Class D Audio Amplifier Market by Device (Smartphones, Television Sets, Home Audio Systems, and Automotive Infotainment Systems), Amplifier Type (Mono-Channel, 2-Channel, 4-Channel, 6-Channel), End-user Industry, and Geography - Global Forecast to 2025-2036

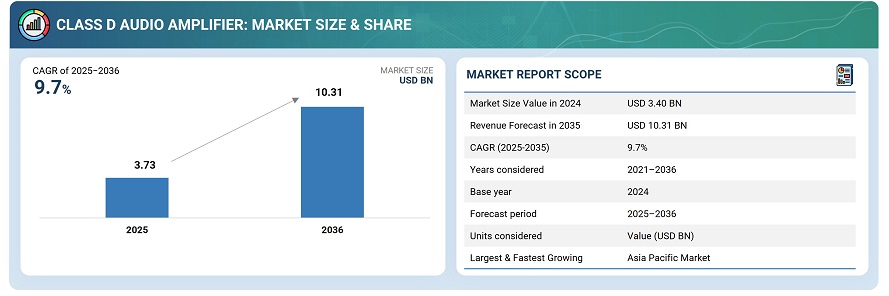

The global Class D Audio Amplifier market was valued at USD 3.73 billion in 2025 and is estimated to reach USD 10.31 billion by 2036, at a CAGR of 9.7% between 2025 and 2036.

The global Class D audio amplifier market is driven by the growing demand for high-efficiency, compact, and cost-effective audio solutions across consumer electronics, automotive, and professional audio systems. Class D amplifiers are increasingly adopted due to their superior power efficiency, reduced heat generation, and ability to deliver high-quality sound in smaller form factors. Continuous advancements in semiconductor technologies, such as GaN and CMOS, are further improving amplifier performance, enabling higher power densities and lower distortion levels. Additionally, the expanding market for smart speakers, electric vehicles, and portable audio devices is accelerating product integration. Leading manufacturers are focusing on innovation, strategic collaborations, and expanding production capabilities to meet rising demand and enhance their competitive position in the global market.

Class D audio amplifier infrastructure comprises the electronic components, technologies, and systems that enable efficient amplification of audio signals using pulse-width modulation (PWM) or similar switching techniques. It includes key elements such as power transistors, driver circuits, feedback control systems, and output filters that collectively deliver high-efficiency audio amplification with minimal heat generation and power loss. Class D amplifiers are widely used across consumer electronics, automotive audio systems, professional sound equipment, and portable devices due to their compact design and superior energy efficiency. They also integrate with advanced semiconductor technologies, digital signal processing (DSP), and system-on-chip (SoC) architectures to enhance performance, scalability, and sound quality, supporting next-generation audio experiences for diverse applications.

Market by Device Type

Home Audio Systems

Home audio systems dominate the Class D audio amplifier market due to the rising consumer demand for high-quality, energy-efficient, and space-saving sound solutions in residential settings. The increasing adoption of smart homes, wireless audio devices, and home entertainment systems is driving the integration of Class D amplifiers, which offer superior power efficiency and compact design. Moreover, the growing popularity of multi-room audio, voice-controlled speakers, and streaming-based entertainment further supports market growth. Continuous advancements in digital amplification and connectivity technologies are expected to enhance user experience, positioning home audio systems as the fastest-growing segment during the forecast period.

Automotive Infotaiment Systems

Automotive infotainment systems are expected to grow at the second-fastest CAGR in the Class D audio amplifier market due to the increasing integration of advanced audio technologies in modern vehicles. Rising consumer preference for premium in-car entertainment, combined with the shift toward electric and connected vehicles, is driving demand for high-efficiency, lightweight amplifiers. Class D amplifiers are ideal for automotive applications as they deliver superior sound quality while minimizing power consumption and heat generation. Additionally, automakers are incorporating multi-speaker surround systems and noise-cancellation features, further boosting the adoption of Class D amplifiers in next-generation infotainment platforms..

Market by End User

Consumer Electronics

The consumer electronics segment dominates the Class D audio amplifier market due to the widespread use of these amplifiers in devices such as televisions, smartphones, wireless speakers, and soundbars. Class D amplifiers offer high power efficiency, compact size, and low heat generation, making them ideal for portable and space-constrained consumer devices. The growing demand for high-quality audio performance in smart and connected devices, coupled with the rapid adoption of IoT-enabled home entertainment systems, is further driving market dominance. Continuous advancements in semiconductor integration and digital audio processing are also enhancing performance, ensuring sustained growth of this segment during the forecast period.

Market by Applifier Type

2-Channel

The 2-channel amplifier segment is expected to dominate the Class D audio amplifier market and grow at the fastest CAGR due to its extensive use in home audio systems, televisions, and automotive applications. These amplifiers provide an optimal balance between performance, efficiency, and cost, making them suitable for both stereo and compact audio setups. The growing popularity of smart TVs, soundbars, and personal entertainment systems is driving demand for high-quality stereo sound solutions. Additionally, advancements in integrated circuits and miniaturization technologies are enhancing the efficiency and sound output of 2-channel Class D amplifiers, supporting their continued market leadership during the forecast period.

Market by Geography

Geographically, the security camera market is experiencing widespread adoption across North America, Europe, Asia Pacific, and the Middle East & Africa. The Asia Pacific region is expected to grow at the fastest CAGR in the Class D audio amplifier market due to rapid industrialization, urbanization, and increasing consumer demand for advanced audio technologies. The region hosts major electronics manufacturing hubs in countries such as China, Japan, South Korea, and Taiwan, driving large-scale production of consumer electronics and automotive infotainment systems. Rising disposable incomes and expanding adoption of smart home devices and electric vehicles are further fueling market growth. Additionally, strong investments in semiconductor innovation and favorable government initiatives supporting local manufacturing are positioning Asia Pacific as a key growth driver during the forecast period.

Market Dynamics

Driver: Growing demand for energy-efficient audio solutions across consumer electronics, and automotive industries

The growing demand for energy-efficient audio solutions is a key driver of the Class D audio amplifier market. Consumers and manufacturers increasingly prefer amplifiers that deliver high performance with lower power consumption. Class D amplifiers are designed to convert power efficiently, reducing energy waste and heat generation. This efficiency makes them ideal for use in portable devices, electric vehicles, and professional sound systems where energy optimization is essential. As sustainability and energy efficiency continue to influence purchasing decisions, the adoption of Class D amplifiers is expected to expand across multiple sectors, supporting long-term market growth.

Restraint: Electromagnetic interference (EMI) issues affecting sound quality and requiring additional filtering components

Electromagnetic interference (EMI) remains a key restraint in the Class D audio amplifier market. Because these amplifiers operate through high-frequency switching, they can generate unwanted noise that interferes with nearby electronic components and affects audio quality. To address this issue, manufacturers often add extra filtering and shielding components, which can increase design complexity and overall cost. Managing EMI effectively is essential to ensure stable performance, especially in high-end consumer and automotive audio systems. The need for precise circuit design and compliance with regulatory standards continues to pose challenges for product development and cost optimization..

Opportunity: Integration with digital signal processing (DSP) and AI-based sound optimization technologies

Integration with digital signal processing (DSP) and AI-based sound optimization technologies presents a major opportunity for the Class D audio amplifier market. DSP enables advanced audio tuning, noise reduction, and equalization, while AI enhances user experience by adapting sound profiles based on listening environments or user preferences. Combining these technologies with Class D amplifiers improves sound clarity and customization across consumer electronics, automotive infotainment, and smart devices. This integration supports the development of intelligent audio systems with enhanced performance and efficiency, driving innovation and differentiation among amplifier manufacturers in a competitive global market.

Challenge: Maintaining audio fidelity at high switching frequencies while minimizing distortion

Maintaining audio fidelity at high switching frequencies is a key challenge for Class D audio amplifier manufacturers. These amplifiers rely on high-speed switching to achieve efficiency, but higher frequencies can introduce distortion and reduce overall sound quality. Engineers must carefully balance switching speed, signal accuracy, and filtering to ensure clean audio output. This requires advanced circuit design, high-quality components, and precise control systems. As demand for premium audio experiences increases across industries, minimizing distortion while maintaining efficiency remains a top priority, pushing manufacturers to invest in research and innovation to achieve superior sound performance.

Future Outlook

Between 2025 and 2035, the global Class D audio amplifier market is expected to experience significant growth, driven by the increasing demand for compact, energy-efficient, and high-performance audio solutions. The widespread adoption of Class D amplifiers across consumer electronics, automotive infotainment, and professional audio systems will accelerate as manufacturers prioritize low power consumption and superior sound quality. Advancements in semiconductor materials such as GaN and CMOS, along with integration of DSP and AI-based sound optimization, will enhance amplifier efficiency and performance. The Asia Pacific region is projected to lead growth due to strong electronics manufacturing capabilities and rising consumer demand. Despite challenges related to EMI management and design complexity, ongoing innovations, expanding smart home ecosystems, and growing adoption in electric vehicles will continue to drive market expansion worldwide.

Key Market Players

Top security cameras companies STMicroelectronics (Switzerland), Texas Instruments Incorporated. (US), NXP Semiconductors (Netherlands), Analog Devices, Inc. (US), and Infineon Technologies AG (Germany).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in Market

4.2 Market, By Device (Million Units)

4.3 2-Channel Class D Audio Amplifier Market, By Device (USD Million)

4.4 Market for Consumer Electronics, By Device

4.5 Market in APAC

4.6 Market, By Geography

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Consumer Electronics

5.2.1.2 Growing Need for Good-Quality Audio

5.2.1.3 Rise in Demand for Energy-Efficient Technologies or Components in Portable and Compact Devices

5.2.1.4 Increasing Traction Toward In-Vehicle Infotainment Systems in Automobiles

5.2.2 Restraints

5.2.2.1 Reduced Price Margin Due to Highly Fragmented Market

5.2.2.2 Complexities Involved in Integration of Class D Amplifiers With Audio Devices

5.2.3 Opportunities

5.2.3.1 Growing Penetration of Iot

5.2.3.2 Escalating Popularity of In-Vehicle Infotainment Systems

5.2.4 Challenges

5.2.4.1 Optimization of Design and Complexity While Maintaining High Efficiency

5.2.4.2 High Cost of Integrating an LC Filter

5.3 Value Chain Analysis

6 Class D Audio Amplifier Market, By Device (Page No. - 41)

6.1 Introduction

6.2 Smartphones

6.2.1 Continuous Technological Advancements With Consumer Electronics Boosting Growth of Smartphone Market

6.3 Television Sets

6.3.1 Increasing Demand for Large-Screen Televisions With Superior Sound Quality

6.4 Home Audio Systems

6.4.1 Continuous Increase in Demand for Smart Speakers

6.5 DesKTops and Laptops

6.5.1 2-Channel Amplifier to Grow at Higher CAGR for DesKTops and Laptops

6.6 Tablets

6.6.1 Decreasing Shipment of Tablets

6.7 Automotive Infotainment Systems

6.7.1 Increasing use of Navigation, and Adoption of Vehicle Diagnostics and Entertainment Services in Passenger Cars and Commercial Vehicles

7 Class D Audio Amplifier Market, By Amplifier Type (Page No. - 54)

7.1 Introduction

7.2 Mono-Channel

7.2.1 Increasing Sales of Smartphones

7.3 2-Channel

7.3.1 Increasing use of 2-Channel in Automotive In-Car Audio and Consumer Electronics Sector

7.4 4-Channel

7.4.1 Television Sets to Grow at Highest Rate During Forecast Period

7.5 6-Channel

7.5.1 Home Audio Systems Hold a Larger Size During Forecast Period

7.6 Others

8 Class D Audio Amplifier Market, By End-User Industry (Page No. - 64)

8.1 Introduction

8.2 Consumer Electronics

8.2.1 Rising Demand for Smart Electronics

8.3 Automotive

8.3.1 Growing Trend of Vehicle Electrification in Automotive Vertical

9 Class D Audio Amplifier Market, By Geography (Page No. - 72)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Presence of Major Class D Audio Amplifier Manufacturers

9.2.2 Canada

9.2.2.1 Huge Popularity of Consumer Electronics

9.2.3 Mexico

9.2.3.1 High Smartphone Adoption Rate

9.3 Europe

9.3.1 Germany

9.3.1.1 Growth of Automotive Industry

9.3.2 UK

9.3.2.1 Growing Demand for Smart Televisions

9.3.3 France

9.3.3.1 Rise in Adoption of Audio Systems in the Automobile Industry

9.3.4 Rest of Europe (RoE)

9.3.4.1 Presence of Major Class D Audio Amplifier Manufacturers

9.4 Asia Pacific (APAC)

9.4.1 China

9.4.1.1 High Demand for Consumer Electronics Devices and Automobiles

9.4.2 Japan

9.4.2.1 Increasing Domestic Shipments of Consumer Electronics in Japan

9.4.3 South Korea

9.4.3.1 Increasing Penetration of Smart TV

9.4.4 Rest of APAC

9.5 Rest of the World (RoW)

9.5.1 Middle East and Africa

9.5.1.1 Increasing Investments in Automotive Sector in Israel, Middle East, and North Africa

9.5.2 South America

9.5.2.1 Rising Adoption of Smartphones and Mobile Networks in South American Countries

10 Competitive Landscape (Page No. - 89)

10.1 Introduction

10.2 Market Ranking Analysis: Market

10.3 Competitive Situations and Trends

10.3.1 Product Launches and Developments

10.3.2 Partnerships and Collaborations

10.3.3 Acquisitions

10.4 Competitive Leadership Mapping

10.4.1 Visionary Leaders

10.4.2 Dynamic Differentiators

10.4.3 Innovators

10.4.4 Emerging Companies

11 Company Profiles (Page No. - 96)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

11.1 Key Players

11.1.1 Stmicroelectronics

11.1.2 Texas Instruments

11.1.3 NXP Semiconductor

11.1.4 Analog Devices

11.1.5 Infineon Technologies

11.1.6 Cirrus Logic

11.1.7 Maxim Integrated

11.1.8 Silicon Labs

11.1.9 Qualcomm

11.1.10 ON Semiconductor

11.2 Other Companies

11.2.1 ROHM Semiconductor

11.2.2 Icepower A/S

11.2.3 Dialog Semiconductor

11.2.4 Integrated Silicon Solution Inc.

11.2.5 Renesas Electronics

11.2.6 Monolithic Power Systems

11.2.7 Tempo Semiconductor

11.2.8 Nuvoton Technology

11.2.9 Dioo Microcircuits

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 125)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Author Details

List of Tables (65 Tables)

Table 1 Class D Audio Amplifier Market, By Device, 2016–2024 (USD Million)

Table 2 Global Market, By Device, 2016–2024 (Million Units)

Table 3 Market for Smartphones, By Amplifier Type, 2016–2024(USD Million)

Table 4 Market for Smartphones, By Region, 2016–2024 (USD Million)

Table 5 Market for Smartphones, By Region, 2016–2024 (Million Units)

Table 6 Market for Television Sets, By Amplifier Type, 2016–2024 (USD Million)

Table 7 Market for Television Sets, By Region, 2016–2024 (USD Million)

Table 8 Market for Television Sets, By Region, 2016–2024 (Million Units)

Table 9 Market for Home Audio Systems, By Amplifier Type, 2016–2024 (USD Million)

Table 10 Market for Home Audio Systems, By Region, 2016–2024 (USD Million)

Table 11 Market for Home Audio Systems, By Region, 2016–2024 (Million Units)

Table 12 Market for Desktops and Laptops, By Amplifier Type, 2016–2024 (USD Million)

Table 13 Market for Desktops and Laptops, By Region, 2016–2024 (USD Million)

Table 14 Market for Desktops and Laptops, By Region, 2016–2024 (Million Units)

Table 15 Market for Tablets, By Amplifier Type, 2016–2024 (USD Million)

Table 16 Market for Tablets, By Region, 2016–2024 (USD Million)

Table 17 Market for Tablet, By Region, 2016–2024 (Million Units)

Table 18 Market for Automotive Infotainment Systems, By Amplifier Type, 2016–2024 (USD Million)

Table 19 Market for Automotive Infotainment Systems, By Region, 2016–2024 (USD Million)

Table 20 Market for Automotive Infotainment Systems, By Region, 2016–2024 (Million Units)

Table 21 Market, By Amplifier Type, 2016–2024 (USD Million)

Table 22 Mono-Channel Class D Audio Amplifier Market, By Device, 2016–2024 (USD Million)

Table 23 Mono-Channel Market, By Device, 2016–2024 (Million Units)

Table 24 2-Channel Class D Audio Amplifier Market, By Device, 2016–2024 (USD Million)

Table 25 2-Channel Market, By Device, 2016–2024 (Million Units)

Table 26 4-Channel Market, By Device, 2016–2024 (USD Million)

Table 27 4-Channel Market, By Device, 2016–2024 (Million Units)

Table 28 6-Channel Market, By Device, 2016–2024 (USD Million)

Table 29 6-Channel Market, By Device, 2016–2024 (Million Units)

Table 30 Other Class D Audio Amplifier Market, By Device, 2016–2024 (USD Million)

Table 31 Other Market, By Device, 2016–2024 (Million Units)

Table 32 Market, By End-User Industry, 2016–2024 (USD Million)

Table 33 Market for Consumer Electronics, By Device, 2016–2024 (USD Million)

Table 34 Market for Consumer Electronics, By Device, 2016–2024 (Million Units)

Table 35 Market for Consumer Electronics, By Region, 2016–2024 (USD Million)

Table 36 Market for Consumer Electronics in North America, By Country, 2016–2024 (USD Million)

Table 37 Market for Consumer Electronics in Europe, By Country, 2016–2024 (USD Million)

Table 38 Market for Consumer Electronics in APAC, By Country, 2016–2024 (USD Million)

Table 39 Market for Consumer Electronics in RoW, By Region, 2016–2024 (USD Million)

Table 40 Market for Automotive Infotainment Systems, in Terms of Value and Volume, 2019–2024

Table 41 Market for Automotive, By Region, 2016–2024 (USD Million)

Table 42 Market for Automotive in North America, By Country, 2016–2024 (USD Million)

Table 43 Market for Automotive in Europe, By Country, 2016–2024 (USD Million)

Table 44 Market for Automotive in APAC, By Country, 2016–2024 (USD Million)

Table 45 Market for Automotive in RoW, By Region, 2016–2024 (USD Million)

Table 46 Market, By Region, 2016–2024 (USD Million)

Table 47 Market in North America, By Country, 2016–2024 (USD Million)

Table 48 Market in North America, By End-User Industry, 2016–2024 (USD Million)

Table 49 Class D Audio Amplifier Market in North America, By Device, 2016–2024 (USD Million)

Table 50 Market in North America, By Device, 2016–2024 (Million Units)

Table 51 Market in Europe, By Country, 2016–2024 (USD Million)

Table 52 Market in Europe, By End-User Industry, 2016–2024 (USD Million)

Table 53 Market in Europe, By Device, 2016–2024 (USD Million)

Table 54 Market in Europe, By Device, 2016–2024 (Million Units)

Table 55 Market in APAC, By Country, 2016–2024 (USD Million)

Table 56 Market in APAC, By End-User Industry, 2016–2024 (USD Million)

Table 57 Market in APAC, By Device, 2016–2024 (USD Million)

Table 58 Market in APAC, By Device, 2016–2024 (Million Units)

Table 59 Market in RoW, By Region, 2016–2024 (USD Million)

Table 60 Market in RoW, By End-User Industry, 2016–2024 (USD Million)

Table 61 Market in RoW , By Device, 2016–2024 (USD Million)

Table 62 Market in RoW , By Device, 2016–2024 (Million Units)

Table 63 Product Launches and Developments (2016–2019)

Table 64 Partnerships and Collaborations, 2017

Table 65 Acquisitions, (2017–2018)

List of Figures (36 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Research Design

Figure 3 Data Triangulation

Figure 4 Process Flow of Market Size Estimation

Figure 5 Market in Terms of Value and Volume (2016–2024)

Figure 6 Market for 2-Channel Class D Audio Amplifiers to Grow at Highest CAGR From 2019 to 2024

Figure 7 Home Audio Devices to Hold Largest Size of Market, in Terms of Value, During Forecast Period

Figure 8 Automotive Industry to Witness Higher CAGR in Market, in Terms of Value, During Forecast Period

Figure 9 APAC Held Largest Share in Market, in Terms of Value, in 2018

Figure 10 Market in RoW to Grow at Highest CAGR From 2019 to 2024

Figure 11 Market for Smartphones to Record Largest Shipment During Forecast Period

Figure 12 Television Sets to Hold Largest Size of 2-Channel Class D Audio Amplifier , in Terms of Value, By 2019

Figure 13 Home Audio Systems to Hold Largest Share of Market for Consumer Electronics, in Terms of Value, By 2024

Figure 14 China and Home Audio Systems Were Largest Shareholders of Market in Terms of Value in APAC in 2018

Figure 15 China to Hold Largest Share of Market, in Terms of Value, By 2019

Figure 16 Increasing Traction Towards In-Vehicle Infotainment Systems Driving the Growth of Market

Figure 17 Market, By Amplifier Type

Figure 18 Smartphones to Account for Largest Size of Mono-Channel Class D Audio Amplifier During Forecast Period

Figure 19 4-Channel Class D Audio Amplifier Market for Television Sets to Grow at Highest CAGR During Forecast Period

Figure 20 Market, By Geography

Figure 21 North America: Class D Audio Amplifier Snapshot

Figure 22 Europe: Class D Audio Amplifier Snapshot

Figure 23 APAC: Class D Audio Amplifier Snapshot

Figure 24 Key Growth Strategies Adopted By Top Companies, 2015–2019

Figure 25 Market Ranking of Top 5 Players in Market, 2018

Figure 26 Market (Global) Competitive Leadership Mapping, 2018

Figure 27 Stmicroelectronics N.V. : Company Snapshot

Figure 28 Texas Instruments: Company Snapshot

Figure 29 NXP Semiconductor: Company Snapshot

Figure 30 Analog Devices: Company Snapshot

Figure 31 Infineon Technologies: Company Snapshot

Figure 32 Cirrus Logic: Company Snapshot

Figure 33 Maxim Integrated: Company Snapshot

Figure 34 Silicon Labs: Company Snapshot

Figure 35 Qualcomm Incorporated : Company Snapshot

Figure 36 On Semiconductor Technologies: Company Snapshot

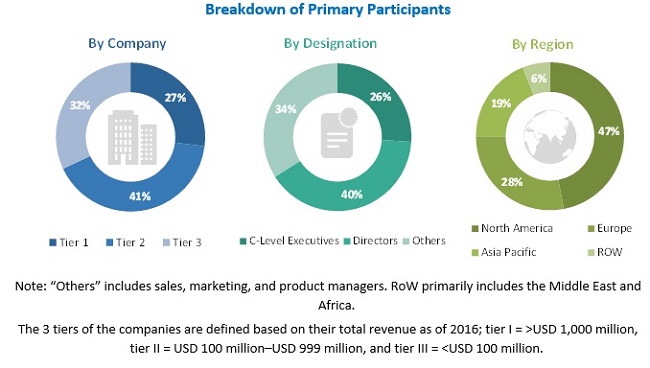

The study involved 4 major activities for estimating the current market size of the class D audio amplifier market. Exhaustive secondary research was conducted to collect information on the market, as well as its peer and parent markets. The next step involved the validation of these findings, assumptions, and sizing with industry experts across the value chain, i.e., through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include Institute of Electrical and Electronics Engineers; European Imaging and Sound Association (EISA); Audio Engineering Society (AES); journals; press releases and financials of companies; white papers and certified publications and articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the class D audio amplifier market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information, as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the class D audio amplifier market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends related to different verticals, identified from both demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

The following are the major Objectives of the Study.

- To define, describe, and forecast the class D audio amplifier market, in terms of value and volume, segmented on the basis of amplifier type, device, end-user industry, and geography

- To forecast the market size, in terms of value and volume, for various segments with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information and analysis of major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To provide a detailed overview of the value chain of the ecosystem of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze growth strategies such as product launches and developments, acquisitions, expansions, and agreements adopted by major players in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Market size for 2021 and 2023 for device, amplifier type, end-user industry and geography

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Class D Audio Amplifier Market