Combustion Controls, Equipments & Systems Market - By Product [Components (Boilers, Thermal Oxidizers, Incinerators, Gas Turbines), Systems, Monitoring & Control Instruments], Application & Geography (2013 - 2018)

Continuous industrial expansion and the ever increasing demand for electricity have created the need for greater number of power generation facilities across the world. This demand is more prominent in emerging economies that are currently undergoing industrial expansion on a very large scale. The large power generation industry of the APAC region is expected to drive the global market for combustion equipment, controls & systems. China and India, in their respective ongoing five-year plans, have planned to invest heavily on growing their power generation capacities. They are already one of the largest markets of boilers in the world. The government and independent power producers in the Asian region are making significant investments in power plants. Most of the industry giants are targeting APAC and are taking initiatives to gain access to this market. For instance, recently, Alstom signed a long term agreement with Harbin Turbine Corporation of China to license the manufacturing, assembly, and sale of its gas turbine in the country through HTC. The agreement has opened doors for Alstom to address the high potential Chinese market. Similarly, Doosan acquired a local Indian manufacturer, recently, as part of its efforts to penetrate into the Indian power plant market. With India planning to construct around 20 GW of power plants worth $20 billion every year until 2017, abundant opportunities exist for the foreign players to address the needs of the power generation market in this region. The growing resistance against nuclear power has also contributed, significantly, towards the growth of this market, as countries such as Germany and Switzerland have decided to gradually phase out their nuclear power plants.

The shale gas revolution, which started in the U.S. in 2010, has soon become a global phenomenon with a much wider impact on world energy markets. Major reserves of shale gas have been found in Poland and Argentina. China, in its first five year plan for the development of shale gas, plans to extract more than 6 million cubic meters of shale gas by 2015, and 10 times more by 2020. The country’s resource ministry claims that the country has explorable shale gas reserves of 25.1 trillion cubic meters. Another country with huge shale gas development potential is Argentina. Gas fired power plants and gas turbine markets are expected to largely benefit from this boom over the coming years. The extent of shale gas revolution in the U.S. energy market is so much that it has started threatening the market for renewable and nuclear energy. Moreover, gas turbine power plants are cheaper and faster to build, and have lower emissions, which give them an additional advantage over others. Emission regulations would also accelerate the switching from coal to natural gas. Recent months saw the cancellation of a $24 billion nuclear project in central Florida by Duke Energy (U.S.), as the competition from the low-cost gas could not be matched by nuclear energy. In another event, EDF (France) pulled out of nuclear production in the U.S. as shale gas had reshaped the complete landscape of electric power in the region. The level of competition in the gas turbine industry has grown to such an extent that Siemens decided to invest $1.3 billion in expanding its gas turbine production to shake the firm grip of GE in this segment.

The combustion equipment controls & systems market segmentation revolves around three major verticals: product, application & geography. Each of the vertical is further segmented into individual sub-segments. The product segment covers components, instruments, and monitoring & control instruments. The various components covered in this report are boilers, thermal oxidizers, incinerators, and gas turbines. The systems include process management systems such as burner management systems and boiler control systems; and emission control systems such as fabric filters, electrostatic precipitators, and Flue Gas Desulphurization (FGD) systems. The various monitoring & control instruments covered in the report are actuators and valves, gas turbine inlet air filters, flow meters, combustion analyzers, and sensors (pressure, temperature and level sensors). The application segment covers all major applications such as process industries, metallurgy, cement industry, refining & petrochemicals, energy & power, and aerospace & marine. Incinerators have been segmented differently, based on the feedstock such as municipal waste, industrial waste, sewage sludge, and clinical/biohazardous waste. The geography vertical is segmented into North America, Europe, APAC, and ROW.

Continuous industrial expansion and the ever increasing demand for electricity have created the need for greater number of power generation facilities across the world. This demand is more prominent in emerging economies that are currently undergoing industrial expansion on a very large scale. The large power generation industry of the APAC region is expected to drive the global market for combustion controls, equipment & systems. China and India, in their respective ongoing five-year plans, have planned to invest heavily on growing their power generation capacities. They are already one of the largest markets of boilers in the world. In the U.S., the shale revolution has had a wide impact on the energy market; and has lead to the construction of several gas turbines based combined cycle power plants for co-generation. This global boom in the availability of shale gas has started threatening the renewable and nuclear energy markets as well.

The growing resistance against nuclear power has also contributed, significantly, towards the growth of this market, as countries such as Germany and Switzerland have decided to gradually phase out their nuclear power plants. The concerns raised towards the VOC and HAP emissions, and the revised emission norms, have been driving the emission control system market for quite some time, now. China is expected to be a major market for these systems, during the forecast period.

The market segmentation revolves around three major verticals: product, application & geography. Each of the vertical is further segmented into individual sub-segments. The product segment covers components, instruments, and monitoring & control instruments. The various components covered in this report are boilers, thermal oxidizers, incinerators, and gas turbines. The systems include process management systems such as burner management systems and boiler control systems; and emission control systems such as fabric filters, electrostatic precipitators, and Flue Gas Desulphurization (FGD) systems. The various monitoring & control instruments covered in the report are actuators and valves, gas turbine inlet air filters, flow meters, combustion analyzers, and sensors (pressure, temperature and level sensors). The application segment covers all major applications such as process industries, metallurgy, cement industry, refining & petrochemicals, energy & power, and aerospace & marine. Incinerators have been segmented differently, based on the feedstock such as municipal waste, industrial waste, sewage sludge, and clinical/biohazardous waste. The geography vertical is segmented into North America, Europe, APAC, and ROW.

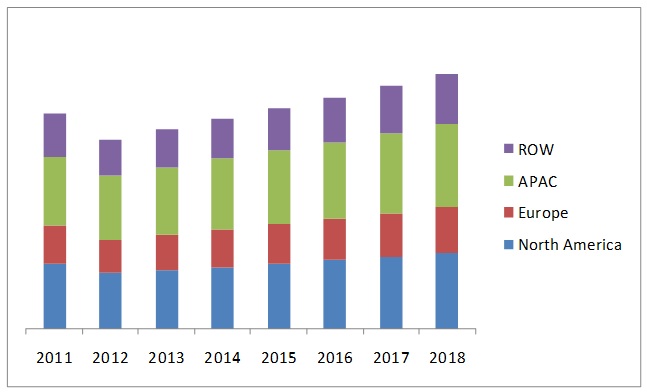

The following bar chart gives an overview of regional splits for the total combustion controls market. The data analysis is done from 2011 to 2018.

Combustion Controls, Equipment & Systems Market Revenue, By Geography, 2011-2018 ($Billion)

Source: MarketsandMarkets Analysis

Few of the major companies profiled in this report are ABB (Switzerland), Alstom (France), Dongfang Boiler Group (China), Doosan (South Korea), General Electric (U.S.), Hitachi Ltd. (Japan), Mitsubishi Heavy Industries (Japan), Siemens (Germany), The Babcock & Wilcox Company (U.S.), and Toshiba (Japan).

Table Of Contents

1 Introduction (Page No. - 21)

1.1 Key Take-Away

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size Estimation

1.5.2 Market Crackdown & Data Triangulation

1.5.3 Key Data Points Taken From Secondary Sources

1.5.4 Key Data Points Taken From Primary Sources

1.5.5 Assumptions Made For This Report

1.5.6 List Of Companies Covered During Study

2 Executive Summary (Page No. - 36)

3 Market Overview (Page No. - 40)

3.1 Introduction of Combustion Controls Market

3.2 Combustion Controls, Equipment & Systems Market Definition

3.3 Combustion Controls, Equipment & Systems Market Dynamics

3.3.1 Combustion Controls, Equipment & Systems Market Drivers

3.3.1.1 Shale Gas Revolution Drives The Growth Of Gas Turbine Market And Gas Fired Power Plants

3.3.1.2 Revised Emission Regulations Boost The Market For Thermal Oxidizers And Emission Control Systems

3.3.1.3 Industrial Expansion In Asia Drives The Power Generation Industry In The Region

3.3.1.4 Growing Resistance Against Nuclear Power Generation

3.3.2 Market Restraints

3.3.2.1 Conservative Nature Of Industries Inhibits Faster Adoption Of Technological Advancements

3.3.3 Market Opportunity

3.3.3.1 Focus On Emerging Economies In South America And Africa

3.4 Burning Issue

3.4.1 Concerns Among U.S. Based Industries Against Boiler Mact Rules

3.5 Winning Imperative

3.5.1 Acquisitions And Joint Ventures With Asian Manufacturers To Gain Access To This Market

3.6 Value Chain Analysis

3.7 Porter’s Five Forces Model

3.7.1 Threat From New Entrants

3.7.2 Threat From Substitutes

3.7.3 Bargaining Power Of Suppliers

3.7.4 Bargaining Power Of Customers

3.7.5 Degree Of Competition

4 Combustion Controls, Equipment and Systems Market By Product (Page No. - 56)

4.1 Introduction of Combustion Controls Market

4.2 Components

4.2.1 Boilers

4.2.1.1 Types Of Boilers

4.2.1.1.1 Firetube Boilers

4.2.1.1.2 Watertube Boilers

4.2.1.1.2.1 Fluidized Bed Combustion (FBC) Boilers

4.2.1.1.2.2 Stoker Boilers

4.2.1.1.2.3 Pulverized Fuel Boilers

4.2.1.2 Major Companies Offering Boilers

4.2.1.3 Boiler Market By Type

4.2.2 Thermal Oxidizers

4.2.2.1 Types Of Thermal Oxidizers

4.2.2.1.1 Direct-Fired Thermal Oxidizers

4.2.2.1.2 Regenerative Thermal Oxidizers

4.2.2.1.3 Catalytic Regenerative Thermal Oxidizers

4.2.2.1.4 Recuperative Thermal Oxidizers

4.2.2.2 Major Companies Offering Thermal Oxidizers

4.2.2.3 Thermal Oxidizer Market By Type

4.2.3 Incinerators

4.2.3.1 Types Of Incinerators

4.2.3.1.1 Rotary Kiln Incinerators

4.2.3.1.2 Fluidized Bed Incinerators

4.2.3.1.3 Liquid Injection Incinerators

4.2.3.1.4 Catalytic Incinerators

4.2.3.2 Incinerator Market By Type

4.2.3.3 Incinerator Market By Feedstock

4.2.3.4 Incinerator Market By Geography

4.2.4 Gas Turbines

4.2.4.1 Types Of Gas Turbines

4.2.4.1.1 Aeroderivative Gas Turbines

4.2.4.1.2 Industrial Gas Turbines

4.2.4.2 Major Companies Offering Gas Turbines

4.2.4.3 Gas Turbine Market By Type

4.2.4.4 Gas Turbines Hold The Future Of Power Generation

4.3 Systems

4.3.1 Process Management Systems

4.3.1.1 Burner Management Systems

4.3.1.2 Boiler Control Systems

4.3.2 Emission Control Systems

4.3.2.1 Fabric Filters

4.3.2.2 Electrostatic Precipitators

4.3.2.3 Flue Gas Desulphurization (FGD) Systems

4.3.2.3.1 Major Companies Offering Fgd Systems

4.4 Monitoring & Control Instruments

4.4.1 Actuators And Valves

4.4.2 Gas Turbine Inlet Air Filters

4.4.3 Flow Meters

4.4.4 Combustion Analyzers

4.4.5 Sensors

4.4.5.1 Pressure Sensors

4.4.5.2 Temperature Sensors

4.4.5.3 Level Sensors

5 Combustion Controls, Equipment and Systems Market By Application (Page No. - 90)

5.1 Introduction of Combustion Controls Market

5.2 Process Industries

5.2.1 Boiler Market By Geography

5.2.2 Thermal Oxidizer Market By Geography

5.2.3 Gas Turbine Market By Geography

5.3 Metallurgy

5.3.1 Boiler Market By Geography

5.3.2 Thermal Oxidizer Market By Geography

5.3.3 Gas Turbine Market By Geography

5.4 Cement Industry

5.4.1 Boiler Market By Geography

5.4.2 Thermal Oxidizer Market By Geography

5.4.3 Gas Turbine Market By Geography

5.5 Refining & Petrochemicals

5.5.1 Boiler Market By Geography

5.5.2 Thermal Oxidizer Market By Geography

5.5.3 Gas Turbine Market By Geography

5.6 Energy & Power

5.6.1 Boiler Market By Geography

5.6.2 Thermal Oxidizer Market By Geography

5.6.3 Gas Turbine Market By Geography

5.7 Aerospace & Marine

5.7.1 Boiler Market By Geography

5.7.2 Thermal Oxidizer Market By Geography

5.7.3 Gas Turbine Market By Geography

6 Combustion Controls, Equipment and Systems Market By Geography (Page No. - 115)

6.1 Introduction of Combustion Controls Market

6.1.1 Combustion Controls, Equipment & Systems Market Life Cycle, By Geography

6.2 North America

6.2.1 Boiler Market By Application

6.2.2 Thermal Oxidizer Market By Application

6.2.3 Gas Turbine Market By Application

6.2.4 Systems Market In North America

6.2.5 Monitoring & Control Instrument Market In North America

6.3 Europe

6.3.1 Boiler Market By Application

6.3.2 Thermal Oxidizer Market By Application

6.3.3 Gas Turbine Market By Application

6.3.4 Systems Market In Europe

6.3.5 Monitoring & Control Instrument Market In Europe

6.4 Apac

6.4.1 Boiler Market By Application

6.4.2 Thermal Oxidizer Market By Application

6.4.3 Gas Turbine Market By Application

6.4.4 Systems Market In Apac

6.4.5 Monitoring & Control Instrument Market In Apac

6.5 Row

6.5.1 Boiler Market By Application

6.5.2 Thermal Oxidizer Market By Application

6.5.3 Gas Turbine Market By Application

6.5.4 Systems Market In Row

6.5.5 Monitoring & Control Instrument Market In Row

7 Competitive Landscape (Page No. - 143)

7.1 Overview of Combustion Controls Market

7.2 Combustion Controls, Equipment & Systems Market Share Analysis

7.2.1 Boiler Market Share

7.2.2 Gas Turbine Market Share

7.2.3 Flue Gas Desulphurization (FGD) Systems Market Share

7.2.4 Pressure Sensor Market Share

7.2.5 Temperature Sensor Market Share

7.2.6 Level Sensor Market Share

7.3 New Product Launch/Development

7.3.2 Mergers & Acquisitions

7.3.3 Partnerships/Agreements/Contracts/Joint Ventures/Collaborations

8 Company Profiles (Page No. - 169)

8.1 ABB

8.2 Adwest Technologies

8.3 Alfa Laval

8.4 Alstom

8.5 Bloom Engineering

8.6 Callidus Technologies

8.7 Catalytic Products International

8.8 Cleaver-Brooks

8.9 Dongfang Boiler Group

8.10 Doosan

8.11 General Electric

8.12 Hitachi Ltd.

8.13 Honeywell International

8.14 Maxon

8.15 Mitsubishi Heavy Industries

8.16 Nestec, Inc.

8.17 Siemens

8.18 The Babcock & Wilcox Company

8.19 Titan Logix Corp.

8.20 Toshiba

List Of Tables (89 Tables)

Table 1 General Assumptions, Terminologies, And Applications Keynotes

Table 2 Combustion Controls, Equipment & Systems Market: List Of Companies Covered

Table 3 Combustion Controls, Equipment & Systems Market Revenue, By Product, 2011 - 2018 ($Billion)

Table 4 Combustion Controls, Equipment & Systems Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 5 Combustion Controls, Equipment & Systems Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 6 Global Combustion Controls, Equipment & Systems Market Revenue, By Product, 2011 - 2018 ($Billion)

Table 7 Global Components Market Revenue, By Type, 2011 - 2018 ($Billion)

Table 8 Major Boiler Manufacturers

Table 9 Global Boiler Market Revenue, By Type, 2011 - 2018 ($Billion)

Table 10 Major Thermal Oxidizer Manufacturers

Table 11 Global Thermal Oxidizer Market Revenue, By Type, 2011 - 2018 ($Million)

Table 12 Global Incinerator Market Revenue, By Type, 2011 - 2018 ($Billion)

Table 13 Global Incinerator Market Revenue, By Feedstock, 2011 - 2018 ($Billion)

Table 14 Global Incinerator Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 15 Major Gas Turbine Manufacturers

Table 16 Global Gas Turbine Market Revenue, By Type, 2011 - 2018 ($Billion)

Table 17 Global Systems Market Revenue, By Type, 2011 - 2018 ($Million)

Table 18 Global Process Management Systems Market Revenue, By Type, 2011 - 2018 ($Million)

Table 19 Major Burner Management System Manufacturers

Table 20 Global Emission Control Systems Market Revenue, By Type, 2011 - 2018 ($Million)

Table 21 Major FGD System Manufacturers

Table 22 Global Monitoring & Control Instrument Market Revenue, By Type, 2011 - 2018 ($Million)

Table 23 Major Flow Meter Manufacturers

Table 24 Major Combustion Analyzer Manufacturers

Table 25 Global Sensors Market Revenue, By Type, 2011 - 2018 ($Million)

Table 26 Major Pressure Sensor Manufacturers

Table 27 Major Temperature Sensor Manufacturers

Table 28 Major Level Sensor Manufacturers

Table 29 Global Combustion Equipment, Controls & Systems Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 30 Process Industries: Boiler Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 31 Process Industries: Thermal Oxidizer Market Revenue, By Geography, 2011 - 2018 ($Million)

Table 32 Process Industries: Gas Turbine Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 33 Top Five Steel Producing Countries, 2011

Table 34 Metallurgy: Boiler Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 35 Metallurgy: Thermal Oxidizer Market Revenue, By Geography, 2011 - 2018 ($Million)

Table 36 Metallurgy: Gas Turbine Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 37 Top 10 Global Cement Producing Countries By Installed Capacity, 2011

Table 38 Cement Industry: Boiler Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 39 Cement Industry: Thermal Oxidizer Market Revenue, By Geography, 2011 - 2018 ($Million)

Table 40 Cement Industry: Gas Turbine Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 41 Refining & Petrochemicals: Boiler Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 42 Refining & Petrochemicals: Thermal Oxidizer Market Revenue, By Geography, 2011 - 2018 ($Million)

Table 43 Refining & Petrochemicals: Gas Turbine Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 44 Energy & Power: Boiler Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 45 Energy & Power: Thermal Oxidizer Market Revenue, By Geography, 2011 - 2018 ($Million)

Table 46 Energy & Power: Gas Turbine Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 47 Top 10 Aerospace & Defense Companies, By Revenue, 2012

Table 48 Aerospace & Marine: Boiler Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 49 Aerospace & Marine: Thermal Oxidizer Market Revenue, By Geography, 2011 - 2018 ($Million)

Table 50 Aerospace & Marine: Gas Turbine Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 51 Global Combustion Controls, Equipment & Systems Market Revenue, By Geography, 2011 - 2018 ($Billion)

Table 52 North America: Combustion Equipment, Controls & Systems Market Revenue, By Product, 2011 - 2018 ($Billion)

Table 53 North America: Boiler Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 54 North America: Thermal Oxidizer Market Revenue, By Application, 2011 - 2018 ($Million)

Table 55 North America: Gas Turbine Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 56 Europe: Combustion Controls, Equipment & Systems Market Revenue, By Product, 2011 - 2018 ($Billion)

Table 57 Europe: Boiler Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 58 Europe: Thermal Oxidizer Market Revenue, By Application, 2011 - 2018 ($Million)

Table 59 Europe: Gas Turbine Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 60 Apac: Combustion Controls, Equipment & Systems Market Revenue, By Product, 2011 - 2018 ($Billion)

Table 61 Apac: Boiler Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 62 Apac: Thermal Oxidizer Market Revenue, By Application, 2011 - 2018 ($Million)

Table 63 Apac: Gas Turbine Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 64 Row: Combustion Controls, Equipment & Systems Market Revenue, By Product, 2011 - 2018 ($Billion)

Table 65 Row: Boiler Market Revenue, By Application, 2011 - 2018 ($Billion)

Table 66 Row: Thermal Oxidizer Market Revenue, By Application, 2011 - 2018 ($Million)

Table 67 Row: Gas Turbine Market Revenue, By Application, 2011 - 2018 ($Million)

Table 68 Combustion Controls, Equipment & Systems Market: New Product Launch/Development, 2011-2013

Table 69 Combustion Controls, Equipment & Systems Market: Mergers & Acquisitions, 2011-2013

Table 70 Combustion Controls, Equipment & SystemsMarket:Partnerships/Agreements/Contracts/Joint Ventures/Collaborations, 2010 - 2013

Table 71 ABB: Financials, 2010 - 2012 ($Billion)

Table 72 ABB: Power Systems Division Revenue, 2010 - 2012 ($Billion)

Table 73 ABB: Geographical Distribution Of Power Systems Division Revenue, 2010 - 2012 (%)

Table 74 Alfa Laval: Financials, 2010 - 2012 ($Million)

Table 75 Alstom: Financials, 2010 - 2012 ($Million)

Table 76 Alstom: Thermal Power Revenue, 2012 - 2013 ($Billion)

Table 77 Doosan: Financials, 2010 - 2011 ($Million)

Table 78 Ge: Financials, 2010 - 2012 ($Million)

Table 79 Hitachi Ltd.: Financials, 2011 - 2012 ($Billion)

Table 80 Hitachi Ltd.: Power Systems Division Revenue, 2010 - 2011 ($Billion)

Table 81 Honeywell International: Financials, 2010 - 2012 ($Billion)

Table 82 Honeywell: Automation & Control Solutions Revenue, 2011 - 2012 ($Billion)

Table 83 Mitsubishi Heavy Industries: Financials, 2011 - 2012 ($Billion)

Table 84 Mitsubishi Heavy Industries: Power Systems Division Revenue, 2010 - 2011 ($Billion)

Table 85 Siemens: Financials, 2011 - 2012 ($Billion)

Table 86 Siemens: Energy Sector Revenue, 2011 - 2012 ($Billion)

Table 87 The Babcock & Wilcox Company: Financials, 2010 - 2012 ($Million)

Table 88 Titan Logix Corp.: Financials, 2010 - 2012 ($Million)

Table 89 Toshiba Corp.: Financials, 2011 - 2012 ($Billion)

List Of Figures (41 Figures)

Figure 1 Combustion Controls, Equipment & Systems Market Segmentation

Figure 2 Combustion Controls, Equipment & Systems Market: Classification By Product

Figure 3 Combustion Controls, Equipment & Systems Market Research Methodology

Figure 4 Combustion Controls, Equipment & Systems Market Size Estimation

Figure 5 Market Crackdown & Data Triangulation

Figure 6 Market Overview: Combustion Controls, Equipment & Systems Market

Figure 7 Market Segmentation: Combustion Controls, Equipment & Systems Market

Figure 8 Impact Analysis Of Market Dynamics, 2013 - 2018

Figure 9 World Power Generation, By Fuel Type, 2010 Vs 2040

Figure 10 Value Chain Of Combustion Controls, Equipment & Systems Market

Figure 11 Porter’s Five Forces Analysis For Combustion Controls, Equipment & Systems Market, 2012

Figure 12 Quantification Of Threat From New Entrants

Figure 13 Quantification Of Threat From Substitutes

Figure 14 Quantification Of Bargaining Power Of Suppliers

Figure 15 Quantification Of Bargaining Power Of Customers

Figure 16 Quantification Of Degree Of Competition

Figure 17 Combustion Controls, Equipment & Systems Market, By Product

Figure 18 Components Market, By Type

Figure 19 Projected Power Generation By Fuel Type, 2030

Figure 20 Combustion Controls, Equipment & Systems Market, By Application

Figure 21 Combustion Controls, Equipment & Systems Market, By Geography, 2011 - 2018 ($Billion)

Figure 22 Combustion Controls, Equipment & Systems Market Life Cycle, By Geography

Figure 23 North America: Combustion Controls Systems Market Revenue, 2011 - 2018 ($Billion)

Figure 24 North America: Monitoring & Control Instrument Market Revenue, 2011 - 2018 ($Billion)

Figure 25 Europe: Combustion Controls Systems Market Revenue, 2011 - 2018 ($Billion)

Figure 26 Europe: Monitoring & Control Instrument Market Revenue, 2011 - 2018 ($Billion)

Figure 27 Apac: Combustion Controls Systems Market Revenue, 2011 - 2018 ($Billion)

Figure 28 Apac: Monitoring & Control Instrument Market Revenue, 2011 - 2018 ($Billion)

Figure 29 Row: Combustion Controls Systems Market Revenue, 2011 - 2018 ($Billion)

Figure 30 Row: Monitoring & Control Instrument Market Revenue, 2011 - 2018 ($Billion)

Figure 31 Boiler Market Share Analysis, 2005 - 2012 (%)

Figure 32 Gas Turbine Market Share Analysis, 2005 - 2012 (%)

Figure 33 Flue Gas Desulphurization (FGD) System Market Share Analysis, 2012 (%)

Figure 34 Pressure Sensor Market Share Analysis, 2012 (%)

Figure 35 Temperature Sensor Market Share Analysis, 2012 (%)

Figure 36 Level Sensor Market Share Analysis, 2012 (%)

Figure 37 ABB: Swot Analysis

Figure 38 GE: Swot Analysis

Figure 39 Hitachi Ltd.: Swot Analysis

Figure 40 Siemens: Swot Analysis

Figure 41 Toshiba: Swot Analysis

Growth opportunities and latent adjacency in Combustion Controls, Equipments & Systems Market