Cloud Backup Market by Component (Solution & Services), Provider (Cloud Service Provider, Telecom & Communication Service Provider, & Managed Service Provider), Deployment Model, Organization Size, Vertical, and Region - Global Forecast to 2022

[135 Pages Report] The cloud backup market size is expected to grow from USD 1.30 billion in 2017 to USD 4.13 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 26.1% during the forecast period.

The demand for cloud backup is increasing due to the huge volume of data generation, lower costs and greater efficiency than on-premises backup, and growing adoption of SaaS. The market is expanding with the emergence of new applications and technologies such as Internet of Things (IoT), big data, Artificial Intelligence (AI), and cloud computing. The base year considered for this study is 2016, and the forecast period is 20172022.

Market Dynamics

Drivers

- Huge volume of data generation leading to rising adoption of cloud backup solution and services

- Lower costs and greater efficiency than on-premises backup

- Growing adoption of SaaS is driving the demand of cloud backup solution and services

Restraints

- Resistance to the adoption of cloud backup solution and services due to time consuming recovery process

Opportunities

- Growing adoption among SMEs

- High adoption rate of hybrid cloud expected to transform the cloud backup market

Challenges

- High adoption rate of hybrid cloud expected to transform the cloud backup market

- Difficulty in achieving compliance

- Rising concerns regarding data privacy and governance

Huge volume of data generation leading to rising adoption of cloud backup solution and services

Earlier, traditional backup was sufficient for organizations to backup and store limited business critical data. In the last few years, in order to save IT expenditure, employers are promoting the use of Bring Your Own Device (BYOD) which is leading to huge generation of data on a continuous basis. Mobile devices such as BlackBerry, iPhone and smartphones connect employees to the internal computing platforms to access business critical data. Also, the data generated within the organization on a daily basis is quite huge making it difficult to be managed using traditional backup. Such business critical data cannot be put at risk and needs continuous backup & on demand availability. Cloud backup enables easy management and access of data from anywhere using an internet connection as required by the organization. It enables continuous and automatic backup to the cloud which makes it easy to manage huge volumes of data. Cloud enables improved security with reduced costs which is one of the major reasons for adopting cloud backup solutions. It enables easy movement of large data sets making backup easier than traditional backup and eliminating the need of server maintenance.

The following are the major objectives of the study

- To describe and forecast the global cloud backup market on the basis of components, service providers, deployment models, organization size, verticals, and regions

- To forecast the market size of the 5 main regional segments, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments with respect to individual growth trends, future prospects, and contribution to the total market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of competitive landscape for major players

- To profile key players and comprehensively analyze their core competencies and positioning

To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships, agreements, and collaborations in the cloud backup market

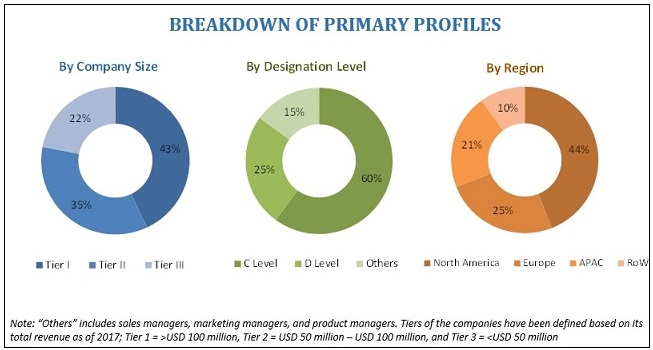

The research methodology used to estimate and forecast the cloud backup market began with capturing data on key vendor revenues through secondary research, such as Cloud Computing Association, Associations of Financial Professional, and Information System Security Association. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud backup market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of primary profiles is depicted in the below figure:

To know about the assumptions considered for the study, download pdf brochure

The cloud backup ecosystem comprises service providers, such as Acronis International GmbH (Switzerland), Asigra Inc. (Canada), Barracuda Networks, Inc. (US), Carbonite, Inc. (US), Code42 Software, Inc. (US), Datto, Inc. (US), Druva Software (US), International Business Machines Corporation (IBM; US), Iron Mountain Incorporated (US), Microsoft Corporation (US), Oracle Corporation (US), and Veeam Software (Switzerland). Other stakeholders of the cloud backup market include systems integrators, application designers and development service providers, and network service providers.

Major Market Developments

- In January 2017, Carbonite acquired Double-Take Software, an affiliate of Vision Solutions, Inc. and Clearlake Capital. Through this acquisition Carbonite would enhance its suite of data protection solutions for Small and Medium-sized Businesses (SMBs) which would significantly reduce downtime.

- In January 2017, Comarch entered into an agreement with Siminn, a leading telecom provider in Iceland. Under this agreement, Comarch would offer managed services to Siminn, to reduce OPEX and enhance its excellence in business operations. The agreement would help the company in expanding its customer base across Europe. With Comarchs Managed Services, Siminn would reduce its OPEX and also have the opportunity to stay ahead of the competition in the cloud OSS/BSS market

- In May 2016, Druva announced new consumption-based pricing for Druva Phoenix. This would allow enterprises to pay only for the actual storage they use. Also, it would increase the adoption of cloud-based technologies among the enterprises.

Key Target Audience for Cloud Backup Market

- Cloud backup vendors

- Cloud service providers

- Telecom service providers

- System integrators

- Cloud service providers

- Government agencies

- Consultancy firms/advisory firms

- Training and consulting service providers

- Managed service providers

The research study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years for prioritizing the efforts and investments.

Critical questions which the report answers

- What are new application areas which the cloud backup companies are exploring?

- Which are the key players in the market and how intense is the competition?

Scope of the Cloud Backup Market Research Report

The research report categorizes the cloud backup market to forecast the revenues and analyzes the trends in each of the following submarkets:By Component

- Solution

- Service

- Training and Consulting

- Support and Maintenance

- System Integration

By Service Provider

- Cloud Service Provider

- Telecom and Communication Service Provider

- Managed Service Provider

- Others

By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By Organization Size

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Goods and Retail

- Education

- Government and Public Sector

- Healthcare and Life Sciences

- Manufacturing

- Media and Entertainment

- Telecommunication and ITES

- Others

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the Latin American market into countries contributing 75% to the regional market size

- Further breakdown of the APAC market into countries contributing 75% to the regional market size

- Further breakdown of the MEA market into countries contributing 75% to the regional market size

- Further breakdown of the European market into countries contributing 75% to the regional market size

Company Information

Detailed analysis and profiling of additional market players (up to 5).The cloud backup market is expected to grow from USD 1.30 billion in 2017 to USD 4.13 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 26.1% during the forecast period. The demand for cloud backup is driven by many factors, such as increasing generation of huge volumes of data and lower costs and greater efficiency than on-premises backup.

Cloud backup is a SaaS based solution leveraged by enterprises to backup their business critical data in order to avoid data loss in the event of manmade or natural disaster. Enterprise data is backed up in the encrypted form to enhance security over cloud. Cloud backup solution provides various benefits such as data protection, data retention, central management & monitoring, and auto scaling. Moreover, it offers benefits of lower infrastructure costs, easy & simple deployment, and integration of cloud backup with other enterprise applications.

The cloud backup market has been segmented on the basis of components, service providers, deployment models, organization size, verticals, and regions. The services segment is expected to grow at the highest CAGR during the forecast period and the training and consulting services segment is estimated to have the largest market size in 2017 in the cloud backup market. Cloud backup offers capabilities such as data retention, data protection, monitoring and reporting, and centralized management. Adoption of cloud backup services among the enterprises has increased due to its benefits, such as improved scalability, low infrastructure cost, faster deployments, improved productivity and performance, and decrease in business downtime and losses.

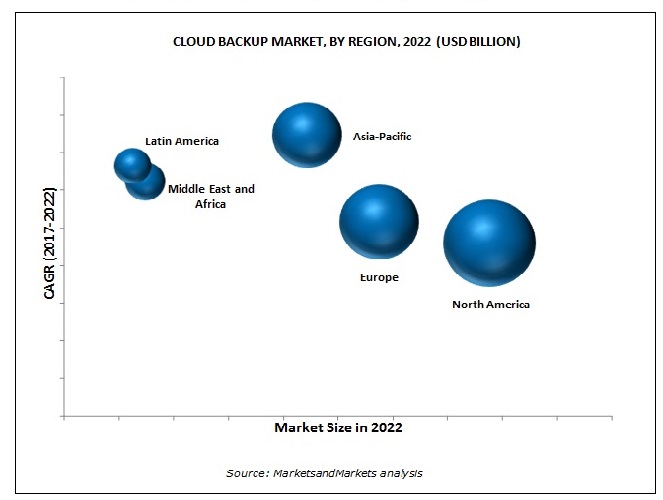

The Asia-Pacific (APAC) region is projected to grow at the highest CAGR during the forecast period in the cloud backup market. There is huge potential in this region for cloud adoption by enterprises which can be addressed to create better business opportunities. The increasing trend towards cloud-based solutions would give rise to the growth of cloud backup market in this region. Moreover, the increasing adoption of cloud backup solutions in this region is due to the economic outlook of Asia which seems to be positive for enterprises and the tendency of cloud backup solutions to improve the operational issues.

Cloud backup solutions and services in home appliances, HVAC, and smart meters drive the growth of reed sensor market

Solutions

The rising adoption of cloud-based technologies and need for management of huge data sets among enterprises has led to the adoption of cloud backup solution. Organizations are deploying cloud backup solution to overcome the loopholes of traditional cloud backup such as slow & expensive customizations, tedious backup process, and need for a reliable server, large & robust local storage. The adoption of cloud backup solution has increased due to various benefits such as simple management and monitoring, real-time backup & recovery, simple integration of cloud backup with enterprises other applications, data deduplication, and customer support. Also, cloud backup provides important features of improved recovery, auto scalability, lesser backup time, reliability and lower costs.

Services

Training and Consulting

The consulting services play an important role for the enterprises to choose the most suitable and possible solutions and services depending upon the requirement of their businesses and end users. This service helps in educating enterprises about the strategic transformation, business assessment, solution assessment, return on investment, and knowledge workshop. On the other hand, training services aim at providing various education programs to mitigate the knowledge gaps. Several companies actively provide online training to the end users with the help of user manuals, blogs, and video instruction and help forums.

Support and Maintenance

The support and maintenance services address technical queries and delivers cost-effective support which enables improved business performance. These services also offer technical support, repair and exchange services, field maintenance, and proactive services. The vendors offering support and maintenance services focus on improving the network performance, reducing the capital expenditure and operational expenditure, and ensuring end-to-end delivery and multivendor support.

System Integration

System integration services help in solving complex problems and assures of cost-efficient business processes to produce a flexible environment that can fulfil performance, security, and availability. It provides facilities and frameworks for the integration of various platforms with third-party environments. The installation and integration services include assistance in deploying backup services within an organization. These services encompass the capabilities of planning and implementation.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for cloud backup?

Resistance to the adoption of cloud backup solution and services due to time consuming recovery process. Organizations implementing cloud backup can leverage various benefits such as scalability, flexibility, accessibility and more. But recovering the data backed up on the cloud is a major issue faced by organizations. The recovery process of large data sets is very time consuming which can lead to huge losses. Organizations expect faster recovery of data which becomes very time consuming and complex if data sets are huge in size. For some industries such as financial institutions, media companies, and entertainment companies the recovery time is expected to be as shorter as possible. According to a survey, the minimum average recovery time for organizations is 2-3 days depending on the volume of data and recovery speed. This might affect the business activities to a large extent. Faster recovery time is a must for organizations to maintain a competitive position in the market. The need to incorporate an efficient recovery process is as important as incorporating an efficient cloud backup solution.

The major vendors providing cloud backup are Acronis International GmbH (Switzerland), Asigra Inc. (Canada), Barracuda Networks, Inc. (US), Carbonite, Inc. (US), Code42 Software, Inc. (US), Datto, Inc. (US), Druva Software (US), International Business Machines Corporation (IBM; US), Iron Mountain Incorporated (US), Microsoft Corporation (US), Oracle Corporation (US), and Veeam Software (Switzerland). These players have adopted various strategies, such as new product developments, mergers and acquisitions, collaborations, and partnerships, to expand their presence in the global cloud backup market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries By Companies, By Designation, and By Region

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Cloud Backup Market

4.2 Cloud Backup Market: Market Share of Deployment Models and Regions, 2017

4.3 Market Investment Scenario

4.4 Cloud Backup Market: Top 3 Verticals, 20172022

5 Market Overview and Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Regulatory Implications

5.2.1 Payment Card Industry Data Security Standard (PCI-DSS)

5.2.2 Federal Information Security Management Act (FISMA)

5.2.3 International Organization for Standardization/ International Electrotechnical Commission 27018

5.3 Innovation Spotlight

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Huge Volume of Generated Data, Leading to Rising Adoption of Cloud Backup

5.4.1.2 Lower Costs and Greater Efficiency Than On-Premises Backup

5.4.1.3 Growing Adoption of Saas Driving the Demand for Cloud Backup

5.4.2 Restraints

5.4.2.1 Compatibility Concerns for Certain Applications With the Cloud Environment

5.4.3 Opportunities

5.4.3.1 Growing Adoption Among SMES

5.4.3.2 High Adoption Rate of Hybrid Cloud Expected to Transform the Cloud Backup Market

5.4.4 Challenges

5.4.4.1 Increasing Complexities of Bandwidth Limitations

5.4.4.2 Difficulty in Achieving Compliance

5.4.4.3 Rising Concerns Regarding Data Privacy and Governance

6 Cloud Backup Market Analysis, By Component (Page No. - 36)

6.1 Introduction

6.2 Solution

6.3 Services

6.3.1 Training and Consulting

6.3.2 Support and Maintenance

6.3.3 System Integration

7 Cloud Backup Market Analysis, By Service Provider (Page No. - 43)

7.1 Introduction

7.2 Cloud Service Providers

7.3 Managed Service Providers

7.4 Telecom and Communication Service Providers

7.5 Others

8 Cloud Backup Market Analysis, By Deployment Model (Page No. - 48)

8.1 Introduction

8.2 Public Cloud

8.3 Private Cloud

8.4 Hybrid Cloud

9 Cloud Backup Market Analysis, By Organization Size (Page No. - 52)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Cloud Backup Market Analysis, By Vertical (Page No. - 56)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Consumer Goods and Retail

10.4 Education

10.5 Government and Public Sector

10.6 Healthcare and Life Sciences

10.7 Manufacturing

10.8 Media and Entertainment

10.9 Telecommunication and Ites

10.10 Others

11 Geographic Analysis (Page No. - 65)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 81)

12.1 Introduction

12.1.1 Vanguards

12.1.2 Innovators

12.1.3 Dynamic

12.1.4 Emerging

12.2 Cloud Backup Market: Competitive Benchmarking

*Top 25 Companies Analyzed for This Study are - Acronis International GmbH, Asigra Inc., Backblaze, Inc., Barracuda Networks, Inc., Carbonite, Inc., Code42 Software, Inc., Commvault, Datto, Inc., Druva Software, Efolder, Inc., Fujitsu Limited, IBM Corporation, Idrive Inc., Iland Internet Solutions, Infrascale Inc., Iron Mountain Incorporated, Livedrive, Inc., Microsoft Corporation, Mozy Inc., Opendrive, Inc., Oracle Corporation, Rapidscale, Inc., Spideroak, Inc., Sugarsync, Inc., Veeam Software

13 Company Profiles (Page No. - 85)

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.1 Acronis International GmbH

13.2 Asigra Inc.

13.3 Barracuda Networks, Inc.

13.4 Carbonite, Inc.

13.5 Code42 Software, Inc.

13.6 Datto, Inc.

13.7 Druva Software

13.8 Efolder, Inc.

13.9 International Business Machines Corporation

13.10 Iron Mountain Incorporated

13.11 Microsoft Corporation

13.12 Veeam Software

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 126)

14.1 Key Industry Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (62 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Cloud Backup Market Size, By Component, 20152022 (USD Million)

Table 3 Solution: Market Size, By Region, 20152022 (USD Million)

Table 4 Services: Market Size, By Region, 20152022 (USD Million)

Table 5 Cloud Backup Market Size, By Service, 20152022 (USD Million)

Table 6 Training and Consulting: Market Size, By Region, 20152022 (USD Million)

Table 7 Support and Maintenance: Market Size, By Region, 20152022 (USD Million)

Table 8 System Integration: Market Size, By Region, 20152022 (USD Million)

Table 9 Cloud Backup Market Size, By Service Provider, 20152022 (USD Million)

Table 10 Cloud Service Providers: Market Size, By Region, 20152022 (USD Million)

Table 11 Managed Service Providers: Market Size, By Region, 20152022 (USD Million)

Table 12 Telecom and Communication Service Providers: Cloud Backup Market Size, By Region, 20152022 (USD Million)

Table 13 Others: Market Size, By Region, 20152022 (USD Million)

Table 14 Cloud Backup Market Size, By Deployment Model, 20152022 (USD Million)

Table 15 Public Cloud: Market Size, By Region, 20152022 (USD Million)

Table 16 Private Cloud: Market Size, By Region, 20152022 (USD Million)

Table 17 Hybrid Cloud: Market Size, By Region, 20152022 (USD Million)

Table 18 Cloud Backup Market Size, By Organization Size, 20152022 (USD Million)

Table 19 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 20 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 21 Cloud Backup Market Size, By Vertical, 20152022 (USD Million)

Table 22 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 23 Consumer Goods and Retail: Market Size, By Region, 20152022 (USD Million)

Table 24 Education: Market Size, By Region, 20152022 (USD Million)

Table 25 Government and Public Sector: Market Size, By Region, 20152022 (USD Million)

Table 26 Healthcare and Life Sciences: Market Size, By Region, 20152022 (USD Million)

Table 27 Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 28 Media and Entertainment: Market Size, By Region, 20152022 (USD Million)

Table 29 Telecommunication and ITes: Market Size, By Region, 20152022 (USD Million)

Table 30 Others: Market Size, By Region, 20152022 (USD Million)

Table 31 Cloud Backup Market Size, By Region, 20152022 (USD Million)

Table 32 North America: Cloud Backup Market Size, By Component, 20152022 (USD Million)

Table 33 North America: Market Size, By Service, 20152022 (USD Million)

Table 34 North America: Market Size, By Service Provider, 20152022 (USD Million)

Table 35 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 36 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 37 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 38 Europe: Cloud Backup Market Size, By Component, 20152022 (USD Million)

Table 39 Europe: Market Size, By Service, 20152022 (USD Million)

Table 40 Europe: Market Size, By Service Provider, 20152022 (USD Million)

Table 41 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 42 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 43 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 44 Asia Pacific: Cloud Backup Market Size, By Component, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size, By Service Provider, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Deployment Model, 20152022 (USD Million)

Table 48 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 49 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 50 Middle East and Africa: Cloud Backup Market Size, By Component, 20152022 (USD Million)

Table 51 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size, By Service Provider, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Deployment Model, 20152022 (USD Million)

Table 54 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 55 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 56 Latin America: Cloud Backup Market Size, By Component, 20152022 (USD Million)

Table 57 Latin America: Market Size, By Service Provider, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 60 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 61 Latin America: Market Size, By Vertical, 20152022 (USD Million)

Table 62 Cloud Backup Market: Ranking Analysis

List of Figures (56 Figures)

Figure 1 Cloud Backup Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Cloud Backup Market: Assumptions

Figure 7 Solution Segment is Expected to Hold A Larger Market Size During the Forecast Period

Figure 8 Training and Consulting Services Segment is Expected to Hold the Largest Market Size During the Forecast Period

Figure 9 North America is Estimated to Hold the Largest Market Share in 2017

Figure 10 Segments With the Largest Market Shares of the Cloud Backup Market

Figure 11 Huge Volume of Generated Data and Growing Adoption of SaaS are Contributing to the Growth of the Cloud Backup Market in the Forecast Period

Figure 12 Public Cloud and North America are Estimated to Have the Largest Market Shares in 2017

Figure 13 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 14 Banking, Financial Services, and Insurance Vertical is Estimated to Have the Largest Market Size in 2017

Figure 15 Cloud Backup Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Solution Segment is Expected to Have A Larger Market Size During the Forecast Period

Figure 17 Training and Consulting Services Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 18 Cloud Service Providers Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 19 Public Cloud Deployment Model is Expected to Hold the Largest Market Size During the Forecast Period

Figure 20 Large Enterprises Segment is Expected to Hold A Larger Market Size During the Forecast Period

Figure 21 Banking, Financial Services, and Insurance Vertical is Expected to Hold the Largest Market Size During the Forecast Period

Figure 22 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Microquadrant Chart

Figure 26 Product Offering Comparison

Figure 27 Business Strategy Comparison

Figure 28 Acronis International GmbH: Product Offering Scorecard

Figure 29 Acronis International GmbH: Business Strategy Scorecard

Figure 30 Asigra Inc.: Product Offering Scorecard

Figure 31 Asigra Inc.: Business Strategy Scorecard

Figure 32 Barracuda Networks, Inc.: Company Snapshot

Figure 33 Barracuda Networks, Inc.: Product Offering Scorecard

Figure 34 Barracuda Networks, Inc.: Business Strategy Scorecard

Figure 35 Carbonite, Inc.: Company Snapshot

Figure 36 Carbonite, Inc.: Product Offering Scorecard

Figure 37 Carbonite, Inc.: Business Strategy Scorecard

Figure 38 Code42 Software, Inc.: Product Offering Scorecard

Figure 39 Code42 Software, Inc.: Business Strategy Scorecard

Figure 40 Datto, Inc.: Product Offering Scorecard

Figure 41 Datto, Inc.: Business Strategy Scorecard

Figure 42 Druva Software: Product Offering Scorecard

Figure 43 Druva Software: Business Strategy Scorecard

Figure 44 Efolder, Inc.: Product Offering Scorecard

Figure 45 Efolder, Inc.: Business Strategy Scorecard

Figure 46 International Business Machines Corporation: Company Snapshot

Figure 47 International Business Machines Corporation: Product Offering Scorecard

Figure 48 International Business Machines Corporation: Business Strategy Scorecard

Figure 49 Iron Mountain Incorporated: Company Snapshot

Figure 50 Iron Mountain Incorporated: Product Offering Scorecard

Figure 51 Iron Mountain Incorporated: Business Strategy Scorecard

Figure 52 Microsoft Corporation: Company Snapshot

Figure 53 Microsoft Corporation: Product Offering Scorecard

Figure 54 Microsoft Corporation: Business Strategy Scorecard

Figure 55 Veeam Software: Product Offering Scorecard

Figure 56 Veeam Software: Business Strategy Scorecard

Growth opportunities and latent adjacency in Cloud Backup Market

Market sizing for cloud backup market in UK and EU

Market sizing for cloud backup market