Commerce Cloud Market by Component (Platforms and Services), Organization Size, Application (Electronics, Furniture, and Bookstores, Grocery and Pharmaceutical, Automotive, and Fashion and Apparel), and Region - Global Forecast 2024

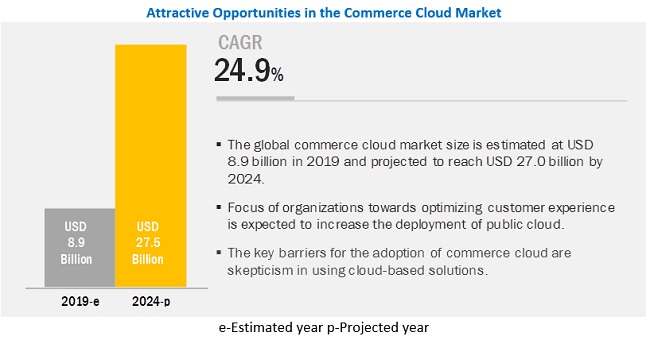

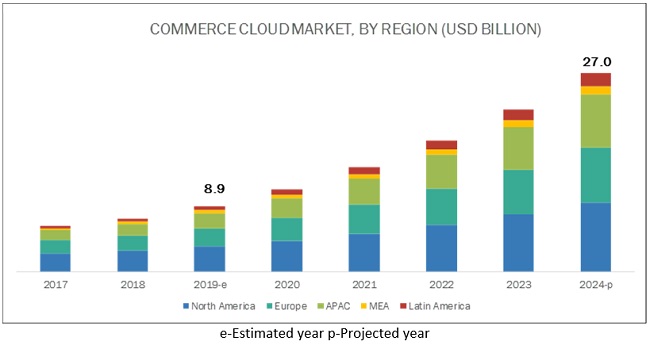

[117 Pages Report] The global commerce cloud market size was valued USD 8.9 billion in 2019 and is expected to reach USD 27.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 24.9% during the forecast period. Currently, many advantages, including increased flexibility and performance, and reduced time and cost, are achieved by commerce cloud deployments. An increasing number of businesses moving online is expected to provide huge opportunities in the market. Traditional players, along with new entrants in the market, are developing new products to tap into the emerging market

By component, the platform segment to be a larger contributor during the forecast period

The commerce cloud platforms provide an enhanced consumer experience across channels, such as mobile, social media, website, and offline stores. It enables a single shared view of customer activity, inventory, products, and promotions that reduce the time needed to synchronize distinct data sources. Moreover, commerce cloud provides capabilities, such as an open development environment. These capabilities aid retail providers in simplified customizations and extended commerce. Moreover, features such as product recommendations, generation of one-to-one predictions, and data-driven commerce insights provide immense opportunities for the commerce cloud market.

By application, the grocery and pharmaceutical segment to be a larger contributor during the forecast period

The Fast Moving Consumer Goods (FMCG) sector has moved to the direct to consumer business model in recent years. People prefer buying their groceries from the comfort of their homes. There is high competition between various online grocery stores present in the market. They try to attract new customers by means of discounts and promotions. In the FMCG sector, goods are being purchased more frequently by the customers. Commerce cloud solutions help to integrate various stakeholders involved in the overall groceries retail process and help in providing a positive buying experience for the shopper. The online pharmaceutical industry has gained traction in the last couple of years. This segment is one of the fastest-growing in the Asia Pacific (APAC) region. Commerce cloud solutions catering to the pharmaceutical sector help companies achieve regulatory compliance, manage product restrictions, and maintain traceability.

North America to have the largest the market share during the forecast period

North America is expected to be the largest contributor among all the regions, owing to its adoption of commerce cloud platforms and solutions by enterprises. The top countries in the North American region, contributing to the growth of the commerce cloud market, include the US and Canada. The enterprises present in various countries of this region, especially in the US, have leveraged Artificial Intelligence (AI), Machine Learning (ML), and deep learning technologies as a part of their ongoing business process to stay competitive in the market. North American countries have a well-established economy, which enables commerce cloud vendors to invest in new technologies. Furthermore, the region is regarded as the center of innovation where Information Technology (IT) giants are rolling out new offerings, and aggressive collaborations are taking place pertaining to the market.

Key Market Players

IBM (US), SAP (Germany), Salesforce (US), Apttus (US), Episerver (US), Oracle (US), Magento (US), Shopify (Canada), BigCommerce (US), and Digital River (US), Elastic Path (Canada), VTEX (Brazil), commercetools (Germany), Kibo (US), and Sitecore (India).

Please visit 360Quadrants to see the vendor listing of Best eCommerce Platforms Quadrant

IBM (US) is a leading provider of commerce cloud solutions. The company uses organic and inorganic growth strategies to improve its market share and increase its annual revenue. IBM offers end-to-end cloud integration services and assisting enterprises to migrate, integrate, and manage applications, workloads, and secure cloud environment. With the aim to increase its footprint, IBM adopts inorganic strategies, which include acquisitions and partnerships with companies that would help IBM strengthen its position in the commerce cloud market space and increase the company’s customer base. For instance, in November 2017, IBM acquired Vivant Digital Business, an Australian boutique digital and innovation agency. With this acquisition, IBM addressed the growing needs of clients seeking transformation via digital reinvention. While in January 2018, IBM entered into a strategic partnership with Salesforce, a global Customer Relation Management (CRM) leader. The partnership integrates IBM Cloud and Watson services with Salesforce Quip and Salesforce Service Cloud Einstein; this enables them to connect with customers and collaborate effectively with deeper insights.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Component, Organization Size, Application ,Platform, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America |

|

Companies covered |

IBM (US), SAP (Germany), Salesforce (US), Apttus (US), Episerver (US), Oracle (US), Magento (US), Shopify (Canada), BigCommerce (US), and Digital River (US), Elastic Path (Canada), VTEX (Brazil), commercetools (Germany), Kibo (US), and Sitecore (India) |

The research report categorizes the commerce cloud market to forecast the revenues and analyze the trends in each of the following subsegments:

Commerce Cloud Market By Component

- Platform

- B2B

- B2C

- Services

- Training and Consulting

- Integration and Deployment

- Support and Maintenance

By Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Electronics, Furniture, and Bookstores

- Grocery and Pharmaceutical

- Automotive

- Fashion and Apparel

- Quick Service Restaurants

- Travel and Hospitality

- Beauty and Cosmetics

By region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific (APAC)

- China

- South Korea

- Japan

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- KSA

- UAE

- South Africa

- Rest of MEA

Recent Developments

- In January 2019, Salesforce enhanced its Commerce Cloud by introducing a platform tool for embedding smart, personalized, and connected shopping experience. The tool enables to bring AI, visual search, and inventory availability service for enhancing commerce experience.

Critical Questions Addressed by the Report:

- Where will all these developments take the industry in the mid to long-term?

- What are the upcoming applications for the commerce cloud market?

- Which segment provides the most opportunity for growth?

- Which are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

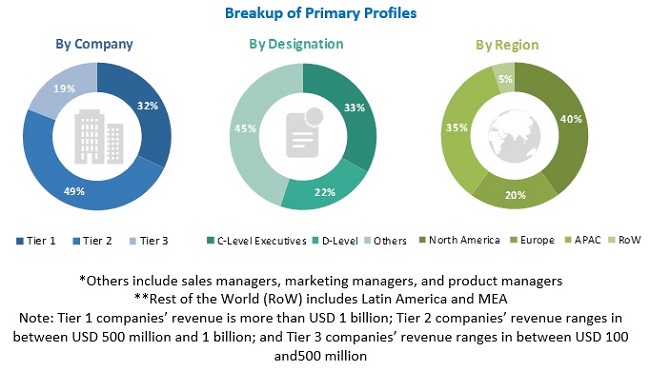

2.1.2.1 Breakup of Primaries’ Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down and Bottom-Up Approaches

2.4 Market Forecast

2.5 Competitive Leadership Mapping Research Methodology

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Growth Opportunities in the Commerce Cloud Market

4.2 Market By Component, 2019

4.3 Market By Service, 2019

4.4 Market By Application, 2019

4.5 Market Investment Scenario, 2019–2024

5 Market Overview and Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Focus of Organizations Toward Optimizing Customer Experience

5.2.1.2 Need to Optimize Operational Efficiencies

5.2.2 Restraints

5.2.2.1 Skepticism in Using Cloud-Based Solutions

5.2.3 Opportunities

5.2.3.1 Growing Instances of Businesses Moving Online

5.2.3.2 Increasing Need to Manage Multiple Storefronts

5.2.4 Challenges

5.2.4.1 Difficulty in Choosing the Right Solution

5.3 Standards and Guidelines for the Commerce Cloud Market

5.3.1 Payment Card Industry Data Security Standard

5.3.2 Health Insurance Portability and Accountability Act

5.3.3 Federal Information Security Management Act

5.3.4 PCI Pin Transaction Security Requirements

5.3.5 International Organization for Standardization 10536

5.3.6 International Standards Organizations 14443

5.3.7 Distributed Management Task Force Standards

5.3.8 Organization for the Advancement of Structured Information Standards

6 Commerce Cloud Market By Component (Page No. - 35)

6.1 Introduction

6.2 Platforms

6.2.1 Business-To-Business

6.2.1.1 Business-To-Business Commerce Cloud to Cater to the Complex Purchasing Needs of Business-To-Business Customers

6.2.2 Business-To-Customer

6.2.2.1 Business-To-Customer Commerce Cloud to Provide a Unified Experience for Customers Shopping on Online or Brick-And-Mortar Stores

6.3 Services

6.3.1 Training and Consulting

6.3.1.1 Focus on Selecting the Right Commerce Cloud Solution to Drive the Adoption of Training and Consulting Services

6.3.2 Integration and Deployment

6.3.2.1 Growing Need to Seamlessly Integrate Native Enterprise Applications With Commerce Cloud Solutions to Drive the Integration and Deployment Services

6.3.3 Support and Maintenance

6.3.3.1 Focus on the Smooth Functioning of Online Business to Drive the Adoption of Commerce Cloud Support and Maintenance Services

7 Commerce Cloud Market By Organization Size (Page No. - 42)

7.1 Introduction

7.2 Small and Medium-Sized Businesses

7.2.1 Growing Potential of Commerce Cloud to Drive the Adoption By Small and Medium-Sized Businesses

7.3 Large Enterprises

7.3.1 Large Enterprises to Deploy Commerce Cloud Platforms to Effectively Execute Trading Strategies

8 Commerce Cloud Market By Application (Page No. - 46)

8.1 Introduction

8.2 Electronics, Furniture, and Bookstores

8.2.1 Growing Need for Reliable and Robust Ecommerce Platform to Drive the Adoption of Commerce Cloud Platforms

8.3 Grocery and Pharmaceutical

8.3.1 Ease in Integrating Various Stakeholders in a Supply Chain to Drive the Adoption of Commerce Cloud

8.4 Automotive

8.4.1 Ability to Ease Inventory Management to Boost the Adoption of Commerce Cloud in the Automotive Sector

8.5 Fashion and Apparel

8.5.1 Ability to Reach Out to a Larger Clientele to Drive the Adoption of Commerce Cloud in Fashion and Apparel Industry

8.6 Quick Service Restaurants

8.6.1 Commerce Cloud to Provide a Competitive Advantage By Catering to Specific and Unique Functional Requirements of Quick Service Restaurants

8.7 Travel and Hospitality

8.7.1 Commerce Cloud Solutions Cater to the Seasonal Demand for Travel and Hospitality and Enable Reduced Capital and Operational Expenditure

8.8 Beauty and Cosmetics

8.8.1 Commerce Cloud to Enhance the Consumer Experience By Providing Personalized Product Suggestions Based on Consumer Demographics, Location, and Lifestyle

9 Commerce Cloud Market By Region (Page No. - 55)

9.1 Introduction

9.2 North America

9.2.1 United States

9.2.1.1 Growing Integration of AI With Commerce Cloud to Fuel the Demand for Commerce Cloud in the US

9.2.2 Canada

9.2.2.1 Increase in AI-Based Investments and Research Activities to Drive the Market in Canada

9.3 Europe

9.3.1 United Kingdom

9.3.1.1 Growing Demand for Commerce Cloud Platforms and Solutions to Create Seamless Experience in the UK

9.3.2 Germany

9.3.2.1 Increasing Adoption of Commerce Cloud Solutions to Drive the Market in Germany

9.3.3 France

9.3.3.1 Heavy Capital Inflow From Various Investors to Drive the Market in France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Commerce Cloud Helps Brands to Understand Their Customers’ Behaviour at Every Stage

9.4.2 Japan

9.4.2.1 Systematic Approach Toward Commerce Cloud Help Commerce Cloud Platforms and Solutions Providers Enhance Customer Experience in Japan

9.4.3 South Korea

9.4.3.1 Increasing Investments for Developing It Infrastructure to Result in Driving the Market in South Korea

9.4.4 Rest of Asia Pacific

9.5 Middle East and Africa

9.5.1 United Arab Emirates

9.5.1.1 Commerce Cloud Platforms and Solutions are Utilized to Generate More Awareness About Products and Services Among the Customers

9.5.2 Kingdom of Saudi Arabia

9.5.2.1 Business Centers With Dynamic and Diversified Economy to Lead the Growth of the Market

9.5.3 South Africa

9.5.3.1 Number of Digital Initiatives and use of Advanced Digital Technologies to Increase in South Africa

9.5.4 Rest of Middle East and Africa

9.6 Latin America

9.6.1 Brazil

9.6.1.1 Brazil to Witness a Higher Growth Rate in the Commerce Cloud Market in Coming Years

9.6.2 Mexico

9.6.2.1 Growing Steps Toward Adopting Commerce Cloud Platforms in Mexico to Enhance Customer Experience

9.6.3 Rest of Latin America

10 Competitive Landscape (Page No. - 76)

10.1 Overview

10.2 Competitive Scenario

10.2.1 New Product/Solution Launches and Product Enhancements

10.2.2 Business Expansions

10.2.3 Acquisitions

10.2.4 Partnerships and Agreements

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

11 Company Profiles (Page No. - 83)

11.1 Introduction

(Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.2 IBM

11.3 SAP

11.4 Salesforce

11.5 Apttus

11.6 Episerver

11.7 Oracle

11.8 Magento

11.9 Shopify

11.10 BigCommerce

11.11 Digital River

11.12 Elastic Path

11.13 VTEX

11.14 Commercetools

11.15 Kibo

11.16 Sitecore

*Details on Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 109)

12.1 Experts Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (55 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Factor Analysis

Table 3 Commerce Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 4 Business-To-Business Market Size, By Region, 2017–2024 (USD Million)

Table 5 Business-To-Customer Market Size, By Region, 2017–2024 (USD Million)

Table 6 Market Size By Service, 2017–2024 (USD Million)

Table 7 Training and Consulting Market Size, By Region, 2017–2024 (USD Million)

Table 8 Integration and Deployment Market Size, By Region, 2017–2024 (USD Million)

Table 9 Support and Maintenance Market Size, By Region, 2017–2024 (USD Million)

Table 10 Market Size By Organization Size, 2017–2024 (USD Million)

Table 11 Small and Medium-Sized Businesses: Market Size By Region, 2017–2024 (USD Million)

Table 12 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 13 Commerce Cloud Market Size, By Application, 2017–2024 (USD Million)

Table 14 Electronics, Furniture, and Bookstores: Market Size By Region, 2017–2024 (USD Million)

Table 15 Grocery and Pharmaceutical: Market Size By Region, 2017–2024 (USD Million)

Table 16 Automotive: Market Size By Region, 2017–2024 (USD Million)

Table 17 Fashion and Apparel: Market Size By Region, 2017–2024 (USD Million)

Table 18 Quick Service Restaurants: Market Size By Region, 2017–2024 (USD Million)

Table 19 Travel and Hospitality: Market Size By Region, 2017–2024 (USD Million)

Table 20 Beauty and Cosmetics: Market Size By Region, 2017–2024 (USD Million)

Table 21 Commerce Cloud Market Size, By Region, 2017–2024 (USD Million)

Table 22 North America: Market Size By Component, 2017–2024 (USD Million)

Table 23 North America: Market Size By Platform, 2017–2024 (USD Million)

Table 24 North America: Market Size By Service, 2017–2024 (USD Million)

Table 25 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 26 North America: Market Size By Application, 2017–2024 (USD Million)

Table 27 North America: Market Size By Country, 2017–2024 (USD Million)

Table 28 Europe: Commerce Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 29 Europe: Market Size By Platform, 2017–2024 (USD Million)

Table 30 Europe: Market Size By Service, 2017–2024 (USD Million)

Table 31 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 32 Europe: Market Size By Application, 2017–2024 (USD Million)

Table 33 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 34 Asia Pacific: Commerce Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 35 Asia Pacific: Market Size By Platform, 2017–2024 (USD Million)

Table 36 Asia Pacific: Market Size By Service, 2017–2024 (USD Million)

Table 37 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 38 Asia Pacific: Market Size By Application, 2017–2024 (USD Million)

Table 39 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 40 Middle East and Africa: Commerce Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 41 Middle East and Africa: Market Size By Platform, 2017–2024 (USD Million)

Table 42 Middle East and Africa: Market Size By Service, 2017–2024 (USD Million)

Table 43 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 44 Middle East and Africa: Market Size By Application, 2017–2024 (USD Million)

Table 45 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 46 Latin America: Commerce Cloud Market Size, By Component, 2017–2024 (USD Million)

Table 47 Latin America: Market Size By Platform, 2017–2024 (USD Million)

Table 48 Latin America: Market Size By Service, 2017–2024 (USD Million)

Table 49 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 50 Latin America: Market Size By Application, 2017–2024 (USD Million)

Table 51 Latin America: Market Size By Country, 2017–2024 (USD Million)

Table 52 New Product/Solution Launches and Product Enhancements, 2017–2019

Table 53 Business Expansions, 2017–2019

Table 54 Acquisitions, 2017–2019

Table 55 Partnerships and Agreements, 2017–2019

List of Figures (33 Figures)

Figure 1 Commerce Cloud Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Commerce Cloud Microquadrant: Criteria Weightage

Figure 4 Global Commerce Cloud Market Size, 2017–2024 (USD Million)

Figure 5 Segments With the Highest CAGR in the Market

Figure 6 North America to Account for the Highest Market Share in 2019

Figure 7 Various Benefits of Commerce Cloud to Drive Its Adoption Among Companies Across Applications

Figure 8 Platforms Segment to Have a Higher Market Share in 2019

Figure 9 Training and Consulting Services to Hold the Largest Market Size in 2019

Figure 10 Grocery and Pharmaceutical Application to Hold the Largest Market Size in 2019

Figure 11 Asia Pacific to Emerge as the Best Market for Investment Over the Next 5 Years

Figure 12 Drivers, Restraints, Opportunities, and Challenges: Commerce Cloud Market

Figure 13 Services Segment to Record a Higher CAGR During the Forecast Period

Figure 14 Business-To-Business Segment to Record a Higher CAGR During the Forecast Period

Figure 15 Support and Maintenance Segment to Grow at the Highest CAGR During the Forecast Period

Figure 16 Small and Medium-Sized Businesses to Grow at a Higher CAGR During the Forecast Period

Figure 17 Beauty and Cosmetics Segment to Grow at the Highest CAGR During the Forecast Period

Figure 18 North America to Hold the Largest Market Size During the Forecast Period

Figure 19 South Korea to Register the Highest CAGR During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Key Developments By the Leading Players in the Commerce Cloud Market, 2017–2019

Figure 23 Commerce Cloud Market (Global), Competitive Leadership Mapping, 2018

Figure 24 IBM: Company Snapshot

Figure 25 IBM: SWOT Analysis

Figure 26 SAP: Company Snapshot

Figure 27 SAP: SWOT Analysis

Figure 28 Salesforce: Company Snapshot

Figure 29 Salesforce: SWOT Analysis

Figure 30 Oracle: Company Snapshot

Figure 31 Oracle: SWOT Analysis

Figure 32 Magento: SWOT Analysis

Figure 33 Shopify: Company Snapshot

The study involved four major activities to estimate the current market size of the commerce cloud market. An exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

The market size for the companies offering commerce cloud solutions and services was arrived at on the basis of the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of the major companies in the ecosystem and rating them according to their performance and quality. In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for making this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the commerce cloud market.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), an extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; competitive landscape of commerce cloud solution and service providers; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key players’ strategies.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Commerce Cloud Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the commerce cloud market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the commerce cloud market.

Report Objectives

- To define, segment, and project the global market size of the market

- To understand the structure of the commerce cloud market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements, in the commerce cloud market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Growth opportunities and latent adjacency in Commerce Cloud Market

Could you Please share market trends and outlook on supply chain?