Cellular Concrete Market by Application (Building Material, Road Sub-bases, Concrete Pipes, Void Filling, Roof Insulation, Bridge Abutment, and others), by End-user (Residential Building, Commercial Building, Infrastructure, Others) - Global Forecasts to 2020

[140 Pages Report] The cellular concrete market size is estimated to grow from USD 337.6 Million in 2015 to reach USD 449.8 Million by 2020, at a CAGR of 5.9%. The segments considered for this report are based on end user, application, and region. The segmentation by end user consists of commercial buildings, residential buildings, and infrastructure. Based on application, the report has been segmented into building materials, road sub-bases, concrete pipes, void filling, roof insulation, and bridge abutment. The final segment, that is, region, consists of North America, Europe, Asia-Pacific, and the Rest of the World (RoW). The base year considered for the study is 2014 and the market size is projected from 2015 to 2020. Factors such as lightweight, low cost, high thermal insulation, and environment friendly have driven the global cellular concrete market.

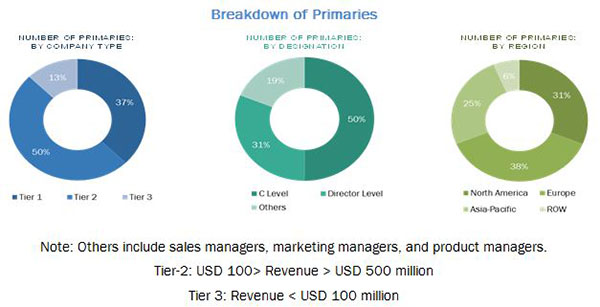

The research methodology used to estimate and forecast the market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up approach was employed to arrive at the overall market size of the global cellular concrete market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub segments, which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the figure below:

Cellular concrete is a formed by mixing of different raw materials (gravel, sand, fly ash and foaming agents). These raw materials available in the market are supplied by major companies such as NEOPOR System GmbH (Germany), Brickwell (India), Masa GmbH (Germany). The cellular concrete market comprises companies such as Saint Gobain (France), Xella Group (Germany), Cellucrete (U.S.), Cematrix (Canada), Litebuilt (Australia).

Target audience

- Government and regulatory bodies

- Market research and consulting firms

- Commercial R&D institutions

- Associations and industry bodies

Scope of the Report

The research report segments the cellular concrete market to following submarkets:

Cellular Concrete Market By End User:

- Residential buildings

- Commercial buildings

- Infrastructure

- Others (agriculture, mining, and utility)

Cellular Concrete Market By Application:

- Building materials

- Road sub-bases

- Concrete Pipes

- Void Filling

- Roof insulation

- Bridge Abutment

- Others (geotechnical application and ornamentation)

Cellular Concrete Market By Region:

- North America

- Europe

- Asia-Pacific

- RoW

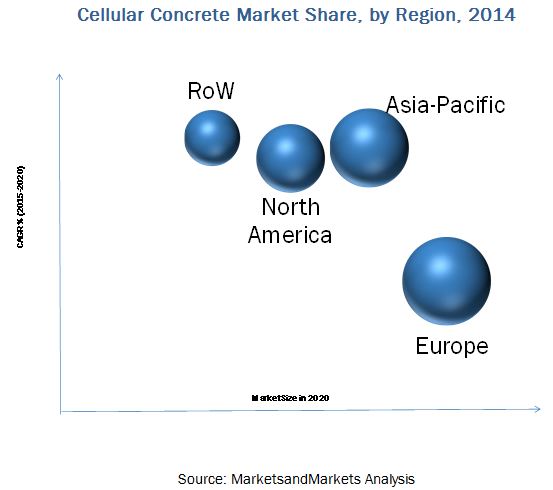

MarketsandMarkets projects that the cellular concrete market size by value will grow at a CAGR of 5.9% between 2015 and 2020. The market has been growing in accordance with the global construction industry. With increasing urbanization and industrialization, the need for new construction has increased significantly throughout the world, which has played a huge part in providing the necessary momentum to the global market, after the economic slowdown between 2007 and 2009. The recovery of global economy would also boost the demand for the cellular concrete market.

Cellular concrete is applicable in building materials, road sub-bases, concrete pipes, void filling, roof insulation and bridge abutment. The building materials segment accounted for the largest share in 2014 as most of the cellular concrete products are equipped in it such as blocks, panels, slabs, and lintels. The road sub-bases segment is estimated to be the fastest-growing market from 2015 to 2020. Cellular concrete provides capillary blocking reducing the damage of the roads by frost heaving and adverse weather conditions. Cellular concrete is less thick compared to other construction materials thus, there is a reduction in the depth of the pit as well.

The cellular concrete market size is estimated to grow from USD 337.6 Million in 2015 to reach USD 449.8 Million by 2020, at a CAGR of 5.9%.

The end-use sectors of cellular concrete are commercial buildings, residential buildings, infrastructure, and others, which include agriculture, mining, and utility. The infrastructure sector accounted for the largest market share in 2014 and the infrastructure segment is projected to be the fastest-growing market for cellular concrete from 2015 to 2020. The rising demand for new constructions across the world and the increasing concern for ecofriendly and sustainable buildings are expected to drive the infrastructure market. The residential buildings and commercial buildings are expected to follow infrastructure sector, registering the second- and third-highest CAGR, respectively, during the forecast period.

The factors that restrain the market are substitutes of cellular concrete and competition from other types of materials. Cellular concrete experiences stiff competition from other construction material, especially from the traditionally used material such as plain concrete slurry, autoclaved sand bricks, gravel.

Supply contract, partnership, and joint ventures were the major strategies adopted by most of the players in the cellular concrete market. Companies such as Saint Gobain (France), Xella Group (Germany), Cellucrete (U.S.), Cematrix (Canada), Litebuilt (Australia), Laston Italiana S.P.A (Italy), Cellular Concrete Technologies (U.S.), Aerix Industries (U.S.), ACICO (Kuwait), Shirke (India), Broco Industries (Indonesia), and Aircrete Europe (Netherlands) are the market players in cellular concrete market

The Asia-Pacific region dominated the cellular concrete market, in terms of both volume and value. Increased demand for lightweight and low-cost construction materials in countries such as China and India is driving the growth of the market in the Asia-Pacific region. Industry players are adopting strategies such as expansions, new product developments, and joint ventures to expand their global presence.

The report includes analysis of the market based on market reach of each application in each major region and country. It also covers the market trends of leading producers, key developments, and strategies implemented to sustain in this market.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Cellular Concrete Market Scope

1.2.1 Market Definition

1.2.1.1 By Region

1.2.2 Years Considered for the Study

1.2.3 Currency

1.2.4 Package Size

1.2.5 Limitations

1.3 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Cellular Concrete Market

4.2 Market, By Region

4.3 Global Cellular Concrete Market, By End User and Region

4.4 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Cellular Concrete Market Segmentation

5.2.1 By Application

5.2.2 By End User

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Cellular Concrete Replacing Traditional Materials in End-Use Applications

5.3.1.2 Growth of Application Markets

5.3.2 Restraints

5.3.2.1 Availability of Alternatives

5.3.3 Opportunities

5.3.3.1 Increasing Demand From Emerging Markets

5.3.4 Challenges

5.3.4.1 Cellular Concrete Can Be Replaced Easily

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

6.4 Strategic Benchmarking

6.4.1 Growth in Cellular Concrete Market

7 Cellular Concrete Market, By Application (Page No. - 45)

7.1 Introduction

7.2 Building Materials

7.3 Road Sub-Bases

7.4 Concrete Pipes

7.5 Void Filling

7.6 Roof Insulation

7.7 Bridge Abutment

7.8 Others

8 Market, By End User (Page No. - 60)

8.1 Introduction

8.2 Residential Building

8.3 Commercial Building

8.4 Infrastructure

8.5 Others

9 Cellular Concrete Market, By Region (Page No. - 69)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 U.K.

9.3.2 Germany

9.3.3 France

9.3.4 Russia

9.3.5 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Australia

9.4.5 Rest of Asia-Pacific

9.5 RoW

9.5.1 South America

9.5.2 Middle East & Africa

10 Competitive Landscape (Page No. - 109)

10.1 Overview

10.2 Supply Contract: Most Popular Growth Strategy Between 2011 and 2015

10.2.1 New Product Launch

10.2.2 Contracts, Agreements, & Joint Ventures

10.2.3 Acquistions

10.2.4 Expansions

11 Company Profile (Page No. - 114)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Introduction

11.2 Cematrix Corporation

11.3 Saint Gobain

11.4 Xella Group

11.5 Cellucrete

11.6 Litebuilt

11.7 Acico

11.8 Aircrete Europe

11.9 Laston Italiana Spa

11.10 Cellular Concrete Technologies, Llc

11.11 Aerix Industries

11.12 Shirke

11.13 Broco Industries

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 134)

12.1 Other Developments

12.2 Insights of Industry Experts

12.3 Discussion Guide

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (88 Tables)

Table 1 Cellular Concrete Market, By Application

Table 2 Market, By End User

Table 3 Cellular Concrete Market Size, By Application, 20132020 (000 Cubic Meter)

Table 4 Market Size, By Application, 20132020 (USD Million)

Table 5 Cellular Concrete Market Size in Building Materials, By Region, 20132020 (000 Cubic Meter)

Table 6 Market Size in Building Materials, By Region, 20132020 (USD Million)

Table 7 Cellular Concrete Market Size in Road Sub-Bases, By Region, 20132020 (000 Cubic Meter)

Table 8 Market Size in Road Sub-Bases, By Region 20132020 (USD Million)

Table 9 Cellular Concrete Market Size in Concrete Pipes, By Region, 20132020 (000 Cubic Meter)

Table 10 Market Size in Concrete Pipes, By Region, 20132020 (USD Million)

Table 11 Market Size in Void Filling, By Region, 20132020 (000 Cubic Meter)

Table 12 Market Size in Void Filling, By Region 20132020 (USD Million)

Table 13 Market Size in Roof Insulation, By Region, 20132020 (000 Cubic Meter)

Table 14 Market Size in Roof Insulation, By Region 20132020 (USD Million)

Table 15 Market Size in Bridge Abutment, By Region, 20132020 (000 Cubic Meter)

Table 16 Market Size in Bridge Abutment, By Region, 20132020 (USD Million)

Table 17 Market Size in Other Applications, By Region, 20132020 (000 Cubic Meter)

Table 18 Market Size in Other Applications, By Region, 20132020 (USD Million)

Table 19 Cellular Concrete Market Size, By End User, 20132020 (000 Cubic Meter)

Table 20 Market Size, By End-User, 20132020 (USD Million)

Table 21 Market Size in Residential Building, By Region, 20132020 (000 Cubic Meter)

Table 22 Market Size in Residential Building, By Region, 20132020 (USD Million)

Table 23 Market Size in Commercial Building, By Region, 20132020 (000 Cubic Meter)

Table 24 Market Size in Commercial Building, By Region, 20132020 (USD Million)

Table 25 Market Size in Infrastructure, By Region 20132020 (000 Cubic Meter)

Table 26 Market Size in Infrastructure, By Region, 20132020 (USD Million)

Table 27 Cellular Concrete Market Size in Other End-Users, By Region 20132020 (000 Cubic Meter)

Table 28 Market Size in Other End Users, By Region, 20132020 (USD Million)

Table 29 Market Size, By Region, 20132020 (000 Cubic Meter)

Table 30 Cellular Concrete Market Size, By Region, 20132020 (USD Million)

Table 31 North America: Market Size, By Country, 20132020 (000 Cubic Meter)

Table 32 North America: Market Size, By Country, 20132020 (USD Million)

Table 33 North America: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 34 North America: Market Size, By Application, 20132020 (USD Million)

Table 35 North America: Market Size, By End User, 20132020 (000 Cubic Meter)

Table 36 North America: Market Size, By End-User, 20132020 (USD Million)

Table 37 U.S.: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 38 U.S.: Market Size, By Application, 20132020 (USD Million)

Table 39 Canada: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 40 Canada: Market Size, By Application, 20132020 (USD Million)

Table 41 Mexico: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 42 Mexico: Market Size, By Application, 20132020 (USD Million)

Table 43 Europe: Cellular Concrete Market Size, By Country, 20132020 (000 Cubic Meter)

Table 44 Europe: Market Size, By Country, 20132020 (USD Million)

Table 45 Europe: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 46 Europe: Market Size, By Application, 20132020 (USD Million)

Table 47 Europe: Market Size, By End-User, 20132020 (000 Cubic Meter)

Table 48 Europe: Market Size, By End-User, 20132020 (USD Million)

Table 49 U.K.: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 50 U.K.: Market Size, By Application, 20132020 (USD Million)

Table 51 Germany: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 52 Germany: Market Size, By Application, 20132020 (USD Million)

Table 53 France: Cellular Concrete Market Size, By Application, 20132020 (000 Cubic Meter)

Table 54 France: Market Size, By Application, 20132020 (USD Million)

Table 55 Russia: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 56 Russia: Market Size, By Application, 20132020 (USD Million)

Table 57 Rest of Europe: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 58 Rest of Europe: Market Size, By Application, 20132020 (USD Million)

Table 59 Asia-Pacific: Market Size, By Country, 20132020 (000 Cubic Meter)

Table 60 Asia-Pacific: Market Size, By Country, 20132020 (USD Million)

Table 61 Asia-Pacific: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 62 Asia-Pacific: Market Size, By Application, 20132020 (USD Million)

Table 63 Asia-Pacific: Market Size, By End-User, 20132020 (000 Cubic Meter)

Table 64 Asia-Pacific: Market Size, By End-User, 20132020 (USD Million)

Table 65 China: Cellular Concrete Market Size, By Application, 20132020 (000 Cubic Meter)

Table 66 China: Market Size, By Application, 20132020 (USD Million)

Table 67 India: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 68 India: Market Size, By Application, 20132020 (USD Million)

Table 69 Japan: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 70 Japan: Market Size, By Application, 20132020 (USD Million)

Table 71 Australia: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 72 Australia: Market Size, By Application, 20132020 (USD Million)

Table 73 Rest of Asia-Pacific: Cellular Concrete Market Size, By Application, 20132020 (000 Cubic Meter)

Table 74 Rest of Asia-Pacific: Market Size, By Application, 20132020 (USD Million)

Table 75 RoW: Market Size, By Country, 20132020 (000 Cubic Meter)

Table 76 RoW: Market Size, By Country, 20132020 (USD Million)

Table 77 RoW: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 78 RoW: Market Size, By Application, 20132020 (USD Million)

Table 79 RoW: Market Size, By End-User, 20132020 (000 Cubic Meter)

Table 80 RoW: Market Size, By End-User, 20132020 (USD Million)

Table 81 South America: Cellular Concrete Market Size, By Application, 20132020 (000 Cubic Meter)

Table 82 South America: Market Size, By Application, 20132020 (USD Million)

Table 83 Middle East & Africa: Market Size, By Application, 20132020 (000 Cubic Meter)

Table 84 Middle East & Africa: Market Size, By Application, 20132020 (USD Million)

Table 85 New Product Launch

Table 86 Contracts, Agreements, & Joint Ventures

Table 87 Acquisitions

Table 88 Expansions

List of Figures (49 Figures)

Figure 1 Cellular Concrete Market By Type, Application, and Region

Figure 2 Research Methodology

Figure 3 Breakdown of Primary Interviews

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Data Triangulation: Cellular Concrete Market

Figure 7 Building Material to Drive the Cellular Concrete Market During the Forecast Period

Figure 8 Infrastructure to Dominate the Market Between 2015 and 2020

Figure 9 Europe Led the Cellular Concrete Market in Terms of Volume in 2014

Figure 10 Asia-Pacific is the Fastest Growing Region in Market in Terms of Volume During the Forecast Period

Figure 11 Cellular Concrete Market to Register High Growth Between 2015 and 2020

Figure 12 The Market in Asia-Pacific and RoW are Projected to Register the Highest Growth Rate, Between 2015 and 2020

Figure 13 Europe to Account for the Largest Share of the Global Cellular Concrete Market, By End-Use Industry

Figure 14 Asia-Pacific to Register the Highest Growth in the Cellular Concrete Market

Figure 15 Market, By Region

Figure 16 Drivers, Restraints, Opportunities and Challenges in the Cellular Concrete Market

Figure 17 Value Chain Analysis: Major Value is Added During the Manufacturing Process

Figure 18 Porters Five Forces Analysis

Figure 19 Inorganic Growth Strategies

Figure 20 Market, By Application

Figure 21 Building and Materials to Be the Largest Segment, 20152020

Figure 22 Europe Accounted for the Largest Share in the Building Martials Application in 2014

Figure 23 Asia-Pacific to Grow at the Highest Rate During the Projected Period

Figure 24 Concrete Pipes Led the Cellular Concrete Market in Asia-Pacific

Figure 25 Europe Dominated the Void Filling Segment in 2014

Figure 26 Asia-Pacific Projected to Be the Fastest-Growing Market in the Roof Insulation Segment, 20152020

Figure 27 Asia Pacific to Present the Highest Growth Potential

Figure 28 Market, By End User

Figure 29 Infrastructure Segment Accounted for the Largest Share in 2014

Figure 30 Europe Accounted for Largest Market Share in 2015

Figure 31 Asia-Pacific to Be the Fastest-Growing Market in Commercial Building Segment

Figure 32 Europe Accounted for the Largest Share in 2015

Figure 33 Geographic Snapshot (20152020): India is Projected to Register the Highest Growth Rate in Terms of Value

Figure 34 Europe Dominated the Cellular Concrete Market in Terms of Value, in 2014

Figure 35 U.S. to Dominate North Americas Cellular Concrete Market, 2014

Figure 36 Germany to Dominate Europes Cellular Concrete Market, 2014

Figure 37 China to Lead Asia-Pacific Cellular Concrete Market, 2014

Figure 38 The Middle East & Africa to Lead RoW Cellular Concrete Market, 2014

Figure 39 To Meet the Growing Demand of Cellular Concrete Companies Adopted Partnership as Their Key Growth Strategy (2011 - 2015 )

Figure 40 Top Companies Adopted Supply Contract as the Key Growth Strategy Between 2011 and 2015

Figure 41 Major Growth Strategies for Acquiring Market Share, 20112015

Figure 42 Cematrix: Company Snapshot

Figure 43 Cematrix : SWOT Analysis

Figure 44 Saint Gobain: Company Snapshot

Figure 45 Saint Gobain : SWOT Analysis

Figure 46 Xella Group: Company Snapshot

Figure 47 Xella : SWOT Analysis

Figure 48 Cellucrete : SWOT Analysis

Figure 49 Litebuilt : SWOT Analysis

Growth opportunities and latent adjacency in Cellular Concrete Market