Collimating Lens Market by Light Source (LED and Laser), Material (Glass and Plastic), End Use (Automobile, Medical, LiDAR, Light and Display Measurement, and spectrometer), Wavelength, and Geography - Global Forecast 2025 to 2035

The global collimating lens market is experiencing strong growth driven by rapid advancements in lighting technologies, optical sensing, and precision measurement applications. Collimating lenses are optical components used to transform divergent or convergent light beams into parallel rays. They are essential in systems that require accurate direction and uniform light intensity. The demand for high performance optical systems in automotive lighting, medical imaging, LiDAR, spectroscopy, and display technologies is creating a substantial opportunity for the collimating lens market from 2025 to 2035.

As industries move toward miniaturization and higher optical precision, collimating lenses have become an integral part of modern optoelectronic systems. These lenses are commonly made from glass or plastic materials and are designed to work with various light sources such as LEDs and lasers. With continuous improvements in lens coating technologies and material sciences, the efficiency and durability of collimating lenses have improved significantly, leading to wider adoption across industries.

Download PDF Sample @ https://www.marketsandmarkets.com/pdfdownloadNewNew.asp?id=12889947

Market Dynamics

The global collimating lens market is driven by increasing demand for energy efficient lighting, advancements in LiDAR and sensing applications, and rapid developments in optical communication. LED lighting systems have become a major driver as collimating lenses are essential to control and shape the light beam. Similarly, in laser applications, collimating lenses play a key role in ensuring high precision in measurement and imaging.

The automotive industry’s adoption of advanced lighting systems such as adaptive headlights and LiDAR sensors is expanding the demand for collimating lenses. In medical imaging, collimating lenses are used for diagnostic instruments such as endoscopes, spectrometers, and optical imaging systems. Additionally, the growing demand for consumer electronics with enhanced display technologies also contributes to market expansion.

The rise in demand for LiDAR systems in autonomous vehicles and drones is another major factor fueling market growth. These systems require accurate collimation to detect objects with precision, increasing the need for efficient optical components. Furthermore, ongoing research and development in optical fiber communication and photonics is expected to open new opportunities for manufacturers in the coming years.

Market Segmentation by Light Source

The collimating lens market is segmented based on light source into LED and laser categories.

LED Light Source Segment

LEDs have become the dominant light source in several industries due to their efficiency and long lifespan. Collimating lenses used with LEDs help in enhancing illumination uniformity, reducing light loss, and improving brightness. In automotive lighting, LED based collimating lenses are extensively used in headlamps, taillights, and interior illumination systems. The healthcare and display industries also rely heavily on LED collimation for accurate light direction and measurement. The increasing shift from traditional lighting to LED solutions across the world is expected to drive this segment significantly during the forecast period.

Laser Light Source Segment

Laser applications are rapidly expanding in fields like LiDAR, spectroscopy, and industrial processing. Collimating lenses for laser systems are designed to handle narrow wavelength ranges and high intensity light. These lenses ensure the laser beam maintains its shape and direction over long distances, which is crucial in precision-based systems. The growing adoption of laser based technologies in manufacturing, defense, and medical sectors will further propel the demand for laser compatible collimating lenses in the coming years.

Market Segmentation by Material

The material segment of the collimating lens market includes glass and plastic lenses, each offering unique performance characteristics and cost advantages.

Glass Collimating Lenses

Glass lenses are preferred in high precision applications requiring excellent optical clarity and thermal stability. They offer better resistance to environmental changes and are used in scientific instruments, LiDAR systems, and medical imaging devices. The demand for glass collimating lenses is expected to remain strong due to their superior light transmission properties and compatibility with laser sources. The development of advanced glass materials with enhanced refractive indices and coatings will further strengthen this segment’s growth.

Plastic Collimating Lenses

Plastic lenses are widely used in cost sensitive applications where lightweight and flexibility are important. They are mainly used in LED lighting systems, consumer electronics, and automotive interior lighting. The ease of manufacturing, low cost, and adaptability of plastic materials have made them popular in mass production environments. However, plastic lenses are less durable under extreme temperature conditions compared to glass lenses. Nonetheless, improvements in polymer materials and coating technologies are helping overcome these limitations, making plastic lenses more competitive.

Market Segmentation by End Use

Collimating lenses find extensive applications across multiple industries such as automotive, medical, LiDAR, light and display measurement, and spectroscopy.

Automobile Industry

The automotive industry represents a significant share of the collimating lens market. The integration of advanced lighting systems and LiDAR sensors in vehicles has increased the use of these lenses. Adaptive lighting, head-up displays, and driver assistance systems rely on precise light management. Collimating lenses help improve visibility, safety, and aesthetic design in modern vehicles. With the rising trend of electric and autonomous vehicles, the demand for efficient optical components is expected to grow exponentially.

Medical Industry

In the medical sector, collimating lenses are used in diagnostic and imaging equipment, such as spectrometers, endoscopes, and surgical lighting systems. These lenses help provide focused and accurate illumination for better visualization during procedures. The growing emphasis on advanced imaging technologies and non-invasive diagnostic tools is fueling the adoption of high performance optical lenses in healthcare.

LiDAR Applications

LiDAR systems have become a crucial technology in various sectors including automotive, robotics, and surveying. Collimating lenses enable accurate beam shaping and direction in LiDAR systems, improving detection and mapping accuracy. The global expansion of autonomous vehicles and smart infrastructure projects will continue to drive demand for LiDAR based systems, thereby boosting the collimating lens market.

Light and Display Measurement

Collimating lenses are essential in instruments that measure light intensity and display performance. These systems require accurate collimation to ensure consistent and repeatable readings. With the rapid growth of digital display technologies such as OLED and micro LED, the need for precise measurement tools using collimating optics is increasing.

Spectrometer Applications

Spectrometers rely on collimating lenses to direct and align light beams for wavelength analysis. These instruments are widely used in scientific research, material testing, and environmental monitoring. The ongoing demand for accurate analytical instruments in laboratories and industrial environments will continue to support the growth of this segment.

Market Segmentation by Wavelength

The wavelength segment of the collimating lens market focuses on lenses optimized for specific light ranges. Different wavelengths require distinct optical coatings and materials to maintain performance and minimize dispersion.

Lenses designed for visible wavelengths are primarily used in LED lighting, automotive, and display applications. Infrared and ultraviolet wavelength lenses are used in LiDAR, spectroscopy, and medical diagnostics. As new laser technologies evolve, manufacturers are developing collimating lenses tailored for specific wavelength requirements, which helps improve efficiency and accuracy in advanced optical systems.

Regional Analysis

The global collimating lens market is analyzed across North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America holds a significant share of the global market due to strong demand from the automotive, aerospace, and defense sectors. The region is a leader in developing LiDAR and laser based technologies, which rely heavily on optical components. The presence of key manufacturers and continuous research in optical technologies further enhances regional growth.

Europe

Europe is witnessing considerable growth driven by the automotive and industrial automation sectors. Countries like Germany, France, and the United Kingdom are major contributors, as they host several automotive and photonics technology companies. The increasing use of energy efficient LED lighting and advancements in medical imaging systems are also fueling market demand across Europe.

Asia Pacific

The Asia Pacific region is expected to record the fastest growth rate during the forecast period. Rapid industrialization, expanding electronics manufacturing, and growing automotive production in countries such as China, Japan, South Korea, and India are key factors supporting market expansion. Additionally, the presence of large LED and semiconductor industries is driving the adoption of collimating lenses across various applications.

Rest of the World

Regions such as Latin America and the Middle East are gradually adopting optical technologies in industrial and automotive applications. As local industries modernize and adopt LED and laser based solutions, the demand for collimating lenses is likely to increase.

Technological Advancements

Technological innovation is a major factor shaping the collimating lens market. The development of precision molding techniques and computer aided optical design tools has improved lens performance and reduced manufacturing costs. Advanced coatings that enhance light transmission and reduce reflection are being introduced to improve optical efficiency.

Emerging trends such as the integration of freeform optics and meta lenses are also transforming the design of collimating systems. These innovations allow for smaller, lighter, and more efficient optical assemblies suitable for compact devices and next generation LiDAR systems. The increasing convergence of optical technologies with artificial intelligence and machine vision will create further opportunities for market expansion.

Competitive Landscape

The collimating lens market is moderately fragmented with the presence of several global and regional manufacturers. Companies are focusing on developing advanced optical designs, expanding production capabilities, and forming strategic partnerships with LED and laser system manufacturers. Product innovation, cost optimization, and material advancements remain key strategies among leading players.

Manufacturers are investing in research to develop lenses with higher optical performance, wider wavelength compatibility, and improved durability. The market is also witnessing growing collaboration between optical component suppliers and system integrators to meet customized requirements for automotive, medical, and industrial applications.

Future Outlook

The future of the global collimating lens market appears promising, with steady growth expected from 2025 to 2035. The market will continue to benefit from the growing use of LED lighting, LiDAR systems, and laser technologies across multiple industries. Advancements in optical materials and fabrication processes will further improve performance and reduce costs, encouraging widespread adoption.

As industries increasingly focus on automation, energy efficiency, and precision measurement, the role of collimating lenses will become even more critical. The integration of these lenses into compact and multifunctional devices will drive innovation in optical design. Additionally, as sustainability and eco-friendly manufacturing become central to industrial strategies, manufacturers are expected to explore recyclable materials and energy efficient production techniques for collimating lenses.

The collimating lens market is entering a dynamic growth phase driven by the convergence of lighting, sensing, and optical communication technologies. From automotive lighting and LiDAR systems to medical diagnostics and display measurement, these lenses play a crucial role in achieving optical precision and performance.

The ongoing shift toward miniaturized, efficient, and intelligent optical systems will sustain market demand well into the next decade. With innovation in materials, design, and manufacturing, the global collimating lens market is poised to expand significantly, creating new opportunities for manufacturers, researchers, and end users across all major regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

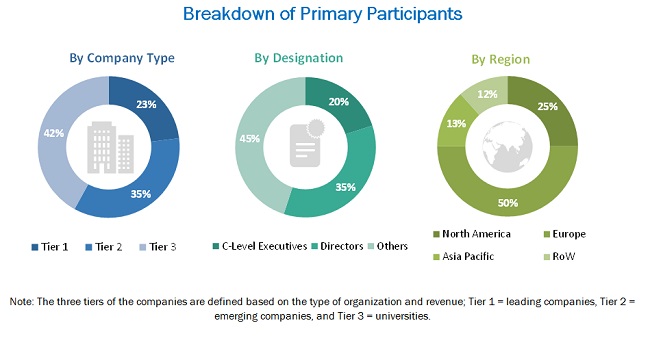

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.2.4 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Market (2018–2023)

4.2 Market, By End Use

4.3 Market, By Light Source and Region

4.4 Market, Geographic Analysis

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Advantages of Collimation of Light in Various Applications

5.2.1.2 Benefits of Using Aspheric Lenses Over Traditional Spherical Lenses in Optics Systems

5.2.2 Restraints

5.2.2.1 High Manufacturing Cost of Aspheric Lenses

5.2.3 Opportunities

5.2.3.1 Growing Demand for Collimating Lenses in Various Applications

5.2.3.2 Increasing Importance of Fiber Optics Collimating Lenses

5.2.4 Challenges

5.2.4.1 Restriction of Hazardous Substances (ROHS) Compliance

6 Collimating Lens Market, By Light Source (Page No. - 38)

6.1 Introduction

6.2 LED

6.2.1 Increase in Demand for LED Headlamp in Automobile to Drive the Growth of LED Collimating Lens Market

6.3 Laser

6.3.1 Benefits Such as High Intensity and Monochromaticity are Expected to Shoot Demand for Laser Light Sources

6.4 Others

7 Collimating Lens Market, By Material (Page No. - 47)

7.1 Introduction

7.2 Glass

7.2.1 Greater Density of Glass Material to Drive Demand for Glass Market

7.3 Plastic

7.3.1 Low-Quality Plastics are Limiting Growth of Plastic Market

7.4 Other Materials

8 Collimating Lens Market, By Wavelength (Page No. - 52)

8.1 Introduction

8.2 <1000 nm

8.2.1 Market for Laser Light Source With <1000 nm Range to Grow at High Rate

8.3 1000–1500 nm

8.3.1 LED to Hold Largest Size of Market for 1000–1500 nm Range

8.4 1500–2000 nm

8.4.1 1500-2000nm Wavelength is Most Suitable for Medical and Industrial Application Which Drives the Market

8.5 >2000 nm

8.5.1 Laser Light Source With >2000 nm Wavelengths is Expected to Have Growth in Spectrometer and Interferometer End Use Applications

9 Collimating Lens Market, By End Use (Page No. - 58)

9.1 Introduction

9.2 Spectroscopy

9.2.1 Demand of Spectroscopy in Determining Refractive Index of A Material, Presence of Undesired Wavelengths, and Colour Properties of Light Source Help to Drive the Market

9.3 Medical

9.3.1 Increasing Use of Collimating Lens in Various Medical Equipment

9.4 Lidar

9.4.1 Increasing Penetration of Lidar Technology in Various Applications to Provide Growth Opportunities for Market

9.5 Automobile

9.5.1 Advancements in Lighting Technologies Adopted in Automobiles Drive Demand for Collimating Lenses

9.6 Light and Display Measurement

9.6.1 Collimating Lens is an Inevitable Component in Light and Display Measurement

9.7 Interferometry

9.7.1 Need for Interferometry in Evaluation of Displacement and Irregularities in Flat and Spherical Surfaces Will Boost Market Growth

9.8 Others

10 Collimating Lens Market, Geographic Analysis (Page No. - 63)

10.1 Introduction

10.2 North America

10.2.1 Us

10.2.1.1 US Accounted for Largest Size in Market in North America

10.2.2 Canada

10.2.2.1 Market in Canada is Expected to Witness Significant Growth in Coming Years

10.2.3 Mexico

10.2.3.1 Rapidly Expanding Automotive Manufacturing in Mexico is Expected to Provide Prospects to Market

10.3 Europe

10.3.1 Germany

10.3.1.1 Growing Presence of Optics Component Manufacturers in Germany is Expected to Drive Market Growth

10.3.2 Uk

10.3.2.1 Increasing Demand for Medical Equipment in UK is Propelling Demand for Collimating Lenses

10.3.3 France

10.3.3.1 High Use of Lidar Systems in Applications Such as Space Exploration, Meteorology, and Corridor Mapping Boost Demand for Collimating Lenses in France

10.3.4 Italy

10.3.4.1 Sophisticated Healthcare Infrastructure in Italy Raises Demand for Collimating Lenses

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 China Accounted for Largest Share of Market in APAC

10.4.2 Japan

10.4.2.1 Increasing Adoption of LED Headlamps in Japan Due to Presence of Large Number of Car Manufacturers Drives Market Growth

10.4.3 India

10.4.3.1 Largest and Fastest-Growing Automobile Markets in India to Provide Growth Opportunities for Collimating Lens Providers

10.4.4 South Korea

10.4.4.1 Applications Such as Light and Display Measurement, Medical, and Automobile Drive Demand for Collimating Lenses in South Korea

10.4.5 Rest of APAC

10.5 Rest of the World

10.5.1 South and Central America

10.5.1.1 Brazil and Argentina is Expected to Witness the Highest Growth Rate in Market in South America

10.5.2 Middle East and Africa

10.5.2.1 Countries Such as Saudi Arabia, Israel, UAE, and Qatar are Major Contributor to Market in Middle East

11 Competitive Landscape (Page No. - 80)

11.1 Introduction

11.2 Market Player Ranking Analysis (2018)

11.2.1 Product Launches/Developments

11.2.2 Agreements and Contracts

11.2.3 Mergers/Acquisitions

11.2.4 Expansions

12 Company Profiles (Page No. - 85)

12.1 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

12.1.1 Lightpath Technologies, Inc.

12.1.2 Ocean Optics, Inc.

12.1.3 Ingeneric GmbH

12.1.4 Trioptics GmbH

12.1.5 Avantes Bv

12.1.6 Auer Lighting GmbH

12.1.7 IPG Photonics Corporation

12.1.8 Optikos Corporation

12.1.9 The Optoelectronics Co. Ltd.

12.1.10 Thorlabs Inc.

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12.2 Other Key Companies

12.2.1 AMS Technologies AG

12.2.2 Axetris AG

12.2.3 Broadcom Limited

12.2.4 Bentham Instruments Limited

12.2.5 Casix, Inc.

12.2.6 Edmund Optics Inc.

12.2.7 Fisba AG

12.2.8 Hamamatsu Photonics K.K.

12.2.9 Opto-Line, Inc.

12.2.10 Ushio Inc.

13 Appendix (Page No. - 107)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (34 Tables)

Table 1 Market, 2015–2023

Table 2 Market, By Light Source, 2015–2023 (USD Million)

Table 3 Market for LED, By Wavelength, 2015–2023 (USD Million)

Table 4 Market for LED, By Material, 2015–2023 (USD Million)

Table 5 Market for LED, By Region, 2015–2023 (USD Million)

Table 6 Market for Laser, By Wavelength, 2015–2023 (USD Million)

Table 7 Market for Laser, By Material, 2015–2023 (USD Million)

Table 8 Market for Laser, By Region, 2015–2023 (USD Million)

Table 9 Market for Others, By Wavelength, 2015–2023 (USD Million)

Table 10 Market for Others, By Material, 2015–2023 (USD Million)

Table 11 Market for Others, By Region, 2015–2023 (USD Million)

Table 12 Market, By Material, 2015–2023 (USD Million)

Table 13 Market for Glass, By Light Source, 2015–2023 (USD Million)

Table 14 Market for Plastic, By Light Source, 2015–2023 (USD Million)

Table 15 Market for Other Materials, By Light Source, 2015–2023 (USD Million)

Table 16 Market, By Wavelength, 2015–2023 (USD Million)

Table 17 Market for <1000 nm, By Light Source, 2015–2023 (USD Million)

Table 18 Market for 1000–1500 nm, By Light Source, 2015–2023 (USD Million)

Table 19 Market for 1500–2000 nm, By Light Source, 2015–2023 (USD Million)

Table 20 Market for >2000 nm, By Light Source, 2015–2023 (USD Million)

Table 21 Market, By End Use, 2015–2023 (USD Million)

Table 22 Market, By Region, 2015–2023 (USD Million)

Table 23 Market in North America, By Country, 2015–2023 (USD Million)

Table 24 Market in North America, By Light Source, 2015–2023 (USD Million)

Table 25 Market in Europe, By Country, 2015–2023 (USD Million)

Table 26 Market in Europe, By Light Source, 2015–2023 (USD Million)

Table 27 Market in APAC, By Country, 2015–2023 (USD Million)

Table 28 Market in APAC, By Light Source, 2015–2023 (USD Million)

Table 29 Market in RoW, By Region, 2015–2023 (USD Million)

Table 30 Market in RoW, By Light Source, 2015–2023 (USD Million)

Table 31 Product Launches/Developments (2015–2018)

Table 32 Agreements and Contracts (2015–2017)

Table 33 Mergers/Acquisitions (2015–2016)

Table 34 Expansion (2018)

List of Figures (42 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Process Flow of Market Size Estimation

Figure 3 Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for Research Study

Figure 8 LED Light Source to Lead Market During Forecast Period

Figure 9 1000–1500 nm Wavelength to Dominate Market During Forecast Period

Figure 10 Market for Glass to Grow at Highest CAGR During Forecast Period

Figure 11 Market for Automobile to Grow at Highest CAGR During 2018–2023

Figure 12 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 13 LED Light Source Segment Expected to Provide Significant Growth Opportunities During the Forecast Period

Figure 14 Market for Automobile to Grow at Highest CAGR During Forecast Period

Figure 15 LED Held Largest Share of Market in 2017

Figure 16 Market in China to Grow at Highest CAGR During Forecast Period

Figure 17 Increasing Demand for Aspheric Lenses Over Traditional Spherical Lenses Drives Market Growth

Figure 18 LED Light to Dominate Market During Forecast Period

Figure 19 1000–1500 nm Wavelength to Dominate LED-Based Market During Forecast Period

Figure 20 Laser-Based Collimating Lens for 1000–1500 nm Wavelength to Grow at Highest CAGR During Forecast Period

Figure 21 Glass to Dominate Market During Forecast Period

Figure 22 LED Light to Dominate Glass Market During Forecast Period

Figure 23 Plastic Collimating Lens for LED Light to Grow at Highest CAGR During Forecast Period

Figure 24 1000–1500 Wavelength to Dominate Market During Forecast Period

Figure 25 LED to Hold Largest Size of Market for <1000 nm During Forecast Period

Figure 26 Market for 1000–1500 nm for Laser to Grow at Highest CAGR During Forecast Period

Figure 27 LED to Dominate Market for 1500–2000 nm During Forecast Period

Figure 28 LED to Dominate Market for >2000 nm During Forecast Period

Figure 29 Light and Display Measurement to Dominate Market During Forecast Period

Figure 30 Market in China to Grow at Highest CAGR During Forecast Period

Figure 31 North America to Account for Largest Size of Market During Forecast Period

Figure 32 North America: Market Snapshot

Figure 33 Market in US to Grow at Highest CAGR During Forecast Period

Figure 34 Europe: Market Snapshot

Figure 35 Germany to Lead Market in Europe During Forecast Period

Figure 36 APAC: Market Snapshot

Figure 37 Market in China to Grow at Highest CAGR During Forecast Period

Figure 38 South and Central America to Dominate Market in RoW During Forecast Period

Figure 39 Organic and Inorganic Strategies Adopted By Companies Operating in Market (2013–2018)

Figure 40 Market Ranking of Players (2018)

Figure 41 Lightpath Technologies: Company Snapshot

Figure 42 IPG Photonics: Company Snapshot

The study involved four major activities in estimating the current size of the market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the collimating lens market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The collimating lens market comprises several stakeholders, such as suppliers of raw material and manufacturing equipment; standard components, original equipment manufacturers (OEMs); original device manufacturers (ODMs) of collimating lens; solutions providers; vendors of assembly, testing, and packaging solutions; and system integrators in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major industries areas and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Research Objective

- To define, describe, and forecast the overall collimating lens market, in terms of value, segmented based on by light source, material, wavelength, end use

- To describe and forecast the market, in terms of volume, by light source

- To describe and forecast the market, in terms of value, by region—Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing market growth of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of collimating lenses

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the collimating lens ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze competitive developments such as product launches, mergers and acquisitions, agreements and contracts, and expansions in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Collimating Lens Market