Carbon Fiber Construction Market by Raw Materials (Pan-based Carbon Fiber, Pitch-based Carbon Fiber), Fiber Type (Virgin Carbon Fiber, Recycled Carbon Fiber), Product Type (Continuous Carbon Fiber, Long Carbon Fiber, Short Carbon Fiber), Application (Residential, Commercial, Bridge, Water Structure, Oil & Natural Gas Pipeline, Industrial Structure, and Others), Region - Forecast to 2027

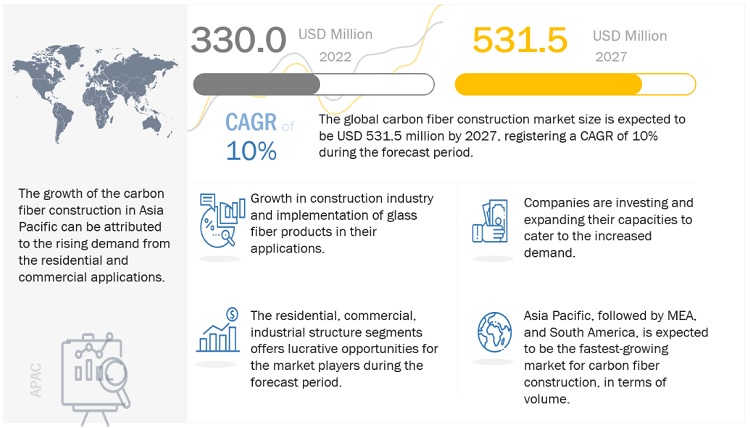

The carbon fiber construction market is projected to reach USD 531.5 million by 2027, at a CAGR of 10.0% from USD 330.0 million in 2022. The carbon fiber construction industry is showing significant growth due to the rising construction projects globally.

Attractive Opportunities in the Carbon Fiber Construction Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growth in the global construction industry driving the demand for carbon fibers from various applications

As per the ICIS, it is expected that the volume of global construction industry will grow by around 35% to reach USD 5.8 trillion by 2030. This high growth is attributed to the growing construction activities in China, US, UAE, and India. This high growth in the construction industry would fuel the demand for carbon fiber for various applications. Asia Pacific is leading the construction market and is expected to dominate during the forecasted years. This is due to the burgeoning growth of commercial, residential, and industrial, projects in various countries such as China and India. The carbon fiber construction industry in Asia Pacific countries is expected to show significant growth as compared to the rest of the world. The growth of the construction industry is expected to fuel the demand for carbon fiber construction market across the world.

Restraints: Higher costs of carbon fiber materials as compared to traditional substitutes

Carbon fiber construction composites get widely used for multiple applications due to their impressive properties, such as high strength, and long durability. These composites are quite expensive as compared to their traditional substitutes. The process of carbon fiber composites depends upon the cost of carbon fibers. The process of carbon fiber reinforced products is higher than glass fiber and basalt fiber products. In many developing regions, the higher prices create a restraint for the growth of carbon fiber construction market as consumer choose traditional products over carbon fiber products.

Opportunities: Growing demand from emerging markets

Traditionally, the carbon fiber construction composites industry used to be more concentrated in Japan, North America, and Europe as compared to other regions. However, in recent years, there has been a shift toward emerging economies in Asia Pacific. Owing to increasing population, rapid industrialization, the building & infrastructure sector is showing rapid development and growth in emerging economies, creating a huge demand for carbon fiber materials used in construction. Thus, carbon fiber construction market has significant demand from such growing economies.

Challenges: Lower adoption and aceptance of carbon fiber construction composites

Carbon fiber construction composites face tough competition from various low–cost substitutes available in the market These substitutes include epoxy–coated, solid stainless steel, galvanized (zinc–coated), and stainless–steel clad. Carbon fiber construction composites offers superior properties to traditional substitutes. However, due to their higher prices, they have a lower acceptability rate. Also, professionals from construction also have long experience with traditional products like steel as compared to composites. Even though the carbon fiber construction market is growing in various emerging markets, traditional substitutes are still getting preferred due to the lower cost.

“Continuous carbon fiber type was the largest product type of carbon fiber construction market in 2021, in terms of value”

The continuous carbon fiber type market accounted for the largest share, in terms of value, in 2021. This dominance is expected to follow the same trend during the forecast period owing to its significant and enhanced properties, and performance. Also, the increasing demand from end-use applications such as residential, commercial, bridge, and industrial structures are fueling the growth of the carbon fiber construction market.

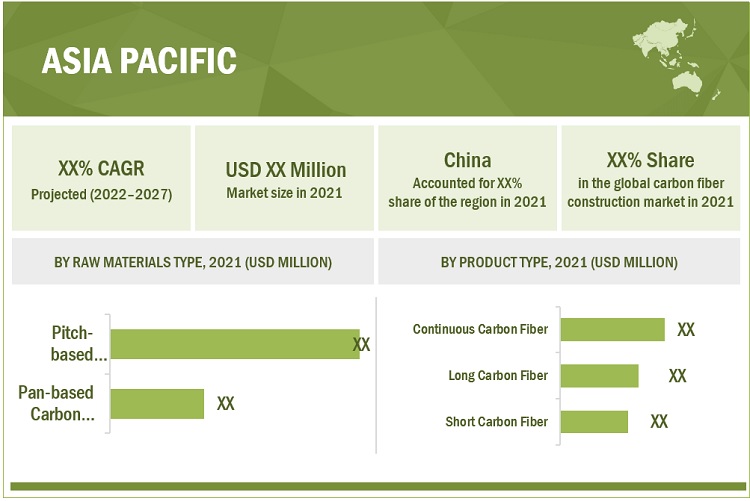

“Asia Pacific was the largest market for carbon fiber construction in 2021, in terms of value.”

Asia Pacific is the largest carbon fiber construction market and is projected to register highest CAGR, in terms of volume, during 2022 to 2027. China, India, and Japan are some of the largest regions of construction industry. Many prominent manufactures have presence in the Asia Pacific region due to availability of raw materials, and relatively cheap labor. Furthermore, the restoration of supply chain after COVID-19 pandemic has resulted into new construction projects in the region which has creating the demand for carbon fiber materials for various applications in construction industry.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market Sika AG (Switzerland), Mapei SpA (Italy), Fosroc (Dubai), Master Builders Solutions (Germany), Fyfe (US), AB-SCHOMBURG Yapı Kimyasalları A.Ş. (Turkey), DowAksa (Turkey), Dextra Group (Thailand), Rhino Carbon Fiber Reinforcement Products (US), Chomarat Group (US), and others. Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of carbon fiber construction market have opted for new product launches to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2018-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Kilotons); Value (USD Million) |

|

Segments |

Raw Materials, Fiber Type, Product Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The key players in this market are Sika AG (Switzerland), Mapei SpA (Italy), Fosroc (Dubai), Master Builders Solutions (Germany), Fyfe (US), AB-SCHOMBURG Yapı Kimyasalları A.Ş. (Turkey), DowAksa (Turkey), Dextra Group (Thailand), Rhino Carbon Fiber Reinforcement Products (US), Chomarat Group (US), and others. |

This report categorizes the global carbon fiber construction market based on raw material type, fiber type, product type, application, and region.

On the basis of raw materials, the carbon fiber construction market has been segmented as follows:

- Pan-based Carbon Fiber

- Pitch-based Carbon Fiber

On the basis of fiber type, the carbon fiber construction market has been segmented as follows:

- Virgin Carbon Fiber

- Recycled Carbon Fiber

On the basis of product type, the carbon fiber construction market has been segmented as follows:

- Continuous Carbon Fiber

- Long Carbon Fiber

- Short Carbon Fiber

On the basis of application, the carbon fiber construction market has been segmented as follows:

- Residential

- Commercial

- Bridge

- Water Structure

- Oil & Natural Gas Pipeline

- Industrial Structure

- Others

On the basis of region, the carbon fiber construction market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is the expected growth rate of carbon fiber construction market?

The forecast period for carbon fiber construction market in this study is 2022-2027. The carbon fiber construction market is projected to grow at CAGR of 10%, in terms of value, during the forecast period.

Who are the major key players in carbon fiber construction market?

Sika AG (Switzerland), Mapei SpA (Italy), Fosroc (Dubai), Master Builders Solutions (Germany), Fyfe (US), AB-SCHOMBURG Yapı Kimyasalları A.Ş. (Turkey), DowAksa (Turkey)

What is the average selling price trend for carbon fiber construction market?

Prices are low in Asian countries (primarily China and India) compared to those in Europe and North America due to the low prices of raw materials and the availability of low-cost workforces in Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology

2.1 Market Share Estimation

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

4.1 Significant Opportunities in Carbon Fiber Construction Market, 2022–2027

4.2 Carbon Fiber Construction Market, By Raw Materials

4.3 Carbon Fiber Construction Market, By Fiber Type

4.3 Carbon Fiber Construction Market, By Product Type

4.4 Carbon Fiber Construction Market, By Application

4.5 Carbon Fiber Construction Market, By Country

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 Carbon Fiber Construction Market, By Raw Materials

5.2.2 Carbon Fiber Construction Market, By Fiber Type

5.2.3 Carbon Fiber Construction Market, By Product Type

5.2.4 Carbon Fiber Construction Market, By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.2 Restraints

5.3.3 Opportunities

5.4.4 Challenges

5.4 Porter's Five Forces Analysis

5.4.1 Bargaining Power of Suppliers

5.4.2 Bargaining Power of Buyers

5.4.3 Threat of New Entrants

5.4.4 Threat of Substitutes

5.4.5 Degree of Competition

5.5 Supply Chain Analysis

5.6 Ecosystem: Carbon Fiber Construction Market

5.7 Value Chain Analysis

5.8 Technology Analysis

5.9 Pricing Analysis

5.10 Trends and Disruptions Impacting Customers

6 Carbon Fiber Construction Market, By Raw Materials

6.1 Pan-based Carbon Fiber

6.2 Pitch-based Carbon Fiber

7 Carbon Fiber Construction Market, By Fiber Type

7.1 Virgin Carbon Fiber

7.2 Recycled Carbon Fiber

8 Carbon Fiber Construction, By Product Type

8.1 Continuous Carbon Fiber

8.2 Long Carbon Fiber

8.3 Short Carbon Fiber

9 Carbon Fiber Construction Market, By Application

9.1 Residential

9.2 Commercial

9.3 Bridge

9.4 Water Structure

9.5 Oil & Natural Gas Pipeline

9.6 Industrial Structure

9.5 Others

10 Carbon Fiber Construction Market, By Region

10.1 Introduction

10.2 North America

10.2.1 Carbon Fiber Construction Market Size in North America, By Application

10.2.2 Carbon Fiber Construction Market Size in North America, By Country

10.2.2.1 Canada

10.2.2.1.1 Carbon Fiber Construction Market Size in Canada, By Application

10.2.2.2 U.S.

10.2.2.2.1 Carbon Fiber Construction Market Size in U.S., By Application

10.2.2.3 Mexico

10.2.2.3.1 Carbon Fiber Construction Market Size in Mexico, By Application

10.3 Europe

10.3.1 Carbon Fiber Construction Market Size in Europe, By Application

10.3.2 Carbon Fiber Construction Market Size in Europe, By Country

10.3.2.1 Germany

10.3.2.1.1 Carbon Fiber Construction Market Size in Germany, By Application

10.3.2.2 France

10.3.2.2.1 Carbon Fiber Construction Market Size in France, By Application

10.3.2.3 UK

10.3.2.3.1 Carbon Fiber Construction Market Size in UK, By Application

10.3.2.4 Italy

10.3.2.4.1 Carbon Fiber Construction Market Size in Italy, By Application

10.3.2.5 Rest of Europe

10.3.2.5.1 Carbon Fiber Construction Market Size in Rest of Europe, By Application

10.4 Asia-Pacific

10.4.1 Carbon Fiber Construction Market Size in Asia-Pacific, By Application

10.4.2 Carbon Fiber Construction Market Size in Asia-Pacific, By Country

10.4.2.1 China

10.4.2.1.1 Carbon Fiber Construction Market Size in China, By Application

10.4.2.2 Japan

10.4.4.2.1 Carbon Fiber Construction Market Size in Japan, By Application

10.4.2.3 India

10.4.2.3.1 Carbon Fiber Construction Market Size in India, By Application

10.4.2.4 South Korea

10.4.2.4.1 Carbon Fiber Construction Market Size in South Korea, By Application

10.4.2.5 Rest of Asia Pacific

10.4.2.5.1 Carbon Fiber Construction Market Size in Rest of Asia Pacific, By Application

10.5 South America

10.5.1 Carbon Fiber Construction Market Size in South America, By Application

10.5.2 Carbon Fiber Construction Market Size in South America, By Country

10.5.2.1 Brazil

10.5.2.1.1 Carbon Fiber Construction Market Size in Brazil, By Application

10.5.2.2 Argentina

10.5.2.2.1 Carbon Fiber Construction Market Size in Argentina, By Application

10.5.2.3 Rest of South America

10.5.2.3.1 Carbon Fiber Construction Market Size in South America, By Application

10.6 Middle East & Africa

10.6.1 Carbon Fiber Construction Market Size in Middle East & Africa, By Application

10.6.2 Carbon Fiber Construction Market Size in Middle East & Africa, By Country

10.5.2.1 Saudi Arabia

10.5.2.1.1 Carbon Fiber Construction Market Size in Saudi Arabia, By Application

10.5.2.2 South Africa

10.5.2.2.1 Carbon Fiber Construction Market Size in South Africa, By Application

10.5.2.3 Rest of Middle East & Africa

10.5.2.3.1 Carbon Fiber Construction Market Size in Rest of Middle East & Africa, By Application

11 Competitive Landscape

11.1 Introduction

11.2 Market Share Analysis

11.3 Market Ranking

11.4 Market Evaluation Framework

11.4.1 Product Launches and Developments

11.4.2 Expansions

11.4.3 Contracts and Agreements

11.4.4 Mergers & Acquisitions

11.5 Revenue Analysis of Top Market Players

11.6 Company Evaluation Matrix

11.4.1 Star

11.4.2 Emerging Leaders

11.4.3 Pervasive

11.4.4 Participants

12 Company Profiles

* (Business Overview, Products Mix, Recent Developments, SWOT Analysis, MnM view)

12.1 Sika AG (Switzerland)

12.2 Mapei SpA (Italy)

12.3 Fosroc (Dubai)

12.4 Master Builders Solutions (Germany)

12.5 Fyfe (US)

12.6 AB-SCHOMBURG Yapý Kimyasallarý A.Þ. (Turkey)

12.7 DowAksa (Turkey)

12.8 Dextra Group (Thailand)

12.9 Rhino Carbon Fiber Reinforcement Products (US)

12.10 Chomarat Group (US)

12.11 Other Companies

*Details Might Not Be Captured in Case of Unlisted Companies.

Note: This is the tentative list, we will provide you the company profiles of major companies in this market.

13 Appendix

The study involved four major activities to estimate the size of carbon fiber construction market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

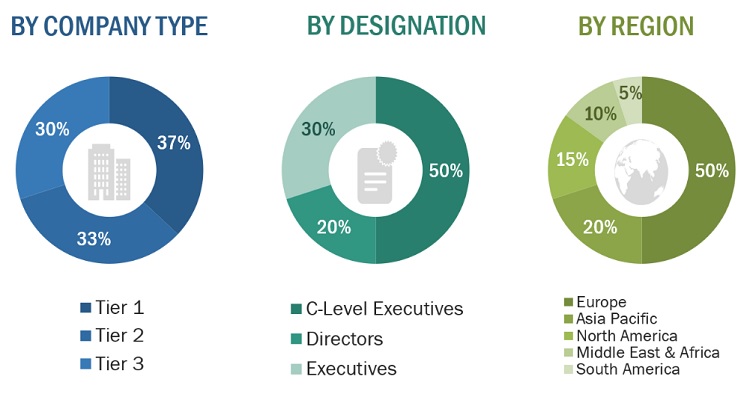

The carbon fiber construction market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the carbon fiber construction market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the carbon fiber construction industry.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

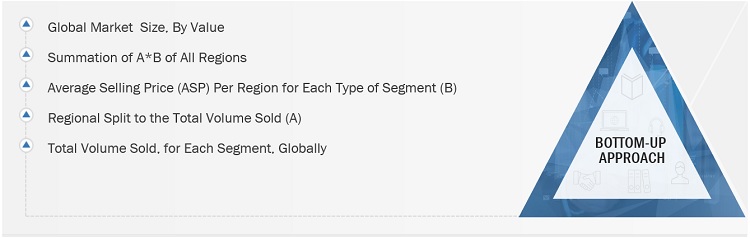

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the carbon fiber construction market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Carbon Fiber Construction Market: Bottom-Up Approach 1

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the carbon fiber construction market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on raw material type, fiber type, product type, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

- Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Carbon Fiber Construction Market