Cloud High Performance Computing (HPC) Market by Service Type (HPC IAAS, HPC PAAS, Data Organization and Workload Management, Clustering Software and Analytics Tool, Professional Service and Managed Service) - Global Forecast to 2020

[119 Pages Report] The Cloud High Performance Computing Market size is estimated to grow from USD 4.37 Billion in 2015 to USD 10.83 Billion by 2020, at an estimated compounded annual growth rate (CAGR) of 19.9% from 2015 to 2020.

The report aims at estimating the market size and future growth potential of cloud HPC market across different segments, such as service type, deployment model, organization size, end user, and region. The base year considered for the study is 2014 and the market size is forecast from 2015 to 2020. The complex applications management, emergence of big data market, and adoption of pay-as-you-go model is expected to play a key role in fueling the growth of the cloud HPC market during the forecast period.

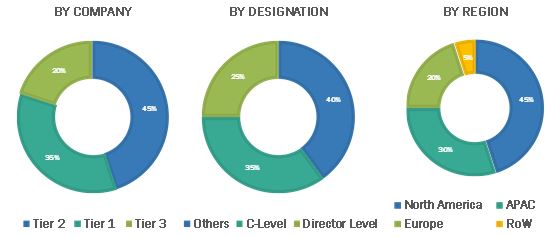

The research methodology used to estimate and forecast the Cloud High Performance Computing Market begins with capturing data from key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud HPC market from the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments, which are then verified through primary research by conducting extensive interviews with key people, such as CEOs, VPs, directors, and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of profiles of primary is depicted in the below figure:

The key vendors providing cloud HPC services are:

- HPC IaaS: Penguin Computing, Google, IBM Corporation, and others

- HPC PaaS: Amazon Web Services, Penguin Computing, and others

- Data organization and workload management: Dell, IBM Corporation, Univa Corporation, and others

- Clustering software and analytics tool: Microsoft Corporation, Univa Corporation, Dell, and more

- Professional service: Sabalcore Computing, Adaptive Computing, and others

- Managed service: Peer 1, TCS, and Penguin Computing.

Target audience

- Software Providers

- Service Providers

- Analytics Providers

- System Integrators

- Market Research and Consulting Firms

- Head of IT and Operations in Organizations

- Investors and Venture Capitalists

- Business Intelligence Providers

Scope of the Report

The research report segments the Cloud High Performance Computing Market to following submarkets:

By Service Type:

- HPC IaaS

- HPC PaaS

- Data Organization and Workload Management

- Clustering Software and Analytics Tool

- Professional Service

- Managed Service

By Deployment model:

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization size:

- Small and Medium Businesses (SMBs)

- Large Enterprises

By End User:

- Academia and Research

- Biosciences

- Design and Engineering

- Financial Services

- Government

- Manufacturing

- Media, Entertainment and Online Gaming

- Weather and Environment

- Others

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- RoW

Available Customizations

With the given market data, MarketsandMarkets offer customization as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America Cloud HPC market

- Further breakdown of the Europe Cloud HPC market

- Further breakdown of the APAC Cloud HPC market

- Further breakdown of the MEA Cloud HPC market

- Further breakdown of the Latin America Cloud HPC market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecast the cloud High Performance Computing market size to grow from USD 4.37 Billion in 2015 to USD 10.83 Billion by 2020, at a compound annual growth rate (CAGR) of 19.9% from 2015 to 2020. HPC involves complex and technical computation that generates huge amount of data making it difficult in collaboration and processing. Cloud HPC addresses these issues by offering distributed and customized execution environment. The complex applications management, emergence of big data market, and adoption of pay-as-you-go model are the main drivers of the cloud HPC market.

Cloud HPC service type market segmentation comprises HPC Infrastructure as a Service (IaaS), HPC, Platform as a Service (PaaS), data organization and workload management, clustering software and analytics tool, professional service, and managed service. The HPC IaaS market is expected to have the largest market share in the cloud HPC market in the service type from 2015 to 2020, due to the growth of complex applications and increasing workloads. Managed service is expected to play a key role in changing the cloud HPC landscape and will grow at the highest growth rate during the forecast period as managed service providers are responsible for managing and monitoring IT systems enabling enterprises to increase efficiency, reduce the downtime, and drive better outcomes.

Hybrid cloud deployment is the fastest-growing deployment model in the Cloud High Performance Computing Market as it seeks to deliver the advantages of scalability, reliability, rapid deployment, and potential cost savings along with security features. The public cloud deployment model is expected to have the largest market share from 2015 to 2020 as it offers various benefits to organizations, such as ease of access, faster deployment, and location independence services.

The cloud HPC services are being increasingly adopted by numerous end users, such as government and academia and research, biosciences, and others that have led to the growth of the market across the globe. The government sector is expected to dominate the cloud HPC market, contributing the largest market share during the forecast period. However, the media, entertainment and online gaming end users are projected to witness the highest growth during the forecast period.

North America is expected to have the largest market share and will dominate the cloud HPC market from 2015 to 2020 owing to innovations through research and development and technology and increasing demand for business flexibility and agility. The cloud HPC market is expected to experience huge growth in Asia-Pacific (APAC) due to improved technology, cost efficiency, scalability, and improved productivity.

However, the increased cost during transition from on-premise to cloud-based HPC services and risk of information loss are restraining the growth of the Cloud High Performance Computing Market. The major vendors in the cloud HPC market include IBM Corporation, Microsoft Corporation, Google, Dell, Amazon Web Services, Penguin Computing, Sabalcore Computing, Adaptive Computing, and others. These players adopted various strategies such as new product launches, mergers, partnerships, collaborations, agreements, and business expansions to expand their product portfolio thereby further increasing their global footprint in the cloud HPC market.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Cloud High Performance Computing Market

4.2 Cloud HPC Market: Market Share of the Top Four Service Types and End Users

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

5 Cloud High Performance Computing Market: Overview (Page No. - 31)

5.1 Introduction

5.2 Market Evolution

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Complex Applications Management

5.3.1.2 Emergence of Big Data Market

5.3.1.3 Adoption of Pay-As-You-Go Model

5.3.2 Restraints

5.3.2.1 Increased Cost During Transition From On-Premise to Cloud-Based HPC Services

5.3.2.2 Risk of Information Loss

5.3.3 Opportunities

5.3.3.1 Faster Deployment, Increased Flexibility, and Scalability

5.3.3.2 High Adoption Rate in Smbs

5.3.4 Challenges

5.3.4.1 Lack of Security

5.3.4.2 Stringent and Time-Consuming Regulatory Policies

6 Cloud High Performance Computing Market: Industry Trends (Page No. - 37)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Ecosystem

6.4 Strategic Benchmarking

7 Cloud High Performance Computing Market Analysis, By Service Type (Page No. - 40)

7.1 Introduction

7.2 HPC IAAS

7.3 HPC PAAS

7.4 Data Organization and Workload Management

7.5 Clustering Software and Analytics Tool

7.6 Professional Services

7.7 Managed Services

8 Cloud High Performance Computing Market Analysis, By Deployment Model (Page No. - 47)

8.1 Introduction

8.2 Public Cloud

8.3 Private Cloud

8.4 Hybrid Cloud

9 Cloud HPC Market Analysis, By Organization Size (Page No. - 51)

9.1 Introduction

9.2 Small and Medium Business

9.3 Large Enterprise

10 Cloud High Performance Computing Market Analysis, By End User (Page No. - 55)

10.1 Introduction

10.2 Academia and Research

10.3 Biosciences

10.4 Design and Engineering

10.5 Financial Services

10.6 Government

10.7 Manufacturing

10.8 Media, Entertainment and Online Gaming

10.9 Weather and Environment

10.10 Others

11 Geographic Analysis (Page No. - 70)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific (APAC)

11.5 Rest of World

12 Competitive Landscape (Page No. - 84)

12.1 Overview

12.2 Competitive Situation and Trends

12.3 New Product Launches

12.4 Mergers and Acquisitions

12.5 Partnerships/ Collaborations/ New Synergies/ Agreements

12.6 Business Expansions

13 Company Profiles (Page No. - 89)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.2 International Business Machines Corporation

13.3 Microsoft Corporation

13.4 Google, Inc.

13.5 Dell, Inc.

13.6 Amazon Web Services

13.7 Penguin Computing

13.8 Sabalcore Computing

13.9 Adaptive Computing

13.10 Gompute

13.11 Univa Corporation

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 113)

14.1 Excerpts From Industry Experts

14.2 Discussion Guide

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customization

14.5 Related Reports

List of Tables (69 Tables)

Table 1 Cloud High Performance Computing Market Size and Growth Rate, 20132020 (USD Billion, Y-O-Y %)

Table 2 Cloud HPC Market: Summary of Drivers

Table 3 Cloud HPC Market: Summary of Restraints

Table 4 Cloud HPC Market: Summary of Opportunities

Table 5 Cloud HPC Market: Summary of Challenges

Table 6 Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 7 HPC IAAS: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 8 HPC PAAS: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 9 Data Organization and Workload Management: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 10 Clustering Software and Analytics Tool: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 11 Professional Services: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 12 Managed Services: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 13 Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 14 Public Cloud: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 15 Private Cloud: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 16 Hybrid Cloud: Cloud High Performance Computing Market Size, By Region, 2013-2020 (USD Million)

Table 17 Cloud HPC Market Size, By Organization Size, 2013-2020 (USD Million)

Table 18 Small and Medium Business: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 19 Large Enterprise: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 20 Cloud HPC Market Size, By End User, 2013-2020 (USD Million)

Table 21 Academia and Research: Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 22 Academia and Research: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 23 Academia and Research: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 24 Biosciences: Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 25 Biosciences: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 26 Biosciences: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 27 Design and Engineering: Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 28 Design and Engineering: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 29 Design and Engineering: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 30 Financial Services: Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 31 Financial Services: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 32 Financial Services: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 33 Government: Cloud High Performance Computing Market Size, By Service Type, 2013-2020 (USD Million)

Table 34 Government: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 35 Government: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 36 Manufacturing: Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 37 Manufacturing: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 38 Manufacturing: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 39 Media, Entertainment and Online Gaming: Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 40 Media, Entertainment and Online Gaming: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 41 Media, Entertainment and Online Gaming: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 42 Weather and Environment: Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 43 Weather and Environment: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 44 Weather and Environment: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 45 Others: Cloud HPC Market Size, By Service Type, 2013-2020 (USD Million)

Table 46 Others: Cloud HPC Market Size, By Deployment Model, 2013-2020 (USD Million)

Table 47 Others: Cloud HPC Market Size, By Region, 2013-2020 (USD Million)

Table 48 Cloud HPC Market Size, By Region, 20152020 (USD Million)

Table 49 North America: Cloud HPC Market Size, By End User, 20132020 (USD Million)

Table 50 North America: Cloud HPC Market Size, By Service Type, 20132020 (USD Million)

Table 51 North America: Cloud HPC Market Size, By Organization Size, 20132020 (USD Million)

Table 52 North America: Cloud HPC Market Size, By Deployment Model, 20132020 (USD Million)

Table 53 Europe: Cloud High Performance Computing Market Size, By End User, 20132020 (USD Million)

Table 54 Europe: Cloud HPC Market Size, By Service Type, 20132020 (USD Million)

Table 55 Europe: Cloud HPC Market Size, By Organization Size, 20132020 (USD Million)

Table 56 Europe: Cloud HPC Market Size, By Deployment Model, 20132020 (USD Million)

Table 57 Asia-Pacific: Cloud HPC Market Size, By End User,20132020 (USD Million)

Table 58 Asia-Pacific: Cloud HPC Market Size, By Service Type, 20132020 (USD Million)

Table 59 Asia-Pacific: Cloud HPC Market Size, By Organization Size, 20132020 (USD Million)

Table 60 Asia-Pacific: Cloud HPC Market Size, By Deployment Model, 20132020 (USD Million)

Table 61 Rest of World: Cloud HPC Market Size, By Region,20132020 (USD Million)

Table 62 Rest of World: Cloud HPC Market Size, By End User,20132020 (USD Million)

Table 63 Rest of World: Cloud HPC Market Size, By Service Type, 20132020 (USD Million)

Table 64 Rest of World: Cloud HPC Market Size, By Organization Size, 20132020 (USD Million)

Table 65 Rest of World: Cloud HPC Market Size, By Deployment Model, 20132020 (USD Million)

Table 66 New Product Launches, 2015

Table 67 Mergers and Acquisitions, 2013-2014

Table 68 Partnerships/Collaborations/New Synergies, 2014-2015

Table 69 Business Expansions, 2014-2015

List of Figures (39 Figures)

Figure 1 Cloud High Performance Computing Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Cloud HPC Market Size, 2015 - 2020 (USD Billion)

Figure 8 Cloud HPC Market, By Service Type (2015 vs 2020)

Figure 9 Cloud HPC Market, By Deployment Model (2015-2020)

Figure 10 North America is Expected to Hold the Largest Market Share of the Cloud HPC Market in 2015

Figure 11 Lucrative Growth Prospects in the Cloud HPC Market Due to the Emergence of Big Data Market

Figure 12 Cloud HPC Market: Market Share of Service Types and End Users

Figure 13 Lifecycle Analysis, By Region (2015): Asia-Pacific is Expected to Enter the Growth Phase in the Coming Years

Figure 14 Market Investment Scenario: Cloud HPC

Figure 15 Evolution of Cloud HPC

Figure 16 Market Dynamics

Figure 17 Cloud High Performance Computing Market: Value Chain Analysis

Figure 18 Cloud HPC Market: Ecosystem

Figure 19 Strategic Benchmarking: Cloud HPC Market

Figure 20 HPC IAAS Estimated to Have the Largest Market Size During the Forecast Period

Figure 21 Hybrid Cloud is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 22 Large Enterprises Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 23 Media, Entertainment and Online Gaming Industry is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 24 North America is Estimated to Have the Largest Market Size During the Forecast Period

Figure 25 Asia-Pacific: an Attractive Destination for the Cloud High Performance Computing Market, 2015-2020

Figure 26 North America Snapshot

Figure 27 Asia-Pacific Market Snapshot

Figure 28 Companies Adopted New Product Launches as the Key Growth Strategy From 2013 to 2015

Figure 29 Market Evaluation Framework

Figure 30 Battle for Market Share: New Product Development and Enhancement is the Key Strategy

Figure 31 Geographic Revenue Mix of Top Market Players

Figure 32 International Business Machines Corporation: Company Snapshot

Figure 33 International Business Machines Corporation: SWOT Analysis

Figure 34 Microsoft Corporation: Company Snapshot

Figure 35 Microsoft Corporation: SWOT Analysis

Figure 36 Google, Inc.: Company Snapshot

Figure 37 Google, Inc.: SWOT Analysis

Figure 38 Dell, Inc.: SWOT Analysis

Figure 39 Amazon Web Services: SWOT Analysis

Growth opportunities and latent adjacency in Cloud High Performance Computing (HPC) Market