Carbon Farming Market Project Type (Afforestation, Soil Carbon Sequestration, Agroforestry, Biochar, Silvopasture), By Practice (Cover Cropping, Conservation Tillage, Integrated Crop-Livestock System), By End-User and By Region - Global Forecast to 2029

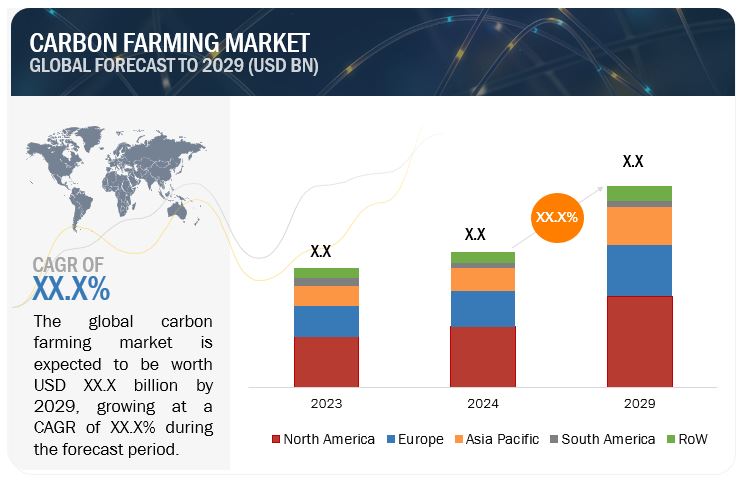

The market for carbon farming is estimated at USD XX.X billion in 2024; it is projected to grow at a CAGR of 14.2% to reach USD XX.X billion by 2029. Carbon farming aims to trap emissions. The difficulty has been to make this type of regenerative farming financially sustainable by compensating landowners for rejuvenating deteriorated soils by transforming their fields into massive CO2 sponges. This involves a variety of regenerative approaches. Cover cropping is especially popular, with fields covered in grasses, cereals, legumes, and other plant species that absorb carbon from the air during photosynthesis and store it in the soil below. After a few years of precise measurements to demonstrate the changing carbon content of the soil, the sequestered carbon is certified and converted into credits before being sold. For its proponents, carbon farming promises a revolutionary new agricultural business model—one that tackles climate change, provides jobs, and protects farms that might otherwise be unprofitable.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Carbon Farming Market Dynamics

Driver: Regulatory Frameworks and Government Policies favoring the market

Governments worldwide are introducing regulations and policies aimed at reducing carbon emissions and promoting sustainable agricultural practices. These policies often include financial incentives, subsidies, and carbon credits that encourage farmers to adopt carbon farming practices.

The Australian Government's Emissions Reduction Fund (ERF) provides incentives for farmers to adopt practices that reduce greenhouse gas emissions. Projects that sequester carbon in soil or vegetation can earn carbon credits, which can be sold to generate revenue. This has led to widespread adoption of carbon farming practices in Australia, particularly in the agricultural sector.

Restraint: Measurement and Verification Challenges

The goal of carbon farming is to use agricultural techniques to absorb carbon dioxide (CO2) from the atmosphere and store it in soil and vegetation. However, there are many obstacles in the way of precisely calculating and confirming the quantity of carbon sequestered. The legitimacy and scalability of carbon farming programs are affected by these issues. Complex biological, chemical, and physical processes that range throughout soil types, climates, and farming practices participate in soil carbon sequestration. It is challenging to develop standardized measurement techniques because of this diversity. The complexity of soil carbon dynamics necessitates advanced technologies and methodologies to obtain reliable data, increasing the cost and effort required for measurement and verification. The choice of measurement technique affects the accuracy, scalability, and cost of carbon sequestration verification. Balancing these factors is crucial for effective implementation. Inconsistent standards and costly verification processes can deter farmers from participating in carbon farming programs and buyers from purchasing carbon credits.

Nori, a Seattle-based startup, faced challenges in standardizing carbon removal quantification. Their marketplace aims to connect farmers with carbon offset buyers, but establishing trust in the accuracy of their carbon credits has been a significant hurdle. Nori uses soil sampling and modelling to estimate carbon sequestration. They faced difficulties in ensuring the accuracy of these measurements due to the variability in soil carbon dynamics. The company collaborated with scientific experts to develop robust measurement methodologies, but the process was time-consuming and costly. Nori's collaboration with scientific experts helped improve the accuracy and credibility of their measurement methodologies. This highlighted the importance of leveraging external expertise. The use of blockchain technology for data transparency was a significant innovation. It demonstrated the potential of advanced technologies to enhance trust and accountability in carbon farming. Nori's efforts to create harmonized verification protocols underscored the need for industry-wide standardization. Consistent standards can reduce complexity and build confidence in carbon credits.

Opportunity: Carbon Offsetting Demand

Growing demand for carbon offsets from businesses, governments, and individuals looking to achieve carbon neutrality or reduce their carbon footprint. Carbon offsets have become a crucial tool in global efforts to mitigate climate change by compensating for greenhouse gas (GHG) emissions that cannot be avoided directly. This demand is driven by various factors, including corporate sustainability goals, regulatory requirements, and consumer preferences for environmentally responsible products and services. Increasing awareness of climate change and regulatory pressures are driving the demand for carbon credits. This creates a market opportunity for farmers to generate revenue by sequestering carbon through sustainable land management practices. Many companies are committing to carbon neutrality targets and are willing to invest in carbon offsets. This presents a significant market opportunity for farmers participating in carbon farming initiatives.

Challenge: Replicating meat and dairy textures challenges due to consumer expectations

Carbon farming, which involves sequestering atmospheric carbon dioxide (CO2) into soil and vegetation using agricultural practices, presents both potential and challenges in terms of land usage and environmental impact. While carbon farming can mitigate climate change and enhance soil health, there are worries about competition for land, biodiversity conservation, and unforeseen environmental repercussions. Carbon farming programs frequently compete with other land uses, including food production, habitat conservation, and urban development. Balancing these competing demands is critical for sustainable land management. Rapid urbanization and infrastructural development encroach on agricultural land, diminishing suitable places for carbon farming and fueling land-use conflicts.

The Cerredo, a biodiverse savanna region in Brazil, has experienced significant land-use conflicts between agriculture expansion, conservation efforts, and carbon farming initiatives. Agricultural expansion, primarily for soybean production, has led to extensive deforestation and habitat loss in the Cerredo, threatening biodiversity and ecosystem services. Efforts to implement carbon farming practices, such as reforestation and agroforestry, face challenges due to competition for land and economic pressures from commodity agriculture. Integrated land-use planning, stakeholder engagement, and policy incentives are essential for balancing agricultural development with biodiversity conservation and carbon sequestration goals.

CARBON FARMING MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable companies providing carbon farming solutions. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Vayda (US), Terramera Inc (Canada), Indigo Ag (USA), Nori (USA), Soil Capital (Belgium), Agoro Carbon Alliance (Norway), Carbon Sequestration Inc. (USA).

Based on project type, the silvopasture sub segment is gaining traction in the carbon farming market.

Silvopasture, an integrated agroforestry practice that grows trees, fodder plants, and cattle on the same site, is gaining popularity for its ability to store carbon, enhance soil health, and boost farm output. This method is especially relevant in the carbon farming market since it provides a comprehensive approach to climate mitigation and agricultural sustainability. According to research, silvopasture systems can sequester more carbon than standard pasture or forestry systems. Silvopasture, for example, can sequester between 1.1 and 4.2 tonnes of CO2 per hectare per year, depending on tree species, environment, and management approaches. This makes silvopasture an appealing choice for farmers who want to generate carbon credits through carbon farming projects.

Traditional cattle ranching operations in the southeastern United States have struggled with soil degradation, water scarcity, and decreased profitability. Silvopasture has been accepted as a sustainable solution to improve both environmental and economic benefits. Farmers cultivated fast-growing tree species such as loblolly pine alongside pasture grasses and cattle. The trees were planted in rows with sufficient space to provide sunshine and machinery access.

The integrated crop-livestock systems in the carbon farming market are forecasted to register the most significant CAGR over the projected period.

Integrated crop-livestock systems are a type of sustainable intensification of agriculture that relies on synergistic linkages between plant and animal system elements to support essential agroecosystem processes, potentially impacting weather resilience.

Currently, global food security faces two major concerns. For starters, one in every nine persons in low- and middle-income countries (LMICs) does not get enough protein and calories from their diet; of them, 50% are smallholder subsistence farmers and 20% are landless families. Second, specialized intensive agriculture practices frequently lead to soil and environmental damage. ICLS is an agricultural practice that has the potential to significantly help mitigate these difficulties. Diversified cropping systems in ICLS can increase the productivity of the main crop while also improving food security by raising nutritional indicators such as food consumption score and household dietary diversity, particularly among rural households. An ICLS might thus play a critical role in ensuring food and nutritional security, as well as environmental sustainability, in the medium and long term.

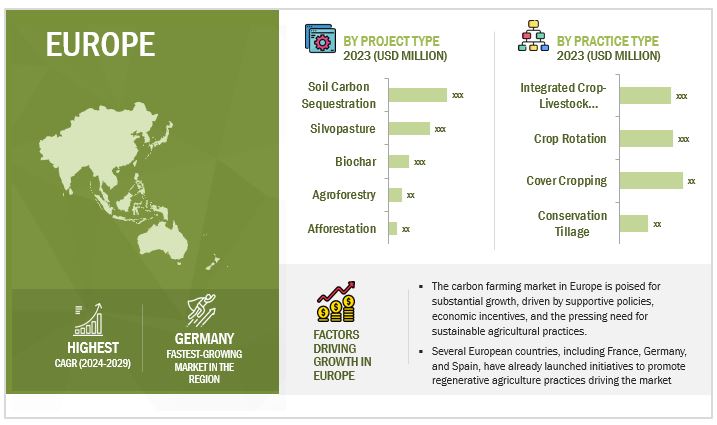

The European region is anticipated to experience the most rapid growth between 2024 and 2029.

The carbon farming market in Europe is rapidly expanding, driven by the EU’s ambitious climate goals and supportive policies. With increasing awareness and incentives, the market is set to grow significantly in the coming years. The European Union has introduced several policies to support carbon farming, such as the Common Agricultural Policy (CAP), Horizon Europe, and the LIFE program. These initiatives provide financial incentives and technical support to farmers and land managers to adopt carbon farming practices.

On April 2024, the European Parliament approved the Carbon Removals and Carbon Farming (CRCF) Regulation, establishing the first EU-wide voluntary framework for certifying carbon removals, carbon farming, and carbon storage in products across Europe. The CRCF Regulation, by defining EU quality criteria and monitoring and reporting mechanisms, will encourage investment in innovative carbon removal technology and sustainable carbon farming solutions, while also combating greenwashing.

Major players operating in the market include Vayda (US), Terramera Inc (Canada), Indigo Ag (USA), Nori (USA), Soil Capital (Belgium), Agoro Carbon Alliance (Norway), Carbon Sequestration Inc. (USA), Regen Network (USA), Agreena (Denmark).

Other market players include Agreed.Earth (UK), Biotrex (Japan), Ruumi (UK), Continuum Ag (US), Carbon Farmers of Australia (Australia), Regen Ag (New Zealand), Soil Carbon Co. (Australia).

Key Market Players

Key Market Players in this Vayda (US), Terramera Inc (Canada), Indigo Ag (USA), Nori (USA), Soil Capital (Belgium), Agoro Carbon Alliance (Norway), Carbon Sequestration Inc. (USA), Regen Network (USA), Agreena (Denmark)

Other market players include Agreed.Earth (UK), Biotrex (Japan), Ruumi (UK), Continuum Ag (US), Carbon Farmers of Australia (Australia), Regen Ag (New Zealand), Soil Carbon Co. (Australia). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe.

Recent Developments

- In June 2024, Nori Adds Unprecedented Number of Soil Carbon Removal Credits to Marketplace from Bayer Carbon Program in the U.S. Nori announced the issuance of over 125,000 regenerative tonnes from the Bayer Carbon Program in the U.S. in its marketplace, marking the largest single issuance of credits in the company’s history. The credits represent an unprecedented expansion to Nori’s carbon removal supply and add significant supply across the soil organic carbon industry. With this volume of credit, climate-conscious companies have the opportunity to support regenerative agriculture and carbon removal at scale. In addition, there are more than 240,000 tonnes in the pipeline to be issued as carbon credits later this year.

- In April 2024, Nori partners with Perennial to support the expansion of its carbon credit issuing program and unlock new capabilities. Nori, a leading carbon removal credit issuer, registry, and market, announced that it has chosen Perennial, the soil carbon standards, tools, and technology company, to support the evolution and expansion of its soil organic carbon credit issuing program. Perennial’s technology will be incorporated into Nori’s soil carbon quantification and broader regenerative agriculture methodology, unlocking new capabilities like expansion to new crop types, international croplands, and precision credit selection.

- In April 2024, Agreena launches pioneering financial services solution for regenerative farmers. Leading climate fintech company, Agreena, has launched a financial services solution as part of its aim to incentivize farmers to adopt regenerative practices. Agreena’s first financial services solution banking partner is Raiffeisen Bank in Ukraine. Agreena’s granular, verified farm-level data will make it easier for the Bank to promote sustainability in agriculture and support its farming customers to transition to regenerative agriculture. Agreena will work with Raiffeisen Bank to refine the Ukrainian partnership in the coming months and plans to extend its financial services solution to more markets and banking partners in 2024.

Frequently Asked Questions (FAQ):

What is the current size of the carbon farming market?

The carbon farming market is estimated at USD XX.X billion in 2024 and is projected to reach USD XX.X billion by 2029, at a CAGR of 14.2% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

Key Market Players in this include Vayda (US), Terramera Inc (Canada), Indigo Ag (USA), Nori (USA), Soil Capital (Belgium), Agoro Carbon Alliance (Norway), Carbon Sequestration Inc. (USA), Regen Network (USA), Agreena (Denmark).

Other market players include Agreed.Earth (UK), Biotrex (Japan), Ruumi (UK), Continuum Ag (US), Carbon Farmers of Australia (Australia), Regen Ag (New Zealand), Soil Carbon Co. (Australia).

Which region is projected to account for the largest share of the carbon farming market?

The North American market is expected to dominate during the forecast period. Regenerative agriculture is a rising movement in North America that seeks to improve soil health, biodiversity, and the general sustainability of agricultural methods. The proliferation of certification programs and labels indicating adherence to regenerative principles in North America is one evidence of the growing popularity of regenerative agriculture. Another indicator of the expansion of regenerative agriculture is the growing number of companies and investors focused on regenerative practices. Major food firms, including General Mills and Danone, have committed to regenerative agriculture, and an increasing number of investment funds are backing regenerative agriculture approaches.

What kind of information is provided in the company profile section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the carbon farming market?

Farmers embrace the extra revenue stream from the carbon market since climate change has resulted in uncertain yields. Growing demand in the carbon market has resulted in new agricultural programs and pledges by agribusiness and food merchants, creating chances for farmers to participate. To ensure farmer interest, a program's carbon price must be higher than its implementation expenses. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Carbon Farming Market