CDN Security Market by Type (DDOS Protection, Web Application Firewall, Bot Mitigation & Screen Scraping Protection, Data Security, and DNS Protection), Organization Size, Vertical, Region - Global Forecast to 2022

[156 Pages Report] The CDN Security Market was valued at USD 1.53 Billion in 2016 and is expected to reach USD 7.63 Billion by 2022, at a CAGR of 31.6% during the forecast period. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

Objectives of the study:

- To determine and forecast the global CDN security market on the basis of type, organization size, vertical, and region from 2017 to 2022, and analyze various macro and micro economic factors that affect market growth

- To forecast the size of market segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze each submarket with respect to individual growth trends, prospects, and contribution to the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile key market players, provide comparative analysis based on business overviews, product offerings, regional presence, business strategies, key financials with the help of in-house statistical tools to understand the competitive landscape

- To track and analyze competitive developments such as mergers & acquisitions, product developments, partnerships & collaborations, and Research & Development (R&D) activities in the market

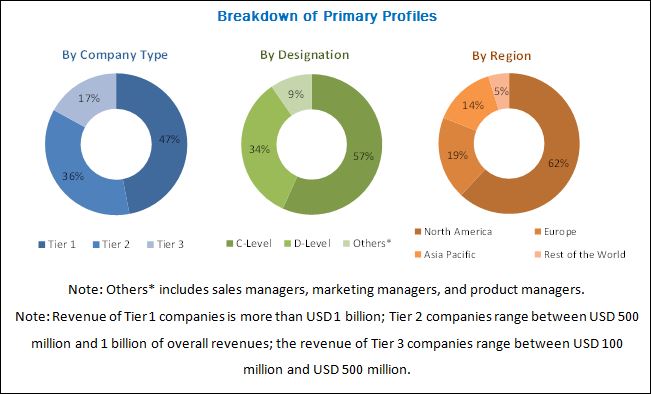

The research methodology used to estimate and forecast the CDN security market size begins with capturing the data of key vendor revenues through secondary research such as annual reports, white papers, certified publications, databases such as Factiva and D&B Hoovers, press releases, and investor presentations of CDN security solutions and service vendors, as well as articles from recognized industry associations, statistics bureaus, and government publishing sources. Vendor offerings were also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall CDN security market size from the revenues of key market players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments.

The breakdown of the profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key Target Audience

- CDN Security Solution Providers

- IT Hardware/Software/Services Suppliers

- Software and System Integrators

- Value Added Resellers (VARs)

- Software Developers

- Application Developers

- CDN Providers

- Security Solution Providers

- DDoS Security Providers

- Over The Top Players

Scope of the CDN Security Market Report

|

Report Metrics |

Details |

|

Market size available for years |

20152022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Type (DDOS Protection, Web Application Firewall, Bot Mitigation & Screen Scraping Protection, Data Security, and DNS Protection), Organization Size, Vertical, Region. |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Akamai Technologies (US), Amazon Web Services (US), Arbor Networks (US), ChinaCache (China), Cloudflare (US), Distil Networks (US), Limelight Networks (US), Microsoft (US), Nexusguard (US), Radware (Israel), StackPath (US), and Verizon Digital Media Services (US). |

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following subsegments:

Market By Type

- DDoS Protection

- Web Application Firewall

- Bot Mitigation & Screen Scraping Protection

- Data Security

- TLS/SSL

- HTTP/2

- DNS Protection

CDN Security Market By Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

Market By Vertical

- Media, Entertainment, and Gaming

- E-commerce, Retail & Consumer Goods

- IT & Telecommunication

- BFSI

- Public Sector

- Manufacturing & Automotive

- Healthcare & Pharmaceutical

- Travel & Tourism

- Others (Education, Power, Electricity & Utility)

CDN Security Market By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- Latin America

Available Customizations

Along with the market data, MarketsandMarkets offers customization as per the companys specific requirements. The following customization options are available for the report:

Geographic Analysis

- Further country-level breakdown of the North America CDN security market

- Further country-level breakdown of the Europe market

- Further country-level breakdown of the Asia Pacific market

- Further country-level breakdown of the Middle East & Africa market

- Further country-level breakdown of the Latin America market

Company Information

- Detailed analysis and profiles of additional market players

The CDN security market is projected to grow from USD 1.93 Billion in 2017 to USD 7.63 Billion by 2022, at a CAGR of 31.6% during the forecast period. The rising need to mitigate increasing DDoS attacks and growing penetration of connected things & enterprise mobility trends among enterprises have increased the deployment of CDN security.

The CDN security market has been segmented based on type, organization size, vertical, and region. Based on type, the market has been further classified into DDoS protection, web application firewall, bot mitigation & screen scraping protection, data security, and DNS protection. In 2017, the DDoS protection segment is estimated to account for the largest share in the market. DDoS protection plays a vital role in the market as there is a rise in need to mitigate increasing DDoS attacks and growing penetration of connected things & enterprise mobility trends among enterprises.

Based on vertical, the CDN security market is segmented into media, entertainment, and gaming; E-commerce, retail & consumer goods; IT & telecommunication, banking, financial services & insurance; public sector; manufacturing & automotive; healthcare & pharmaceutical; travel & tourism; and others (education, power, electricity & utility). The media, entertainment, and gaming segment is estimated to account for the largest share in 2017. Increase in media content such as video, audio, virtual reality games over the internet and securing the content from cyber-attacks plays a crucial role in increasing the demand for CDN security.

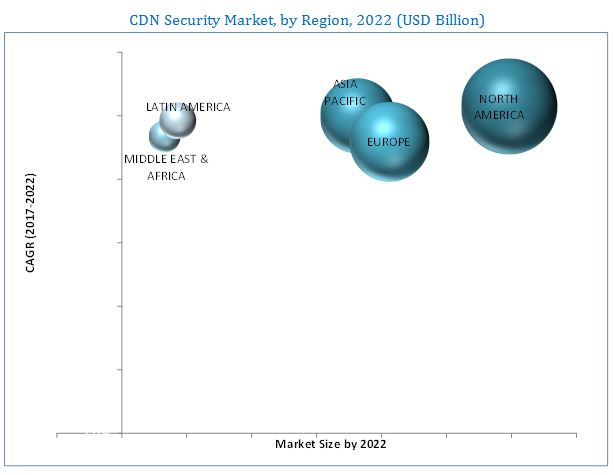

As per geographic analysis, the North American region is estimated to lead the CDN security market in 2017. The growth of the market in North America can be attributed to the increased deployment of CDN security in the region along with the presence of key companies and technical advancement to manage expertise to integrate CDN security with other technologies in businesses is very high. In addition, there have been innovations in CDN security technology through R&D and the rise in deployment of the cloud CDN solutions across industries.

Security issues due to the complexity of CDN and security and operational costs are restraining the growth of the CDN security market.

Key players operating in the CDN security market include Akamai Technologies (US), Cloudflare (US), Stackpath (US), Limelight Networks (US), Amazon Web Services (US), Microsoft (US), Radware (Israel), Arbor Networks (US), Nexusguard (US), Distil Networks (US), Verizon Digital Media Services (US), and ChinaCache (China). These companies are focusing on developing CDN security along with the adoption of various growth strategies, such as partnerships and collaborations, contracts, mergers & acquisitions, new product launches, and business expansions to increase their shares in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries: By Company Type, Designation, and Region

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the CDN Security Market

4.2 North America: Market By Type

4.3 Europe: Market By Vertical

4.4 Asia Pacific: Market By Organization Size

4.5 Market By Type & Region

5 CDN Security Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for CDN Security to Protect Content Against Rising Security Attacks/Threats

5.2.1.2 Increasing Instances of DDoS and Application Layer Security Attacks

5.2.1.3 Increasing Preference for Cloud-Based Services

5.2.2 Restraints

5.2.2.1 Security Issues Due to Complexity of CDN

5.2.2.2 Security and Operational Costs

5.2.3 Opportunities

5.2.3.1 Rising Demand for Integrated and Next-Generation Security Solutions and Services

5.2.4 Challenges

5.2.4.1 Lack of Technical Cybersecurity Expertise

5.2.4.2 Lack of Situational Awareness and Understanding Among Stakeholders

5.3 Industry Trends

5.3.1 CDN Security: Case Studies

5.3.1.1 Case Study #1: Sky Italia Selects Akamai's Aura Managed Content Delivery Network to Manage and Control Their Content and Traffic

5.3.1.2 Case Study #2: OB Design Uses Arbor Networks APS

5.3.1.3 Case Study #3: Drupal Uses Distil Networks Cloud CDN

6 CDN Security Market By Type (Page No. - 37)

6.1 Introduction

6.2 DDoS Protection

6.3 Web Application Firewall (WAF)

6.4 Bot Mitigation & Screen Scraping Protection

6.5 Data Security

6.5.1 TLS/SSL

6.5.2 HTTP/2

6.6 DNS Protection

7 Market By Organization Size (Page No. - 44)

7.1 Introduction

7.2 Small & Medium-Sized Enterprises (SMEs)

7.3 Large Enterprises

8 CDN Security Market By Vertical (Page No. - 48)

8.1 Introduction

8.2 Media, Entertainment, and Gaming

8.3 E-Commerce, Retail & Consumer Goods

8.4 IT & Telecommunication

8.5 Banking, Financial Services & Insurance (BFSI)

8.6 Public Sector

8.7 Manufacturing & Automotive

8.8 Healthcare & Pharmaceutical

8.9 Travel & Tourism

8.10 Others

9 Regional Analysis (Page No. - 57)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 83)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 New Product Launches & Product Enhancements

10.2.2 Agreements, Collaborations & Partnerships

10.2.3 Acquisitions

10.2.4 Expansions

10.3 CDN Security Market Share Analysis, By Key Player

11 Company Profiles (Page No. - 91)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Akamai Technologies

11.2 Cloudflare

11.3 Stackpath

11.4 Limelight Networks

11.5 Amazon Web Services

11.6 Microsoft

11.7 Radware

11.8 Arbor Networks

11.9 Nexusguard

11.10 Distil Networks

11.11 Verizon Digital Media Services

11.12 Chinacache

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11.13 Key Innovators

11.13.1 Imperva Incapsula

11.13.2 Fastly

11.13.3 Cachenetworks

11.13.4 CDNetworks

12 Appendix (Page No. - 140)

12.1 Insights of Industry Experts

12.2 Other Developments

12.2.1 New Product Launches and Product Enhancement

12.2.2 Agreements, Collaboration & Partnerships

12.2.3 Acquisitions

12.2.4 Expansion

12.3 Discussion Guide

12.4 Knowledge Store: Marketsandmarkets Subscription Portal

12.5 Introducing RT: Real-Time Market Intelligence

12.6 Available Customizations

12.7 Related Reports

12.8 Author Details

List of Tables (70 Tables)

Table 1 CDN Security Market Size, By Type, 20152022 (USD Billion)

Table 2 DDoS Protection Type, By Region, 20152022 (USD Million)

Table 3 WAF Type, By Region, 20152022 (USD Million)

Table 4 Bot Mitigation & Screen Scraping Protection Type, By Region, 20152022 (USD Million)

Table 5 Data Security Type, By Region, 20152022 (USD Million)

Table 6 DNS Protection Type, By Region, 20152022 (USD Million)

Table 7 CDN Security Market Size, By Organization Size, 2015-2022 (USD Million)

Table 8 Small & Medium-Sized Enterprises: Market Size, By Region, 2015-2022 (USD Million)

Table 9 Large Enterprises: Market Size, By Region, 2015-2022 (USD Million)

Table 10 CDN Security Market Size, By Vertical, 20152022 (USD Million)

Table 11 Media, Entertainment, and Gaming: Market Size, By Region, 20152022 (USD Million)

Table 12 E-Commerce, Retail & Consumer Goods: Market Size, By Region, 20152022 (USD Million)

Table 13 IT & Telecommunication: Market Size, By Region, 20152022 (USD Million)

Table 14 Banking, Financial Services & Insurance (BFSI): Market Size, By Region, 20152022 (USD Million)

Table 15 Public Sector: Market Size, By Region, 20152022 (USD Million)

Table 16 Manufacturing & Automotive: Market Size, By Region, 20152022 (USD Million)

Table 17 Healthcare & Pharmaceutical: Market Size, By Region, 20152022 (USD Million)

Table 18 Travel & Tourism: Market Size, By Region, 20152022 (USD Million)

Table 19 Others: Market Size, By Region, 20152022 (USD Million)

Table 20 CDN Security Market, By Region, 20152022 (USD Million)

Table 21 North America Market, By Type, 20152022 (USD Million)

Table 22 DDoS Protection: North America Market, By Vertical, 20152022 (USD Million)

Table 23 Web Application Firewall: North America Market, By Vertical, 20152022 (USD Million)

Table 24 Bot Mitigation & Screen Scraping Protection: North America Market, By Vertical, 20152022 (USD Million)

Table 25 Data Security: North America Market, By Vertical, 20152022 (USD Million)

Table 26 DNS Protection: North America Market, By Vertical, 20152022 (USD Million)

Table 27 North America Market, By Organization Size, 20152022 (USD Million)

Table 28 North America Market Size, By Vertical, 20152022 (USD Million)

Table 29 Europe Market, By Type, 20152022 (USD Million)

Table 30 DDoS Protection: Europe Market, By Vertical, 20152022 (USD Million)

Table 31 Web Application Firewall: Europe Market, By Vertical, 20152022 (USD Million)

Table 32 Bot Mitigation & Screen Scraping Protection: Europe Market, By Vertical, 20152022 (USD Million)

Table 33 Data Security: Europe Market, By Vertical, 20152022 (USD Million)

Table 34 DNS Protection: Europe Market, By Vertical, 20152022 (USD Million)

Table 35 Europe CDN Security Market, By Organization Size, 20152022 (USD Million)

Table 36 Europe Market Size, By Vertical, 20152022 (USD Million)

Table 37 Asia Pacific Market, By Type, 20152022 (USD Million)

Table 38 DDoS Protection: Asia Pacific Market, By Vertical, 20152022 (USD Million)

Table 39 Web Application Firewall: Asia Pacific Market, By Vertical, 20152022 (USD Million)

Table 40 Bot Mitigation & Screen Scraping Protection: Asia Pacific Market, By Vertical, 20152022 (USD Million)

Table 41 Data Security: Asia Pacific Market, By Vertical, 20152022 (USD Million)

Table 42 DNS Protection: Asia Pacific Market, By Vertical, 20152022 (USD Million)

Table 43 Asia Pacific Market, By Organization Size, 20152022 (USD Million)

Table 44 Asia Pacific Market Size, By Vertical, 20152022 (USD Million)

Table 45 Middle East & Africa Market, By Type, 20152022 (USD Million)

Table 46 DDoS Protection: Middle East & Africa Market, By Vertical, 20152022 (USD Million)

Table 47 Web Application Firewall: Middle East & Africa Market, By Vertical, 20152022 (USD Million)

Table 48 Bot Mitigation & Screen Scraping Protection: Middle East & Africa Market, By Vertical, 20152022 (USD Million)

Table 49 Data Security: Middle East & Africa CDN Security Market, By Vertical, 20152022 (USD Million)

Table 50 DNS Protection: Middle East & Africa Market, By Vertical, 20152022 (USD Million)

Table 51 Middle East & Africa Market, By Organization Size, 20152022 (USD Million)

Table 52 Middle East & Africa Market Size, By Vertical, 20152022 (USD Million)

Table 53 Latin America Market, By Type, 20152022 (USD Million)

Table 54 DDoS Protection: Latin America Market, By Vertical, 20152022 (USD Million)

Table 55 Web Application Firewall: Latin America Market, By Vertical, 20152022 (USD Million)

Table 56 Bot Mitigation & Screen Scraping Protection: Latin America Market For, By Vertical, 20152022 (USD Million)

Table 57 Data Security: Latin America CDN Security Market, By Vertical, 20152022 (USD Million)

Table 58 DNS Protection: Latin America Market, By Vertical, 20152022 (USD Million)

Table 59 Latin America Market, By Organization Size, 20152022 (USD Million)

Table 60 Latin America Market Size, By Vertical, 20152022 (USD Million)

Table 61 Market Evaluation Framework

Table 62 New Product Launches & Product Enhancements, 2017

Table 63 Agreements, Collaborations & Partnerships, 2016-2017

Table 64 Acquisitions, 2016-2017

Table 65 Expansions, 2016-2017

Table 66 CDN Security Market: Market Share Analysis, 2017

Table 67 New Product Launches and Product Enhancement, 2015-2017

Table 68 Agreements, Collaboration & Partnerships, 2015-2017

Table 69 Acquisitions, 2015-2016

Table 70 Expansion, 2015-2016

List of Figures (34 Figures)

Figure 1 CDN Security Market: Research Design

Figure 2 Data Triangulation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Assumption

Figure 6 CDN Security Market, By Type (2017 & 2022)

Figure 7 Market By Organization Size (2017 & 2022)

Figure 8 Market By Vertical (2017 & 2022)

Figure 9 Market By Region (2017 & 2022)

Figure 10 Cyberattack is One of the Key Reasons for the Increasing Adoption of CDN Security Solutions Across Industries

Figure 11 North America: the DNS Protection Segment is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 12 Europe: the Media, Entertainment, and Gaming Segment is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 13 Asia Pacific: the Small & Medium-Sized Enterprises Segment is Projected to Grow at A Highest CAGR Rate From 2017 to 2022

Figure 14 The DDoS Protection Segment is Expected to Account for the Largest Share in 2017

Figure 15 CDN Security Market: Drivers, Restraints, Opportunities& Challenges

Figure 16 Cyber Security: Top 10 Espionage Targeted Industries, 2015

Figure 17 DDoS Protection Segment is Estimated to Lead the Market in 2017

Figure 18 The Large Enterprises Segment is Estimated to Lead the Market in 2017

Figure 19 Media, Entertainment, and Gaming is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America is Estimated to Be the Largest Market for CDN Security in 2017

Figure 21 CDN Security Market in North America is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 22 North America: CDN Security Market Snapshot

Figure 23 Companies Adopted New Product Launches and Product Enhancements as the Key Growth Strategies From 2015 to 2017

Figure 24 Akamai Technologies: Company Snapshot

Figure 25 Akamai Technologies: SWOT Analysis

Figure 26 Limelight Networks: Company Snapshot

Figure 27 Limelight Networks: SWOT Analysis

Figure 28 Amazon Web Services: Company Snapshot

Figure 29 Amazon Web Services: SWOT Analysis

Figure 30 Microsoft: Company Snapshot

Figure 31 Microsoft: SWOT Analysis

Figure 32 Radware: Company Snapshot

Figure 33 Radware: SWOT Analysis

Figure 34 Chinacache: Company Snapshot

Growth opportunities and latent adjacency in CDN Security Market