Citric Acid Market by Form (Anhydrous and Liquid), Application (Food, Pharmaceuticals, and Cosmetics), Function (Acidulant, Antioxidant, Preservative, and Sequestrant), and by Region (North America, Europe, Asia-Pacific, and RoW) - Global Forecast to 2020

The citric acid market is directly influenced by the growth of food additives in the processed food industry. Consumer interest in food & beverage products prepared from safe ingredients is projected to remain strong during the forecast years. Moreover, increasing application in the pharmaceutical & personal care industries also help in augmenting market demand for citric acid products.

Citric acid helps manufacturers in offering a clean label to their products, and satisfying consumer demand for safe and permitted ingredients within their budget. However, manufacturers face intense competition from inter- and intra-industry peers in sourcing raw material, ultimately restraining the market growth to a significant extent.

The global market is projected to witness augmented growth due to surging demand for citric acid in food & beverages, pharmaceuticals, detergents, cosmetics & personal care products. The report estimates the market size, in terms of value and volume, of citric acid, based on their form, function, application, and region.

The report provides a detailed analysis of the citric acid market, which is segmented into two major forms- anhydrous citric acid and liquid citric acid. The market has also been segmented on the basis of its main function- acidulant, preservatives, antioxidant, and sequestrant. The report provides a comprehensive analysis of the citric acid market for new and existing players in the food processing, animal feed, pharmaceutical, and personal care industries. The regions covered in this report are North America, Europe, Asia-Pacific, and Rest of the World (RoW). The market is further segmented on the basis of the key countries in these regions.

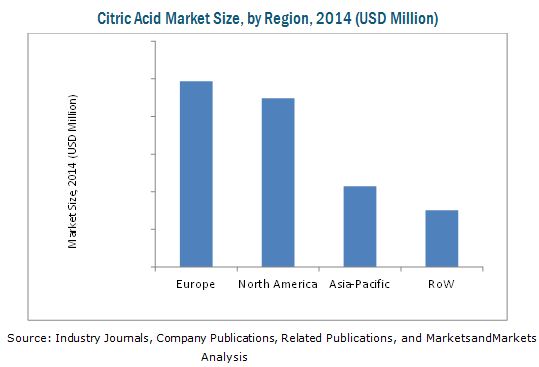

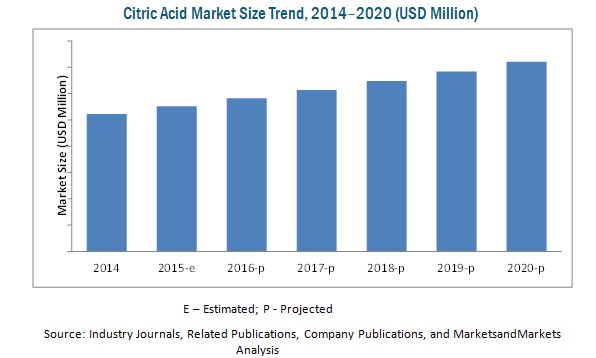

The global market stood at USD 2.6 Billion in 2014, at USD 3.6 Billion by 2020 and is projected to grow at a CAGR of 5.5% from 2015 to 2020. The European region accounted for the largest share in the market in 2014, owing to the heavy demand for functional food additives from the flourishing processed food & beverage market of the region. Food as an application dominates the market with more than three-fourth share, in terms of value as well as volume. It is the fastest-growing application, and is expected to continue to be, during the forecast years. The market for citric acid for application in the pharmaceutical and personal care sectors is emerging with substantial opportunities and is projected to grow at a competitive CAGR from 2015 to 2020.

Anhydrous citric acid is the most preferable form, owing to its ease of transportation and longer shelf life.

The report provides a qualitative analysis of the leading players in the market. It also enumerates the development strategies preferred by these players. The market dynamicsin terms of market drivers, restraints, opportunities, and challenges are discussed in detail in the report. Key players profiled in the report include Archer-Daniels-Midland Company (U.S.), Cargill, Incorporated (U.S.), Tate & Lyle PLC (U.K.) and JUNGBUNZLAUER SUISSE AG (Switzerland), COFCO Biochemical (AnHui) Co., Ltd. (China), HUANGSHI XINGHUA BIOCHEMICAL CO.LTD (China), RZBC Group Co. Ltd. (China), Weifang Ensign Industry Co., Ltd. (China), Gadot Biochemical Industries Limited (Israel), and S.A. Citrique Belge N.V. (Belgium).

Scope of the Report

This study categorizes the global market on the basis of form, function, application, and region. The regional analysis is further extended with projections of the market size of their key contributing countries.

On the basis of key forms, the market was segmented as follows:

- Anhydrous citric acid

- Liquid citric acid

On the basis of key functions, the market was segmented as follows:

- Acidulant

- Preservative

- Antioxidant

- Sequestrant

On the basis of applications, the market was segmented as follows:

- Food

- Beverages

- Confectioneries

- Convenience food products (creams, fats, mayonnaise, soups & sauces, oils, and fillings)

- Dairy products

- Pharmaceuticals & personal care

- Others (detergents & cleansers, animal feed, textile)

On the basis of key regions, the market was segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations-

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe citric acid market into Sweden, Poland, Norway, and Greece

- Further breakdown of the Rest of Asia-Pacific citric acid market into Malaysia, Australia & New Zealand, and Thailand

- Further breakdown of the RoW citric acid market into Paraguay, Uruguay, Chile, and Cuba

Company Information

- Detailed analysis and profiling of additional market players and their global operations and financial performance (Up to 5)

The global market is growing in accordance with the advancement of the processed food industry and increasing applications in the pharmaceutical, personal care & cosmetics, detergents & cleansers sectors. The citric acid market is considered to be one of the fastest-growing segments of the food additives market for its versatile functionalities as a flavor enhancer, acidulant, antioxidant, preservative, buffering agent, and sequestrant.

The market is segmented on the basis of key forms, functions, applications, and regions. The citric acid industry is restrained by scarcity if raw materials and intense competition for the same. Emerging applications of citric acid in pharmaceuticals, personal care, and cosmetics are estimated to be the key driving factors for the citric acid market.

The global market stood at USD 2.6 Billion in 2014, at USD 3.6 Billion by 2020 and is projected to grow at a CAGR of 5.5% from 2015 to 2020. owing to the flourishing food sector across the globe which is driving the market for various food additives, including citric acid. The global market in 2014 was dominated by anhydrous citric acid.

The citric acid market is fragmented, with the leading companies driving its growth. The report provides qualitative analyses of the prominent market players, their products, and preferred development strategies. Key players such as Archer-Daniels-Midland Company (U.S.), Cargill, Incorporated (U.S.), Tate & Lyle PLC (U.K.), JUNGBUNZLAUER SUISSE AG (Switzerland), COFCO Biochemical (AnHui) Co., Ltd. (China), Huangshi Xinghua Biochemical Co. Ltd. (China), RZBC Group Co. Ltd. (China), Weifang Ensign Industry Co., Ltd. (China), Gadot Biochemical Industries Limited (Israel), and S.A. Citrique Belge N.V. (Belgium) have been profiled in the report.

The leading players have adopted new product development as their key development strategy to serve different consumers from food and non-food sectors in matured and untapped markets as well. They also focus on acquiring local players of the industry and developing a new customer base for long-term client relationships. This has not only enabled them to expand their geographical reach, but has also reinforced their market position by gaining a larger share in terms of revenue and product portfolios. Small-scale players also adopted this strategy to expand their businesses globally, by investing in the establishment of manufacturing facilities and global innovation centers in various regions. This organic growth strategy serves an important proposition for smaller companies, enabling them to improve their technical expertise through intensive R&D infrastructure offered by key players.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Base Currency Considered for the Citric Acid Market

1.5 Base Unit Considered for the Citric Acid Market

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.2.1 Breakdown of Primaries, By Company Type, Designation & Region

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Overview of the Parent Industry

2.2.2.1 Key Segments in the Food Sector

2.2.3 Demand-Side Analysis

2.2.3.1 Rising Population

2.2.3.1.1 Increase in Middle-Class Population, 20102030

2.2.3.2 Developing Economies, GDP (Purchasing Power Parity), 2013

2.2.4 Supply-Side Analysis

2.2.4.1 Research & Development

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations of the Research Study

3 Executive Summary (Page No. - 28)

3.1 Overview

3.2 Citric Acid

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in this Market

4.2 Citric Acid Market, By Application

4.3 Overview of the Citric Acid Market in the Asia-Pacific Region

4.4 India is Projected to Be the Fastest-Growing Market

4.5 Citric Acid Market, By Function

4.6 Citric Acid Market: Developed vs Emerging Markets

4.7 Anhydrous Form Accounted for the Largest Share in the Market in 2014

4.8 Citric Acid Market Life Cycle Analysis, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Consumption of Convenience Food & Beverage Products

5.3.1.2 Multi-Functionality of Citric Acid, A Key Feature

5.3.1.3 Increasing Need for Food Safety

5.3.1.4 Research & Development Driving Innovation

5.3.2 Restraints

5.3.2.1 Competition for Basic Raw Materials

5.3.3 Opportunities

5.3.3.1 Growth Opportunities in the Untapped Markets

5.3.3.2 Less Impact of Regulations

5.3.4 Challenges

5.3.4.1 Lactic Acid Emerging as A New Substitute for Citric Acid

5.3.4.2 Challenges for Citric Acid Manufacturers in Developed Markets

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Supply Chain

6.3 Industry Insights

6.4 Porters Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Trade Analysis

6.6 Regulations

6.7 Price Trend

7 Citric Acid Market, By Form (Page No. - 56)

7.1 Introduction

7.2 Anhydrous

7.3 Liquid

8 Citric Acid Market, By Application (Page No. - 60)

8.1 Introduction

8.2 Food

8.2.1 Beverages

8.2.2 Confectioneries

8.2.3 Convenience Food Products

8.2.3.1 Creams, Fats & Fillings

8.2.3.2 Soups & Sauces

8.2.3.3 Oils

8.2.4 Dairy Products

8.3 Pharmaceutical & Cosmetics

8.4 Reagent

8.5 Others

9 Citric Acid Market, By Function (Page No. - 71)

9.1 Introduction

9.2 Acidulant

9.3 Antioxidant

9.4 Preservative

9.5 Sequestrant

10 Citric Acid Market, By Grade (Page No. - 77)

10.1 Food Grade

10.2 Pharmaceutical Grade

10.3 Industrial Grade

11 Citric Acid Market, By Region (Page No. - 79)

11.1 Introduction

11.2 Pest Analysis

11.2.1 Political/Legal Factors

11.2.1.1 Government Regulations

11.2.2 Economic Factors

11.2.2.1 Fluctuating Raw Material Prices

11.2.2.2 Rising Middle-Class Population With High Disposable Income

11.2.3 Social Factors

11.2.3.1 Food Safety

11.2.4 Technological Factors

11.2.4.1 R&D Initiatives

11.3 North America

11.3.1 U.S.

11.3.2 Canada

11.3.3 Mexico

11.4 Europe

11.4.1 Italy

11.4.2 Spain

11.4.3 Germany

11.4.4 U.K.

11.4.5 France

11.4.6 Rest of Europe

11.5 Asia-Pacific

11.5.1 China

11.5.2 Japan

11.5.3 India

11.5.4 Rest of Asia-Pacific

11.6 Rest of the World (RoW)

11.6.1 Latin America

11.6.2 Africa

11.6.3 Middle East

12 Company Profiles (Page No. - 109)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Archer Daniels Midland Company

12.3 Cargill, Incorporated

12.4 Tate & Lyle PLC

12.5 Jungbunzlauer Suisse AG

12.6 Cofco Biochemical (Anhui) Co., Ltd.

12.7 Huangshi Xinghua Biochemical Co.Ltd

12.8 RZBC Group Co. Ltd.

12.9 Weifang Ensign Industry Co., Ltd.

12.10 Gadot Biochemical Industries Ltd.

12.11 S.A. Citrique Belge N.V.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 127)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (69 Tables)

Table 1 China Led the Global Citric Acid Exports, in Terms of Value & Volume in 2014

Table 2 The U.S. Led the Global Citric Acid Imports, in Terms of Value & Volume in 2014

Table 3 Regulations Pertaining to the Use of Citric Acid in Key Countries

Table 4 Citric Acid Market Size, By Form, 20132020 (USD Million)

Table 5 Market Size, By Form, 20132020 (KT)

Table 6 Anhydrous Citric Acid Market Size, By Region, 20132020 (USD Million)

Table 7 Liquid Citric Acid Market Size, By Region, 20132020 (USD Million)

Table 8 Citric Acid is Acceptable in Foods Conforming to the Following Commodity Standards: Cs 117-1981, as Per the Codex Alimentarius Commission,

Table 9 Market Size, By Application, 20132020 (USD Million)

Table 10 Market Size for Food, By Region, 20132020 (USD Million)

Table 11 Market Size for Food, By Application, 20132020 (USD Million)

Table 12 Beverages Market Size, By Region, 20132020 (USD Million)

Table 13 Confectioneries Market Size, By Region, 20132020 (USD Million)

Table 14 Convenience Food Products Market Size, By Region, 20132020 (USD Million)

Table 15 Dairy Products Market Size, By Region, 20132020 (USD Million)

Table 16 Citric Acid Market Size for Pharmaceutical & Cosmetics, By Region, 20132020 (USD Million)

Table 17 Market Size for Reagent Applications, By Region, 20132020 (USD Million)

Table 18 Market Size for Other Applications, By Region, 20132020 (USD Million)

Table 19 Market Size, By Function, 20132020 (USD Million)

Table 20 Citric Acid in Acidulant Market Size, By Region, 20132020 (USD Million)

Table 21 Citric Acid in Antioxidant Market Size, By Region, 20132020 (USD Million)

Table 22 Citric Acid in Preservative Market Size, By Region, 20132020 (USD Million)

Table 23 Citric Acid in Sequestrant Market Size, By Region, 20132020 (USD Million)

Table 24 Citric Acid Market Size, By Grade, 20132020 (USD Million)

Table 25 Food Grade Citric Acid Market Size, By Region, 20132020 (USD Million)

Table 26 Pharmaceutical Grade Citric Acid Market Size, By Region, 20132020 (USD Million)

Table 27 Industrial Grade Market Size, By Region, 20132020 (USD Million)

Table 28 Citric Acid Market Size, By Region, 20132020 (USD Million)

Table 29 Market Size, By Region, 20132020 (KT)

Table 30 North America: Citric Acid Market Size, By Country, 20132020 (USD Million)

Table 31 North America: Market Size, By Country, 20132020 (KT)

Table 32 North America: Market Size, By Function, 20132020 (USD Million)

Table 33 North America: Market Size, By Application, 20132020 (USD Million)

Table 34 North America: Market Size, By Food Application, 20132020 (USD Million)

Table 35 North America: Market Size, By Form, 20132020 (USD Million)

Table 36 U.S.: Citric Acid Market Size, By Form, 20132020 (USD Million)

Table 37 Canada: Market Size, By Form, 20132020 (USD Million)

Table 38 Mexico: Market Size, By Form, 20132020 (USD Million)

Table 39 Europe: Citric Acid Market Size, By Country, 20132020 (USD Million)

Table 40 Europe: Market Size, By Country, 20132020 (KT)

Table 41 Europe: Market Size, By Function, 20132020 (USD Million)

Table 42 Europe: Market Size, By Application, 20132020 (USD Million)

Table 43 Europe: Citric Acid in Food Market Size, By Food Type, 20132020 (USD Million)

Table 44 Europe: Market Size, By Form, 20132020 (USD Million)

Table 45 Italy: Citric Acid Market Size, By Form, 20132020 (USD Million)

Table 46 Spain: Market Size, By Form, 20132020 (USD Million)

Table 47 Germany: Market Size, By Form, 20132020 (USD Million)

Table 48 U.K.: Market Size, By Form, 20132020 (USD Million)

Table 49 France: Market Size, By Form, 20132020 (USD Million)

Table 50 Rest of Europe: Citric Acid Market Size, By Form, 20132020 (USD Million)

Table 51 Asia-Pacific: Citric Acid Market Size, By Country, 20132020 (USD Million)

Table 52 Asia-Pacific: Market Size, By Country, 20132020 (KT)

Table 53 Asia-Pacific: Market Size, By Function, 20132020 (USD Million)

Table 54 Asia-Pacific: Market Size, By Application, 20132020 (USD Million)

Table 55 Asia-Pacific: Citric Acid in Food Market Size, By Application, 20132020 (USD Million)

Table 56 Asia-Pacific: Market Size, By Form, 20132020 (USD Million)

Table 57 China: Citric Acid Market Size, By Form, 20132020 (USD Million)

Table 58 Japan: Market Size, By Form, 20132020 (USD Million)

Table 59 India: Market Size, By Form, 20132020 (USD Million)

Table 60 Rest of Asia-Pacific: Citric Acid Market Size, By Function, 20132020 (USD Million)

Table 61 RoW: Citric Acid Market Size, By Country, 20132020 (USD Million)

Table 62 RoW: Market Size, By Region, 20132020 (KT)

Table 63 RoW: Market Size, By Function, 20132020 (USD Million)

Table 64 RoW: Market Size, Application, 20132020 (USD Million)

Table 65 RoW: Citric Acid in Food Market Size, By Application, 20132020 (USD Million)

Table 66 RoW: Market Size, By Form, 20132020 (USD Million)

Table 67 Latin America: Market Size, By Form, 20132020 (USD Million)

Table 68 Africa: Market Size, By Form, 20132020 (USD Million)

Table 69 Middle East: Market Size, By Form, 20132020 (USD Million)

List of Figures (47 Figures)

Figure 1 Citric Acid Market

Figure 2 Citric Acid Market: Research Design

Figure 3 Bakery Segment Accounted for ~31% in the Food Sector in 2015

Figure 4 Impact of Key Factors Influencing the Parent Industry

Figure 5 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Limitations of the Research Study

Figure 10 Market Snapshot (2015 vs 2020): Market for Beverages is Projected to Grow at the Highest CAGR

Figure 11 Anhydrous Citric Acid Will Cover the Largest Share By 2020

Figure 12 Asia-Pacific is Projected to Grow at the Highest CAGR From 2015 to 2020

Figure 13 Citric Acid Used as Acidulant Accounted for the Largest Share in 2014 (In Terms of Value)

Figure 14 Emerging Economies Offer Attractive Opportunities in this Market

Figure 15 Food Segment to Grow at the Highest Rate

Figure 16 Beverage Application Captured the Largest Share in the Emerging Asia-Pacific Market in 2014

Figure 17 India is Projected to Be the Fastest-Growing Country-Level Market for Citric Acid

Figure 18 Europe Dominated the Market in 2014

Figure 19 Emerging Markets to Grow Faster Than the Developed Markets

Figure 20 Anhydrous Form Was the Largest Market in 2014

Figure 21 The Citric Acid Market in Asia-Pacific is Experiencing High Growth in the Review Period

Figure 22 Market Segmentation

Figure 23 Rising Consumption of Convenience Food & Beverage Products is the Key Driver of this Market

Figure 24 Food & Beverage Manufacturers are the Key Players in the Citric Acid Supply Chain

Figure 25 Development of New Products is the Most Prevailing Strategic Trend in the Citric Acid Industry

Figure 26 Porters Five Forces Analysis: Citric Acid Market

Figure 27 Increase in Prices of Citric Acid Due to Increasing Raw Material Cost

Figure 28 Citric Acid Market Size, By Form, 2015 vs 2020

Figure 29 Market Share (Value), By Application, 2015 vs 2020

Figure 30 Market for Pharmaceutical & Cosmetics, 2015 vs 2020

Figure 31 Market Size, By Function, 2015 vs 2020 (USD Million)

Figure 32 Regional Snapshot (2014): the Markets in Asia-Pacific and RoW are Emerging as New Hot Spots

Figure 33 North American Citric Acid Market Snapshot: the U.S. is Projected to Be the Global Leader Between 2015 & 2020

Figure 34 The U.S. to Become the Largest Market for Citric Acid By 2020

Figure 35 European Citric Acid Market Snapshot: Mature Market Sees Steady Sales and Stagnant Demand

Figure 36 Asia-Pacific Citric Acid Market Snapshot: India is the Most Lucrative Market

Figure 37 RoW Citric Acid Market Snapshot: Availability of Basic Raw Materials is Driving the Market for Citric Acid

Figure 38 Geographical Revenue Mix of Top Players

Figure 39 Archer Daniels Midland Company: Company Snapshot

Figure 40 Archer Daniels Midland Company: SWOT Analysis

Figure 41 Cargill, Incorporated: Company Snapshot

Figure 42 Cargill, Incorporated: SWOT Analysis

Figure 43 Tate & Lyle PLC: Company Snapshot

Figure 44 Tate & Lyle PLC: SWOT Analysis

Figure 45 Jungbunzlauer Suisse AG: SWOT Analysis

Figure 46 Cofco Biochemical (Anhui) Co., Ltd.: Company Snapshot

Figure 47 Cofco Biochemicals: SWOT Analysis

Growth opportunities and latent adjacency in Citric Acid Market