Cardiac Safety Services Market by Type (Standalone, Integrated), Services (ECG/Holter Measurement, Blood Pressure Measurement, Cardiac Imaging, Thorough QT Studies), End User (Pharmaceutical & Biopharma, CROs) & Region - Global Forecast to 2028

Updated on : September 24, 2024

Overview of the Cardiac Safety Services Market

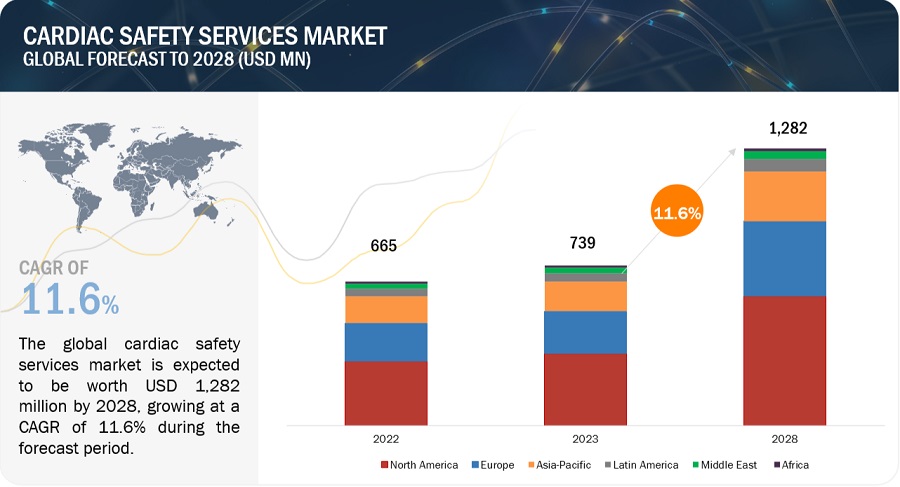

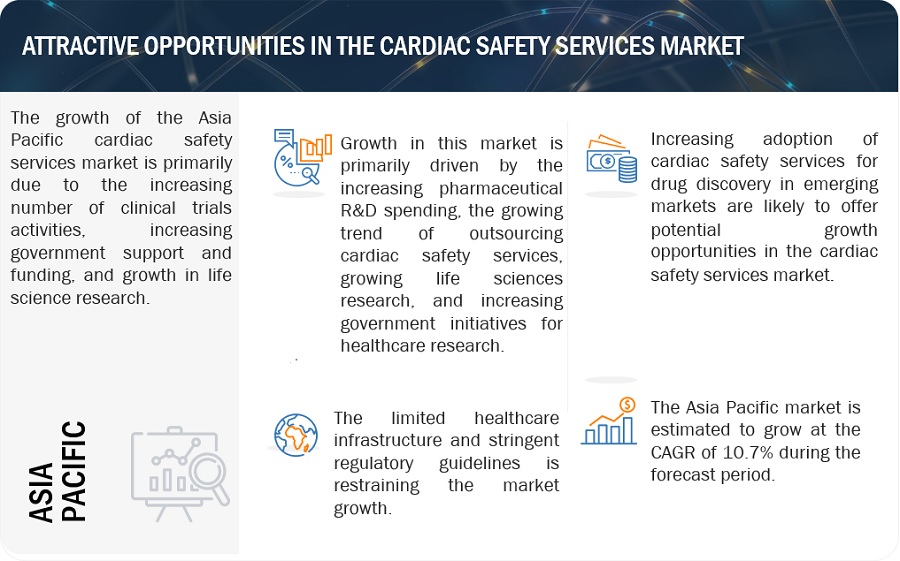

The global Cardiac safety services market market, valued at US$665 million in 2022, stood at US$739 million in 2023 and is projected to advance at a resilient CAGR of 11.6% from 2023 to 2028, culminating in a forecasted valuation of US$1,282 million by the end of the period. Key drivers of this growth include the rising incidence of cardiovascular diseases, which boosts demand from pharmaceutical companies and CROs. However, challenges such as inadequate cardiotoxicity testing and high evaluation costs are notable constraints. Opportunities are emerging through new methods to detect cardiotoxicity, such as digital twin technology and non-invasive imaging. North America is anticipated to lead the market, supported by a strong pharmaceutical sector and extensive clinical trials. Major players include Laboratory Corporation of America Holdings, Medpace, and IQVIA.

The growth of this market is majorly driven by the rising pace of R&D and growing expenditure. On the other hand, inadequacy of cardiotoxicity testing is a major factor restraining market growth to a certain extent.

Cardiac Safety Services Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Cardiac Safety Services Market Dynamics

DRIVER: Rising incidence of cardiovascular diseases

The increasing incidence of cardiovascular diseases directly amplifies the demand for cardiac safety services by pharmaceutical companies and Contract Research Organizations (CROs) in various ways. For instance, According to the World Health Organization (WHO), cardiovascular diseases (CVDs) are the leading cause of death globally, taking an estimated 17.9 million lives annually. Similarly, according to AstraZeneca report (UK) around 523 million people live with CVD globally. Moreover, according to the Centers for Disease Control and Prevention (CDC), heart disease is the leading cause of death for men, women, and people of most racial & ethnic groups in the US, about 695,000 people in the US died from heart disease in 2021—that’s one in every five deaths. Therefore, the rising incidence of cardiovascular diseases ensures the critical role of cardiac safety services in ensuring patient safety, regulatory compliance, and the success of cardiovascular drug development initiatives.

RESTRAINT: Inadequacy of cardiotoxicity testing

Inadequacy of cardiotoxicity testing represents a critical bottleneck in the market, with far-reaching implications. Patient safety is compromised when potential cardiac risks associated with drugs or treatments go undetected, potentially resulting in severe health consequences. For instance, when cardiotoxicity testing is not properly done, it can lead to the approval of drugs that later show serious cardiovascular side effects. For example, the FDA approved Vioxx, but it was later withdrawn from the market due to concerns about its heart-related risks. Such occurrences can cause delays in new drug approvals as regulatory agencies become more cautious. Regulatory hurdles become pronounced, as regulatory agencies like the FDA and EMA demand comprehensive cardiac safety evaluations for drug approvals. Thus, an inadequacy in testing can lead to delays in drug development and market entry. Furthermore, the repercussions extend to research & development, with companies hesitant to invest in drugs that may carry cardiac side effects, stifling innovation. Moreover, this situation can tarnish the reputation of pharmaceutical companies and CROs, affecting their competitiveness.

OPPORTUNITY: Emergence of new methods to curb cardiotoxicity

The evolution of mechanistic preclinical strategies for the detection of drug-induced electrophysiological and structural cardiotoxicity, mainly using in vitro human ion channel assays, human-based in silico reconstructions, and human stem cell-derived cardio¬myocytes. New methods such as digital twin technology, non-invasive electrocardiographic imaging (ECGI), high-throughput screening assays are gaining popularity in the market, and it presents a paradigm shift from traditional approaches that rely on simplistic in vitro assays. These new strategies can improve sensitivity and specificity in the early detection of genuine cardiotoxicity risks, thereby reducing the likelihood of mistakenly discarding viable drug candidates and expediting the progression of worthy drugs to the clinical trial stage. The introduction of these new methods, given their high efficiency and their growing usage, will provide significant opportunities for cardiac safety services to expand in the coming years. Furthermore, these methods encompass advancements in drug formulations, delivery systems, and targeted therapies, as well as more sensitive biomarkers and in vitro models for early cardiotoxicity detection. For cardiac safety services providers, these new methods represent a vital role in offering specialized guidance to pharmaceutical companies and researchers by facilitating comprehensive cardiac safety assessments, including monitoring during clinical trials, data analysis, and adherence to regulatory standards.

CHALLENGE: High cost of cardiac safety evaluation services

The US FDA’s Critical Path Initiative emerged with the general recognition that the rising costs of drug development and the decline in the number of new drugs approved in the US are significant problems that threaten public health. For example, cardiac safety evaluations of off-target drug effects are generally expensive, time-consuming, and contribute to the termination of many new molecular entities. cardiac safety evaluation thus constitutes an area that fits the core mission of the FDA’s Critical Path. However, the high cost remains a challenge for pharmaceutical & biopharmaceutical companies, as conducting the usual stand-alone Thorough QT (TQT) can cost USD 2–4 million, a huge investment before the commercialization of a new molecule/drug. This cost challenge encompasses several aspects of cardiac safety assessment, including the need for specialized equipment, extensive data analysis, and compliance with stringent regulatory requirements. Some cardiac safety evaluations entail the continuous monitoring of patients, particularly in clinical trials for drugs with potential cardiovascular side effects. This ongoing monitoring involves dedicated staffing and resources, further contributing to overall expenditure. For instance, in a clinical trial for a novel hypertension treatment, the continuous monitoring of participants' blood pressure and heart rate is essential, necessitating the deployment of dedicated personnel and equipment.

Cardiac Safety Services Market Ecosystem

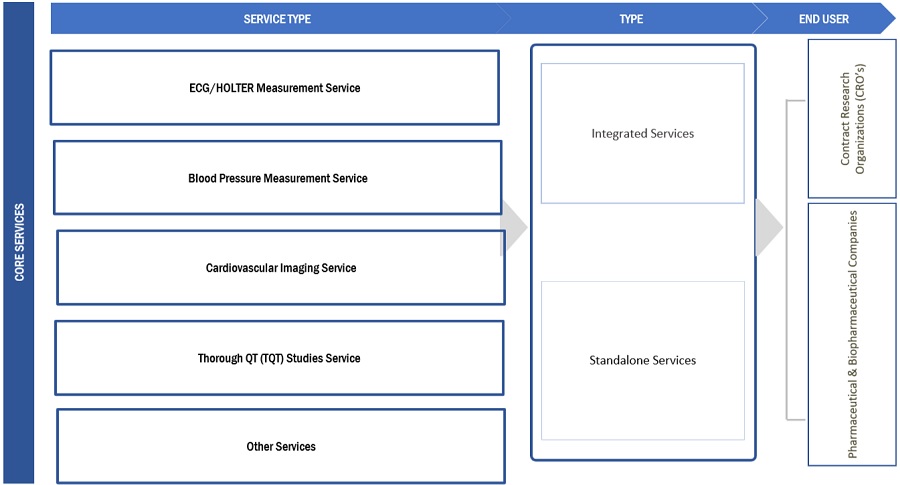

The cardiac safety services market is a complex ecosystem involving various stakeholders, including supply side i.e companies providing cardiac safety services and demand side i.e. pharmaceutical & biopharmaceutical companies and contract research organization (CROs).

Several key companies provide cardiac safety services . For example, Laboratory Corporation of America Holdings (US) is the leading market player. LabCorp has built its expertise in entering new markets and successfully impacting them. The company has pursued competitive strategies such as acquisitions and expansions to solidify its market presence. The company provides cardiac safety services through its LabCorp Drug Development or DD segment. This segment provides end-to-end drug development, medical device, and companion diagnostic development solutions from early-stage research to clinical development and commercial market access. Other service providers include Medpace (US), Koninklijke Philips N.V. (Netherland), Clario (US), Ncardia (Netherlands), and others.

The integrated services segment dominated cardiac safety services industry by type

Integrated cardiac safety services refer to a comprehensive collection of clinical & medical services that help monitor and assessing the potential effects of a drug in the cardiovascular system. Integrated services are provided as a bundle of services to pharmaceutical & biopharmaceutical companies. These include cardiac safety services, such as cardiovascular imaging services, blood pressure measurement, ECG/ Holter measurement TQT studies, and profile QT studies. Integrated services offer multiple benefits as compared to standalone services. For instance, TQT services of MedPace monitor off-target cardiovascular liability and onsite multichannel telemetry conducted by certified nurses to aid in the real-time assessment of heart rate and rhythm. As a result, these services help enhance and expedite clinical trials in the pharmaceutical and biopharmaceutical development cycle.

The ECG/Holter measurement services segment dominated cardiac safety services industry by service type

ECG is a widely used diagnostic tool for assessing cardiac arrhythmias, acute & old cardiac ischemia, and left ventricular hypertrophy. Further analysis allows differentiating between physiological & pathological bradycardia & tachycardia and changes in conduction times (QT time or bundle branch block). As such, ECG continues to plays a critical role in many clinical trials studying the cardiac safety of a drug across all clinical study phases. Holter measurements are continuous ECG measurements that allow for extended analysis outside the pre-specified windows, including arrhythmia analysis, trends assessment, and enhanced quality metrics. These services help in the R&D of novel methods for clinical trials and drug discovery. For instance, ECG/ Holter data can serve as sources for identifying novel biomarkers associated with cardiac health or specific disease conditions.

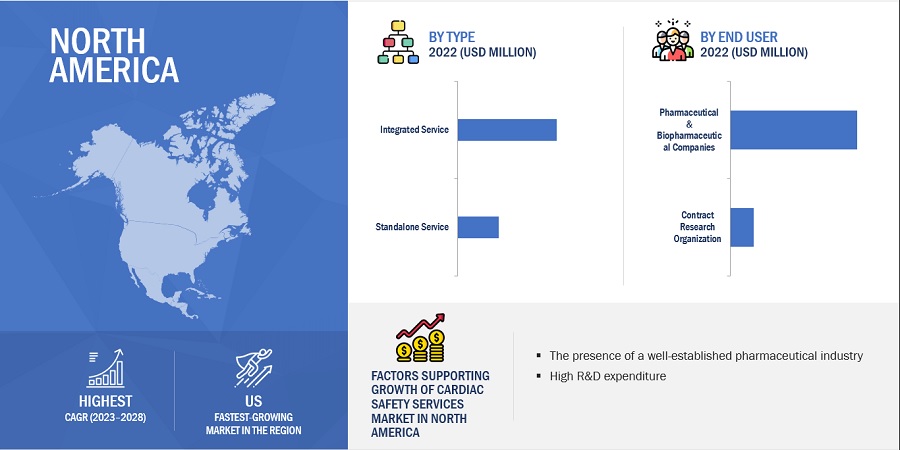

North America region of the cardiac safety services industry is estimated to register the highest CAGR during the forecast period.

North America offers lucrative growth potential for the cardiac safety services market. This can be attributed to the presence of a well-established pharmaceutical industry, many ongoing clinical trial studies, high R&D expenditure, growth in the biosimilars and generics market, and rising outsourcing of preclinical, clinical, and laboratory testing services by pharmaceutical and biopharmaceutical companies.

According to ClinicalTrials.gov, as of December 2022, around 31% of registered and 33% of recruiting clinical studies are conducted in the US. This can be attributed to the presence of world-class facilities for conducting clinical trials in the country and the significant investments in R&D for drug development. Moreover, North America is the largest pharmaceutical market in the world with many global pharmaceutical and medical device giants, such as Pfizer (US), AbbVie (US), Abbott Laboratories (US), and Johnson & Johnson (US), headquartered in the region.

Some of the major players operating in the North American cardiac safety services market are IQVIA (US), Laboratory Corporation of America Holdings (US), ICON (US), and PPD, Inc. (US)

To know about the assumptions considered for the study, download the pdf brochure

Key players in the cardiac safety services market include Laboratory Corporation of America Holdings (US), Medpace (US), Koninklijke Philips N.V. (Netherland), Clario (US), Ncardia (Netherlands), IQVIA (US), Certara (US), PPD Inc. (Part of Thermo Fisher Scientific, Inc.) (US), SGS S.A. (Switzerland), ICON Plc (Ireland), WuXi AppTec (China), Charles River Laboratories (US), Eurofins Scientific (Luxembourg), Frontage Labs (US), Banook Group (France), Biotrial (France), Celerion (US), Richmond Pharmacology (UK), PhysioStim (France), Shanghai Medicilon Inc. (China), ACM Global Laboratories (India), Worldwide Clinical Trials (US), Nova Research Laboratories LLC (US), Biobeat (Israel), and CRS. Experts. Early Phase. (Germany).

Scope of the Cardiac Safety Services Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$739 million |

|

Projected Revenue Size by 2028 |

$1,282 million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 11.6% |

|

Market Driver |

Rising incidence of cardiovascular diseases |

|

Market Opportunity |

Emergence of new methods to curb cardiotoxicity |

This report categorizes the Cardiac Safety Services Market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Integrated Services

- Standalone Services

By Service Type

- ECG/Holter Measurement Services

- Blood Pressure Measurement Services

- Cardiovascular Imaging Services

- Thorough QT Studies Services

- Other Cardiac Safety Services

By End User

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research Organization (CROs)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Australia

- Rest of Asia Pacific (RoAPAC)

-

Latin America (LATAM)

- Brazil

- Rest of Latin America (RoLATAM)

- Middle East

- Africa

Recent Developments of Cardiac Safety Services Industry

- In August 2023, Clarion (US) collaborated with Dr. Vince Clinical Research (DVCR) (US). The strategic collaboration helps Clario (US) deliver accurate and cost-efficient cardiac safety data in the early clinical development stages.

- In October 2022, IQVIA (US) launched its first self-collection safety lab panel for US clinical trial participants by a leading global clinical trial laboratory.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global cardiac safety services market?

The global cardiac safety services market boasts a total revenue value of $1,282 million by 2028.

What is the estimated growth rate (CAGR) of the global cardiac safety services market?

The global cardiac safety services market has an estimated compound annual growth rate (CAGR) of 11.6% and a revenue size in the region of $739 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising incidence of cardiovascular diseases- Increasing outsourcing of services to CROs- High number of clinical trials for cardiac treatmentsRESTRAINTS- Stringent regulations and compliance guidelines- Inadequacy of cardiotoxicity testingOPPORTUNITIES- Emergence of innovative testing methods- Growth in biosimilars and biologics developmentCHALLENGES- High cost of cardiac safety evaluation servicesTRENDS- Rising technological advancements- Transition to patient-centric approach

- 5.3 TECHNOLOGY ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.7 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 PRICING ANALYSIS

- 5.9 KEY CONFERENCES AND EVENTS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 INTEGRATED SERVICESCOMPREHENSIVE DATA INTEGRATION AND IMPROVED QUALITY TO PROPEL MARKET

-

6.3 STANDALONE SERVICESCOST-EFFECTIVE BENEFITS TO SUPPORT MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 ECG/HOLTER MEASUREMENT SERVICESFEATURES SUCH AS TREND ASSESSMENT AND ENHANCED QUALITY METRICS TO BOOST DEMAND

-

7.3 BLOOD PRESSURE MEASUREMENT SERVICESGROWING IMPORTANCE IN CARDIOVASCULAR HEALTH ASSESSMENT TO SUPPORT GROWTH

-

7.4 CARDIOVASCULAR IMAGING SERVICESNEED TO ASSESS DRUG EFFICACY AND SAFETY TO PROPEL DEMAND

-

7.5 THOROUGH QT STUDIESNEED TO CONDUCT CLINICAL INVESTIGATIONS AND MEASURE MEDICAL INTERVENTION TO DRIVE GROWTH

- 7.6 OTHER CARDIAC SAFETY SERVICES

- 8.1 INTRODUCTION

-

8.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIESGROWING COLLABORATIONS FOR CLINICAL TRIALS TO PROPEL MARKET

-

8.3 CONTRACT RESEARCH ORGANIZATIONS (CROS)RISING OUTSOURCING OF DRUG DISCOVERY SERVICES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Increasing clinical trials for drug discovery & development to drive marketCANADA- Availability of high-end facilities for drug discovery to propel marketNORTH AMERICA: RECESSION IMPACT

-

9.3 EUROPEGERMANY- High pharmaceutical production to propel marketUK- Growth in life science research to drive marketFRANCE- Growing focus on biosimilars to fuel marketITALY- Availability of funding for novel services to support market growthSPAIN- Presence of multinational pharma companies to drive marketREST OF EUROPEEUROPE: RECESSION IMPACT

-

9.4 ASIA PACIFICCHINA- China to dominate APAC market for cardiac safety servicesJAPAN- Supportive regulatory policies for safety measures to drive marketINDIA- Rising growth in pharmaceutical & biotechnology industries to propel marketAUSTRALIA- Rising investments by medical device companies to support market growthREST OF ASIA PACIFICASIA PACIFIC: RECESSION IMPACT

-

9.5 LATIN AMERICABRAZIL- Low costs and presence of skilled clinical investigators to drive marketREST OF LATIN AMERICALATIN AMERICA: RECESSION IMPACT

-

9.6 MIDDLE EASTGROWING CRO HUB TO DRIVE MARKETMIDDLE EAST: RECESSION IMPACT

-

9.7 AFRICARISING PREVALENCE OF CARDIOVASCULAR DISEASES TO SUPPORT MARKET GROWTHAFRICA: RECESSION IMPACT

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE SHARE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.6 COMPETITIVE BENCHMARKING OF LEADING 25 PLAYERS (2022)SERVICE FOOTPRINT OF COMPANIES (25 COMPANIES)REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

-

10.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.8 COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS (2022)

-

10.9 COMPETITIVE SCENARIO AND TRENDSSERVICE LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSLABORATORY CORPORATION OF AMERICA HOLDINGS- Business overview- Services offered- Recent developments- MnM viewMEDPACE- Business overview- Services offered- Recent developments- MnM viewKONINKLIJKE PHILIPS N.V.- Business overview- Services offered- Recent developments- MnM viewCLARIO- Business overview- Services offered- Recent developmentsNCARDIA- Business overview- Services offered- Recent developmentsIQVIA- Business overview- Services offered- Recent developmentsCERTARA- Business overview- Services offeredPPD, INC. (PART OF THERMO FISHER SCIENTIFIC, INC.)- Business overview- Services offered- Recent developmentsSGS S.A.- Business overview- Services offered- Recent developmentsICON PLC- Business overview- Services offered- Recent developmentsWUXI APPTEC- Business overview- Services offeredCHARLES RIVER LABORATORIES- Business overview- Services offeredEUROFINS SCIENTIFIC- Business overview- Services offeredFRONTAGE LABS- Business overview- Services offered- Recent developmentsBANOOK GROUP- Business overview- Services offered- Recent developments

-

11.2 OTHER PLAYERSBIOTRIALCELERIONRICHMOND PHARMACOLOGYPHYSIOSTIMSHANGHAI MEDICILON INC.ACM GLOBAL LABORATORIESWORLDWIDE CLINICAL TRIALSNOVA RESEARCH LABORATORIES LLCBIOBEATCRS. EXPERTS. EARLY PHASE.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 2 CARDIAC SAFETY SERVICES MARKET: IMPACT ANALYSIS

- TABLE 3 CARDIAC SAFETY SERVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 CARDIAC SAFETY SERVICES MARKET: LIST OF KEY CONFERENCES AND EVENTS (2023–2024)

- TABLE 10 CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 11 INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 12 NORTH AMERICA: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 13 EUROPE: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 ASIA PACIFIC: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 LATIN AMERICA: INTEGRATED CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 STANDALONE CARDIAC SAFETY SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 NORTH AMERICA: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 EUROPE: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 ASIA PACIFIC: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 LATIN AMERICA: STANDALONE CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 22 ECG/HOLTER MEASUREMENT SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: ECG/HOLTER MEASUREMENT SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 LATIN AMERICA: ECG/HOLTER MEASUREMENT SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 BLOOD PRESSURE MEASUREMENT SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: BLOOD PRESSURE MANAGEMENT SERVICES MARKET BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 EUROPE: BLOOD PRESSURE MANAGEMENT SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: BLOOD PRESSURE MANAGEMENT SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 LATIN AMERICA: BLOOD PRESSURE MANAGEMENT SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 CARDIOVASCULAR IMAGING SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 EUROPE: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 LATIN AMERICA: CARDIOVASCULAR IMAGING SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 THOROUGH QT STUDIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 EUROPE: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 LATIN AMERICA: THOROUGH QT STUDIES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 OTHER CARDIAC SAFETY SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 EUROPE: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 LATIN AMERICA: OTHER CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 48 CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET FOR CONTRACT RESEARCH ORGANIZATIONS (CROS), BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 CARDIAC SAFETY SERVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 63 TOTAL NUMBER OF CLINICAL TRIALS REGISTERED

- TABLE 64 US: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 US: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 66 US: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 67 CANADA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 CANADA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 76 GERMANY: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 77 UK: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 78 UK: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 79 UK: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 80 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 82 FRANCE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 ITALY: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 ITALY: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 85 ITALY: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 86 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 88 SPAIN: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 91 REST OF EUROPE: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 CHINA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 CHINA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 98 CHINA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 101 JAPAN: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 102 INDIA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 INDIA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 104 INDIA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 105 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 107 AUSTRALIA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 111 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 114 LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 BRAZIL: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 BRAZIL: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 117 BRAZIL: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 118 REST OF LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 REST OF LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 120 REST OF LATIN AMERICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 MIDDLE EAST: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 124 AFRICA: CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 AFRICA: CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2021–2028 (USD MILLION)

- TABLE 126 AFRICA: CARDIAC SAFETY SERVICES MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 CARDIAC SAFETY SERVICES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 128 CARDIAC SAFETY SERVICES MARKET: SERVICE FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 129 CARDIAC SAFETY SERVICES MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 130 CARDIAC SAFETY SERVICES MARKET: DETAILED LIST OF STARTUPS/SME PLAYERS

- TABLE 131 CARDIAC SAFETY SERVICES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS

- TABLE 132 CARDIAC SAFETY SERVICES MARKET: SERVICE LAUNCHES (JANUARY 2020−SEPTEMBER 2023)

- TABLE 133 CARDIAC SAFETY SERVICES MARKET: DEALS (JANUARY 2020−SEPTEMBER 2023)

- TABLE 134 CARDIAC SAFETY SERVICES MARKET: OTHER DEVELOPMENTS (JANUARY 2020−SEPTEMBER 2023)

- TABLE 135 LABORATORY CORPORATION OF AMERICA HOLDINGS: BUSINESS OVERVIEW

- TABLE 136 MEDPACE: BUSINESS OVERVIEW

- TABLE 137 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 138 CLARIO: BUSINESS OVERVIEW

- TABLE 139 NCARDIA: BUSINESS OVERVIEW

- TABLE 140 IQVIA: BUSINESS OVERVIEW

- TABLE 141 CERTARA: BUSINESS OVERVIEW

- TABLE 142 PPD, INC.: BUSINESS OVERVIEW

- TABLE 143 SGS S.A.: BUSINESS OVERVIEW

- TABLE 144 ICON PLC: BUSINESS OVERVIEW

- TABLE 145 WUXI APPTEC: BUSINESS OVERVIEW

- TABLE 146 CHARLES RIVER LABORATORIES: BUSINESS OVERVIEW

- TABLE 147 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 148 FRONTAGE LABS: BUSINESS OVERVIEW

- TABLE 149 BANOOK GROUP: BUSINESS OVERVIEW

- FIGURE 1 CARDIAC SAFETY SERVICES MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 CARDIAC SAFETY SERVICES MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION FOR CARDIAC SAFETY SERVICES: REVENUE SHARE ANALYSIS

- FIGURE 6 MARKET VALIDATION FROM PRIMARY EXPERTS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 CARDIAC SAFETY SERVICES MARKET: CAGR PROJECTIONS

- FIGURE 9 CARDIAC SAFETY SERVICES MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 CARDIAC SAFETY SERVICES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 CARDIAC SAFETY SERVICES MARKET, BY SERVICE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 CARDIAC SAFETY SERVICES MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF CARDIAC SAFETY SERVICES MARKET

- FIGURE 15 RISING INCIDENCE OF CARDIOVASCULAR DISEASES TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 16 INTEGRATED SERVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- FIGURE 17 ECG/HOLTER MEASUREMENT SERVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 EUROPEAN COUNTRIES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 CARDIAC SAFETY SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, CHALLENGES, AND TRENDS

- FIGURE 20 TOTAL CLINICAL TRIAL REGISTRATIONS WORLDWIDE (2000−2022)

- FIGURE 21 CARDIAC SAFETY SERVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 CARDIAC SAFETY SERVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 CARDIAC SAFETY SERVICES MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA FOR END USERS

- FIGURE 25 NORTH AMERICA: CARDIAC SAFETY SERVICES MARKET SNAPSHOT

- FIGURE 26 EUROPE: CARDIAC SAFETY SERVICES MARKET SNAPSHOT

- FIGURE 27 CARDIAC SAFETY SERVICES MARKET: STRATEGIES ADOPTED BY KEY PLAYERS (2020−2023)

- FIGURE 28 CARDIAC SAFETY SERVICES MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 29 REVENUE SHARE ANALYSIS FOR KEY COMPANIES (2020−2022)

- FIGURE 30 CARDIAC SAFETY SERVICES MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- FIGURE 31 CARDIAC SAFETY SERVICES MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 32 LABORATORY CORPORATION OF AMERICA HOLDINGS: COMPANY SNAPSHOT (2022)

- FIGURE 33 MEDPACE: COMPANY SNAPSHOT (2022)

- FIGURE 34 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 35 IQVIA: COMPANY SNAPSHOT (2022)

- FIGURE 36 CERTARA: COMPANY SNAPSHOT (2022)

- FIGURE 37 PPD, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 38 SGS S.A.: COMPANY SNAPSHOT (2022)

- FIGURE 39 ICON PLC: COMPANY SNAPSHOT (2022)

- FIGURE 40 WUXI APPTEC: COMPANY SNAPSHOT (2022)

- FIGURE 41 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT

- FIGURE 42 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 43 FRONTAGE LABS: COMPANY SNAPSHOT (2022)

This research study involved the extensive use of Secondary sources, directories, and databases were used extensively to identify and collect helpful information for this technical, market-oriented, and financial study of the global cardiac safety services market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess the market growth prospects. The global size of the market (estimated through various secondary research approaches) was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include directories; databases such as Bloomberg Businessweek, Factiva, and Wall Street Journal; white papers; and clinicaltrial.gov, among others. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research. Some of the key secondary sources referred to for this study include, World Health Organization (WHO), Food and Drug Administration (FDA), Association of Clinical Research Organizations (ACRO), Clinical Research Society (CRS), Clinical Research Association of Canada (CRAC), Association of International Contract Research Organizations (AICROS), Clinical and Contract Research Association (CCRA), American Association of Pharmaceutical Scientists (AAPS), Pharmaceutical Research and Manufacturers of America (PhRMA), European Medicines Agency (EMA), International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), Safety Pharmacology Society (SPS) and Cardiac Safety Research Consortium (CSRC).

Primary Research

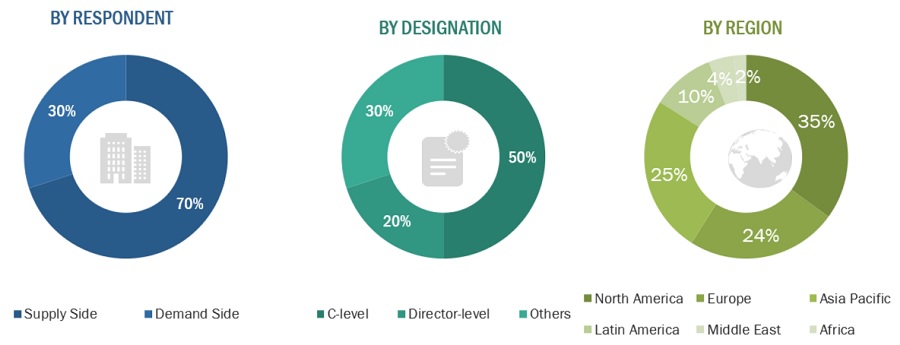

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand-side personnel (such as contract research organizations (specialists), academic medical researchers, scientists, and pharmaceutical and biopharmaceutical company experts) and supply-side (such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market) across six major regions—North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants respectively. This preliminary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

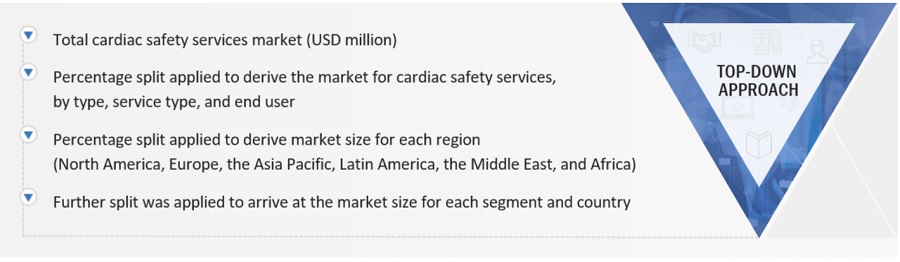

The global size of the market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the Cardiac Safety Services Market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

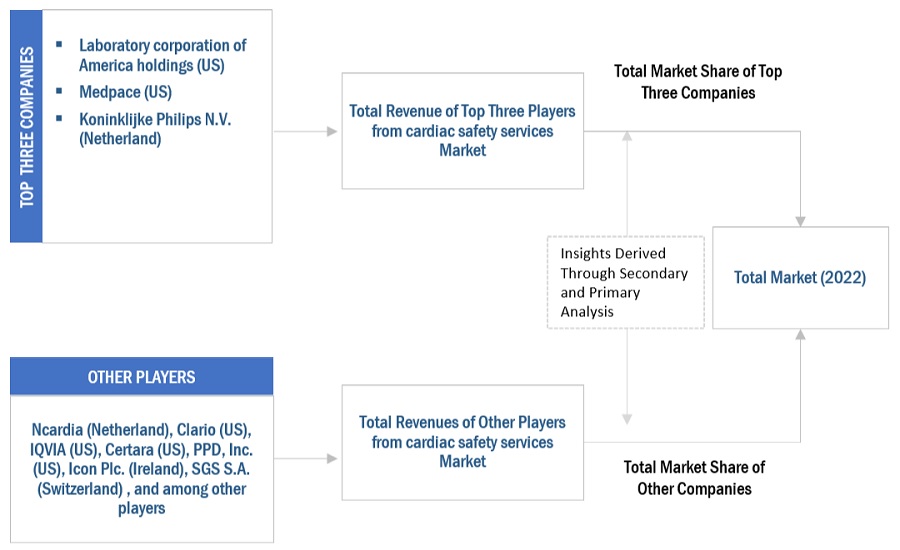

- The key players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the cardiac safety services business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Cardiac Safety Services Market: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Cardiac Safety Services Market: Top Down Approach

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Cardiac safety services encompass a specialized range of services conducted within the pharmaceutical & biopharmaceutical industries. These services aim to assess the safety of new drugs and monitor the potential effects on the cardiovascular system. This market involves services such as continuous cardiac monitoring during clinical trials, electrocardiography (ECG) services, cardiovascular risk assessment, regulatory compliance, data management, consulting, arrhythmia detection, and QT interval analysis. Its primary purpose is to support pharmaceutical & biopharmaceutical companies in adhering to regulatory standards, assessing the cardiac safety of their products, and ultimately safeguarding patient well-being while advancing medical innovations.

Key Stakeholders

- Pharmaceutical & Biopharmaceutical Companies

- Cardiac Safety Service Providers

- Hospitals

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Government Associations

- Healthcare Associations/Institutes

- Business Research & Consulting Service Providers

- Venture Capitalists & Investors

Report Objectives

- To define, describe, and forecast the global Cardiac Safety Services Market based on type, service type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to six main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players and comprehensively analyze their service portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, service launches, expansions, agreements, partnerships, and collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the Rest of Europe Market, by country

- Further breakdown of the Rest of Asia Pacific Market, by country

- Further breakdown of the Latin America and Middle East & Africa Market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Segment Analysis

- Further breakdown of the services segment as per the service portfolio of prominent players operating in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cardiac Safety Services Market

The following categories can be used to broadly group the macro to micro growth drivers for the cardiac safety services market:

Macro drivers:

Micro drivers:

What are the macro to micro growth drivers for the cardiac safety services industry?