Cerium Oxide Nanoparticles Market by Form (Dispersion and Powder), Application (Chemical Mechanical Planarization, Catalyst, Biomedical, Energy), and Region (North America, APAC, Europe, and RoW) - Global Forecast to 2022

[118 Pages Report] The cerium oxide nanoparticles market was valued at USD 218.8 million in 2016 and is projected to reach USD 630.2 million by 2022, at a CAGR of 19.4% during the forecast period. In this study, 2016 has been considered as the base year and 2017 to 2022 as the forecast period to estimate the market size for cerium oxide nanoparticles.

Market Dynamics

Drivers

- Increasing use of cerium oxide nanoparticles used in various applications

- Rising focus of government on nanotechnology research

- Increasing government spending on pharmaceutical R&D in emerging nations

Restraints

- Toxicity caused due to nanoparticles

Opportunities

- Potential of nanoceria to be used as an antioxidant in medical applications

- Environmentally friendly synthesis of nanoceria

Challenges

- Negative impact of cerium oxide nanoparticles on the environment

Use of cerium oxide nanoparticles in the biomedical applications is expected to drive the global cerium oxide nanoparticles market

Due to the presence of reactive oxygen species (ROS) the cerium oxide nanoparticles are used for various biomedical applications. These particles have antibacterial activity, neurodegenerative effect, SOD mimicking activity, catalase mimicking activity, and peroxidase mimicking activity. Ongoing studies suggest that cerium oxide nanoparticles also have antioxidant properties for other applications. Hence the increased government funding to understand the potential applications of cerium oxide nanoparticles is expected to drive the demand of cerium oxide nanoparticles in the biomedical applications.

Objectives of the Study

- To estimate and forecast the cerium oxide nanoparticles market size, in terms of value

- To identify and analyze the key drivers, restraints, challenges, and opportunities affecting the cerium oxide nanoparticles market

- To define and segment the cerium oxide nanoparticles market on the basis of form, application, and region

- To forecast the cerium oxide nanoparticles market based on 4 regions, namely, North America, Europe, Asia Pacific, and RoW, along with key countries in each of these regions

- To analyze the market opportunities and competitive landscape of the stakeholders and market leaders

- To analyze recent market developments and competitive strategies such as expansions, new product launches, agreements, and partnerships to draw the competitive landscape in the market for cerium oxide nanoparticles

- To identify and profile the key market players and analyze their core competencies1

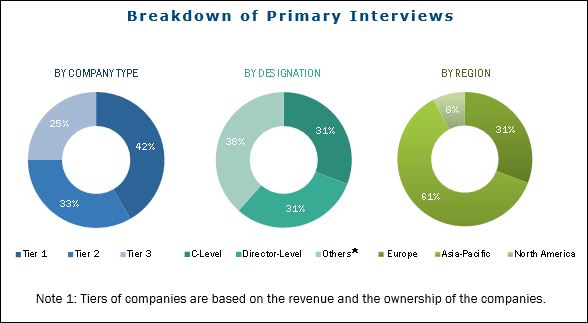

This research study involves extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, Businessweek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the cerium oxide nanoparticles market. Primary sources are mainly industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to different segments of the industrys supply chain. The bottom-up approach has been used to estimate the size of cerium oxide nanoparticles market on the basis of form, application, and region in terms of value. The top-down approach has been implemented to validate the market size in terms of value. With the data triangulation procedure and validation of the data through primary interviews, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The cerium oxide nanoparticles market is led by major players, such as Cerion, (US), Plasmachem (Germany), American Elements (US), Inframat Advanced Materials (US.), NYACOL Nano Technologies (US), and Nanophase Technologies (US). These key players have adopted various organic and inorganic strategies to maintain their shares in the cerium oxide nanoparticles market.

Target Audience

- Cerium Oxide Nanoparticles Manufacturers

- Cerium Oxide Nanoparticles Traders, Distributors, and Suppliers

- End-users of Different Segments of the Cerium Oxide Nanoparticles Market

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

This study answers several questions for stakeholders, primarily which market segments they need to focus upon in the next two to five years to prioritize their efforts and investments.

Scope of the Report

This research report categorizes the cerium oxide nanoparticles market on the basis of form, application, and region. It forecasts revenue growth and analyzes the trends in each of the submarkets.

Cerium Oxide Nanoparticles Market, based on Form

- Dispersion

- Powder

Cerium Oxide Nanoparticles Market, based on Application

- CMP

- Catalyst

- Biomedical

- Energy

- Others

Cerium Oxide Nanoparticles Market, based on Region

- APAC

- China

- India

- Japan

- South Korea

- Taiwan

- Malaysia

- Rest of APAC

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Russia

- Rest of Europe

- RoW

- Brazil

- Saudi Arabia

- Rest of the World

These segments are further described in detail in the report. The value forecasts for these segments have also been provided till 2022.

Critical questions which the report answers

- What are new application areas which the reed sensor companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

The following customization options are available in the report:Company Information

- Analysis and profiles of additional global as well as regional market players (up to three)

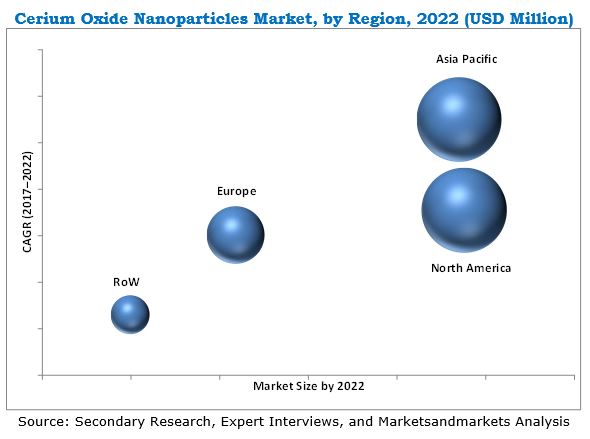

The cerium oxide nanoparticles market is projected to reach USD 630.2 million by 2022 from USD 259.7 million in 2017, at a CAGR of 19.4% from 2017 to 2022. The high demand for cerium oxide nanoparticles from the CMP application especially in North America is driving the growth of the global cerium oxide nanoparticles market.

Cerium oxide nanoparticles, commonly referred to as nanoceria, are nanoparticles of ceria having a diameter of 1500 nm. Ceria is a rare earth metal belonging to the lanthanide series in the periodic table. It is abundantly found in monazite and bastnaesite rocks. These nanoparticles have gained high importance in recent times due to the presence of reactive oxygen. They have high oxygen storage capacity and can easily transit between trivalent and tetravalent states.

The cerium oxide nanoparticles market is segmented by form in two major forms namely, powder form and dispersion form. Dispersion form segment is projected to lead the cerium oxide nanoparticles between 2017 and 2022. sIn dispersion form, the particle size can be retained preventing particle agglomeration.

North America is the largest market for cerium oxide nanoparticles and APAC is the fastest-growing market, in terms of value. Countries in North America are witnessing a significant increase in the use of cerium oxide nanoparticles in CMP and biomedical applications. The region is witnessing a growth in the healthcare industry and presence of the largest producers and exporters of semiconductors driving the market for cerium oxide nanoparticles. The US was the largest market for cerium oxide nanoparticles in 2016 in this region

Cerium oxide nanoparticles used in CMP and biomedical applications drive the growth of cerium oxide nanoparticles market

Chemical Mechanical Planarization (CMP)

The chemical mechanical planarization (CMP) process has been incorporated in the semiconductor manufacturing to reduce uneven topography on the wafer. Currently, the process is adopted by most semiconductor fabrication facilities producing feature sizes below 0.35 micron. This process is advantageous to chipmakers in the semiconductor industry as it can be used for smaller size circuits and for improving the performance of lithography tools. The cerium oxide nanoparticles are used to make slurry. CMP slurries typically contain particles composed of alumina, silica, and ceria, which are suspended in an acidic or basic solution. This is a widely used application of cerium oxide nanoparticles in the semiconductor industry.

Catalyst

Cerium oxide nanoparticles are used as a catalyst, as ceria can be easily reversed between the transition states of Ce3+ and Ce4+. Hence, these particles act as catalytic converters in automobiles as they can give up oxygen without decomposing. Nanoceria can release or take up oxygen in the exhaust stream of a combustion engine depending on its ambient partial pressure of oxygen.

Biomedical

Due to the presence of reactive oxygen species (ROS) the cerium oxide nanoparticles are used for various biomedical applications. These particles have antibacterial activity, neurodegenerative effect, SOD mimicking activity, catalase mimicking activity, and peroxidase mimicking activity. Ongoing studies suggest that cerium oxide nanoparticles also have antioxidant properties for other applications.

Energy

In energy applications, the cerium oxide nanoparticles are used as an electrolyte in solid oxide fuel cells (SOFC) because of their oxygen storage capacity and chemical reactivity. Solar power, wind power, and other sources of renewable energy can help overcome the environmental issues such as global warming, but their working is influenced by weather conditions. Fuel cells are an effective solution to this problem. A fuel cell is a device that converts chemical energy from fuel into electrical energy through a chemical reaction with oxygen and other oxidizing agents.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for cerium oxide nanoparticles?

The toxicity caused due to nanoparticles is a major factor restraining the growth of the market. There is an increasing concern about nanoceria toxicity due to its use in various applications. Nanoparticle toxicity can be caused due to various factors such as the size of the particles, their surface properties, type of cells, and the method of exposure. Smaller particle size can cause toxicity as these particles get easily absorbed into the bloodstream or central nervous system. Hence, nanoceria has been reported to induce and catalyze the generation of ROS across multiple biological systems.

Cerion (US), Plasmachem (Germany), American Elements (US), Inframat Advanced Materials (US), NYACOL Nano Technologies (US), and Nanophase Technologies (US) are the leading players in the cerium oxide nanoparticles market. These companies have adopted various organic and inorganic growth strategies, such as expansions, partnerships, and new product launches to enhance their shares in the cerium oxide nanoparticles market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.3.2 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Market Size Estimation: Top-Down Approach

2.2.2 Market Size Estimation: Bottom-Up Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in Cerium Oxide Nanoparticles Market

4.2 Cerium Oxide Nanoparticle Market, By Type (20172022)

4.3 Cerium Oxide Nanoparticles Market in North America, By Application and Country, 2016

4.4 Cerium Oxide Nanoparticle Market: Developing vs Developed Countries

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of Cerium Oxide Nanoparticles in Various Applications

5.2.1.2 Rising Focus of Government on Nanotechnology Research

5.2.1.3 Increasing Government Spending on Pharmaceutical R&D in Emerging Nations

5.2.2 Restraints

5.2.2.1 Toxicity Caused Due to Nanoparticles

5.2.3 Opportunities

5.2.3.1 Potential of Nanoceria to Be Used as an Antioxidant in Medical Applications

5.2.3.2 Environmental Friendly Synthesis of Nanoceria

5.2.4 Challenges

5.2.4.1 Negative Impact of Cerium Oxide Nanoparticles on the Environment

6 Industry Trends (Page No. - 37)

6.1 Porters Five Forces Analysis

6.1.1 Bargaining Power of Suppliers

6.1.2 Threat of New Entrants

6.1.3 Threat of Substitutes

6.1.4 Bargaining Power of Buyers

6.1.5 Intensity of Competitive Rivalry

6.2 Macroeconomic Indicators

6.2.1 Trends and Forecast of GDP

6.2.2 Contribution of the Healthcare Sector to GDP

7 Cerium Oxide Nanoparticles Market, By Form (Page No. - 44)

7.1 Introduction

7.2 Dispersion

7.3 Powder

8 Cerium Oxide Nanoparticles Market, By Application (Page No. - 48)

8.1 Introduction

8.2 Chemical Mechanical Planarization (CMP)

8.3 Catalyst

8.4 Biomedical

8.5 Energy

8.6 Others

9 Cerium Oxide Nanoparticles Market, By Region (Page No. - 55)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.2 Japan

9.2.3 South Korea

9.2.4 Taiwan

9.2.5 India

9.2.6 Malaysia

9.2.7 Rest of APAC

9.3 North America

9.3.1 US

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 Spain

9.4.4 UK

9.4.5 Italy

9.4.6 Russia

9.4.7 Rest of Europe

9.5 Rest of the World

9.5.1 Brazil

9.5.2 Saudi Arabia

9.5.3 Others

10 Competitive Landscape (Page No. - 88)

10.1 Overview

10.1.1 Competitive Situation and Trends

10.1.2 New Product Launch

10.1.3 Partnership

11 Company Profiles (Page No. - 91)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Cerion, LLC

11.2 Plasmachem GmbH

11.3 American Elements

11.4 Nyacol Nano Technologies Inc.

11.5 Nanophase Technologies Corporation

11.6 Meliorum Technologies, Inc.

11.7 ANP Corporation

11.8 Inframat Advanced Materials LLC

11.9 Nanostructured & Amorphous Materials, Inc.

11.10 Skyspring Nanomaterials, Inc.

11.11 Additional Company Profiles

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 111)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (67 Tables)

Table 1 Forecast of GDP, By Key Country, 20152022 (USD Billion)

Table 2 Contribution of Healthcare Sector to GDP, 2015 and 2016 (Percentage)

Table 3 Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 4 Dispersion Form of Cerium Oxide Nanoparticle Market Size, By Region, 20152022 (USD Million)

Table 5 Powder Form of Cerium Oxide Nanoparticle Market Size, By Region, 20152022 (USD Million)

Table 6 Cerium Oxide Nanoparticle Market Size, By Application, 20152022 (USD Million)

Table 7 Cerium Oxide Nanoparticle Market Size in CMP Application, By Region, 20152022 (USD Million)

Table 8 Cerium Oxide Nanoparticle Market Size in Catalyst Application, By Region, 20152022 (USD Million)

Table 9 Cerium Oxide Nanoparticle Market Size in Biomedical Application, By Region, 20152022 (USD Million)

Table 10 Cerium Oxide Nanoparticle Market Size in Energy Application, By Region, 20152022 (USD Million)

Table 11 Cerium Oxide Nanoparticle Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 12 Cerium Oxide Nanoparticle Market Size, By Region, 20152022 (USD Million)

Table 13 APAC: Cerium Oxide Nanoparticle Market Size, By Country 20152022 (USD Million)

Table 14 APAC: Market Size, By Form, 20152022 (USD Million)

Table 15 APAC: Market Size, By Application, 20152022 (USD Million)

Table 16 China: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 17 China: Market Size, By Application, 20152022 (USD Million)

Table 18 Japan: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 19 Japan: Market Size, By Application, 20152022 (USD Million)

Table 20 South Korea: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 21 South Korea: Market Size, By Application, 20152022 (USD Million)

Table 22 Taiwan: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 23 Taiwan : Market Size, By Application, 20152022 (USD Million)

Table 24 India: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 25 India: Market Size, By Application, 20152022 (USD Million)

Table 26 Malaysia: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 27 Malaysia: Market Size, By Application, 20152022 (USD Million)

Table 28 Rest of APAC: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 29 Rest of APAC: Market Size, By Application, 20152022 (USD Million)

Table 30 North America: Cerium Oxide Nanoparticle Market Size, By Country, 20152022 (USD Million)

Table 31 North America: Market Size, By Form, 20152022 (USD Million)

Table 32 North America: Market Size, By Application, 20152022 (USD Million)

Table 33 US: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 34 US: Market Size, By Application, 20152022 (USD Million)

Table 35 Canada: Cerium Oxide Nanoparticle Market Size, By Type, 20152022 (USD Million)

Table 36 Canada: Market Size, By Application, 20152022 (USD Million)

Table 37 Mexico: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 38 Mexico: Market Size, By Application, 20152022 (USD Million)

Table 39 Europe: Cerium Oxide Nanoparticle Market Size, By Country, 20152022 (USD Million)

Table 40 Europe: Market Size, By Form, 20152022 (USD Million)

Table 41 Europe: Market Size, By Application, 20152022 (USD Million)

Table 42 Germany: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 43 Germany: Market Size, By Application, 20152022 (USD Million)

Table 44 France: Cerium Oxide Nanoparticle Market Size, By Form, 20142021(USD Million)

Table 45 France: Market Size, By Application, 20152022 (USD Million)

Table 46 Spain: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 47 Spain: Market Size, By Application, 20152022 (USD Million)

Table 48 UK: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 49 UK: Market Size, By Application, 20152022 (USD Million)

Table 50 Italy: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 51 Italy: Market Size, By Application, 20152022 (USD Million)

Table 52 Russia: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 53 Russia: Market Size, By Application, 20152022 (USD Million)

Table 54 Rest of Europe: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 55 Rest of Europe: Market Size, By Application, 20152022 (USD Million)

Table 56 RoW : Cerium Oxide Nanoparticles Market Size, By Country, 20152022 (USD Million)

Table 57 RoW : Market Size, By Type, 20152022 (USD Million)

Table 58 RoW : Market Size, By Application, 20152022 (USD Million)

Table 59 Brazil: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 60 Brazil: Market Size, By Application, 20152022 (USD Million)

Table 61 Saudi Arabia: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 62 Saudi Arabia: Market Size, By Application, 20152022 (USD Million)

Table 63 Others: Cerium Oxide Nanoparticle Market Size, By Form, 20152022 (USD Million)

Table 64 Others : Market Size, By Application, 20152022 (USD Million)

Table 65 New Product Launch, 20132017

Table 66 Partnership, 20132017

Table 67 Expansions, 20132017

List of Figures (32 Figures)

Figure 1 Cerium Oxide Nanoparticles Market Segmentation

Figure 2 Cerium Oxide Nanoparticle Market Segmentation, By Region

Figure 3 Cerium Oxide Nanoparticle Market: Research Methodology

Figure 4 Cerium Oxide Nanoparticle Market: Data Triangulation

Figure 5 Dispersion to Be the Larger Segment of Cerium Oxide Nanoparticles Between 2017 and 2022

Figure 6 Biomedical Application to Register the Highest Growth Between 2017 and 2022

Figure 7 North America Was Largest Cerium Oxide Nanoparticle Market in 2016

Figure 8 Cerium Oxide Nanoparticle Market to Grow at A High Rate Between 2017 and 2022

Figure 9 Dispersion to Be the Larger Segment During the Forecast Period

Figure 10 CMP Was the Largest Application of Cerium Oxide Nanoparticle in North America in 2016

Figure 11 China to Emerge as the Most Lucrative Market Between 2017 and 2022

Figure 12 Overview of the Factors Governing the Cerium Oxide Nanoparticle Market

Figure 13 Porters Five Forces Analysis

Figure 14 Trends of GDP, By Key Country, 2016

Figure 15 Contribution of Healthcare to GDP, 2015 and 2016

Figure 16 The Dispersion Segment to Drive the Cerium Oxide Nanoparticle Market During the Forecast Period

Figure 17 North America is the Largest Market for Dispersion Form in the Cerium Oxide Nanoparticle Market

Figure 18 Biomedical to Be the Fastest-Growing Application in the Cerium Oxide Nanoparticle Market

Figure 19 CMP Process

Figure 20 APAC to Be the Largest Market for Cerium Oxide Nanoparticles Used in the CMP Application

Figure 21 APAC to Register the Highest CAGR in the Cerium Oxide Nanoparticles Market, 20172022

Figure 22 APAC: Cerium Oxide Nanoparticle Market Snapshot

Figure 23 North America: Cerium Oxide Nanoparticles Market Snapshot

Figure 24 Europe: Cerium Oxide Nanoparticle Market Snapshot

Figure 25 RoW: Cerium Oxide Nanoparticles Market Snapshot

Figure 26 Companies Adopted New Product Launch as the Key Growth Strategy, 20132017

Figure 27 Cerion, LLC: SWOT Analysis

Figure 28 Plasmachem GmbH: SWOT Analysis

Figure 29 American Elements: SWOT Analysis

Figure 30 Nyacol Nano Technologies, Inc.: SWOT Analysis

Figure 31 Nanophase Technologies Corporation: Company Snapshot

Figure 32 Nanophase Technologies Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Cerium Oxide Nanoparticles Market