Car Care Products Market by Product Type (Cleaning & Washing, Polishing & Waxing, Sealing Glaze & Coating), Application (Interior, Exterior), Consumption, Solvent (Water, Foam-based), Vehicle Type, Distribution Channel & Region - Global Forecast to 2027

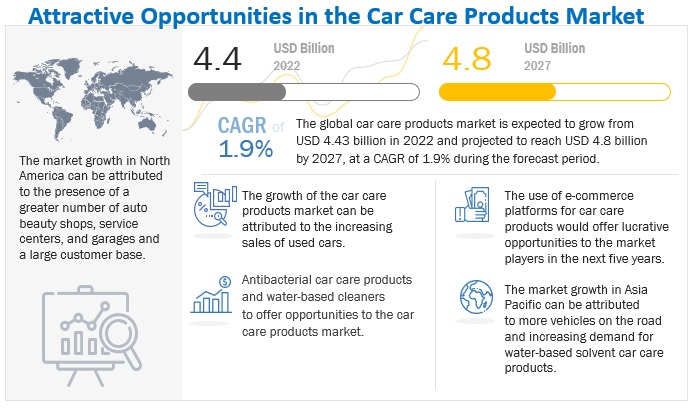

[199 Pages Report] The global car care products market size was valued at USD 4.4 billion in 2022 and is expected to reach USD 4.8 billion by 2027, growing at a CAGR of 1.9% from 2022 to 2027. Car care products are usually surface solvents and chemicals (acids or bases) used for removing stains, cleaning marks, restoring gloss and shine of car surfaces. Car care products are used to prevent or repair damages like swirl marks, scratch, paint fade to ensure. Waxes, polishes, paint protection products, tire cleaners, rim protectors, and glass cleaners are various automotive appearance chemicals available in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Use of e-commerce platforms by leading players to increase customer base

E-commerce refers to purchasing goods and services over the internet with the help of an e-commerce website or application. E-commerce is one of the fastest-growing markets in the world. The global e-commerce retail market has increased from USD 2.4 trillion in 2017 to USD 4.3 trillion in 2020 and experienced a growth of 79.2% from 2017 to 2020. Ease of purchase or convenience, pricing and discounts on various products and services, and home delivery are the major reasons for increasing preference of e-commerce platforms around the world. Considering the success of e-commerce platforms and increasing consumer spending on car care products to maintain the aesthetics of a vehicle, many car care product manufacturers such as 3M, Illinois Tool Works, SONAX, and others have adopted this strategy to sell their car care products through online platforms and retail stores as well.

RESTRAINT: Regulations pertaining to car wash and car care products

The car care industry for DIY auto care products is directly impacted by the EPA's recommendation suggested car owners utilise professional detailing services rather than do-it-yourself (DIY) cleaning activities at home. If someone wants to run a carwash business, they should adhere to a number of rules and regulations that are associated to the environment's safety and the workers' safety at work. Each state or nation has its own regulatory permits and water runoff laws, and they all follow to the same law. The market depends on how strictly the laws like Clean Water Act of 1972 is applied by the EPA. Consequently, the demand for DIY and DIFM car maintenance products is directly impacted by these regulations.

OPPORTUNITY: Increasing demand for water-based cleaners

Water-based cleaners not only eliminate soils by dissolving contaminants, but they can chemically react with these pollutants, making them increasingly dissolvable in water. Most water-based cleaners consist of a range of other components as well to enhance their effectiveness. Some substances can include detergents or surfactants, builders, emulsifiers, saponifiers, sequestering agents, and chelating agents. Demand for water-based cleaners is increasing due to their various benefits over solvent-based cleaners in the car care products market.

CHALLENGE: Possibility of Recession in 2022-2023

Due to the recent series of global events like the Ukraine-Russia war, the global economy especially Europe and US has been seriously impacted causing disruptions in global supply chains and energy markets. As a result there is a rising concerns about an impending recession. There are increasing signs of this such as layoff in US, rising interest rates and lowering demand. In a recession, auto sales decline significantly as many buyers back out of the market. Due to this the car detailing work shops and service centers will see reduced visits by customers and hence the car detailing and care products will see a reduced demand. Due to this war the European union has been facing energy shortages and that has spiked the prices of other goods substantially therevt reducing the demands of goods and services that has negatively impacted the economies. Similarly the US Federal Reserves has also been increasing interest rates continuously that has negatively impacted the demands of goods and services in US as well. These signs of economic downturn or even a recession many negatively impact the market.

Individual sources will the fastest growing consumers during the forecast period

The increasing awareness regarding car detailing has helped to increase the demand for car care product. However the increasing labour cost has compelled many car lovers to take up the task on an individual level rather than visiting to a car care workshop. With presence of sufficient training material online regarding car detailing many of these consumers now learn and do some basic detailing task themselves. With time the number of such people is expected to increase and so will the demand for car care products.

Passenger cars will be the biggest market for car care products

The passenger vehicles are increasing a high rates due to the increasing sales in Asia Pacific region. There is also increasing market for used cars. Used cars fetch a good value only when sold in a good condition. Hence in order to keep the car in good condition for long time and also to keep the resale value of the car as high as possible. This is expected to drive the demand for care products. Also, the sales of premium and luxury cars have increased significantly globally, especially in US, Europe and China. This has proportionally driven the demand of car care products globally. The growing passenger car fleet, especially in Asia Pacific is expected to boost car care market in the coming years.

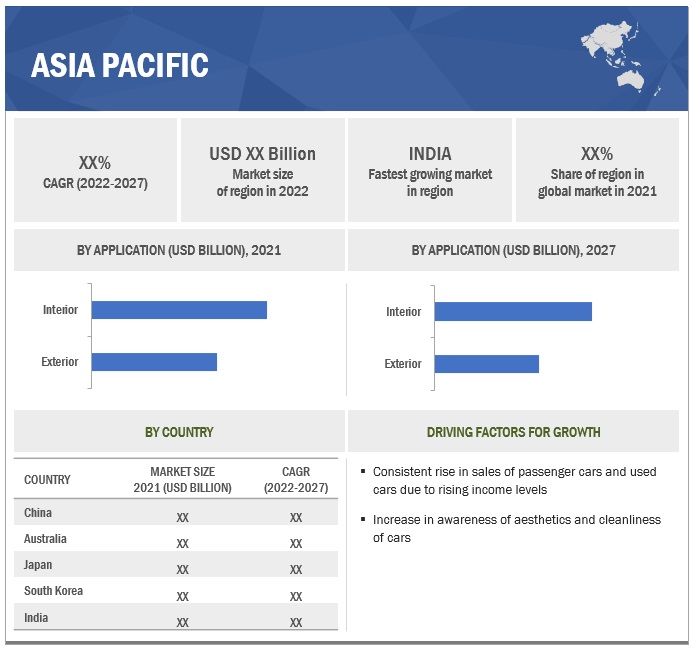

Asia Pacific is expected to be the fastest growing market

Asia Pacific region is expected to be the fastest growing market. Several factors can be attributed to this observations which are first, there is an increase in sales of automobiles in some of the largest market of this regions i.e. China and India. Second, there is an increase in disposable income and awareness regarding good maintenance of car which allows people to spend more generously on maintenance of their car. Thirdly, there is an increasing use car market in this region where the most well maintained used car get a higher value. Expansion car care shops/parlors by various top players such as 3M, ITW, Wurth Group etc. is expected to drive popularity of car care products. This factors are expected to boost growth of car care products in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Tetrosyl (UK), Illinois Tool Works (US), 3M (US), Sonax Gmbh (Germany), and Wurth Group (Germany). These companies adopted new product launches and expansion to gain traction in the car care product market.

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 4.4 billion |

|

Estimated Value by 2030 |

USD 4.8 billion |

|

Growth Rate |

Poised to grow at a CAGR of 1.9% |

|

Market Segmentation |

By product type, by application, by vehicle type, by consumption, by distribution channel, by solvent, and region |

|

Market Driver |

Use of e-commerce platforms by leading players to increase customer base |

|

Market Opportunity |

Increasing demand for water-based cleaners |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

This research report categorizes the car care products market to forecast revenues and analyze trends in each of the following subsegments:

By Product Type

- cleaning & caring

- polishing & waxing

- sealing glaze & coating, others

By Application

- interior

- exterior

By Vehicle Type

- passenger cars

- light commercial vehicles

- heavy commercial vehicles

By End Use

- auto beauty shops

- service centers & garages

- individuals

By Solvent

- water-based

- foam-based

By Distribution Channel

- DIY/retail stores

- DIFM (do it for me)/service centers

By Region

- North America

- Asia Pacific

- Rest of the World

Recent Developments

- In September 2022, Turtle wax inaugurated its first car care service and detailing center in Mumbai (India).

- In 2021, Tata Motors (India) collaborated with several car care products brand to offer car care services in its workshops.

- In March 2021, Soft99 Corporation launched the Fukupika Wash & Wax Gen.5 and G-Jetta.

- In February 2021, Altro Group launched The Royal Warranted car-care expert’s new Fogger that requires just 10 minutes to work, helping mask nasty smells behind a pleasant minty freshness thanks to its simple ‘one-shot’ operation.

- In May 2019, Castrol India and 3M India teamed up to launch an assortment of vehicle care products. Under the purview of this collaboration, a range of 3M-Castrol branded bike and car care products, such as glass cleaner, shampoo, dashboard, and tire dressers, cream wax, etc., will be retailed in India.

- In May 2019, Liqui Moly has continued its collaboration with the Italian motorcycle manufacturer Betamotor. Since 2014, all the motorcycles manufactured at the Beta plant have Liqui Moly oil in their engines. The two companies have now decided to extend their cooperation up to 2021. This partnership includes additives, care products, service products, etc., that are geared specifically toward motorcycles

Frequently Asked Questions (FAQ):

What is the size of car care products market?

The car care products market is projected to grow from $4.4 billion in 2022 and reach $4.8 billion in 2027, at a CAGR of 1.9%.

Which application type is currently leading the car care products market?

Interior segment is leading application type in the car care products market.

Many companies are operating in the car care products market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

Tetrosyl, 3M, Illinois Tool Works, Wurth Group, and SONAX GmbH. These companies adopted new product launches and expansion strategies to gain traction in the car care products market.

How is the demand for car care products varies by region?

The market in the North America region with presence of US the largest car care products market in the world is projected to be the largest. Car care products can help to maintain the aesthetics of a vehicle. Also, the region is home to some of the dominant players in this market, such as 3M and Illinois Tool Works.

What drivers and opportunities for the car care products manufacturer?

Development of anti-microbial car care products, increasing demand of water based cleaners, increase in sale of used cars, use of e-commerce platforms by leading players to increase customer base are expected to offer promising future growth of the market for car care products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

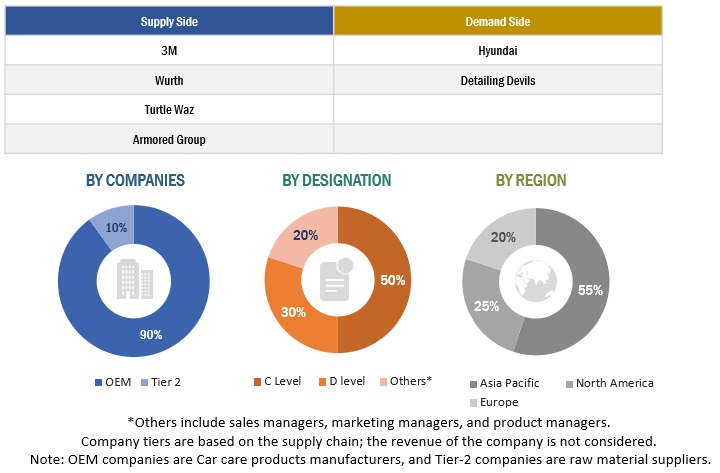

The study involves four main activities to estimate the current size of the car care products market. Exhaustive secondary research was done to collect information on the market, such as product type and application types. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Top-down approach was employed to estimate the complete market size for different segments considered under this study. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include international car care organizations and car wash associations; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. The secondary data was collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the scenario of the car care products market through secondary research. Several primary interviews were conducted with market experts from both demand- (auto beauty shops, service centers/garages) and supply-side (car care products manufacturers) across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). Approximately 90% of the primary interviews were conducted with experts from the supply side, and 10% of them were conducted from the demand side. Primary data was collected through questionnaires, emails, and telephonic interviews. In our canvassing of primaries, we strived to cover various departments within organizations, which included sales, operations, and administration, to provide a holistic viewpoint of the car care products industry in our report.

After interacting with industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings as described in this report.

To know about the assumptions considered for the study, download the pdf brochure

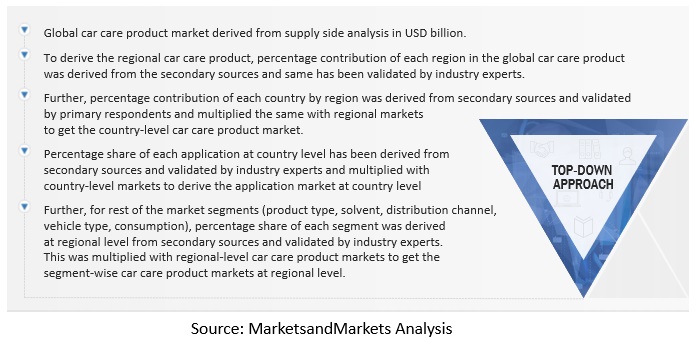

Market Size Estimation

The top-down approach was used to estimate and validate the size of the car care product market. In these approaches, the production statistics for passenger cars, LCVs, trucks, and buses at a country and production statistics of BEVs, PHEVs, FCEVs, autonomous vehicles at regional level were considered to estimate the aggregate market of various car care product segments. The research methodology used to estimate the market size includes the following:

- Key players in the car care product market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players as well as interviews with industry experts for detailed market insights.

- All application-level penetration rates, percentage shares, splits, and breakdowns for the market was determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and sub segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

The top-down approach was used to estimate and validate the regional size for the car care products market by product type, application, consumption, solvent, vehicle type, distribution channel, and region in terms of value. The global market was derived from supply-side data where we analyzed the annual car care products sales of top companies and international car wash and car care associations, and it was further validated by primary respondents. The regional and country markets were derived by understanding the percentage contribution of each region in the global car care product market and the percentage contribution of each country in their regional car care product market. The percentage share of each application at the country level was derived from secondary sources and was further validated by primary respondents. Further, for the rest of the market segments (product type, solvent, distribution channel, vehicle type, consumption), the percentage share of each segment was derived at the regional level from secondary sources and validated by industry experts. These percentage shares were multiplied with regional-level car care product markets to get the segment-wise car care product market at a regional level.

Car Care Products Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-Up Approach

In the bottom-up approach, vehicle production of each vehicle type at the country level was considered. Penetration of each car care product application was derived through model mapping for each vehicle type. The country-level production by vehicle type was then multiplied with the penetration for each application to determine the market size of the car care product market in terms of volume. The country-level market size, in terms of volume, by application, was then multiplied with the country-level average OE Price (AOP) of each car care product application to determine the market size in terms of value for each vehicle type. Summation of the country-level market size for each vehicle type by application, by volume and value, would give the regional-level market size. Further, the summation of the regional markets provided the car care market size. The market size for vehicle type was derived from the global market.

Report Objectives

-

To define, describe, and forecast the car care products market in terms of value (USD billion), based on the following segments:

- By Product Type [cleaning & caring, polishing & waxing, sealing glaze & coating, others]

- By Application [interior, exterior]

- By Vehicle Type [passenger cars, light commercial vehicles, heavy commercial vehicles]

- By End Use [auto beauty shops, service centers & garages, individuals]

- By Solvent [water-based, foam-based]

- By Distribution Channel [DIY/retail stores, DIFM (do it for me)/service centers]

- By Region (North America, Asia Pacific, Europe, and the Rest of the World)

- To analyze the impact of the recession on the market across all regions

- To understand the market dynamics (drivers, restraints, opportunities, and challenges)

- To analyze the market ranking of key players operating in the market

- To analyze recent developments, partnerships, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry players in the market

- To analyze the impact of the recession in terms of the most likely scenario, low-impact, and high-impact scenario

- To conduct a case study analysis, technology analysis, supply chain analysis, trade analysis, market ecosystem analysis, tariff and regulatory landscape analysis, Porter’s Five Forces analysis, and average selling price analysis

- To analyze the market share of key players in the motor lamination market and conduct a revenue analysis of the top five players

- To formulate the competitive leadership mapping of key players in the motor lamination market

Car Waxing & Its impact on Car Care Products Market

The market for automobile care products is directly related to the widespread practise of car waxing, which is used to protect and maintain a car's exterior. Products for cleaning, protecting, and maintaining the appearance of cars are referred to as "car care" products. Products like automotive wax, polish, cleansers, and sealants fall under this category. To protect a vehicle's paint and clear coat from the damaging effects of UV rays, pollution, and other environmental variables, car waxing is a crucial part of automotive maintenance. Car wax creates a barrier over the paint that helps keep dirt, grime, and other contaminants from adhering to the car's surface. This facilitates cleaning of the car and aids in preserving its aesthetic over time.

The car care products market includes a wide range of products designed to assist consumers in protecting and maintaining their vehicles. Car wax is one of the most popular car care products, and there are many different types of wax on the market. Paste wax, liquid wax, and spray wax are some of the most popular types of car wax.

By extending the reach of Car Waxing services, companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Electric and Self-Driving Vehicles: As electric and self-driving vehicles become more prevalent, there may be an increased demand for car wax and other car care products that are specifically designed for these types of vehicles.

- Sustainable Car Care: As consumers become more environmentally conscious, there may be a growing demand for car wax and other car care products that are formulated with sustainable and eco-friendly ingredients.

- Smart Car Care: As the Internet of Things (IoT) continues to evolve, car waxing and other car care products could become smarter and more connected.

- Customizable Car Care: As consumers become more interested in personalization and customization, there may be a growing demand for car wax and other car care products that can be tailored to their specific needs and preferences.

Top Players in Car Waxing Market are Turtle Wax, Inc., Meguiar's Inc., Chemical Guys, Griot's Garage, Inc., P21S, Inc.

Some of the key industries that are going to get impacted because of the growth Car Waxing are,

1. Automotive Aftermarket Industry: The automotive aftermarket industry, which includes companies that produce replacement parts, accessories, and performance upgrades for vehicles, is likely to be impacted by the growing demand for car polishing and waxing products.

2. Car Detailing Industry: The car detailing industry, which offers professional detailing services to car owners, is likely to benefit from the growing popularity of car polishing and waxing.

3. Automotive Paint Industry: The automotive paint industry, which produces the paints and coatings used on cars, is likely to be impacted by the growing demand for car polishing and waxing.

4. Tourism Industry: The tourism industry may also be impacted by the growing popularity of car polishing and waxing, as car owners may be more likely to take road trips and attend car shows and other automotive events to showcase their well-maintained vehicles.

5. Chemicals and Materials: Car waxing involves the use of chemicals and materials that help protect and maintain the appearance of vehicles.

6. Retail and E-commerce: Car waxing and other car care products are often sold through retail channels, both in physical stores and online.

7. Professional Detailing Services: Many consumers choose to have their vehicles professionally detailed, which often involves the use of car wax and other car care products.

Speak to our Analyst today to know more about Car Waxing Market

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Car Care Products Market, By Product Type, By Country

- North America

- US

- Canada

- Mexico

- Asia Pacific

- China

- Australia

- Japan

- South Korea

- India

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of the World

- Brazil

- Russia

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Car Care Products Market

What are the recent developments in the Global Car Care Products Market?