Global Chronic Care Management Market - Global Forecast to 2030

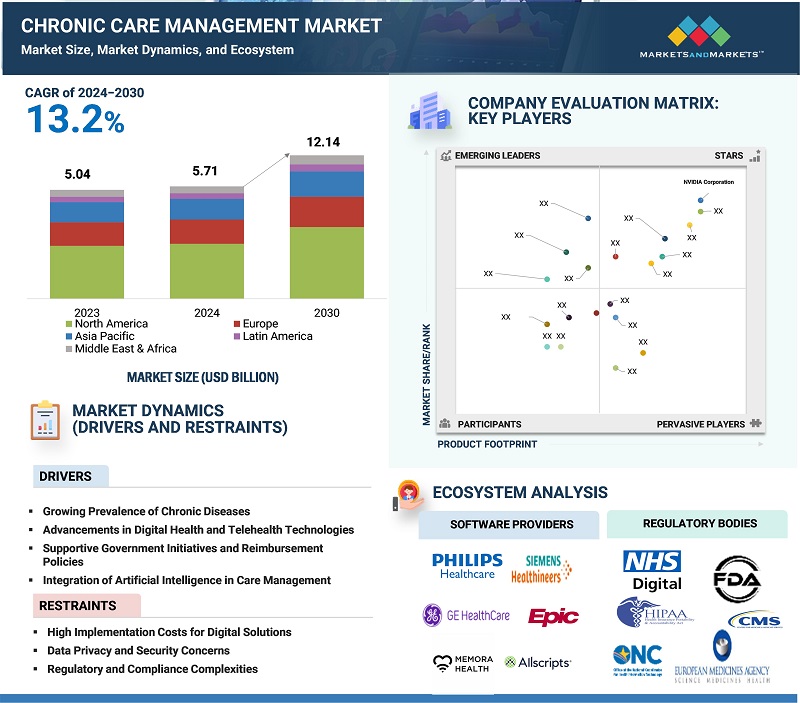

The global chronic care management (CCM) market, valued at US$5.04 billion in 2023, is forecasted to grow at a robust CAGR of 13.2%, reaching US$5.71 billion in 2024 and an impressive US$12.14 billion by 2030. The market sustains on advances in digital health technologies and increasing demand for patient-centered care, backed by a well-developed ecosystem of healthcare providers, technology vendors, payers, and regulatory bodies. These stakeholders work together to get CCM solutions integrated into telehealth platforms, electronic health records (EHRs), and remote monitoring systems while assuring compliance with healthcare standards and improving care delivery to patients with chronic conditions. The ecosystem encourages innovation and cooperation by addressing challenges such as data interoperability and patient privacy, driving the adoption of technology-driven solutions that streamline care coordination, improve patient outcomes, and reduce healthcare costs.

Global Chronic Care Management Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Global Chronic Care Management Market Dynamics

Driver: Government Initiatives and Reimbursement Policies for Chronic Care Management

Chronic care management (CCM) is a crucial healthcare service aimed at improving care quality for patients with various chronic conditions. Governments, particularly in developed nations, have implemented policies and reimbursement mechanisms to support healthcare providers in delivering these services. These initiatives emphasize preventive care, reducing hospital readmissions, and improving patient outcomes while addressing healthcare disparities.

For instance, Medicare's CCM program reimburses providers for non-face-to-face care coordination for patients with two or more chronic conditions under Medicare Part B. Using CPT codes like 99490 (20 minutes) and 99491 (30 minutes), healthcare providers can bill for creating care plans, medication management, and offering 24/7 urgent care access. Costs for patients may be offset by supplemental insurance such as Medicaid or Medigap.

Restraint: Data Privacy and Regulatory Challenges Impeding Chronic Disease Management Market Growth

Nowadays, digital tools and telehealth platforms are becoming more prevalent which is rising the concern about data privacy and security, hampering the growth of the chronic disease management (CDM) market. The increased dependency on these technologies increases the risk of data breaches and illegal access to restricted patient data and other related information. For instance, a 2021 survey reported that over 45 million patient medical records were compromised due to cyberattacks, marking a significant rise from 2020.

Additionally, compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) imposes strict constraints on healthcare organizations to protect patient data. Non-compliance can lead to strict penalties and legal outcomes, preventing some providers from fully implementing digital solutions for chronic disease management.

Opportunity: Integration with Artificial Intelligence (AI)

AI-driven predictive analytics improve care planning, examine patient outcome, and recognize high-risk patients for targeted interventions, authorizing more effective and specified chronic care administration. Moreover, certain small and time taking routine administrative tasks, such as storing, retrieving and disposing medical records, and documentation & billing, among others, can be automated using AI which help healthcare providers to focus on patient care. Advanced machine learning models can examine substantial datasets to discover patterns, forecast disease progression, and advise measures to prevent them. AI-powered tools advance real-time decision-making, granting appropriate interventions to lower hospitalizations and get better outcomes.

For instance, in July 2024, AI-driven platforms like Memora Health enhance Chronic Care Management (CCM) by automating data collection, streamlining workflows, and supporting patients through symptom management and SDOH barriers. These innovations reduce administrative burdens on care teams, improve care coordination, and deliver actionable insights, enabling better patient outcomes and efficient chronic care delivery.

Additionally, AI enhances patient engagement through virtual assistants and personalized health recommendations, fostering better adherence to care plans.

Challenge: High Costs of Implementation in Chronic Care Management (CCM) Programs

The small and medium sized healthcare providers face challenges in adoption of chronic care management (CCM) programs due to factors such as high upfront costs for staff training, software implementation, EHR systems adoption, and infrastructure development. Additional, further operational costs such as software licenses, hardware upgrades, and ongoing maintenance, coupled with the need for extra staff to operate care coordination add to the expense, hampering the market growth. Although chronic care management provides various benefits such as better patient outcomes and limited hospital readmissions, still its adoption is limited due to high initial investment limits, particularly in underserved or resource-constrained areas.

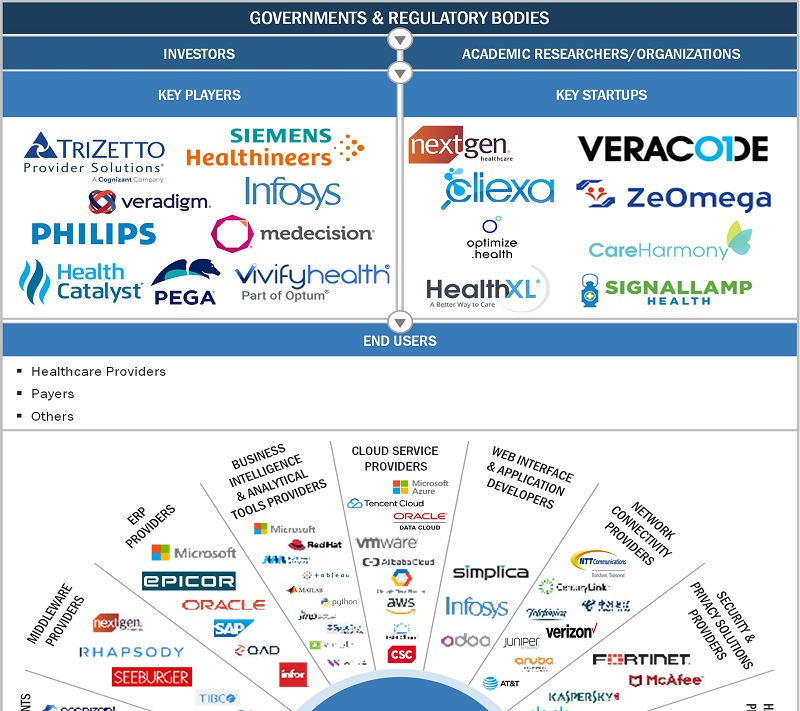

Global Chronic Care Management Market Ecosystem Analysis

The "Chronic Care Management Market Ecosystem" is a comprehensive framework designed to provide seamless management of chronic disease data across healthcare systems by connecting various stakeholders, advanced technologies, and regulatory standards. Key functions such as patient monitoring, data storage, retrieval, and analysis from multiple clinical specialties—such as cardiology, endocrinology, neurology, and pulmonology—are facilitated within this ecosystem. The goal is to create a unified, vendor-neutral environment that enables healthcare providers to enhance clinical decision-making, reduce operational costs, and improve patient outcomes. Below is a detailed analysis of the key components, stakeholders, and technological factors that shape the chronic care management market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

By deployment model, the cloud-based segment accounted for the largest share of the market for chronic care management in 2023.

Based on deployment model, the chronic care management market is bifurcated into cloud-based, on-premise, and hybrid. In this regard, cloud-based takes the lead because it is a cost-effective and scalable mode of deployment for dealing with large amounts of complex data in healthcare. Real-time access to patient records is possible, and integration with EHRs, remote monitoring devices, and telehealth platforms can be easily managed. This setup provides timely and coordinated care to patients with chronic conditions, as well as improved outcomes and operational efficiency.

Cloud-based systems have revolutionized the CCM landscape through the simplification of patient data management and collaboration. This will enable healthcare providers to utilize the tools required in personalized care planning, predictive analytics, and the early detection of complications. The cloud deployment is, hence, critical in improving care delivery, lowering costs, and responding to the increasing requirements for effective chronic disease care through providing seamless communication between stakeholders as well as data sharing with the outside world. A shift to cloud solutions reflects change in health care priorities regarding accessibility, innovation, and scalability.

The oncology segment is set to register the highest CAGR during the forecast period.

Based on indication, the market for chronic care management is segmented into cardiovascular diseases, diabetes, oncology, respiratory diseases, neurology, and others. The oncology segment registered the highest growth rate during the forecast period. As the rate of cancer increases, patients will require special long-term care through the cycle of treatment. A long-term management part of the cancer treatment includes early detection and treatment, follow-up care, and recurrence monitoring. It is one of the ideal candidates for chronic care management solutions. For instance, other technologies used in the management of the continuing needs of cancer patients are telehealth, remote monitoring, and personalized treatment plans-all directed toward better outcomes for the patient and the quality of life.

The oncology segment in CCM uses advanced technologies like artificial intelligence and data analytics, thus enabling health care providers to monitor patients more accurately, predict complications, and change care plans if needed. Such tools also allow for more effective coordination among multidisciplinary care teams, thus ensuring comprehensive, continuous care. Chronic care management solutions are crucial in satisfying the demand for better and more personalized cancer care, as well as ensuring timely interventions to patients and overall improvement of care management in oncology.

North America accounted for the largest share of the market for chronic care management in 2023.

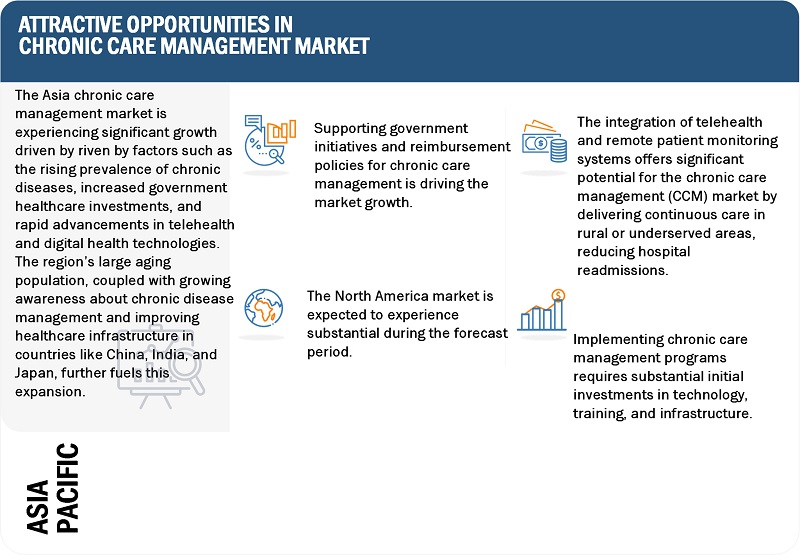

The chronic care management market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, North America accounted for the largest share of the market for chronic care management due to the developed health care structure, early use of the digital health system, and also because of government support towards the schemes related to chronic disease management. The Centres for Medicare & Medicaid Services of the United States has been implementing policies that support the adoption of CCM services. In addition, the growing adoption of electronic health records and telehealth platforms in the region makes integration and coordination with chronic care management much easier and significantly contributes to the growth of the market.

The region's high prevalence of chronic diseases such as diabetes, cardiovascular disease, and cancer is accelerating the demand for robust CCM solutions. Increased investment in healthcare technology, combined with a focus on personalized care and patient engagement, has hastened the adoption of digital tools for chronic condition management. CCM systems are becoming increasingly important in this area as there is a greater demand for remote monitoring, wearable devices, and AI-driven analytics to monitor patient health and predict complications. North America's innovative nature, combined with its emphasis on regulatory framework, quality care, and outcomes, propels it to the top of the chronic care management market, setting the standard for competitors.

Key Market Players

- ExlService Holdings, Inc.

- NXGN Management, LLC.

- Infosys Limited

- Optum, Inc. (Vivifyhealth)

- Cognizant (TriZetto)

- Medecision

- Veradigm LLC

- Siemens Healthcare Private Limited

- Veracode

- Koninklijke Philips N.V.

- ZeOmega

- Health Catalyst

- Pegasystems Inc.

- cliexa Inc.

- CareHarmony, Inc.

- HealthXL

- Signallamp Health

- Engooden Health

- Optimize Health, Inc.

- TimeDoc, Inc.

Recent developments in the chronic care management market:

- In December 2024, ChartSpan has collaborate with Main Line Health to deliver Chronic Care Management (CCM) services to Medicare patients across Philadelphia and its suburbs, enhancing care for thousands of beneficiaries.

- In March 2024, Inova Health System and ChartSpan have partnered to enhance chronic care management services in Northern Virginia and the Washington, DC area. This collaboration leverages ChartSpan’s CCM solutions and Inova’s healthcare expertise to provide patients with tailored, comprehensive health management.

- In February 2022, VillageMD acquired Healthy Interactions, enhancing chronic condition management through interactive education. The program, offering virtual, in-person, and hybrid sessions, was set to launch in 14 markets via Village Medical and Village Medical at Walgreens by the end of 2022, benefiting over 30 million patients globally since 2005.

- In July 2024, insurance startup Acko acquired digital chronic care management company OneCare to expand its healthcare offerings. OneCare’s cofounders will join Acko's leadership team as part of the deal.

Frequently Asked Questions (FAQ):

1. Who are the major market players covered in the report?

The key players in the chronic care management market include ExlService Holdings, Inc. (US), Optum, Inc. (Vivifyhealth) (US), NXGN Management, LLC.(US), Infosys Limited (Asia Pacific), and Cognizant (TriZetto) (US).

2. Define the market for chronic care management market.

Chronic care management (CCM) is the comprehensive and coordinated care given to people with chronic health conditions like diabetes, heart disease, or asthma. The market includes a variety of services such as monitoring, treatment plans, medication management, and patient education, all aimed at improving long-term health outcomes and lowering hospital admissions. It also includes technological solutions such as telemedicine, wearable devices, and health apps that allow for remote monitoring and management of conditions. An aging population, rising chronic disease prevalence, and increased demand for cost-effective, patient-centered care are driving the CCM market.

3. Which region is projected to account for the largest market share for chronic care management?

The chronic care management market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is projected to account for the largest share of the market for chronic care management during the forecast period.

4. Which end-user segments have been included in the chronic care management market report?

The report contains the following end-user segments:

- Healthcare Providers

- Payers

- Others

5. How big is the global chronic care management market today?

The global chronic care management market is projected to grow from USD 5.71 billion in 2024 to USD 12.14 billion by 2030, at a CAGR of 13.2%.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Global Chronic Care Management Market