Cash Management System Market - Global Forecast to 2029

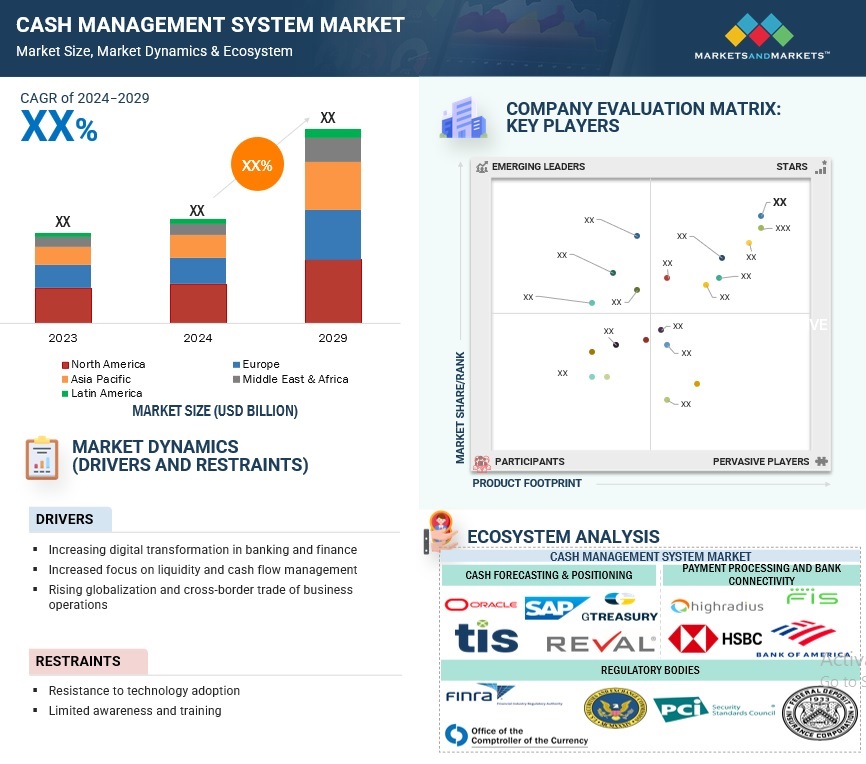

The cash management system market is estimated to be worth USD XX billion in 2024 to USD XX billion by 2029 at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. The growth of the cash management system market is attributed to the rising digital transformations in banking and finance. Since most businesses now use online banking and mobile payment applications, effective cash management tools should be adopted by business organizations that will increase their demand for services this way. The increasing focus on liquidity and cash flow management also resulted from economic uncertainties as organizations wanted to control and track things in real-time. Changing landscapes such as globalization will also demand economies with multi-currency and cross-border capabilities within the systems, which drive adoption further. AI and advanced analytics will increase the power of cash flow forecasting and fraud detection, while the ever-growing market for cloud solutions will also enable flexibility for all organizations. Further, the sustainability factor and demand for mobility and user-friendly platforms could also widen market avenues in particular and underserved sections such as SMEs.

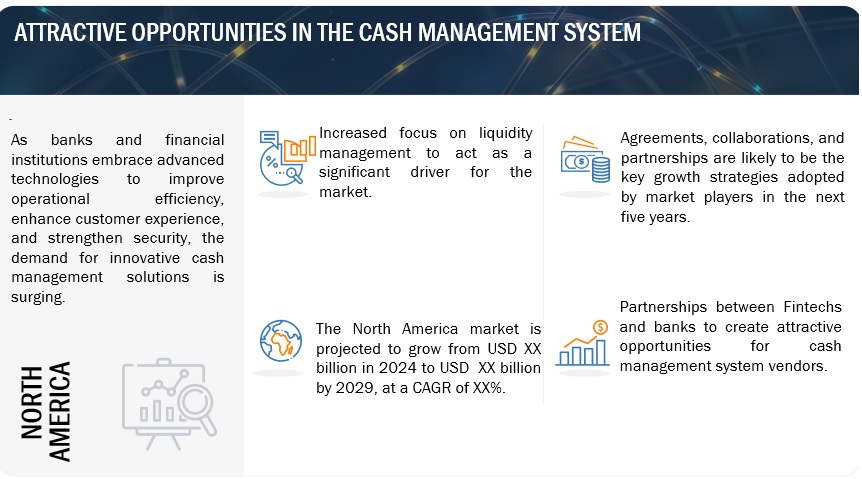

ATTRACTIVE OPPORTUNITIES IN THE CASH MANAGEMENT SYSTEM MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

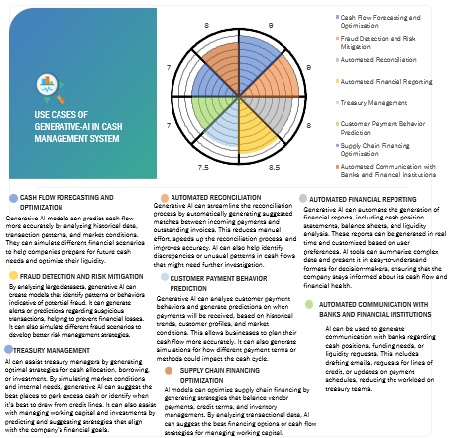

IMPACT OF AI/GEN AI ON THE CASH MANAGEMENT SYSTEM MARKET

Generative AI significantly changes how organizations and financial institutions handle cash management, liquidity, and financial operations. With the capabilities of automating manual processes such as forecasting requirements for cash flow, optimizing payments, and detecting fraud-related activity, the AI/Gen AI adds value in accuracy, efficiency, and security concerning cash resources management. Altered methods of behavior exhibited through generative AI enable such scenarios as a simulation of various financial scenarios from which personalized choices can be derived for investment, payment schedules, and liquidity management occurrences. Not only does such an approach reduce operational costs, but it also provides decision-makers in organizations with insights in real-time, leading to improved strategic decision-making. Furthermore, AI automation will reduce human error and enhance risk management. However, using AI in cash management systems requires an eye on data privacy and system integration and, most importantly, ensures that they use high-quality data to achieve their defined purpose. Consequently, AI is used in the CMS market so that various organizations can conduct their financial transactions far more conveniently, competitively, and efficiently in an evolving economic environment.

Cash Management System Market Dynamics

Driver: Increasing digital transformation in banking and finance

Digital transformation in banking and finance serves as the leading promoter of the cash management system (CMS) market as institutions embrace innovative technology for enhanced efficiency, decision-making, and customer experiences. With the advancement of technology, the automation of cash-handling processes minimizes manual error and operational inefficiencies. At the same time, data-driven analytics provide real-time visibility into cash flow trends and liquidity. It provides scalability, flexibility, and secure access complemented by emerging technologies such as AI, blockchain, and RPA, which offer enhanced predictive analytics, fraud detection, and automation processes for cash management in any system based on the cloud. They also reduce the management of large-scale cash across currencies and geographies while simplifying compliance with arduous financial regulations. Also, the integration of cash management systems with digital banking will result in increased customer satisfaction because of faster transactions, personalized services, and reduced operational costs. The demand for cash management system solutions continues to grow as mobile banking and digital payment channels proliferate.

Restraint: Limited awareness and training

Awareness limits are an excellent inhibition factor, as is quality training toward cash management system market growth. Most enterprises, mainly startups and medium-sized, do not even realize the type of benefit they would achieve through the system or know evaluation and implementation. An employee usually resorts to traditional cash management habits, which require adopting more efficient and automated systems. Lack of proper education makes it hard for many to understand these systems; thus, the employees are not trained. The whole heap of costs borne in hiring and on-the-go training for the new governmental regulations and system updates have also contributed to this problem. Without the appropriate training, an organization is never in the place of being able to take full advantage of the cash management system; hence, it ends up being underutilized or poorly managed. These obstacles slow down adoption in a market characterized by many smaller businesses and fragmented growth.

Opportunity: Adoption of real-time payments and innovations in financial technology

The real-time payments (RTP) system, in conjunction with financial technology (fintech) innovations, is creating a revolution in the cash management system market, thus enabling companies to manage their cash flows and liquidity increasingly faster and more efficiently. RTP allows for real-time or near-real-time movement of funds, increasing the visibility of cash flows and reducing the payment lag, thus opening faster reinvestment opportunities and less reliance on short-term borrowing. The advances such as cloud-based fintech solutions, AI cash forecasting, blockchain-protected transactions, and robotic process automation (RPA) enable companies to drive efficiency, automate monotonous work, and enhance fraud detection. Real-time insights would provide better financial decision-making and operational business agility. Most companies will begin to seek real-time payments with data-driven solutions, allowing such cash management systems to be incorporated with advanced technologies and immensely grow in market share, creating new windows to streamline liquidity management, reduce transaction costs, and improve cross-border payment processes. This continues the extension of the RTP and fintech worlds into an evolving approach to companies' financial management, which produces a more dynamic and responsive cash management ecosystem.

Challenge: Data privacy and maintaining customer trust

The challenges in the cash management system (CMS) market brought about by data privacy and trust are huge, as financial data is highly sensitive and needs heavy protection. Most CMS solutions process huge loads of personal and financial information, which makes these systems highly coveted for cyber threats. Some examples of these compliance regulations include GDPR and PCI DSS, apart from the compulsory job of protecting sensitive data in codes, secure authentication, limited access control, etc. Transparency in gathering, storing, and using data helps form customers' trust. There is a need for timely communication in case of a breach; such action would potentially have reputational damage. In addition, companies must manage risks from third parties, lay down policies such as data retention and disposal, and ensure compliance with international data protection laws. Furthermore, it is vital to secure a good reputation against customer data compromise, as this, in turn, ensures clientele retention and competitiveness in the market.

ECOSYSTEM OF CASH MANAGEMENT SYSTEM MARKET

The cash management system market ecosystem includes cash forecasting and positioning, payment processing and bank connectivity, and regulatory bodies. The following figure illustrates the ecosystem of the cash management system market:

To know about the assumptions considered for the study, download the pdf brochure

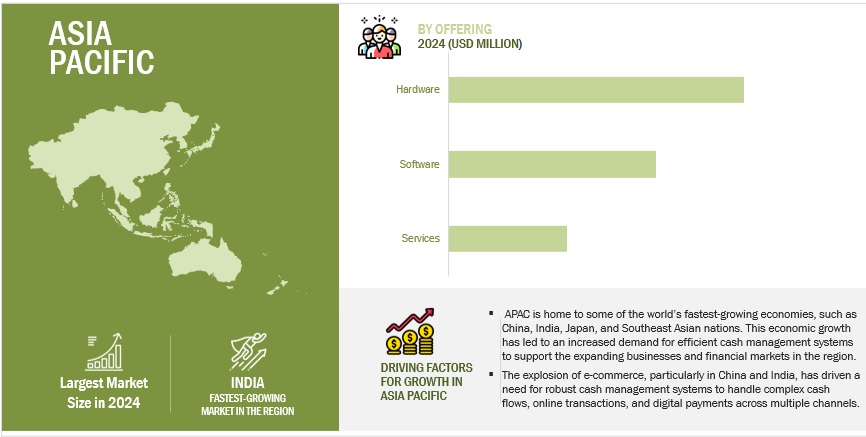

Based on offering, the hardware segment is expected to hold the largest market size.

While cash management systems handle cash across diverse sectors like banking, retail, and hospitality, hardware plays a significant role in protecting cash and making its handling efficient and accurate. Automated Teller Machines (ATMs) are hardware components that usually dispense cash and accept deposits; Cash Recycling Machines (CRMs) validate cash and recycle it for use in further transactions; Coin and Banknote Sorters ensure that cash is categorized and counted correctly. Smart Safe Systems counts and stores cash securely and performs much cash by detailing the cash dispensers and counting machine. Banknote Validators are validations intended to accept cash as a deposit or payment, while mobile devices accept contactless payment methods. In addition to Cash-in-Transit (CIT), robotic systems are improving security and automation in handling cash. These hardware devices are often integrated into a software system that provides real-time data, enhances operational performance, reduces labor costs, prevents theft, and gives accurate cash flow management. Such automation will also develop business functions by doing away with mundane manual tasks.

Based on offering, the software segment is expected to have the highest CAGR during the forecast period.

The software allows the integration of bank accounts into a single view for easier cash positioning and reconciliation, as well as automating payments and collections to quicken transaction cycles. The software contains modules for payment, collections, and banks and has processes for risk management and detecting frauds and discrepancies in real time. Its multi-currency capabilities make it an essential tool for an organization that is doing international cash business. Advanced reporting and analytics give organizations the necessary insights concerning cash trends geared toward excellent financial planning and forecasting. Mobile and cloud solutions allow real-time monitoring and management, granting financial managers greater flexibility.

Asia Pacific will have the largest market size during the forecast period.

The cash management system market in the Asia Pacific is growing rapidly due to factors such as digital transformation initiatives pursued across all industry sectors, growing economic activity in the region, and increasing demand for real-time financial insights. The other driving factors include the rise of e-commerce and increased disposable incomes for adopting integrated solutions that enhance cash flow management, forecasting, and liquidity optimization. Improved cloud-based technologies and automation are expected to drive into cost and economies, access, and security because of their promise for scalability and affordability, appealing to businesses established in the region. High-order transactional volumes, thereby altering the timing for financial decision-making, will make it increasingly urgent to have advanced cash management systems as the retail and banking sectors grow.

Key Market Players

The major players in the cash management system market include FIS Global (US), Glory Global Solutions (UK), Posiflex (Taiwan), Oracle (US), SAP (Germany), Citi (US), GTreasury (US), Bottomline Technologies (UK), HighRadius (US), TIS Payments (Germany), Bank of America (US), J.P. Morgan (US), HSBC (UK), BNP Paribas (France), Standard Chartered (UK), Sumitomo Mitsui Banking Corporation (Japan), ALVARA Digital Solutions (Germany), BairesDev (US), ION Group (UK), Giesecke+Devrients (Germany), Sage (UK), HCLTech (India), Beyond Software (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their cash management system market footprint.

Recent Developments:

- In September 2024,?GTreasury announced the acquisition of CashAnalytics, the world’s leading cash forecasting and AR/AP analytics solution. The acquisition enhances GTreasury’s suite of solutions with a critical first point of treasury automation that can be deployed in just weeks as a single solution. It also offers seamless data orchestration and user interface across GTreasury’s suite of Digital Treasury Solutions.

- In February 2024, FIS Global announced it has entered a strategic partnership with Banked, a leading provider of open banking solutions, to drive new pay-by-bank offerings for businesses and consumers.

- In February 2024, HighRadius announced the acquisition of Cforia Software, a leading provider of Billing and Collections automation software, with over 100 customers globally.

Frequently Asked Questions (FAQ):

What is the definition of the cash management system market?

A Cash Management System (CMS) is a set of tools, processes, and technologies businesses use to effectively track and manage their cash flow, optimize liquidity, and ensure financial stability. It involves the monitoring, controlling, and planning of cash inflows and outflows across various business activities, including operating, investing, and financing activities, which helps businesses avoid liquidity shortages, ensure timely payments, and manage financial risk.

What is the market size of the cash management system market?

The cash management system market is estimated to be worth USD XX billion in 2024 to USD XX billion by 2029 at a Compound Annual Growth Rate (CAGR) of XX%.

What are the major drivers in the cash management system market?

The major drivers in the cash management system market are the increasing digital transformation in banking and finance, the increased focus on liquidity and cash flow management, and the rising globalization and cross-border trade of business operations.

Who are the key players operating in the cash management system market?

The key market players profiled in the cash management system market include FIS Global (US), Glory Global Solutions (UK), Posiflex (Taiwan), Oracle (US), SAP (Germany), Citi (US), GTreasury (US), Bottomline Technologies (UK), HighRadius (US), TIS Payments (Germany), Bank of America (US), J.P. Morgan (US), HSBC (UK), BNP Paribas (France), Standard Chartered (UK), Sumitomo Mitsui Banking Corporation (Japan), ALVARA Digital Solutions (Germany), BairesDev (US), ION Group (UK), Giesecke+Devrients (Germany), Sage (UK), HCLTech (India), Beyond Software (US).

What are the key opportunities in the cash management system market?

The key opportunities in cash management systems are the adoption of real-time payments, innovations in financial technology, integration with blockchain technology, and rising government initiatives and incentives.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Cash Management System Market