Care Management Solutions Market by Component (Software and Services), Delivery Mode (On-Premise and Cloud-Based), Application (Disease Management, Case Management, Utilization Management), End User (Payers, Providers) & Region - Global Forecast to 2026

Market Growth Outlook Summary

The global care management solutions market growth forecasted to transform from $12.6 billion in 2021 to $21.6 billion by 2026, driven by a CAGR of 11.4%. Key factors driving this growth include initiatives that shift risk from healthcare payers to providers, government regulations promoting patient-centric care, and increasing healthcare IT adoption. Opportunities exist in emerging markets, particularly in Asia, where government programs like India's Digital India and China's healthcare reforms are expanding the use of HCIT solutions. However, the market faces challenges such as data breaches and a shortage of skilled professionals. North America is expected to dominate, with significant contributions from key players like EXL Service Holdings, Cerner Corporation, and Epic Systems. The market is segmented by component (software, services), delivery mode (on-premise, cloud-based), application (disease management, case management, etc.), and regions (North America, Europe, Asia Pacific, and Rest of World). Recent developments include Philips' acquisition of Capsule Technologies and Innovaccer's partnership with Microsoft Teams to enhance care delivery.

Care Management Solutions Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Care Management Solutions Market Dynamics

Driver: Implementation of initiatives to shift the burden of risk from healthcare payers to providers

Globally, various initiatives are being implemented to shift the burden of risk borne by healthcare payers to providers. This shift promotes the adoption of healthcare information technology (HCIT) solutions (such as care management solutions) to increase the efficiency of healthcare delivered and reduce unnecessary costs. Value-based care is also promoted through alternative payment models such as bundled payments, physician incentives, and consumer incentives, among others. These models of payment are designed to encourage healthcare providers to accept the accountability of care delivered, thus leading to the shift of risk from payers to providers.

Restraint: Shortage of skilled professionals

The effective utilization of care management solutions demands a strong IT infrastructure and IT support within the organization as well as at the solution provider’s end. In a healthcare organization, there is a continuous need for technical support for maintaining the server and network for the smooth operation of clinical workflows and optimum interfacing speed of care management solutions. If the maintenance of the server or network is inadequate, it leads to the generation of screen loads, which slows down the clinical workflow.

Opportunity: Emerging countries offer high-growth potential

A number of factors, such as the implementation of government initiatives supporting the adoption of HCIT solutions and rising government healthcare expenditure, are driving the growth of this market in Asia. Technological advancements are playing a key role as authorities in China are focusing on reforming the country’s healthcare management sector, which is currently facing challenges such as underfunded rural health centers, overburdened city hospitals, and a nationwide shortage of doctors. The Indian government started the Digital India campaign in July 2015 to ensure that government services are made available to citizens electronically by improving IT infrastructure and improving internet connectivity in the country. Government initiatives for the implementation of HCIT solutions, rise in government spending on healthcare systems, and the presence of skilled IT experts are favoring the growth of the global market in the Asia Pacific region.

Challenge: Data breaches and loss of confidentiality

The digitization of medical/patient information has created greater data risks and liabilities and increased the chance of data breaches. This could be mainly due to a lack of internal control over patient information, adherence to outdated policies and procedures/non-adherence to existing ones, and inadequate personnel training. The potential for data security and confidentiality breaches associated with digitization may affect the adoption of HCIT solutions in the short term until measures are taken to address current issues. As a result, this may negatively impact the growth of the market.

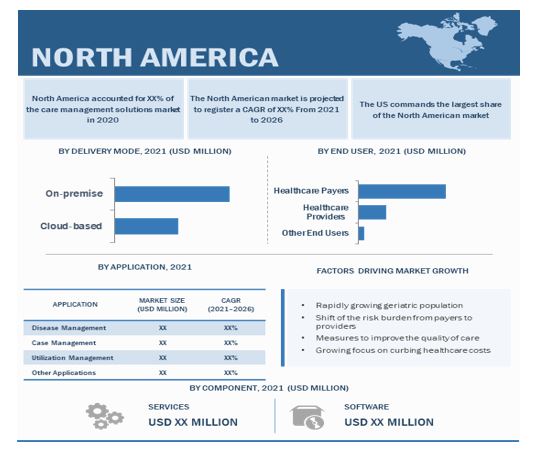

North America will witness significant growth in the care management solutions industry from 2021 to 2026.

North America is expected to account for the largest share of the care management solutions market in 2020, followed by Europe. The large share of North America can be attributed to the increased adoption of care management solutions by healthcare providers and payers to meet the healthcare goals of better quality care and lower healthcare costs. Also, several major global players are based in the US, owing to which the US has become a center for innovation in the global market.

EXL Service Holdings, Inc. (US), Casenet, LLC (US), Medecision Inc. (US), ZeOmega Inc. (US), Cognizant Technology Solutions (US), Cerner Corporation (US), Allscripts Healthcare Solutions, Inc. (US), and Epic Systems Corporation (US) are the key players in the care management solutions market.

Scope of the Care Management Solutions Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$12.6 billion |

|

Projected Revenue Size by 2026 |

$21.6 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 11.4% |

|

Market Driver |

Implementation of initiatives to shift the burden of risk from healthcare payers to providers |

|

Market Opportunity |

Emerging countries offer high-growth potential |

This report categorizes the care management solutions market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Software

- Services

By Delivery Mode

- On-premise

- Cloud-based

By Application

- Disease Management

- Case Management

- Utilization Management

- Other Applications

By End User

- Payers

- Providers

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

- RoW

Recent Developments of Care Management Solutions Industry

- In January 2021, Philips acquired Capsule Technologies, Inc. Capsule’s platform captures streaming clinical data and transforms it into actionable information for patient care management to enhance patient outcomes, improve collaboration between care teams, streamline clinical workflows and increase productivity

- In November 2019, Innovaccer partnered with Microsoft Teams to launch its care management solution. This new solution can assist care teams in sharing crucial patient information in real time and ensure seamless care delivery.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global care management solutions market?

The global care management solutions market boasts a total revenue value of $21.6 billion by 2026.

What is the estimated growth rate (CAGR) of the global care management solutions market?

The global care management solutions market has an estimated compound annual growth rate (CAGR) of 11.4% and a revenue size in the region of $12.6 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN: CARE MANAGEMENT SOLUTIONS MARKET

2.1.1 SECONDARY DATA

2.1.2 SECONDARY SOURCES

2.1.3 PRIMARY DATA

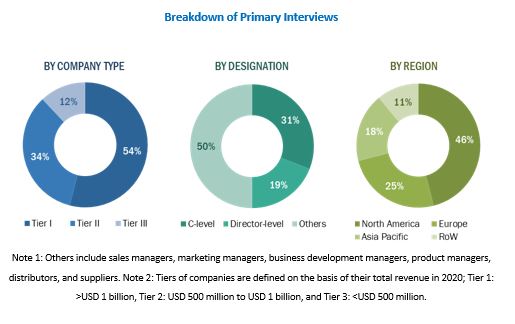

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT, 2021 VS. 2026 (USD MILLION)

FIGURE 8 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY DELIVERY MODE, 2021 VS. 2026 (USD MILLION)

FIGURE 9 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 MARKET OVERVIEW

FIGURE 10 GLOBAL MARKET TO WITNESS DOUBLE-DIGIT GROWTH RATE FROM 2021 TO 2026

4.2 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY END USER AND REGION (2020)

FIGURE 11 HEALTHCARE PAYERS SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2020

4.3 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY

FIGURE 12 EUROPE TO WITNESS THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 CARE MANAGEMENT SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Implementation of initiatives to shift the burden of risk from healthcare payers to providers

5.2.1.2 Government initiatives and regulations promoting patient-centric care

5.2.1.3 Rising geriatric population

5.2.1.3.1 Growing need to reduce healthcare costs

5.2.2 RESTRAINTS

5.2.2.1 Shortage of skilled professionals

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Technological advancements in healthcare IT solutions

5.2.3.3 Rising focus on personalized medicine

5.2.4 CHALLENGES

5.2.4.1 Lack of interoperability

5.2.4.2 High cost of deployment

5.2.4.3 Data breaches and loss of confidentiality

FIGURE 14 TYPES OF HEALTHCARE BREACHES REPORTED TO THE US DEPARTMENT OF HEALTH AND HUMAN SERVICES, 2018−2020

5.3 REGULATIONS

5.3.1 INTEROPERABILITY AND PATIENT ACCESS FINAL RULE

5.3.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996 (HIPAA)

5.3.3 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH ACT OF 2009 (HITECH)

5.3.4 CONSUMER PRIVACY PROTECTION ACT OF 2017

5.3.5 NATIONAL CYBERSECURITY PROTECTION ADVANCEMENT ACT OF 2015

5.3.6 CYBERSECURITY LAW OF THE PEOPLE’S REPUBLIC OF CHINA

5.3.7 AFFORDABLE CARE ACT, 2010

5.4 CASE STUDIES

5.4.1 CLOSING GAPS IN HEALTHCARE

5.4.1.1 Use case 1: Focus on identifying and closing gaps in healthcare

5.4.2 PRIORITIZING OUTREACH FOR CARE COORDINATION AMIDST THE PANDEMIC

5.4.2.1 Use case 2: Prioritizing outreach for care coordination amidst the COVID-19 pandemic

5.5 TECHNOLOGY ANALYSIS

TABLE 1 TECHNOLOGICAL DEVELOPMENTS BY LEADING VENDORS

5.6 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.7 ECOSYSTEM

FIGURE 15 GLOBAL MARKET ECOSYSTEM

5.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 DEGREE OF COMPETITION IS HIGH IN THE GLOBAL MARKET

6 CARE MANAGEMENT SOLUTIONS MARKET, BY COMPONENT (Page No. - 63)

6.1 INTRODUCTION

TABLE 2 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 3 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOFTWARE

6.2.1 SOFTWARE SEGMENT DOMINATED THE MARKET IN 2020

TABLE 4 CARE MANAGEMENT SOFTWARE MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 5 CARE MANAGEMENT SOFTWARE MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

6.3.1 INCREASING ADOPTION OF CARE MANAGEMENT SOLUTIONS TO DRIVE MARKET GROWTH

TABLE 6 CARE MANAGEMENT SERVICES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 7 CARE MANAGEMENT SERVICES MARKET, BY REGION, 2021–2026 (USD MILLION)

7 CARE MANAGEMENT SOLUTIONS MARKET, BY DELIVERY MODE (Page No. - 68)

7.1 INTRODUCTION

TABLE 8 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 9 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY DELIVERY MODE, 2021–2026 (USD MILLION)

7.2 ON-PREMISE SOLUTIONS

7.2.1 ON-PREMISE SOLUTIONS SEGMENT DOMINATED THE MARKET IN 2020

TABLE 10 ON-PREMISE CMS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 11 ON-PREMISE CMS MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 CLOUD-BASED SOLUTIONS

7.3.1 CLOUD-BASED SOLUTIONS SEGMENT TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 12 CLOUD-BASED CMS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 13 CLOUD-BASED CMS MARKET, BY REGION, 2021–2026 (USD MILLION)

8 CARE MANAGEMENT SOLUTIONS MARKET, BY END USER (Page No. - 73)

8.1 INTRODUCTION

TABLE 14 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY END USER, 2018–2020 (USD MILLION)

TABLE 15 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY END USER, 2021–2026 (USD MILLION)

8.2 HEALTHCARE PAYERS

8.2.1 GROWING STRINGENCY OF REGULATIONS FOR PAYERS IS DRIVING THE ADOPTION OF CARE MANAGEMENT SOLUTIONS

TABLE 16 GLOBAL MARKET FOR HEALTHCARE PAYERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 17 GLOBAL MARKET FOR HEALTHCARE PAYERS, BY REGION, 2021–2026 (USD MILLION)

8.3 HEALTHCARE PROVIDERS

8.3.1 HEALTHCARE PROVIDERS SEGMENT TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 18 GLOBAL MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 19 GLOBAL MARKET FOR HEALTHCARE PROVIDERS, BY REGION, 2021–2026 (USD MILLION)

8.4 OTHER END USERS

TABLE 20 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 21 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2021–2026 (USD MILLION)

9 CARE MANAGEMENT SOLUTIONS MARKET, BY APPLICATION (Page No. - 78)

9.1 INTRODUCTION

TABLE 22 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 23 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 DISEASE MANAGEMENT

9.2.1 DISEASE MANAGEMENT IS THE LARGEST AND FASTEST-GROWING APPLICATION SEGMENT IN THIS MARKET

TABLE 24 DISEASE MANAGEMENT SOLUTIONS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 DISEASE MANAGEMENT SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 27 DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 28 CANCER MANAGEMENT SOLUTIONS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 CANCER MANAGEMENT SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 COPD MANAGEMENT SOLUTIONS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 31 COPD MANAGEMENT SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 32 DIABETES MANAGEMENT SOLUTIONS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 DIABETES MANAGEMENT SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 CARDIOVASCULAR DISEASE MANAGEMENT SOLUTIONS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 35 CARDIOVASCULAR DISEASE MANAGEMENT SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 OTHER DISEASE MANAGEMENT SOLUTIONS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 OTHER DISEASE MANAGEMENT SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 CASE MANAGEMENT

9.3.1 CASE MANAGEMENT IS THE SECOND-LARGEST APPLICATION SEGMENT IN THIS MARKET

TABLE 38 CASE MANAGEMENT SOLUTIONS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 CASE MANAGEMENT SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4 UTILIZATION MANAGEMENT

9.4.1 DIVERSE FUNCTIONS PERFORMED BY UTILIZATION MANAGEMENT SOLUTIONS WILL DRIVE MARKET GROWTH

TABLE 40 UTILIZATION MANAGEMENT SOLUTIONS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 41 UTILIZATION MANAGEMENT SOLUTIONS MARKET, BY REGION, 2021–2026 (USD MILLION)

9.5 OTHER APPLICATIONS

TABLE 42 GLOBAL MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2020 (USD MILLION)

TABLE 43 GLOBAL MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

10 CARE MANAGEMENT SOLUTIONS MARKET, BY REGION (Page No. - 89)

10.1 INTRODUCTION

TABLE 44 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, BY REGION, 2018–2020 (USD MILLION)

TABLE 45 GLOBAL MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

TABLE 46 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 17 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US is the largest market for care management solutions

TABLE 58 US: MACROECONOMIC INDICATORS

TABLE 59 US: CARE MANAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 60 US: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 61 US: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 62 US: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 63 US: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 64 US: MARKET, BY END USER,2021–2026 (USD MILLION)

TABLE 65 US: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 66 US: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 67 US: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 68 US: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Implementation of digital health initiatives expected to drive market growth in Canada

TABLE 69 CANADA: CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 70 CANADA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 71 CANADA: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 72 CANADA: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 73 CANADA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 74 CANADA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 75 CANADA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 76 CANADA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 77 CANADA: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 78 CANADA: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 18 EUROPE: CARE MANAGEMENT SOLUTIONS MARKET SNAPSHOT

TABLE 79 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 84 EUROPE: SOLUTIONS MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 89 EUROPE: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 90 EUROPE: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.3.1 UK

10.3.1.1 Increasing public-private initiatives are supporting the adoption of care management solutions in the UK

TABLE 91 UK: CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 92 UK: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 93 UK: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 94 UK: MARKET, BY DELIVERY MODE 2021–2026 (USD MILLION)

TABLE 95 UK: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 96 UK: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 97 UK: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 98 UK: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 99 UK: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 100 UK: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Germany is the second-largest market for care management solutions in Europe

TABLE 101 GERMANY: CARE MANAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 102 GERMANY: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 103 GERMANY: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 104 GERMANY: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 105 GERMANY: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 107 GERMANY: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 108 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 109 GERMANY: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 110 GERMANY: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Rising geriatric population to support market growth

TABLE 111 FRANCE: CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT,2018–2020 (USD MILLION)

TABLE 112 FRANCE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 113 FRANCE: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 114 FRANCE: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 115 FRANCE: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 116 FRANCE: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 117 FRANCE: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 118 FRANCE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 119 FRANCE: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 120 FRANCE: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Increasing focus on improving patient care will drive the market growth

TABLE 121 ITALY: CARE MANAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 122 ITALY: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 123 ITALY: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 124 ITALY: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 125 ITALY: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 126 ITALY: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 127 ITALY: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 128 ITALY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 129 ITALY: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 130 ITALY: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increasing initiatives to promote HCIT solutions will support the market growth

TABLE 131 SPAIN: CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 132 SPAIN: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 133 SPAIN: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 134 SPAIN: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 135 SPAIN: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 136 SPAIN: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 137 SPAIN: MARKET, BY APPLICATION,2018–2020 (USD MILLION)

TABLE 138 SPAIN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 139 SPAIN: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 140 SPAIN: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 141 ROE: CARE MANAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 142 ROE: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 143 ROE: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 144 ROE: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 145 ROE: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 146 ROE: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 147 ROE: MARKET, BY APPLICATION,2018–2020 (USD MILLION)

TABLE 148 ROE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 149 ROE: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 150 ROE: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

TABLE 151 APAC: CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 152 APAC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 153 APAC: MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 154 APAC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 155 APAC: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 156 APAC: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 157 APAC: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 158 APAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 159 APAC: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 160 APAC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 161 APAC: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 162 APAC: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan accounted for the largest share of the APAC market in 2020

TABLE 163 JAPAN: CARE MANAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 165 JAPAN: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 166 JAPAN: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 167 JAPAN: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 168 JAPAN: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 169 JAPAN: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 170 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 171 JAPAN: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 172 JAPAN: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Government initiatives coupled with the focus on delivering comprehensive care to support market growth

TABLE 173 CHINA: CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 174 CHINA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 175 CHINA: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 176 CHINA: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 177 CHINA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 178 CHINA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 179 CHINA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 180 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 181 CHINA: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 182 CHINA: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Growing number of startups and increasing COVID-19 cases to drive market growth

TABLE 183 INDIA: CARE MANAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 184 INDIA: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 185 INDIA: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 186 INDIA: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 187 INDIA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 188 INDIA: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 189 INDIA: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 190 INDIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 191 INDIA: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 192 INDIA: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 193 ROAPAC: CARE MANAGEMENT SOLUTIONS INDUSTRY, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 194 ROAPAC: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 195 ROAPAC: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 196 ROAPAC: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 197 ROAPAC: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 198 ROAPAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 199 ROAPAC: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 200 ROAPAC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 201 ROAPAC: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 202 ROAPAC: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 203 ROW: CARE MANAGEMENT SOLUTIONS MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 204 ROW: MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 205 ROW: MARKET, BY DELIVERY MODE, 2018–2020 (USD MILLION)

TABLE 206 ROW: MARKET, BY DELIVERY MODE, 2021–2026 (USD MILLION)

TABLE 207 ROW: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 208 ROW: MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 209 ROW: MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 210 ROW: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 211 ROW: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 212 ROW: DISEASE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 158)

11.1 INTRODUCTION

FIGURE 19 KEY MARKET DEVELOPMENTS, JANUARY 2018 AND MAY 2021

11.2 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 20 CARE MANAGEMENT SOLUTIONS MARKET: REVENUE ANALYSIS OF KEY MARKET PLAYERS (2020)

11.3 MARKET RANKING ANALYSIS

FIGURE 21 CERNER DOMINATED THE GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY IN 2020

11.4 COMPETITIVE LEADERSHIP MAPPING

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 EMERGING COMPANIES

FIGURE 22 COMPETITIVE LEADERSHIP MAPPING: GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY, 2020

11.5 COMPETITIVE LEADERSHIP MAPPING – START-UPS/SMES

11.5.1 PROGRESSIVE COMPANIES

11.5.2 STARTING BLOCKS

11.5.3 RESPONSIVE COMPANIES

11.5.4 DYNAMIC COMPANIES

FIGURE 23 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2020

11.6 GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY: GEOGRAPHICAL ASSESSMENT

FIGURE 24 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN THE GLOBAL CARE MANAGEMENT SOLUTIONS INDUSTRY (2020)

11.7 COMPETITIVE SITUATION AND TRENDS

11.7.1 PRODUCT LAUNCHES AND APPROVALS

11.7.1.1 Other developments

12 COMPANY PROFILES (Page No. - 168)

12.1 MAJOR PLAYERS

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12.1.1 ALLSCRIPTS HEALTHCARE SOLUTIONS

TABLE 213 ALLSCRIPTS HEALTHCARE SOLUTIONS: BUSINESS OVERVIEW

FIGURE 25 COMPANY SNAPSHOT: ALLSCRIPTS HEALTHCARE SOLUTIONS (2020)

12.1.2 CERNER CORPORATION

TABLE 214 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 26 COMPANY SNAPSHOT: CERNER CORPORATION (2020)

12.1.3 CASENET, LLC

TABLE 215 CASENET, LLC: BUSINESS OVERVIEW

12.1.4 MEDECISION, INC.

TABLE 216 MEDECISION, INC: BUSINESS OVERVIEW

12.1.5 TCS HEALTHCARE TECHNOLOGIES

TABLE 217 TCS HEALTHCARE TECHNOLOGIES: BUSINESS OVERVIEW

12.1.6 SALESFORCE.COM, INC.

TABLE 218 SALESFORCE.COM, INC: BUSINESS OVERVIEW

FIGURE 27 COMPANY SNAPSHOT: SALESFORCE.COM, INC. (2020)

12.1.7 I2I POPULATION HEALTH

TABLE 219 I2I POPULATION HEALTH: BUSINESS OVERVIEW

12.1.8 ZEOMEGA INC.

TABLE 220 ZEOMEGA INC.: BUSINESS OVERVIEW

12.1.9 HEALTH CATALYST LLC.

TABLE 221 HEALTH CATALYST LLC: BUSINESS OVERVIEW

FIGURE 28 COMPANY SNAPSHOT: HEALTH CATALYST LLC (2020)

12.1.10 ATHENAHEALTH, INC.

TABLE 222 ATHENAHEALTH: BUSINESS OVERVIEW

12.1.11 EPIC SYSTEMS CORPORATION

TABLE 223 EPIC SYSTEMS CORPORATION: BUSINESS OVERVIEW

12.1.12 COGNIZANT TECHNOLOGY SOLUTIONS

TABLE 224 COGNIZANT TECHNOLOGY SOLUTIONS: BUSINESS OVERVIEW

FIGURE 29 COMPANY SNAPSHOT: COGNIZANT TECHNOLOGY SOLUTIONS (2020)

12.1.13 IBM CORPORATION

TABLE 225 IBM CORPORATION: BUSINESS OVERVIEW

FIGURE 30 COMPANY SNAPSHOT: IBM CORPORATION (2020)

12.1.14 PEGASYSTEMS INC.

TABLE 226 PEGASYSTEMS INC.: BUSINESS OVERVIEW

FIGURE 31 COMPANY SNAPSHOT: PEGASYSTEMS INC. (2020)

12.1.15 EXL SERVICE HOLDINGS, INC.

TABLE 227 EXL SERVICE HOLDINGS INC.: BUSINESS OVERVIEW

FIGURE 32 COMPANY SNAPSHOT: EXL SERVICE HOLDINGS INC. (2020)

12.1.16 KONINKLIJKE PHILIPS N.V.

TABLE 228 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

FIGURE 33 COMPANY SNAPSHOT: KONINKLIJKE PHILIPS N.V. (2020)

12.1.17 WELLSKY (FORMERLY MEDIWARE INFORMATION SYSTEMS)

TABLE 229 WELLSKY: BUSINESS OVERVIEW

12.1.18 HGS AXIS POINT HEALTH LLC.

12.1.19 NEXTGEN HEALTHCARE, INC.

12.1.20 ECLINICALWORKS

12.1.21 VIRTUALHEALTH

12.1.22 OPTUM (A PART OF UNITEDHEALTH GROUP)

12.1.23 ASSURECARE LLC

12.1.24 INNOVACCER

12.1.25 ARCADIA

(Business Overview, Products Offered, Recent Developments, MnM View)*

13 APPENDIX (Page No. - 220)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities in estimating the size of the Care management solutions market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the American Case Management Association (ACMA), American Association of Healthcare Administrative Management (AAHAM), Commission for Case Manager Certification (CC), American Association of Managed Care Nurses (AAMCN), Case Management Society of Australia and New Zealand (CMSA), Institute for Health Technology Transformation (iHT2), Healthcare Information and Management Systems Society (HIMSS), American Medical Group Association (AMGA), International Association of Health Policy (IAHP), Institute of Population and Public Health (IPPH), Public Health Agency of Canada (PHAC), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the care management solutions market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the care management solutions market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Care management solutions market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Report Objectives

- To define, describe, and forecast the care management solutions market on the basis of component, delivery mode, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as agreements, collaborations, and partnerships; product deployments; product launches, enhancements, and integrations; acquisitions; and expansions in the care management solutions market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the care management solutions market.

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Care Management Solutions Market