Cell Sorting Market by Technology (FACS-based Droplet Sorting, MACS, Microfluidics), Product (Cell Sorters, Reagents, Consumables), Application (Research, Clinical), End User (Research Institutes, Biopharma Companies, Medical Schools) - Forecasts to 2021

[167 Pages Report] The global cell sorting market is projected to reach USD 247.4 Million by 2021, at a CAGR of 7.0% in the forecast period (2016-2021). Factors such as technological advancements in cell sorters, rising funding and investments for development of technologically advanced cell sorters, and growing adoption of cell sorting techniques in research activities are driving the growth of global Market. The market is further driven by factors such as the growing prevalence of HIV/AIDS and cancer, expanding pharmaceutical and biotechnology industries, and launch of specific reagents for specific applications. However, factors such as the high cost of instruments and lack of awareness & technical knowledge regarding the use of cell sorters are hampering the growth of market.

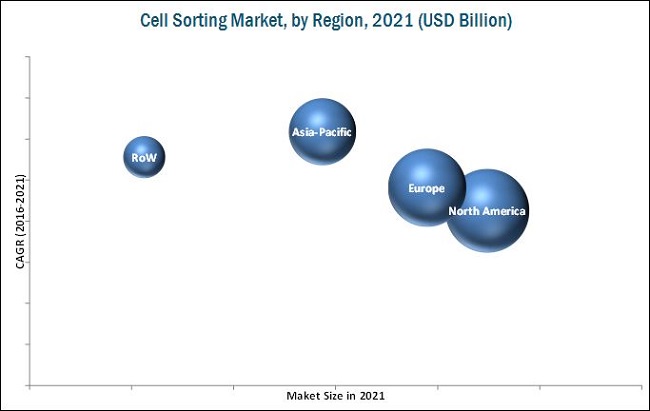

Geographically, the market is segmented into North America, Europe, Asia-Pacific, and RoW. Among the four geographic regions, North America is estimated to command the largest share of the market in 2016, followed by Europe and Asia-Pacific. Emerging markets, including India and China, have become attractive destinations for companies engaged in the development and marketing of cell sorters. Rising incidence and prevalence of cancer, HIV, leukemia, thalassemia, and Alzheimer's disease is among the major driving factors for the growth of this market in China and India. For instance, according to the World Cancer Report 2014, China is witnessing an alarming rise in cancer incidences-it saw an estimated 3.07 million new cancer cases in 2012, accounting for 21.8% of the global new cancer cases. As many as 2.2 million cancer deaths (26.9% of global cancer deaths) were reported in this country in the same year. In addition to this, increasing research initiatives, expansions by key players, and technological advancements are the key factors propelling the demand for cell sorters in the emerging markets.

As of 2015, Becton, Dickinson and Company (U.S.), Beckman Coulter, Inc. (U.S.), and Bio-Rad Laboratories, Inc. (U.S.) dominated the global cell sorting market. In the past three years, these companies adopted product launches, product showcase, agreements, and partnerships as their key business strategies to ensure market dominance. Miltenyi Biotec GmbH (Germany), Sony Biotechnology, Inc. (U.S.), Affymetrix Inc. (U.S.), Sysmex Partec GmbH (Japan), On-Chip Biotechnologies Co., Ltd. (Japan), Cytonome/ST, LLC (U.S.), and Union Biometrica, Inc. (U.S.) are some of the other players in this market.

Stakeholders

- Cell Sorter Manufacturers, Vendors, and Distributors

- Cell Sorting Services Companies

- Research Institutes, Academic Institutes, and Government Organizations

- Venture Capitalists and Other Government Funding Organizations

- Research and Consulting Firms

- Healthcare Institutions (Hospitals and Medical Schools)

- Pharmaceutical and Biotechnology Companies

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

This report categorizes the global cell sorting market into the following segments and subsegments:

Cell Sorting Market, by Technology

-

Fluorescence-based Droplet Cell Sorting

- Jet-in-air Cell Sorting

- Cuvette-based Cell Sorting

- Magnetic-activated Cell Sorting

- MEMS - Microfluidics

By Product and Service

- Cell Sorters

- Reagents and Consumables

- Services

By Application

-

Research Applications

- Immunology & Cancer Research

- Stem Cell Research

- Drug Discovery

- Other Research Applications

- Clinical Applications

By End User

- Research Institutions

- Medical Schools and Academic Institutions

- Pharmaceutical and Biotechnology Companies

- Hospitals and Clinical Testing Laboratories

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- France

- Rest of Europe (RoE)

-

Asia-Pacific

- Japan

- China

- India

- Rest of Asia-Pacific (RoAPAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company's specific needs. The following customization options are available for the report:

Geographical Analysis

- Further breakdown of the cell sorting market into Rest of Europe (RoE), Rest of Asia-Pacific (RoAPAC), and Rest of the World (RoW)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Technological advancements in cell sorters, increasing cell sorter-based research, and development of application specific cell sorter reagents are expected to drive the global cell sorting market close to USD 247.4 Million by 2021

Cell sorters are utilized for separation and purification of various cell populations and sub-populations from a complex mixture of cells. A cell sorter separates the target cell population based on their intracellular or extracellular properties (such as protein or enzyme expression; cell size and shape; and presence of specific biomarkers). Key application of cell sorters is in research which includes fields such as immunological research, cancer and stem cell research, diseases diagnosis, and drug development.

The global market size is projected to reach USD 247.4 Million by 2021, mainly due to the technological advancements in the field of cell sorting technologies, increasing adoption of cell sorters by various end users across the research and clinical field, increasing incidence and prevalence of target diseases (such as HIV/AIDS and cancer), and launch of application-specific cell sorters. Furthermore, fast growing emerging markets (including Asia Pacific and LATAM countries, among others), emergence of microfluidics technology for cell sorting, and continuous growth in stem cell research are expected to offer new growth opportunities for companies operating in the market during the forecast period.

High cost of cell sorting instruments and lack of technical expertise are the major restraining factors for the market

Cell sorting instruments are equipped with advanced features and functionalities, and thus are associated with high cost. Research institutions require a large number of cell sorters to carry out multiple research activities leading to a significant increase in the capital cost associated with the procurement of cell sorting products. Furthermore, academic research laboratories find it difficult to afford such instruments, due to budgetary constraints. This factor is expected to restraint the market growth in forecast period. Additionally, the use of advanced cell sorters having complex experimental setup requires relevant technical experience and knowledge of the latest cell sorter technology. In current scenario, there is lack of awareness among researchers (especially in emerging countries) about newly developed technologically advanced products, this is coupled with a dearth of skilled personnel who can effectively operate and process these instruments. These factors are expected to limit the adoption of cell sorters among end users.

Leading cell sorting product manufacturers are focusing on new product development strategy to strengthen their position

Product manufacturer involved in cell sorting market are focusing on new product development as their key growth strategy, to maintain their position in the market and strengthen their revenue base. Companies also aim to differentiate themselves in the highly competitive market by expanding their product portfolios in accordance with industry trends and client needs. Currently, leading market players are focusing on entering new markets by launching technologically advanced and innovative products in both developed as well as emerging markets.

Market Dynamics

Market Drivers

- Technological advancements in cell sorters

- Increasing research activities focused on cell sorting technologies

- Increasing funding and investments for development of technologically advanced cell sorters

- Growing prevalence of HIV and Cancer patients

- Expanding pharmaceutical and biotechnology industry

- Launch of novel reagents for specific applications

Market Restraints

- High cost of cell sorting instruments

- Lack of awareness and technical knowledge regarding the use of cell sorters

Market Opportunities

- Emerging markets

- Emergence of microfluidics technology for cell sorting

- Growth in stem cell research

Market Challenges

- Complexities related to reagent development

- Inadequate infrastructure for research in emerging countries

- Limited applications of cell sorting technology in clinical settings

Key Questions

- Technological advancements such as 'automation' and introduction of microfluidics are expected to fuel the market demand for cell sorters among end users. What would be other factors impacting the growth of cell sorters market?

- Cell sorting market is witnessing advent of easy-to-use bench-top cell sorters. Will the bench-top cell sorters replace the market for high-complexity cell sorters in upcoming 3-5 years?

- Cell Sorting market is mainly dominated by Becton Dickinson and Beckman Coulter among others. What are key challenges faced by emerging market players to enter market?

- What are the other alternative/disruptive technologies challenging the growth of market?

- Till what extent, the low complexity cell sorters (having 2 or 3 lasers) will capture the market share of high complexity cell sorters (having more than 3 lasers and offering multiparametric detection)?

The cell sorting market is expected to reach USD 247.4 Million by 2021 from USD 176.5 Million in 2016, at a CAGR of 7.0% between 2016 and 2021. Factors such as technological advancements in cell sorters, rising funding and investments for development of innovative cell sorting techniques, growing adoption of cell sorter techniques in research activities, and launch of specific reagents for specific applications are driving the growth of this market. However, factors such as the lack of awareness and technical knowledge regarding the use of cell sorters and high cost of instruments are hampering the growth of this market.

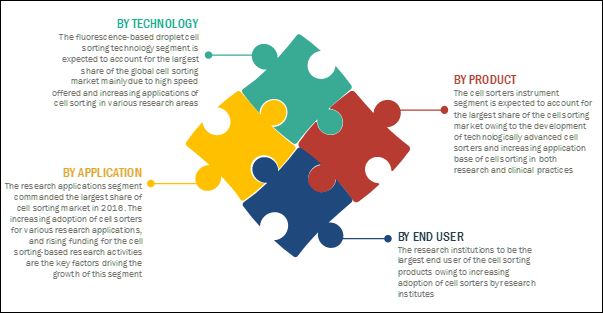

On the basis of technology, the global market is segmented into fluorescence-based droplet cell sorting, magnetic-activated cell sorting (MACS), and micro-electromechanical systems (MEMS)-microfluidics. The MEMS-microfluidics segment is expected to grow at the highest CAGR owing to the easy multiplexing capabilities offered by this technique for higher throughput and low-cost operations eliminating the requirement of skilled labor.

On the basis of product and service, the global market is segmented into cell sorters, reagents & consumables, and services. The cell sorters segment is expected to account for the largest share of the market in 2016. The large share of this segment can be attributed to the increasing development of technologically advanced cell sorters, growing research activities across the globe, and growing applications of cell sorting in both research and clinical practices.

On the basis of application, the global market is segmented into research applications and clinical applications. The research applications segment is expected to grow at the highest CAGR during the forecast period owing to increasing adoption of cell sorters in various research applications, such as immunology research, stem cell research, and drug discovery.

On the basis of end user, the market is segmented into research institutions, academic institutions and medical schools, pharmaceutical and biotechnology companies, and hospitals and clinical testing laboratories. The research institutions segment is expected to account for the largest share of the global market in 2016, and is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the increasing adoption of cell sorters by research institutes for sorting various cell populations in shorter time periods as compared to other Cell Isolation techniques.

This report covers the market across four major geographies, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is expected to account for the largest share of the global market in 2016, followed by Europe and Asia-Pacific. The Asia-Pacific market is expected to register the highest CAGR during the forecast period. The high growth of this regional segment can be attributed to growing prevalence of diseases such as cancer and HIV/AIDS, increasing research initiatives, and expansions by key players in APAC countries.

The major players in the global cell sorting market include Becton, Dickinson and Company (U.S.), Beckman Coulter, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Miltenyi Biotec GmbH (Germany), Sony Biotechnology, Inc. (U.S.), Affymetrix Inc. (U.S.), Sysmex Partec GmbH (Japan), On-Chip Biotechnologies Co., Ltd. (Japan), Cytonome/ST, LLC (U.S.), and Union Biometrica, Inc. (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Covered

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Research

2.2.2.1 Breakdown of Primaries

2.2.2.2 Key Data From Primary Sources

2.3 Market Size Estimation

2.3.1 Research Methodology: Bottom-Up Approach

2.3.2 Research Methodology: Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions and Limitations

2.5.1 Assumptions for the Study

2.5.2 Limitations

3 Executive Summary (Page No. - 29)

3.1 Introduction

3.2 Evolution

3.3 Conclusion

4 Premium Insights (Page No. - 35)

4.1 Cell Sorting: Market Overview

4.2 Geographic Analysis: By Technology, 2016

4.3 By Technology, 2016 vs 2021

4.4 By Product & Service (2016 vs 2021)

4.5 Geographical Snapshot of the Global Market

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements in Cell Sorters

5.2.1.2 Increasing Research Activities on Cell Sorting Technologies

5.2.1.3 Rising Funding and Investments for Development of Technologically Advanced Cell Sorters

5.2.1.4 Growing Prevalence of Hiv and Cancer

5.2.1.5 Expanding Pharmaceutical and Biotechnology Industries

5.2.1.6 Launch of Specific Reagents for Specific Applications

5.2.2 Restraints

5.2.2.1 High Cost of Cell Sorting Instruments

5.2.2.2 Lack of Awareness and Technical Knowledge Regarding the Use of Cell Sorters

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Emergence of Microfluidics Technology for Cell Sorting

5.2.3.3 Growth in Stem Cell Research

5.2.4 Challenges

5.2.4.1 Complexities Related to Reagent Development

5.2.4.2 Inadequate Infrastructure for Research in Emerging Countries

6 Industry Insights (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends

6.3.1 Rising Focus of Market Players Towards the Development of Benchtop Cell Sorters

6.3.2 Combination of Various Technologies for Efficient Cell Sorting

6.3.3 Emerging Microfluidics Technology

6.4 Pricing Analysis

6.5 Porter’s Five Forces Analysis

6.5.1 Threat From New Entrants

6.5.2 Threat From Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Regulatory Challenges

6.6.1 Challenging Fda Requirements

6.6.2 Validation Challenges for Cell-Based Instruments

6.6.3 Absence of Established Laboratory-Developed Test (LDT) Guidelines on Cell-Based Fluorescence Assays

6.6.4 Changing Regulatory Environment

7 Cell Sorters Market, By Technology (Page No. - 58)

7.1 Introduction

7.2 Fluorescence-Based Droplet Cell Sorting

7.2.1 Jet-In-Air Cell Sorting

7.2.2 Cuvette-Based Cell Sorting

7.3 Magnetic-Activated Cell Sorting (MACS)

7.4 Micro-Electromechanical Systems (MEMS) - Microfluidics

8 By Product & Service (Page No. - 66)

8.1 Introduction

8.2 Cell Sorters

8.2.1 Cell Sorters Market, By Price Range

8.2.1.1 High-Range Cell Sorters (Priced Above USD 300,000)

8.2.1.2 Mid-Range Cell Sorters (Priced Between USD 200,000–USD 300,000)

8.2.1.3 Low-Range Cell Sorters (Priced Below USD 200,000)

8.3 Cell Sorting Reagents and Consumables

8.4 Cell Sorting Services

9 By Application (Page No. - 74)

9.1 Introduction

9.2 Research Applications

9.2.1 Immunology & Cancer Research

9.2.2 Stem Cell Research

9.2.3 Drug Discovery

9.2.4 Other Research Applications

9.3 Clinical Applications

10 By End User (Page No. - 83)

10.1 Introduction

10.2 Research Institutions

10.3 Medical Schools and Academic Institutions

10.4 Pharmaceutical and Biotechnology Companies

10.5 Hospitals and Clinical Testing Laboratories

11 By Region (Page No. - 90)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.3 Europe

11.3.1 Germany

11.3.2 U.K.

11.3.3 France

11.3.4 Rest of Europe (RoE)

11.4 Asia-Pacific

11.4.1 Japan

11.4.2 China

11.4.3 India

11.4.4 Rest of Asia-Pacific (RoAPAC)

11.5 Rest of the World

12 Competitive Landscape (Page No. - 122)

12.1 Introduction

12.2 Strategic Overview

12.3 Market Share Analysis

12.4 Competitive Situation and Trends

12.4.1 Product Launches and Showcase

12.4.2 Acquisitions

12.4.3 Agreements and Collaborations

12.4.4 Expansions

12.4.5 Other Developments

13 Company Profiles: Cell Sorting Market (Page No. - 130)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 Becton, Dickinson and Company

13.3 Beckman Coulter, Inc. (A Subsidiary of Danaher Corporation)

13.4 Bio-Rad Laboratories, Inc.

13.5 Sony Biotechnology Inc. (A Wholly Owned Subsidiary of Sony Corporation of America)

13.6 Miltenyi Biotec GmbH

13.7 Affymetrix, Inc. (A Thermo Fisher Scientific Company)

13.8 Sysmex Partec GmbH (A Subsidiary of Sysmex Corporation)

13.9 On-Chip Biotechnologies Co., Ltd.

13.10 Cytonome/St, LLC

13.11 Union Biometrica, Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 156)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (67 Tables)

Table 1 By Technology, 2014–2021 (USD Million)

Table 2 Fluorescence-Based Droplet Cell Sorting Technology Market Size, By Region, 2014–2021 (USD Million)

Table 3 MACS Cell Sorting Technology Market Size, By Region, 2014–2021 (USD Million)

Table 4 MEMS – Microfluidics Cell Sorting Technology Market Size, By Region, 2014–2021 (USD Million)

Table 5 Market Size, By Product & Service, 2014–2021 (USD Million)

Table 6 Cell Sorters Market Size, By Region, 2014–2021 (USD Million)

Table 7 Cell Sorters Market Size, By Prize Range, 2014–2021 (USD Million)

Table 8 Cell Sorting Reagents and Consumables Market Size, By Region, 2014–2021 (USD Million)

Table 9 Cell Sorting Services Market Size, By Region, 2014–2021 (USD Million)

Table 10 Global Market Size, By Application, 2014–2021 (USD Million)

Table 11 Global Market Size for Research Applications, By Type, 2014–2021 (USD Million)

Table 12 Global Market Size for Research Applications, By Region, 2014–2021 (USD Million)

Table 13 Immunology & Cancer Research Applications Market Size, By Region, 2014–2021 (USD Million)

Table 14 Stem Cell Research Applications Market Size, By Region, 2014–2021 (USD Million)

Table 15 Drug Discovery Research Applications Market Size, By Region, 2014–2021 (USD Million)

Table 16 Other Research Applications Market Size, By Region, 2014–2021 (USD Million)

Table 17 Cell Sorting Market Size for Clinical Applications, By Region, 2014–2021 (USD Million)

Table 18 Market Size, By End User, 2014–2021 (USD Million)

Table 19 Market Size for Research Institutions, By Region, 2014–2021 (USD Million)

Table 20 Market Size for Medical Schools and Academic Institutions, By Region, 2014–2021 (USD Million)

Table 21 Market Size for Pharmaceutical & Biotechnology Companies, By Region, 2014–2021 (USD Million)

Table 22 Market Size for Hospitals and Clinical Testing Labs, By Region, 2014–2021 (USD Million)

Table 23 Market Size, By Region, 2014-2021 (USD Million)

Table 24 North America: Cell Sorting Market Size, By Country, 2014–2021 (USD Million)

Table 25 North America: Market Size, By Technology, 2014–2021 (USD Million)

Table 26 North America: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 27 North America: Market Size, By Application, 2014–2021 (USD Million)

Table 28 North America: Market Size, By End User, 2014–2021 (USD Million)

Table 29 U.S.: Cell Sorting Market Size, By Product and Service, 2014–2021 (USD Million)

Table 30 U.S.: Market Size, By Application, 2014–2021 (USD Million)

Table 31 Canada: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 32 Canada: Market Size, By Application, 2014–2021 (USD Million)

Table 33 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 34 Europe: Market Size, By Technology, 2014–2021 (USD Million)

Table 35 Europe: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 36 Europe: Cell Sorting Market Size, By Application, 2014–2021 (USD Million)

Table 37 Europe: Market Size, By End User, 2014–2021 (USD Million)

Table 38 Germany: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 39 Germany: Market Size, By Application, 2014–2021 (USD Million)

Table 40 U.K.: Cell Sorting Market Size, By Product and Service, 2014–2021 (USD Million)

Table 41 U.K.: Market Size, By Application, 2014–2021 (USD Million)

Table 42 France: Cell Sorting Market Size, By Product and Service, 2014–2021 (USD Million)

Table 43 France: Market Size, By Application, 2014–2021 (USD Million)

Table 44 RoE: Cell Sorting Market Size, By Product and Service, 2014–2021 (USD Million)

Table 45 RoE: Market Size, By Application, 2014–2021 (USD Million)

Table 46 Asia-Pacific: Cell Sorting Market Size, By Country, 2014–2021 (USD Million)

Table 47 Asia-Pacific: Market Size, By Technology, 2014–2021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Application, 2014–2021 (USD Million)

Table 50 Asia-Pacific: Market Size, By End User, 2014–2021 (USD Million)

Table 51 Japan: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 52 Japan: Market Size, By Application, 2014–2021 (USD Million)

Table 53 China: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 54 China: Market Size, By Application, 2014–2021 (USD Million)

Table 55 India: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 56 India: Market Size, By Application, 2014–2021 (USD Million)

Table 57 RoAPAC: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 58 RoAPAC: Market Size, By Application, 2014–2021 (USD Million)

Table 59 RoW: Market Size, By Technology, 2014–2021 (USD Million)

Table 60 RoW: Market Size, By Product and Service, 2014–2021 (USD Million)

Table 61 RoW: Market Size, By Application, 2014–2021 (USD Million)

Table 62 RoW: Market Size, By End User, 2014–2021 (USD Million)

Table 63 Product Launches and Showcase, 2013–2016

Table 64 Acquisitions, 2013–2016

Table 65 Agreements and Collaborations, 2013-2016

Table 66 Expansions, 2013–2016

Table 67 Other Developments, 2013–2016

List of Figures (42 Figures)

Figure 1 Global Cell Sorting Market: Research Methodology Steps

Figure 2 Breakdown of Supply-Side Primary Interviews: By Company Type, Designation, and Region

Figure 3 Research Design

Figure 4 Cell Sorting Market: Data Triangulation

Figure 5 Evolution of Cell Sorters

Figure 6 Global Cell Sorting Market, By Technology, 2016 vs 2021 (USD Million)

Figure 7 Global Market, By Product, 2016 (USD Million)

Figure 8 Global Market, By Application, 2016 (USD Million)

Figure 9 Global Market, By End User, 2016 vs 2021 (USD Million)

Figure 10 Geographical Snapshot: Cell Sorting Market

Figure 11 Technological Advancements in Cell Sorters and Growing Adoption of Cell Sorting Techniques in Research Activities Across the Globe are Driving Growth in the Market

Figure 12 Fluorescence-Based Droplet Cell Sorting to Dominate the Market in 2016

Figure 13 Fluorescence-Based Droplet Cell Sorting Will Continue to Dominate the Market in 2021

Figure 14 Cell Sorters Segment to Dominate the Market

Figure 15 Asia-Pacific to Register the Highest CAGR During the Forecast Period

Figure 16 Market Drivers, Restraints, Opportunities, and Challenges

Figure 17 Value Chain Analysis

Figure 18 Porter’s Five Forces Analysis, 2016

Figure 19 Segmentation, By Technology

Figure 20 Size, By Technology, 2016 vs 2021 (USD Million)

Figure 21 Segmentation, By Product & Service

Figure 22 Size, By Product & Service, 2016 vs 2021 (USD Million)

Figure 23 Segmentation, By Application

Figure 24 Size, By Application, 2016 vs 2021 (USD Million)

Figure 25 Segmentation, By End User

Figure 26 Size, By End User, 2016 vs 2021 (USD Million)

Figure 27 Cell Sorting Market, By Region

Figure 28 Asia-Pacific to Grow at the Highest Rate During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 Europe: Market Snapshot

Figure 31 Asia-Pacific: Market Snapshot

Figure 32 RoW: Market Snapshot

Figure 33 Key Developments By Leading Players in the Cell Sorting Market, 2013–2016

Figure 34 Global Market Share, By Key Player, 2015

Figure 35 Product Launches and Showcase—Most Widely Adopted Growth Strategy Pursued By Market Players Between 2013 & 2016

Figure 36 Financial Performance of the Top 4 Market Players in 2015

Figure 37 Company Snapshot: Becton, Dickinson and Company

Figure 38 Company Snapshot: Danaher Corporation

Figure 39 Company Snapshot: Bio-Rad Laboratories, Inc.

Figure 40 Company Snapshot: Sony Corporation

Figure 41 Company Snapshot: Affymetrix, Inc.

Figure 42 Company Snapshot: Sysmex Corporation

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cell Sorting Market