Cell Dissociation Market by Product (Trypsin, Papain, DNase, Hyaluronidase, Instruments), Tissue Type (Connective Tissue, Epithelial Tissue), End User (Pharma, Biopharma, Research Institutes) & Region - Global Forecasts to 2028

The global cell dissociation market, stood at US$0.6 billion in 2023 and is projected to advance at a resilient CAGR of 17.8% from 2023 to 2028, culminating in a forecasted valuation of US$1.4 billion by the end of the period. The new edition of the report provides updated financial information through 2022 (depending on availability) for each listed company in a graphical representation. This would help in the easy analysis of the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region or country, and business segment focus in terms of the highest revenue-generating segment. Key driving factors of the market include an increase in demand for personalized medicine, cGMP approvals each year for new production facilities developing cell therapies, and the growing use of cell dissociation products in mammalian cell culture to develop recombinant therapeutics. Additionally, advancements in non-enzymatic dissociation approaches are expected to offer lucrative opportunities for the end users of this market. Expensive cell-based research is a major hindrance to the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Cell dissociation Market Dynamics

Driver: Increase in recombinant therapeutics sourced from mammalian cells

The biopharmaceutical industry has witnessed a considerable increase in the proportion of recombinant therapeutics sourced from mammalian cells since 2002. The number of approved recombinant products from mammalian cell culture increased by 8.5% annually from 2002 to 2022. As of June 2022, more than 300 recombinant products have been commercialized, indicating a rapid shift towards mammalian-based therapeutics, which nearly account for 67% of therapeutics in 2022. .Cell culture products, including cell dissociation form an integral part of developing mammalian-based recombinant therapeutics, propelling the industry growth.

Restraint: High cost of cell-based research

Isolation and purification of cell organelles integrates expensive products, additionally, automated/sem-automated benchtop instruments are more expensive than traditional methods. Despite significant benefits offered by automated instruments, high costs associated with these instruments may limit the adoption of products further restraining the market growth.

Opportunity: Advancements in non-enzymatic tissue dissociation

Companies operating in the market are introducing innovative and advanced products to overcome competition and generate more revenue. Most researchers in R&D institutes and biotechnology companies have primarily relied on traditional enzymatic dissociation products to separate cells from primary tissues. Although these traditional enzymatic dissociation products have advantages, such as better dissociation while performing research, they can sometimes be cytotoxic and damage viable cells. To overcome this issue and differentiate their product offerings, several companies are introducing non-enzymatic products that are non-cytotoxic. Owing to this advantage, the demand for non-enzymatic dissociation products is increasing among several end users.

Challenge: Limitations associated with dissociated cell culture

The key limitation of dissociated cultures is the small number of cells relative to immortalized cell lines. This makes it difficult to perform biochemical experiments requiring a high starting material volume. Additionally, most primary cell cultures are not homogeneous, which poses a challenging scenario for cell dissociation experiments. Neuronal cultures are often mixtures of both glia and neurons that respond to different neurotransmitters, so identifying an individual population of cells can be difficult.

The enzymatic dissociation segment accounted for the largest share of the cell dissociation industry in 2022

Based on the product, the cell dissociation market is segmented into non-enzymatic dissociation products, enzymatic dissociation products and instruments & accessories. Collagenase segment is the key contributor to the dominance of enzymatic dissociation products. More than 20 different types of collagenases exist, but only a handful are most suited for the enzyme dissociation of tissues. These suitable collagenases can maximize the number of viable, dissociated cells. Collagenase type 1 is typically recommended for liver, epithelial, adrenal, and adipocyte tissue dissociation.

The connective tissue segment of the cell dissociation industry is expected to grow at the highest CAGR during the forecast period

By tissue type, the cell dissociation market is segmented cell detachment and tissue dissociation. The tissue dissociation segment accounted for the largest market share in 2022. Collagen fibers are present in varying concentrations in almost all connective tissues. Elastic fibers are less abundant than the collagen varieties, somewhat similar to reticular fibers, wherein they form branching networks in connective tissues.

Pharmaceutical and biotechnology companies are the dominant end user segment of the cell dissociation industry in 2022

Based on end-users, the cell dissociation market is segmented into pharmaceutical & biotechnology companies, research institutes & academic institutes, and other end users. Pharmaceutical & biotechnology companies utilize cell culture products, including cell dissociation products, to research various chronic diseases. Additionally, the R&D investments in these companies have been increasing over the last few years, which has contributed to the dominance of this segment.

Asia Pacific region is anticipated to grow at the fastest pace in the cell dissociation industry through the forecast period

Based on the region, the cell dissociation market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific region is anticipated to grow at the fastest pace in the market through the forecast period. APAC’s pharmaceutical markets remain highly competitive and extremely fragmented, with thousands of small manufacturers competing for market shares. From an economic and policy standpoint, government support is expected to drive innovation in life sciences research and the growth of the pharmaceutical and biopharmaceutical sector.

The prominent players in the global cell dissociation market are Merck KGaA (Germany), Danaher Corporation (US), Thermo Fisher Scientific, Inc. (US), Corning Incorporated (US), Becton, Dickinson and Company (US), STEMCELL Technologies (Canada), PromoCell GmbH (Germany), Miltenyi Biotec (Germany), ATCC (US), HiMedia Laboratories (India), PAN-Biotech (Germany), CellSystems GmbH (Germany), AMSBIO (England), Neuromics (US), VitaCyte, LLC. (US), ALSTEM (US), Biological Industries (Israel), Gemini Bio (US), Innovative Cell Technologies, Inc. (US), Central Drug House (P) Ltd. (India), Worthington Biochemical Corporation (US), Capricorn Scientific (Germany), Abeomics (US), and Genlantis, Inc. (US).

Scope of the Cell Dissociation Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.6 billion |

|

Estimated Value by 2028 |

$1.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 17.8% |

|

Market Driver |

Increase in recombinant therapeutics sourced from mammalian cells |

|

Market Opportunity |

Advancements in non-enzymatic tissue dissociation |

This research report categorizes the cell dissociation market to forecast revenue and analyze trends in each of the following submarkets

By Product

-

Enzymatic Dissociation Products

- Collagenase

- Trypsin

- Papain

- Elastase

- DNase

- Hyaluronidase

- Other Enzymes

- Non-Enzymatic Dissociation Agents

- Instruments & Accessories

By Tissue Type

- Connective Tissues

- Epithelial Tissues

- Other tissues

By Application

- Tissue dissociation

- Cell detachment

By End User

- Pharmaceutical and Biotechnology companies

- Research and Academics

- other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- RoE

-

Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- RoAPAC

- Rest of the World

Recent Development of Cell Dissociation Industry

- In 2020, Miltenyi Biotec launched automated and closed adherent cell culture solutions on CliniMACS Prodigy.

- In 2020, Merck The company expanded its Life Sciences production facilities in Danvers, Massachusetts, and Jaffrey, New Hampshire (US).

- In 2020, STEMCELL Technologies partnered with CollPlant to secure CollPlant rhCollagen for STEMCELL’s use in cell culture applications.

- In 2021, Danaher (Cytiva) partnered with Diamyd Medical, wherein Diamyd selected Cytiva’s FlexFactory platform for making precision medicine type-1 diabetes vaccines.

- In 2021, Danaher (Cytiva) collaborated with the Government of Telangana (India) to strengthen the biopharma industry in India with new labs.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global cell dissociation market?

The global cell dissociation market boasts a total revenue value of $1.4 billion by 2028.

What is the estimated growth rate (CAGR) of the global cell dissociation market?

The global cell dissociation market has an estimated compound annual growth rate (CAGR) of 17.8% and a revenue size in the region of $0.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increase in recombinant therapeutics sourced from mammalian cells- Growing focus on personalized medicine- cGMP approvals for new cell therapy production facilitiesRESTRAINTS- High cost of cell-based researchOPPORTUNITIES- Advancements in non-enzymatic tissue dissociationCHALLENGES- Limitations associated with dissociated cell culture

- 5.3 TECHNOLOGY ANALYSIS

- 5.4 SUPPLY/VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSDEGREE OF COMPETITION

-

5.7 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE TREND

- 5.9 KEY CONFERENCES & EVENTS, 2023–2024

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR CELL DISSOCIATION PRODUCTS

- 6.1 INTRODUCTION

-

6.2 ENZYMATIC DISSOCIATION AGENTSCOLLAGENASE- Collagenase to hold largest share of enzymatic dissociation agents marketTRYPSIN- Established protocols for using trypsin to contribute to segment growthPAPAIN- Benefits of papain-based dissociation to drive usageELASTASE- Elastase to find frequent use in dissociating tissues containing extensive intercellular fiber networksDNASE- Increasing demand in single-cell suspensions to propel marketHYALURONIDASE- Increasing use of hyaluronidase as supplement for tissue dissociation to support market growthOTHER ENZYMES

-

6.3 NON-ENZYMATIC DISSOCIATION AGENTSHIGH YIELD AND OTHER BENEFITS TO DRIVE DEMAND FOR NON-ENZYMATIC PRODUCTS

-

6.4 INSTRUMENTS & ACCESSORIESINTRODUCTION OF ADVANCED BENCHTOP INSTRUMENTS TO PROPEL MARKET

- 7.1 INTRODUCTION

-

7.2 CONNECTIVE TISSUEEXTENSIVE RESEARCH ON CONNECTIVE TISSUES TO PROPEL SEGMENT GROWTH

-

7.3 EPITHELIAL TISSUENEW PROTOCOLS TO COMBAT DISSOCIATION-INDUCED CHANGES IN EPITHELIAL CELLS LIKELY TO SUPPORT GROWTH

- 7.4 OTHER TISSUES

- 8.1 INTRODUCTION

-

8.2 TISSUE DISSOCIATIONINCREASING USE OF TISSUE DISSOCIATION PRODUCTS IN SINGLE-CELL ANALYSIS TO CONTRIBUTE TO SEGMENT GROWTH

-

8.3 CELL DETACHMENTUSE OF CELL DETACHMENT PRODUCTS IN ADHERENT CELL CULTURES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESPHARMA & BIOTECH COMPANIES TO HOLD LARGEST MARKET SHARE

-

9.3 RESEARCH & ACADEMIC INSTITUTESRISING FUNDING FOR CELL-BASED RESEARCH TO DRIVE MARKET

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

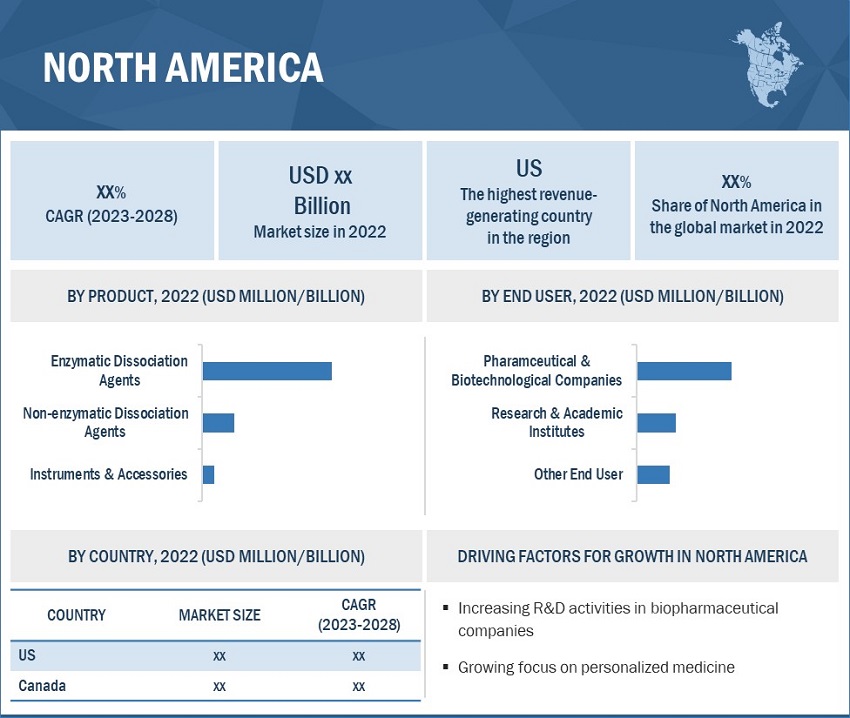

10.2 NORTH AMERICARECESSION IMPACTUS- US to dominate North American marketCANADA- Advancements in regenerative medicine to drive market

-

10.3 EUROPERECESSION IMPACTGERMANY- Germany to hold largest share of European marketUK- Government investments in biotech industry to support market growthFRANCE- Increasing R&D investments by key players to boost marketITALY- Large life science research base in Italy to boost market prospectsSPAIN- Increasing funding from private and public organizations to aid market growthREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACTCHINA- China to dominate APAC marketJAPAN- Strategic developments by companies to drive marketINDIA- Growing life sciences industry to push growthAUSTRALIA- New cell/tissue culture technologies to promote market growthSOUTH KOREA- Increasing pharmaceutical and biotech R&D investment to bolster marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICAGOVERNMENT INVESTMENTS AND FAVORABLE FUNDING SCENARIO TO PROPEL MARKETRECESSION IMPACT

-

10.6 MIDDLE EAST & AFRICAINCREASING R&D FUNDING FOR STEM CELL THERAPY TO BOOST MARKETRECESSION IMPACT

- 11.1 INTRODUCTION

- 11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.7 COMPETITIVE BENCHMARKING OF START-UPS/SMES

-

11.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSTHERMO FISHER SCIENTIFIC- Business overview- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewCYTIVA (DANAHER CORPORATION)- Business overview- Products offered- Recent developments- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offeredCORNING INC.- Business overview- Products offeredSTEMCELL TECHNOLOGIES- Business overview- Products offered- Recent developmentsPROMOCELL GMBH- Business overview- Products offered- Recent developmentsMILTENYI BIOTEC- Business overview- Products offered- Recent developmentsATCC- Business overview- Products offered- Recent developmentsHIMEDIA LABORATORIES- Business overview- Products offeredPAN-BIOTECH- Business overview- Products offeredCELLSYSTEMS GMBH- Business overview- Products offered- Recent developmentsAMSBIO- Business overview- Products offeredNEUROMICS- Business overview- Products offered

-

12.2 OTHER PLAYERSVITACYTEALSTEMBIOBIOLOGICAL INDUSTRIES (SARTORIUS)GEMINIBIOINNOVATIVE CELL TECHNOLOGIES, INC.CENTRAL DRUG HOUSE (P) LTD.WORTHINGTON BIOCHEMICAL CORPORATIONCAPRICORN SCIENTIFICABEOMICSGENLANTIS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 2 CELL DISSOCIATION MARKET: IMPACT ANALYSIS

- TABLE 3 NEW GMP FACILITIES AND EXPANSIONS, 2017-2022

- TABLE 4 CELL DISSOCIATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 AVERAGE SELLING PRICES OF KEY PLAYERS, BY PRODUCT (REAGENTS)

- TABLE 10 PRICING TRENDS FOR CELL DISSOCIATION REAGENTS OFFERED BY KEY PLAYERS

- TABLE 11 CELL DISSOCIATION CONFERENCES & EVENTS (2023–2024)

- TABLE 12 CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 13 CELL DISSOCIATION MARKET FOR ENZYMATIC DISSOCIATION AGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 14 CELL DISSOCIATION MARKET FOR ENZYMATIC DISSOCIATION AGENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 NORTH AMERICA: CELL DISSOCIATION MARKET FOR ENZYMATIC DISSOCIATION AGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 EUROPE: CELL DISSOCIATION MARKET FOR ENZYMATIC DISSOCIATION AGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR ENZYMATIC DISSOCIATION AGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 CELL DISSOCIATION MARKET FOR COLLAGENASE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 NORTH AMERICA: CELL DISSOCIATION MARKET FOR COLLAGENASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 EUROPE: CELL DISSOCIATION MARKET FOR COLLAGENASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR COLLAGENASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 CELL DISSOCIATION MARKET FOR TRYPSIN, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: CELL DISSOCIATION MARKET FOR TRYPSIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: CELL DISSOCIATION MARKET FOR TRYPSIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR TRYPSIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 CELL DISSOCIATION MARKET FOR PAPAIN, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: CELL DISSOCIATION MARKET FOR PAPAIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 EUROPE: CELL DISSOCIATION MARKET FOR PAPAIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR PAPAIN, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 CELL DISSOCIATION MARKET FOR ELASTASE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: CELL DISSOCIATION MARKET FOR ELASTASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: CELL DISSOCIATION MARKET FOR ELASTASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR ELASTASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 CELL DISSOCIATION MARKET FOR DNASE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: CELL DISSOCIATION MARKET FOR DNASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 EUROPE: CELL DISSOCIATION MARKET FOR DNASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR DNASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 CELL DISSOCIATION MARKET FOR HYALURONIDASE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: CELL DISSOCIATION MARKET FOR HYALURONIDASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: CELL DISSOCIATION MARKET FOR HYALURONIDASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR HYALURONIDASE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 CELL DISSOCIATION MARKET FOR OTHER ENZYMES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: CELL DISSOCIATION MARKET FOR OTHER ENZYMES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: CELL DISSOCIATION MARKET FOR OTHER ENZYMES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR OTHER ENZYMES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 CELL DISSOCIATION MARKET FOR NON-ENZYMATIC DISSOCIATION AGENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: CELL DISSOCIATION MARKET FOR NON-ENZYMATIC DISSOCIATION AGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 EUROPE: CELL DISSOCIATION MARKET FOR NON-ENZYMATIC DISSOCIATION AGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR NON-ENZYMATIC DISSOCIATION AGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 CELL DISSOCIATION MARKET FOR INSTRUMENTS & ACCESSORIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: CELL DISSOCIATION MARKET FOR INSTRUMENTS & ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: CELL DISSOCIATION MARKET FOR INSTRUMENTS & ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR INSTRUMENTS & ACCESSORIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 55 CELL DISSOCIATION MARKET FOR CONNECTIVE TISSUE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: CELL DISSOCIATION MARKET FOR CONNECTIVE TISSUE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: CELL DISSOCIATION MARKET FOR CONNECTIVE TISSUE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR CONNECTIVE TISSUE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 CELL DISSOCIATION MARKET FOR EPITHELIAL TISSUE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: CELL DISSOCIATION MARKET FOR EPITHELIAL TISSUE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 EUROPE: CELL DISSOCIATION MARKET FOR EPITHELIAL TISSUE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR EPITHELIAL TISSUE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 CELL DISSOCIATION MARKET FOR OTHER TISSUES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: CELL DISSOCIATION MARKET FOR OTHER TISSUES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 EUROPE: CELL DISSOCIATION MARKET FOR OTHER TISSUES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR OTHER TISSUES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 TISSUE DISSOCIATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: TISSUE DISSOCIATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: TISSUE DISSOCIATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: TISSUE DISSOCIATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 CELL DETACHMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: CELL DETACHMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: CELL DETACHMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: CELL DETACHMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 CELL DISSOCIATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: CELL DISSOCIATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: CELL DISSOCIATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 CELL DISSOCIATION MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: CELL DISSOCIATION MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: CELL DISSOCIATION MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR RESEARCH & ACADEMIC INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 CELL DISSOCIATION MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: CELL DISSOCIATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 EUROPE: CELL DISSOCIATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CELL DISSOCIATION MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 CELL DISSOCIATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: CELL DISSOCIATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 US: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 97 US: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 US: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 99 US: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 100 US: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 101 CANADA: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 102 CANADA: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 CANADA: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 104 CANADA: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 105 CANADA: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: CELL DISSOCIATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 EUROPE: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 EUROPE: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 110 EUROPE: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 EUROPE: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 GERMANY: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 113 GERMANY: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 GERMANY: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 115 GERMANY: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 116 GERMANY: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 117 UK: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 118 UK: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 UK: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 120 UK: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 121 UK: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 122 FRANCE: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 123 FRANCE: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 FRANCE: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 125 FRANCE: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 126 FRANCE: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 ITALY: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 128 ITALY: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 ITALY: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 130 ITALY: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 ITALY: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 132 SPAIN: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 133 SPAIN: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 SPAIN: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 135 SPAIN: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 136 SPAIN: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 137 ROE: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 138 ROE: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 ROE: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 140 ROE: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 141 ROE: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: CELL DISSOCIATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 148 CHINA: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 149 CHINA: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 CHINA: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 151 CHINA: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 152 CHINA: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 153 JAPAN: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 154 JAPAN: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 JAPAN: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 156 JAPAN: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 157 JAPAN: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 INDIA: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 159 INDIA: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 INDIA: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 161 INDIA: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 162 INDIA: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 163 AUSTRALIA: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 164 AUSTRALIA: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 AUSTRALIA: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 166 AUSTRALIA: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 167 AUSTRALIA: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 168 SOUTH KOREA: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 169 SOUTH KOREA: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 170 SOUTH KOREA: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 171 SOUTH KOREA: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 172 SOUTH KOREA: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 173 ROAPAC: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 174 ROAPAC: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 ROAPAC: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 176 ROAPAC: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 177 ROAPAC: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 179 LATIN AMERICA: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: CELL DISSOCIATION MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ENZYMATIC DISSOCIATION AGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2021–2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: CELL DISSOCIATION MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: CELL DISSOCIATION MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 188 CELL DISSOCIATION MARKET: DEGREE OF COMPETITION

- TABLE 189 CELL DISSOCIATION MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 190 CELL DISSOCIATION MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 191 CELL DISSOCIATION MARKET: PRODUCT LAUNCHES, JANUARY 2020 TO JANUARY 2023

- TABLE 192 CELL DISSOCIATION MARKET: DEALS, JANUARY 2020 TO JANUARY 2023

- TABLE 193 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 194 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 195 CYTIVA: BUSINESS OVERVIEW

- TABLE 196 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 197 CORNING INC.: BUSINESS OVERVIEW

- TABLE 198 STEMCELL TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 199 PROMOCELL GMBH: BUSINESS OVERVIEW

- TABLE 200 MILTENYI BIOTEC: BUSINESS OVERVIEW

- TABLE 201 ATCC: BUSINESS OVERVIEW

- TABLE 202 HIMEDIA LABORATORIES: BUSINESS OVERVIEW

- TABLE 203 PAN-BIOTECH: BUSINESS OVERVIEW

- TABLE 204 CELLSYSTEMS: BUSINESS OVERVIEW

- TABLE 205 AMSBIO: BUSINESS OVERVIEW

- TABLE 206 NEUROMICS: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES: CELL DISSOCIATION MARKET

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF CELL DISSOCIATION COMPANIES

- FIGURE 4 AVERAGE MARKET SIZE ESTIMATION, 2022

- FIGURE 5 CELL DISSOCIATION MARKET: CAGR PROJECTIONS, 2022–2027

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 MARKET VALIDATION FROM PRIMARY EXPERTS

- FIGURE 9 CELL DISSOCIATION MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 CELL DISSOCIATION MARKET, BY TISSUE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 CELL DISSOCIATION MARKET, BY APPLICATION, 2022 VS. 2026 (USD MILLION)

- FIGURE 12 CELL DISSOCIATION MARKET, BY END USER, 2022 VS. 2026 (USD MILLION)

- FIGURE 13 GEOGRAPHICAL SNAPSHOT

- FIGURE 14 INCREASING INVESTMENTS AND FUNDING FOR CELL RESEARCH TO DRIVE MARKET

- FIGURE 15 ENZYMATIC DISSOCIATION AGENTS TO COMMAND LARGEST SHARE OF NORTH AMERICAN MARKET

- FIGURE 16 EPITHELIAL TISSUE SEGMENT TO GROW AT HIGHEST CAGR IN NORTH AMERICA

- FIGURE 17 CELL DISSOCIATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 RISE IN MARKETED THERAPEUTICS, 2002 VS 2022

- FIGURE 19 MARKETED THERAPEUTICS, BY ORIGIN, 2022

- FIGURE 20 SHARE OF PERSONALIZED MEDICINES IN TOTAL NUMBER OF FDA- APPROVED NEW MOLECULAR ENTITIES, 2015–2021

- FIGURE 21 CELL DISSOCIATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 CELL DISSOCIATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF CELL DISSOCIATION PRODUCTS

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

- FIGURE 25 NUMBER OF RESEARCH ARTICLES FOR CONNECTIVE TISSUE, 2020–2022

- FIGURE 26 NORTH AMERICA: CELL DISSOCIATION MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: CELL DISSOCIATION MARKET SNAPSHOT

- FIGURE 28 CELL DISSOCIATION MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 29 CELL DISSOCIATION MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 30 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS (2020–2022)

- FIGURE 31 CELL DISSOCIATION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 32 CELL DISSOCIATION MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 33 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2021)

- FIGURE 34 MERCK KGAA: COMPANY SNAPSHOT (2021)

- FIGURE 35 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

- FIGURE 36 BD: COMPANY SNAPSHOT (2021)

- FIGURE 37 CORNING INC.: COMPANY SNAPSHOT (2020)

This study involved four major activities in estimating the current size of the cell dissociation market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the cell dissociation market. The secondary sources used for this study include publications from government sources National Cancer Institute (NCI), Cancer Research UK, Israel Cancer Research Fund (ICRF), Department of Health and Social Care (DHSC), Global Cancer Observatory (GLOBOCAN), Breast Cancer Research Foundation (BCRF), Centre for Cellular and Molecular Biology (CCMB), Chinese Academy of Medical Sciences (CAMS), National Centre for Cell Science (NCCS), Annual Reports, SEC Fillings, Press Releases, Investor Presentation, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

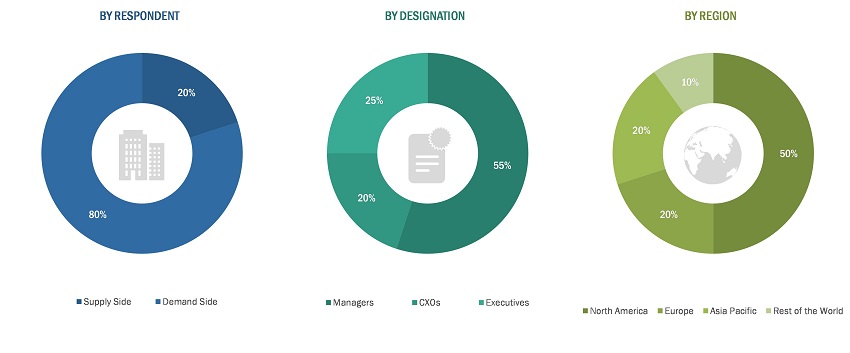

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cell dissociation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the cell dissociation industry.

Report Objectives

- To define, describe, and forecast the global cell dissociation market based on product, tissue type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, Asia Pacific, Latin America and the Middle East and Africa

- To strategically profile key players and comprehensively analyze their product portfolios, market shares, and core competencies

- To track and analyze competitive developments such as acquisitions, new product launches, expansions, regulatory approvals, and agreements in the cell dissociation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis:

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis:

- Further breakdown of the Rest of the World cell dissociation market into Latin America, the Middle East, and Africa cell dissociation market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cell Dissociation Market