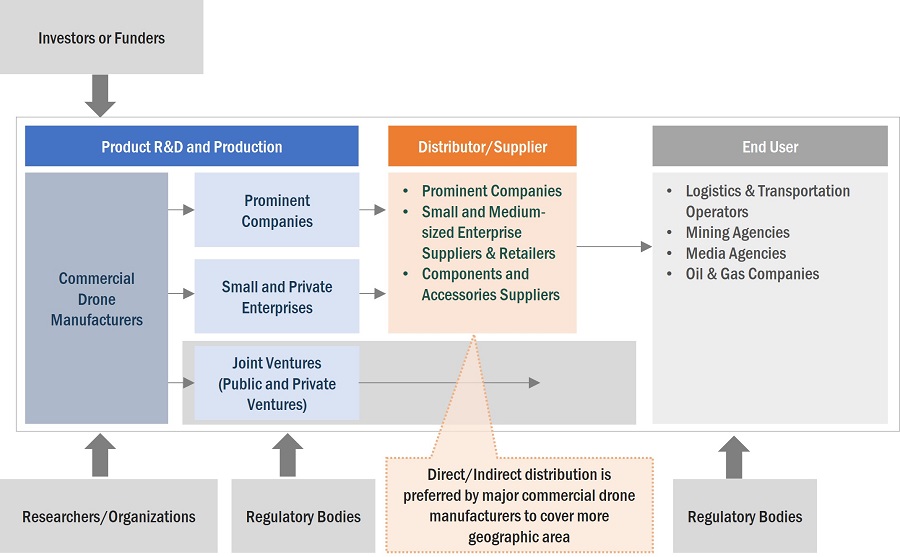

Ecosystem Map: Commercial Drone Market

Based on End Use, the Transport, Logistics and Warehousing segment is anticipated to record the highest growth rate during the forecast period

By End Use, the Commercial Drone market has been segmented into logistics & transportation, agriculture, energy & power, construction & mining, media & entertainment, insurance, wildlife & forestry, academics & research. Logistics & Transportation segment is estimated to record the highest CAGR during the forecast period with the significant growth of the global e-commerce sector, postal companies are opting for new methods to modify their traditional delivery business models. With several countries focusing on the use of commercial drones for postal deliveries, the commercial drone market will witness growth. The US Postal Service is exploring the possibility of introducing commercial drone into its vehicle fleets to advance mail delivery operations and support its collection of geospatial, sensor, image, and other data. Companies such as DJI (China) are actively developing solutions for Drone-based package delivery. Amazon (US) has already developed these services. Lower cost, density of urban environments, and the rising demand for reduced delivery times are contributing to the growth of this segment

Based on Function, the Passenger Drone segment is estimated to register large share in the base year

Based on function, the Commercial Drone market has been segmented into passenger drones, inspection & monitoring drones, surveying & mapping drones, spraying & seeding drones, cargo air vehicles, and others. Passenger Drone segment is projected to record the highest growth during the forecast period with emergence of dronee taxis as convienent means of aerial transportation of passsenger at high speed.

Based on Operational Mode, the Fully Autonomous segment is estimated to register highest CAGR during the forecast period

Based on operational mode, the commercial drone market has been classified into remotely piloted, optionally piloted, and fully autonomous. The remotely piloted segment is projected to grow at a significant rate during the forecast period, driven by the cost-effective usage of remotely piloted UAVs in several applications ranging from defense operations to surveys. Fully autonomous drones significantly enhance operational efficiency and reduce costs across various end use such as agriculture, transport, logistics & warehousing, and Oil & Gas.

The Asia Pacific region is projected to be high growth potential markets for the Commerical Drone market during the forecast period.

Rising number of drone manufacturers in China and India and increased procurement of military drones in Asia Pacific is the lea China held the leading share in the Asia Pacific Commercial Drone Market during 2023. China is one of the prime manufacturers of drones globally. Surge in E-Commerce, which demand faster delivery times and innovative logistics solutions have boosted the demand for the drones which offers a rapid delivery service

Major players in the Commercial Drone market are DJI (China), Parrot Drone SAS (France), EHANG Holdings Limited (China), Aerovironment, Inc. (US), The Boeing Company (US)

Commercial Drone Market by Region

To know about the assumptions 11565470 for the study, download the pdf brochure

Key Market Players

The major players in the Commercial Drone market are DJI (China), Parrot Drone SAS (France), EHANG Holdings Limited (China), Aerovironment, Inc. (US), The Boeing Company (US). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the Commercial Drone market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Point of Sale, By Systems, By Platform, By End Use, By Function, By Application, By Type, By Mode of Operation, MTOW, Range and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East, Latin America, and Africa |

|

Companies covered |

DJI (China), Parrot Drone SAS (France), EHANG Holdings Limited (China), Aerovironment, Inc. (US), The Boeing Company (US) |

This research report categorizes the Commercial drone market based on Point of sale, systems, platform, type, mode of operation, end use, MTOW, range, and region

By Point of Sale

- OEM

- Aftermarket

By Systems

- Platform

- Payload

- Datalink

- Ground Control Station

- Launch & Recovery System

By Platform

- Micro

- Small

- Medium

- Large

By Type

- Fixed Wing

- Rotary Wing

- Hybrid

By Mode of Operation

- Remotely Piloted

- Optionally Piloted

- Fully Autonomous

By Function

- Passenger Drones

- Inspection & Monitoring Drones

- Surveying & Mapping Drones

- Spraying & Seeding Drones

- Cargo Air Vehicles

- Others

By End-Use

- Agriculture

- Insurance

- Energy

- Mining & Quarrying

- O&G

- Transport, Logistics & Warehousing

- Journalism & Media

- Arts, Entertainment & Recreation

- Healthcare & Social Assistance

By Mtow

- <25 KG

- 25-170 KG

- >170 KG

By Range

- Visual Line Of Sight

- Extended Visual Line Of Sight

- Beyond Visual Line Of Sight

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Recent Developments

- In December 2023, JOUAV introduced the PH-20, an upgrade to its heavy-lift multi-rotor drone, formerly known as the PH-25. The revamped model promises a leap forward in performance, flexibility, and reliability, catering to diverse applications

- In July 2023, SZ DJI Technology Co., Ltd. launched DJI Air 3, a new powerful drone. It is in addition to Air Series with dual primary cameras. Featuring a wide-angle camera and a 3X medium tele camera, it empowers more users to get a sense of compression in teir shots

- In March 2022, DJI launched DJI RS 3 and DJI RS 3 Pro, which incorporate a range of new features to get filmmakers up and running as quickly as possible. A redesigned axes-locking system means that the process is now automated. By simply turning on the gimbal, the automated axis locks release and unfold the gimbal, allowing the operator to get started in seconds.

- In June 2021, EHang Holdings Limited conducted a test flight of its first passenger-grade autonomous aircraft for permission to fly in open airspace in Japan. It acquired a preliminary flight grant from the Ministry of Land, Infrastructure, Transport, and Tourism of Japan (MLIT) with a local partner.

Frequently Asked Questions (FAQ):

What is the current size of the Commercial Drone market?

The Commercial Drone market is projected to grow from USD 26.2 billion in 2022 to USD 38.3 Billion by 2027, at a CAGR of 7.9% from 2022 to 2027.

Who are the winners in the Commercial Drone market?

DJI (China), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Israel Aerospace Industry Ltd. (Israel), and General Atomics Aeronautical Systems (GA-ASI) (US) .

What are some of the technological advancements in the market?

- Network functions virtualization (NFV) is a network architecture concept that leverages IT virtualization technologies to virtualize entire classes of network node functions into building blocks that may connect or chain together to create and deliver communication services. NFV reduces the need for deploying specific network devices for the integration of UAVs.

- Manned-Unmanned Teaming (MUM-T) is revolutionizing mission autonomy. Combining manned and unmanned autonomous vehicles enhances mission effectiveness through greater situational awareness and decision-making capabilities

What are the factors driving the growth of the market?

The use of drones is growing rapidly across many civil application domains, including real-time monitoring, providing wireless coverage, remote sensing, search & rescue, delivery of goods, security & surveillance, precision agriculture, and civil infrastructure inspection

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

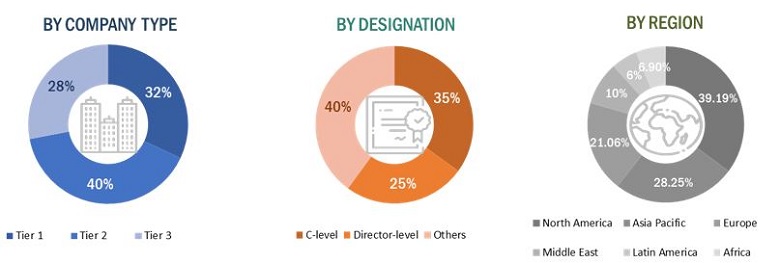

This research study on the commercial drone market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the Commerical drone market as well as assess its growth prospects.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and component research papers.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to platform, solution, technologies, and regions. Stakeholders from the demand side include logistics companies, construction & minining companies, and healthcare industry, who are willing to adopt drone by participating in various trials. These interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the point of sale, systems, platform, function, end use, type, mode of operation, MTOW, range segment of the market for six key regions.

To know about the assumptions considered for the study, download the pdf brochure

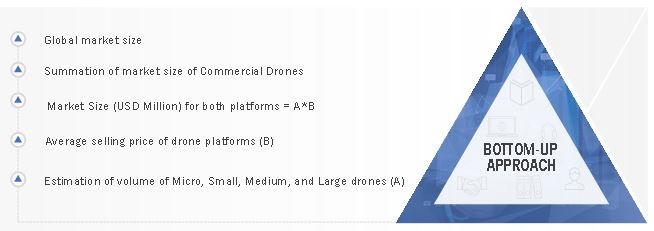

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of Commerical drone market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top- Down Approach

Data Triangulation

After arriving at the overall size of the Commercial drone market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the Commercial drone market based on point of sale, systems, platform, end use, type, mode of operation, MTOW, range and region

- To forecast sizes of various segments of the Commercial drone market with respect to 6 major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Commercial drone market across the globe

- To identify industry trends, market trends, and technology trends that are currently prevailing in the Commercial drone market

- To provide an overview of the tariff and regulatory landscape with respect to the drone regulations across regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new service launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the Commercial drone market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Commercial Drone Market