Carbon Fiber Wrap Market by Appearance, by Type, by End-Use Industry, and by Region - Global Forecast to 2029

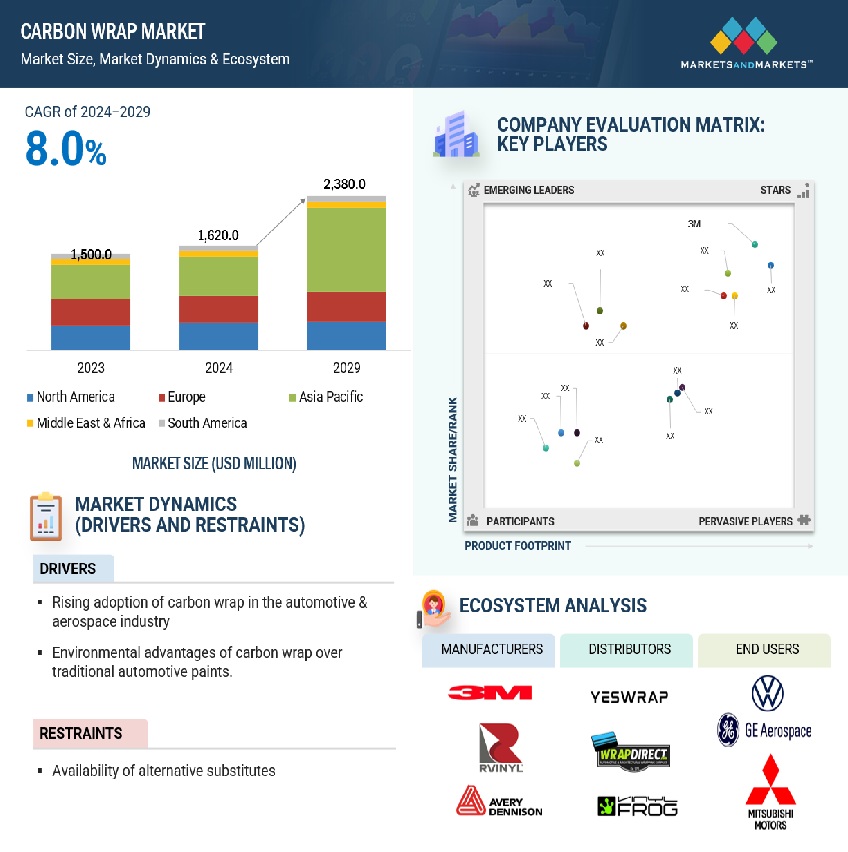

The carbon fiber wrap market is estimated at USD 1,620.0 million in 2024 and is projected to reach USD 2,380.0 million by 2029, at a CAGR of 8.0% from 2024 to 2029. The growth of carbon fiber wrap market is attributed to increasing adoption in automotive, aerospace, electronics, sporting goods, and other industries. These wraps provide surfaces of cars, bikes, electronics goods etc. a premium look without the time and effort of a paint job. They are made of lightweight, durable vinyl and are available in various colors and finishes. Carbon fiber wraps are easy to maintain and offer several advantages such as light-weight, cost-effectiveness, longevity, flexibility, protection, and customization.

Attractive Opportunities in the Carbon Fiber Wrap Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global Carbon Fiber Wrap Market Dynamics

DRIVER: Stringent regulatory environment in the automotive industry regarding VOC emissions

Carbon fiber wrap contribute significantly to reducing VOC emissions as compared to traditional paint jobs. Automotive painting leads to volatile organic compounds (VOCs) associated with the paint solvents are emitted to the atmosphere. Apart from reducing VOC emissions, these wraps are designed to resist yellowing, fading, and cracking, providing long-lasting protection for the underlying paintwork

RESTRAINT: Availability of alternative substitutes

There is a significant competition to carbon fiber wraps from alternative materials. These substitutes such as PVC vinyl wraps and other synthetic materials offer same benefits at lower costs. Carbon fiber wraps are increasingly being used to improve aesthetic looks along with several benefits. However, all this benefits attract prices and stiff competition from alternative materials.

Opportunity: Increasing adoption of EVs

The carbon fiber wraps are largely used in automotive industry for several benefits such as ease of application, protection, durability, low-cost, and enhancing aesthetic looks tailored to one’s style and taste. The growth in the EVs sector has given one more reason to the automotive industry for larger adoption of carbon fiber wraps. EVs are popular amongst younger generation and offers eco-friendly advantages. According to IEA, electric car sales reached around 14 million in 2023. There sales in 2023 grew by 35% from 2022.

This trend indicate that EV growth remains robust during the forecast period providing endless opportunities for carbon fiber wraps.

Challenge: Maintaining consistency in cost and quality

Carbon fiber wraps are available in various forms and finishes. The overall cost-effectiveness is greatly influenced by quality and durability offered by several manufacturers and can vary significantly between different brands and types of carbon fiber vinyl.

Though carbon fiber wraps have cost advantage over carbon fiber, the performance properties of carbon fiber wraps are not at par with carbon fiber. For instance, carbon fiber wraps may not withstand high temperatures as carbon fibers, limiting its use in certain automotive and industrial applications. These wraps may also not have the same longevity as carbon fiber, especially in harsh environmental conditions.

Global Carbon fiber wrap Market Ecosystem Analysis

The carbon fiber wrap market ecosystem is characterized by a dynamic interplay of key players, including manufacturers, suppliers, and regulatory bodies, all driven by the increasing demand for lightweight and fuel-efficient materials in aircraft design. Major carbon fiber manufacturers like 3M and Sika Group lead the market, utilizing carbon fiber wrap that mimics the looks of expensive carbon fiber, providing several benefits at a reduced price. The market is further supported by stringent eco-friendly regulations encouraging use of materials that would emits led VOCs in the environment. This ecosystem is marked by collaboration between companies and research institutions to innovate and meet the evolving needs of the aviation sector, ensuring robust growth in the coming years.

Automotive industry accounted for the largest market share, both in terms of value and volume.

Automotive industry is the largest consumer of carbon fiber wraps in terms of value and volume. Apart from enhancing the aesthetic looks, carbon fiber wraps prevent fading of dashboard, steering, and side panels caused by UV rays. Further demand for carbon fiber wraps in the automotive industry is stimulated by their eco-friendly properties and increasing adoption of EVs.

Global economies are focusing on reducing VOCs emission by the automotive industry by using carbon fiber wraps as a sustainable alternative to traditional paint jobs.

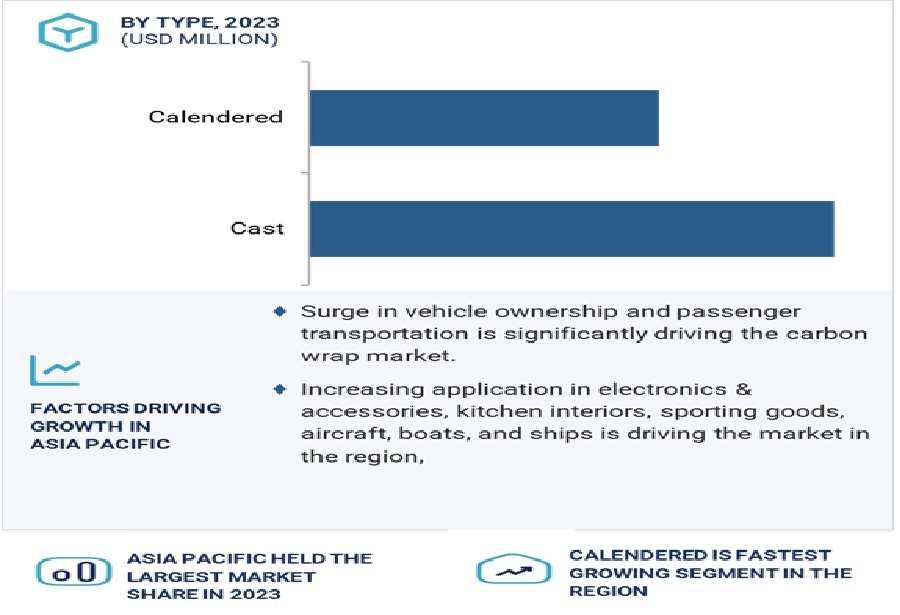

Based on the type, cast type accounted for the largest share of the overall carbon fiber wrap market in 2023.

Based on type, the carbon fiber wrap market has been segmented into calendered and cast.

Cast type accounted for the majority share owing to its properties such as conformability, shrinkage & peel resistance, durability and flexibility. All these properties have made cast type popular in the automotive industry.

Further, cast type retains color and texture integrity over longer durations which makes it popular amongst consumers and professional installers who want long-term aesthetics and security.

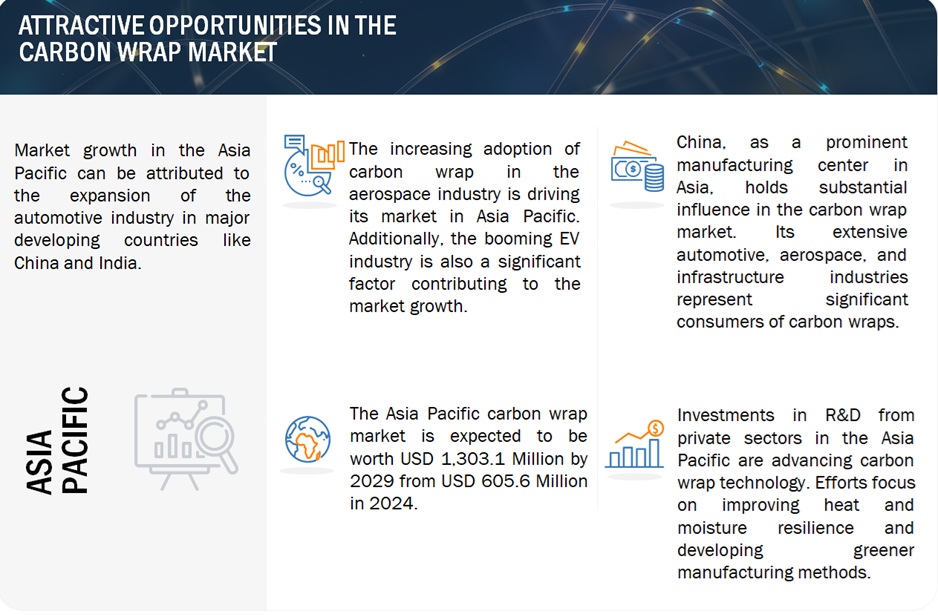

Asia Pacific region holds the largest share of the carbon fiber wrap market

The growth of carbon fiber wrap in Asia Pacific is fueled by the presence of growing automotive & transportation industry. The region is witnessing continuous urbanization, economic prosperity, rising population, and mobility needs. Vehicle ownership and passenger transport is expected to rise during the forecast period. Further, the demand is fueled by a large consumer base who are now significantly spending on luxury goods. The increasing demand for customizing aesthetic looks of cars, bikes, and motorcycles, the younger population is investing in high-end products. With their high purchasing power and interest in value for money, they want to better utilize the time spent on the wheel and monetize their assets such as the vehicle they own.

The carbon fiber wraps in the region are also gaining traction from electronics & accessories, kitchen interiors, sporting goods, aircraft, and boats & ships.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- 3M (US)

- Hexis SAS (France)

- Guangzhou Carbins Film Co., LTD. (China)

- CARLIKE (China)

- The WRPD Group LTD (UK)

- Axevinyl (China)

- Grafityp (Belgium)

- Metro Restyling (US)

- Rvinyl (US)

- Orafol (Germany)

- Avery Dennison (US)

- Fedrigoni Group (Italy)

- VViViD Vinyl Inc. (Canada)

- KPMF (US)

- Arlon Graphics LLC (US)

Recent Developments in Carbon Fiber Wrap Market

- In May 2019, Avery Dennison expanded its automotive range by introducing three new Supreme Wrapping Film colors: SWF Gloss Metallic Fun Purple, SWF Gloss Metallic Passion Red, and SWF Satin Metallic Energetic Yellow. Additionally, the company has launched the Pure Defense Series, which offers economical paint protection lasting up to 8 years. These new products complement the existing premium Supreme Protection Film XI, enhancing protection and promoting long-term vehicle maintenance.

- In February 2019, 3M launched its Wrap Film Series 1080 by introducing four fresh hues. The new colors, namely Gloss Silver Chrome, Gloss Flip Ghost Pearl, Satin Flip Psychedelic, and Shadow Military Green, join the existing lineup of this renowned series. This expansion brings the total count of available colors and patterns to an impressive 100. These latest films made their debut on a Lamborghini at 3M's worldwide headquarters, emphasizing the fusion of captivating aesthetics with exceptional performance.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What are the opportunities in the carbon fiber wrap market?

Increased adoption EVs, significant growth of automotive industry, and increasing purchasing power globally provide significant opportunities to the market growth.

Define the carbon fiber wrap market.

Carbon fiber wraps are premium adhesive films that replicate the look of authentic carbon fibers. They are cost-effective alternative as compared to carbon fibers and traditional paint jobs and offer exceptional performance properties. Customers are increasingly adopting carbon fiber vinyl wraps to achieve the aesthetic appeal at low cost.

Which region is expected to have the largest market share in the carbon fiber wrap market?

APAC’s carbon fiber wrap market has been experiencing growth and significant industry demand. APAC is home to several prominent automotive companies and has expanding consumer base contributing to the increasing adoption of carbon fiber wraps.

What are the major market players covered in the report?

Some of the key players in the carbon fiber wrap market are Prominent companies include 3M (US), Rvinyl (US), Sika Group (Switzerland), Metro Restyling (US), The WRPD Group LTD (UK), Axevinyl (China), Grafityp (Belgium), Hexis SAS (France), Guangzhou Carbins Film Co., LTD. (China), CARLIKE (China), Arlon Graphics LLC (US), KPMF (US), Fedrigoni Group (Italy), VViViD Vinyl Inc. (Canada), Orafol (Germany), Avery Dennison (US), among others. These key manufacturers have secured partnerships, acquisitions, contracts, deals in the last few years to strengthen their position in the carbon fiber wrap market.

How big is the global carbon fiber wrap market today?

The carbon fiber wrap market is estimated at USD 1,620.0 million in 2024 and is projected to reach USD 2,380.0 million by 2029, at a CAGR of 8.0% from 2024 to 2029.

Carbon Fiber Wrap Market

Growth opportunities and latent adjacency in Carbon Fiber Wrap Market