Cloud TV Market by Deployment Type (Public Cloud and Private Cloud), Device Type (STBs, and Mobile Phones and Connected TVs), Organization Size, Vertical (Telecom Companies, and Media Organizations and Broadcasters), and Region - Global Forecast to 2026

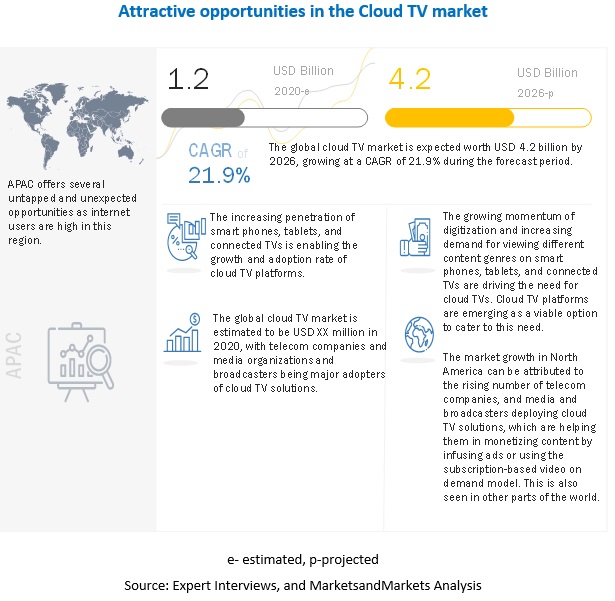

[222 Pages Report] The Cloud TV market size is expected to grow from USD 1.2 billion in 2020 to USD 4.2 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 21.9% during the forecast period. The cloud TV platform is used to deliver audio, video, rich media, and other media content over the internet. Cloud TV is delivered over end users’ handheld devices, such as smartphones, tablets, and connected TVs, through a wireless connection over the internet. It offers features such as live TV, video-on- demand, and web surfing.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 health crisis has fundamentally impacted lifestyles and routines of all consumers. Work-from-home mandates and social distancing have driven in-home video consumption to unprecedented levels. Consumers are also learning new skills and keeping themselves entertained through a plethora of internet-based content. Be it OTT platforms, video hosting websites such as YouTube, or video conferencing tools and software for hosting webinars and internal meetings, the COVID-19 pandemic has transformed the way people function. This current era, marked by the COVID-19 pandemic, has accelerated in-home video consumption to levels never seen before. While devices such as smartphones, connected TVs, and tablets enhance the entertainment experience, technological advancements, the continued proliferation of video apps, and improved interoperability and connectivity with other devices have pushed cloud TVs to even greater heights during the COVID-19 pandemic. Many users opted for SVODs during this pandemic. For instance, Netflix reached a whopping 15.8 million paid subscribers in the first three months of 2020 amid the coronavirus pandemic as people were forced to stay at home. Netflix had expected 7.2 million subscribers but witnessed more than a double rise in paid subscribers. As per Limelight Networks, online videos continue to rapidly grow in popularity at the expense of traditional broadcast viewing. On average, viewers spend nearly 7 hours 55 minutes per week watching various types of content.

Market Dynamics

Driver: Demand for higher user experience for on-demand or interactive viewing

Advances in technology and consumer behaviour are changing the way video content is being delivered to consumers. These advances involve migration from traditional broadcasting models and platforms to digital distribution over the internet to a wide range of connected devices. This fundamental shift is triggering three major disruptions for broadcasters and telecom providers, each calling for the scalability, cost flexibility, and agility of cloud TV platforms. Online video consumption has increased enormously in the last decade. Customers are accustomed to using OTT videos and internet services; therefore, they are valuing a more tailored and interactive viewing experience. As a result, they are demanding more choice, convenience, and control over their viewing, choosing to watch a network’s scheduled line-up, enjoy a live event, or record favorite content and watch it whenever and on whatever device they want. This requires far more computing power and resources than traditional broadcasting. Thus, many telecom providers and broadcasters are leveraging the cloud TV platform for providing customers a range of viewing options, along with personalized content suggestions. Customers are also expecting to view content as per their choice. Hence, this is expected to fuel the demand for cloud TVs.

Restraint: Lack of high-speed network infrastructure and internet access in rural areas

One of the main restraints in adopting cloud TV is the lack of high-speed network infrastructure. Internet and mobile phone connectivity is an integral part of cloud TV. There is an ongoing mobile network connectivity problem in rural areas. These areas are remote and backward because of a lack of facilities and poor connectivity. This issue has made it extremely difficult for cloud TV providers to enter the rural areas. Although the last couple of years have seen significant improvements in access to decent broadband and 3G,4G, and mobile services in rural areas, rural networks are struggling due to the increasing demand for digital services, widening the digital divide between urban and rural areas. While all urban areas in the world are covered by mobile-broadband networks, there are gaps in connectivity and internet access in rural areas, according to International Telecommunication Union (ITU), a subsidiary of the United Nations. Connectivity gaps in the rural areas are high in Least developed countries (LDCs), where 17% of the rural population live in areas with no mobile coverage at all, and 19% of the rural population is covered by 2G. According to 2019 data, about 72% of households in urban areas have internet access internet at home, while 37% of the population in rural areas uses the internet. These factors hamper the adoption of cloud TV solutions.

Opportunities: Adoption of 5G to increase the demand for cloud TV

The rising adoption of 5G technology and growing advancements in wireless communication are expected to boost the market growth. Many telecom vendors invest in the progress of 5G technology to strengthen the cloud TV experience. For instance, Nokia and AT&T collaborate to advance the 5G technology in the 39 GHz band by finishing fixed wireless 5G tests with AT&T's internet TV streaming service, DIRECTV NOW. Speed and low latency are essential to make the experience of cloud TV seamless. Developed countries such as the US, and certain European and APAC countries have high-speed network infrastructure, i.e., 5G in place, and adopt new-age technologies much faster and easier. Carriers in North America, Europe, and Australia have set up 5G. As the demand for high-quality content and seamless streaming would rise, 5G would drive cloud TV viewer experience to new heights videos account for the majority of mobile internet bandwidth used today.

Challenge: Concerns over digital piracy

As cloud TV providers are offering more TV channels in cloud, the importance of content protection in cloud TV is becoming a concern for them. The problem of piracy is still a big concern, and any operator looking to launch a cloud TV service needs to be aware of its potential challenges. Robust content protection in cloud TV needs to be implemented using a form of multiple DRM that acknowledges increased fragmentation in the marketplace. To tackle such challenges, in 2017, 30 leading content creators and on-demand entertainment companies from around the world launched the Alliance for Creativity and Entertainment (ACE), a new global coalition dedicated to protecting the dynamic legal market for creative content and reduce online piracy. The worldwide members of ACE are Amazon, AMC Networks, BBC Worldwide, Bell Canada and Bell Media, Canal+ Group, CBS Corporation, Constantin Film, Foxtel, Grupo Globo, HBO, Hulu, Lionsgate, Metro-Goldwyn-Mayer (MGM), Millennium Media, NBCUniversal, Netflix, Paramount Pictures, SF Studios, Sky, Sony Pictures Entertainment, Star India, Studio Babelsberg, STX Entertainment, Telemundo, Televisa, Twentieth Century Fox, Univision Communications Inc., Village Roadshow, The Walt Disney Company, and Warner Bros. Entertainment Inc. Cloud TV platforms are now relying on multi-DRM solutions so that their premium content remains secure across devices. Therefore, the support for multi-DRM is required in cloud TV platforms to tackle the digital piracy challenge.

Media companies and broadcasters vertical to grow at the highest CAGR during the forecast period

Media and broadcasting is a huge and diverse vertical. It encompasses video and audio content distribution, publishing, film, music, and social media, among others. However, a common trend across all the segments of media and broadcasting is the rising importance of video content delivered over the internet. Advances in technology and consumer behaviour are driving a transformation in the way video content is delivered to consumers. The change involves a migration from traditional broadcasting models and media platforms toward digital distribution over the internet to a wide array of connected devices. This fundamental shift is triggering three major disruptions for broadcasters and media companies. These disruptions are scalability, cost flexibility, and agility of cloud computing. With the digitalization of media and broadcasting mediums, the consumer appetite for gaining access to the right information or preferred channels is growing increasingly. The media and broadcasting vertical seeks to interact with its consumers to achieve deeper customer engagement. Various companies use cloud TV platforms to do live broadcasting of sports, which includes live voting for viewers. This ensures consumer engagement and retention. Using AI and analytics, the media and broadcasting companies show preferred content to their consumers, which, in turn, increases the viewing time and ad revenue. These factors help the cloud TV platforms to be consumed by media and broadcasting companies.

Large enterprises to hold a larger market size during the forecast period

Cloud TVs help enterprises with easy and quick deployments, thus helping them in expanding their existing markets. They save a lot of time and reduce building and maintenance costs. Integrated solutions can leverage the power of cloud computing platforms, such as AWS, Google Cloud, and Microsoft Azure, to provide a streamlined cloud TV platform from planning to delivery of personalized content, deployment and implementation of online video services, and incorporate the growth for customers launching large-scale cloud TV services. Many global operators are looking to migrate from legacy solutions to more agile and flexible cloud infrastructure powered solutions by proven technologies and delivered by providers with unique expertise in deploying cloud TV services. These benefits and features of cloud TVs have favored their adoption among large enterprises.

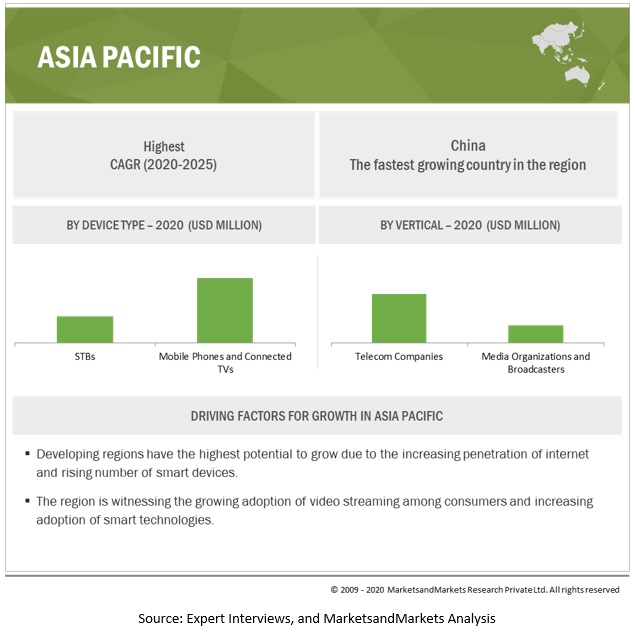

Asia Pacific to grow the highest during the forecast period

The global Cloud TV market by region covers 5 major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East and Africa (MEA), and Latin America. Asia Pacific is expected to grow the highest owing to the rising internet and smart phone penetration.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Cloud TV market comprises major solution providers, such as Kaltura (US), Brightcove (US), Amino Technologies (UK), Muvi (US), IntelliMedia Networks (US), Pontis Technologies (Argentina), Mware Solutions (Netherlands), MatrixStream Technologies (US), CSG Systems International Inc (US), Viaccess-Orca (France), Simplestream (UK), MediaKind (US), Comcast Technology Solutions (US), ActiveVideo (US), Synamedia (UK), Entertainment And Interactivity For Digital Tv (Brazil), Egla Communications (US), Minerva Networks (US), SeaChange International (US), Icareus (Finland), video.space (US), AVITENG (Turkey), Amagi Corporation (US), Metrological (Netherlands), and Streemfire (Austria). These players adopt new product developments as their key growth strategy.

The study includes an in-depth competitive analysis of these key players in the Cloud TV market with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Deployment type, device type, organization size, vertical and regions. |

|

Geographies covered |

North America, APAC, Europe, Latin America, and MEA |

|

Companies covered |

Kaltura (US), Brightcove (US), Amino Technologies (UK), Muvi (US), IntelliMedia Networks (US), Pontis Technologies (Argentina), Mware Solutions (Netherlands), MatrixStream Technologies (US), CSG Systems International Inc (US), Viaccess-Orca (France), Simplestream (UK), MediaKind (US), Comcast Technology Solutions (US), ActiveVideo (US), Synamedia (UK), Entertainment And Interactivity For Digital Tv (Brazil), Egla Communications (US), Minerva Networks (US), SeaChange International (US), Icareus (Finland), video.space (US), AVITENG (Turkey), Amagi Corporation (US), Metrological (Netherlands), and Streemfire (Austria). |

This research report categorizes the Cloud TV market based on deployment type, device type, organization size, vertical, and region.

Based on deployment type, the Cloud TV market has been segmented as follows:

- Public cloud

- Private cloud

Based on organization size, the Cloud TV market has been segmented as follows:

- Small and Medium-sized Enterprises

- Large Enterprises

Based on verticals, the Cloud TV market has been segmented as follows:

- Telecom companies

- Media organizations and broadcasters

Based on regions, the Cloud TV market has been segmented as follows:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia and New Zealand

- Rest of APAC

-

MEA

- KSA (Kingdom of Saudi Arabia)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In November 2020, CommScope and Kaltura partnered to deliver cloud TV offerings to communication service providers and media companies worldwide. The integrated solutions would leverage the power of AWS to provide a streamlined cloud platform, from planning to delivery, deployment, and implementation, and ongoing growth for customers launching large-scale cloud TV services. AWS enables video providers to enhance operational flexibility and resilience, and take advantage of optimized resources and cost structures.

- In April 2019, Brightcove acquired the online video platform business of Ooyala, a provider of the cloud video technology, for USD 15 million in cash and stock. The strategic acquisition strengthens Brightcove’s position as a market leader in the online video industry. With this acquisition, Ooyala’s OVP customers joined the list of companies working with Brightcove.

- In July 2020, CSG Systems International and Bell Canada, Canada’s largest communication company that provides advanced wireless, Internet, TV, and business services, announced a seven-year extension to their long-standing partnership. CSG Systems International would continue to support the residential customer service and billing for Bell Canada’s Fibe and Alt TV services. Bell Canada’s Fibe TV is an IP-based television service. It enables users to stream live TV on the screen of their choice.

Frequently Asked Questions (FAQ):

How big is the Cloud TV Market?

What is growth rate of the Cloud TV Market?

What are the key trends affecting the global Cloud TV Market?

Who are the key players in Cloud TV Market?

What are the major revenue pockets in the Cloud TV Market currently?

What is Cloud TV?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

FIGURE 6 CLOUD TV: MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2016–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 7 CLOUD TV MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primary profiles

FIGURE 8 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE FROM CLOUD TV VENDORS

FIGURE 11 CLOUD TV MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS OF THE STUDY

2.5.1 SUPPLY SIDE

FIGURE 12 MARKET SIZE PROJECTIONS FROM SUPPLY SIDE

2.5.2 DEMAND SIDE

FIGURE 13 MARKET SIZE PROJECTIONS FROM DEMAND SIDE

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 3 CLOUD TV MARKET SIZE AND GROWTH RATE, 2020–2026 (USD MILLION)

FIGURE 14 NORTH AMERICA TO HOLD HIGHEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN CLOUD TV MARKET

FIGURE 15 DEMAND FOR HIGHER USER EXPERIENCES FOR ON-DEMAND OR INTERACTIVE VIEWING DRIVES MARKET GROWTH

4.2 MARKET: MARKET SHARE OF VERTICALS, 2020

FIGURE 16 TELECOM COMPANIES VERTICAL TO HOLD HIGHER MARKET SHARE IN 2020

4.3 MARKET INVESTMENT SCENARIO

FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT SIX YEARS

4.4 CLOUD TV MARKET: MARKET SHARE OF DEVICE TYPES, 2020

FIGURE 18 MOBILE PHONES AND CONNECTED TV TO HOLD HIGHER MARKET SHARE IN 2020

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 CLOUD TV MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Demand for higher user experience for on-demand or interactive viewing

5.2.1.2 Ability to increase ARPU through personalized experiences and infuse ads via analytics

5.2.1.3 Cloud TV enables telcos to be super aggregators

5.2.2 RESTRAINTS

5.2.2.1 Lack of high-speed network infrastructure and internet access in rural areas

FIGURE 20 HOUSEHOLDS WITH INTERNET ACCESS AT HOME IN RURAL AND URBAN AREAS, 2019

5.2.3 OPPORTUNITIES

5.2.3.1 Multi-CDN strategy for high content delivery

5.2.3.2 Adoption of 5G to increase the demand for cloud TV

TABLE 4 DATA SPEED: 3G, 4G, AND 5G

5.2.4 CHALLENGES

5.2.4.1 Concerns over digital piracy

5.2.4.2 Advertising frauds impacting revenue of companies

FIGURE 21 FRAUD TYPES BY ENVIRONMENT

5.3 CUMULATIVE GROWTH ANALYSIS

TABLE 5 COVID-19 IMPACT ON CLOUD TV MARKET

5.4 PRICING ANALYSIS

TABLE 6 PRICING ANALYSIS

5.5 ECOSYSTEM

FIGURE 22 MARKET: ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

FIGURE 23 CLOUD TV MARKET: VALUE CHAIN

5.7 TECHNOLOGY ANALYSIS

5.7.1 TECHNOLOGY IN AD INSERTION

5.7.1.1 Server-side ad insertion

5.7.1.2 Video ad serving template

5.7.1.3 Video player ad interface definition

5.7.1.4 Secure interactive media interface definition

5.7.2 DIGITAL RIGHTS MANAGEMENT

5.7.3 CONTENT MANAGEMENT

5.7.4 VIDEO ANALYTICS

5.7.5 ELECTRONIC PROGRAM GUIDE

5.8 INDUSTRY STANDARDS AND PROTOCOLS

5.8.1 ADVANCED TELEVISION SYSTEMS COMMITTEE STANDARDS

5.8.2 INTEGRATED SERVICES DIGITAL BROADCASTING

5.8.3 MOVING PICTURES EXPERT GROUP - DYNAMIC ADAPTIVE STREAMING OVER HTTP

5.8.4 REAL-TIME MESSAGING PROTOCOL

5.8.5 HTTP LIVE STREAMING

5.9 CASE STUDY ANALYSIS

5.9.1 USE CASE 1

5.9.2 USE CASE 2

5.9.3 USE CASE 3

5.9.4 USE CASE 4

5.9.5 USE CASE 5

5.1 PATENT ANALYSIS

TABLE 7 IMPORTANT INNOVATION AND PATENT REGISTRATIONS

6 CLOUD TV MARKET, BY DEPLOYMENT TYPE (Page No. - 68)

6.1 INTRODUCTION

6.1.1 DEPLOYMENT TYPES: MARKET DRIVERS

6.1.2 DEPLOYMENT TYPES: COVID-19 IMPACT

FIGURE 24 PUBLIC CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 8 MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 9 MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

6.2 PUBLIC CLOUD

TABLE 10 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 PRIVATE CLOUD

TABLE 12 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 CLOUD TV MARKET, BY DEVICE TYPE (Page No. - 73)

7.1 INTRODUCTION

7.1.1 DEVICE TYPES: MARKET DRIVERS

7.1.2 DEVICE TYPES: COVID-19 IMPACT

FIGURE 25 MOBILE PHONES AND CONNECTED TV SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 14 MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 15 MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

7.2 SET-TOP-BOX

TABLE 16 SET TOP BOX: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 SET TOP BOX: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 MOBILE PHONES AND CONNECTED TV

TABLE 18 MOBILE PHONES AND CONNECTED TV: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 MOBILE PHONES AND CONNECTED TV: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 CLOUD TV MARKET, BY ORGANIZATION SIZE (Page No. - 78)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 26 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 20 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 21 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 22 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 24 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 CLOUD TV MARKET, BY VERTICAL (Page No. - 83)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

9.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 27 MEDIA ORGANIZATIONS AND BROADCASTERS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 26 MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 27 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

9.2 TELECOM COMPANIES

TABLE 28 TELECOM COMPANIES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 TELECOM COMPANIES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 MEDIA ORGANIZATIONS AND BROADCASTERS

TABLE 30 MEDIA ORGANIZATIONS AND BROADCASTERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 MEDIA ORGANIZATIONS AND BROADCASTERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 CLOUD TV MARKET, BY REGION (Page No. - 88)

10.1 INTRODUCTION

FIGURE 28 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 32 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 30 CANADA TO GROW AT HIGHER CAGR FROM 2020–2026

TABLE 34 NORTH AMERICA: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.4 UNITED STATES

TABLE 44 UNITED STATES: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 45 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 46 UNITED STATES: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 47 UNITED STATES: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 48 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 49 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.2.5 CANADA

TABLE 50 CANADA: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 51 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 52 CANADA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 53 CANADA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 54 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 55 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: CLOUD TV MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATIONS

FIGURE 31 UNITED KINGDOM TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 56 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 57 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 58 EUROPE: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 66 UNITED KINGDOM: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 67 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 68 UNITED KINGDOM: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 69 UNITED KINGDOM: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 70 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 71 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.5 GERMANY

TABLE 72 GERMANY: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 73 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 74 GERMANY: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 75 GERMANY: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 76 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 77 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.6 FRANCE

TABLE 78 FRANCE: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 79 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 80 FRANCE: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 81 FRANCE: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 82 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 83 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 84 REST OF EUROPE: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 85 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 86 REST OF EUROPE: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 87 REST OF EUROPE: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 88 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 89 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 33 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 90 ASIA PACIFIC: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 92 ASIA PACIFIC: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 100 AUSTRALIA AND NEW ZEALAND: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 101 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 102 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 103 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 104 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 105 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.5 CHINA

TABLE 106 CHINA: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 107 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 108 CHINA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 109 CHINA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 110 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 111 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.6 JAPAN

TABLE 112 JAPAN: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 113 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 114 JAPAN: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 115 JAPAN: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 116 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 117 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 118 REST OF ASIA PACIFIC: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 119 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 122 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: CLOUD TV MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

FIGURE 34 UNITED ARAB EMIRATES TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 124 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

TABLE 134 KINGDOM OF SAUDI ARABIA: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 135 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 136 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 137 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 138 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 139 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.5 UNITED ARAB EMIRATES

TABLE 140 UNITED ARAB EMIRATES: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 141 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 142 UNITED ARAB EMIRATES: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 143 UNITED ARAB EMIRATES: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 144 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 145 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.6 SOUTH AFRICA

TABLE 146 SOUTH AFRICA: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 147 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 148 SOUTH AFRICA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 149 SOUTH AFRICA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 150 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 151 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.7 REST OF MIDDLE EAST AND AFRICA

TABLE 152 REST OF MIDDLE EAST AND AFRICA: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 153 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 154 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 155 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 156 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 157 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: CLOUD TV MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATIONS

FIGURE 35 BRAZIL TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 158 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.4 BRAZIL

TABLE 168 BRAZIL: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 169 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 170 BRAZIL: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 171 BRAZIL: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 172 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 173 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6.5 MEXICO

TABLE 174 MEXICO: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 175 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 176 MEXICO: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 177 MEXICO: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 178 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 179 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6.6 REST OF LATIN AMERICA

TABLE 180 REST OF LATIN AMERICA: CLOUD TV MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 181 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 182 REST OF LATIN AMERICA: MARKET SIZE, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 183 REST OF LATIN AMERICA: MARKET SIZE, BY DEVICE TYPE, 2020–2026 (USD MILLION)

TABLE 184 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 185 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 149)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK

11.3 MARKET SHARE OF TOP PLAYERS

FIGURE 37 MARKET SHARE OF MAJOR PLAYERS IN CLOUD TV MARKET, 2019

11.4 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 38 TOP FIVE PLAYERS DOMINATED MARKET IN LAST THREE YEARS

11.5 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 186 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

11.5.4 PARTICIPANTS

FIGURE 39 CLOUD TV MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2019

11.6 STARTUP EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 187 STARTUP EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 40 CLOUD TV MARKET (GLOBAL): STARTUP EVALUATION MATRIX, 2019

11.7 KEY MARKET DEVELOPMENTS

11.7.1 NEW PRODUCT/SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 188 PRODUCT/SOLUTION LAUNCHES AND ENHANCEMENTS, 2019–2020

11.7.2 ACQUISITIONS

TABLE 189 ACQUISITIONS, 2019

11.7.3 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 190 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2019-2020

12 COMPANY PROFILES (Page No. - 158)

12.1 KEY PLAYERS

(Business Overview, Products & Services, Key Insights, Recent Developments, MnM View)*

12.1.1 INTRODUCTION

12.1.2 KALTURA

12.1.3 BRIGHTCOVE

FIGURE 41 BRIGHTCOVE: COMPANY SNAPSHOT

12.1.4 AMINO TECHNOLOGIES

FIGURE 42 AMINO TECHNOLOGIES: COMPANY SNAPSHOT

12.1.5 MWARE SOLUTIONS

12.1.6 MATRIXSTREAM

12.1.7 MUVI

12.1.8 INTELLIMEDIA NETWORKS

12.1.9 PONTIS TECHNOLOGIES

12.1.10 CSG SYSTEMS INTERNATIONAL

FIGURE 43 CSG SYSTEMS INTERNATIONAL: COMPANY SNAPSHOT

12.1.11 VIACCESS-ORCA

12.1.12 COMCAST TECHNOLOGY SOLUTIONS

FIGURE 44 COMCAST TECHNOLOGY SOLUTIONS: COMPANY SNAPSHOT

12.1.13 ACTIVEVIDEO

12.1.14 EITV

12.1.15 EGLA COMMUNICATIONS

12.1.16 MINERVA NETWORKS

12.1.17 SEACHANGE

12.1.18 ICAREUS

12.1.19 METROLOGICAL

12.1.20 AMAGI

12.1.21 SIMPLESTREAM

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 STARTUP PROFILES

12.2.1 AVITENG

12.2.2 VIDEO.SPACE

12.2.3 SYNAMEDIA

12.2.4 STREAMFIRE

12.2.5 MEDIAKIND

13 ADJACENT MARKET (Page No. - 199)

13.1 INTRODUCTION

13.1.1 RELATED MARKET

TABLE 191 RELATED MARKET

13.1.2 LIMITATIONS

13.2 CONTENT DELIVERY NETWORK MARKET

13.2.1 INTRODUCTION

13.2.2 MARKET OVERVIEW

13.2.3 CONTENT DELIVERY NETWORK, BY COMPONENT

TABLE 192 CONTENT DELIVERY NETWORK MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 193 CONTENT DELIVERY NETWORK MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

13.3 SOLUTIONS

TABLE 194 SOLUTIONS: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 195 SOLUTIONS: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 196 SOLUTIONS: CONTENT DELIVERY NETWORK MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 197 SOLUTIONS: CONTENT DELIVERY NETWORK MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

13.4 SERVICES

TABLE 198 SERVICES: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 199 SERVICES: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 200 SERVICES: CONTENT DELIVERY NETWORK MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 201 SERVICES: CONTENT DELIVERY NETWORK MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

13.4.1 CONTENT DELIVERY NETWORK, BY CONTENT TYPE

TABLE 202 CONTENT DELIVERY NETWORK MARKET SIZE, BY CONTENT TYPE, 2016–2019 (USD MILLION)

TABLE 203 CONTENT DELIVERY NETWORK MARKET SIZE, BY CONTENT TYPE, 2019–2025 (USD MILLION)

13.5 STATIC CONTENT

TABLE 204 STATIC CONTENT: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 205 STATIC CONTENT: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.6 DYNAMIC CONTENT

TABLE 206 DYNAMIC CONTENT: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 207 DYNAMIC CONTENT: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.6.1 CONTENT DELIVERY NETWORK, BY PROVIDER TYPE

TABLE 208 CONTENT DELIVERY NETWORK MARKET SIZE, BY PROVIDER TYPE, 2016–2019 (USD MILLION)

TABLE 209 CONTENT DELIVERY NETWORK MARKET SIZE, BY PROVIDER TYPE, 2019–2025 (USD MILLION)

13.7 TRADITIONAL CONTENT DELIVERY NETWORK

TABLE 210 TRADITIONAL CDN: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 211 TRADITIONAL CDN: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.8 TELCO CONTENT DELIVERY NETWORK

TABLE 212 TELCO CDN: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 213 TELCO CDN: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.9 CLOUD CONTENT DELIVERY NETWORK

TABLE 214 CLOUD CDN: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 215 CLOUD CDN: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.10 PEER-TO-PEER CONTENT DELIVERY NETWORK

TABLE 216 P2P CDN: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 217 P2P CDN: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.11 OTHER PROVIDER TYPES

TABLE 218 OTHER PROVIDER TYPES: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 219 OTHER PROVIDER TYPES: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.11.1 CONTENT DELIVERY NETWORK, BY APPLICATION AREA

TABLE 220 CONTENT DELIVERY NETWORK MARKET SIZE, BY APPLICATION AREA, 2016–2019 (USD MILLION)

TABLE 221 CONTENT DELIVERY NETWORK MARKET SIZE, BY APPLICATION AREA, 2019–2025 (USD MILLION)

TABLE 222 MEDIA AND ENTERTAINMENT: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 223 ONLINE GAMING: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 224 RETAIL AND ECOMMERCE: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 225 ELEARNING: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 226 HEALTHCARE: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 227 ENTERPRISES: CONTENT DELIVERY NETWORK MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 228 CONTENT DELIVERY NETWORK MARKET SIZE, BY ENTERPRISE, 2019–2025 (USD MILLION)

14 APPENDIX (Page No. - 216)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORT

14.5 AUTHOR DETAILS

The study involved 4 major activities in estimating the current market size for Cloud TV. An exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg, Statista and BusinessWeek have been referred for, to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

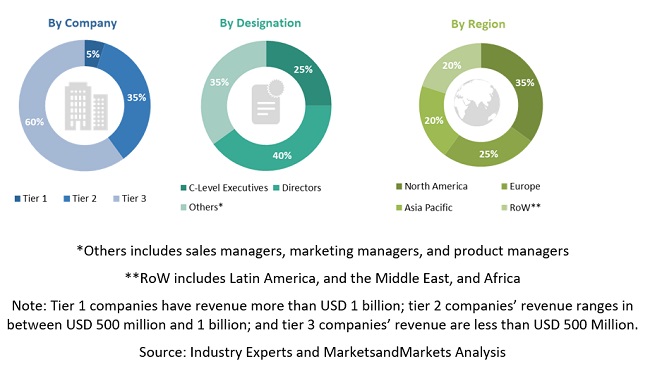

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various leading companies and organizations operating in the Cloud TV market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the Cloud TV market, and the other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global Cloud TV market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the global Cloud TV market based on solution, service, organization size, vertical, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To forecast the market size with respect to five main regions - North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America

- To profile the key players and comprehensively analyze their core competencies2

- To track and analyze the competitive developments, such as joint ventures, mergers and acquisitions, new product developments, COVID-19-related developments, and research and development (R&D) activities, in the global Cloud TV market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 3

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud TV Market