Cockpit Domain Controller Market by Vehicle Type (Passenger Cars, Commercial Vehicles), Propulsion Type (ICE, EV), Vehicle Class (Economy, Mid-Segment and Luxury), Level of Autonomy, and Region - Global Forecast to 2030

Automotive industry is witnessing rapid advancement in terms of amount of electronics being used in the vehicles. Modern automotive cockpit comprises digital displays for infotainment, instrument cluster, climate control and others. Thus, cockpit domain controller has emerged as an important aspect for controlling multiple cockpit functions from a single control unit. Cockpit domain controller gives the cockpit intelligent perception and interaction capabilities. This helps to provide users with an improved interactive experience. In addition, cockpit domain controller is a single system that ensures multi-display management across the vehicle, thereby reducing the complexity of ECUs in the vehicle. Considering the improving in-vehicle infotainment and increasing penetration of ADAS features, the importance of cockpit domain controller is expected continue growing in the future.

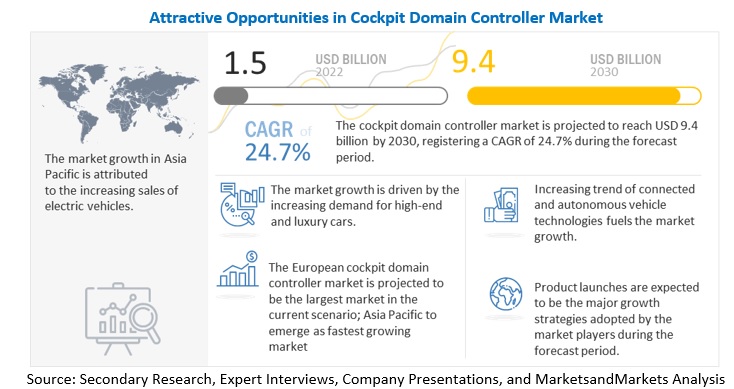

The global cockpit domain controller market is projected to reach USD 9.4 billion by 2030 from an estimated USD 1.5 billion in 2022, at a CAGR of 24.7% from 2022 to 2030. Factors such as the demand for high-end and luxury cars, increasing focus towards new features in vehicles, and increasing sales of electric vehicles, are expected to drive the demand for cockpit domain controller.

Market Dynamics

DRIVERS: Increasing focus towards new features such as enhanced user comfort, safety, and convenience

Automotive manufacturers are constantly focusing on new features & designs in screens/displays in order to gain significant competition in the global market. This includes use of larger display panels with higher resolution, distinctive cluster designs, and the capacity to incorporate Artificial Intelligence (AI) as well as video processing. Rapid digitization of instrument cluster and consistently improving in-vehicle infotainment is expected to ensure strong need for centralized function control through cockpit domain controller. In addition, increasing connectivity in line with the emerging 5G technology is also likely to provide vehicle with more features. Thus, growing focus on digitizing automotive cockpits for seamless experience, is anticipated to increase the revenue growth of the cockpit domain controller market during the forecast period.

DRIVERS: Increasing demand for premium car segment

The demand for premium passenger cars is anticipated to grow at a promising rate in the near future, especially in the Europe region. This is owing to the increasing features in luxury vehicles such as autonomous-driving options, comfort, advanced connectivity elements, convenience, entertainment, and safety features, among others. For instance, the combined sales of luxury cars in Germany were 2.5 million units from 2016-2020. Similarly, in the UK, the combined sales of luxury car were 1.7 million units from 2016-2020. Further, the luxury car sales for Volkswagen were 5.3 million units for the year 2020. Similarly, for Mercedes Benz, the the luxury car sales were 2.1 million units in 2020. Thus, increasing demand for premium car is likely to increase the demand for automotive cockpits. This in turn, is likely to support the revenue growth of the cockpit domain controller market during the forecast period.

OPPORTUNITIES: Trends towards multiple domains with same ECU

The integrated digital automotive cockpit is likely to be the future of the automotive industry. This digital automotive cockpit would consist of multiple displays powered by a single domain controller for infotainment, connectivity, instrument cluster, full dashboard displays, Head-Up Display (HUD) and driver monitoring functions, among others. Currently, Cockpit Domain Controller (CDC) allows multiple electronic applications such as digital instrument cluster, infotainment system, HUD, etc., with separate ECUs to be integrated into one domain controller which supports multiple levels of safety. However, in the foreseeable future, digital cockpit domain controller will support multiple mixed criticality workloads on the same electronic control unit.

OEMs are putting consistent efforts to offer enhanced in-vehicle experience, which is expected to result in rise in the number of displays in vehicles. Additionally, trends such as integrated dashboard displays, AR-HUDs and displays with multiple resolution screens would create strong demand for cockpit domain controller over the forecast period. All these parameters will increase the demand for automotive cockpits, which in turn, is likely to create lucrative opportunities for cockpit domain controllers in the foreseeable future.

Key Market Players

Major players such as Continental AG (Germany), Infineon Technologies AG (Germany), Visteon Corporation (US), Aptiv Plc (Ireland), and Panasonic Corporation (Japan) lead the cockpit domain controller market. These companies have strong distribution networks at a global level and offer an extensive product range. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Recent Developments

- In January 2022, Visteon Corporation unveiled “4th generation SmartCore Domain Controller” for enhanced safety and connected mobility. This domain controller delivers high-quality intelligent cockpit experience across conventional as well as electric vehicle applications.

- In December 2021, Marelli Corporation introduced its Cockpit Domain Controller (CDC) to support the evolution of the vehicle’s electronic architecture. Marelli Corporation has chosen the BlackBerry QNX Neutrino RTOS and BlackBerry QNX Hypervisor to power its Cockpit Domain Controller (CDC).

- In January 2019, Panasonic Automotive, which is one of the leading global suppliers for automotive infotainment as well as connectivity systems solutions, launched its latest integrated technology platform in order to transform the user experience as well as deliver new flexibility for automotive manufacturers. The company revealed its latest “SPYDR 2.0” at CES 2019, which is a single brain cockpit domain controller solution that features a Driver Monitoring System (DMS) with Head-Up Display (HUD) Integration.

|

Report Metrics |

Details |

| Base year for estimation | 2022 |

| Forecast period | 2022 – 2030 |

| Market Growth and Revenue forecast | $ 9.4 Bn by 2030 at a CAGR of 24.7% |

| Top Players | Continental AG (Germany), Infineon Technologies AG (Germany), Visteon Corporation (US), Aptiv Plc (Ireland), and Panasonic Corporation (Japan). |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Europe |

| Segments covered | |

| By Vehicle Type | Passenger Cars and Commercial Vehicles |

| By Level of Autonomy | Non-autonomous and Semi- Autonomous & Autonomous |

| By Propulsion | Internal Combustion Engines and Electric Vehicles |

| By Vehicle Class | Economic Passenger Cars, Luxury Passenger Cars, and Mid-Segment Passenger Cars |

| By Region | North America - US, Canada, and Mexico |

| Europe - Germany, Italy, France, UK, and Spain | |

| Asia Pacific - China, Japan, South Korea, and India | |

| Rest of the World - Argentina, and Brazil | |

| Additional Customization to be offered | 1) Cockpit domain controller market, by level of autonomy at the regional level 2) Profiling of Additional Market Players (Up to 5) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 RESEARCH ASSUMPTIONS

2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 EVOLUTION OF MULTI-DOMAIN CONTROLLERS IN AUTOMOTIVE

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.2 RESTRAINTS

5.3.3 OPPORTUNITIES

5.3.4 CHALLENGES

5.3.5 IMPACT ANALYSIS OF MARKET DYNAMICS

5.4 PORTER’S FIVE FORCES MODEL

5.5 CASE STUDY ANALYSIS

5.6 MNM INSIGHTS ON TECHNOLOGY & TREND ANALYSIS

5.6.1 INTEGRATED DIGITAL COCKPIT

5.6.2 CO-DRIVER DISPLAY

5.6.3 SPLIT DISPLAY

5.6.4 INTEGRATED DISPLAY (FULL DASHBOARD DISPLAY)

5.6.5 HEAD-UP DISPLAY

5.7 PRICING ANALYSIS

5.8 PATENT ANALYSIS

5.9 ECOSYSTEM ANALYSIS

5.10 SUPPLY CHAIN ANALYSIS

5.11 TRENDS AND DISRUPTIONS IN COCKPIT CONTROLLER MARKET

5.12 REGULATORY LANDSCAPE

5.12.1 LIST OF REGULATORY BODIES, ORGANIZATIONS AND ASSOCIATIONS

5.13 BUYING CRITERIA AND STAKEHOLDERS IN BUYING PROCESS

5.13.1 BUYING CRITERIA

5.13.2 KEY STAKEHOLDERS IN BUYING PROCESS

5.14 COCKPIT CONTROLLER MARKET: SCENARIO ANALYSIS, 2022-2030

5.14.1 OPTIMISTIC SCENARIO

5.14.2 MOST LIKELY SCENARIO

5.14.3 PESSIMISTIC SCENARIO

(MnM will provide regional market size in terms of value & volume in scenario analysis)

6 COCKPIT DOMAIN CONTROLLER MARKET, BY VEHICLE TYPE

6.1 INTRODUCTION

6.1.1 RESEARCH METHODOLOGY

6.1.2 OPERATIONAL DATA

6.1.3 KEY INDUSTRY INSIGHTS

6.2 PASSENGER CARS

6.3 COMMERCIAL VEHICLES

7 COCKPIT DOMAIN CONTROLLER MARKET, BY PROPULSION TYPE

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 OPERATIONAL DATA

7.1.3 KEY INDUSTRY INSIGHTS

7.2 INTERNAL COMBUSTION ENGINES

7.3 ELECTRIC VEHICLES

8 COCKPIT DOMAIN CONTROLLER MARKET, BY LEVEL OF AUTONOMY

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 OPERATIONAL DATA

8.1.3 KEY INDUSTRY INSIGHTS

8.2 NON-AUTONOMOUS

8.3 SEMI- AUTONOMOUS & AUTONOMOUS

9 COCKPIT DOMAIN CONTROLLER MARKET, BY VEHICLE CLASS

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 OPERATIONAL DATA

9.1.3 KEY INDUSTRY INSIGHTS

9.2 ECONOMY PASSENGER CARS

9.3 MID-SEGMENT PASSENGER CARS

9.4 LUXURY PASSENGER CARS

NOTE: *Qualitative data will be provided for this chapter

10 COCKPIT DOMAIN CONTROLLER MARKET, BY REGION

10.1 INTRODUCTION

10.2 ASIA PACIFIC

10.2.1 CHINA

10.2.2 JAPAN

10.2.3 INDIA

10.2.4 SOUTH KOREA

10.3 EUROPE

10.3.1 FRANCE

10.3.2 GERMANY

10.3.3 SPAIN

10.3.4 ITALY

10.3.5 UK

10.4 NORTH AMERICA

10.4.1 US

10.4.2 CANADA

10.4.3 MEXICO

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS – COCKPIT DOMAIN CONTROLLER

11.3 COMPETITIVE SCENARIO

11.3.1 NEW PRODUCT DEVELOPMENTS

11.3.2 EXPANSIONS

11.3.3 PARTNERSHIPS/SUPPLY CONTRACTS/COLLABORATIONS/JOINT VENTURES/AGREEMENTS/MERGERS & ACQUISITIONS

11.4 COMPETITIVE LEADERSHIP MAPPING

11.11.1 STARS

11.11.2 EMERGING LEADERS

11.11.3 PERVASIVE

11.11.4 PARTICIPANTS

11.5 STARTUP/SME EVALUATION QUADRANT

11.6 WINNERS VS. TAIL-ENDERS

12 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, MnM view)*

12.1 CONTINENTAL AG

12.2 VISTEON CORPORATION

12.3 INFINEON TECHNOLOGIES

12.4 APTIV PLC

12.5 PANASONIC CORPORATION

12.6 HARMAN INTERNATIONAL

12.7 FAURECIA

12.8 MAGNA INTERNATIONAL INC.

12.9 LG MOBILITY

12.10 MARELLI

12.11 TEXAS INSTRUMENTS

12.12 TATA ELXSI

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, might not be captured in case of unlisted companies.

12.13 OTHER KEY PLAYERS

13 APPENDIX

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

Growth opportunities and latent adjacency in Cockpit Domain Controller Market