Cardiac Mapping Market by Product (Contact Mapping Systems (Electroanatomical Mapping, Basket Catheter Mapping), Non-contact Mapping Systems), Indication (Atrial Fibrillation, Atrial Flutter, AVNRT), Region - Global Forecasts to 2024

Updated on : February 21, 2023

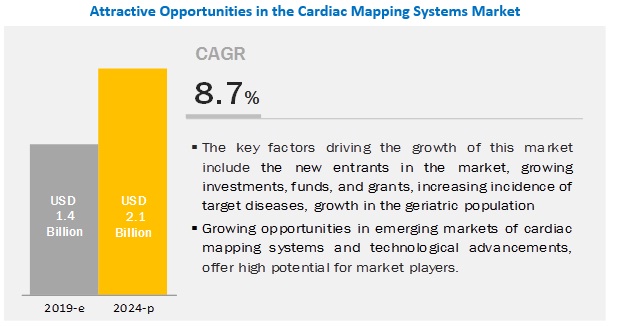

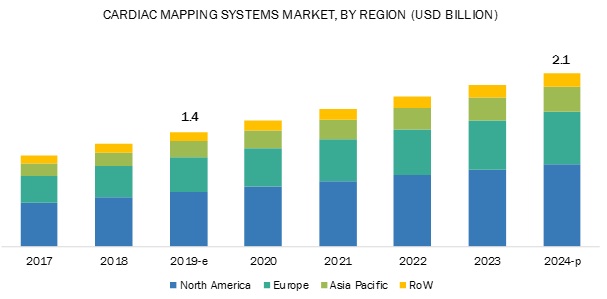

The global cardiac mapping market in terms of revenue was estimated to be worth $1.4 billion in 2019 and is poised to reach $2.1 billion by 2024, growing at a CAGR of 8.7% from 2019 to 2024. Growth in the cardiac mapping industry is driven primarily by factors such as new entrants in the market, growing investments, funds, and grants, increasing incidence of target diseases, and growth in the geriatric population.

The contact cardiac mapping segment is projected to grow at the highest rate during the forecast period

By product, the cardiac mapping market is segmented into contact cardiac mapping (electroanatomical mapping, basket catheter mapping, traditional endocardial mapping) and non-contact cardiac mapping. The contact cardiac mapping segment is expected to witness the fastest growth during the forecast period. Advantages offered by contact cardiac mapping, such as detection of the precise locations of mapping and ablation catheters in a three-dimensional environment, also with multi-electrode basket catheter, recording just a few beats might be enough to uncover the arrhythmia circuit; these factors are increasing its adoption. Consequently, the demand for cardiac mapping devices for diagnosing complex arrhythmias is also growing.

Atrial fibrillation held the largest share of the cardiac mapping systems market in 2019

Cardiac mapping is used widely for the identification, characterization, and localization of an arrhythmia. The cardiac mapping systems indication market is segmented into atrial fibrillation, atrial flutter, atrioventricular nodal reentry tachycardia (AVNRT), other arrhythmias. The atrial fibrillation segment held the largest share of the market in 2019, a trend that is expected to continue during the forecast period. The large share of this segment can primarily be attributed to the rising incidences of AF throughout the globe.

North America is expected to hold a dominant share in the cardiac mapping market during the forecast period

North America held the largest share of the market in 2019 and is projected to continue to do so during the forecast period. Factors such as the increase in approval rate of mapping systems and clinical trials validating cardiac mapping systems in the US, high incidence of CVDs, growing focus of government organizations on providing funding for research, and increasing geriatric population in Canada are driving the North American market.

The major vendors in the cardiac mapping market include Biosense Webster (US), Abbott (US), and Boston Scientific Corporation (US). These leading players offer a strong suit of products for cardiac mapping and have a broad geographic presence. The other players in this market include Medtronic (Ireland), MicroPort Scientific Corporation (China), EP Solutions SA (Switzerland), Acutus Medical (US), Koninklijke Philips N.V. (Royal Philips) (Netherlands), Lepu Medical (China), BIOTRONIK (Germany), AngioDynamics (US), BioSig Technologies (US), APN Health (US), CoreMap (US), Kardium (Canada), Catheter Precision (US), and Epmap-System (Germany).

Cardiac Mapping Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Indication, and Region |

|

Geographies covered |

North America (US & Canada), Europe (UK, Germany, France, Italy, Sapin, RoE), APAC (China, Japan, India, ROAPAC), RoW |

|

Companies covered |

Biosense Webster (US), Abbott (US), Boston Scientific Corporation (US). |

This research report categorizes the cardiac mapping market into following segments and sub-segments:

Based on Product:

-

Contact Cardiac mapping systems

- Electroanatomical mapping

- Basket catheter mapping

- Traditional endocardial catheter mapping

- Non-contact Cardiac mapping systems

Based on Indication:

- Atrial Fibrillation

- Atrial Flutter

- AVNRT

- Other Arrhythmias

Based on Region:

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World

Recent Developments

- In 2019, Acutuc medical partnered with Peerbridge Health, US. Under the partnership, Peerbridge Health offered its advanced ambulatory ECG—Peerbridge Cor that has been cleared to detect up to 26 different arrhythmias to be used with the AcQMap System.

- In 2018, Royal Philips acquired EPD Solutions, Israel, an innovator in image-guided procedures for cardiac arrhythmias.

Key questions addressed by the report:

- Which of the product segments will dominate the global market in the next five years?

- Emerging countries have immense opportunities for the growth and adoption of cardiac mapping. Will this scenario continue in the next five years?

- What are the upcoming technologies in the global market?

- Which indication segment will dominate the global market in the next five years?

- What will be the effect of the developments undertaken by market players?

Frequently Asked Questions (FAQ):

What is the projected market value of the global cardiac mapping market?

The global market of cardiac mapping is projected to reach USD 2.1 billion by 2024.

What is the estimated growth rate (CAGR) of the cardiac mapping market for the next 5 years?

The global cardiac mapping market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.7% from 2019 to 2024.

Who are the major players offering cardiac mapping in the market?

Biosense Webster, Abbott, and Boston Scientific Corporation are the major players in the global cardiac mapping market.

What are the various indications targeted by this market and which is the highest growing indication for cardiac mapping?

Atrial fibrillation, Atrial flutter, Atrioventricular Nodal Reentry Tachycardia (AVNRT), Other Arrhythmias are the indication areas of cardiac mapping market. Atrial Fibrillation is the leading segment with the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Research Methodology Steps

2.2.1 Secondary Data

2.2.1.1 Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Insights From Primary Sources

2.2.3 Market Size Estimation Methodology

2.2.4 Revenue Mapping-Based Market Estimation

2.3 Market Data Estimation and Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Market Overview

4.2 Geographic Analysis: European Cardiac Mappingmarket, By Indication & Country (2019)

4.3 Market Share, By Type, 2019 vs. 2024

4.4 Market Share, By Indication, 2019 vs. 2024

4.5 Geographic Outlook: Market

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 New Entrants in the Market

5.2.1.2 Growing Investments, Funds, and Grants

5.2.1.3 Increasing Incidence of Target Diseases

5.2.1.4 Growth in the Geriatric Population

5.2.2 Restraints

5.2.2.1 Unfavorable Healthcare Reforms in the US

5.2.2.2 Lack of Skilled and Experienced Electrophysiologists

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Technological Advancements

5.2.4 Challenges

5.2.4.1 Unfavorable Regulatory Scenario

5.2.4.2 Alternative Technologies

6 Cardiac Mapping Market, By Type (Page No. - 43)

6.1 Introduction

6.2 Contact Cardiac Mapping Systems

6.2.1 Electroanatomical Mapping Systems

6.2.1.1 Electroanatomical Mapping Systems Account for the Largest Share of the Contact Mapping Systems Market

6.2.2 Basket Catheter Mapping Systems

6.2.2.1 Basket Catheter Mapping Systems Provide Simultaneous, Multiple, Stable Recordings for Most Endocardial Surfaces—A Key Factor Driving Market Growth

6.2.3 Traditional Endocardial Catheter Mapping Systems

6.2.3.1 Exposure to Ionizing Radiation Due to the Need for Fluoroscopy Guidance is A Key Disadvantage of Traditional Endocardial Catheter Mapping Systems

6.3 Non-Contact Cardiac Mapping Systems

6.3.1 Non-Contact Mapping is Applicable in Cases Where the Arrhythmia Cannot Be Tolerated Or in Cases Where Clinical Arrhythmia is Not Reproducible During the Electrophysiology Study

7 Cardiac Mapping Market, By Indication (Page No. - 55)

7.1 Introduction

7.2 Atrial Fibrillation

7.2.1 Growing Number of Cases of Atrial Fibrillation and the Subsequent Increase in the Number of Ablation Procedures to Drive Market Growth

7.3 Atrial Flutter

7.3.1 High Success Rate of Radiofrequency Catheter Ablation for the Treatment of Atrial Flutter is A Major Factor Contributing to the Growth of This Market

7.4 Atrioventricular Nodal Reentry Tachycardia (Avnrt)

7.4.1 Growing Number of Avnrt Cases Across the Globe is Supporting the Growth of This Segment

7.5 Other Arrhythmias

8 Cardiac Mapping Market, By Region (Page No. - 65)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 High Burden of Cvds to Drive the Demand for Cardiac Mapping in the US

8.2.2 Canada

8.2.2.1 Growing Focus of Government Organizations on Providing Research Funding to Support Market Growth in Canada

8.3 Europe

8.3.1 Germany

8.3.1.1 Favorable Healthcare Expenditure and Growing Use of Crt Devices to Drive Market Growth

8.3.2 UK

8.3.2.1 Rising Geriatric Population to Support Market Growth

8.3.3 France

8.3.3.1 Increasing Incidence of Heart Failure to Support Market Growth

8.3.4 Italy

8.3.4.1 Increasing Incidence of Cvd to Drive the Adoption of Cardiac Mapping Systems

8.3.5 Spain

8.3.5.1 Increasing Cardiac Ablation Procedures to Drive the Market in Spain

8.3.6 Rest of Europe

8.4 Asia Pacific

8.4.1 Japan

8.4.1.1 Favourable Reimbursement Scenario to Support Market Growth

8.4.2 China

8.4.2.1 Growing Geriatric Population to Drive the Market for Cardiac Mapping Systems

8.4.3 India

8.4.3.1 Increasing Government Initiatives Towards Healthcare are Supporting the Growth of the Market in India

8.4.4 Rest of Asia Pacific

8.5 Rest of the World

9 Competitive Landscape (Page No. - 95)

9.1 Introduction

9.2 Market Ranking Analysis

9.3 Competitive Leadership Mapping (Overall Market)

9.3.1 Visionary Leaders

9.3.2 Innovators

9.3.3 Emerging Companies

9.3.4 Dynamic Differentiators

9.4 Competitive Scenario

9.4.1 Product Launches & Approvals

9.4.2 Partnerships, Agreements, and Collaborations

9.4.3 Acquisitions

10 Company Profile (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, Competitive Analysis)*

10.1 Biosense Webster, Inc. (A Johnson & Johnson Company)

10.2 Abbott Laboratories

10.3 Medtronic Plc

10.4 Boston Scientific Corporation

10.5 Microport Scientific Corporation

10.6 EP Solutions Sa

10.7 Acutus Medical

10.8 Koninklijke Philips N.V.

10.9 Lepu Medical

10.1 Biotronik

10.11 Angiodynamics

10.12 Biosig Technologies, Inc.

10.13 APN Health, LLC

10.14 Coremap

10.15 Kardium, Inc.

10.16 Catheter Precision, Inc.

10.17 Epmap-System

*Business Overview, Products Offered, Recent Developments, Competitive Analysis Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 129)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (102 Tables)

Table 1 New Entrants in the Market

Table 2 Population Statistics, 2015 vs 2030 vs 2050 (Million Individuals)

Table 3 Market, By Type, 2017–2024 (USD Million)

Table 4 Market, By Region, 2017–2024 (USD Million)

Table 5 Contact Cardiac Mapping Market, By Type, 2017–2024 (USD Million)

Table 6 Contact Cardiac Mapping Market, By Region, 2017–2024 (USD Million)

Table 7 North America: Contact Cardiac Mapping Market, By Country, 2017–2024 (USD Million)

Table 8 Europe: Contact Cardiac Mapping Market, By Country, 2017–2024 (USD Million)

Table 9 APAC: Contact Cardiac Mapping Market, By Country, 2017–2024 (USD Million)

Table 10 Electroanatomical Mapping Systems Market, By Region, 2017–2024 (USD Million)

Table 11 North America: Electroanatomical Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 12 Europe: Electroanatomical Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 13 APAC: Electroanatomical Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 14 Basket Catheter Mapping Systems Market, By Region, 2017–2024 (USD Million)

Table 15 North America: Basket Catheter Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 16 Europe: Basket Catheter Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 17 APAC: Basket Catheter Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 18 Traditional Endocardial Mapping Systems Market, By Region, 2017–2024 (USD Million)

Table 19 North America: Traditional Endocardial Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 20 Europe: Traditional Endocardial Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 21 APAC: Traditional Endocardial Mapping Systems Market, By Country, 2017–2024 (USD Million)

Table 22 Non-Contact Cardiac Mapping Market, By Region, 2017–2024 (USD Million)

Table 23 North America: Non-Contact Cardiac Mapping Market, By Country, 2017–2024 (USD Million)

Table 24 Europe: Non-Contact Cardiac Mapping Market, By Country, 2017–2024 (USD Million)

Table 25 APAC: Non-Contact Cardiac Mapping Market, By Country, 2017–2024 (USD Million)

Table 26 Market, By Indication, 2017–2024 (USD Million)

Table 27 Market, By Region, 2017–2024 (USD Million)

Table 28 Market for Atrial Fibrillation, By Region, 2017–2024 (USD Million)

Table 29 North America: Market for Atrial Fibrillation, By Country, 2017–2024 (USD Million)

Table 30 Europe: Market for Atrial Fibrillation, By Country, 2017–2024 (USD Million)

Table 31 APAC: Market for Atrial Fibrillation, By Country, 2017–2024 (USD Million)

Table 32 Market for Atrial Flutter, By Region, 2017–2024 (USD Million)

Table 33 North America: Market for Atrial Flutter, By Country, 2017–2024 (USD Million)

Table 34 Europe: Market for Atrial Flutter, By Country, 2017–2024 (USD Million)

Table 35 APAC: Market for Atrial Flutter, By Country, 2017–2024 (USD Million)

Table 36 Market for Atrioventricular Nodal Reentry Tachycardia , By Region, 2017–2024 (USD Million)

Table 37 North America: Market for Atrioventricular Nodal Reentry Tachycardia, By Country, 2017–2024 (USD Million)

Table 38 Europe: Market for Atrioventricular Nodal Reentry Tachycardia, By Country, 2017–2024 (USD Million)

Table 39 APAC: Market for Atrioventricular Nodal Reentry Tachycardia, By Country, 2017–2024 (USD Million)

Table 40 Market for Other Arrhythmias, By Region, 2017–2024 (USD Million)

Table 41 North America: Market for Other Arrhythmias, By Country, 2017–2024 (USD Million)

Table 42 Europe: Market for Other Arrhythmias, By Country, 2017–2024 (USD Million)

Table 43 APAC: Market for Other Arrhythmias, By Country, 2017–2024 (USD Million)

Table 44 Market, By Region, 2017–2024 (USD Million)

Table 45 North America: Market, By Country, 2017–2024 (USD Million)

Table 46 North America: Market, By Type, 2017–2024 (USD Million)

Table 47 North America: Contact Market, By Type, 2017–2024 (USD Million)

Table 48 North America: Market, By Indication, 2017–2024 (USD Million)

Table 49 Clinical Trials Related to Cardiac Mapping Devices

Table 50 US: Market, By Type, 2017–2024 (USD Million)

Table 51 US: Contact Cardiac Mapping Market, By Type, 2017–2024 (USD Million)

Table 52 US: Market, By Indication, 2017–2024 (USD Million)

Table 53 Research Grants Towards Research in Cardiology

Table 54 Canada: Market, By Type, 2017–2024 (USD Million)

Table 55 Canada: Contact Market, By Type, 2017–2024 (USD Million)

Table 56 Canada: Market, By Indication, 2017–2024 (USD Million)

Table 57 Europe: Market, By Country, 2017–2024 (USD Million)

Table 58 Europe: Market, By Type, 2017–2024 (USD Million)

Table 59 Europe: Contact Cardiac Mapping Market, By Type, 2017–2024 (USD Million)

Table 60 Europe: Market, By Indication, 2017–2024 (USD Million)

Table 61 Germany: Market, By Type, 2017–2024 (USD Million)

Table 62 Germany: Contact Market, By Type, 2017–2024 (USD Million)

Table 63 Germany: Cardiac Mappingmarket, By Indication, 2017–2024 (USD Million)

Table 64 UK: Market, By Type, 2017–2024 (USD Million)

Table 65 UK: Contact Cardiac Mapping Market, By Type, 2017–2024 (USD Million)

Table 66 UK: ing Market, By Indication, 2017–2024 (USD Million)

Table 67 France: Market, By Type, 2017–2024 (USD Million)

Table 68 France: Contact Market, By Type, 2017–2024 (USD Million)

Table 69 France: Market, By Indication, 2017–2024 (USD Million)

Table 70 Italy: Market, By Type, 2017–2024 (USD Million)

Table 71 Italy: Contact Cardiac Mapping Market, By Type, 2017–2024 (USD Million)

Table 72 Italy: Market, By Indication, 2017–2024 (USD Million)

Table 73 Spain: Market, By Type, 2017–2024 (USD Million)

Table 74 Spain: Contact Market, By Type, 2017–2024 (USD Million)

Table 75 Spain: Market, By Indication, 2017–2024 (USD Million)

Table 76 Cardiac Af Ablation Procedures, By Country, 2015 vs. 2016

Table 77 RoE: Market, By Type, 2017–2024 (USD Million)

Table 78 RoE: Contact Cardiac Mapping Market, By Type, 2017–2024 (USD Million)

Table 79 RoE: Market, By Indication, 2017–2024 (USD Million)

Table 80 APAC: Market, By Country, 2017–2024 (USD Million)

Table 81 APAC: Market, By Type, 2017–2024 (USD Million)

Table 82 APAC: Contact Market, By Type, 2017–2024 (USD Million)

Table 83 APAC: Market, By Indication, 2017–2024 (USD Million)

Table 84 Japan: Market, By Type, 2017–2024 (USD Million)

Table 85 Japan: Contact Cardiac Mappingmarket, By Type, 2017–2024 (USD Million)

Table 86 Japan: Market, By Indication, 2017–2024 (USD Million)

Table 87 China: Contact Cardiac Mappingmarket, By Type, 2017–2024 (USD Million)

Table 88 China: Contact Cardiac Mappingmarket, By Type, 2017–2024 (USD Million)

Table 89 China: Market, By Indication, 2017–2024 (USD Million)

Table 90 India: Market, By Type, 2017–2024 (USD Million)

Table 91 India: Contact Cardiac Mapping Market, By Type, 2017–2024 (USD Million)

Table 92 India: Market, By Indication, 2017–2024 (USD Million)

Table 93 RoAPAC: Market, By Type, 2017–2024 (USD Million)

Table 94 RoAPAC: Contact Cardiac-Mapping Market, By Type, 2017–2024 (USD Million)

Table 95 RoAPAC: Market, By Indication, 2017–2024 (USD Million)

Table 96 RoW: Market, By Type, 2017–2024 (USD Million)

Table 97 RoW: Contact Cardiac-Mapping Market, By Type, 2017–2024 (USD Million)

Table 98 RoW: Market, By Indication, 2017–2024 (USD Million)

Table 99 Right-To-Win

Table 100 Product Launches & Approvals (2017–2019)

Table 101 Agreements, Collaborations, and Partnerships (2017–2019)

Table 102 Acquisitions (2017–2019)

List of Figures (27 Figures)

Figure 1 Research Methodology: Cardiac Mapping Market

Figure 2 Research Design

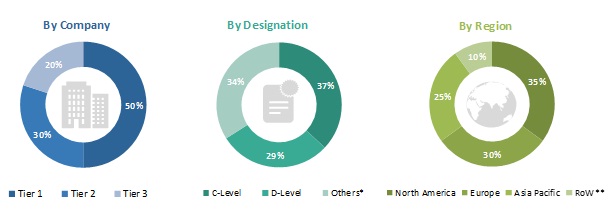

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Research Methodology: Hypothesis Building

Figure 5 Data Triangulation Methodology

Figure 6 Market Share, By Type, 2019

Figure 7 Market, By Indication, 2019 vs. 2024 (USD Million)

Figure 8 Geographical Snapshot of the Market

Figure 9 Increasing Incidence of Target Diseases and Entry of New Players to Drive the Growth of the Market

Figure 10 Atrial Fibrillation to Account for the Largest Share of the European Market in 2019

Figure 11 Contact Cardiac Mapping to Dominate the Market During the Forecast Period

Figure 12 Atrial Fibrillation to Account for the Largest Market Share in 2019

Figure 13 APAC to Register the Highest CAGR in the Forecast Period

Figure 14 Market: Drivers, Restraints, Opportunities, & Challenges

Figure 15 Market, By Region, 2019 vs. 2024

Figure 16 North America: Market Snapshot

Figure 17 Asia Pacific: Market Snapshot

Figure 18 Key Developments in the Market, 2017–2019

Figure 19 Market Ranking Analysis, By Key Player, 2018

Figure 20 Market (Global) Competitive Leadership Mapping, 2018

Figure 21 Abbott Laboratories: Company Snapshot

Figure 22 Medtronic Plc: Company Snapshot

Figure 23 Boston Scientific Corporation: Company Snapshot

Figure 24 Microport Scientific Corporation: Company Snapshot

Figure 25 Koninklijke Philips N.V.: Company Snapshot

Figure 26 Lepu Medical: Company Snapshot

Figure 27 Angiodynamics: Company Snapshot

The study involved four major activities in estimating the current size of the cardiac mapping market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation was used to estimate the market size of segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, D&B, Bloomberg Business, and Factiva have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The cardiac mapping market has several stakeholders such as cardiac mapping systems and related device manufacturing companies, Suppliers and distributors of cardiac mapping systems, Electrophysiology Devices Manufacturing Companies, Healthcare Service Providers (Including Hospitals), Research and Development (R&D) Companies, Research Laboratories and Academic Institutes, Medical Device Suppliers and Distributors, Market Research and Consulting Firms, Group Purchasing Organizations (GPOs), regulatory bodies, and venture capitalists. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cardiac mapping market. These methods were also used extensively to determine the extent of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the cardiac mapping industry.

Report Objectives

- To define, describe, and forecast the cardiac mapping market based on the product, indication, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players and analyze their market shares and core competencies3

- To track and analyze competitive developments such as product launches & approvals; partnerships, agreements, & collaborations; expansions, and acquisitions in the market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global cardiac mapping systems market report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cardiac Mapping Market