Canine Orthopedics Market by Product (Implants and Instruments), Application (Tibial Plateau Leveling Osteotomy (TPLO), Tibial Tuberosity Advancement (TTA), Joint Replacement, Trauma), End User (Hospitals, Clinics) and Geography - Global Forecast to 2027

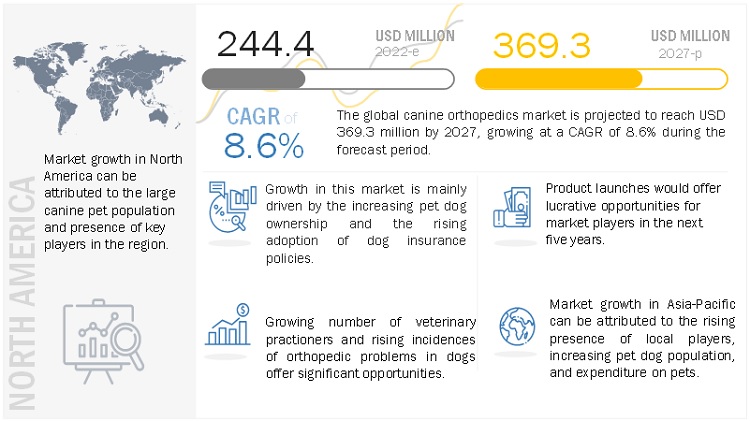

The global canine orthopedics market size is projected to reach USD 369.3 million by 2027 from USD 244.4 million in 2022, at a CAGR of 8.6% during the forecast period. Market is driven by factors such as growing pet dog ownership, adoption of dog insurance policies, growing investments by key market players, growing number of veterinary practionioners and their rising income levels in developed countries, and the growing number of veterinary orthopedic surgeries in canine. On the other hand, Limited availability of trained professionals in the treatment of canine orthopedic problems and expensive treatment is expected to limit market growth to a certain extent in the coming years.

Some of the most common orthopedic problems in dogs include hip dysplasia, cruciate ligament tears, luxating patellas, and disc disease. The rise in the prevalence of canine obesity has made it the most common nutritional health problem in dogs, which results in osteoarthritis, hence driving the growth of the canine orthopedics market.

In 2020, According to the Association for Pet Obesity Prevention (APOP), more than 50% of pet dogs in US were overweight or obese. Moreover, according to the Banfield Pet hospital in the US, in 2017, 450 out of 10,000 dogs suffered from osteoarthritis. Increasing obesity and arthritis in animals is expected to increase chances of orthopedic diseases in them, which, in turn is expected to increase demand for products such as implants and drive the global canine orthopedic market growth.

However, limited availability of trained professionals in the treatment of canine orthopedic problems and expensive treatment are expected to restrict market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

“The implants accounted for the largest share in the canine orthopedics market, by product, during the forecast period”

The canine orthopedics market, by product is segmented into implants and instruments. Implant segment is further segmented into plates and others. Plates segment is further categorized into TPLO plate, TTA plates, Speciality plates, and other. In 2021, implant accounted for the largest share in the canine orthopedic market. However, instruments segment is expected to grow with highest CAGR during 2022 and 2027. The rising incidence of severe musculoskeletal injuries or orthopedic disorders, such as cruciate ligament tears and hip and elbow dysplasia, has led to an increase in the adoption of implants in canine orthopedic market.

“Tibial Plateau Leveling Osteotomy (TPLO) segment accounted for the largest market share in 2021”

Based on application, the canine orthopedics market is segmented into tibial plateau leveling osteotomy (TPLO), tibial tuberosity advancement (TTA), Joint Replacement, Trauma, and others. The tibial plateau leveling osteotomy (TPLO) segment accounted for the largest share in 2021, while tibial tuberosity advancement (TTA) segment is expected to grow at the fastest rate in the years ahead, from 2022 to 2027. This can be attributed to the increasing product advancement and a growing number of surgeries in dogs.

“Veterinary Hospitals and Clinics segment accounted for the largest market share in 2021”

Based on end user, the canine orthopedics market is segmented into veterinary hospitals and clinics, and others. The veterinary hospitals and clinics segment accounted for the largest share in 2021 in canine orthopedics market, while other end users segment is expected to grow at the fastest CAGR during 2022 to 2027. The others segment comprises veterinary research centers and ambulatory care units.

“APAC region accounted for the highest CAGR during the forecast period”

The global canine orthopedics market is divided into five regions: North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the regional analysis, the North America region is expected to gain major market share in 2021 for canine orthopedics market. The North America canine orthopedics market is being driven by large canine pet population, adoption of pet insurance, presence of key players, and growing pet health concerns. Asia-Pacific, on the other hand, will experience highest CAGR in the coming years due to the rising presence of local players, increasing pet dog population, and expenditure on pets.

To know about the assumptions considered for the study, download the pdf brochure

Competitive Landscape

The canine orthopedics market is moderately competitive and consists of several major players. The key 5 – 7 major players currently dominate the market. The prominent market players in canine orthopedics market includes B. Braun Melsungen AG (Germany); Movora (US); STERIS (US); DePuy Synthes (Johnson & Johnson) (US); AmerisourceBergen Corporation (US); Arthrex, Inc. (US); Orthomed (UK) Ltd (Infiniti Medical); Narang Medical Limited (India); Fusion Implants (UK); and Veterinary Instrumentation (UK).

Key Industry Development:

- June 2019- Kyon AG (Switzerland) was acquired by Fidelio Capital(Sweden), and it later became a part of Movora Company (US), established by Fidelio. Kyon AG (Switzerland) specializes in veterinary orthopedic implants, instruments, and services.

- In January 2022, Movora Company (US) expanded its presence in the US by establishing new distribution center at St. Augustine, Florida for the distribution of veterinary orthopedic implants.

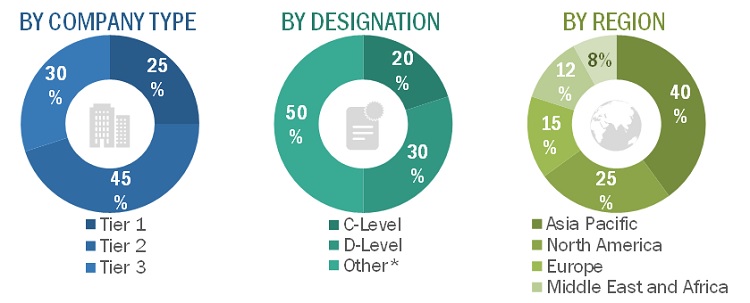

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: C-level - 20%, D-level - 30%, and Others - 50%

- By Region: Asia Pacific – 40%, North America - 25%, Europe - 15%, , Latin America – 8% , and the Middle East & Africa – 12%

Lits of Companies Profiled in the Report:

- B. Braun Melsungen AG (Germany)

- Movora (US)

- STERIS (US)

- DePuy Synthes (Johnson & Johnson) (US)

- AmerisourceBergen Corporation (US)

- Arthrex, Inc. (US)

- Orthomed (UK) Ltd (Infiniti Medical)

- Veterinary Instrumentation (UK)

- Fusion Implants (UK)

- Narang Medical Limited (India).

Scope of the Report:

|

Report Metric |

Details |

|

Market Size available for years |

2020-2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast Unit |

Value (USD) |

|

Segments covered |

Canine orthopedics market : |

|

Geographies covered |

|

|

Companies Covered |

B. Braun Melsungen AG (Germany); Movora (US); STERIS (US); DePuy Synthes (Johnson & Johnson) (US); AmerisourceBergen Corporation (US); Arthrex, Inc. (US); Orthomed (UK) Ltd (Infiniti Medical); Veterinary Instrumentation (UK); Fusion Implants (UK); Narang Medical Limited (India). |

The research report categorizes the market into the following segments:

Canine orthopedics market, By Product

- Implant

- Plates

- Tibial Plateau Leveling Osteotomy (TPLO) Plates

- Tibial Tuberosity Advancement (TTA) plates

- Speciality plates

- Other Plates

- Plates

- Others

- Instruments

Canine orthopedics market, By Application

- Tibial Plateau Leveling Osteotomy (TPLO)

- Tibial Tuberosity Advancement (TTA)

- Joint Replacement

- Trauma

- Others

Canine orthopedics market, By End User

- Veterinary Hospitals and Clinics

- Other End Users

Canine orthopedics market, by Region

- North America North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH APPROACH

2.1.1 SECONDARY SOURCES

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY SOURCES

2.1.2.1 KEY DATA FROM PRIMARY SOURCES

2.1.2.2 BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.4 REGULATORY ANALYSIS

5.5 ECOSYSTEM ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 VALUE CHAIN ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

5.9 PATENT ANALYSIS

5.10 SUPPLY CHAIN ANALYSIS

5.11 PRICING ANALYSIS

5.12 KEY CONFERENCES AND EVENTS (2022-2023)

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

6 CANINE ORTHOPEDICS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

6.1 INTRODUCTION

6.2 CANINE ORTHOPEDICS MARKET, BY IMPLANT

6.2.1 PLATES

6.2.1.1 TIBIAL PLATEAU LEVELING OSTEOTOMY (TPLO) PLATES

6.2.1.2 TIBIAL TUBEROSITY ADVANCEMENT (TTA) PLATES

6.2.1.3 SPECIALITY PLATES

6.2.1.4 OTHER PLATES

6.2.2 OTHERS

6.3 CANINE ORTHOPEDICS MARKET, BY INSTRUMENTS

7 CANINE ORTHOPEDICS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

7.1 INTRODUCTION

7.2 TIBIAL PLATEAU LEVELLING OSTEOTOMY (TPLO)

7.3 TIBIAL TUBEROSITY ADVANCEMENT (TTA)

7.4 JOINT REPLACEMENT

7.5 TRAUMA

7.6 OTHERS

8 CANINE ORTHOPEDICS MARKET, BY END USER, 2020-2027 (USD MILLION)

8.1 INTRODUCTION

8.2 VETERINARY HOSPITALS AND CLINICS

8.3 OTHERS

9 CANINE ORTHOPEDICS MARKET, BY COUNTRY/REGION, 2020-2027 (USD MILLION)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.3 EUROPE

9.3.1 UK

9.3.2 GERMANY

9.3.3 FRANCE

9.3.4 ITALY

9.3.5 SPAIN

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 JAPAN

9.4.2 CHINA

9.4.3 INDIA

9.4.5 REST OF ASIA PACIFIC

9.5 LATIN AMERICA

9.5.1 BRAZIL

9.5.2 MEXICO

9.5.3 REST OF LATIN AMERICA

9.6 MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPES

10.1 OVERVIEW

10.2 REVENUE SHARE ANALYSIS OF KEY PLAYERS (2021)

10.3 COMPETITIVE BENCHMARKING

10.4 MARKET SHARE/RANKING ANALYSIS, BY KEY PLAYERS (2021)

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

10.6 STARTUPS/SMES EVALUATION QUADRANT (2021)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

10.7 COMPANY GEOGRAPHIC FOOTPRINT

10.8 COMPANY PRODUCT FOOTPRINT

10.9 COMPANY APPLICATION FOOTPRINT

10.10 COMPANY END USER FOOTPRINT

10.11 COMPETITIVE SITUATION & TRENDS

11 COMPANY PROFILES

(Business Overview, Financials, Recent Developments, MnM View)

11.1 KEY PLAYERS

11.1.1 B. BRAUN MELSUNGEN AG

11.1.2 MOVORA

11.1.3 STERIS

11.1.4 DEPUY SYNTHES (JOHNSON & JOHNSON)

11.1.5 AMERISOURCEBERGEN CORPORATION

11.1.6 ARTHREX, INC.

11.1.7 ORTHOMED (UK) LTD (INFINITI MEDICAL)

11.1.8 VETERINARY INSTRUMENTATION

11.1.9 FUSION IMPLANTS

11.1.10 NARANG MEDICAL LIMITED

11.2 OTHER PLAYERS

12 APPENDIX

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

*The segmentation of the study can be updated during the course of the study based on primary insights and secondary research

*The list of companies mentioned above is indicative only and might change during the course of the study.

*Details on key financials might not be captured in case of unlisted companies.

The growth of canine orthopedics market is driven by factors such as growing pet dog ownership, adoption of dog insurance policies, growing investments by key market players, growing number of veterinary practionioners and their rising income levels in developed countries, and the growing number of veterinary orthopedic surgeries in canine. Some of the most common orthopedic problems in dogs include hip dysplasia, cruciate ligament tears, luxating patellas, and disc disease. The rise in the prevalence of canine obesity has made it the most common nutritional health problem in dogs, which results in osteoarthritis, hence driving the growth of the canine orthopedics market. Limited availability of trained professionals in the treatment of canine orthopedic problems and expensive treatment may restrain the market growth. Increasing veterinary orthopedic surgical procedures and rising demand for surgical interventions among canine animals expected to offer significant opportunities to canine orthopedics market.

The global canine orthopedics market is segmented on the basis of products, application, and end user. Based on products, market is segmented into implants and instruments. Implant segment is further segmented into plates and others. Plates segment is further categorized into TPLO plate, TTA plates, Speciality plates, and other. Based on applications, market is segmented into TPLO, TTA, Joint Replacement, Trauma, and others. Based on end user, market is segmented into veterinary hospitals and clinics, and other.

The prominent market players in canine orthopedics market includes, B. Braun Melsungen AG (Germany); Movora (US); STERIS (US); DePuy Synthes (Johnson & Johnson) (US); AmerisourceBergen Corporation (US); Arthrex, Inc. (US); Orthomed (UK) Ltd (Infiniti Medical); Veterinary Instrumentation (UK); Fusion Implants (UK); and Narang Medical Limited (India).

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the canine orthopedics market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The canine orthopedics market comprises several stakeholders such as large enterprises, small & medium enterprises (SMEs), distributors, and regulatory organizations. The demand side of this market is characterized by veterinary hospitals and clinics, and other end users. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents for canine orthopedics market is provided below:

* Others include sales managers, marketing managers, and product managers

Note: Tiers of companies are defined by their total revenues; as of 2021, Tier 1>= USD 500 million, Tier 2 = USD 200 million to USD 500 million, and Tier 3<= USD 200 million

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, by application, by end user, and region).

Data Triangulation

After arriving at the market size, the total canine orthopedics market was divided into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, analyze, and forecast the size of the canine orthopedics market on the basis of product, application, end user, and region.

- To provide detailed information on the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market segments with respect to North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches, partnerships, acquisitions and other developments in the market.

- To benchmark players within the canine orthopedics market using the Competitive Leadership Mapping framework which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific canine orthopedics market into Australia, New Zealand, and other countries.

- Further breakdown of the Rest of Europe canine orthopedics market into Sweden, Poland, Switzerland, and other countries.

- Further breakdown of the Rest of Latin America canine orthopedics market into Argentina, Peru, Chile, and other countries.

Growth opportunities and latent adjacency in Canine Orthopedics Market