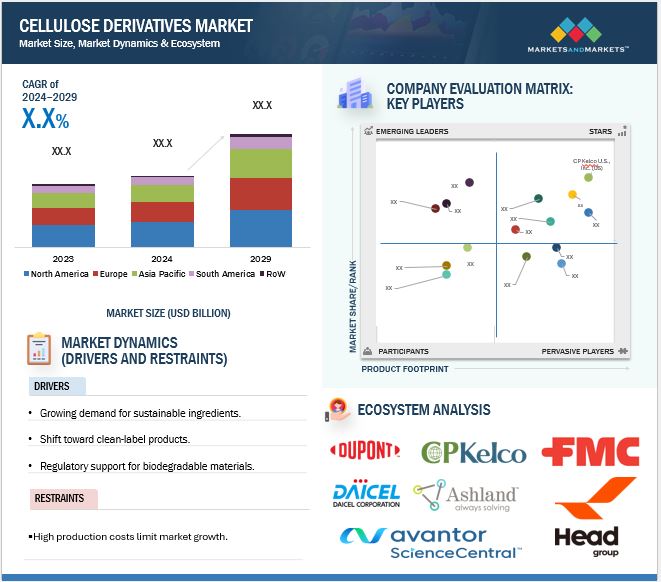

Cellulose Derivatives Market

The cellulose derivatives market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of XX% from 2024 to 2029. The cellulose derivatives market is expanding due to a rising demand for sustainable, natural ingredients in food, agricultural, cosmetic, and pharmaceutical products. Consumers prefer more eco-friendly products made with plant-based sources, moving toward clean-label trends; hence, cellulose-derived ingredients, such as CMC and methylcellulose, are used for texture enhancement, shelf-life extension, and stabilization formulations in food products. Similarly, in agriculture, these derivatives are used for seed coatings and slow-release fertilizers to support sustainable farming practices. Governments and organizations around the world are encouraging eco-friendly solutions that are driving the market. The United Nations pushed for biodegradable alternatives to plastics and synthetic chemicals.

The market grows through strategic expansions, investments, and innovations by companies. Most producers have increased production capacity to ensure that demand is covered. Among them, Dow Chemical, for instance, recently upgraded investments in its cellulose derivatives for food applications. Additionally, firms are coming up with new products based on specific requirements, like biodegradable polymers for personal care from Ashland, and beverage additives by Celanese for better texture and stability. This focus on targeted innovation expands the market in both established and emerging sectors.

Advances in technology are playing a big role in driving the market forward. Companies are now creating cellulose derivatives with improved properties, such as higher biodegradability and multifunctional use. For example, new technologies are allowing the development of ethylene oxide (EO)-free polymers, which are safer and more environmentally friendly. In the pharmaceutical industry, innovations like low-substituted hydroxypropyl cellulose (HPC) are making drug formulations more effective. These innovations not only improve product functionality but also ensure that industries meet higher safety and environmental standards, thus sustaining market growth.

Market Dynamics

Drivers: Rising demands for eco-friendly, and plant-based solutions

The cellulose derivatives market is experiencing an upsurge due to rising demands for eco-friendly, and plant-based solutions for both the food and agriculture sectors. Natural ingredients in food will cause greater usage of cellulose derivatives, for instance, methylcellulose, and carboxymethyl cellulose as thickeners, stabilizers, and emulsifiers in bakery products, dairy, and beverages among others. For instance, the U.S. The FDA approved methylcellulose as GRAS in 2021 and, consequently, encouraged its application in plant-based meats as well as gluten-free foodstuffs.

One major agricultural sector uses cellulose derivatives sustainably, such as using cellulose-based biodegradable seed coatings and controlled nutrient-releasing fertilizers. For instance, USDA initiatives during 2022 also involve climate-smart farms such as the use of materials such as cellulose that support enhancing soil health and limiting chemical pesticides. Cellulose derivatives are also environmentally friendlier when compared to synthetic substances as they contribute to more sustainable expansion within this market.

Other than that, government regulations in various countries, including Codex Alimentarius, promote cellulose derivatives as safe food additives, thus boosting market demand. People are getting more and more interested in plant-based diets and eco-friendly farming, so cellulose derivatives are becoming increasingly important.

Restraint: High production cost

There are a few challenges in the cellulose derivatives market, mostly because of the high production cost and the complexity of manufacturing processes. Cellulose derivatives come from plant-based materials like wood pulp or cotton, which need chemical processing that requires a lot of energy, thus making the products expensive.

Regulations can also slow down the market. In 2023, EFSA came out with stricter rules regarding food additives, which included cellulose derivatives; thus, more research and testing ensued, delaying the launches of their products.

Supply chain disruptions, such as the COVID-19 pandemic, have also made it difficult to obtain raw materials on time, which increases costs. In agriculture, some farmers prefer cheaper synthetic derivatives in place of cellulose-derived products. Consumer aversions to food additives, regardless of their safety, might also limit market growth. Thus, reducing production costs will be crucial in overcoming this challenge and making the product more accessible.

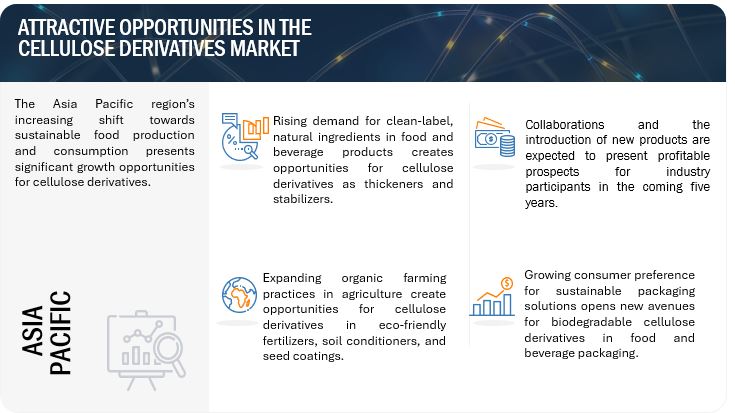

Opportunity: Growing demand for sustainable and biodegradable materials

There are many opportunities for cellulose derivatives, especially with the growing demand for sustainable and biodegradable materials. Governments worldwide are looking for alternatives to plastic and cellulose derivatives can help in that quest. For example, the 2022 report of the United Nations Environment Programme (UNEP) brought to the fore the potential of cellulose-based materials to reduce plastic waste.

This area has an interest in using environmentally friendly fertilizers and delivery systems for pesticides, so cellulose derivatives have relevance. USDA 2023 Organic Transition Initiative also supports the usage of biodegradable coatings and soil enhancers and thus creates a door for cellulose-based products.

The rise in plant-based diets also opens new doors for cellulose derivatives, especially in meat substitutes and dairy alternatives. For instance, the demand for plant-based foods has led to increased use of methylcellulose in creating meat analogs.

The Asian countries, especially the emerging markets like India, are also in great growth. In 2022, the Indian Ministry of Food Processing Industries promoted advanced food technologies, which include cellulose derivatives. These trends, along with innovation in biotechnologies, such as cellulose for packaging, give the market exciting opportunities to expand.

Challenge: Changes in environmental legislation

Changes in environmental legislation are another threat. As an illustration, the U.S. Environmental Protection Agency (EPA) recently updated its air quality standards in 2024, which would raise production costs for companies that produce cellulose derivatives. On the same note, laws like the EU's 2023 Forest Preservation Law limit access to wood, the primary source of cellulose, making it challenging to produce such derivatives.

The market also faces threats from economic downturns. For instance, inflation in 2023 increases the cost of products to consumers and thus may lead to decreased spending on premium food products containing cellulose derivatives. Other risks include legal ones such as patent disputes over biopolymer technology among companies that seek to capture market share. To stay ahead, companies have to innovate and adapt to these challenges.

Market Ecosystem

Bakery and Confectionery in the Food & Beverage Application Segment Has a Significant Share in the Market

In the food and beverage business, the industry of bakery and confectionery experienced high adoption levels of cellulose derivatives primarily methylcellulose and carboxymethyl cellulose (CMC) because of these versatile functionalities, which acted as thickening agents, stabilizers, or gelling agents. These derivatives help enhance texture, prolong shelf life, and improve the quality of baked goods and confectioneries. The FDA has approved methylcellulose as a food additive (21 CFR 172.890) to be used in several applications, including bakery products, where it can exhibit stabilizing and emulsifying properties.

Methylcellulose is for example applied in low-fat and gluten-free baked products as a fat substitute; its ability to improve mouthfeel without affecting the texture. Cellulose derivatives have been essential as gluten-free and healthier baked products continue gaining worldwide popularity. According to Food Processing Technology, in the report in September 2023, the demand for these ingredients is on the rise as people choose them based on diet health.

Asia Pacific, which includes China and India, are also among the contributing factors toward the increasing demand for cellulose derivatives in bakery products. The increasing urbanization and awareness of healthy nutrition have led to the increased incorporation of functional ingredients in confectionery, where cellulose derivatives help stabilize and upgrade the quality of the products.

Methylcellulose (MC) Has a Significant Share in the Cellulose Derivatives Market

Methylcellulose (MC) is one of the most widely used cellulose derivatives in both the food and beverage industry and agriculture due to its diverse functional benefits. In food applications, MC acts as a stabilizer, emulsifier, and fat replacer, making it indispensable in bakery, dairy, and processed food items. The U.S. FDA has accepted MC as a food additive, which is categorized under 21 CFR 172.890. The use of MC in low-fat or gluten-free bakery products has also increased substantially over the past few years. In fact, according to a February 2023 report by the U.S. Department of Agriculture, demand for gluten-free foods grew by 10% year-over-year as consumers turned to MC-based solutions that improve the texture and stability of gluten-free products.

MC is also critical in the production of plant-based food alternatives, especially in plant-based meat products, where it helps to mimic the texture and chewiness of animal-based meat. According to a report by the European Commission in April 2023, the market for plant-based foods in Europe, especially meat substitutes, grew 13% in 2022, with MC playing a crucial role in enhancing the textural properties of these products.

In agriculture, MC is used in pesticide formulation and as a soil stabilizer. Its property to retain water is beneficial for efficient farming. The FAO, in its 2022 publication on sustainable agricultural practices, indicated that MC helps increase the effectiveness of fertilizers and other chemicals applied in agriculture.

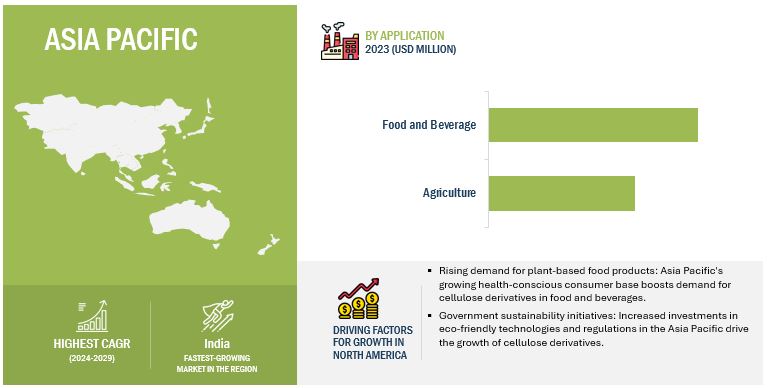

Asia Pacific Has Seen Steady Growth in the Cellulose Derivatives Market

Asia Pacific is one of the largest and fastest-growing regions for cellulose derivatives, driven by increased industrial applications in the food, beverage, and agricultural sectors. According to the United Nations Food and Agriculture Organization, the Asia-Pacific region accounted for a significant share of global food and beverage production in 2022. Cellulose derivatives are used as stabilizers, thickeners, and emulsifiers in this region. Direct contributions to increased use arise from the diversified consumer demands for processed foods and functional beverages in the region.

China and India are significant markets, where rapid urbanization has gradually shifted consumer preferences toward ready-to-eat meals as well as bakery products due to their reliance on cellulose derivatives to provide texture and stability to the food products. In the case of India, FSSAI has approved the use of multiple cellulose derivatives in different food products to ensure consumer safety while improving product functionality.

The agriculture industry in the region has integrated cellulose derivatives into fertilizer formulations, seed coats, and pest control products. The intensive agricultural production in countries such as India and China, wherein sustainable farming practices are becoming increasingly prominent, also accelerates the consumption of these additives. Additionally, the regulatory frameworks, as offered by national food safety authorities such as China's National Health Commission (NHC), support the growth in this market.

Key Market Players

- DuPont de Nemours, Inc. (US)

- Ashland Global Holdings Inc. (US)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- AkzoNobel N.V. (Netherlands)

- Lotte Fine Chemical Co., Ltd. (South Korea)

- Eastman Chemical Company (US)

- Daicel Corporation (Japan)

- CP Kelco U.S., Inc. (US)

- FMC Corporation (US)

- Tianpu Chemicals Co., Ltd. (China)

- Shandong Head Co., Ltd. (China)

- J. Rettenmaier & Söhne GmbH + Co KG (Germany)

- Alfa Aesar (US)

- ChemPoint (US)

- Avantor, Inc. (US)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In October 2024, Ashland showcased its new pharmaceutical excipient, Klucel ls™, at the CPHI Milan and AAPS PharmSci 360 trade shows. This low-substituted hydroxypropyl cellulose (HPC) serves as a multifunctional binder and disintegrant for oral solid dosage forms, offering rapid disintegration and dissolution. This highlights Ashland’s dedication to advancing excipients that meet stringent pharmaceutical standards.

- In September 2024, Dow Chemical announced a major investment to expand production capacity for cellulose derivatives used in food applications. This initiative addresses the rising demand for natural thickeners and stabilizers, driven by consumer trends favoring clean labels and sustainable ingredients.

- In August 2024, Celanese Corporation launched a new line of cellulose-based additives tailored for the beverage industry. These additives improve texture and stability, meeting the growing demand for premium and functional beverages. The products are designed to help manufacturers achieve desired sensory qualities while maintaining clean-label compliance.

- In July 2024, Nouryon introduced sustainable cellulose ethers aimed at food applications like sauces and dressings. These products enhance viscosity and stability while supporting environmental sustainability goals, aligning with industry efforts to minimize environmental impact in food production.

- In November 2023, Ashland announced the expansion of its cellulose derivatives portfolio with new ethylene oxide (EO)-free, biodegradable polymers. These polymers are tailored for applications in hair care, home care, oral care, and skin care, emphasizing sustainability through responsibly sourced biopolymers and multifunctional, tunable additives.

Frequently Asked Questions (FAQ):

What is the current size of the cellulose derivatives market?

The cellulose derivatives market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of XX% from 2024 to 2029.

Which are the key players in the cellulose derivatives market, and how intense is the competition?

Key players include Ashland Global Holdings Inc. (US), Shin-Etsu Chemical Co., Ltd. (Japan), AkzoNobel N.V. (Netherlands), Lotte Fine Chemical Co., Ltd. (South Korea), Eastman Chemical Company (US). The market competition is intense, with continuous R&D investments, mergers, acquisitions, and innovations in cellulose derivatives.

What factors drive the demand for cellulose derivatives in these markets?

The demand is driven by the increasing shift toward sustainable and plant-based products. Clean-label trends in food manufacturing and global sustainability initiatives like the USDA’s Climate-Smart Agriculture programs (2022) emphasize the use of cellulose derivatives. Their biodegradable and eco-friendly properties align with regulations to reduce plastic and synthetic material use, further boosting their demand.

What kind of information is provided in the company profile section?

The company profiles cover comprehensive business overviews, financial data, geographic reach, product lines, strategic initiatives, and key innovations, offering detailed insights into the companies' market strategies.

What are the key applications of cellulose derivatives in the food, beverage, and agriculture sectors?

Cellulose derivatives are widely used in food and beverages as thickeners, stabilizers, emulsifiers, and dietary fiber. They improve texture, extend shelf life, and support clean-label trends. In agriculture, they are used in biodegradable seed coatings, controlled-release fertilizers, and water-retaining agents, promoting sustainable farming practices. For example, methylcellulose is popular in plant-based meats, while carboxymethylcellulose is used in processed foods and soil conditioners.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Cellulose Derivatives Market