Cash Flow Management Market by Component (Solution and Services), Deployment (Cloud and On-premises), End User (SMEs and Professionals), Vertical (IT and ITes, Construction and Real Estate, and Retail and eCommerce), and Region - Global Forecast to 2025

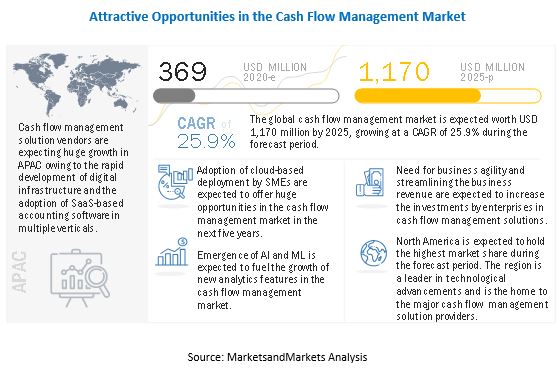

[182 Pages Report] The Cash Flow Management Market size is estimated to reach USD 1,170 million by 2025 from USD 369 million in 2020, at a Compound Annual Growth Rate (CAGR) of 25.9% during the forecast period. There has been an increasing adoption of technologies such as Artificial Intelligence (AI), Machine Learning (ML), data analytics, and business intelligence. These technologies help in improving the efficiency of cash flow management. Cash flow management is important to maintain liquidity of a business and thus contributing to the growth of the business

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

The quick spread of the coronavirus has created a health crisis and triggered a massive financial crisis worldwide. During this difficult time, maintaining a strong customer relationship and having a seamless cash flow have become crucial for businesses to keep themselves competent. Organizations are worried about their cash position as they are uncertain of the impact of COVID-19 on their businesses. They need to prepare financial forecasts in which predictive analytics can play a critical role by predicting impacts of COVID-19 and managing cash flow through the current challenge. Moreover, organizations are gradually adopting big data and analytics capabilities combined in cash flow management solutions to gain financial insights and prepare for the future.

Market Dynamics

Driver: Cash flow management improves the planning and budgeting cycles

Planning and monitoring of business budgets help identify wasteful expenditure, adapt quickly if the financial situation changes, and, therefore, achieve financial goals. A little planning in advance can help avoid short-term shortages of cash. A cash flow budget summarizes likely income and expenses for a given period, usually twelve months in advance. Moreover, the budget provides a tangible, organized, and easily understood breakdown of how much money coming in and going out of the business. It makes a business think about its plan for the year and tests if the business will produce enough income to meet all its cash needs.

Restraint: Surge of new regulations and financial standards

Successful financial regulation prevents market failure, promotes macroeconomic stability, protects investors, and mitigates the effects of financial failures on the global economy. However, financial regulations also impose a variety of costs on regulated firms and the economy. For instance, reactions to regulation often cause institutions to conduct business sub-optimally and can cause firms to leave or restrict their entry into the marketplace. Financial reporting standards and requirements vary from country to country, which creates inconsistencies. This problem becomes more prevalent for investors when they are considering funding capital-seeking companies that follow the accounting standards and financial reporting of the country in which they are doing business.

Opportunity: Evolution of AI and ML

The adoption of AI and ML is increasing across industries to automate the business processes. These technologies are also transforming the financial industry, and organizations are finding new ways to enhance decision-making and strengthen their competitive advantage. AI helps in cash flow forecasting to make it easier to resolve discrepancies, such as customer payments that dont match existing transactions and analyze accounts payable timing. ML can significantly improve the accuracy of financial forecasts.

Challenge: Integration of data from data silos

Today, majority of finance teams in the organizations are struggling with disparate data silos belonging to different cash streams, due to the organizations adaptation to todays ever-changing business conditions, with a specific focus on the people, processes, and technologies. These unprecedented changes have led to an urgency for finance teams to effectively derive insights from consolidated data. However, if mission-critical data is siloed across multiple source systems, then planning with agility and integration of data from complex data silos become a lot harder to execute. Data silos make it difficult to achieve a holistic view of business performance. This can prevent finance teams from helping key business stakeholders make decisions as market conditions continue to evolve.

Solution segment to lead the cash flow management market in 2020

The cash flow solution enables organizations to define financial goals, monitor costs and revenue, and develop business plans through early identification of trends and anomalies. Modern mathematical methods, and the emergence of IT applications and infrastructure, such as big data and predictive analytics, have enhanced the capabilities of cash flow solution to gain insights from the financial data in real time.

Cloud segment to lead the cash flow management market in 2020

Cloud-based cash flow management solutions are SaaS solutions provided by a service provider hosted within their data centers or other facilities. On-demand solutions are usually accessible through the internet and can be accessed from anywhere, whenever required. These solutions are subscription-based and are easily customizable. Businesses are interested in cloud-based solutions, owing to its multiple advantages, such as low operational expenses, ease of deployment, improved scalability, and integration.

Professionals segment to grow at a higher CAGR during the forecast period

The professionals subsegment consists of individual users of cash flow tools, which comprises accountants, bookkeepers, freelancers, etc. These individuals do not earn huge revenue compared to the corporates, and they have to minimize the risk of financial losses or leakage of cash in hand on unnecessary expenses. On the other hand, they do not possess a huge amount of budget to invest in financial management tools or big accounting software.

IT and ITes vertical to lead the cash flow management market in 2020

The IT and ITes vertical has witnessed rapid growth during the past decade, and it is undergoing various transformations. With its enormous size, the vertical exhibits complex contracts, interdependencies of services, disparate spending, and minimal resources and time. The cash flow management solutions can help these companies overcome such challenges through advanced cash flow forecasting capabilities. These solutions significantly help the companies in identifying the potential threats that are prevailing in the vertical to avoid losses.

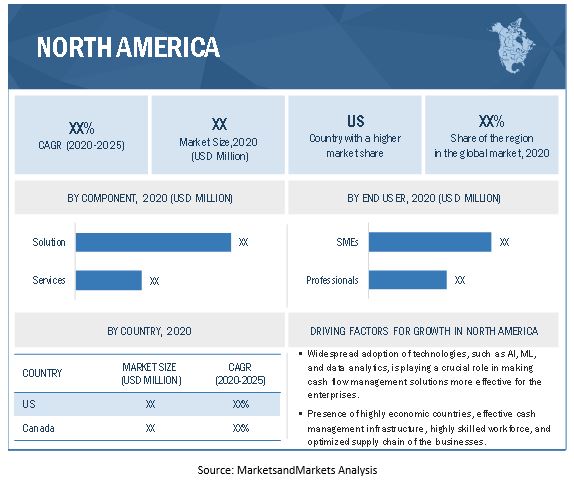

North America to lead the cash flow management market in 2020

North America is estimated to hold the largest share of the global cash flow management market in 2020. Due to the emergence of trending technologies, such as AI, ML, BI, and data analytics, enterprises in this region are adopting cash flow management software and services to future-proof their businesses. Moreover, predictive analytics and cash flow forecasting are transforming the way companies are operating and performing ahead of the competition in their industries. As these solutions continue to evolve, businesses in the region are discovering new ways to increase efficiency and reduce costs.

Key market players

The cash flow management market comprises key solution and service providers, such as Intuit (US),Xero (New Zealand)Anaplan (US), Sage (UK), Float (UK), Planguru (US), Dryrun (Canada), Caflou (Czech Republic), Pulse (US), Cash Analytics (Ireland), Fluidly (UK), Finagraph (US), Cashflowmapper (Australia), Finsync (US), Cashflow Manager (Australia), Agicap (France), Calqulate (Finland), Cashbook (Ireland), Cash Flow Mojo (US), Cashforce (Belgium), BeyondSquare Solutions (India), Calxa (Australia), CashflowCafe (England), Futrli (UK), Vistr (Australia), and Runway (US).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Component, Deployment, End User, Vertical |

|

Regions covered |

North America, Europe, APAC, RoW |

|

Companies covered |

Intuit (US), Xero (New Zealand), Anaplan (US), Sage (UK), Float (UK), Planguru (US), Dryrun (Canada), Caflou (Czech Republic), Pulse (US), Cash Analytics (Ireland), Fluidly (UK), Finagraph (US), Cashflowmapper (Australia), Finsync (US), Cashflow Manager (Australia), Agicap (France), Calqulate (Finland), Cashbook (Ireland), Cash Flow Mojo (US), Cashforce (Belgium), BeyondSquare Solutions (India), Calxa (Australia), CashflowCafe (England), Futrli (UK), Vistr (Australia), and Runway (US) |

This research report categorizes the cash flow management market to forecast revenues and analyze trends in each of the following subsegments:

Based on components, the cash flow management market has the following segments:

- Solutions

- Services

- Consulting Services

- Implementation Services

- Support Services

Based on deployment, the cash flow management market has the following segments

- On-premises

- Cloud

Based on end user, the cash flow management market has the following segments

- Small and Medium Enterprises (SMEs)

- Professionals

Based on vertical, the cash flow management market has the following segments

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Information Technology Enabled Services (ITes)

- Construction and Real Estate

- Retail and eCommerce

- Manufacturing

- Government and Non-Profit Organizations

- Healthcare

- Others (Utilities, Education, and Travel and Hospitality)

Based on region, the cash flow management market has the following segments

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

- APAC

- China

- Australia and New Zealand (ANZ)

- Rest of APAC

- RoW

- Middle East and Africa (MEA)

- Latin America

Recent Developments

- In May 2020, Xero and one of Canadas largest national accounting, tax, and business consulting firms, MNP, collaborated to help Canadian businesses succeed. The objective of the partnership is to provide accountants across MNPs more than 80 offices in Canada with access to cloud accounting ledger and financial management tools and services anytime, and on any device.

- In March 2020, Intuit QuickBooks signed a strategic agreement with Visa to strengthen its business propositions for SME customers in India. As a result of this collaboration in India, Visa cardholders will be able to subscribe to Intuit QuickBooks and use its features, such as anytime and anywhere access to data, GST compliance, expense management, automated bank reconciliation, and document management.

- In October 2019, Anaplan has released an updated platform User Experience (UX) and a new mobile app. The new product is featured with a modern design and highly customizable views and reports, and delivers an intuitive, consumer-like personalized experience.

- In September 2019, Sage acquired AutoEntry, a leading provider of data entry automation for accountants, bookkeepers, and businesses. The objective of the acquisition is to accelerate Sages vision to become a great SaaS company, and it follows a successful two-year partnership

Frequently Asked Questions (FAQ):

How big is the cash flow management market?

The global cash flow management market size is projected to grow from USD 0.4 billion in 2020 to USD 1.2 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 25.9% during the forecast period.

What region holds the highest market share in the cash flow management market?

North America has the highest market share in the cash flow management market due to early adoption of technology and presence of various solution providers.

What are the major factors driving the growth of cash flow management market?

The major drivers for the cash flow management market include cash flow management for improving the planning and budgeting cycles, increasing demand for cash flow analysis, and forecasting due to rapid business expansion, increasing adoption of predictive analytics across industries to drive the market, and increasing demand for supply chain management and working capital management to boost cash flow. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECAST FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACTSCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 20162019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 6 CASH FLOW MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY ̶ APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTION AND SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ̶ APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTION AND SERVICES OF THE CASH FLOW MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 TOP-DOWN (DEMAND SIDE): SHARE OF THE MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS FOR THE STUDY

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 11 CASH FLOW MARKET SIZE, 20202025

FIGURE 12 SOLUTION SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 13 CLOUD SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 14 SMALL AND MEDIUM ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CASH FLOW MARKET

FIGURE 15 RISING DEMAND FOR BUSINESS REVENUE STREAMLINING TO DRIVE THE MARKET GROWTH

4.2 MARKET IN ASIA PACIFIC, BY COMPONENT AND COUNTRY

FIGURE 16 SOLUTION SEGMENT AND CHINA TO ACCOUNT FOR LARGER MARKET SIZES IN ASIA PACIFIC IN 2020

4.3 MARKET: MAJOR COUNTRIES

FIGURE 17 AUSTRALIA AND NEW ZEALAND TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CASH FLOW MARKET

5.2.1 DRIVERS

5.2.1.1 Cash flow management improves the planning and budgeting cycles

5.2.1.2 Increasing demand for cash flow analysis and forecasting due to rapid business expansion

5.2.1.3 Increasing adoption of predictive analytics across industries to drive the market

5.2.1.4 Increasing demand for supply chain management and working capital management to boost cash flow

5.2.2 RESTRAINTS

5.2.2.1 Surge of new regulations and financial standards

5.2.3 OPPORTUNITIES

5.2.3.1 Evolution of AI and ML

5.2.3.2 Emergence of new IT applications and infrastructure

5.2.4 CHALLENGES

5.2.4.1 Integration of data from data silos

5.2.4.2 Managing currency risk affecting international companies

5.3 COVID-19 IMPACT ANALYSIS: IMPACT ON DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS: CASH FLOW MARKET

5.5 ECOSYSTEM

FIGURE 20 ECOSYSTEM: MARKET

5.6 TECHNOLOGY ANALYSIS

5.6.1 ARTIFICIAL INTELLIGENCE

5.6.2 MACHINE LEARNING

5.6.3 DATA ANALYTICS

5.6.4 BUSINESS INTELLIGENCE

5.7 CASE STUDY ANALYSIS

5.7.1 MEDIA AND COMMUNICATIONS

5.7.1.1 Use case 1: Anaplan helped Vodafone improve their sales plan in half the time

5.7.2 HEALTHCARE

5.7.2.1 Use case 2: Sage helped HSG free up cash flow with faster client payments

5.7.3 FLUID ENGINEERING

5.7.3.1 Use case 3: CashAnalytics helped Sulzer improve cash forecasting and liquidity reporting

5.7.4 RETAIL

5.7.4.1 Use case 4: Finagraph helped Fidalgo Coffee with cash flow management and future predictions

5.8 REGULATORY LANDSCAPE

5.8.1 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001

5.8.2 BASEL COMMITTEE ON BANKING SUPERVISION

5.8.3 DODD-FRANK ACT

5.8.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.8.5 GENERAL DATA PROTECTION REGULATION

5.8.6 MARKETS IN FINANCIAL INSTRUMENTS DIRECTIVE

5.8.7 FINANCIAL INDUSTRY INFORMATION SYSTEMS

5.9 AVERAGE SELLING PRICE TREND

6 CASH FLOW MARKET, BY COMPONENT (Page No. - 65)

6.1 INTRODUCTION

6.1.1 MARKET DRIVERS

6.1.2 COVID-19 IMPACT ON THE MARKET

FIGURE 21 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 3 MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

6.2 SOLUTION

TABLE 4 SOLUTION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.3 SERVICES

FIGURE 22 SUPPORT SERVICES SUBSEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 5 SERVICES: MARKET SIZE, BY TYPE 20182025 (USD MILLION)

TABLE 6 SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.3.1 CONSULTING SERVICES

TABLE 7 CONSULTING SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.3.2 IMPLEMENTATION SERVICES

TABLE 8 IMPLEMENTATION SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

6.3.3 SUPPORT SERVICES

TABLE 9 SUPPORT SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

7 CASH FLOW MARKET, BY DEPLOYMENT (Page No. - 71)

7.1 INTRODUCTION

7.1.1 MARKET DRIVERS

7.1.2 COVID-19 IMPACT ON THE MARKET

FIGURE 23 CLOUD SEGMENT TO SHOW A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

7.2 CLOUD

TABLE 11 CLOUD: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

7.3 ON-PREMISES

TABLE 12 ON-PREMISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8 CASH FLOW MARKET, BY END USER (Page No. - 75)

8.1 INTRODUCTION

8.1.1 MARKET DRIVERS

8.1.2 COVID-19 IMPACT ON THE MARKET

FIGURE 24 PROFESSIONALS SEGMENT TO WITNESS A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY END USER, 20182025 (USD MILLION)

8.2 SMALL AND MEDIUM ENTERPRISES

TABLE 14 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

8.3 PROFESSIONALS

TABLE 15 PROFESSIONALS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9 CASH FLOW MARKET, BY VERTICAL (Page No. - 79)

9.1 INTRODUCTION

9.1.1 MARKET DRIVERS

9.1.2 COVID-19 IMPACT ON THE MARKET

FIGURE 25 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES SEGMENT TO WITNESS THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 16 MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 17 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.3 IT AND ITES

TABLE 18 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.4 CONSTRUCTION AND REAL ESTATE

TABLE 19 CONSTRUCTION AND REAL ESTATE: CASH FLOW MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.5 RETAIL AND ECOMMERCE

TABLE 20 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.6 MANUFACTURING

TABLE 21 MANUFACTURING: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.7 GOVERNMENT AND NON-PROFIT ORGANIZATION

TABLE 22 GOVERNMENT AND NON-PROFIT ORGANIZATION: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.8 HEALTHCARE

TABLE 23 HEALTHCARE: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

9.9 OTHERS

TABLE 24 OTHERS: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

10 CASH FLOW MARKET, BY REGION (Page No. - 87)

10.1 INTRODUCTION

TABLE 25 MARKET SIZE, BY REGION, 20182025 (USD MILLION)

FIGURE 26 ASIA PACIFIC TO EXHIBIT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

10.2.2 NORTH AMERICA: MARKET DRIVERS

10.2.3 IMPACT OF COVID-19 ON THE NORTH AMERICAN MARKET

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

TABLE 26 NORTH AMERICA: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 31 NORTH AMERICA: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 32 NORTH AMERICA: INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 33 NORTH AMERICA: CONSTRUCTION AND REAL ESTATE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 34 NORTH AMERICA: RETAIL AND ECOMMERCE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 35 NORTH AMERICA: MANUFACTURING MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 36 NORTH AMERICA: GOVERNMENT AND NON-PROFIT ORGANIZATIONS MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 37 NORTH AMERICA: HEALTHCARE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 38 NORTH AMERICA: OTHERS MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.2.4 UNITED STATES

TABLE 40 UNITED STATES: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 41 UNITED STATES: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 42 UNITED STATES: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 43 UNITED STATES: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

10.2.5 CANADA

TABLE 44 CANADA: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 45 CANADA: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 46 CANADA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 47 CANADA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET REGULATORY IMPLICATIONS

10.3.2 EUROPE: MARKET DRIVERS

10.3.3 IMPACT OF COVID-19 ON THE EUROPEAN MARKET

TABLE 48 EUROPE: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 53 EUROPE: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 54 EUROPE: INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 55 EUROPE: CONSTRUCTION AND REAL ESTATE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 56 EUROPE: RETAIL AND ECOMMERCE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 57 EUROPE: MANUFACTURING MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 58 EUROPE: GOVERNMENT AND NON-PROFIT ORGANIZATIONS MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 59 EUROPE: HEALTHCARE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 60 EUROPE: OTHERS MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 62 UNITED KINGDOM: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 63 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 64 UNITED KINGDOM: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 65 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

10.3.5 GERMANY

TABLE 66 GERMANY: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 67 GERMANY: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 68 GERMANY: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 69 GERMANY: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET REGULATORY IMPLICATIONS

10.4.2 ASIA PACIFIC: MARKET DRIVERS

10.4.3 IMPACT OF COVID-19 ON THE ASIA PACIFIC MARKET

FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 70 ASIA PACIFIC: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 75 ASIA PACIFIC: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 76 ASIA PACIFIC: INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 77 ASIA PACIFIC: CONSTRUCTION AND REAL ESTATE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 78 ASIA PACIFIC: RETAIL AND ECOMMERCE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 79 ASIA PACIFIC: MANUFACTURING MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 80 ASIA PACIFIC: GOVERNMENT AND NON-PROFIT ORGANIZATIONS MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 81 ASIA PACIFIC: HEALTHCARE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 82 ASIA PACIFIC: OTHERS MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.4.4 CHINA

TABLE 84 CHINA: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 85 CHINA: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 86 CHINA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 87 CHINA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

10.4.5 AUSTRALIA AND NEW ZEALAND

TABLE 88 AUSTRALIA AND NEW ZEALAND: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 89 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 90 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 91 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

10.5 REST OF WORLD

TABLE 92 REST OF WORLD: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 93 REST OF WORLD: MARKET SIZE, BY SERVICE, 20182025 (USD MILLION)

TABLE 94 REST OF WORLD: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 95 REST OF WORLD: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 96 REST OF WORLD: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

TABLE 97 REST OF WORLD: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 98 REST OF WORLD: INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 99 REST OF WORLD: CONSTRUCTION AND REAL ESTATE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 100 REST OF WORLD: RETAIL AND ECOMMERCE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 101 REST OF WORLD: MANUFACTURING MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 102 REST OF WORLD: GOVERNMENT AND NON-PROFIT ORGANIZATIONS MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 103 REST OF WORLD: HEALTHCARE MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 104 REST OF WORLD: OTHERS MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 105 REST OF WORLD: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

10.5.1 MIDDLE EAST AND AFRICA

TABLE 106 MIDDLE EAST AND AFRICA: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 107 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 108 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 109 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

10.5.2 LATIN AMERICA

TABLE 110 LATIN AMERICA: CASH FLOW MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 111 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 20182025 (USD MILLION)

TABLE 112 LATIN AMERICA: MARKET SIZE, BY END USER, 20182025 (USD MILLION)

TABLE 113 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20182025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 125)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 29 MARKET EVALUATION FRAMEWORK, 2018-2020

11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 30 REVENUE ANALYSIS OF THE CASH FLOW MARKET

11.4 HISTORICAL REVENUE ANALYSIS

11.4.1 INTRODUCTION

FIGURE 31 HISTORIC FIVE YEARS REVENUE ANALYSIS OF LEADING PLAYERS

11.5 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 32 RANKING OF KEY PLAYERS, 2020

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 33 CASH FLOW MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11.7 PRODUCT FOOTPRINT ANALYSIS OF KEY VENDORS

FIGURE 34 PRODUCT FOOTPRINT ANALYSIS OF CASH FLOW VENDORS

12 COMPANY PROFILES (Page No. - 131)

12.1 INTRODUCTION

(Business overview, Products offered, Recent developments, MNM view)*

12.2 INTUIT

FIGURE 35 INTUIT: COMPANY SNAPSHOT

12.3 XERO

FIGURE 36 XERO: COMPANY SNAPSHOT

12.4 ANAPLAN

FIGURE 37 ANAPLAN: COMPANY SNAPSHOT

12.5 SAGE

FIGURE 38 SAGE: COMPANY SNAPSHOT

12.6 FLOAT

12.7 PLANGURU

12.8 DRYRUN

12.9 CAFLOU

12.10 PULSE

12.11 CASHANALYTICS

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

12.12 FLUIDLY

12.13 FINAGRAPH

12.14 CASHFLOWMAPPER

12.15 FINSYNC

12.16 CASHFLOW MANAGER

12.17 AGICAP

12.18 CALQULATE

12.19 CASHBOOK

12.20 CASH FLOW MOJO

12.21 CASHFORCE

12.22 BEYONDSQUARE SOLUTIONS (FINALYZER)

12.23 CALXA

12.24 CASHFLOW CAFE

12.25 FUTRLI

12.26 VISTR

12.27 RUNWAY (LTSE)

13 APPENDIX (Page No. - 158)

13.1 ADJACENT/RELATED MARKETS

13.1.1 DIGITAL PAYMENT MARKET

13.1.1.1 Market definition

13.1.1.2 Market overview

13.1.1.3 Digital payment market, by type

TABLE 114 SOLUTIONS: DIGITAL PAYMENT MARKET SIZE, BY TYPE, 20162023 (USD BILLION)

TABLE 115 SOLUTIONS: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 116 PAYMENT GATEWAY SOLUTIONS: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 117 PAYMENT PROCESSING SOLUTIONS: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 118 PAYMENT WALLET SOLUTIONS: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 119 PAYMENT SECURITY AND FRAUD MANAGEMENT SOLUTIONS: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 120 POS SOLUTIONS: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 121 SERVICES: DIGITAL PAYMENT MARKET SIZE, BY TYPE, 20162023 (USD BILLION)

TABLE 122 SERVICES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 123 PROFESSIONAL SERVICES: DIGITAL PAYMENT MARKET SIZE, BY TYPE, 20162023 (USD BILLION)

TABLE 124 PROFESSIONAL SERVICES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 125 CONSULTING SERVICES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 126 SYSTEM INTEGRATION AND DEPLOYMENT SERVICES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 127 SUPPORT AND MAINTENANCE SERVICES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 128 MANAGED SERVICES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

13.1.1.4 Digital payment market by deployment

TABLE 129 DIGITAL PAYMENT MARKET SIZE, BY DEPLOYMENT MODE, 20162023 (USD BILLION)

TABLE 130 ON-PREMISES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 131 CLOUD: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

13.1.1.5 Digital payment market by organization size

TABLE 132 DIGITAL PAYMENT MARKET SIZE, BY ORGANIZATION SIZE, 20162023 (USD BILLION)

TABLE 133 SMALL AND MEDIUM ENTERPRISES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

TABLE 134 LARGE ENTERPRISES: DIGITAL PAYMENT MARKET SIZE, BY REGION, 20162023 (USD BILLION)

13.1.1.6 Digital payment market by region

TABLE 135 NORTH AMERICA: DIGITAL PAYMENT MARKET SIZE, BY COUNTRY, 20162023 (USD BILLION)

13.1.2 CONTACTLESS PAYMENT MARKET

13.1.2.1 Market definition

13.1.2.2 Market overview

13.1.2.3 Contactless payment market, by component

TABLE 136 CONTACTLESS PAYMENT MARKET SIZE, BY COMPONENT, 20182025 (USD MILLION)

TABLE 137 HARDWARE: CONTACTLESS PAYMENT MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 138 NORTH AMERICA: HARDWARE MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 139 EUROPE: HARDWARE MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 140 HARDWARE: CONTACTLESS PAYMENT MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 141 POINT OF SALE MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 142 NORTH AMERICA: POINT OF SALE MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 143 EUROPE: POINT OF SALE MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 144 CARDS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 145 NORTH AMERICA: CARDS MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 146 EUROPE: CARDS MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 147 OTHERS MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 148 NORTH AMERICA: OTHERS MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 149 EUROPE: OTHERS MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 150 SERVICES: CONTACTLESS PAYMENT MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 151 NORTH AMERICA: SERVICES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 152 EUROPE: SERVICES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 153 SERVICES: CONTACTLESS PAYMENT MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 154 CONSULTING MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 155 NORTH AMERICA: CONSULTING MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 156 EUROPE: CONSULTING MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 157 INTEGRATION AND DEPLOYMENT MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 158 NORTH AMERICA: INTEGRATION AND DEPLOYMENT MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 159 EUROPE: INTEGRATION AND DEPLOYMENT MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 160 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 161 NORTH AMERICA: SUPPORT AND MAINTENANCE MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 162 EUROPE: SUPPORT AND MAINTENANCE MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 163 SOLUTIONS: CONTACTLESS PAYMENT MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 164 NORTH AMERICA: SOLUTIONS MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

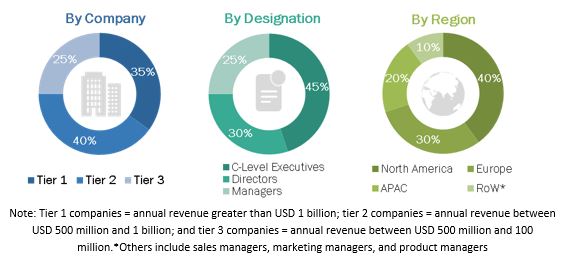

The study involved four major activities to estimate the current market size for the cash flow management market. An exhaustive secondary research was done to collect information on the cash flow management market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the cash flow management market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg Business Week, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard, and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The cash flow management market comprises several stakeholders, such as cash flow operators, cash flow management service providers, venture capitalists, government organizations, regulatory authorities, policy makers and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors, and training providers. The demand side of the cash flow management market consists of all the firms operating in several industry verticals. The supply side includes cash flow providers, offering cash flow management solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top Down Approach

In the top-down approach, an exhaustive list of all the vendors who offer solutions and services in the cash flow management market was prepared. The revenue contribution for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on their offerings by solution and service. The aggregate of all companies revenue was extrapolated to reach the overall market size. Further, each sub segment was studied and analyzed for its global market size and regional penetration.

Bottom Up Approach

The bottom-up procedure was employed to arrive at the overall market size of the cash flow management market from the revenues of the key players (companies) and their market shares. The calculation was done based on estimations and by verifying their revenues through extensive primary interviews. Calculations based on the revenues of the key companies identified in the market led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of the other individual segments (offering, deployment mode, organization size, vertical, and region) via percentage splits of market segments from the secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To describe and forecast the size of the cash flow management market, by component, deployment, end user, vertical, and region, in terms of value

- To describe and forecast the size of the market segments with respect to 4 main regions: North America, Europe, Asia Pacific (APAC), and Rest of World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the cash flow management market

- To analyze the impact of COVID-19 on segments of the cash flow management market

- To analyze each subsegment with respect to the individual growth trends, prospects, and contributions to the overall cash flow management market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the markets competitive landscape

- To analyze competitive developments such as mergers and acquisitions (M&A); product launches and product enhancements; agreements, partnerships, and collaborations; business expansions; and research and development (R&D) activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Company Analysis

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Cash Flow Management Market