China Smart Cities Market by ICT Components (Hardware, Software, Services), Segments (Smart Infrastructure, Smart Transportation, Video), Market Overview, Trends, Vendor Ecosystem Analysis, and Smart Cities Initiatives - Forecast to 2023

[163 Pages Report] The China smart cities market is projected to reach USD 59.9 billion by 2023 from USD 30.4 billion in 2018, at a Compound Annual Growth Rate (CAGR) of 14.5%. The growth in this market is driven by the increase in population, the need for rapid urbanization, and governments investments and policies to speed up the successful implementation and development of smart cities projects.

The video segment is expected to grow at the highest CAGR from 2018 to 2023

China is taking efforts to improve the surveillance of its people by bringing in capabilities, such as Artificial Intelligence (AI), and facial and gait recognition. The video camera segment in China is annually growing with a rate of 18.1%. China is more focused on surveillance systems that connect security cameras nationwide via the cloud to a database of every person’s facial ID profile and a file of their personal details. Hangzhou-based Hikvision, a video surveillance company, possess 21.4% of world’s market share of CCTV cameras and video surveillance equipment. The Chinese government owns a 42% stake of Hikvision. In 2015, the Ministry of Public Security launched a project, aiming to establish a giant facial recognition database to identify any citizen within seconds; the project is still under the development phase. It targets to achieve an accuracy rate of 90% but faces formidable technological hurdles. The project aims to identify any one of its 1.3 billion citizens within 3 seconds. The country is more focused on real-time analysis of surveillance data using sensor systems to improve the public system and the security.

Below mentioned are the major trends in Video segment:

Smart Responders

Panoramic-View Body Cameras with Inbuilt Facial Recognition: China is taking efforts to identify wanted suspects in real-time. For that, police officers across China will be equipped with panoramic-view body cameras that come loaded with facial and gesture recognition technology. Beijing-based Nebula Science and Technology have developed the surround-body camera with inbuilt facial recognition technology that enables cops to identify suspects and ensure complete video evidence of incidence. The camera can capture 720-degree (fish-eye-like panoramic views), high-definition footage and has gesture recognition capability. It is estimated that 3,000 and 4,000 police officers in China are currently equipped with its body cameras. The device is equipped with 4G and Wi-Fi connectivity, connected to a central database containing identification photos of Chinese citizens.

City Surveillance

Facial Recognition Cameras: A school in eastern China installed cameras to monitor students’ facial expressions and attentiveness in class. The cameras will act as a part of school’s “Smart Classroom Behaviour Management System”, providing real-time information of the students to their teachers.

Shenzhen has expanded its traffic surveillance programme by installing facial recognition cameras to identify drivers violating the traffic rules such as driving without valid license. The cameras are able to provide an image of not only number plate but also the driver’s face.

Facial Recognition Database

China is building the giant facial recognition database with the power of identifying any one of its 1.3 billion citizens within 3 seconds.

Immigration/Border Control and Criminal Identification

Facial Recognition System: The system has been installed at Hong Kong-Shenzhen border to accelerate custom checks on the border that consists 6,40,000 crossings every day. It checks visitors’ appearances against a database of faces and travel information and alerts customs officials if found suspicious.

Fingerprint matching, facial recognition, and thermal-scanning technology: The technology is being tested at the border crossing of Hong Kong-Zhuhai-Macau Bridge. The system is based on AI technology and is able to complete immigration clearance in under a second with up to 99.5% accuracy. The high-resolution cameras, fingerprint matching, and thermal-scanning technology have been deployed for one immigration lane at border control.

Key China Smart Cities Market Players

The major vendors in the China Smart Cities Market are Advantech (China), Kontron (Germany), CRRC (China), Hollysys (China), Nari Technology (China), China Railway Electrification Engineering Group (China), Hikvision (China), Dahua Technology (China), and Seavo Technology (China).

Scope of the China Smart Cities Market Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Values (USD Billion), |

|

Segments covered |

By Smart Transportation, Smart Infrastructure, and Video |

|

Geographies covered |

China |

|

Companies covered |

|

This research report categorizes the smart cities market in China based on the smart transportation, smart infrastructure, and video.

On the basis of areas, the China Smart Cities Market has been segmented as follows:

- Smart transportation

- Smart infrastructure

- Video

- Others (smart manufacturing, smart healthcare, smart environment, smart energy, smart education, and smart buildings)

Key Questions Addressed by the Report:

- Who are the major players in the China smart cities market?

- What are different growth trends in the market?

- What are the drivers and restraints for the market?

- What are the major verticals types in the market?

- Which verticals in China are the major adaptors of smart cities solutions?

Frequently Asked Questions (FAQ):

What is a smart city?

What are the key smart city initiatives in China?

Which are the top industry players in the China smart cities market?

What are the top trends in China smart cities market?

Trends that are impacting the China smart cities market include:

- Population push and need of rapid urbanization

- Strongleadershipandinstitutionalsupport

- Highlevelofinvestmentsacrosssectors

- Boostfrom Public Private Partnership (PPP) model

Opportunities for the China smart cities market:

- More than 100 smart cities under 13th five-year plan

- Infrastructure modernization and achieving higher efficiencies

What are the top verticals in the China smart cities market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Scope

1.3 Definitions and Scope

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation: Bottom-Up and Top-Down Approach

2.3 Vendor Analysis Matrix Methodology

2.3.1 Vendor Inclusion Criteria

2.4 Research Assumptions

2.5 Smart Cities Market Sizing Methodology

3 Premium Insights (Page No. - 31)

3.1 Executive Summary

3.1.1 Marketing Recommendations

3.1.2 Partner Recommendations

3.2 Smart Cities Dynamics

3.3 China Government Focus and Investments

3.4 Go-To Market Assessment

4 China Smart Cities Market Overview (Page No. - 39)

4.1 Market Drivers

4.2 Market Opportunities

4.3 Market Challenges

5 Market Sizing (Page No. - 48)

5.1 China Smart Cities Market

5.2 Market By ICT Components

5.3 Market By Verticals

5.4 Smart Infrastructure Market

5.4.1 Smart Infrastructure Market: Trends

5.5 Smart Transportation Market

5.5.1 Smart Transportation Market: Trends

5.6 Video Market

5.6.1 Video Market: Trends

6 Key Smart City Initiatives in China (Page No. - 65)

6.1 Belt and Road Initiative

6.1.1 Belt and Road Initiative : Overview

6.1.2 Belt and Road Initiative : Economic Corridors

6.1.3 Belt and Road Initiative : Challenges

6.1.4 Belt and Road Initiative : Key Stakeholders

6.2 Hangzhou City Brain

6.2.1 Hangzhou City Brain : Overview

6.2.2 Hangzhou City Brain : Focus Areas

6.2.3 Hangzhou City Brain : Et City Brain: Use Cases

6.3 Xiong’an Smart City

6.3.1 Xiong’an Smart City : Overview

6.3.2 Xiong’an Smart City : Focus Areas

6.3.3 Xiong’an Smart City : Key Stakeholders

6.4 Smart Shanghai

6.4.1 Smart Shanghai : Overview

6.4.2 Smart Shanghai : Priority Framework

6.4.3 Smart Shanghai : Focus Areas – Smart Infrastructure

6.4.4 Smart Shanghai : Focus Areas – Smart Transportation

6.4.5 Smart Shanghai : Focus Areas - Governance

6.5 Smart Tianjin

6.5.1 Smart Tianjin : Overview

6.5.2 Smart Tianjin : Focus Areas – Smart Transportation

6.5.3 Smart Tianjin : Focus Areas – Smart Infrastructure

6.6 Smart Yinchuan

6.6.1 Smart Yinchuan : Overview

6.6.2 Smart Yinchuan : Focus Areas - Smart Transportation

6.6.3 Smart Yinchuan : Focus Areas - Smart Governance

6.6.4 Smart Yinchuan : Focus Areas - Video

6.6.5 Smart Yinchuan : Focus Areas - Environmental Protection

6.6.6 Smart Yinchuan : Focus Areas - Industry Promotion

6.7 Smart Shenzhen

6.7.1 Smart Shenzhen : Overview

6.7.2 Smart Shenzhen : Focus Areas - Smart Transportation

6.7.3 Smart Shenzhen : Focus Areas - Smart Infrastructure

6.7.4 Smart Shenzhen : Focus Areas - Smart Utility

6.8 Smart Guangzhou

6.8.1 Smart Guangzhou : Overview

6.8.2 Smart Guangzhou : Focus Area

6.8.3 Smart Guangzhou : Focus Projects

6.9 Ningbo Smart City

6.9.1 Ningbo Smart City : Overview

6.9.2 Ningbo Smart City : Focus Areas - Smart Transportation

6.9.3 Ningbo Smart City : Focus Projects

6.10 Beijing Smart City

6.10.1 Beijing Smart City : Overview

6.10.2 Beijing Smart City : Focus Area - Smart Infrastructure

6.10.3 Beijing Smart City : Focus Area - Video

6.10.4 Beijing Smart City : Focus Area – Smart Transportation

7 Competitive Landscape (Page No. - 111)

7.1 Smart City Ecosystem

7.2 Smart City Vendor Ecosystem

7.2.1 Vendor Market Assessment

7.2.2 Key Vendors Important Partnerships/Investments

7.2.3 Smart Transportation Ecosystem

7.2.4 Smart Infrastructure Ecosystem

7.2.5 Video Ecosystem

7.3 Growth Strategy

8 Company Profile (Page No. - 130)

8.1 Advantech

8.2 Kontron

8.3 Crrc

8.4 Hollysys

8.5 Nari Technology

8.6 China Railway Electrification Engineering Group

8.7 Hikvision

8.8 Dahua Technology

8.9 Seavo Technology

9 Appendix (Page No. - 154)

9.1 Marketsandmarkets Knowledge Store: Snapshot

9.2 Our Custom Research and Consulting

9.3 List of Abbreviations

9.4 Related Reports

9.5 Disclaimer

List of Tables (15 Tables)

Table 1 Key Data From Secondary Sources

Table 2 Key Data From Primary Sources

Table 3 Research Assumptions

Table 4 Population vs Pilot Assessment for 2025

Table 5 China Smart Cities Market 2018–2023 (USD Billion)

Table 6 Market By 2018–2023 (USD Billion) - ICT Components

Table 7 Market 2018–2023 (USD Billion) - By Verticals

Table 8 Smart Infrastructure Market 2018–2023 (USD Billion)

Table 9 Smart Transportation Market 2018–2023 (USD Billion)

Table 10 Smart Transportation Market By Use Cases

Table 11 Video Market 2018–2023 (USD Billion)

Table 12 Et City Brain Construction Principles

Table 13 Partnerships, Agreements, and Collaborations

Table 14 China Smart Cities Market: Mergers and Acquisitions

Table 15 New Product Launches and Investments

List of Figures (47 Figures)

Figure 1 China Smart Cities Market Covered

Figure 2 Years Considered in the Report

Figure 3 China Smart City Market: Research Design

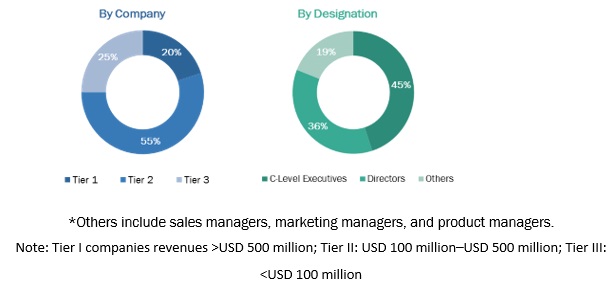

Figure 4 Primary Split By Designation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Vendor Analysis: Criteria Weightage

Figure 8 Smart Cities Market Sizing Methodology

Figure 9 Partner Recommendations

Figure 10 Smart Cities Dynamics

Figure 11 Transportation Investments (By Mode) (2016-2020)

Figure 12 Smart Transportation Market (USD Billion)

Figure 13 ICT Market Opportunity Analysis in Smart Transportation By Segment in 2018

Figure 14 Sharing and Renting Market Analysis By Segment in 2018

Figure 15 Go-To Market Assessment

Figure 16 China Mega and Emerging Cities in 2025

Figure 17 China Smart City Investment By Segment (2018)

Figure 18 China Smart City Investments, By Sector, 2018

Figure 19 China’s 13th Five Year Plan: Focus Areas

Figure 20 13th Five-Year Plan: Structure of Transportation Sector

Figure 21 13th Five-Year Plan: Key Targets for Transportation Sector

Figure 22 Market Opportunity: Infrastructure Modernization and Achieving Higher Efficiencies

Figure 23 China Smart Cities Market 2018–2023 (USD Billion)

Figure 24 Market 2018–2023 (USD Billion) - By ICT Components

Figure 25 Market 2018–2023 (USD Billion) – By Verticals

Figure 26 Smart Infrastructure Market 2018–2023 (USD Billion)

Figure 27 Smart Transportation Market 2018–2023 (USD Billion)

Figure 28 Video Market 2018–2023 (USD Billion)

Figure 29 Et City Brain Construction Principles

Figure 30 Highlights of the Master Plan for Xiong’an New Area

Figure 31 Smart Shanghai Priority Framework

Figure 32 Smart Tianjin : Overview

Figure 33 Smart Guangzhou: Construction Model

Figure 34 Smart Guangzhou : Focus Area

Figure 35 Smart City Ecosystem

Figure 36 Smart City Vendor Ecosystem

Figure 37 Smart Transportation Ecosystem

Figure 38 Smart Infrastructure Ecosystem

Figure 39 Video Ecosystem

Figure 40 Companies Adopted Partnership and Acquisition as Key Growth Strategies During the Period 2016–2018

Figure 41 China Smart Cities Market Evaluation Framework

Figure 42 Battle for Market Share: Partnerships, Agreements, and Collaborations has Been the Key Strategy Adopted By Key Players in the Smart City Market in China

Figure 43 Advantech: Company Snapshot

Figure 44 Crrc: Company Snapshot

Figure 45 Hollysys: Company Snapshot

Figure 46 Hikvision: Company Snapshot

Figure 47 Dahua Technology: Company Snapshot

The study involved 4 major activities in estimating the current size of the China smart cities market. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the associated segments and subsegments of the market.

China Smart Cities Market: Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet were referred to, to identify and collect useful information for a technical, market-oriented, and commercial study of the smart cities market in China. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, World Bank reports, and reports from the Organization for Economic Co-operation and Development (OECD).

Secondary data was collected and analyzed to arrive at the overall market splits, which was further validated using primary research. Secondary research was mainly used to obtain key information around the industry’s supply chain, the total pool of key players, market classification, and segmentation. It was also used to obtain information about the key developments from a market-oriented perspective.

China Smart Cities Market: Primary Research

Extensive primary research was conducted after acquiring extensive knowledge about the smart cities market in China through secondary research. Primary interviews were conducted with market experts in China. Approximately 30% and 70% of primary interviews were conducted with both the demand and supply sides. This primary data was collected through questionnaires, emails, online surveys, and telephonic interviews. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

China Smart Cities Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the China smart cities market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research

- Software product portfolios were studied for each player

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

Data Triangulation

After deriving the market size of the overall China smart cities market, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by ana

- To define, describe, segment, and forecast the smart cities market in China by smart transportation, smart infrastructure, and video

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for the stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market’s segments in China

- To profile the key players and comprehensively analyze their core competencies in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments, such as acquisitions, product developments, partnerships, agreements, collaborations, and business expansions in the smart cities market in China

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific needs.

Growth opportunities and latent adjacency in China Smart Cities Market